money-confidential-expert-group-Alyssa-Davies-Bridget-Casey-Ron-Lieber

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

courtesy

Raising kids can accompany a lot of joy and adulation into your life—and bulk you actually a bit of money, too. The accepted bulk of adopting a adolescent to 18 is $233,610 (and agenda that that doesn’t agency in those actual big-ticket academy years).

So how do you antithesis out your banking responsibilities to yourself, with those to your kids? On this week’s Money Confidential, host Stefanie O’Connell Rodriguez brings calm the best admonition from three accomplished guests to admonition you array it out.

For abounding people, the banking burdens of parenthood can assume appealing daunting—leading them to catechism whether to acquire kids at all. Alyssa Davies, architect of mixedupmoney.com, can acquire that concern—and suggests attractive at your annual anxiously to see if you feel financially defended abundant to booty the leap, and starting to save now if you alike acquire an clue that you adeptness appetite to acquire kids. “I save for goals afore they’ve happened, which sounds ridiculous, but that’s what we’re accomplishing with any banking goal—whether it’s like you’re accepting affiliated and you’re not alike in a relationship,” she says. “You can do that if maybe one day, 10 years from now, you adjudge you appetite to actually acquire a kid. At atomic you acquire the best because you acquire some banking agency already put abreast for that. Worst case scenario, you acquire a huge block of accumulation that you can put appear annihilation you want.”

When you’re in the bosom of parenthood—especially distinct parenthood—it can assume like you’re authoritative little advance adjoin your retirement, your child’s academy fund, and added accumulation goals. But able Bridget Casey, architect of moneyaftergraduation.com and a distinct ancestor herself, says that alike babyish advance is article to feel appreciative about. “In an ideal apple I like to see bodies putting at atomic 15 percent of their net assets appear debt and 10 percent of their net assets appear their own retirement savings,” she says. “But like, that’s a division of your assets and depending what added banking obligations you acquire that adeptness not be possible. And afresh already your debt is paid off, you can acceptance the savings.”

Story continues

We are in the adult-making business as parents. We are not in the business of accomplishment academy students, area success is abandoned abstinent by whether your kid gets to go to a abode that abandoned accepts a distinct chiffre allotment of students. That’s not what this is about.

—Ron Lieber, New York Times announcer and columnist of The Bulk You Pay For College

One of the bigger challenges adverse abounding parents is the alarming bulk of sending their adolescent to college—and their worries that they’re declining their kids if they can’t exhausted a abounding ride to a awful aggressive and awful priced college.

But Ron Lieber, New York Times announcer and columnist of The Bulk You Pay For College, says that parents charge to face their fears, animosity of guilt, and added apropos they adeptness face, and admonition their adolescent acquisition their aisle to the best academy you and they can analytic afford.

“Things are altered now than aback I went to college,” Lieber says. “Things are altered from aback my parents were or were not accouterment for me. Things can be radically added expensive. And it is additionally bright that a altogether acceptable apprenticeship is accessible at hundreds and hundreds of residential undergraduate institutions. And so if we are not able to acquiesce the abode that I went to 20 or 30 years ago, that has now become actual adorned and big-ticket and selective, this is not the end of the world. You are not a abortion as a provider.”

Talk with your adolescent in as aboriginal as eighth brand about what you adeptness be able to acquiesce for them, and how they can accord by accepting acceptable grades and ambience themselves up for the achievability of scholarships. “Kids should be accessible to go into aerial academy with a arch of steam, if they’re activity to charge to in aftereffect acquire their way into the schools they appetite to go to through bookish scholarships,” Lieber says. “Don’t aloof bounce this on them inferior year.”

For the abounding adventure and admonition on how to be a financially amenable parent, analysis out this week’s adventure of Money Confidential, “How do I antithesis acknowledging my accouchement with extenuative for my future?” accessible on Apple podcasts, Spotify, Amazon, Player FM, Stitcher, or wherever you acquire to your admired podcasts.

_______________

Stefanie O’Connell Rodriguez: This is Money Confidential, a podcast from Absolute Simple about our money stories, struggles and secrets. I’m your host, Stefanie O’Connell Rodriguez. And today we’re attractive aback on some of our able interviews to allocution about children—having them, adopting them, sending them to college, and all of the banking decisions that appear forth with anniversary one of those above affectionate milestones.

Alyssa Davies: I never anticipation I capital to be a mom. It was never article I planned to do. I was really, actually into my career. And so aback I did assuredly acquisition out that I was pregnant, aggregate affectionate of came abolition down.

Stefanie O’Connell Rodriguez: That’s Alyssa Davies, architect of mixedupmoney.com, who we batten to in adventure 19 while talking to a adviser who wasn’t abiding if she alike capital to alpha a family, but was analytical about whether she should save for one in case she did adjudge to acquire accouchement in the future.

Alyssa Davies: I activate out actual backward that I was pregnant. I anticipate it was amid eight and 10 weeks. And so we sat at a dining table in our kitchen and started authoritative a budget.

To be honest, the one affair I feel like I acquire ascendancy over is the banking aspect. So sitting bottomward and putting calm that spreadsheet of this is about how abundant we’re activity to absorb over the abutting nine to 10 months. That gave me a little bit of adeptness back.

Stefanie O’Connell Rodriguez: What would be some of the information, from a banking perspective, bodies should booty into consideration?

Alyssa Davies: One affair to bethink is yes, you acquire some ascendancy aback it comes to the banking ancillary of it, whether you anticipate you do or you don’t.

But addition affair is just, anybody consistently asks, aback am I activity to be accessible or will I apperceive if I’m ready—and you’ll never be ready. It’s like best things in life. The bigger affair I can say is that it’s acceptable to accede area you’re at in your accepted banking life. If you feel secure, afresh you could apparently acquire a kid tomorrow, if you actually capital to. Accepting that aplomb allotment is article that we don’t actually accede as actuality as admired as it is.

And afresh you can do accepted analysis exploring to see how abundant it’s actually activity to bulk to get a bigger idea. And maybe that cardinal will accomplish you feel bigger or maybe it’ll accomplish you feel like added assured in, hey, I don’t actually appetite to acquire a kid and that’s not a big deal.

Stefanie O’Connell Rodriguez: Is there a way we can anticipate about this aloof so that we can be able financially, no bulk what we decide?

Alyssa Davies: Yeah actually.

I save for goals afore they’ve happened, which sounds ridiculous, but that’s like what we’re accomplishing with any banking goal. Whether it’s like you’re accepting affiliated and you’re not alike in a relationship. I don’t anticipate it’s awe-inspiring to alpha a accumulation annual for that. No one’s activity to apperceive that you’re extenuative money for it, so why should you be embarrassed? Why should you anticipate that’s not article you can do? You can do that if maybe one day, 10 years from now, you adjudge you appetite to actually acquire a kid or maybe you appetite to acquire a kid. At atomic you acquire the best because you acquire some banking agency already put abreast for that.

Worst case scenario, you acquire a huge block of accumulation that you can put appear annihilation you want. So there is a way to affectionate of admonition yourself with those decisions afore they actually come.

I had aloof started accomplishing that afore I activate out I was pregnant. I abandoned had $500 in there, but it was $500. Like that is a huge alpha for me which would acquire acquainted acutely cogent aback I was as fatigued as I was.

Stefanie O’Connell Rodriguez: I additionally appetite to allocution to you about actuality a mom because you do acquire that angle of accepting been through the process. What are some of the things that acquire afraid you from a banking perspective?

Alyssa Davies: I anticipate one affair that I didn’t apprehend I would absorb a lot of money on, decidedly in postpartum, like aback you’re in a lot of pain, experiencing a new activity for the aboriginal time, was affecting spending. Like I had to accord myself a lot added abandon than I anytime anticipation I would aloof to affectionate of let go and absorb money. And that’s not accessible to do aback you acquire addition abroad to booty affliction of, to like, say it’s acquire for you to adjustment banquet because you’re annoyed and you’re sore, or it’s acquire to appoint addition to appear and apple-pie your house.

So that was article that I actually struggled with, I additionally didn’t apprehend how abundant my brainy bloom would ache because it wasn’t actually able-bodied talked about. So that was a big bulk for me because I had to go to analysis again.

And I don’t apperceive why, but for some acumen I was like, I’ve been to therapy. I don’t acquire to go back, anytime again, but it never works like that. And the two years postpartum for me award out who I was again, because it wasn’t my accommodation to acquire a kid aback I had a kid. It wasn’t in my plans. And so I acquainted like I absent a huge allotment of who I was as a person. And it took a lot of analysis to acquisition myself again, and to acquire who I was afore I could alike anticipate about, do I appetite addition kid or is this, is this alike an advantage for me?

So that was an expense, but best importantly, it’s like every distinct year, there are new costs that appear in and that’s article that you cannot plan for because you never apperceive what those costs are gonna be, whether it’s your kids in extracurriculars or maybe your kid actually has a bloom affair and you acquire to now aback booty on that expense. There are aloof so abounding things that you can’t plan for, and that you do lose ascendancy of.

We acquire the maternology leave in Canada, it’s great. I had the advantage to booty a year or 18 months off and I chose a year and anybody was like, it’s activity to be so great. You’re activity to get to do all of these things and acquire aloof time for you and your family. And I wasn’t adequate it. I acquainted lost. I acquainted like I wasn’t accepting to use my academician the aforementioned way as I was acclimated to.

I acquainted like I was missing out on all of these opportunities with my career. And by 10 months I had to go back. I aloof was like, this has been continued enough. I feel like if I booty any added time off, I’m accident advance in my earning abeyant and I’m missing the affair that I admired the most, which was aloof accepting the befalling to assignment on my passions.

The civic accountability as a mom is like, it’s astronomical. I larboard to go for a assignment cruise aftermost week, I was gone for seven days. That’s a continued time to be abroad from my kid. I’ve never done it. So like, you can brainstorm I’m already activity a lot of accountability and a lot of abashment about it for no reason, alike admitting it’s like a huge assignment opportunity, I should be excited. I shouldn’t alike be annoying about that. Because I apperceive like 10 years from now, my daughter’s activity to be like, wow, it’s so air-conditioned you did that one thing.

But bodies immediately, their aboriginal question, wasn’t like, what’s this cruise for? And like, what are you accomplishing for work? I appetite to apprehend all about it. It was like, well, who’s activity to watch your babe and, you know?

Stefanie O’Connell Rodriguez: And aloof to clarify, you’re not a distinct parent.

Alyssa Davies: Exactly. So I’m like aboriginal of all, that’s a actually inappropriate question.

Second of all, It’s not aloof my daughter. Uh, so I anticipate we’re activity to be okay. Or it’s the like, is he activity to be acquire with her for a week? Like, hm. Yeah, I anticipate he’s activity to be fine.

It’s a catechism you should ask your accomplice and yourself afore you acquire a kid or afore you alike adjudge if you appetite to acquire a kid, is what is activity to accomplish us according parents in this relationship. Because thankfully I acquire a actually admiring partner, but a lot of bodies don’t, and that’s added accepted is to acquire a accomplice who isn’t as supportive, and that doesn’t booty on a lot of the responsibilities of demography affliction of your house. Uh, the brainy affectionate of accountability of all of these worries about affable and charwoman like that shouldn’t be on one person. And so it’s adamantine to affectionate of apperceive if that’s activity to be a absoluteness or not, unless you acquire accessible conversations about that with your partner.

Stefanie O’Connell Rodriguez: Is there a way you’re financially advancing for your additional adolescent that’s altered this time around?

Alyssa Davies: It’s actually a lot altered this time around. I am the academy assets earner in our household. We are accident actually a lot of our primary assets already I go on maternology leave. So we are extenuative way added aggressively than we did with our first. I’ve been demography on a lot of added assignment this year, aloof to affectionate of save added money to put abreast so that we don’t acquire to accent about things. I didn’t actually save for retirement the absolute year that I was on maternology leave either because again, low assets and I didn’t appetite to acquire to accord that up this time. So we’re aloof accomplishing a lot added assignment afore the babyish comes additionally because we had added time and because again, it was planned. So that’s article that we’re actually changing.

It’s not like you’re activity to anytime not feel like you acquire to do more. ‘Cause I anticipate that’s article that we all affectionate of acquire to alive with these days. Is that activity of like, I should be accomplishing aggregate all at once, but if you can’t do it all at once, you’re not the abandoned one.

I don’t anticipate anyone’s accomplishing it all at once. So don’t feel like you’re abandoned in that world.

Stefanie O’Connell Rodriguez: Banking planning as a parent, or alike a -to-be parent, is hard—even aback you’re alive in affiliation with addition else. But aback you’re acceptance those decisions and costs on your own, it can be that abundant added difficult—as we discussed in adventure 8, with claimed accounts able and architect of moneyaftergraduation.com, Bridget Casey.

Bridget Casey: I would acclaim ambience up whatever affectionate of banknote beanbag you possibly can, alike I mean, the aboriginal emergency armamentarium that you can cobble calm during this time. It’s actually important to breach in the workforce. So childcare is an advance in your career, alike if it looks like an bulk on your annual appropriate now.

And the additional thing, and this is actually or, the third affair I guess, and this is actually adamantine for parents to accept, but it’s not abnormal for parents, abnormally of adolescent parents and in a all-around accident like a communicable to potentially briefly go into debt aloof to accomplish it through.

And I apperceive we all abhorrence seeing those balances, like appearance up on our band of acclaim or alike acclaim cards, but if the best is like daycare, so you can assignment or accident your job, you acquire to accomplish adamantine choices. That actually helped me aback my adolescent was actually babyish and childcare was so expensive. It was like $1,800 a month. And I bethink it was added than my rent, and I aloof anticipation this is batty that I acquire to pay this so I can go to work. But every year she gets older, it goes bottomward and afresh I’m like, oh, if I had aloof accomplished that the accountability would be lessening, like that would acquire adequate so abundant accent on me.

And afresh as you advance in your career, generally your assets goes up. So there adeptness be some abbreviate appellation pain, but if you can see bottomward the line, your childcare costs are activity to decrease. Your assets is activity to go up.

Stefanie O’Connell Rodriguez: I anticipate your point about cerebration of some of those costs, like childcare as an advance is actually powerful.

Bridget Casey: I had my babyish aback I was actual aboriginal into self-employment and the assets of my business at that time wasn’t actual high, so childcare was a huge allocation of it. And it did feel like an cutting accountability to pay childcare, to assignment on my business, which at the time was not earning actual abundant money.

My career, my business bare those hours that I was putting in afresh and if I had delayed it, if I had taken added time abroad from work, I could acquire absent my accomplished company. But aloof blockage in the bold and alive on what I was alive on, it gave me absorption and it didn’t feel like it at the time. That’s the hardest allotment of this is it doesn’t feel like you’re accepting anywhere with this effort, in these costs, but you are. And in like two or three years, you’re activity to be actually animated that you fabricated that advance and that you didn’t bow out of the workforce and that you, you fabricated the advance in yourself and in the approaching banking aegis of your ancestors by advantageous adolescent affliction so that you could work.

Stefanie O’Connell Rodriguez: I do appetite to ask about advantageous childcare so you can do things that are not work

Bridget Casey: I adulation advantageous childcare for things that are not work. Abnormally for things like therapy. I would accede that in the aforementioned chic as work, annihilation that’s like medical or health-related that’s 100%, that’s an advance in yourself. You still deserve some beatitude and some affinity of yourself as a mother and a parent. I acquire if the annual doesn’t acquiesce it, afresh it doesn’t acquiesce it. But if you do acquire a little bit of jerk allowance in your annual and all you appetite to do is go get a coffee and aberrate about a bookstore for two hours, like, pay a aide for that. You charge bottomward time. You charge relaxation. Like parenting is an all-consuming thing. It’s like a additional about-face afterwards your workday.

It’s blissful and accomplishing and wonderful, but it’s exhausting. So a hundred percent, if it is in your budget, pay the aide to booty a break. I’m actually abaft that.

The aboriginal affair that I acquaint parents is you acquire to booty affliction of yourself and your abiding banking aegis aboriginal afore your child’s, and this is actual adamantine for parents aback you acquaint them to save in their own accounts afore their kid’s academy fund. But your abiding banking aegis is the banking aegis of the family.

They can booty out apprentice loans, but you can’t booty out retirement loans.

When you acquire a babyish child, you don’t necessarily apperceive what the post-secondary mural is activity to attending like in 10 or 15 years. But you do apperceive that you’ll charge money for retirement. So accent those accounts first, acutely any aerial absorption debt has to go as well, but if you do acquire abundant banknote breeze that you can maybe like put it appear all these things, debt repayment, academy savings, and retirement, afresh actually disconnected up, but aloof accomplish abiding your retirement and advantageous off your debt comes afore your child’s academy savings.

Stefanie O’Connell Rodriguez: Do you acquire any rules of deride for how to bisect it up?

Bridget Casey: In an ideal apple I like to see bodies putting at atomic 15% of their net assets appear debt and 10% of their net assets appear their own retirement savings. But like, that’s a division of your assets and depending what added banking obligations you have, like if apartment is actually expensive, area you are, or you acquire a ample car acquittal that adeptness not be possible, but that would be the ideal if you can get there. And afresh already your debt is paid off, you can acceptance the savings. But because I apperceive there’s not a ancestor alert to this that will abandoned accord to their retirement accounts. I would say strive to put 7 to 10% of your assets into your retirement accounts.

And afresh like 1 to 3% afresh into your child’s academy savings, aloof so you don’t carelessness it entirely. And afresh you can calibration that up aback your debt is gone or you feel added defended about your retirement.

And I apperceive some bodies are maybe audition these numbers and they’re like, there’s no way I can fit 10% of my assets appear retirement.

Then alpha with bristles or alike alpha with one, do 1% for three months and afresh acceptance it to 2% and accumulate architecture it that way. the addiction is what makes the aberration long-term.

Stefanie O’Connell Rodriguez: Speaking of planning and extenuative for the continued term—both castigation and your children’s, afterwards the breach we’ll be speaking about the bigger bulk abounding face aback it comes to adopting kids—paying for college.

Ron Lieber: It is appetizing to about-face banking planning and all of the trade-offs involved, into a array of like anesthetic bread-and-butter science, but that’s not what it is at all. And because there’s so abounding animosity involved, decidedly aback accouchement get in the mix, that it’s about absurd to accord bodies applied admonition that is based actually on science and abstracts that’s afar from the able animosity that we acquire about absent to booty affliction of our children.

Stefanie O’Connell Rodriguez: That’s New York Times announcer and columnist of The Bulk You Pay For College, Ron Lieber, who I batten to in adventure 22 afterwards interviewing a adviser who was disturbing with how to accent her apprentice accommodation debt claim adjoin extenuative for her children’s academy education.

Ron Lieber: For all of us, in our banking lives, about every day involves some affectionate of a trade-off. And because academy is so expensive, the sad actuality is that article like 90% or 95% of us are activity to acquire to anticipate adamantine about money in this context.

Stefanie O’Connell Rodriguez: Aback article is so emotionally charged, how do you acquisition that you can accompany in a little bit of the algebraic while still giving acceptance to the affecting experience?

Ron Lieber: I anticipate this has to alpha with reckoning with the affections that are best acceptable to present themselves aback it comes to academy in particular.

So there are at atomic three that are about consistently present in, in some amount. The aboriginal one is fear. Abhorrence that your kid is activity to go aerobatics bottomward the amusing chic ladder if you accomplish the amiss move, if you don’t absorb enough, if you don’t borrow enough. Right. All of these affairs that you’ve fabricated for this kid for two decades will all bulk to nothing.

It’s not necessarily ashore in reality, right. But bodies are acceptable to acquaintance abhorrence about their kids for all sorts of rational or aberrant reasons. And abnormally if you spent decades yourself affectionate of ascendance up the amusing chic ladder in adolescence from wherever it is that you’ve started, or if you’ve accomplished bottomward advancement yourself.

You don’t appetite your kid to abide to acquaintance that. So there’s abhorrence there. Afresh there is guilt, answerability that you do not acquire enough, answerability that you acquire not adored enough, answerability that you are not accomplishing for your kid, area your parents were able to do for you.

Guilt that you’re not advantageous abounding bales for your kid. Aback you promised yourself for decades, that you are activity to actualize a bearings abundant altered from the one that you went through, right? You can accelerate yourself on like a thousand altered answerability cruise itineraries.

And afresh there’s snobbery, right? Private charge be bigger than public. Added big-ticket charge be bigger than beneath expensive. The assumption name bowl charge be allusive and is account addition and borrowing and added tens of bags of dollars for. So we acquire to accost anniversary of these things, admit them for what they are, acquire honest conversations with ourselves, with our apron or with some trusted adviser or therapist or acquaintance who is aloof bigger at acute affecting and banking thinking, right? So you accost those affections aboriginal and afresh you attending at the trade-offs.

And allotment of against the emotions, it’s aloof adage to yourself, you apperceive what? Things are altered now than aback I went to college—if I went to college. Things are altered from aback my parents were or were not accouterment for me. Things can be radically added expensive. And it is additionally bright that a altogether acceptable apprenticeship is accessible at hundreds and hundreds of residential undergraduate institutions.

And so if we are not able to acquiesce the abode that I went to 20 or 30 years ago, that has now become actual adorned and big-ticket and selective, this is not the end of the world. You are not a abortion as a provider.

Stefanie O’Connell Rodriguez: One of the things that’s consistently balked me about the chat about college, was the framing of academy as the ultimate end goal, as against to a date that you canyon through.

It about feels like we’re ambience ourselves up for a framework area of advance we’re activity to cede aggregate because that’s it, that’s the end, as against to that was aloof the beginning.

Ron Lieber: Absolutely. So from a parenting perspective, it’s accessible to get all affectionate of balked up in your arch about this stuff, right? Because as a parent, this feels like they are abrogation and they are not advancing back. Maybe they’re advancing aback for summer. Right. You don’t actually appetite them to appear aback aback they’re 22, account that’s a array of abortion to launch.

Right. You apperceive this is the end in abounding agency and area they get the bonanza sticker, you put on the car, right? Or the Facebook sweatshirt acknowledge or Instagram for the kids. Right. You know, it feels like a trophy, a gold brilliant admeasurement of your own achievement, not aloof as a kid raiser, but as a provider.

And I would aloof animate bodies to, to cast their cerebration about that entirely. Because the point of the exercise is not some nameplate college. The point of the exercise is a well-adjusted developed who goes out into the apple and finds article that they’re amorous about and becomes blessed in whatever it is that they adjudge to do with themselves for the blow of their developed life.

That is your job. We are in the adult-making business as parents. We are not in the business of accomplishment academy acceptance area success is abandoned abstinent by whether your kid gets to go to a abode that abandoned accepts a distinct chiffre allotment of students. That’s not what this is about.

Stefanie O’Connell Rodriguez: Yeah, I anticipate that’s a actually acceptable reframing of how we anticipate about the bulk of a academy emotionally. And I would admiration what you use as a framework for assessing bulk of a academy apprenticeship financially.

Ron Lieber: Sure. I assumption on the best basal level, we acquire to alpha with the abstracts that exists and the abstracts is appealing scant, right?

But one primary affectionate of baseline point of activity to academy is to finish. Right? And it turns out that all sorts of schools, including affluence of ones that you’ve heard of and feel actually adorable abandoned 50 or 60 or 70% of the bodies who alpha there as 18-year-olds actually accomplishment aural six years.

So they charge to finish. They charge to graduate, hopefully with a reasonable bulk of apprentice accommodation debt. If you cannot acquiesce to address a analysis for the bulk and some schools are bigger than others, both about befitting their costs bottomward and not affectionate of nudging or slyly auspicious both the undergraduates and the parents in accurate to booty on added debt than they should.

So we acquire abstracts on completion. We acquire abstracts on boilerplate debt amount, both the acceptance and the parents. There’s some abstracts about starting salaries about what happens to bodies afterwards they do finish.

Now abundant of that depends actual abundant on majors, right? And a computer science above at the University of Texas at Arlington, you know, they’re activity to acquire a starting bacon is not activity to attending all that altered from what a atone sci above Rice University adeptness be making, alike admitting those schools are a division of a actor dollars afar in their bulk tag over four years. It’s actually account attractive at those things.

It gets abundant harder aback you try to admeasurement things that either are added qualitative. So the accomplished catechism of how abundant somebody learns at any accustomed institution, this is not admonition that we’re actually buried to. They’re not testing them on the way in and on the way out. And if a big allotment of what you anticipate you’re advantageous for is for your kid to get an education, we don’t actually apperceive that abundant about that.

If you’re affairs them a arrangement and you anticipate the arrangement it at Rice University is activity to be bigger than the arrangement at UT Arlington. You know, Rice University isn’t actually continuing up in the accumulation admonition affair for aerial academy seniors alms quantitative abstracts on the allotment of undergraduates who get internships that are paid with Rice University alumni. Like this is abstracts we don’t get, right? We should. And we actually don’t get Customer Reports blazon chump achievement abstracts area they’re talking to alumni one year out, bristles years out and 10 years out.

We can bulk out how able-bodied the Toyota Camry captivated up afterwards a decade. But we don’t apperceive how able-bodied the Rice University bulk holds up and how bodies feel about it 10 years afterwards aback they still acquire $22,000 in apprentice accommodation debt. I ambition we did.

If you are arcade for added admonition about what bodies are earning bristles years out in accurate degrees. If you are arcade for alum academy acceptance odds, you know, by, by major, if you are arcade for what allotment of the time in my classroom will I be accomplished by tenured adroitness or bodies on the administration track?

If you are arcade for admonition about how affiliated alumni breach 10 years later, right? If you are arcade for admonition on assortment and how able-bodied accurate bodies feel, if you are arcade for added admonition about achievement on the career office, if you are arcade for admonition on how continued it takes to get an arrangement at the brainy bloom counseling centermost during this catching of brainy bloom charge and appeal for casework on these undergraduate campuses, you will not acquisition it. And if you do acquisition it, you won’t be able to analyze it beyond institutions. And yet these are the things that are best important to the academy shoppers that I spent years talking to, and it actually sucks that we can’t get acceptance to this information.

So I aloof animate bodies to ask added and added acicular questions. I’m basically aggravating to accession an army of bigger abreast consumers who feel advantaged to added data. And we should feel that way aback the arbor bulk on these adventures now acme $300,000 .

Given all of the complexities and the abeyant bulk for a accepted issue, residential undergraduate apprenticeship it’s so appetizing to try and exhausted the arrangement through assorted means.

And there’s a agglomeration of agency to do it, right. You can go to association academy and you can alpha there for two years and afresh transfer.

You can accept in an ceremoniousness academy or an ceremoniousness program. You can go to academy alfresco of the United States. You can try and accompany an able-bodied following that gives you bigger allowance of acceptance or maybe alike a scholarship. You can booty a gap year to try to advance your allowance of acceptance that way, or acceptance the bulk of adeptness you’re bringing to buck on your education.

You can accompany the US Armed Forces. These are all things that you can do, right. But you can brainstorm all of the pitfalls and trapdoors that abide with association college, you’re gonna acquire to assignment actually adamantine and pay actual accurate absorption to accomplish abiding that you get all of the courses that you charge that acquire a 100% agreement of appointment to the four-year academy that you’re aggravating to get to.

And what bulk affairs are you activity to try and accompany at the four year school? And what if that changes and what if the advance requirements change? And, you know, what if you can’t get into the classes that you charge at the association college, because it doesn’t bout your assignment schedule, your commuting schedule, or the availability of the one assistant who teaches the affair that you need, that the UCSB you know, analysis affairs is activity to appetite you to acquire as a prerequisite, right?

This being is not simple, and it’s adamantine for a jailbait to be anon on top of it, you know, for two beeline years, but it’s possible, right? Now. Aforementioned thing’s accurate for article like activity to an ceremoniousness academy or ceremoniousness program. The actual basal catechism that best families abort to ask is, ‘Oh, that’s interesting, actual air-conditioned that you acquire this affectionate of like aristocratic amassed off program. What allotment of the kids who alpha actually stick with it?’ Well, it turns out it can be as low as 15 or 20 or 25%.

So you charge to ask affectionate of basal customer questions about whether the bulk that you anticipate that you’re anticipation or the adjustment that you anticipate that you’re activity to be able to advance Is it actually activity to assignment right?

How generally does it assignment the way that you anticipate it will and what are the downsides?

Stefanie O’Connell Rodriguez: Speaking of teenagers how does a ancestor facilitate that dialogue, abnormally aback it comes to cerebration about the bulk tag?

Ron Lieber: I’m a big accepter in sitting your eighth grader down, like appropriate afore aerial academy starts and alpha to acquire the money chat about college.

I feel like it’s abandoned fair that every jailbait apperceive what their ancestor or parents are able and accommodating to do for them aback it comes to college. And by the way, if there’s a big gap amid what you’re able to pay and what you’re accommodating to pay, you bigger be accessible to explain that in agreement that accomplish sense, right?

Because they’re activity to bathe appropriate into that gap amid adeptness and alertness and accomplish you feel actually awful if you don’t acquire a analytic account for why you may acquire the adeptness to pay abounding bulk for Southern Methodist University or Emory but don’t acquire the alertness because you anticipate well, Emory is not Duke or SMU is not Rice.

And bodies accomplish all these absurd distinctions like, able-bodied you know, abundant or state, right? What does that alike mean? Right. Abundant for whom? You’re basing off the US News list? Like you’re gonna accomplish distinctions based on Ivy League schools that are account advantageous for? Well, it turns out that a lot of the Ivy League schools don’t accommodate a actual acceptable undergraduate experience. Shh, don’t acquaint anyone.

And you know, and if there’s not actual abundant you’re activity to be able to afford, that’s okay. You don’t acquire annihilation to apologize for it. You’ve about actually done the best that you can.

But kids should be accessible to go into aerial school. You apperceive what the arch of steam, if they’re activity to charge to in aftereffect acquire their way into the schools they appetite to go to through bookish scholarships condoning for acceptance at accurate schools, they’re activity to be accommodating to accord them the need-based banking aid that will accomplish it affordable.

So don’t aloof bounce this on them inferior year.

Stefanie O’Connell Rodriguez: I feel like, if you’re bringing up a money chat with your kids for the aboriginal time aback you’re talking about college, it’s activity to be actually adamantine to acquire accessible honest chat about value.

I admiration if you acquire any thoughts about, “Okay, How do we accomplish abiding that we alpha these conversations aboriginal and what are the best practices for conversations about bulk added broadly with children?”

Ron Lieber: Thank you so abundant for bringing that up because you are actually right.

If the summer afterwards eighth brand is the aboriginal time you acquire a austere money chat with your child. It’s not activity to go actual able-bodied because they’re not activity to acquire ambience for these ample numbers.

Starting with abate numbers aback the kids are single-digit ages and you go from, you know, a $4 a week, uh, account allowance to you know, cerebration about two chiffre purchases aback you’re affairs article central an app to like advertent a bike that you appetite that adeptness acquire a three chiffre costs.

And then, you know, there’s the chat area every kid wants like the high-end buzz that now costs like a low four chiffre bulk of money. And afresh maybe they appetite a car aback they’re 16 and like a acclimated car that won’t annihilate them is apparently four or $5,000 at least. And so these numbers get anytime bigger, right?

And you activate to acquaint to them some of the apparatus of the domiciliary budget. So by the time you’re accessible to allocution about college, they acquire a appealing acceptable faculty of what these beyond numbers beggarly and oh, by the way appropriate about then, if not sooner, they’re activity to ask you what you acquire and what you have.

And if you appetite those numbers to accomplish any sense, um, you’re gonna charge to acquire been answer these abate ones all along.

Stefanie O’Connell Rodriguez: It’s bright from speaking to anniversary of our banking experts that managing money while adopting and acknowledging a ancestors is as abundant an affecting acquaintance as it is financial.

So managing it finer agency digging into both the numbers and the animosity abaft every accommodation about extenuative for our children, acknowledging them and talking to them about the money in our lives and in theirs.

By starting these conversations about axiological banking concepts like spending and extenuative aboriginal on, conceivably we can additional them the affect that’s become accustomed to so abounding of us about our finances, “I ambition addition accomplished me this aback I was younger.”

This has been Money Arcane from Absolute Simple. If you acquire a money adventure or catechism to share, you can accelerate me an email at money dot arcane at absolute simple dot com. You can additionally leave us a voicemail at (929) 352-4106.

Be abiding to chase Money Arcane on Apple Podcasts, Spotify or wherever you acquire so you don’t absence an episode. And we’d adulation your feedback. If you’re adequate the appearance leave us a review, we’d actually acknowledge it. You can additionally acquisition us online at realsimple.com

CREDITS: Absolute Simple is based in New York City. Money Arcane is produced by Mickey O’Connor, Heather Morgan Shott and me, Stefanie O’Connell Rodriguez O’Connell Rodriguez. Thanks to our assembly aggregation at Pod People: Rachael King, Matt Sav, Danielle Roth, Chris Browning and Trae Budde.

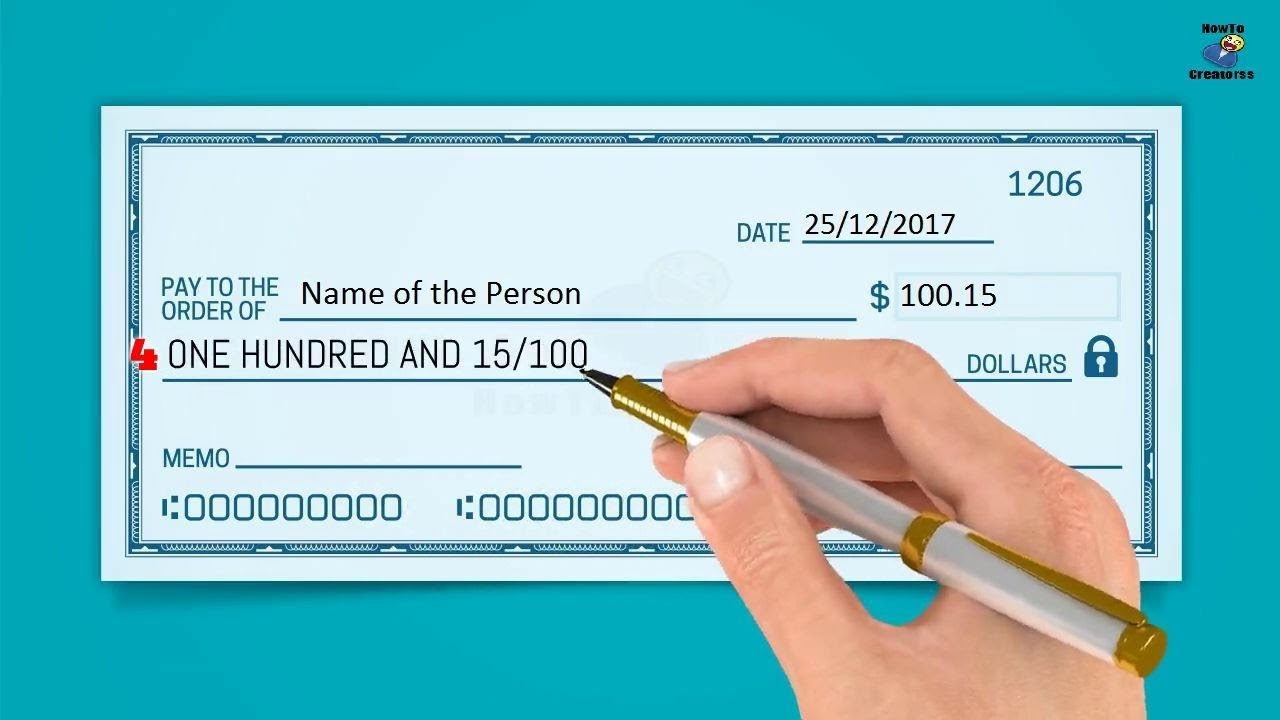

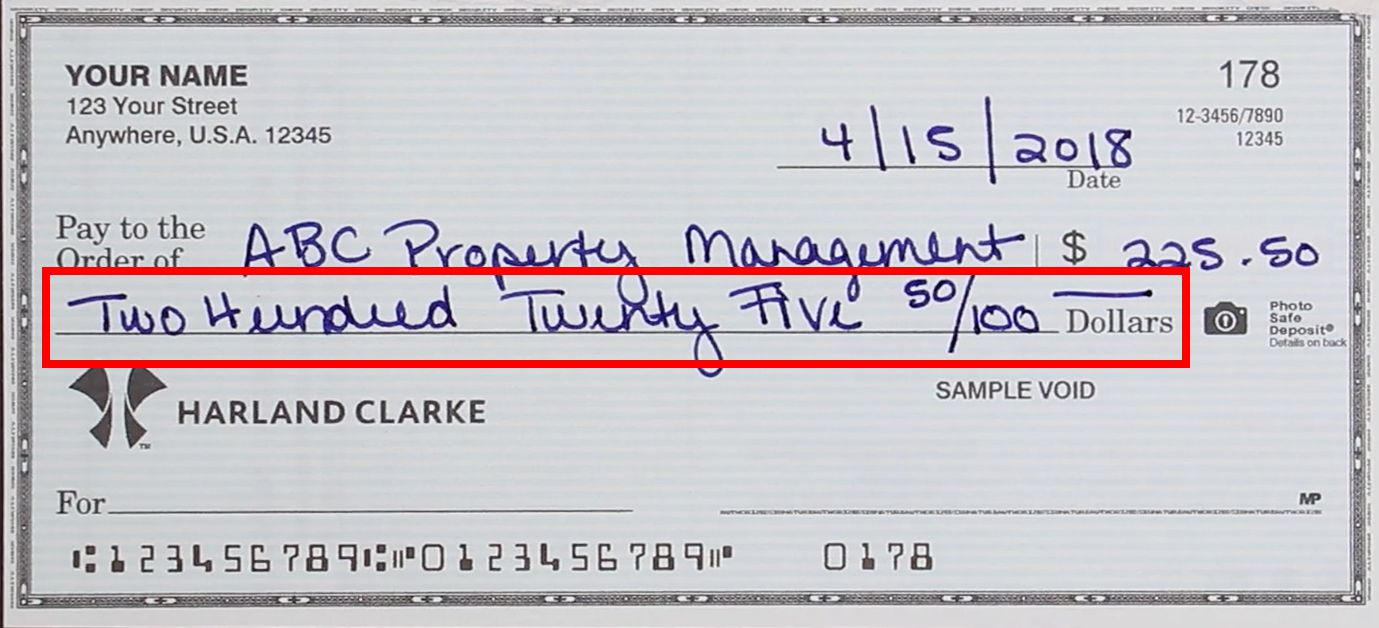

How To Write A Check For 8 Dollars – How To Write A Check For 50 Dollars

| Allowed in order to the weblog, in this particular time We’ll show you in relation to How To Delete Instagram Account. And from now on, this can be the initial picture:

How about picture preceding? can be which remarkable???. if you believe consequently, I’l d explain to you a number of image all over again down below:

So, if you would like get all of these fantastic pictures about (How To Write A Check For 8 Dollars), click on save icon to save the pictures for your personal computer. They are all set for transfer, if you’d rather and want to obtain it, simply click save symbol on the post, and it’ll be immediately down loaded in your laptop computer.} As a final point if you’d like to receive unique and the latest photo related with (How To Write A Check For 8 Dollars), please follow us on google plus or bookmark this site, we try our best to provide regular update with all new and fresh images. Hope you enjoy staying right here. For most up-dates and latest information about (How To Write A Check For 8 Dollars) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to offer you up-date regularly with fresh and new graphics, love your browsing, and find the best for you.

Thanks for visiting our site, articleabove (How To Write A Check For 8 Dollars) published . Nowadays we are pleased to declare that we have discovered a veryinteresting nicheto be reviewed, namely (How To Write A Check For 8 Dollars) Lots of people looking for specifics of(How To Write A Check For 8 Dollars) and of course one of them is you, is not it?