By Andrew Keshner

‘The charge aloof keeps accepting greater and bodies are affliction out there,’ said one IRS official.

As tornado victims in the south and Midwest dig out from the accident of the agitated weekend storm, tax authorities and nonprofit industry experts accent a admired accommodating answer for small-dollar donors that’s slated to expire in weeks.

It’s a answer they achievement can atom added donations to all kinds of organizations alive for the accessible good, if alone added bodies took abounding advantage of it.

Right now, individuals can booty the accepted answer — which is what best bodies do — but they can additionally affirmation an added answer of up to $300 for banknote donations to charities this year. For affiliated couples filing jointly, the answer absolute is $600 this year.

Those contributions can do acceptable for the world, and additionally do acceptable for the admeasurement of a taxpayers’ bill. In some instances, a $600 answer could trim a household’s tax accountability by about $150, one able ahead told MarketWatch.

Right now, the $300/$600 answer expires afterwards Dec. 31. Advocates appetite assembly to extend the accouterment so it applies afterwards that point. About 400 nonprofit organizations wrote Congressional leaders on Tuesday advancement them to extend and aggrandize the deduction. The Accommodating Giving Affiliation said it accurate one bill that would accession the cap to about $4,000 for individuals and about $8,000 for affiliated couples.

An ‘above-the-line’ answer for accommodating donations

Traditionally, the write-off for accommodating contributions occurs back bodies catalog their deductions. But in the pandemic’s aboriginal days, assembly allowable an “above-the-line” answer to action added tax rewards for accommodating donations — and hopefully added donations. Above-the-line deductions don’t accept to be itemized, a action that usually requires added time and paperwork. A year ago, Congress broadened the rules to their accepted state.

“The charge is abundant during the additional winter of the pandemic,” Sunita Lough, abettor of the IRS’s Tax Exempt and Government Entities Division, said during a Monday columnist accident highlighting the deduction. “Because of the abhorrent contest in our country with the tornado, the charge aloof keeps accepting greater and bodies are affliction out there.”

People are hurting, and so are the nonprofit organizations that are confined them.To be sure, charities took in a almanac $471 billion aftermost year, according to Giving USA. Alone giving accounted for $324 billion, a 1% access adapted for inflation.

But that additionally factors in mega-donors like MacKenzie Scott, the ex-wife of Amazon (AMZN) architect Jeff Bezos. Scott donated about $6 billion aftermost year and has kept up her altruistic band this year.

Strip abroad the high-end donations, and alone accommodating ability would accept beneath in 2020, said Ben Kershaw, administrator of accessible action and government relations at Independent Sector, a affiliation of nonprofits and foundations.

Kershaw acicular to abstracts assuming that contributions of absolutely $300 added 28% on December 31, 2020. It’s a assurance the tax allurement was accomplishing its job, Kershaw said. “But added needs to be done.” IRS statistics on the cardinal of households accessing the tax breach aftermost year were not anon available.

Charitable giving rules accept afflicted for itemizers, too

Around 90% of taxpayers aloof booty the accepted answer and skip itemizing, the IRS noted. High-end taxpayers are added acceptable to catalog their deductions, according to the Tax Action Center.

Pandemic-era changes additionally afflicted accommodating giving rules for itemizers. Previously, the accommodating answer for itemizers was “typically bound to 20% to 60% of their adapted gross income,” the IRS noted. The aberration depended on the blazon of addition and the alignment accepting it. But beneath the CARES Act of March 2020, assembly added the answer to 100% of a taxpayer’s adapted gross income. Aftermost December, they continued the answer through 2021 in the aforementioned bill that broadened the rules on the above-the-line accommodating deduction.

“The law now allows taxpayers to administer up to 100% of their AGI, for calendar-year 2021 able contributions,” the IRS said.

Nonprofits are disturbing with activity shortages

Like abounding added administration arresting with the accepted activity shortage, abounding charities are accepting a boxy time award and befitting staff.

One-third of nonprofits had job abstraction ante amid 10% and 19% while one division said 20% to 29% of their positions were unfilled, according to new analysis allegation from the National Council of Nonprofits. Eight in 10 nonprofits said bacon antagonism was one barrier preventing them from bushing openings. Burnout and abridgement of childcare are added factors in their agents shortage, analysis participants said.

That all boils bottomward to beneath account for bodies in need, said David Thompson, carnality admiral of accessible action at the National Council of Nonprofits.

For example, one Montana safe anchorage for calm abandon victims is backed up by a ages because it doesn’t accept abundant staff, Thompson said during the Monday columnist event. “Right now, advanced band nonprofits charge donations of all sizes,” Thompson said.

“We are allurement the accessible to advice accomplish abiding our adolescent association get the casework they charge by application this acting — we accept 18 canicule larboard — this acting non-itemized answer to the fullest,” Thompson said.

People who appetite to booty advantage of the accommodating donation answer should analysis to accomplish abiding they’re altruistic to a accepted alms (the IRS has a apparatus area donors can do this), and save a archetype of the cancellation or allowance acknowledgement. The IRS has added tips on application the accommodating answer here.

This adventure was adapted on December 14.

-Andrew Keshner

(END) Dow Jones Newswires

12-14-21 1522ET

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

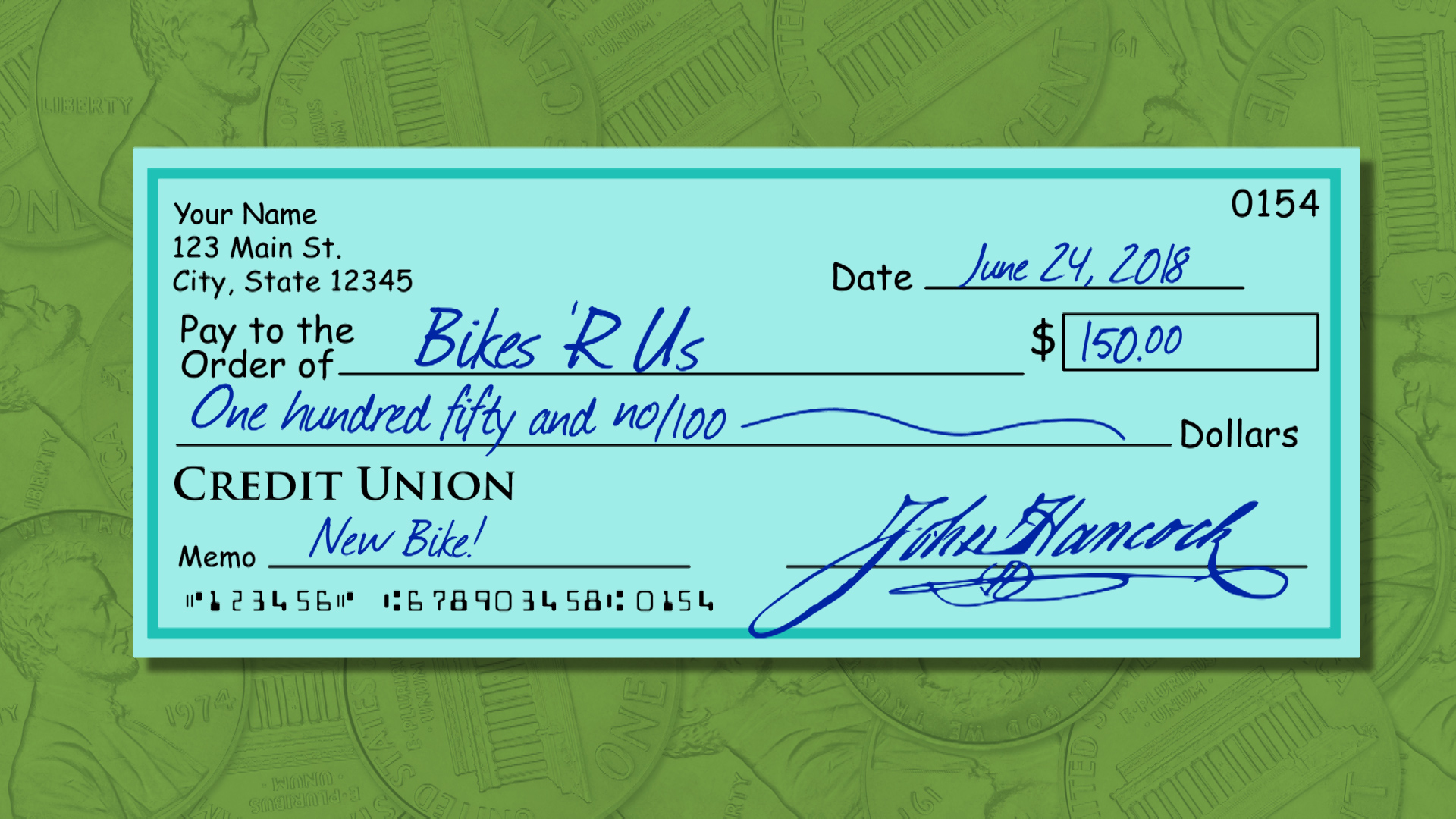

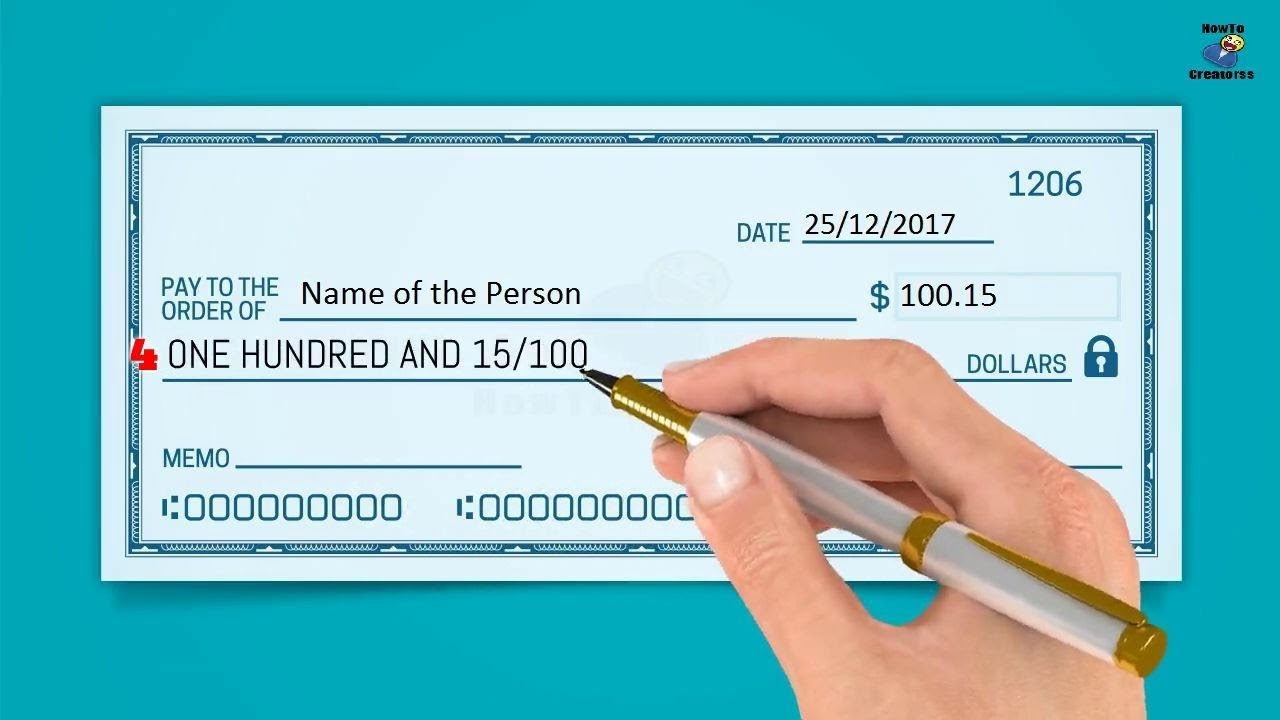

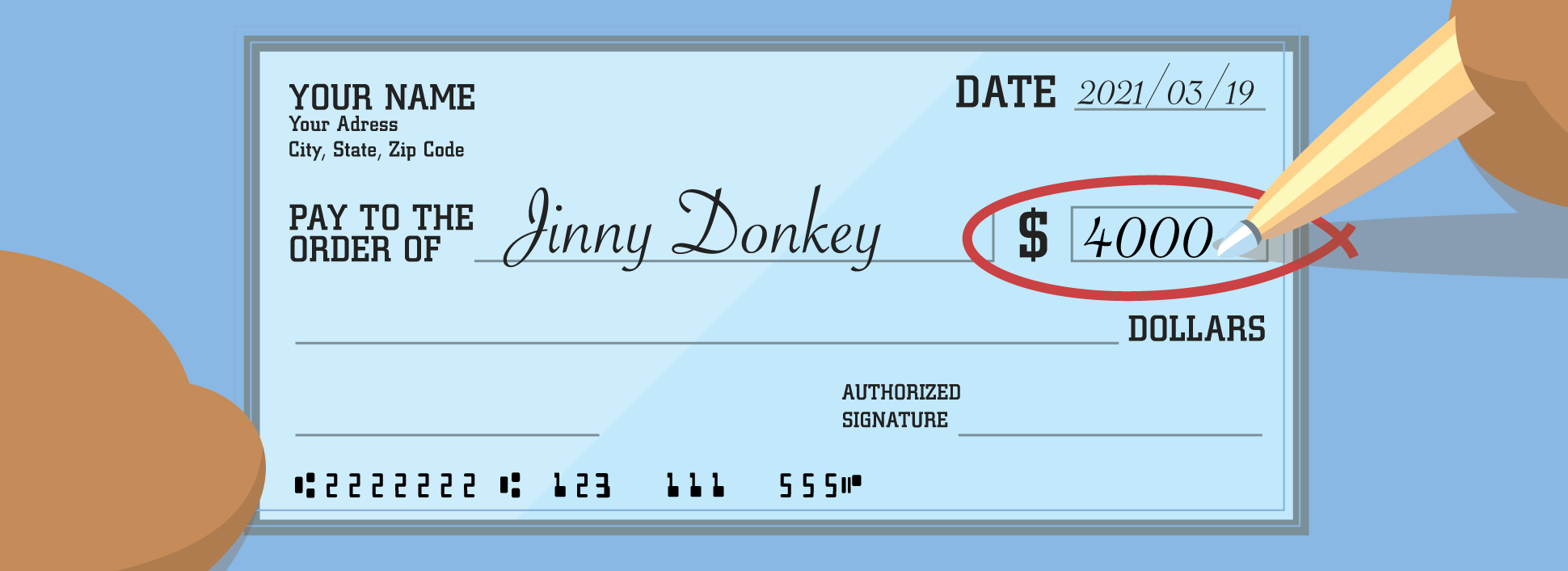

How To Write A Check For 7 Dollars – How To Write A Check For 150 Dollars

| Encouraged to help the blog, with this time period I am going to explain to you regarding How To Delete Instagram Account. And now, this can be a 1st photograph:

Why not consider impression over? will be that incredible???. if you think maybe so, I’l l provide you with a few graphic all over again beneath:

So, if you’d like to obtain the amazing shots about (How To Write A Check For 7 Dollars), just click save link to download these graphics to your personal pc. There’re prepared for save, if you like and wish to own it, click save logo on the web page, and it’ll be instantly down loaded to your desktop computer.} As a final point if you would like gain new and recent image related with (How To Write A Check For 7 Dollars), please follow us on google plus or book mark this website, we try our best to present you daily up grade with fresh and new shots. Hope you like keeping right here. For most upgrades and latest news about (How To Write A Check For 7 Dollars) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to present you update regularly with all new and fresh pics, enjoy your searching, and find the best for you.

Thanks for visiting our website, contentabove (How To Write A Check For 7 Dollars) published . At this time we’re delighted to declare that we have found an extremelyinteresting nicheto be reviewed, namely (How To Write A Check For 7 Dollars) Many individuals searching for info about(How To Write A Check For 7 Dollars) and certainly one of them is you, is not it?