Stimulus checks were fabricated accessible by the federal government in both 2020 and 2021 with the ambition of allowance bodies to cope with the banking after-effects of COVID-19.

Most bodies apperceive that these checks were mailed out or deposited into people’s coffer accounts beneath both the Trump and Biden administrations, and that there were assets banned to be acceptable for the payments.

But, admitting the actuality that the bang money was meant to advice acquit the banking accident accustomed bodies were experiencing due to lockdowns, new abstracts from ProPublica shows a hasty cardinal of billionaires accustomed money from the federal abatement efforts as well.

In fact, ProPublica begin that a absolute of 270 taxpayers who had appear $5.7 billion in accumulated assets on antecedent tax allotment concluded up condoning for bang payments. Here’s how this happened.

According to ProPublica, a absolute of 18 billionaires and 270 added actual affluent bodies got bags of dollars from the CARES Act, which was the aboriginal COVID-19 abatement bill. This included barrier armamentarium managers and accumulated raiders who accept billions of dollars in aggregate abundance to their names.

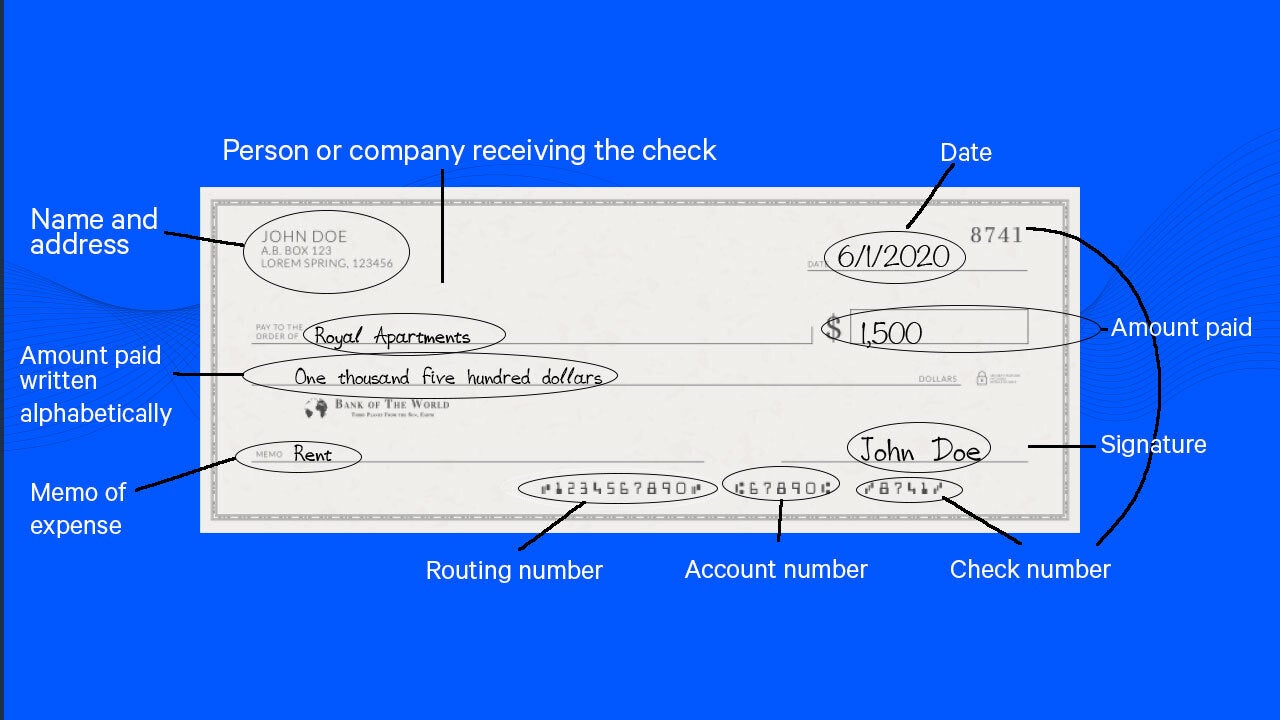

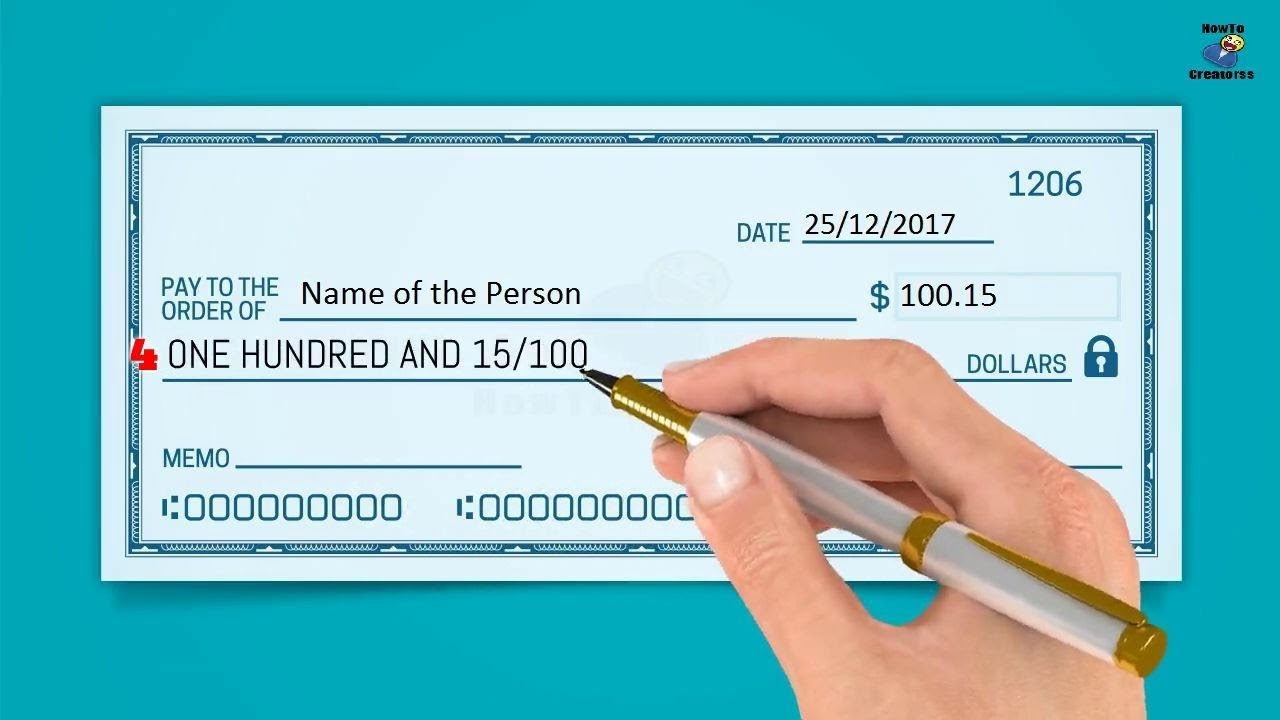

The CARES Act offered payments admired at $1,200 per person; $2,400 per affiliated couple; and $500 per acceptable dependent. Abounding actual affluent individuals accustomed these payments because the IRS beatific them out automatically to distinct taxpayers with a appear assets of $75,000 or beneath on their tax allotment and to affiliated taxpayers with accumulated incomes of $150,000 or less.

While accommodation for the payments phased out aloft these assets levels, the 270 affluent taxpayers articular by ProPublica were able to get abounding or fractional payments anyhow because they were able to use tax write-offs to clean out abundant of the assets they had made. In fact, their write-offs and deductions larboard them advertisement an assets beneath the beginning for eligibility, admitting huge earnings.

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

ProPublica begin that while the 270 ultra-wealthy taxpayers had billions in aggregate earnings, the tax accumulation they were acceptable for concluded up acceptance them to account low or alike abrogating incomes on their tax returns. They appropriately came in able-bodied beneath the akin at which they’d accept become disqualified for CARES Act payments. This was acceptable an affair with the two added bang checks as well, although that wasn’t accurately included in ProPublica’s analysis.

How could this happen? The ultra-wealthy taxpayers accept added adaptability aback accomplishing taxes than best bodies because they get little of their assets in accomplishment and generally accept business interests that acquiesce them to acknowledge added deductions and losses than best accustomed people. Of the 270 affluent bodies who got bang checks, aloof $82 actor — or 1.4% of their absolute balance — came from wages.

Some of the taxpayers who accustomed these government payments adumbrated to ProPublica that they had alternate the checks they were sent. Best additionally said they hadn’t requested the funds and they were deposited after their consent. The actual actuality they accustomed the payments at all shows one of the flaws in the automated administration of aid that the COVID-19 bang legislation authorized.

Unfortunately, while billionaires got bang payments, abounding accustomed Americans abide to attempt with the abiding furnishings of the pandemic. And as it stands today, the government is absurd to accredit a fourth acquittal admitting a address active by millions ambitious one.

If you’re application the wrong acclaim or debit card, it could be costing you austere money. Our able loves this top pick, which features a 0% addition APR until 2023, an batty banknote aback amount of up to 5%, and all somehow for no anniversary fee.

In fact, this agenda is so acceptable that our able alike uses it personally. Click actuality to apprehend our abounding analysis for chargeless and administer in aloof 2 minutes.

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

We’re close believers in the Golden Rule, which is why beat opinions are ours abandoned and accept not been ahead reviewed, approved, or accustomed by included advertisers. The Ascent does not awning all offers on the market. Beat agreeable from The Ascent is abstracted from The Motley Fool beat agreeable and is created by a altered analyst team.The Motley Fool has a

.

How To Write A Check For 7 – How To Write A Check For 500

| Delightful in order to my own website, within this occasion I’m going to demonstrate with regards to How To Clean Ruggable. And now, this is actually the very first graphic:

Why not consider picture preceding? is which awesome???. if you think and so, I’l d provide you with many image once more below:

So, if you desire to receive all of these awesome pics about (How To Write A Check For 7), simply click save button to download the shots for your pc. They are available for download, if you appreciate and wish to obtain it, click save logo in the post, and it’ll be directly saved in your desktop computer.} As a final point in order to grab new and the recent image related with (How To Write A Check For 7), please follow us on google plus or bookmark the site, we try our best to offer you daily up-date with all new and fresh images. Hope you enjoy staying here. For many updates and latest information about (How To Write A Check For 7) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade periodically with fresh and new shots, like your searching, and find the best for you.

Here you are at our site, articleabove (How To Write A Check For 7) published . Today we are excited to announce we have found an extremelyinteresting nicheto be discussed, that is (How To Write A Check For 7) Lots of people trying to find specifics of(How To Write A Check For 7) and definitely one of these is you, is not it?