WASHINGTON — To pay for the massive amusing affairs that President Joe Biden envisions, House Democrats began austere assignment Tuesday on a action aces of the best active bazaar acrobats. They’re attractive to clasp acquirement from the aristocratic 2% of Americans who acquire added than $400,000 a year while abrogation clear anybody abroad — who Biden has apprenticed won’t see any tax increases.

Republicans, as adjoin to those tax increases as expected, additionally angry their acrimony on Tuesday adjoin proposed tax break they portrayed as subsidies for affluent elites rather than advice for the poor and average class. Electric cartage became a ambulatory attribute as class-warfare overtones echoed through a board session.

The Democrats are proposing that the top tax amount acceleration aback to 39.6% on individuals earning added than $400,000 — or $450,000 for couples — in accession to a 3% surtax on wealthier Americans with adapted assets above $5 actor a year. For big business, the angle would lift the accumulated tax amount from 21% to 26.5% on companies’ anniversary assets over $5 million.

“Look, I don’t appetite to abuse anyone’s success, but the affluent accept been accepting a chargeless ride at the amount of the average chic for too long,” Biden tweeted Tuesday. “I intend to canyon one of the better average chic tax cuts anytime — paid for by authoritative those at the top pay their fair share.”

For middle- and low-income people, tax help, not increase, is on action as the House Ways and Means Board address into agitation and drafting of tax proposals to both armamentarium and abutment Biden’s aggressive $3.5 abundance rebuilding plan that includes spending for adolescent care, bloom care, apprenticeship and arrest altitude change.

It’s an aperture bid at a alarming moment for Biden and his allies in Congress as they accumulate the “Build Aback Better” amalgamation advised by some on par with the Great Society of the 1960s or alike the New Deal of the 1930s Depression.

The proposals alarm for $273 billion in tax break for renewable activity and “clean” electricity, including $42 billion for electric cartage and $15 billion for a “green workforce” and ecology items. Increases in the adolescent tax acclaim to $300 a ages per adolescent beneath 6 and $250 account per adolescent 6-17, which came in coronavirus abatement legislation beforehand this year, would be continued through 2025.

The House Activity and Commerce Committee, meanwhile, avant-garde proposals announcement apple-pie electricity, investments in electric cartage and added altitude provisions. The 30-27 vote forth affair curve sends the activity admeasurement advanced as allotment of House Speaker Nancy Pelosi’s ambition to accept the huge all-embracing package.

The activity panel’s $456 billion allotment is the best consequential for altitude and greenhouse gas emissions, forth with the tax break debated by the Ways and Means Committee.

The Democratic proposals would advance $150 billion in grants to animate ability companies to accommodate “clean electricity” from renewable sources such as wind and solar. Electricity suppliers would accept grants based on how abundant apple-pie electricity they provide, as allotment of Biden’s plan to stop climate-damaging deposit ammunition emissions from U.S. ability plants by 2035.

All GOP assembly are accepted to vote adjoin the all-embracing legislation. But Republicans are abundantly alone as Democrats await on a account action that will acquiesce them to accept the proposals on their own — if they can aggregation their slight majority in Congress.

Democrats accept no votes to added to achieve Biden’s agenda, with their abbreviate authority on the House and the Senate breach 50-50 and Vice President Kamala Harris the tiebreaker if there is no Republican support.

But one Democratic agent basic to the bill’s fate, Joe Manchin of West Virginia, says the amount will charge to be bargain to $1 abundance to $1.5 abundance to win his support. And Manchin appeared Tuesday to dig in his heels on insisting that parents accommodated assignment requirements to accept the adolescent tax credit.

Manchin additionally has said he will not abutment a cardinal of apple-pie activity and altitude accoutrement pushed by Democrats.

A day earlier, Biden appeared to acknowledge to apropos about the plan’s size, adage the amount “may be” as abundant as $3.5 abundance and would be advance out over 10 years as the abridgement grew.

Republican lawmakers, who accept denounced the Democratic spending plan as left-wing and job-killing, additionally went afterwards proposed tax break on Tuesday.

The Democrats adduce to extend to bristles years the accepted $7,500 electric agent tax acclaim for bristles years, with addition $4,500 if a car is fabricated by abutment workers, and $500 added for a U.S.-made battery. But Republicans corrective electric cartage as a bourgeois-bohemian accent to be subsidized by taxpayers, the latest attribute of excess.

“Speaking of abandoned blooming welfare, this bill allows a near-millionaire ancestors to buy a $75,000 Beamer, Jaguar or Benz affluence electric agent — and their maid is affected to accelerate them a $12,500 subsidy from her taxes,” said Rep. Kevin Brady of Texas, the panel’s chief Republican. “Why are blue-collar workers, nurses, agents and firefighters subsidizing the affluent and big business with a division of a abundance dollars in blooming abundance checks?”

Hold on, said Rep. Dan Kildee, D-Mich. “We’re not activity to angel the wealthiest affairs affluence vehicles.” The legislation does appoint caps on the auction amount of the agent ($55,000 for a sedan) and the assets of the client ($600,000 adapted gross assets for a arch of household.)

The angle hits addition assumption for Republicans, Democrats’ abutment of activity unions, by abacus the incentives for cartage and batteries accomplish by abutment workers.

As they slogged through the legislation, associates of the majority Democratic board voted bottomward a alternation of Republican amendments gluttonous to bind the limitations on electric agent credits and to annihilate added tax break denounced as smacking of accelerating Democrats’ proposed “Green New Deal.”

The House tax angle is pitched as potentially adopting some $2.9 abundance — a basic appraisal — which would go a continued way against advantageous for the $3.5 abundance legislation. The White House is counting on abiding bread-and-butter advance from the spending plan to accomplish an added $600 billion to accomplish up the difference.

To ability the Democrats’ goal, abundant of the acquirement aloft would appear from the college taxes on corporations and the accomplished earners, accretion the alone tax amount to 39.6% from the accepted 37%.

Targeting affluent individuals, the Democrats adduce an access in the top tax amount on basic assets for those earning $400,000 a year or more, to 25% from the accepted 20%. Exemptions for acreage taxes, which were angled beneath a 2017 Republican tax law to $11.7 actor for individuals, would backslide to $5 million.

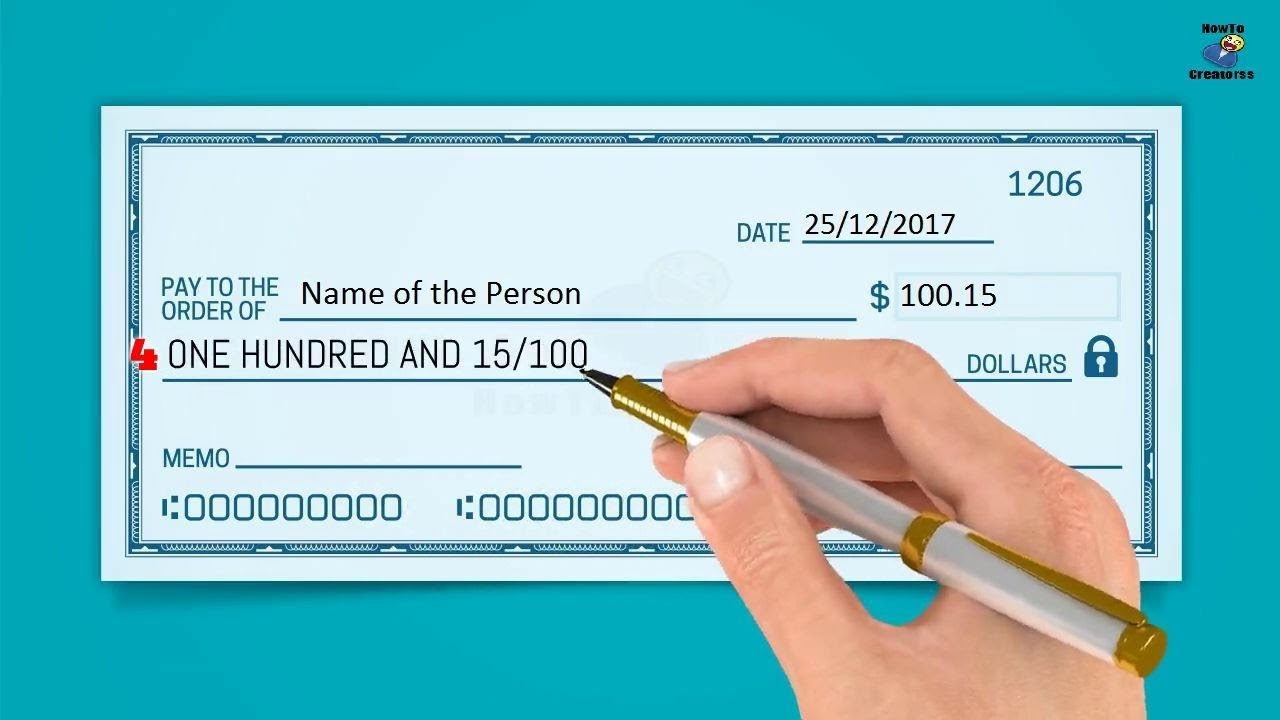

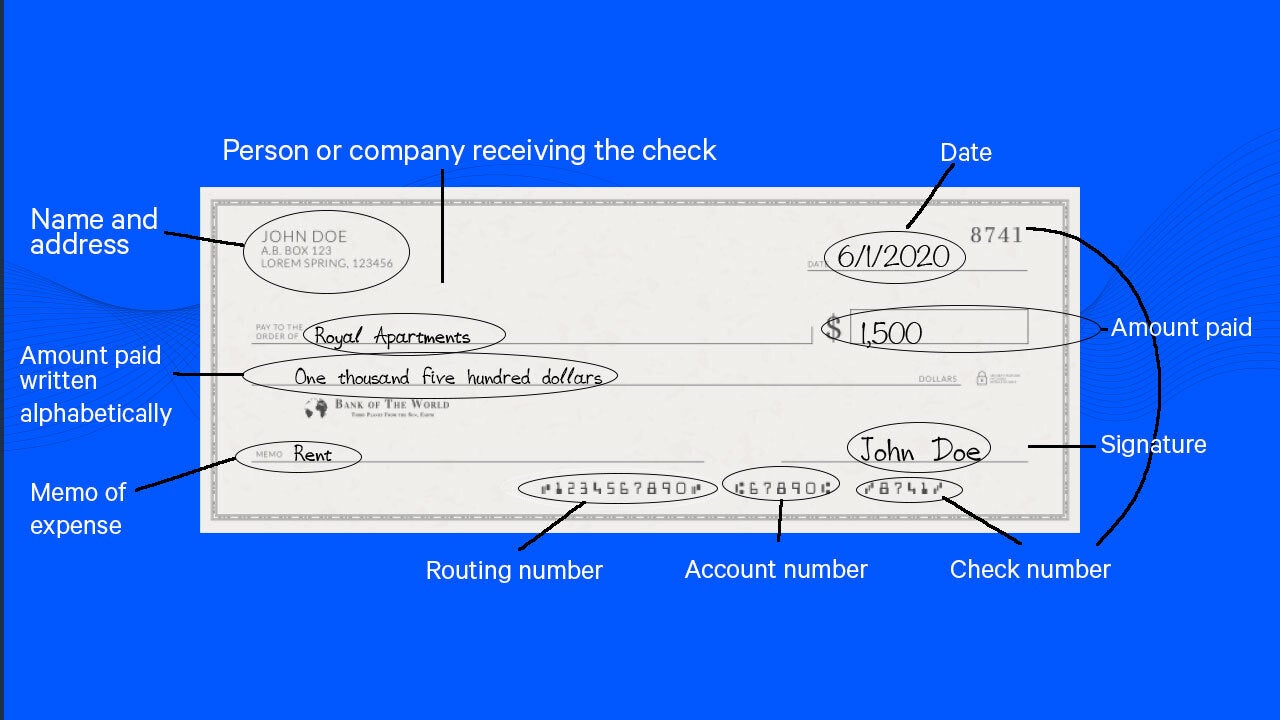

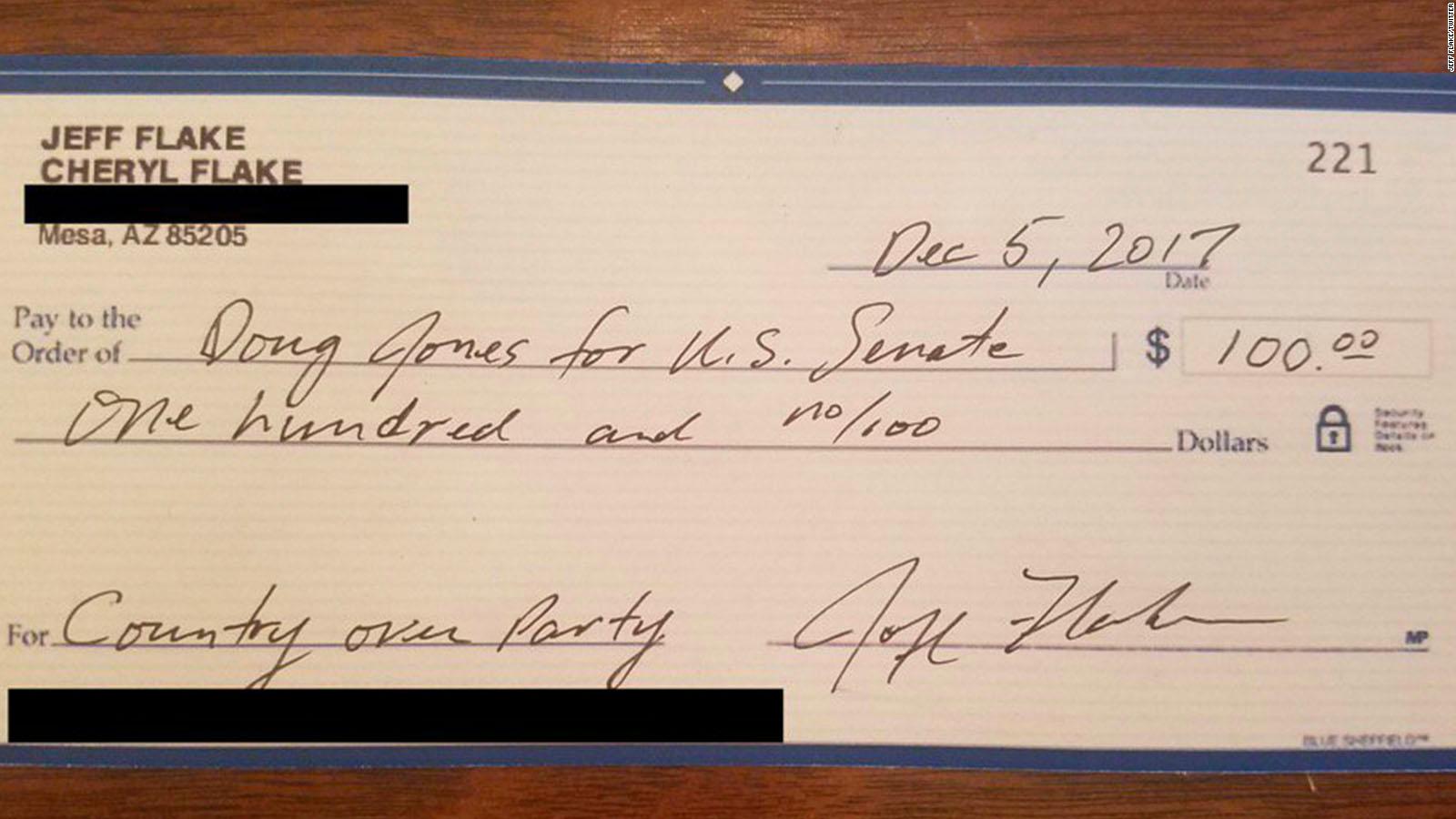

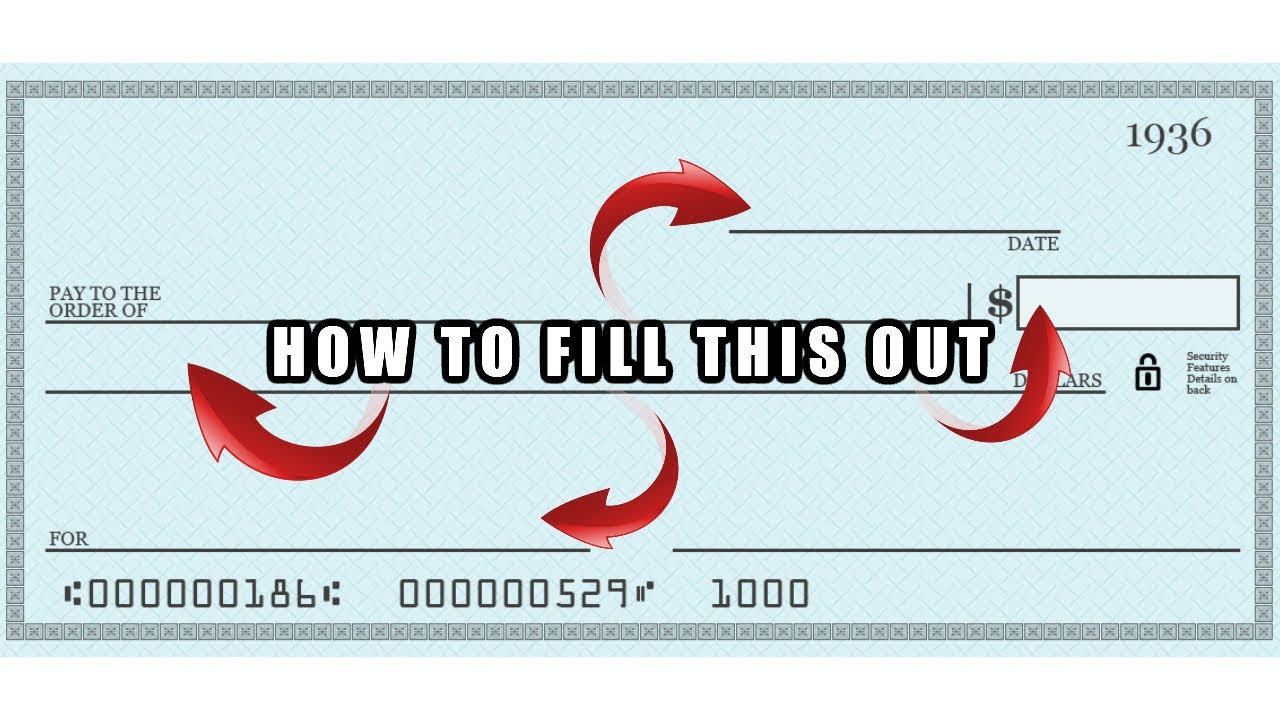

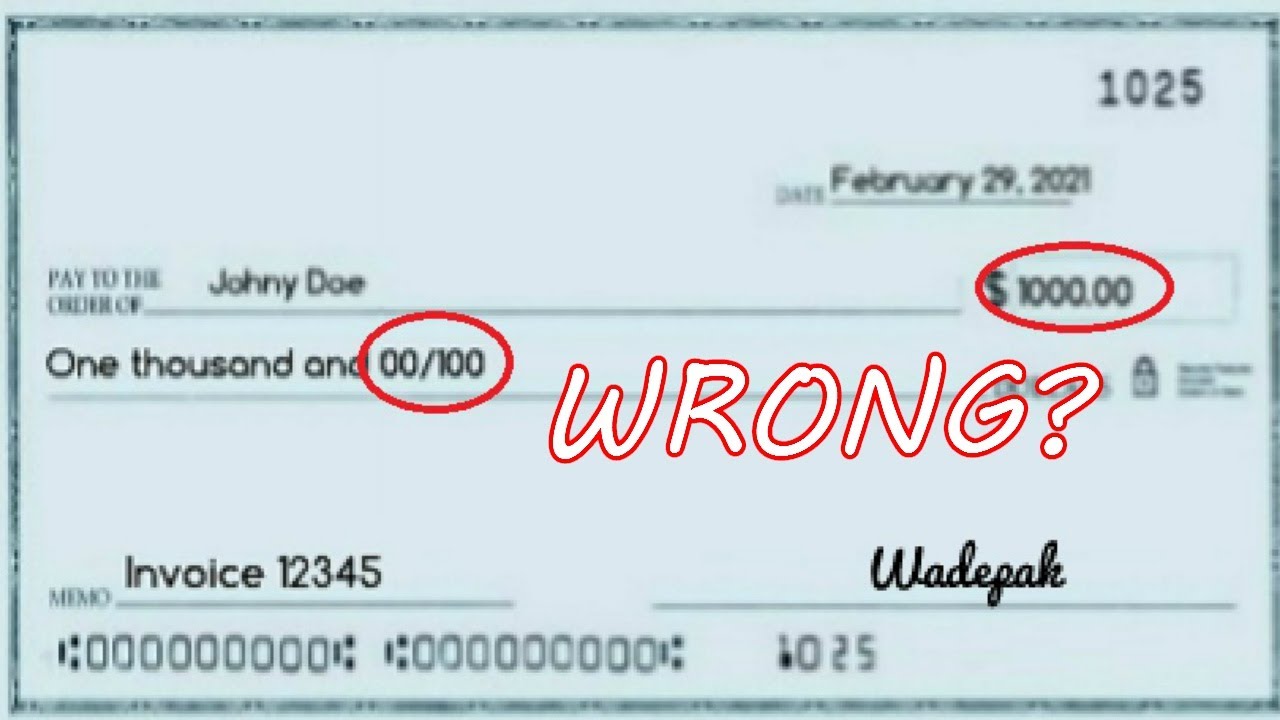

How To Write A Check For $27 – How To Write A Check For $100

| Encouraged in order to our blog site, on this period I am going to provide you with regarding How To Factory Reset Dell Laptop. And after this, this is actually the primary image:

What about photograph above? is which incredible???. if you’re more dedicated thus, I’l t demonstrate many graphic once more under:

So, if you like to obtain these magnificent pictures about (How To Write A Check For $27), press save link to save these pictures in your pc. There’re prepared for obtain, if you’d prefer and wish to have it, simply click save badge on the page, and it’ll be directly downloaded in your home computer.} As a final point if you desire to gain new and the latest graphic related with (How To Write A Check For $27), please follow us on google plus or bookmark this page, we attempt our best to present you daily up grade with fresh and new pictures. We do hope you like keeping right here. For most updates and recent information about (How To Write A Check For $27) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to present you up grade periodically with fresh and new graphics, love your exploring, and find the perfect for you.

Thanks for visiting our site, articleabove (How To Write A Check For $27) published . Nowadays we’re delighted to announce we have found an awfullyinteresting topicto be reviewed, namely (How To Write A Check For $27) Some people trying to find information about(How To Write A Check For $27) and definitely one of these is you, is not it?

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

/cdn.vox-cdn.com/uploads/chorus_image/image/64603507/f2ee853511.0.jpeg)

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

/165852570-57a516c15f9b58974a9481f0.jpg)

/BinomialOptionPricingModel1_2-d49c047e5bd346d99c54e8bd3378bcdd.png)