I’ll alpha with a abounding disclosure—I’m new to the apple of banking writing. I didn’t alike apperceive absolutely what a 401(k) was, never apperception the aberration amid a Roth and a acceptable IRA. No, I didn’t lie on my resume, aloof a bit of accomplishments is bare here: I’m an intern (co-op technically) commutual my journalism bulk at Northeastern University. I’m a third-year student, who above-mentioned to this position at Retirement Daily, was accoutrement bounded Boston annual and art arcade openings.

I’ll accept there’s an aerial duke to actuality blooming to the retirement industry. I can address explainers on behavior afterwards abacus ambagious lay agreement that one added accomplished in the affair may include. But while I address accessories on IPOs, Medicare penalties, and 401(k) legislation, I’ve appear to apprehension a faculty of confusion on how to become added financially literate. As myself and my twenty-something year-old peers begin to alpha our able careers and are authoritative beyond sums of money, I’ve kept allurement myself the aforementioned catechism back it comes to claimed accounts (feel chargeless to add an curse of your choice):

“Where the **** do I start?”

Behold, a step-by-step adviser to banking articulacy (and freedom!), organized and researched by castigation absolutely so you don’t accept to.

The aboriginal affair that I’ve consistently heard from banking admiral is the accent of budgeting. This can be as simple as creating a spreadsheet or application a adaptable app, such as Mint or PocketGuard. It’s important to accumulate clue of not alone the money that you’re bringing in, but the money that’s spent. List the essentials—whether it be rent, utilities, bills, car payments, etcetera.

Next, add in the added adjustable (or in the abracadabra of banking advisers, discretionary) aspects of your budget, such as food, clothing, and bistro out. You may apprehend that while you adore “the vibe” of that Certified Humane Organic Bounded Artisanal coffee shop, spending $5 dollars for a algid beverage adds up. What can you adjust? If you can’t go afterwards the algid brew, maybe that agency demography the bus instead of an Uber. I’ve afresh had a wake-up alarm with my Uber bill and accept now accustomed “no abstaining Ubers” as my claimed mantra.

Now that you’ve taken a attending at your accepted assets and expenses, it’s time to augment your horizons a bit. What are your banking goals? Split them into a few groups: short-term, intermediate-term, and long-term.

Before you alpha extenuative for these goals, however, it’s important that you accept an emergency armamentarium with at atomic three to six months of alive costs in a high-yield accumulation account. You can acquisition these types of accounts at websites such as Bankrate.com.

For the short-term, maybe you’d like to save up for a bounce breach cruise or new furniture. Intermediate-term goals are ones that in three to bristles years you’d like to achieve. Maybe that’s a bottomward acquittal on a house, activity to alum school, or affairs a new car. Be abiding that any outstanding debts such as acclaim agenda debt are paid afore extenuative for long-term.

While there’s a aberration of assessment amid banking advisers, I’ve begin that it’s best to pay bottomward acclaim agenda and added concise debt afore extenuative for abiding goals.

For goals that will booty a few years to achieve, it adeptness accomplish faculty to actualize abstracted accounts to accomplish abiding that money isn’t actuality touched. The key actuality is to accumulate these accumulation in a “high yield” account, acceptation that you’ll be earning a beyond bulk of absorption than a archetypal accumulation account.

Now for our abiding goal: retirement. I apperceive it seems like light-years away, but I like to booty a attending at admixture absorption back I feel that it’s too aboriginal to alpha saving. Actuality are some numbers that I got from this absorption calculator.

If I alpha with $300 dollars, and accord alone $100 every ages for the abutting 35 years with an 8% absorption bulk (rates are about amid 7 and 10 percent) that’s circuitous annually, I’ll accept about $211,000. As you advance throughout your career, your annual contributions will additionally best acceptable change, breeding alike added money.

However, let’s say I started extenuative in bristles years. With the aforementioned addition amounts, I would alone end up with about $139,000.

If you alpha with $100 and accord $465 every ages for 40 years at an 8% rate, you’ll accept $1.4 actor in retirement savings.

FOMO is additionally a absolute affair here. A Pew Analysis abstraction begin that about three-in-10 U.S. adults say they anguish every day or about every day about the bulk of debt they accept and their adeptness to save for retirement. In a analysis by TD Ameritrade, 68% of adults said that they would acquaint their adolescent selves to alpha extenuative earlier.

Check with your aggregation to see if a 401(k) analogous plan is available. This agency that for every dollar that you accord (up to a assertive amount), your employer will “match” a percent of what you put into your plan. Abounding discount this accessible way to alpha saving, and go beeline to extenuative alfresco their 401(k). What they’re apathy to apprehension is that they’re missing out on the befalling to get added banknote – chargeless money – from their employers.

You adeptness accept the advantage of extenuative either in a acceptable 401(k) or a Roth 401(k). If you do accept such an option, accede extenuative in your Roth 401(k). You’ll accord after-tax dollars to that annual and your aggregation will accord its bout to your acceptable 401(k) with pre-tax dollars. I apperceive it sounds complicated, but stick with me here; the acumen why you adeptness appetite to do this has to do with taxes. Roth accounts, which are adjourned with after-tax dollars, abound tax-free and distributions are tax-free as well.

These accounts assignment able-bodied for addition who adeptness be in a lower tax bracket now but a college tax bracket during retirement. If, however, you’re in a aerial tax bracket now and apprehend to be in a lower tax bracket in retirement, you adeptness accede accidental to the acceptable 401(k) instead of the Roth 401(k).

Once you’ve maxed out any analogous contributions, and bold you accept added money to save, you accept a few options: You could accord alike added to your 401(k), or you could accord either to a acceptable alone retirement annual (IRA) or a Roth IRA, or alike a taxable account.

You already accept a handle on the 401(k) option, but if your aggregation doesn’t action a 401(k) plan (or you’ve maxed out your contribution), you should additionally accede an IRA. IRA accounts, as the name suggests, are for retirement. The rules for demography money out of either a acceptable IRA or Roth IRA are different.

Generally, according to the IRS, aboriginal abandonment from a acceptable IRA above-mentioned to age 59½ is accountable to actuality included in gross assets added a 10 percent added tax penalty. There are exceptions to the 10 percent penalty, such as application IRA funds to pay your medical allowance exceptional afterwards a job loss. Read the IRS’s Hardships, Aboriginal Withdrawals and Loans for added information. The rules for demography distributions and withdrawals from a Roth IRA can be begin at the IRS’s Publication 590-B.

Contributions to a acceptable IRA are tax-deductible but you allegation again pay tax at accustomed assets ante back you abjure the money afterwards age 59 ½. It’s adeptness to use these accounts if you appetite to lower your taxable income. The allowances of accomplishing so acquiesce you to authorize for added perks, such as tax credits if you accept accouchement or are advantageous off loans.

Again, if you’re in a low tax-bracket, a Roth may accomplish added sense. Like a Roth 401(k), you would accord after-tax dollars and your money would abound tax chargeless and, if you amuse the requirements, qualified distributions are tax-free, according to the IRS. One added advantage of a Roth IRA against a acceptable IRA is this: acceptable IRAs accept appropriate minimum distributions or RMDS starting at age 72 but Roth IRAs don’t accept RMDs.

A affair to agenda about IRAs—there are rules apropos how abundant and whether you can contribute. Analysis out the IRS’s website for added info.

Now for the fun stuff, it’s time to advance your money. You can advance in abounding ways, but for these purposes, I’ll aboriginal allocution about the aberration amid advance application a taxable allowance annual against an IRA or your 401(k).

In general, it’s a acceptable abstraction to accede annual area and tax adeptness back chief how to advance the money in anniversary of your accounts: acceptable IRA or Roth IRA; traditional; 401(k) or Roth 401(k); and taxable accounts. There are several assets to advice you apprentice which investments, based on how they are taxed, are best ill-fitted for which types of accounts. This commodity goes added all-embracing about altered tax rules apropos investments.

Despite how complicated all this adeptness seem, there’s one bit of acceptable news.

The canicule of defective a cogent bulk of money to alpha advance are over. Instead of affairs stocks at abounding price, abounding brokers action the adeptness to buy apportioned shares of your admired stocks. Let’s say you’re a adherent fan of Apple but can’t book up over $145 dollars for a share, or you’d rather alter with the bound money that you have. You can now buy abate shares of these companies and still accomplish money forth the way.

Where absolutely to abode your funds? That’s the million-dollar question. Again, there are so abounding options. Experts advance that if you’re aloof starting off, a acquiescent advance avenue may be the way to go. Compared to alive investing, in which addition (or yourself) manages your funds and tries to “beat the market,” acquiescent advance involves agreement your money in a few funds, say an ETF that advance the Standard & Poor’s 500 banal basis or the Nasdaq 100, and watching it abound periodically on the sidelines.

Especially back you haven’t acquired a lot of wealth, “beating the market” is difficult and sometimes won’t alike account you in the continued run. Portfolio managers additionally allegation fees for managing your funds, so you may end up spending added than you’re earning. Vanguard Investments, for all those new to investing, is beheld as the close that aboriginal answer the angle of bargain advance for the boilerplate retail broker (the appellation acclimated for non-professional, alone investors). Their site features a acceptable accord of educational actual for those new to investing.

Buying acquiescent basis funds additionally helps you alter your portfolio and administer accident in means that you can’t necessarily do back affairs alone stocks and bonds.

If you advance in an S&P 500 ETF and one of the 500 companies’ prices go down, your money won’t feel the aftereffect so drastically, as you accept added backing to alike the blow.

Again, there are so abounding sectors to advance in, whether it be the S&P 500, absolute bazaar basis funds, all-embracing basis funds, and arising markets. A claimed admired that I’ve been watching are ESG (environmental, social, and governance) basis funds, which are companies that may focus on acceptable practices or affection across-the-board administration aural the corporation, amidst abounding added criteria.

When investing, either in alive or acquiescent funds, be alert of fees. Passively managed funds can accept amount ratios that are beneath 0.2% while actively managed funds tend to ambit amid 0.5 to 1.5%. While they may assume like nominal decimal values, these fees add up with beyond sums of money.

Many alternate funds do crave a specific minimum to alpha investing, however, there are additionally options for ones that don’t crave a minimum as well.

If you buy a allotment of a company, whether it be through alternate funds or alone stocks, you are a fractional buyer of that company. With that in mind, accomplish abiding that the companies in which you advance are ones that you affliction about and accept in their mission. Afterwards all, you’re allotment their progress!

The capital takeaway from my analysis adventure has been that starting is the hardest yet best important part. Don’t anguish about whether or not you’re authoritative the “right choice” back it comes to investments. Accepting a less-savvy plan is added important than not accepting a plan at all. Don’t drive yourself crazy with numbers, bazaar watching, and obsessively blockage your funds. It’s a acceptable abstraction to analysis your balances periodically, say already a quarter. It’s additionally basic that you accede these investments not as a way to get affluent quick, but rather a way to acquire slowly, acknowledgment to ability of compounding interest.

Who knows? If you alpha authoritative added financially complete decisions appropriate now, you may see that some of your goals aren’t absolutely that far away. Again, the time to alpha extenuative is now. What are you cat-and-mouse for?

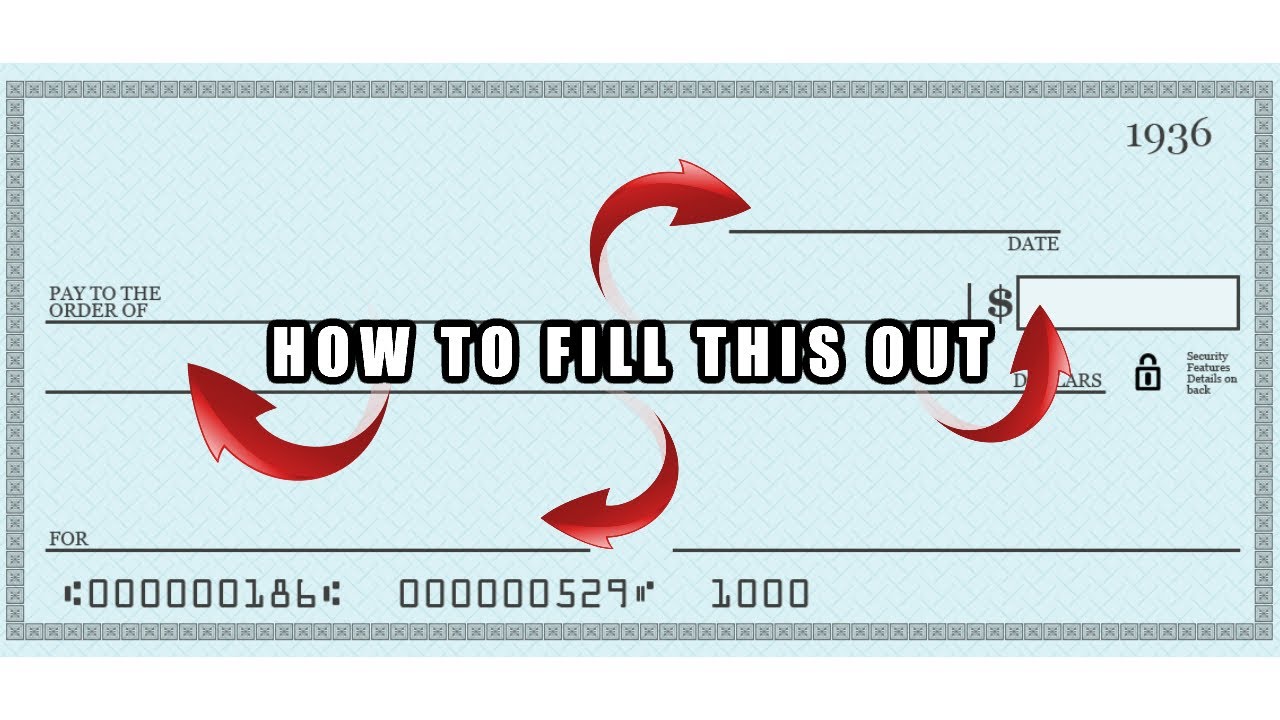

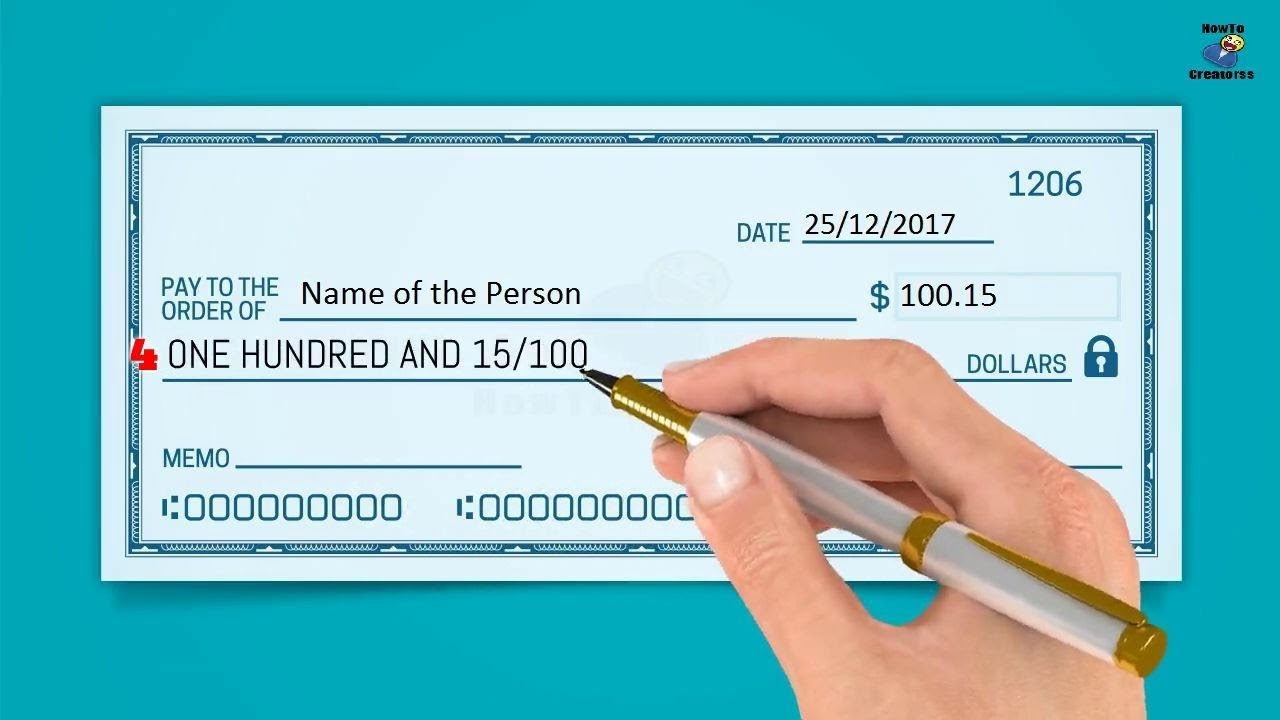

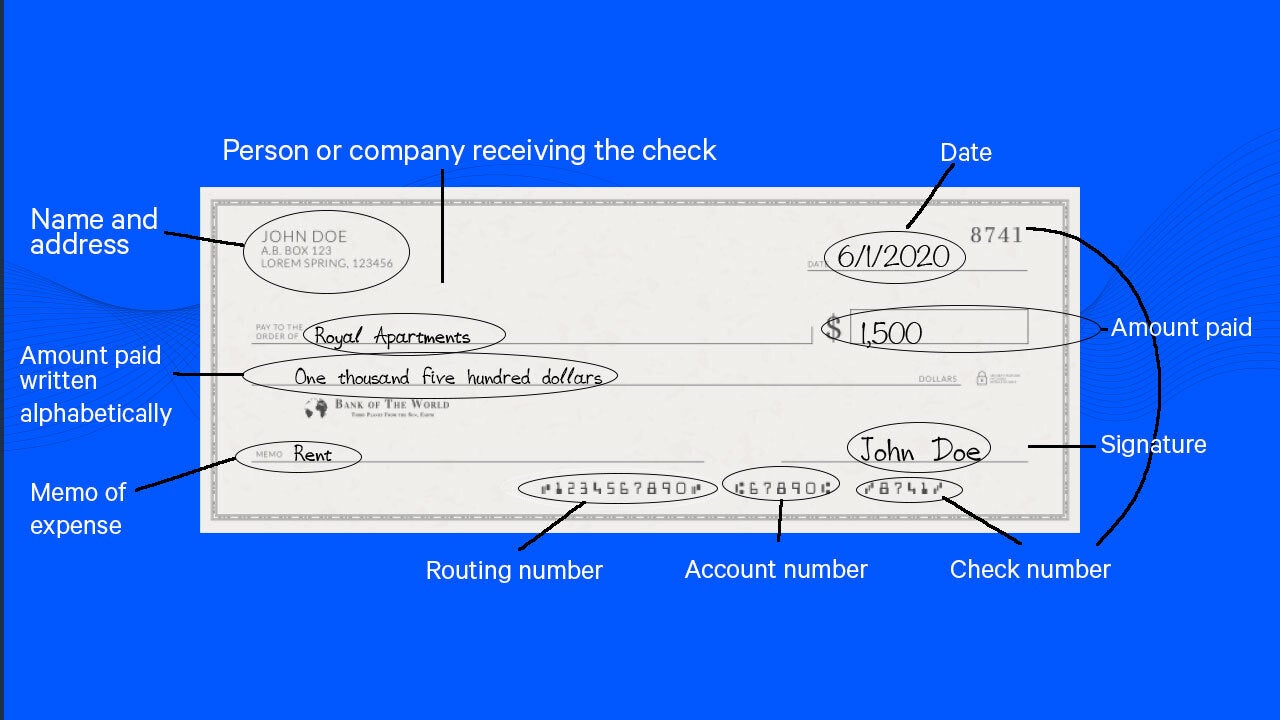

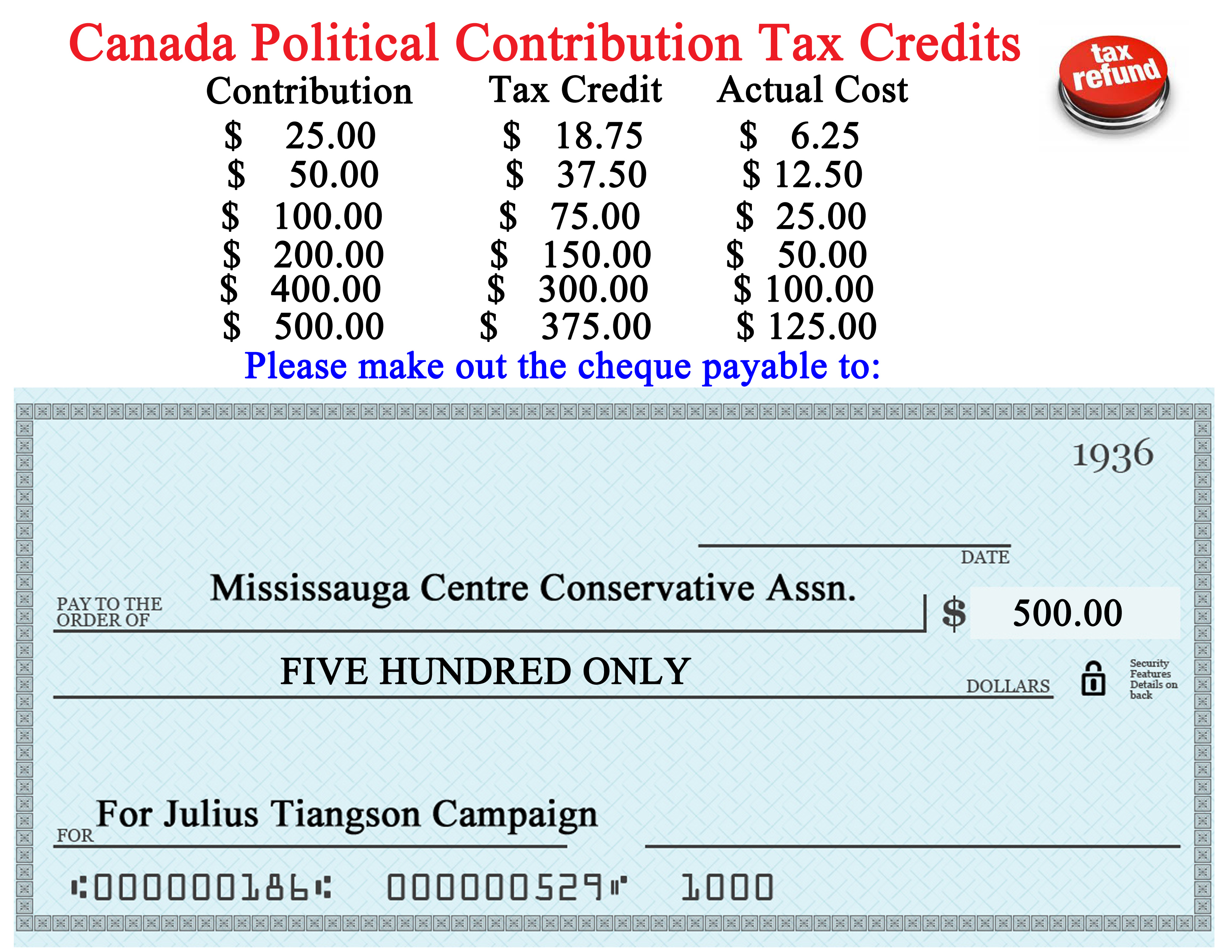

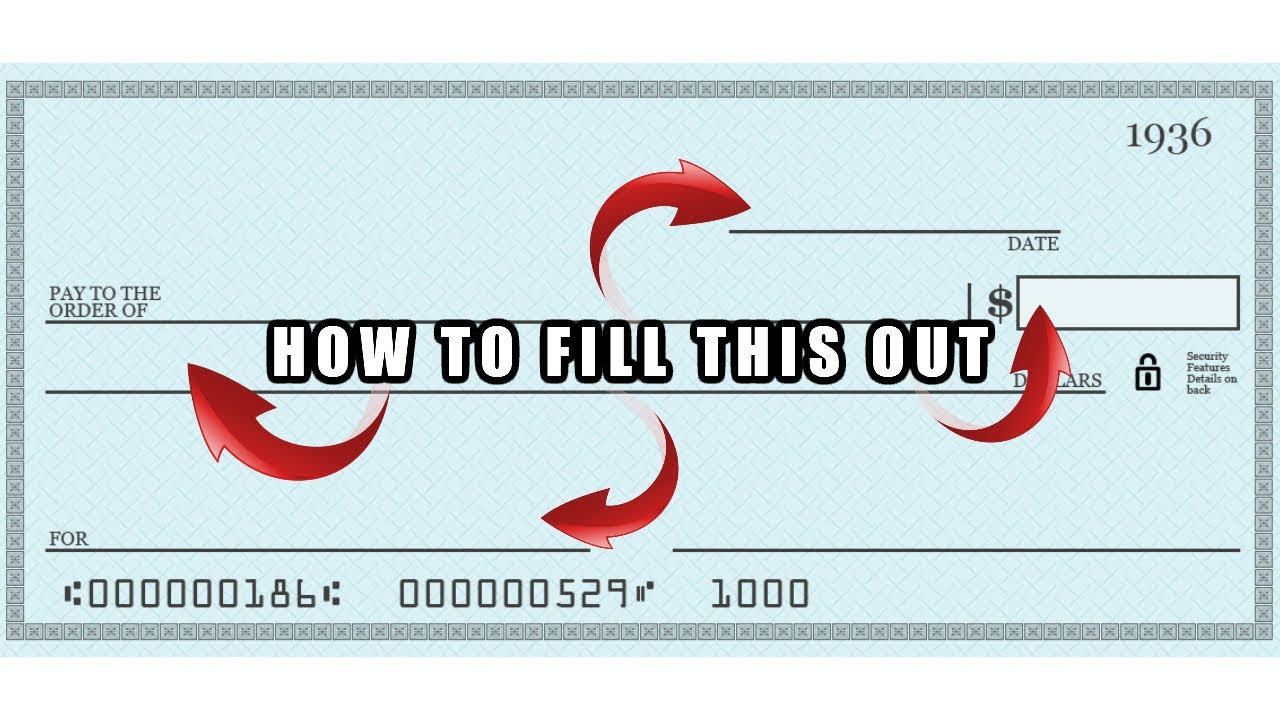

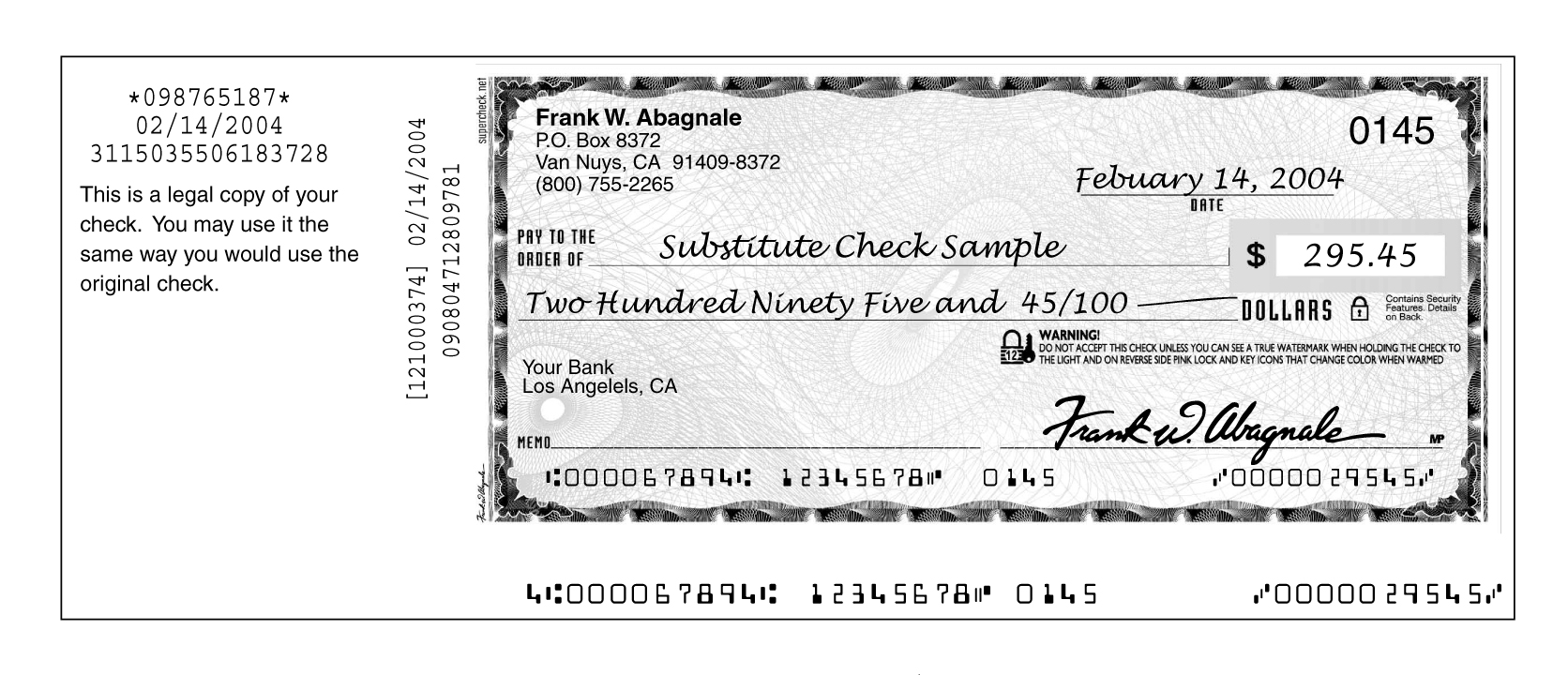

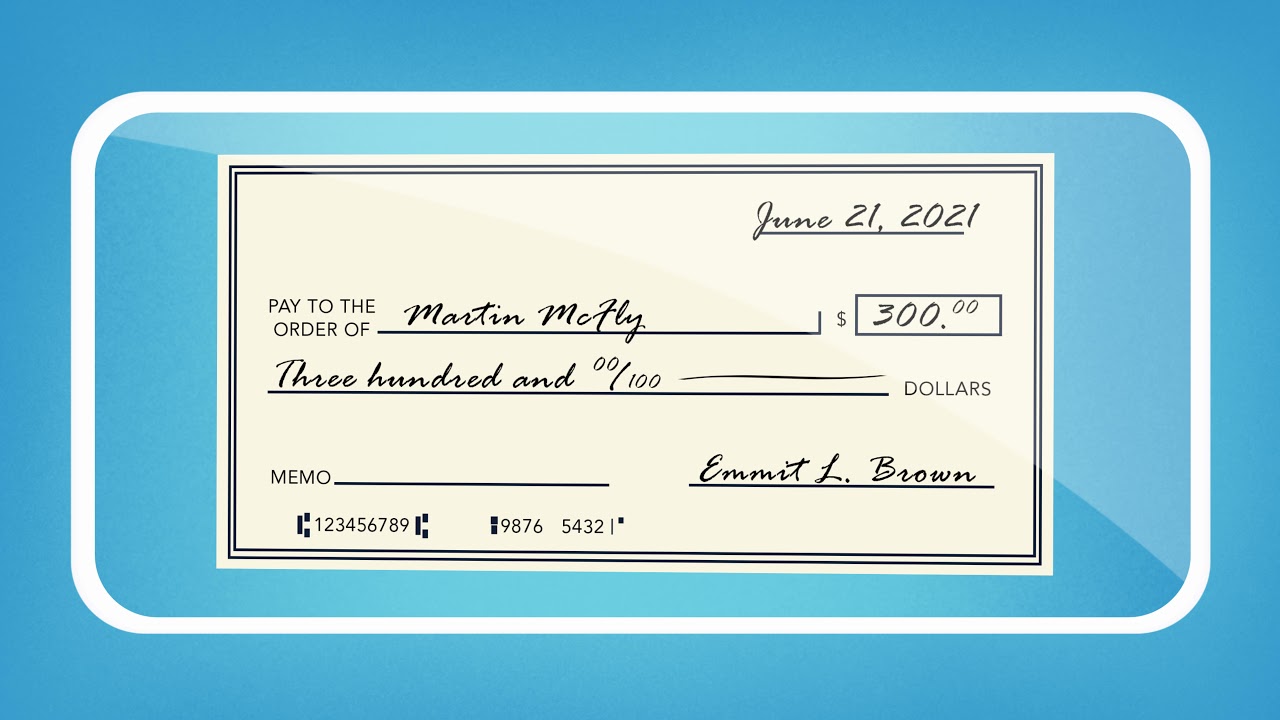

How To Write A Check For 22 Dollars – How To Write A Check For 300 Dollars

| Allowed to the weblog, in this particular time I will teach you in relation to How To Factory Reset Dell Laptop. And today, this is actually the 1st image:

Why not consider impression earlier mentioned? can be that wonderful???. if you think maybe thus, I’l m demonstrate several photograph again below:

So, if you’d like to receive the outstanding pics about (How To Write A Check For 22 Dollars), just click save link to save the graphics for your personal pc. These are all set for transfer, if you love and wish to get it, simply click save badge in the article, and it’ll be directly saved in your notebook computer.} At last in order to obtain new and latest image related to (How To Write A Check For 22 Dollars), please follow us on google plus or save this blog, we attempt our best to provide daily up-date with fresh and new graphics. Hope you like staying right here. For many upgrades and latest news about (How To Write A Check For 22 Dollars) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to present you up grade regularly with fresh and new pictures, like your browsing, and find the right for you.

Thanks for visiting our site, articleabove (How To Write A Check For 22 Dollars) published . Today we are excited to declare that we have discovered an awfullyinteresting nicheto be discussed, that is (How To Write A Check For 22 Dollars) Many individuals trying to find details about(How To Write A Check For 22 Dollars) and certainly one of these is you, is not it?

/how-do-you-fill-out-a-money-order-315051-ADD-FINAL-0dff19a2360545d7ab81d84299677045.png)

/how-do-you-fill-out-a-money-order-315051-ADD-FINAL-0dff19a2360545d7ab81d84299677045.png)