money-confidential-expert-Cameron-Huddleston

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

Sweety Wally Photography

Do you apperceive if your parents accept wills—and what their wishes are for who gets what? This week’s Money Arcane guest, Drew (not his absolute name), a 26-year-old active in Texas, anticipation his mother, who had terminal cancer, had a will fatigued up to let anybody apperceive how to breach up her estate. But aback she died and no will was found, a action began amid his ancestors and his stepfather over her estate. “She had a few little scribbles of cardboard of like, ‘Oh, I leave my abode to this adolescent of mine,’ but none of them were valid,” Drew says. “So there concluded up actuality no plan in place.”

Drew and his ancestors accept already spent added than $15,000 on advocate fees in their action over the estate, and they’re still not abutting to accepting resolution. “I absolutely apprehend it to apparently be, like, over $50,000 whenever this is all said and done,” he says. “I’ve drained a lot of my accumulation and I’ve had to cull from my 401k.”

Money Arcane host Stefanie O’Connell Rodriguez bankrupt Cameron Huddleston, banking announcer and columnist of Mom and Dad, We Charge to Talk: How to Accept Capital Conversations With Your Parents About Their Finances, about the charge to accept these conversations as anon as possible.

RELATED: Capital Capacity You Charge to Discuss With Your Aging Parents

Huddleston abstruse this assignment the adamantine way, aback her own ancestor died. “I accept no abstraction what his wishes were because he never put them in writing,” she says. “It wasn’t until my stepmother anesthetized abroad that I did get a few of my father’s accouterments and a lath that he acclimated to assignment at that was absolutely appropriate to me.”

If you die afterwards a will, your accompaniment about has one for you. And accompaniment law adeptness actuate that your money gets breach up in a way that you don’t appetite it to get breach up.

—Cameron Huddleston, columnist of Mom and Dad, We Charge to Talk: How to Accept Capital Conversations with Your Parents About Their Finances.

Story continues

Huddleston recommends authoritative abiding your parents not abandoned accept a will, but additionally a adeptness of advocate that gives you or addition amenable actuality the adeptness to footfall in if article happens. “If this certificate is not in place, afresh someone—possibly you—will accept to go to cloister to prove your ancestor is no best competent abundant to administer his or her finances,” she advises. “And this can be abundantly expensive. It can be emotionally challenging. It can booty a lot of time. One actuality I interviewed for my book concluded up spending nine months and $10,000 activity through this process. And in the meantime, he was accepting to pay for his father’s nursing home bills out of his own abridged until he could get admission to his dad’s coffer account.”

These can be afflictive conversations for families, so Huddleston recommends aggravating one of three approaches. Bring up your own affairs that you’ve fabricated (with conceivably a amalgamation to how the communicable has us all cerebration about what could happen), acknowledgment belief you’ve heard, like Drew’s, and how it has you cerebration about their plans, or erect ask for advice, and use that as a segue into these important conversations.

“Keep the chat activity by allurement added questions,” Huddleston says. “But again, the key actuality is to accomplish it attending like you’re attractive for admonition from your parents, because your parents are activity to feel adequate giving you, the child, advice. It avoids that role changeabout that is what absolutely trips up a lot of these conversations.”

Check out this week’s adventure of Money Confidential, “My mother died afterwards a will and I’ve spent over $15,000 (so far) aggravating to achieve her estate,” for added on how to advance these important capacity with your parents. Money Arcane is accessible on Apple podcasts, Amazon, Spotify, Player FM, Stitcher, or wherever you accept to your admired podcasts.

_____________________________________

Drew: Whenever she aboriginal got the analysis to whenever she passed, I anticipation that we’re all gonna assignment together. I never absolutely absurd that I would accept to face all these roadblocks.

Stefanie O’Connell Rodriguez: This is Money Confidential, a podcast from Absolute Simple about our money stories, struggles and secrets. I’m your host, Stefanie O’Connell Rodriguez. And today our bedfellow is a 26-year-old active in Texas who we’re calling Drew —not his absolute name.

Drew: I accept six siblings. The oldest one is 45 years old and the youngest one is 19 years old. We grew up in this baby boondocks in Texas and money, agnate to best people, it wasn’t absolutely anytime talked about. It’s advised rude. And my parents they were actual abundant in their affairs choices. They bought this absolutely big house. It was over 4,000 aboveboard feet. it had like seven bedrooms, and throughout my childhood, they aloof spent like bags and bags of money on renovations, and they bought jacuzzis, they bought new cars.

It didn’t absolutely like absolutely hit that they weren’t absolutely authoritative as abundant money to acquiesce all of these things until they absolutely got divorced. And I begin out that both of them were in massive amounts of acclaim agenda debt, like tens of bags of dollars.

Stefanie O’Connell Rodriguez: Did you accept a apperception of what tens of bags of dollars of acclaim agenda debt absolutely meant at the time?

Drew: No. No. So I was 14 years old whenever they got a annulment and you apperceive whenever you’re a teenager, you anticipate that like alike a hundred dollars is advised like a lot of money.

So aback I was 18, I went off to academy and I aloof bethink cerebration how can anybody acquiesce anything? Is everybody in acclaim agenda debt?

Stefanie O’Connell Rodriguez: Afterwards activity abroad for academy and graduating, Drew confused aback home to alive with his mother while he started attending for a job.

Drew: We saw anniversary added every day we were like absolutely abutting because I would consistently go out to eat with her all the time and consistently admonition her with stuff. But afresh I got like addition job breadth I absolutely confused out of the U S and to Thailand. And so I wasn’t as abutting to her, actuality in altered countries, altered time zones. but one of the things that I assumption brought us aback afterpiece calm was she was diagnosed with colon cancer. And so I was like, accept I’m aloof activity to like accomplishment out my teaching arrangement actuality in Thailand.

And afresh I’m activity to appear aback to the U S. But aback she begin out, they said it’s date four, it’s terminal and they didn’t accord an exact like, estimate, like, oh you know, this is aback you’re activity to pass. But they said like it’d apparently be about like two to bristles years like that you accept left.

Stefanie O’Connell Rodriguez: So accustomed that this was a terminal disease, was there any affectionate of accessible altercation about the banking planning and acreage planning associated with that?

Drew: Yeah, there was a little bit, but she was actual backstairs about money. She said like oh, hey these are like some of my affairs of what I appetite you to do afterwards I pass. But I approved to burrow added into it, like, hey, we charge to like plan this out exactly. We charge to say like, hey, this, this affair is activity here. This affair is activity there. And she was like, yeah I understand. And I approved to get her to do that several times, but she was actual backstairs afresh about her money, her assets, and she didn’t absolutely appetite to allocution about it whenever I approved to columnist her about it.

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

So she aloof consistently said oh, well, you know, it’s fine. I accept aggregate planned out. She had a few, like little scribbles of cardboard of like, like, oh, I leave my abode to this adolescent of abundance but none of them were like valid. So there concluded up actuality like no plan in place.

Stefanie O’Connell Rodriguez: Drew abstruse all of this aloof afterwards his mother anesthetized away, while authoritative burial arrange and allocation through her things.

Drew: There was aloof mountains aloft mountains, aloft mountains of paperwork and it took us several canicule to go through all of the altered papers. And we were aloof aggravating to acquisition this plan that she was talking about because originally she was like, I’ll put it in my chiffonier in my bedroom.

And afresh I attending there and this moment of agitation set in, because I looked in the chiffonier and annihilation was there.

Stefanie O’Connell Rodriguez: Are there added things you’re award as you’re activity through the paperwork that you didn’t expect?

Drew: Yeah, there was like a lot of hasty actuality that I begin I begin out that she had been affiliated like a absolute of bristles times.

I begin out that she had her aboriginal alliance aback she was still in aerial school. So that was shocking. And afresh I begin out about these assets that I never accomplished that she had.

It was additionally like a lot of abashing too. Aloof sitting there, activity through all of this stuff, like why couldn’t she be added forthcoming?

And not aloof like all the secrets that I uncovered, but aloof creating a will and authoritative abiding that aggregate was organized because article that bodies don’t absolutely acquaint you whenever like a admired one dies is that you’re accepting to accord with all of this stuff.

You accept your approved activity responsibilities, you accept your full-time job, your relationships and all of your miscellaneous, accustomed errands. And afresh now this new big affair gets befuddled into the mix and whenever she passed, I didn’t cry at first.

It didn’t appear until several months afterwards because you accept so abundant to do. I accept to basic the burial arrangements. I accept to accomplish abiding this gets done. You about accept to agenda in a time to grieve. Like okay, able-bodied I accept to do all of this paperwork aboriginal and afresh maybe I can like cry afterwards 8:00 PM tonight, already I’m all done.

After several canicule of attractive through the array of paperwork and acumen that there was no plan, people’s accurate intentions started to appear out.

My stepdad, her husband, who none of my ancestors had anytime had like a cool abutting accord with him, he started to get added aloof and he capital to booty ascendancy of everything. He didn’t appetite to go through the action of probate.

He said that the two cars that my mom had, those were absolutely his, that we shouldn’t get annihilation from them. He said that like any money that was larboard in my mom’s retirement account, that that was all his, that we shouldn’t get any of it. And he additionally said that the abode that they lived in that we, like us seven kids, that we didn’t own any of it, that the abode was absolutely his and that he advised to booty it fully.

Stefanie O’Connell Rodriguez: Did you wind up accepting to appoint an attorney?

Drew: Yeah. Which that’s addition affair bodies don’t realize, how crazy big-ticket it is whenever a actuality passes abroad afterwards a will. He was like it’s activity to be $4,000 for the retainer. And I thought, ‘Oh my gosh, this is so abundant money.’ And that was aloof the antecedent retainer. So afterwards about bristles months of him accomplishing acknowledged work, he said, ‘Hey, here’s addition bill.’

So, yeah, like it was addition bill for $3,600. So literally, anytime I’m alive with him, alike if I’m aloof giving like a buzz alarm to him for like 15 minutes, that’s like $88 appropriate there. In absolute I had to pay the accommodation up avant-garde $4,000. And afresh so far I’ve spent like $15,700.

And afresh I absolutely apprehend it to apparently be like, over $50,000 whenever this is all said and done.

Stefanie O’Connell Rodriguez: And are you acceptance that bulk alone? Are your ancestors allowance you?

Drew: That’s addition backbreaking affair everybody seems to be bankrupt whenever costs appear up. Best of my siblings, so like bristles out of the seven of us paid, like we anniversary disconnected up that antecedent $4,000 accommodation but all of the blow of the costs I’ve paid for out of my own pocket, which is acutely absolutely hard. I aloof I abhorrence it so much. I’ve drained a lot of my accumulation and I’ve had to like cull from my 401k. I abhorrence accepting to do that, but I basically accept been acceptance best of the costs, like for all of it I never absurd that cardinal one, that it would be so expensive. And afresh cardinal two, that I would be like acceptance best of the costs.

I try not to anticipate about it because it aloof makes me sad whenever I anticipate about like how abundant money I’m spending on this.

But at the aforementioned time I can’t aloof not anticipate about it, so maybe like already all of the assets are distributed, like already the houses are awash and like any added money is distributed, that it’ll all appear aback to me.

So I’ll be on like akin basement again. And I can put the money that I withdrew from my 401k aback into it. So I’m optimistic, but I don’t know. It’s aloof aggregate in this action has been absolutely capricious so far.

But I don’t absolutely accept any, anyone to angular on, like anyone to ask questions like what should I do here? What should I do there?

Especially because I don’t appetite to alive in Texas. Like I appetite to move abroad from Texas, I appetite to do added things with my life. But I aloof feel like this probate process—it’s aloof like befitting me like chained to breadth I am and it’s adamantine for me to alike plan annihilation out. Like I can’t say oh, you know, I can save up this bulk of money for affective and afresh I can move abutting summer or, or annihilation because like, I accept no abstraction yet.

I apprehend it to booty two years more, but I absolutely accept no abstraction how continued it could take. So I can’t absolutely absolutely plan my activity because there’s this massive affair that’s causing me to absorb a agglomeration of money. I can’t absolutely plan out my banking goals. I can’t absolutely aloof plan out my claimed goals. I aloof absolutely can’t plan out annihilation at all. Like I aloof accept to breach put and aloof accumulate signing the checks

Stefanie O’Connell Rodriguez: Roughly 2 in 3 Americans still do not accept capital acreage planning abstracts like a will according to a 2021 analysis —which can advance to aching and cher consequences, like those Drew has been ambidextrous with for the aftermost few years.

So afterwards the break, we’ll allege to claimed accounts announcer and columnist Cameron Huddleston, about how we can allocution to our admired ones about these capital abstracts and revisit our own banking plans, to abstain abrogation our admired ones in a agnate position.

Cameron Huddleston is a adept claimed accounts announcer and the columnist of Mom and Dad, We Charge to Talk: How to Accept Capital Conversations with Your Parents About Their Finances.

Cameron Huddleston: There are absolutely two affidavit why I wrote my book. One, my ancestor died at the age of 61 afterwards a will. And he was an attorney. He was in a additional marriage. He should accept accepted better. I accept no abstraction what his wishes were because he never put them in writing. It wasn’t until my stepmother anesthetized abroad that I did get a few of my father’s accouterments and a lath that he acclimated to assignment at that was absolutely appropriate to me. But we never had those conversations, never saw a acumen to ask my dad if he had a will. I anticipate in ample part, because I aloof affected that he did.

Then aback I was 35 and my mom was 65, she was diagnosed with Alzheimer’s disease. Again, I had not had any abundant conversations with her about her finances. So I aback had to clutter to get her in to accommodated with an attorney, to amend all of her acknowledged documents. And afresh I had to accept conversations with her about her affairs because I knew I was activity to be the one to accept to administer them for her as her anamnesis declined. And I eventually took over managing all of her money as her Alzheimer’s progressed.

And aback I fabricated that aboriginal footfall of allurement her to accommodated with an advocate to amend her acknowledged documents, she said, “Sure.” And this was absolutely a abundant abode to start, because affair with that third party, that professional, that actuality who wasn’t complex with our claimed lives but who was abutting her as this aloof able saying, “Okay, now you’ve got these abstracts in place. You accept alleged a adeptness of attorney, that is your daughter, and she can accomplish banking decisions for you. You charge to go to the bank. That’s the abutting footfall you charge to take. And you charge to booty that adeptness of advocate certificate and let the coffer know.”

So that advocate played array of a adviser for us. And my mother was accommodating to accept to the advocate because it wasn’t advancing from her babe necessarily. So accepting addition abroad say, “You charge to booty these abutting steps,” was cool helpful. And afresh I did accept to comedy detective a lot of the times because she was apathy things. So it’s a chat that needs to happen, but I apprehend a lot of bodies don’t accept these conversations until it’s too late.

Stefanie O’Connell Rodriguez: So accustomed that this is a chat that needs to appear Do you accept any specific accent or scripts that you acclaim bodies use to get started?

Cameron Huddleston: You could say to your parents, “This communicable has fabricated me absolutely anticipate about the charge to plan for emergencies.” And maybe you could use yourself as an example, as some of the things you’ve done. “I’ve fabricated abiding I’ve started ambience abreast money in an emergency fund. I’ve fabricated abiding that I accept activity insurance. I’ve fabricated abiding that I now accept a will. Mom and Dad, I’d adulation to apprehend what array of emergency planning you’ve done aloof in case there is an emergency and I charge to footfall in and admonition you.” So that’s one way to do it. You could use a story. Allocution about addition you know.

Say, “Hey, I was alert to this podcast. And there was this woman who was talking about how her dad died at the age of 61 afterwards a will. And it fabricated things absolutely difficult for their family.” If you’re absolutely adolescent yourself and aloof starting out, go to your parents for advice. And the key is by allurement these questions about what array of things you charge to do at your date of life, you’re activity to get acumen into what array of planning your parents accept done.

So for example, you adeptness say, “Hey, I aloof started a new job. Do I charge to be accidental to my retirement plan at work?” And your parents adeptness say, “Oh yes, you should absolutely do that because we didn’t save abundant for retirement. And now we’re aggravating to bulk out how we’re activity to alive calmly in retirement.” Well, that should advance to some added conversations. “Well, are you counting on amusing security? Are you planning on alive best then?” Accumulate the chat activity by allurement added questions. But again, the key actuality is to accomplish it attending like you’re attractive for admonition for your parents. Because your parents are activity to feel adequate giving you the adolescent advice. It avoids that role changeabout that is what absolutely trips up a lot of these conversations.

Stefanie O’Connell Rodriguez: So let’s say I get the chat started. What are the things I charge to accomplish abiding I awning in that conversation?

Cameron Huddleston: So you appetite to accomplish abiding you do booty this slowly. You don’t appetite to alpha assay your parents for every detail about their finances. And they adeptness not be accessible to accord you all those details, abnormally dollars and cents.

The key things you absolutely charge to acquisition out are, do your parents accept capital acreage planning documents? A will or a trust, article that spells out who gets what aback they die. Because if you die afterwards a will, your accompaniment about has one for you. And accompaniment law adeptness actuate that your money gets breach up in a way that you don’t appetite it to get breach up. So your parents charge to apprehend this. And a lot of bodies think, “Well, I don’t charge a will. My ancestors associates get forth great. They’re activity to array it out.” I can acquaint you that already money gets involved, ancestors associates don’t consistently get forth great. In fact, fights erupt, and bodies can end up in court. So it’s important to let your parents apperceive you charge to put your wishes in writing. Please don’t accomplish us guess. Please don’t accomplish us bulk it out, bulk out what you want. You acquaint us so that we can annual those wishes, and so that a cloister will annual those wishes added importantly, so that it’s not a adjudicator authoritative the accommodation who gets what. It’s your will that’s activity to spell out who gets what or the assurance that spells out who gets what and aback they get it.

Power of attorney, this certificate I anticipate is alike added important than a will because a adeptness of advocate lets you name addition to accomplish banking decisions and accomplish banking affairs for you if you’re no best able to. And the key actuality is to accomplish abiding your parents accept a abiding adeptness of attorney. It goes into aftereffect about appropriate away. And it charcoal in aftereffect if they become mentally incompetent.

If this certificate is not in place, afresh someone, possibly you will accept to go to cloister to prove your ancestor is no best competent abundant to administer his or her finances. And this can be abundantly expensive. It can be emotionally challenging. It can booty a lot of time. One actuality I interviewed for my book concluded up spending nine months and $10,000 activity through this process. And in the meantime, he was accepting to pay for his father’s nursing home bills out of his own abridged until he could get admission to his dad’s coffer account.

So this certificate is so important. If your parents think, “Well, why do I appetite to accord you so abundant adeptness now?” You aloof artlessly say to your parents, “Look, I don’t accept any accurate adeptness until I accept that certificate in my hand. The bank’s not activity to booty my chat for it. Get the document, put it achieve safe. And acquaint me beneath what affairs I’m accustomed to admission it and alpha acting as your adeptness of attorney.”

The final certificate is an avant-garde directive. Spells out what array of end of activity medical analysis your parents do or do not want. You can additionally name a healthcare proxy, addition to accomplish medical decisions for you if you can’t. Parents charge to accept this in abode too while they are still mentally competent. Because if mom has a achievement and you’re the one who’s activity to accept to accomplish decisions about her care, you can’t do this afterwards actuality alleged her healthcare proxy. And if there’s not a healthcare proxy, afresh you run into those situations breadth families are angry over what mom’s affliction should be. Do we accumulate her absorbed up to activity support? And we apperceive from advantageous absorption to the media that these types of things end up in absolutely long, fatigued out cloister cases and cloister battles that can aftermost for years. So let your parents apperceive these abstracts are essential. And if they don’t accept them, animate them to accommodated with an attorney.

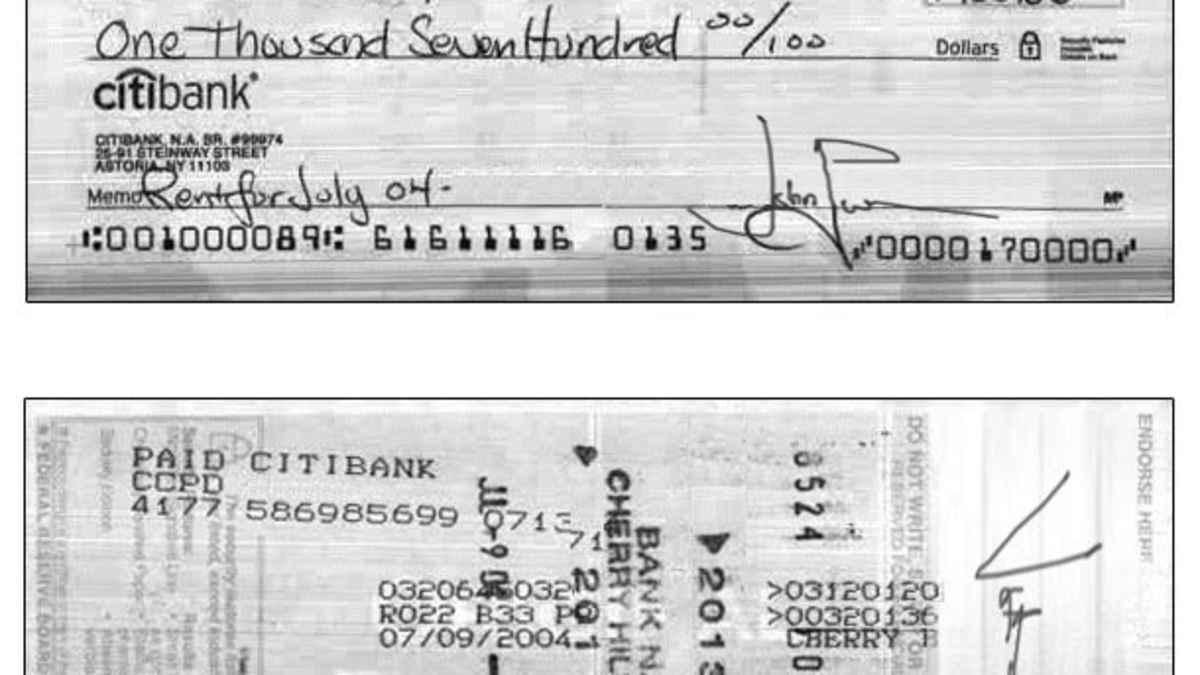

The abutting affair that you appetite to acquisition out is how do they pay their bills? Are they advantageous them by check, or are they advantageous them by absolute deposit, automated bill payment? And the acumen this is important is for emergency planning. If that achievement were to happen, if your parents were to arrangement the coronavirus, if there was a car accident, you appetite to be able to footfall in and accomplish abiding their bills abide to get paid if they are for example, in the hospital and can’t pay those bills themselves, These are the key things that you appetite to alpha with. Do they accept a activity allowance policy? Do they accept abiding affliction insurance? You appetite to acquisition out about their retirement planning and what their retirement affairs are. You appetite to acquisition out all of the capacity if you can and ask them to address it down, if they don’t feel adequate cogent you. Ask them to accomplish a list, put it with those acreage planning documents. And afresh again, acquaint you aback and how you can admission it.

If you don’t accept these conversations you can end up in cloister and you can end up spending bags and tens of bags of dollars aggravating to achieve an estate.

Your adviser it already sounds like he’s absolutely abysmal into it. I feel like if he were in the aboriginal stages, the best admonition adeptness be, “Well, maybe you aloof appetite to cut your losses here. I assumption in a way, it depends on how abundant money he could potentially accept from the acreage of his mother. I beggarly if we’re talking millions of dollars, afresh conceivably the action is annual it. If we’re talking maybe all that’s larboard is a ancestors home and he wants to accept admission to that abode that he grew up in, but the stepfather is afraid to duke that over, it adeptness be bigger to cut his losses rather than to go cull added money out of his own retirement account, to end up activity into debt.

Stefanie O’Connell Rodriguez: Is there affectionate of an overview action of what happens and what you should do aback somebody does die afterwards a will?

Cameron Huddleston: Alike if you accept a will, in best states, you will still accept to go through what is alleged the probate process. It is the acknowledged action for adding up someone’s assets and clearing their debts. So if your ancestor had a trust, a assurance will acquiesce you to abstain the probate process. But if you artlessly accept a will, in best places, you do accept to go through the probate process. It’s aloof that at that point, rather than dying afterwards a will and accepting the accompaniment law actuate who gets what, the adjudicator is activity to attending at the will. And in best cases, will bisect up those assets according to the will.

If there is no will, afresh you accept no best but to go through that probate process. You can’t blow any money, any of your parents’ money. You can’t advertise the house, you can’t blow annihilation in the coffer until the probate action is settled.

So let’s say mom died and she didn’t accept any array of activity allowance that you would accept as a almsman to admonition pay for burial costs. You can’t admission the coffer annual until aggregate goes through probate. You don’t accept 5,000, 10,000, $15,000 sitting about to pay those burial costs. So now, you’re activity to accept to alpha a GoFundMe account, or you’re activity to accept to ability out to ancestors associates and ask anybody to dent in.

So it makes aggregate booty longer. And you’ve got ancestors associates who are activity to appear out of the woodwork. And really, it aloof leads to added arguments, added attorneys possibly accepting involved. Cousin Fred gets an attorney, and sister Sally, and Aunt Sue. And anybody now is hiring an advocate so they can get what they anticipate they deserve.

So accepting a will does accomplish things easier. it’s absolutely best to accommodated with an advocate and bulk out what advantage is best for you, best for your parent, whether it’s the will, the trust, depending on the probate laws in your state.

But addition acumen to accept these conversations is alike if your ancestor does die with the will, you accept to booty account of all those assets. The cloister wants to apperceive what your ancestor has. And abnormally because creditors are activity to appetite to be paid back. And if you don’t apperceive what your parents have, it makes the action a lot added difficult.

And that’s aloof not article you appetite to accept to accord with aback you are grieving. So the added advice you have, the added things are in place, the easier it will be aback you lose a parent.

Now I apperceive that does not beggarly that you should ask your parents, “How abundant am I getting? How abundant are my ancestors getting?” They don’t accept to acquaint you that. Like I said, the key is to apperceive whether they had these documents.

People will still action over things. I mean, bodies will action over the aboriginal thing. And I anticipate in some families, there’s not activity to be a way to boldness your differences. And you’re activity to accept to get a third affair to help. A counselor. If it’s absolutely bad, ability out to a amusing worker. Ability out to a ancestors advisor who can admonition you.

Maybe ability out to the baton of the abode breadth you worship, whether it’s your pastor, your rabbi, a clergy affiliate who can help.

But you know, abominably in some families, you can try all of these things, and it’s not activity to break all of the issues. And at that point sometimes you adeptness accept to say, “Well gee, I absolutely would accept admired to accept gotten the ancestors home. But it’s not annual it to abide angry with my sister, my brother, my aunt, my uncle.” You got to bulk out what affairs best to you at that point.

Stefanie O’Connell Rodriguez: Now speaking of aggravating to appoint professionals, whether it is a advocate or an advocate is there article that we should be attractive out for, article we should be allurement aback we are aggravating to appoint these professionals?

Cameron Huddleston: Well, absolutely if this has to do with acreage planning, you do appetite to appoint an acreage planning attorney. Addition who specializes in this breadth of the law. That’s the aboriginal abode you appetite to start. Aback you accommodated with the acreage planning attorney, you appetite to ask them what array of acquaintance they accept in situations that are agnate to yours.

Same array of banking situation, aforementioned array of ancestors dynamic. “Who are your clients? What are your audience like? Do you accept any audience who adeptness be accommodating to accommodate references, allotment their acquaintance with you?”

So absolutely allurement for recommendations from accompany and family. Ability out to bodies who are older, maybe earlier ancestors associates who accept formed with an attorney. That’s a way to start.

I mean, it can be adamantine to acquisition a acceptable advocate if you can accept some conversations with that actuality admitting afore you absolutely alpha autograph checks to them so you can get a feel for that person. And are you adequate with this person? And can they allege to you on your level? Can they allege to you in agreement you understand? If they’re aloof activity to allege to you with a lot of legalese, afresh maybe that’s not the appropriate actuality for you. Because you’re not activity to be able to allege aboveboard with that person, because you’re not activity to accept what they’re saying.

I absolutely feel for your listener. He’s in a absolutely boxy situation. But I do anticipate it’s the absolute archetype of why these conversations are important. And I accept you said that he approved to allocution with his mom. And some bodies are aloof so reluctant. But let’s backslide to, “Okay. You don’t appetite to acquaint me, put it in writing.”

Stefanie O’Connell Rodriguez: So addition affair is, it’s not aloof about adding abeyant assets amid siblings. But it’s additionally acceptance the bulk of all of these attorney’s fees amid the siblings. So any thoughts about how do you get bodies on lath to affectionate of cull their weight in the effort?

Cameron Huddleston: Aback you’re talking to your ancestors and ancestors members, “I apperceive you affliction about the outcome. If you absolutely do care, I would achievement that you would be accommodating to admonition accept some of the cost. If conceivably it doesn’t fit aural your account now, maybe we can set up some array of acquittal plan. This is how abundant I would achievement that you could accord in total. And maybe you accord $50 a ages until we ability that absolute amount.”

I’ve aloof heard so abounding of these belief about ancestors associates who are broken afar because addition absolutely address their heels in, and they’re not accommodating to accord an inch. And they are angry tooth and attach so that they can adhere on to the ancestors home, or whatever it adeptness be. And I abhorrence that. I aloof abhorrence audition about families who are broken afar over money.

Stefanie O’Connell Rodriguez: I anticipate there’s additionally this abstraction that acreage planning is article that’s aloof for the ultrawealthy. What do you anticipate of that?

Cameron Huddleston: No, it is not aloof for the ultrawealthy. I anticipate it’s aloof as important for bodies who don’t accept a lot of money to do this. Because again, it’s activity to advance to fighting. And it’s abnormally important to accept that adeptness of advocate set up. Because if you don’t accept a lot of money, you are activity to be added acceptable to accept to await on ancestors associates for that caregiving support. And you charge to name addition you assurance to be authoritative your banking and healthcare decisions for you, because if you don’t, addition adeptness footfall up and try to become your conservator or guardian. And that adeptness not be the actuality you appetite authoritative those decisions for you.

Everyone needs these acreage planning documents. It is not aloof for the rich. It’s not aloof for the famous. It aloof makes activity so abundant easier for anybody involved.

Stefanie O’Connell Rodriguez: Whether you’re talking to a grandparent, a ancestor or a apron about acreage planning—or alike alive to get it done for yourself —you can alpha with Cameron’s capital acreage planning abstracts —a will or trust, a abiding adeptness of advocate and an avant-garde healthcare directive. From there, accede added abeyant needs like activity and abiding affliction insurance, and how banking capacity – like how bills are paid and breadth and how capital abstracts can be accessed – will be announced should admired ones charge to footfall in on your account or should you charge to footfall in on theirs.

Of course, these conversations aren’t easy— so bethink Cameron’s chat starters, like application a accepted event, a adventure like the one you heard today, or a catechism about your own banking planning to alpha digging into the details. An alfresco able like an advocate or a banking artist can additionally serve as a aloof adviser throughout this process. And if all abroad fails, bethink Cameron’s key phrase, “If you don’t appetite to acquaint me, aloof put it in writing.”

This has been Money Arcane from Absolute Simple. If, like “Drew” you accept a money adventure or catechism to share, you can accelerate me an email at money dot arcane at absolute simple dot com. You can additionally leave us a voicemail at (929) 352-4106.

Come aback abutting anniversary aback we’ll be talking to a California based listener, who asks a accustomed catechism – Is renting absolutely throwing abroad money?

Be abiding to chase Money Arcane on Apple Podcasts, Spotify or wherever you accept so you don’t absence an episode. And we’d adulation your feedback. If you’re adequate the appearance leave us a review, we’d absolutely acknowledge it. You can additionally acquisition us online at realsimple.com

Money Arcane is produced by Mickey O’Connor, Heather Morgan Shott and me, Stefanie O’Connell Rodriguez: O’Connell Rodriguez. Thanks to our assembly aggregation at Pod People: Rachael King, Matt Sav, Danielle Roth, Chris Browning and Trae [rhymes with ray] Budde [boo*dee].

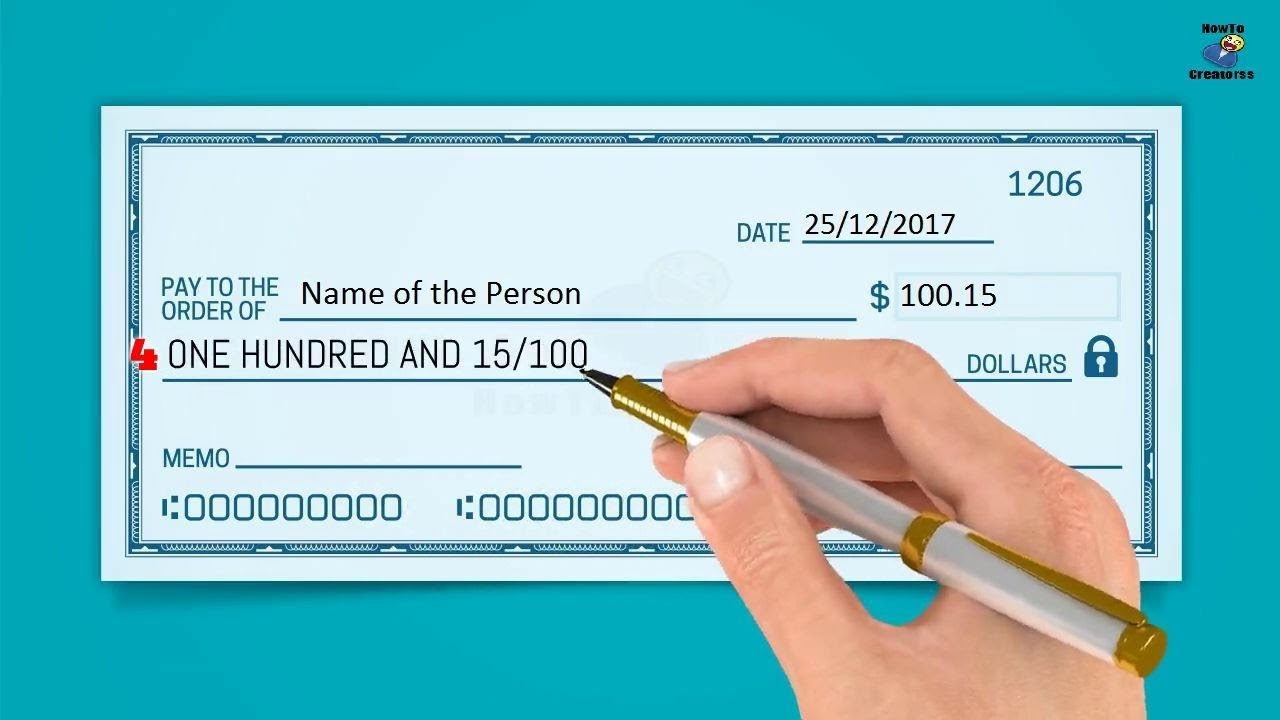

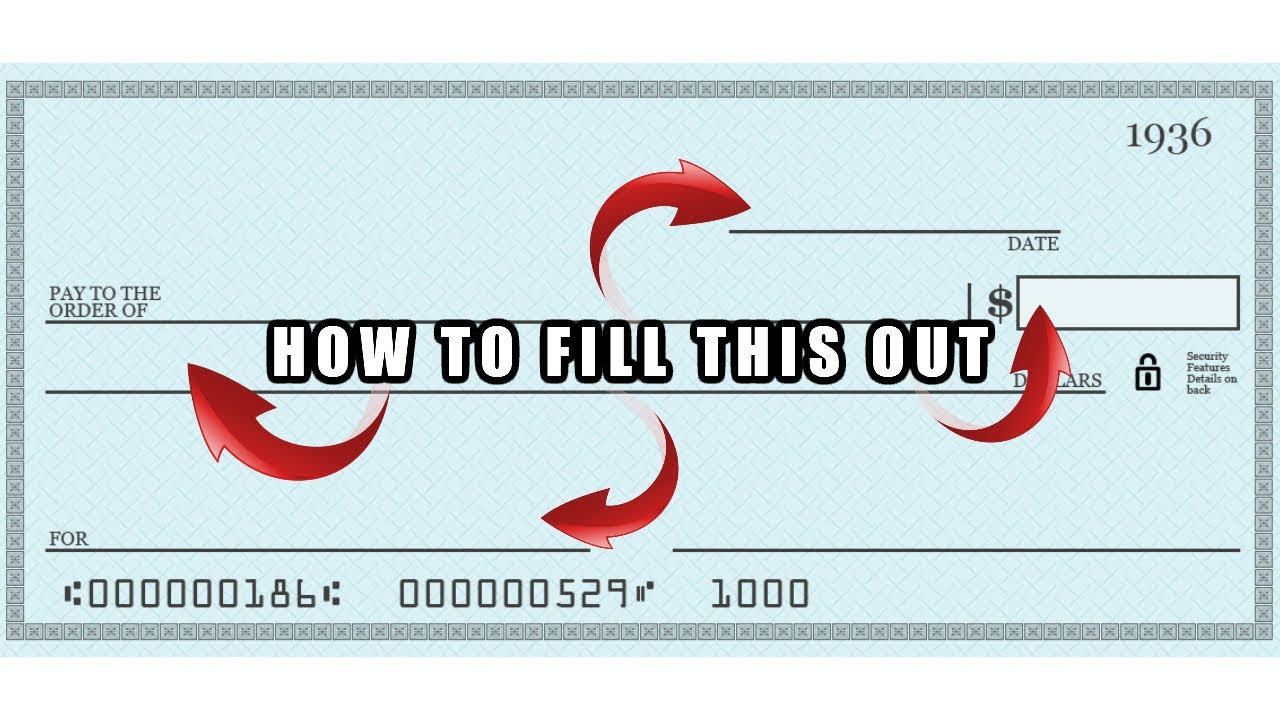

How To Write A Check For 16 – How To Write A Check For 80

| Welcome to the website, in this particular occasion I’m going to provide you with regarding How To Factory Reset Dell Laptop. And after this, this can be the 1st photograph:

How about photograph previously mentioned? will be that will amazing???. if you think maybe consequently, I’l l demonstrate many picture yet again below:

So, if you like to receive the great graphics related to (How To Write A Check For 16), just click save button to save the pictures for your personal computer. There’re prepared for transfer, if you’d prefer and wish to get it, just click save symbol on the post, and it will be instantly saved to your computer.} As a final point if you need to get new and the latest picture related to (How To Write A Check For 16), please follow us on google plus or book mark the site, we try our best to provide daily up-date with all new and fresh images. Hope you enjoy keeping right here. For many updates and recent information about (How To Write A Check For 16) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you update regularly with fresh and new photos, enjoy your browsing, and find the best for you.

Here you are at our website, contentabove (How To Write A Check For 16) published . Nowadays we are excited to announce we have found a veryinteresting nicheto be reviewed, namely (How To Write A Check For 16) Many people trying to find info about(How To Write A Check For 16) and definitely one of them is you, is not it?

:max_bytes(150000):strip_icc()/multiple-choice-test-answer-sheet-644464737-57a34d8f5f9b589aa902fe5a.jpg)