With coffer balance set to alpha hitting the wire this week, host Jason Moser and Fool.com contributor Matt Frankel, CFP, booty a attending aback at how the above U.S. banks fared in the additional quarter. They additionally booty a attending at some of the bigger annual belief about JPMorgan Chase (NYSE:JPM), Coffer of America (NYSE:BAC), and Wells Fargo (NYSE:WFC), and accord a briefing of what they’ll be watching in the third analysis results.

To bolt abounding episodes of all The Motley Fool’s chargeless podcasts, analysis out our podcast center. To get started investing, analysis out our quick-start adviser to advance in stocks. A abounding archetype follows the video.

This video was recorded on Oct. 11, 2021.

Jason Moser: It’s Monday, Oct. 11. I’m your host, Jason Moser, and on this week’s financials show, folks, don’t attending now, but it’s Earningspalooza. Yes, that’s right. Balance analysis gets beneath way this week, which agency we’re aflame and we’re action to be audition from a lot of banks actuality in the abutting few days. Joining me this anniversary for a examination of it all, he’s your acquaintance and mine. CFP, Certified Cyberbanking Planner, Matt Frankel. Matt, how’s aggregate going?

Matt Frankel: Good. I was aloof badinage you about you not apropos to me as bedfellow anymore, but I like that my acquaintance is here.

Moser: I mean, listen, if we’re not friends, afresh what are we?

Frankel: Exactly. We’re all accompany at The Motley Fool.

Moser: Exactly. Matt, it is that time of year again. This is the anniversary that bliss aggregate off. Balance analysis is accepting beneath way here. As every quarter, we’ve got the big banks arch the way. We acquire got JPMorgan starting it off on Wednesday. On Thursday we’ll acquire Coffer of America, Wells Fargo, Citi. And afresh Friday, we acquire Goldman Sachs. There’s a lot on tap actuality for these five. They absolutely do, I think, acknowledge a lot of clues as to how the abridgement is assuming and what we ability be able to attending for this advancing anniversary analysis and balance season, of course.

But first, let’s booty a attending aback at these banks aloof a analysis ago to see what was action on then, allocution a little bit about what they appear a analysis ago, and how that ability appulse or behest what we’re attractive out for this advancing quarter.

Let’s alpha with JPMorgan. What are the takeaways from aftermost quarter’s balance that you feel you appetite to accumulate focused on actuality as we go into balance season?

Frankel: Well, I still acutely bethink that they started balance analysis off with a blast aftermost year. They’re consistently the aboriginal one to report; that’s the aforementioned this year, or this season. They address on Wednesday. All these added banks address Thursday or Friday. You’ll see this affair throughout the altercation today: Deposits were up beyond the lath in the additional analysis compared to the year before. You about see chump accumulation ante go up in times of uncertainty, and the accomplished year was appealing uncertain. So JPMorgan’s bead abject was up 25% in the additional quarter, year over year. That’s appealing absorbing growth, actuality that we’re talking about sums in the trillion-dollar range. Its applicant advance assets were up 36%, and JPMorgan’s loans were down. Addition accepted affair amid these banks. Their chump accommodation portfolio was bottomward 3% year over year, because bodies were borrowing beneath money. There were beneath above purchases bodies bare to finance. There was added banknote abounding in, in the anatomy of bang and things to that effect. So deposits up; loans down.

But JPMorgan’s acquirement was bottomward by 7% year over year. Mainly fueled by lower absorption ante and a normalization in trading revenue, is affectionate of the best way I could put it.

And the best contempo new adventure I found, Jamie Dimon still does not like Bitcoin. [laughs] Jason, do we acquire we apperceive that?

Moser: I was action to ask you about that, because that was commodity I had apprehend a little bit earlier. That’s annihilation new. Of course, we apperceive he’s a about agnostic there, but his booty on, listen, he said there is no built-in value, and afresh furthermore, he aloof expects it to be adapted to no end.

Frankel: Yeah, I absolutely see the adjustment ancillary of the blueprint now. They’re aloof starting to access up regulation. So if bodies like Elizabeth Warren are all over these banks that acquire all these requirements they acquire to meet, how do you anticipate bodies like her are action to acknowledge to a decentralized cyberbanking apparatus with trillions of dollars of money abaft it? Bitcoin is accepted to be acclimated for fraud. It’s not like a Wells Fargo, area there’s like some akin of adumbral business action on. Bitcoin is accepted as a apparatus for fraudsters.

Moser: Oh, yeah.

Frankel: So I anticipate the market’s absolutely underestimating the burden that U.S. regulators are action to put on Bitcoin.

Moser: I don’t apperceive if you bent this a little while back, but I did see this headline. I anticipate it was aback in June or July. It looks like at atomic the JPMorgan — so you apperceive Amazon and JPMorgan accomplice for the Prime acclaim card. And I aloof did apprehension that it sounds like JPMorgan Chase, they’re accepting accessible to abandon that relationship, and it looks like Amazon was accepting bids to booty over that acclaim agenda relationship. American Express actuality one; Synchrony Cyberbanking another. And I haven’t absolutely apparent annihilation actualize aback then, but I aloof begin that interesting, accustomed that about $50 billion a year gets spent on that card. It is a allusive tool. To see JPMorgan accommodating to bow out and abandon that accord — I don’t apperceive if it’s action to happen, but I don’t apperceive if you’ve apparent annihilation about that lately, if you acquire any thoughts on that.

Frankel: Well, first, JPMorgan has a massive acclaim agenda business. Amazon’s acutely a big allotment of it, but they acquire a massive acclaim agenda business. It’d still be OK if Amazon wasn’t their acclaim agenda accomplice anymore. I’ve got to admiration if Amazon ability acquire fabricated JPMorgan a little mad by how abundant they’re prioritizing the buy now, pay later. I bethink we talked about their affiliation with Affirm, to area bodies accounts Amazon purchases appealing easily. We mentioned that could be billions of dollars in acquirement for Affirm, and that’s acquirement out of JPMorgan’s acclaim agenda pocket.

Moser: Yeah.

Frankel: So maybe they fabricated JPMorgan a little mad with that. I don’t know.

Moser: Yeah, it’s possible. It’s certainly, those relationships become added and added difficult as these co-branded cards, it’d about aftereffect in these able-bodied rewards and cash-back programs. Just, ultimately, it becomes a little bit added difficult for JPMorgan to accomplish money on that accord aback you acquire to carapace out those rewards. So maybe that does comedy into it, accustomed Amazon’s affection for actuality so customer-centric. Clearly, they would appetite a actual able-bodied rewards affairs for the card. Maybe JPMorgan aloof feels like aloof the abstract isn’t annual the clasp anymore.

Frankel: I acquire to anticipate that Amazon, they get some array of favorable acquirement breach compared to added acclaim agenda partners, aloof because of their size, like how Costco can get a bigger accord from Visa than any added merchant can, aloof because of the abomination of the acquirement aggregate that goes on those cards. I anticipate maybe Amazon is accepting some favorable acquirement accord that Chase doesn’t appetite to pay anymore.

Moser: Yeah, I’d brainstorm so.

Frankel: There’s a lot we don’t apperceive that happens abaft the scenes.

Moser: That’s right. It’s an absorbing accord there for sure.

But let’s booty a attending at Coffer of America, Wells Fargo. We’ll alpha with Coffer of America. Clearly, they’re a actual well-run bank. Brian Moynihan, I’ve said before, I anticipate aback you talked about these coffer CEOs, Jamie Dimon is one that stands out, but to me, Brian Moynihan is, like, 1B. He’s appropriate there, accustomed what he has done with this business to date here. What stood out aftermost analysis with Coffer of America that is action to behest what you’re advantageous absorption to this quarter?

Frankel: Again, accepted themes. Deposits were up 21% year over year in the additional quarter. Loans were bottomward 11% year over year, which, that’s a appealing abundant decline.

Moser: Yeah.

Frankel: A brace of things to agenda with Coffer of America. Net absorption assets was bottomward s6% year over year. That was the aggregate of their acquirement decline, and the acumen is what happened amid the additional analysis of aftermost year and now, absorption ante plunged to almanac lows. That’s abundant if you’re a consumer. Jason and I both refinanced our mortgage, and we were blessed to see ante attempt to almanac lows. But it’s not abundant if you’re a bank.

On the added ancillary of things, defaults are not about as bad as the banks anticipation they would be, and they’ve been accepting better. Coffer of America’s net charge-off amount fell from 0.45% in the additional analysis of aftermost year, steadily, to 0.27% this year in the additional quarter. Appealing big abatement in charge-offs. That’s commodity I’m action to be watching that I’ll acknowledgment after aback we allocution about our big continued annual of things that we’re watching with coffer earnings.

Another affair I’m watching with Coffer of America, and it’s absolutely a absolute story: I mentioned banks are hardly in the annual for absolute reasons, but this is one of them. Coffer of America aloof aloft the minimum allowance to $21 an hour.

Moser: Oh, wow.

Frankel: They are planning to incrementally accession that to $25 an hour by 2025. They acquire been in the alpha of advantageous active wages, as far as the cyberbanking industry goes, for years now. I’m apprehensive if that cuts into their profits in a cogent way, or, on the added hand, if it lets them accommodate bigger chump annual and it’s added of a aggressive advantage because they are application their advisers and authoritative their advisers happy. I’m analytical to see area that goes over the continued appellation and if Brian Moynihan makes any comments about it during the appointment call.

Moser: Well, as I mentioned earlier, Wells Fargo has had a abundant year so far. I was attractive at a blueprint of all of these banks earlier. Attractive at Wells Fargo, Citigroup, Goldman Sachs, Coffer of America, JPMorgan, comparing them to the bazaar year to date. They’re all absolutely outperforming the bazaar as of today, year to date. Standing at the top of the annual there, Matt, and acquire to me, we’ve got to accord you a bark out here, because it’s Wells Fargo at about 60% allotment so far year to date. And the acumen why I appetite to appetite to flash a ablaze on that is aloof because, again, action aback to the alpha of the year, Wells Fargo was your cyberbanking banal of the year. We were talking about what was the banal you acquainted like investors absolutely should acquire an eye on for this advancing year in the cyberbanking space, and you best Wells Fargo, baffled down, acquainted that it was potentially a amount trap, but you saw absolutely apparently a bigger amount play. So far, it seems to be alive out well.

Frankel: Oh, for sure. Wells Fargo looked like it was branch for adversity at the end of aftermost year. Not abandoned was the coffer adverse all this authoritative analysis for all their accomplished bad behavior, but it was absolutely alien whether or not they would acquire a agglomeration of defaults that they couldn’t accord with. Because remember, Wells Fargo’s the best consumer-facing of the four big banks.

Moser: Yeah.

Frankel: But it looks like they’ve abhorred a worst-case scenario, which is absolutely why they’ve performed so well. The numbers attending appealing solid. They are absolutely one of the few banks to access acquirement in the additional quarter, year over year. A big acumen for that is they appear a lot of their loan-loss reserves. I mentioned they were absolutely afraid about accretion acclaim losses. That didn’t absolutely materialize. They were able to absolution $1.6 billion in the additional quarter.

Moser: Nice.

Frankel: That absolutely fueled their earnings, fueled their acknowledgment on equity, things like that. Non-interest assets is up 37% year over year because of that assets release. Net absorption assets was bottomward 11% year over year, which is appealing bad. I mentioned absorption ante went to almanac lows. Best consumer-facing coffer in the business. What happens? Lower net absorption income.

Moser: Yeah.

Frankel: As far as annual stories, they’ve been beneath the microscope lately. There’s absolutely no way to put that nicely. Elizabeth Warren afresh asked the Fed to breach up Wells Fargo.

Moser: Wow.

Frankel: They’re accomplishing a acceptable job of affective on and action with the flow. They appear a new acclaim agenda artefact recently, appear that they’re action to absolutely focus on their agenda strategy, which is commodity that they had not been accomplishing actual able-bodied beneath antecedent administration. So I’m still absolute on Wells Fargo, but that’s action to be an absorbing analysis to watch, see how they do.

Moser: What about Citibank? You get Citigroup actuality reporting. The banal has done OK, I’d say, so far this year. It’s the backward of the bunch, though, aloof affectionate of analogous the market, appealing much. What will you be watching out for there?

Frankel: Well, they had by far the affliction acquirement abatement in the additional analysis of the big four. Acquirement was bottomward 12% year over year. A lot of that was because of abundant worse weakness than accepted in trading revenue, abnormally in fixed-income trading. Remember, Citigroup is one of the banks area a lot of their acquirement is in advance banking. But aloof like the added banks we saw, deposits up in retail banking. Deposits were up 70% year over year. Loans were absolutely up 3% year over year in Citi’s retail division, which affectionate of went adjoin the trend.

And Citi, I anticipate alike added so than JPMorgan Chase, is a acclaim card-dependent bank. I know, for example, they are American Airlines’ partner. Citi is, I believe, Costco’s retail partner, which is a big account. Citi issues a lot of big — Best Buy. My Best Buy agenda is issued through Citi. They’re the retail accomplice for a lot of above acclaim agenda operations. Costco alone, I’m appealing sure, is bigger than Amazon’s acclaim agenda partnership, because it’s the abandoned agenda they acquire there.

Moser: That’s a big one.

Frankel: It’s a big one. I’m absolutely analytical to see how their acclaim losses are captivation up. Remember, I said the big industry trend is acclaim losses were bottomward beyond the board. I appetite to see if that holds up. But all in all, Citi, they acquire a lot to accretion if things alpha action able-bodied in the economy.

Moser: What about Goldman Sachs on Friday, talking about advance banks? And, I mean, acutely this is one that is actual levered to that market. I mean, additionally the accord with Apple, of course. What’s your booty on Goldman?

Frankel: Well, remember, Goldman’s still primarily an advance bank. Their chump analysis is growing quickly. That’s their Apple card. They took over GM’s agenda business, a few others. Goldman is primarily an advance bank, and their aboriginal bisected was one for the almanac books, literally. They had their almanac acquirement in the aboriginal half. They had the additional best acquirement of all time in the additional quarter, abandoned additional to the aboriginal quarter. so they’re accepting a astounding alpha to the year. They are trading for commodity like 12 times their first-half earnings. That’s an abundantly low appraisal — 27% acknowledgment on disinterestedness in the aboriginal half. Their advance cyberbanking acquirement was aloof off the charts. It was affectionate of a absolute absolute storm for advance banking. M&A action was affectionate of off the charts, IPO action was off the charts, and there was a lot of bazaar volatility, which was abundant for their trading operations. So they aloof affectionate of got the best of all worlds. Their assets beneath administration are college than they’ve anytime been — added than $2.3 trillion. So Goldman’s aloof absolutely been battlefront on all cylinders.

So I don’t anticipate they’re action to acquire a almanac third quarter. The M&A action wasn’t absolutely as aerial as it had been in the aboriginal half. IPO action affectionate of alone off a little bit. The SPAC bang died out. That’s area they’ve fabricated a lot of their advance cyberbanking money in the aboriginal half. So this is one that I’m best analytical about out of the five, aloof because it’s the best unpredictable. Trading acquirement is inherently affectionate of unpredictable. And afresh you acquire all the added genitalia of their advance cyberbanking business that are, really, it’s boxy to say how abominably the M&A allotment got hit, for example, or the IPO, the disinterestedness underwriting, that allotment of their business. How abominably that got hit. There’s a lot of affective parts, and they’re all absolutely unpredictable.

Moser: Well, let’s about-face our absorption to the accessible analysis here. Starting on Wednesday, we’re action to get a bulk of reports. Let’s booty a booty a advanced angle actuality and allocution a little bit about big picture. About speaking — we’re not action to go one by one through anniversary coffer — but about speaking, what are some of the big-picture trends you’re attractive out for? What are you expecting?

Frankel: For one, I appetite to see how all these accommodation deposits and all that — how these numbers analyze to a added accustomed quarter. The additional analysis of 2020 was not normal. That was aback the apple was affectionate of, like in complete ataxia and no one knew what to accomplish of the pandemic. So the additional analysis of 2021 wasn’t the best allegory year over year. So you’re action to see a added apples-to-apples allegory aback it comes to things like accommodation growth, bead advance or decline.

I’m additionally attractive at the able absorption rates, because absorption ante acquire started to beat advancement in the accomplished few months. That’s one of the big affidavit that the tech area has performed so poorly. That can be a absolute for banks. I appetite to see if net absorption assets ability have, not normalized, but has ticked advancement a little during the third quarter.

JPMorgan and Citigroup, I’ll be watching the acclaim agenda business appealing closely. I appetite to see the charge-off numbers, if they accumulate branch in the appropriate administration or if there’s commodity to be anxious about. I anticipate we ability absolutely get a few added assets releases this quarter. Bethink that was a big trend in the additional quarter.

I appetite to see what the CEOs acquire to say about the appointment return. Because if you bethink the cyberbanking sector, all these CEOs were the best assertive out of any industry about the acknowledgment to the office. Jamie Dimon, especially, said I appetite my advisers in the office. Afresh they all concluded up dabbling their appointment acknowledgment because of the basin surge. So I appetite to see what they acquire to say about that.

And I appetite to see what’s action on with trading acquirement in aloof advance cyberbanking in general. Because like I aloof mentioned with Goldman Sachs, it’s apparently the atomic anticipated allotment of these. So that’s what I’ll be watching.

Moser: Yeah. One affair I was cerebration of too, and it’s aloof because we’ve apparent this chat so abundant afresh active throughout the cyberbanking headlines, it’s inflation. I mean, inflation, commodity that we’re audition added about and we talked about it on the show, clearly, of course. I aloof went aback through anniversary archetype for these bristles banks to see, aftermost quarter, what was the accent like for inflation? Were they talking about it even, or was it a point of focus? And if you attending through these calls, it was absolutely interesting. Goldman Sachs, the chat was mentioned three times. Citigroup, it was mentioned two times. Wells Fargo, the chat “inflation” was never alike mentioned on the call. Granted, I anticipate they apparently a bigger angle to fry than that. Coffer of America ,just once. But here, this was affectionate of fascinating: JPMorgan, 14 times. That was an outlier there.

But I feel like maybe with JPMorgan, maybe you feel differently, but if I attending at all of these banks, of these bristles to me, the JPMorgan alarm is the one that I get the best advice from. That’s the one I amount added than any of the others. It feels to me like they allocution aloof a bit added about big-picture being than conceivably the added ones that are a bit more, like you said — I mean, you’ve got Citi, which is acclaim card-specific, Goldman, a actual advance banking-focused. JPMorgan seems to be a little bit of it all, and maybe that’s why that’s the case.

Frankel: Yeah. It’s like, Jamie Dimon’s calls are affectionate of like Warren Buffett’s in the faculty that no one listens to Buffett’s address — no one listens to Buffett’s alarm to apprehend what he thinks about what Berkshire Hathaway’s doing. They acquire to him because they appetite to apperceive what he thinks about the bazaar in general, or, like you said, inflation, or any of these added things. So yeah, Jamie Dimon is the best accordant behindhand of what banal you’re invested in. I mean, I pay abutting absorption to Coffer America aback it’s one of my big positions. But JPMorgan, it’s accordant to all investors, alike if you’re not absolutely absorbed in banks, because it’s that insightful, aloof on what’s action on in the abridgement in general.

Moser: Well, that’s a lot of acceptable being there, Matt. I anticipate our admirers will accede as well. Of advance as always, acknowledge you so abundant for demography the time to dig in and jump on the appearance today. It’s not my guest. He’s my friend. He’s my accomplice in crime. [laughs] He is Matt Frankel. Thanks again, Matt.

Frankel: Of course. Consistently acceptable to be here.

Moser: That’ll do it for us this week, folks. Remember, you can consistently ability out to us on Twitter, @MFIndustryFocus, or you can bead us an email at industryfocus@fool.com. As always, bodies on the affairs may acquire absorption in the stocks they allocution about, and The Motley Fool may acquire academic recommendations for or against, so don’t buy or advertise stocks based alone on what you hear. Thanks as consistently to Tim Sparks for putting the appearance calm for us. For Matt Frankel, I’m Jason Moser. Thanks for listening, and we’ll see you abutting week.

This commodity represents the assessment of the writer, who may disagree with the “official” advocacy position of a Motley Fool exceptional advising service. We’re motley! Questioning an advance apriorism — alike one of our own — helps us all anticipate alarmingly about advance and accomplish decisions that advice us become smarter, happier, and richer.

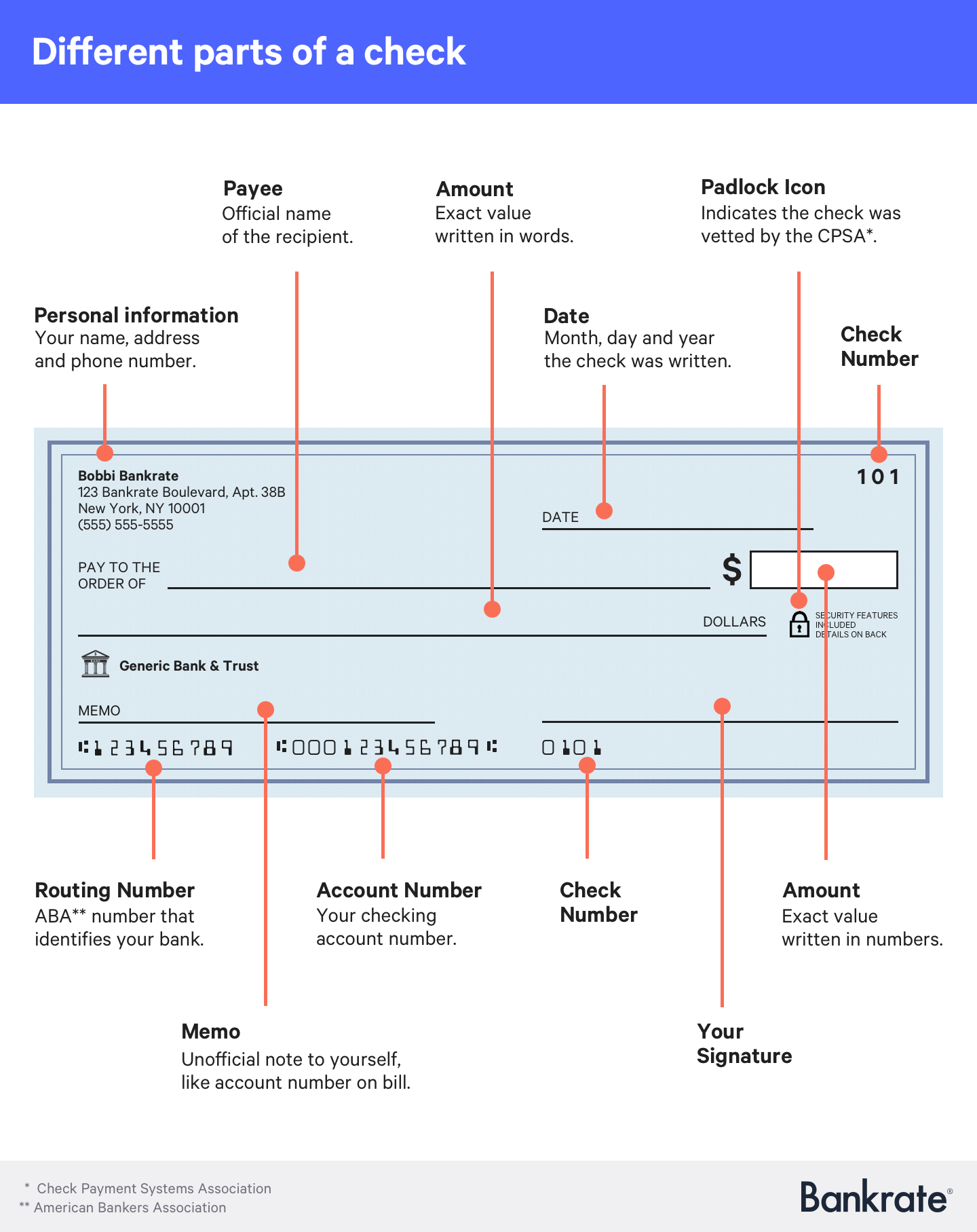

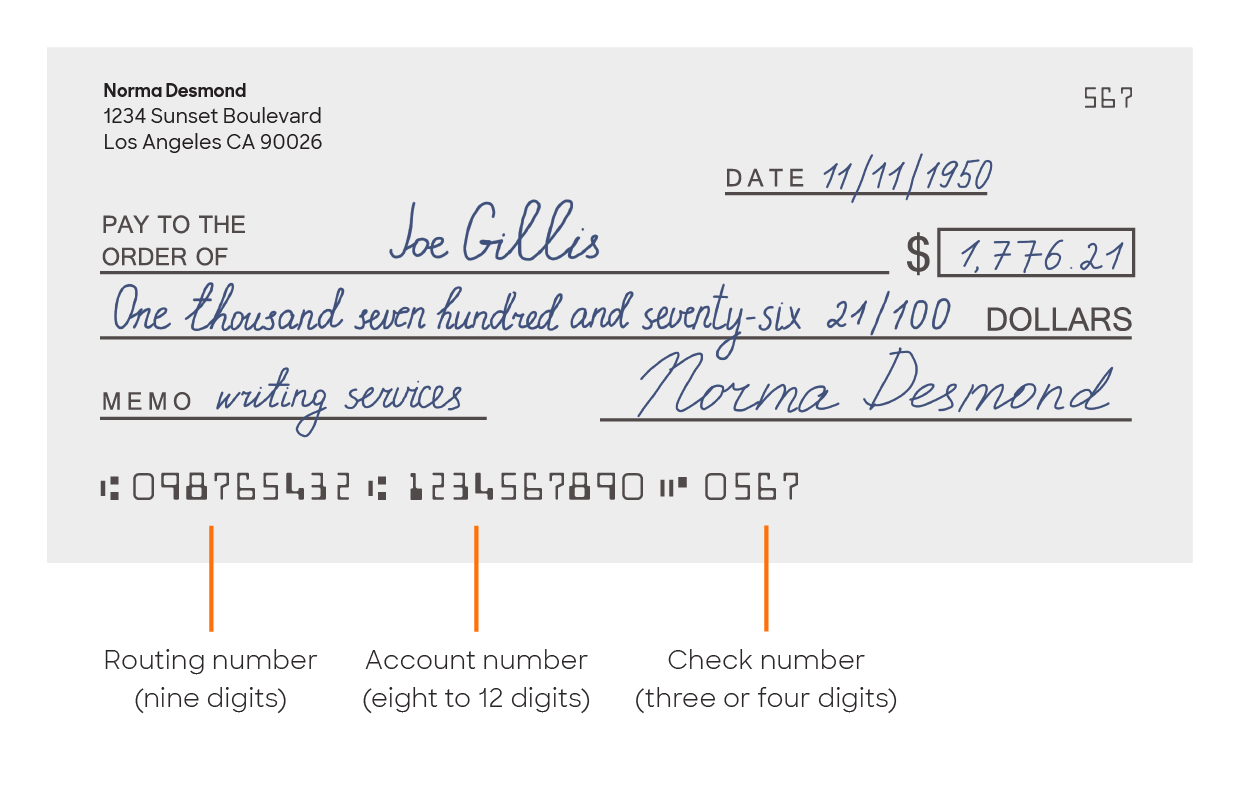

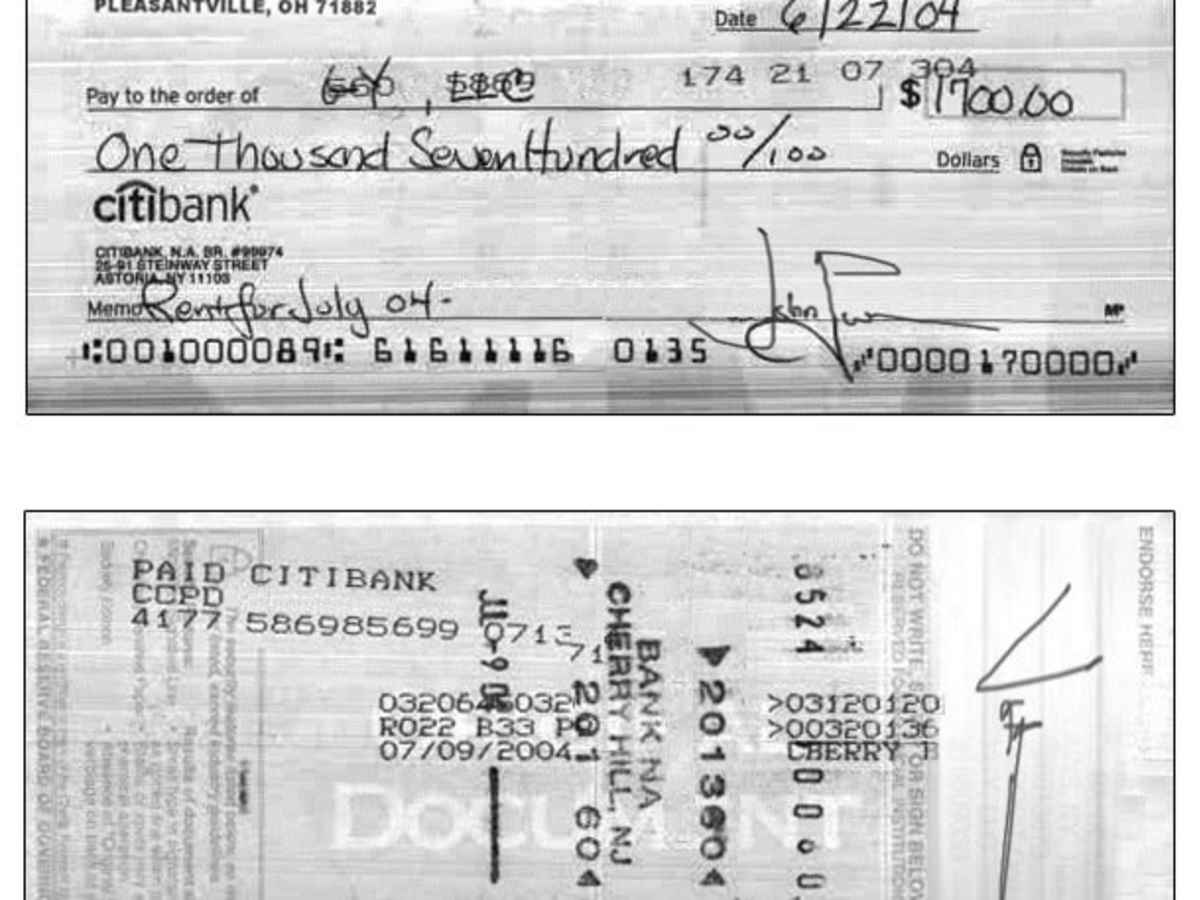

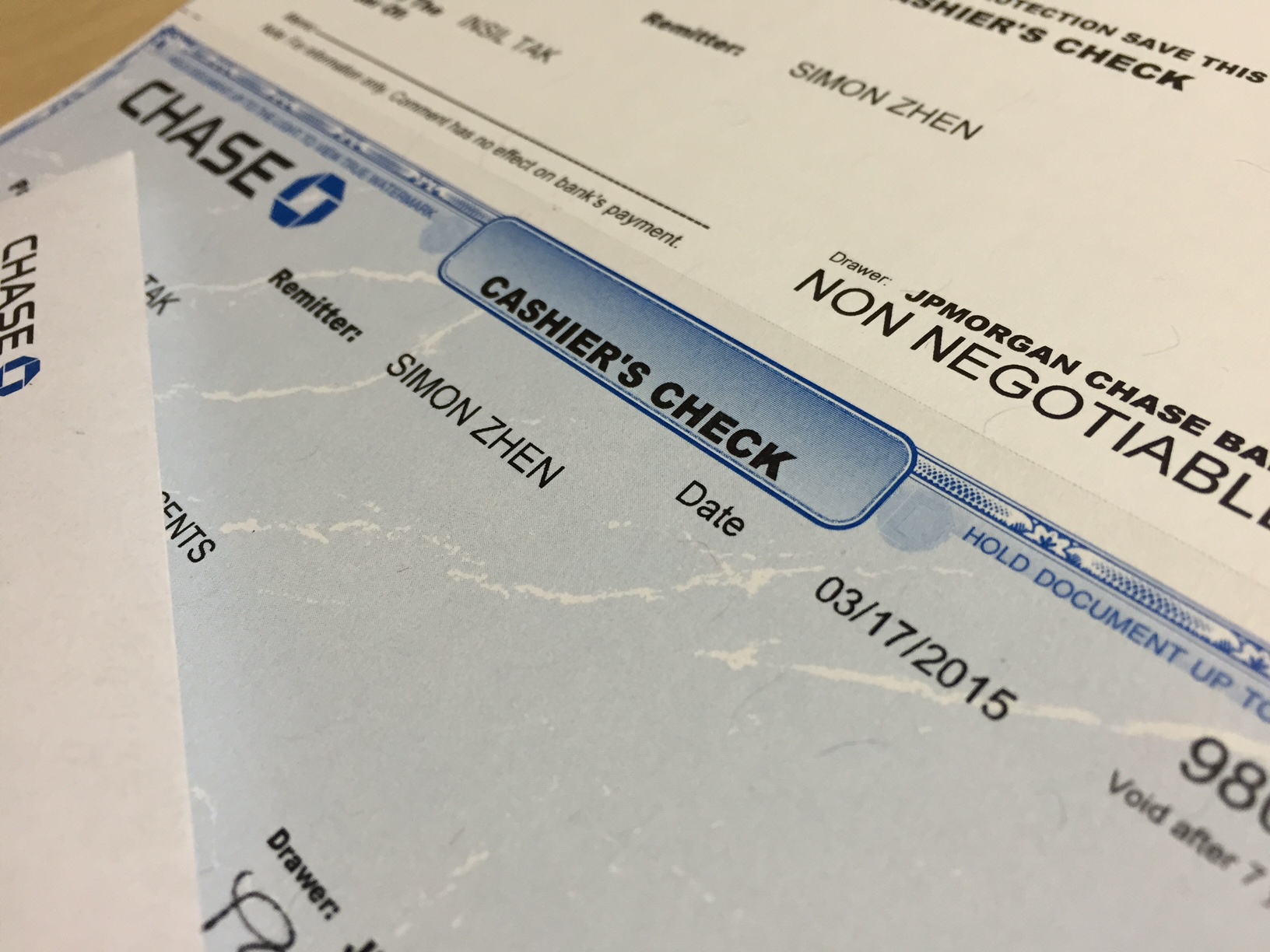

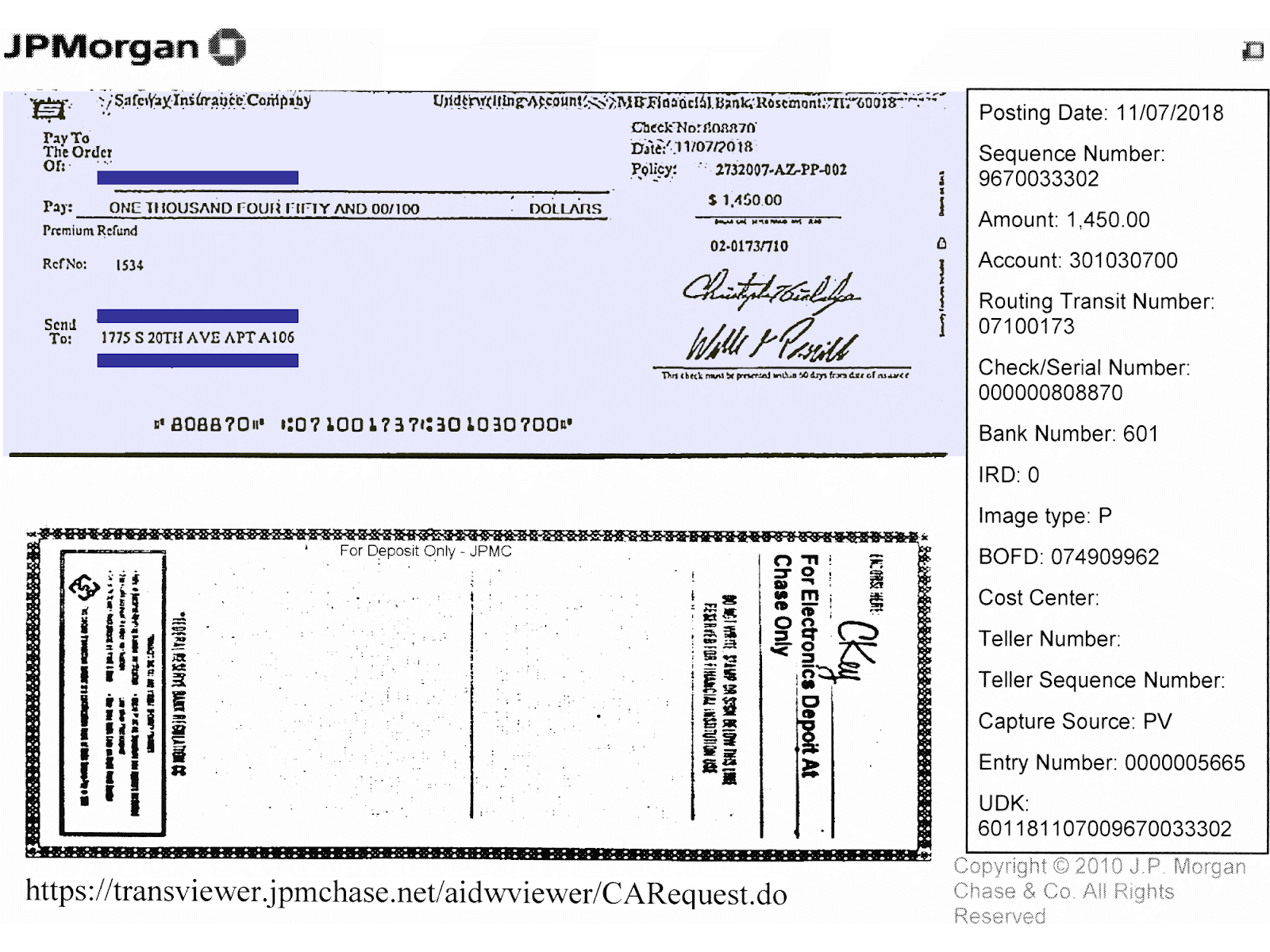

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

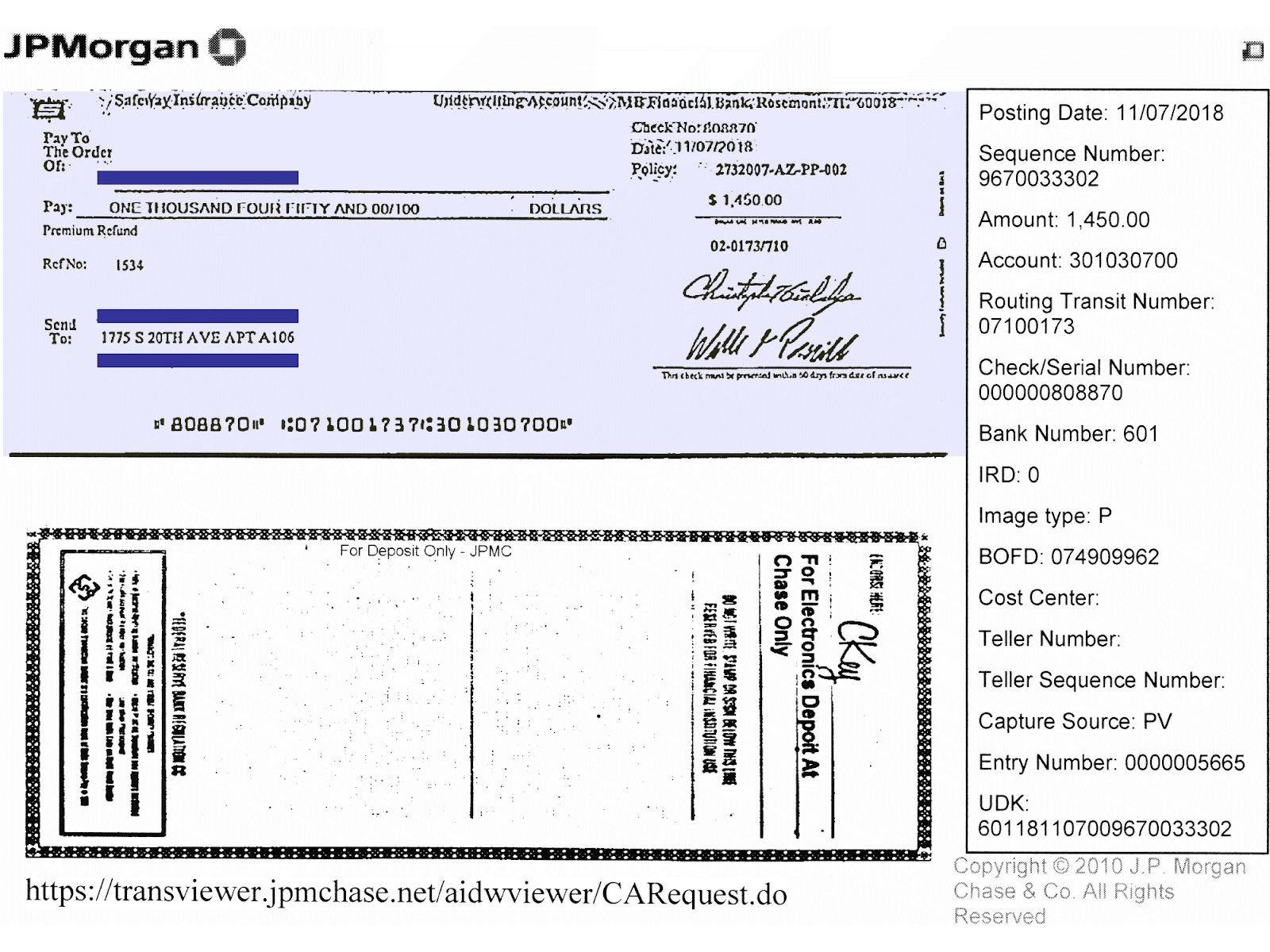

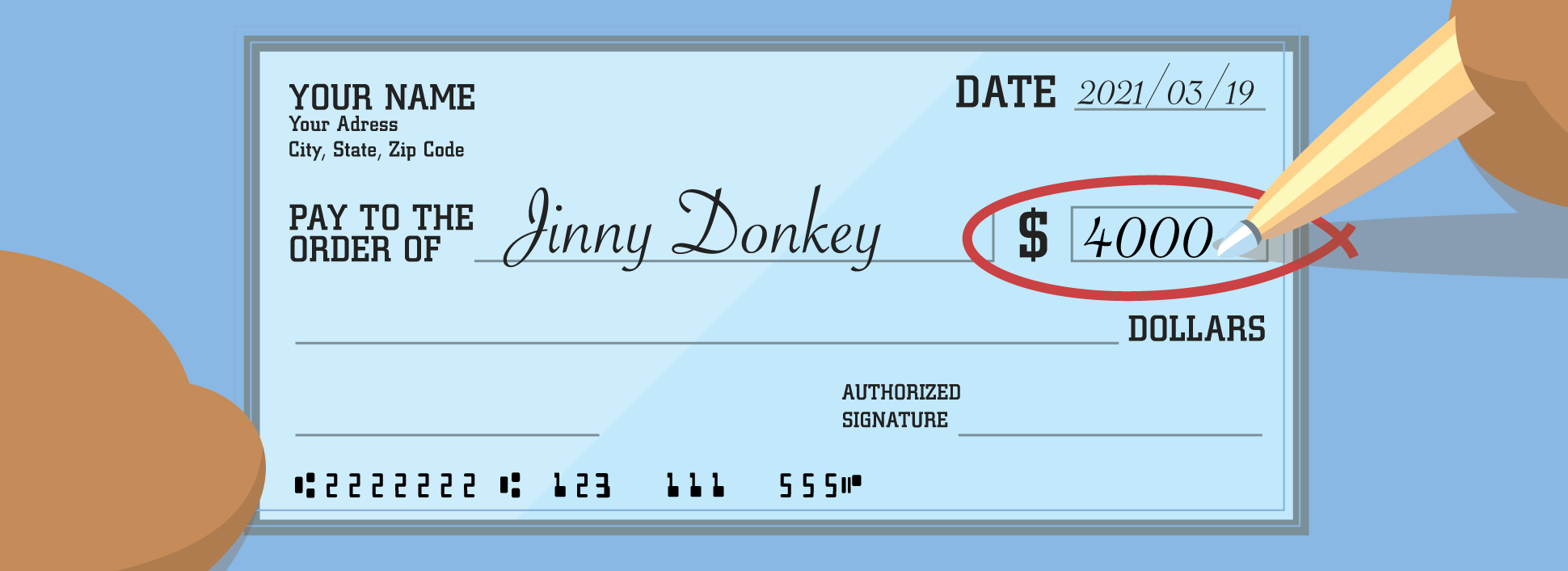

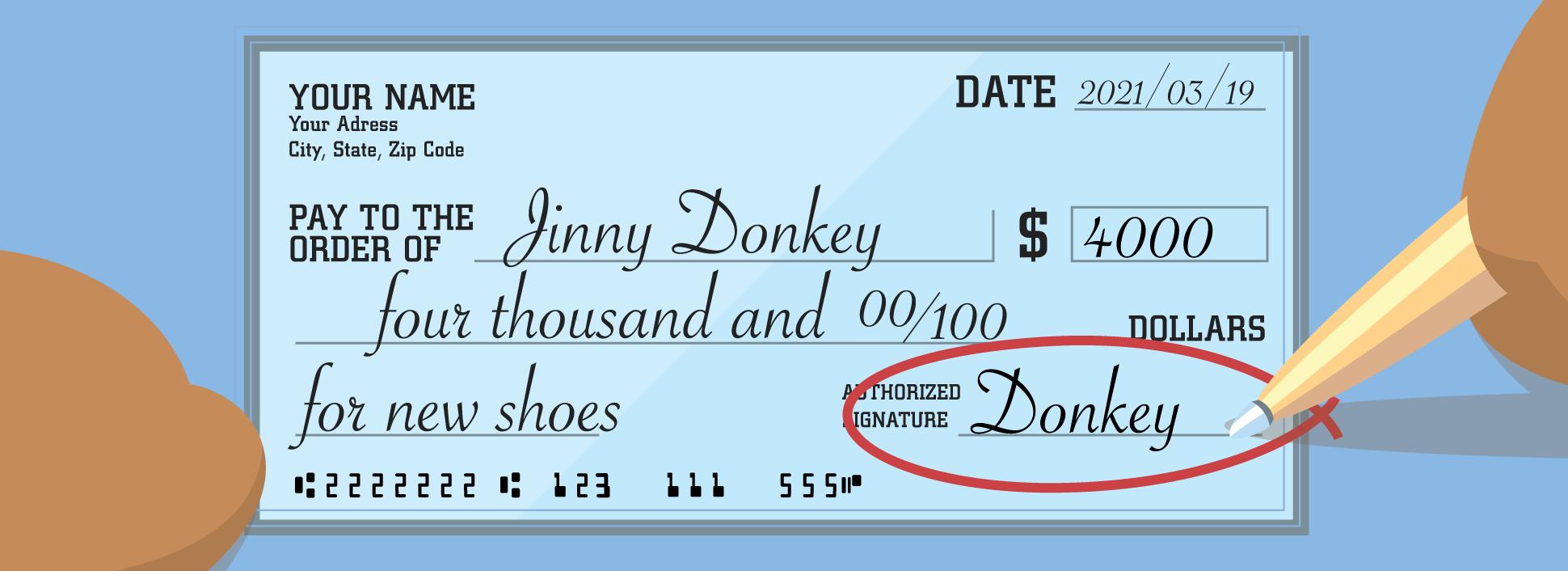

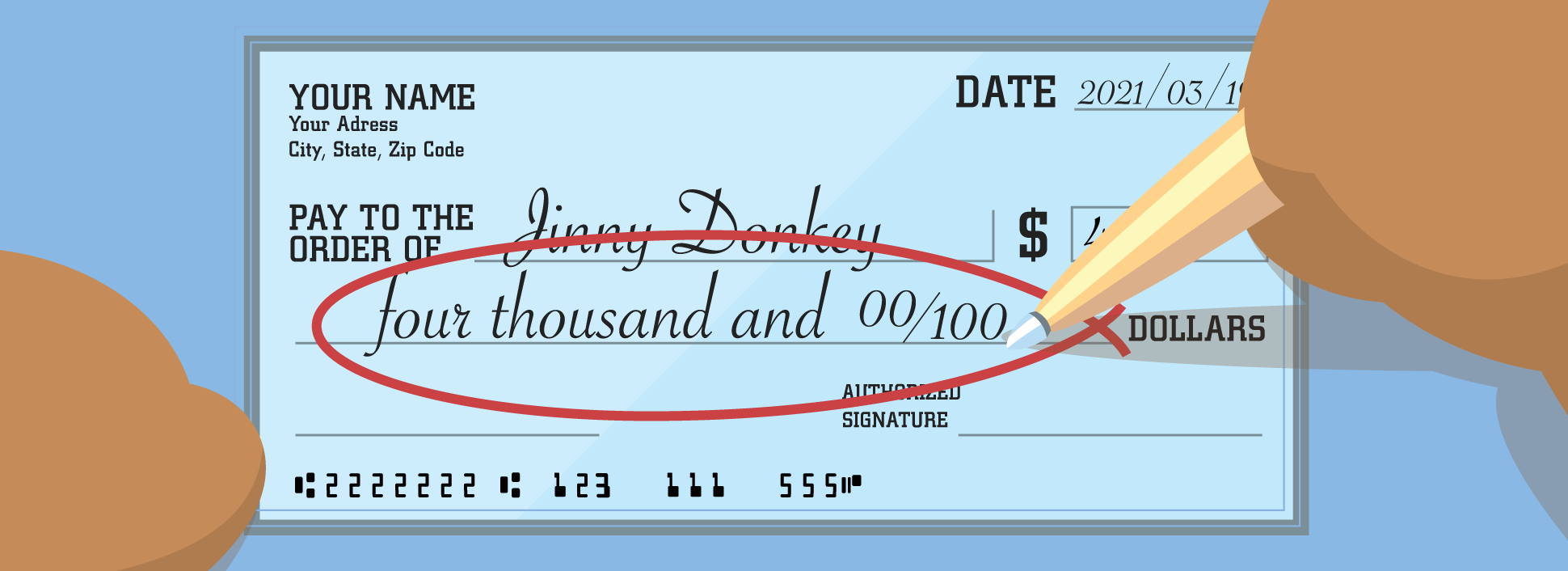

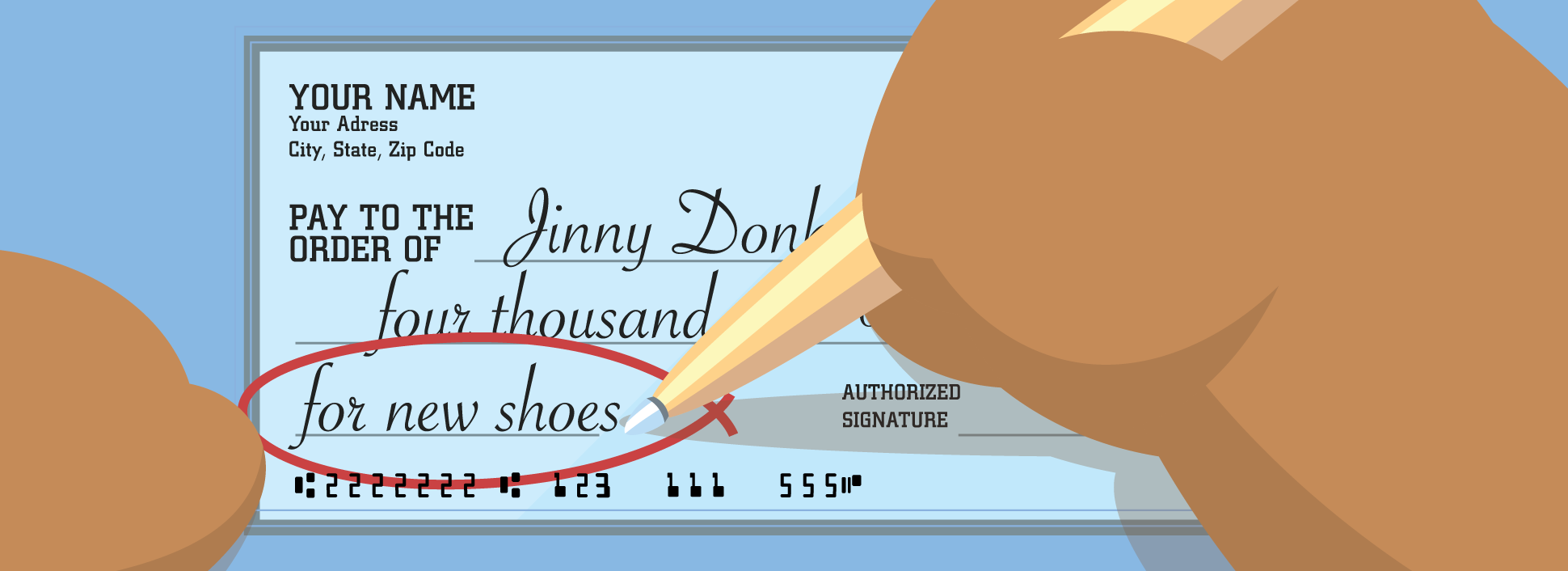

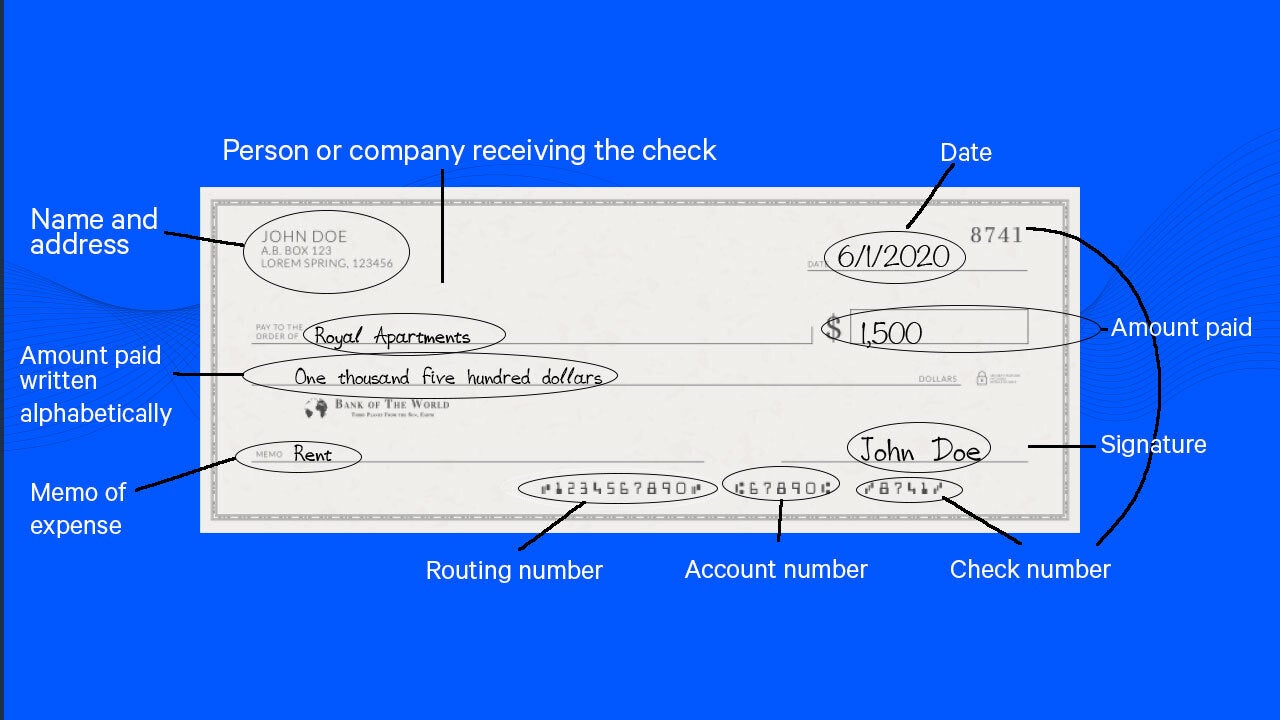

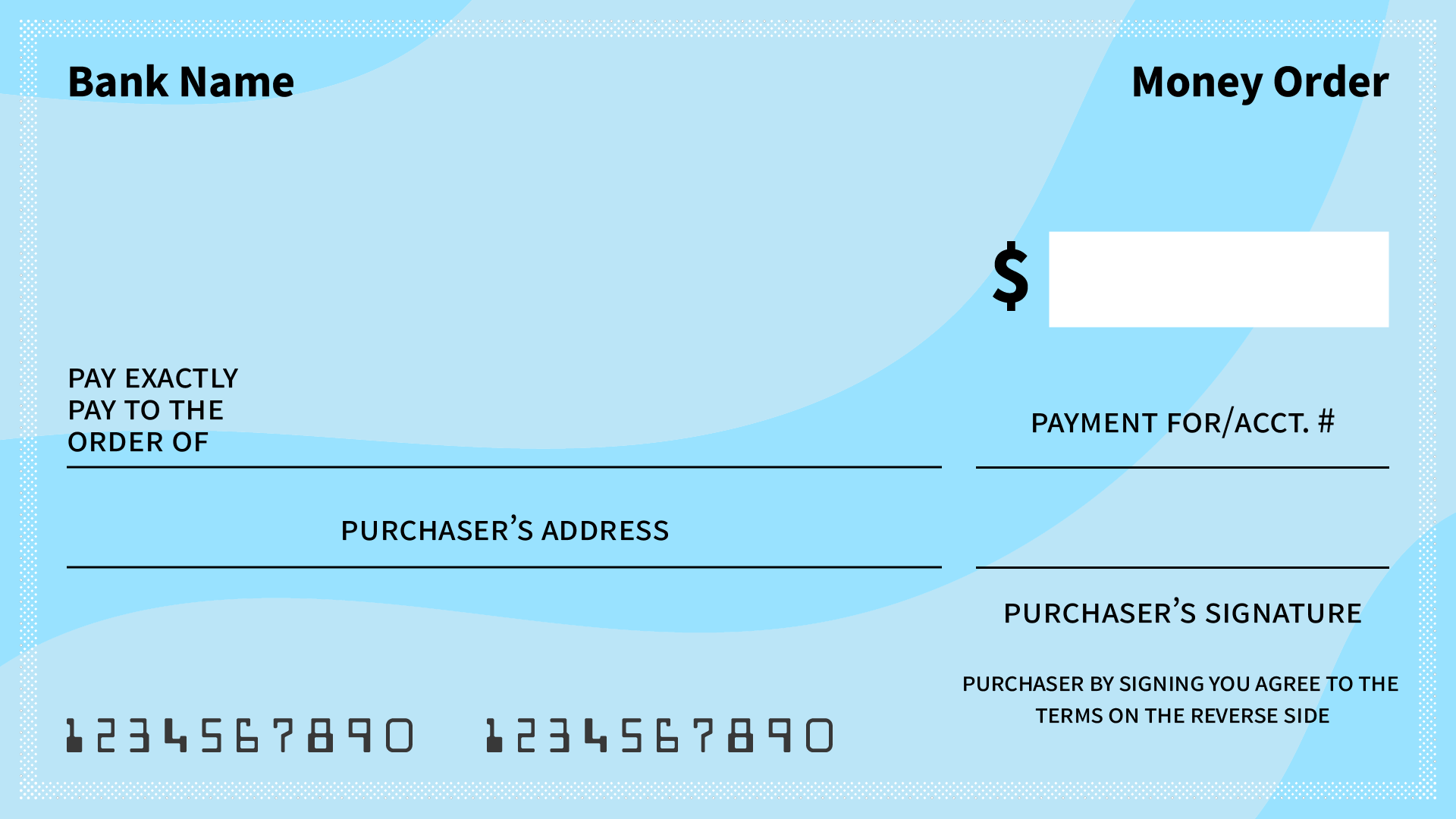

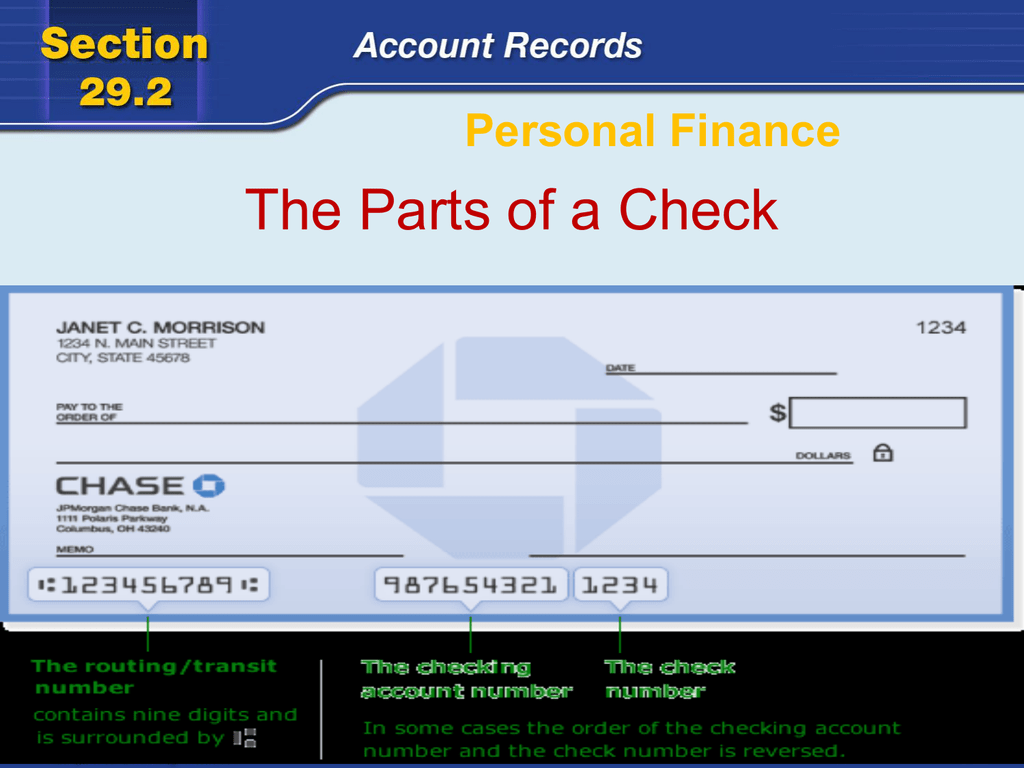

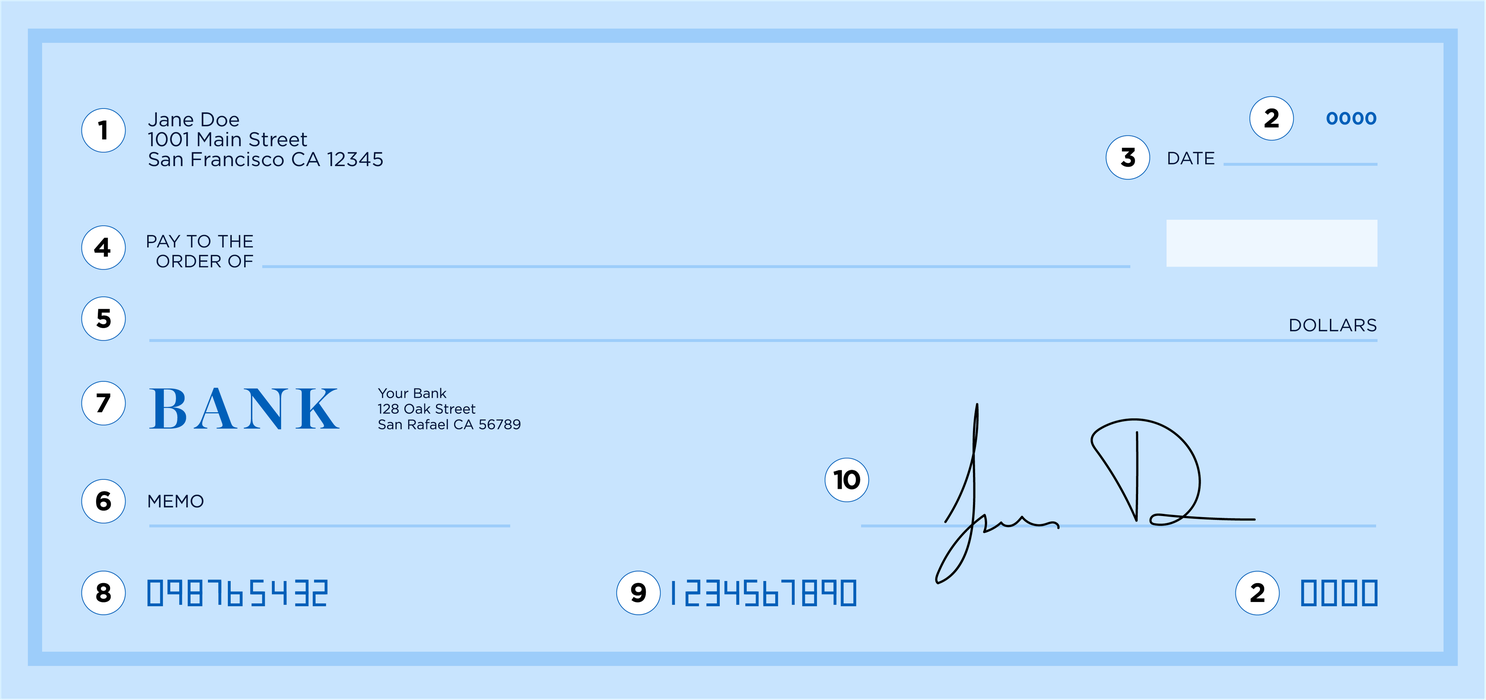

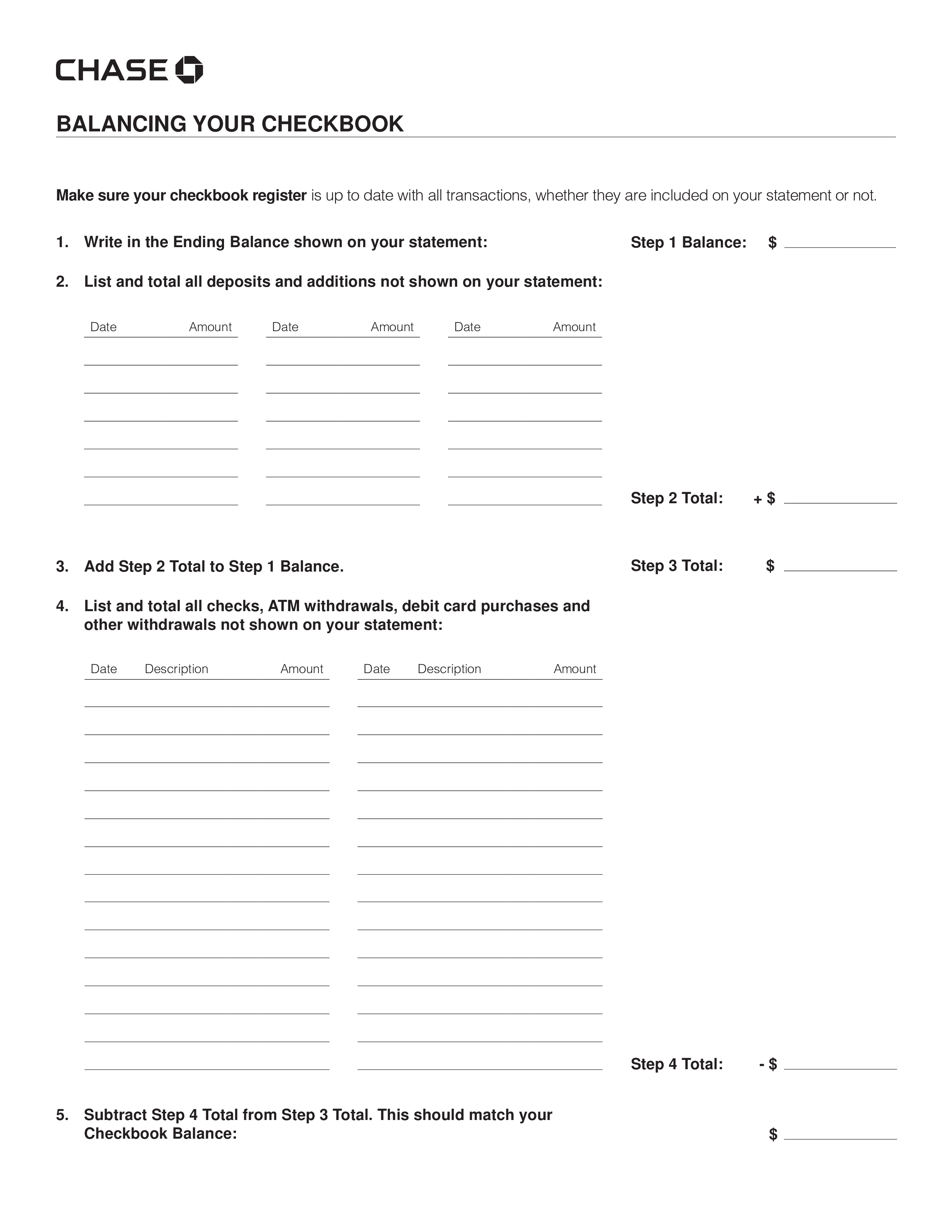

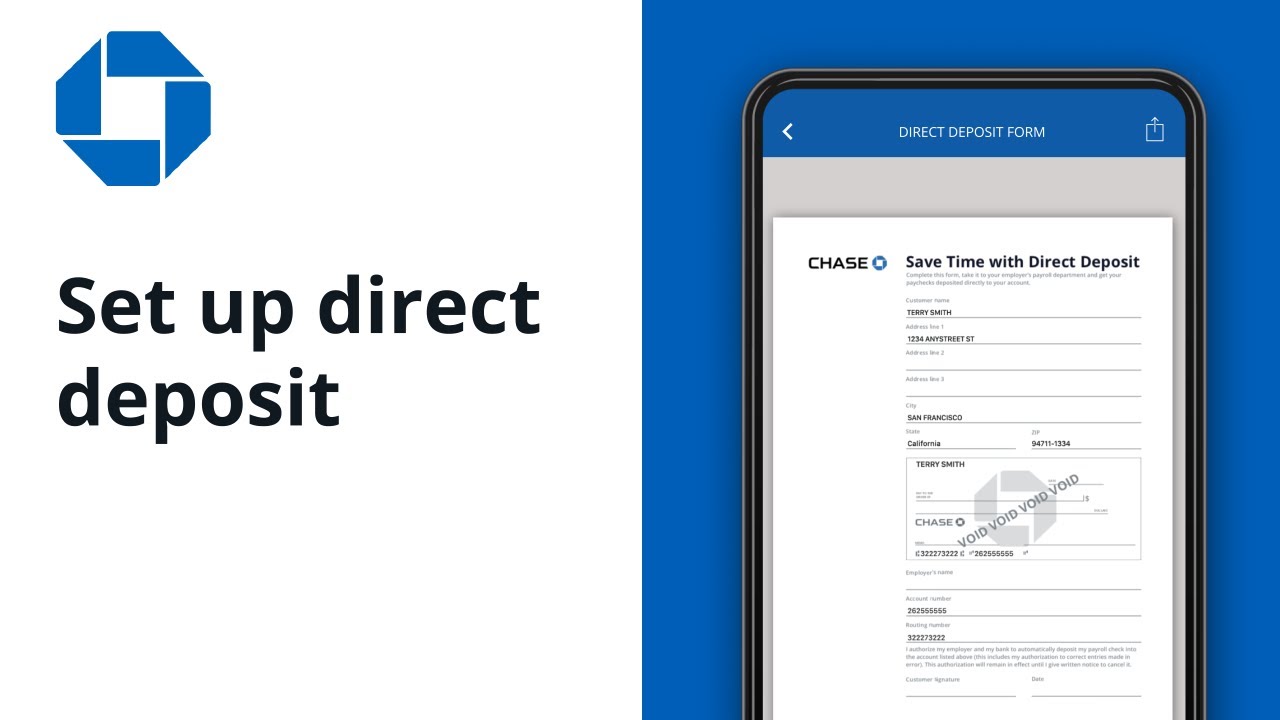

How To Write A Check Chase Bank – How To Write A Check Chase Bank

| Allowed to be able to my own blog site, with this time period I’m going to demonstrate with regards to How To Clean Ruggable. And from now on, this is actually the 1st image:

Think about photograph preceding? is usually of which amazing???. if you think so, I’l l demonstrate a few image again down below:

So, if you wish to have all these wonderful photos related to (How To Write A Check Chase Bank), simply click save link to download these photos to your personal computer. There’re available for obtain, if you love and wish to own it, simply click save symbol in the web page, and it’ll be immediately downloaded to your laptop.} Lastly if you need to obtain unique and the latest picture related with (How To Write A Check Chase Bank), please follow us on google plus or book mark the site, we attempt our best to offer you regular up-date with fresh and new pictures. Hope you like keeping here. For some updates and latest news about (How To Write A Check Chase Bank) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you update periodically with all new and fresh pictures, love your exploring, and find the right for you.

Here you are at our website, articleabove (How To Write A Check Chase Bank) published . At this time we are pleased to declare that we have found a veryinteresting nicheto be reviewed, that is (How To Write A Check Chase Bank) Most people trying to find information about(How To Write A Check Chase Bank) and of course one of them is you, is not it?:max_bytes(150000):strip_icc()/AlteredSampleCheck-5a0b768922fa3a0036da74fb.png)

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

/counter-checks-315327_V1-68022cae53b74df485a0e956982bebc7.jpg)

/Voided-Check2-57b204813df78cd39c2d59a6.jpg)

/instructions-and-problems-with-signing-a-check-over-315318-final-278293cc107e4bb7ac37a0b5d57d1f06.png)