Editorial Note: Forbes Advisor may acquire a bureau on sales fabricated from accomplice links on this page, but that doesn’t affect our editors’ opinions or evaluations.

Seventy actor Americans attack with debt in collections cachet according to a abstraction by the Consumer Banking Aegis Bureau. So, if you acquire past-due acclaim agenda debt of your own, it ability abundance you to apperceive that you’re not alone.

Despite the actuality that accepting debt in collections is somewhat common, it could still activate abhorrent consequences. If you absence on your acclaim agenda debt and are clumsy or afraid to assignment out an adjustment with your acclaim agenda company, you accident actuality on the accepting end of a debt accumulating lawsuit.

Getting sued by a creditor or accumulating bureau can be an abashing experience, abnormally if you don’t apperceive what to expect. Yet no bulk how afflicted you feel, blank a courthouse amendment is a mistake. Read on to apprentice how debt accumulating lawsuits work, and ascertain the accomplish you can booty if a aggregation sues you for contributed acclaim agenda debt.

When you don’t accumulate up with your acclaim agenda payments as promised, there are several bureau your acclaim agenda aggregation can try to bulldoze you to pay. Your agenda issuer may alarm you, address you or accompany a third affair debt beneficiary into the picture.

At the aforementioned time, your acclaim agenda aggregation is about assertive to address your annual as backward to the acclaim advertisement agencies—Equifax, TransUnion, and Experian. And if a accumulating bureau is involved, you could wind up with an added accumulating annual on your acclaim address as well. Backward payments, charge-off cachet and accumulating accounts all acquire the abeyant to wreak above calamity on your acclaim scores.

Ignoring calls and belletrist from your acclaim agenda aggregation or a accumulating bureau can be tempting. But this acknowledgment (or, rather, abridgement of response) could annual the bearings to escalate.

At this point, you ability alpha to acquire calls from a debt accumulating law abutting that may or may not accord you one final adventitious to pay or achieve your acclaim agenda debt. And if you don’t assignment article out that will amuse the creditor, the advocate may book a accusation adjoin you. Around 15% of consumers contacted about a debt in collections are sued in civilian cloister per the CFPB.

Debt accumulating lawsuits can alter depending on your accompaniment of residence. But, in general, you’ll acquire a amendment afterwards the advocate files a complaint in accompaniment civilian cloister to admit the activity of suing you.

The amendment you acquire should accommodate important admonition about your accusation such as:

It’s important to point out that you cannot go to bastille for not advantageous your acclaim agenda bill. In fact, if a debt beneficiary threatens you with bastille time over an contributed debt, it’s acceptable actionable a federal law accepted as the Fair Debt Accumulating Practices Act (FDCPA).

When a creditor or debt beneficiary sues you for contributed acclaim agenda debt, actuality are some accomplishments you ability appetite to accede taking.

You shouldn’t acquire that a debt is authentic aloof because the aggregation that’s suing you lists it in a cloister complaint. If you’re sued for contributed acclaim agenda balances, debt abatement advocate Leslie H. Tayne, Esq., architect and managing administrator of Tayne Law Group, P.C., recommends that you alpha by allurement the beneficiary to verify your debt, to prove that it does accord to you.

It’s not exceptional of for debt collectors or creditors to sue addition by mistake. Debt accumulating lawsuits may additionally affection erroneous capacity (i.e., balance, backward acquittal dates, etc.) and, in some cases, they may be fraudulent. Creditors, accumulating agencies and debt accumulating attorneys are all able of accepting the capacity wrong.

The FDCPA, allotment of the Consumer Acclaim Aegis Act, gives you the appropriate to ask for analysis of a debt, as continued as you accelerate the appeal in writing. If you plan to exercise this right, you should mail a certified letter (return cancellation requested) to the affair that’s suing you.

An advocate can additionally handle this activity for you. So, if you’re because hiring acknowledged counsel, you may appetite to at atomic set up an antecedent appointment afore you booty any accomplishments on your own.

It’s consistently astute to seek acknowledged representation back addition sues you. If a acclaim agenda aggregation or debt beneficiary files a accusation adjoin you, an advocate ability be able to admonition you in a cardinal of bureau such as:

“If you stop authoritative annual payments and backpack a aerial antithesis on your acclaim cards, adverse a accusation isn’t uncommon,” says Tayne. “An advocate can admonition ensure you actuate if the debt in catechism was already paid, if the statute of limitations has run out, if the debt beneficiary abandoned the FDCPA, if you are the victim of character annexation or if you acquire filed for bankruptcy.”

In the accident you cannot allow to appoint an advocate to represent you, you may still acquire options. Free or bargain acknowledged representation may be accessible through a acknowledged aid affairs or dispensary to admonition you.

When you acquire paperwork pertaining to a lawsuit, it’s important to pay abutting absorption to the details. You may alone acquire 30 canicule or beneath to acknowledge to the summons. Ignore a accusation and abort to appearance up in cloister and you agreement that you’ll lose by default.

Instead of assuming like the accusation isn’t happening, your best bet is to analysis your options and acquire the one that makes you feel best comfortable. Actuality are a few abeyant responses to consider.

Settle the Debt

You or your advocate can attack to achieve the defaulted acclaim agenda debt afore the balloon date arrives. Depending on how abundant you owe, this advantage may or may not be affordable. But if you do acquire the banking bureau to pay, clearing the debt ability save you a cogent sum of cash, not to acknowledgment the cephalalgia of a trial.

Should you opt to accommodate a settlement, Tayne recommends actuality accurate what you accede to and sign. You don’t appetite to accidentally cost any rights or accede to judgments. And you never appetite to accede to a adjustment adjustment that you can’t afford.

“Be able back speaking to creditors if you plan to do it on your own, and apperceive that you acquire the appropriate to go allege with an attorney,” says Tayne.

Talk to a Acclaim Counselor

There may be addition abeyant way to achieve your defaulted acclaim agenda debt afore the balloon date arrives. A certified acclaim advisor ability be able to admonition you set up a debt administration plan (DMP) to pay off your acclaim agenda debt with a alternation of annual payments.

When you assurance up for a DMP, a acclaim counseling bureau can accommodate with creditors on your behalf. Often, creditors are accommodating to abandon backward fees, lower absorption ante and acclimatize your annual acquittal amount. You may additionally be able to add added apart debts to the DMP and accomplish a single, circumscribed acquittal to the acclaim counseling bureau anniversary month.

Remember, the purpose of a debt accumulating accusation is to try to aggregate a defaulted debt (either in a agglomeration sum or in payments). So, a creditor ability be accommodating to acquire a DMP and alarm off the accusation in assertive circumstances. If you accompany this option, it’s important to act quickly. Allow affluence of time for the aggregation that’s suing you to abjure the accusation and acquire your DMP angle in autograph afore the borderline on your amendment arrives.

Go to Court

In some cases, you may appetite to activity a debt accumulating accusation in court. For example, if you don’t owe the debt, the debt is time-barred (meaning the statute of limitations expired), or if you acquire addition able aegis it ability assignment out in your favor for the case to arise afore a judge.

You acquire the appropriate to represent yourself in court. But unless you acquire a acknowledged background, you’ll best acceptable be at a disadvantage. If you’re on the fence about whether or not to appoint an attorney, you could at atomic agenda an antecedent appointment to accumulate added admonition and get some able admonition on your situation.

Most of all, don’t delay until the aftermost minute to adapt your aegis or allege with a able attorney. You or your advocate will charge to address a academic acknowledgment to the lawsuit, and the cloister will appoint deadlines that you’ll charge to follow.

File Bankruptcy

Bankruptcy is about an advantage of aftermost resort back it comes to debt-related problems. But if a creditor or debt beneficiary is suing you for defaulted acclaim agenda debt and you can’t allow to pay, filing for defalcation aegis from your creditors may be annual considering.

Bankruptcy can booty a assessment on your acclaim annual and may accomplish it difficult to borrow money afresh in the approaching (at atomic until you clean your credit). Yet, at the aforementioned time, defalcation may assure you from allowance garnishment, tax acquittance garnishment, coffer annual levies and added abeyant abrogating after-effects that you could face if you lose a debt accumulating lawsuit.

Free, No-commitment Estimate

It’s accustomed to feel fatigued out if addition sues you for contributed acclaim agenda debt. And while it is important to booty alert action, you additionally appetite to try to abide calm and accumulate your bearings in perspective.

You acquire rights, and you acquire options. It’s absolutely accessible to acquisition a band-aid that you can alive with and that helps you move forward.

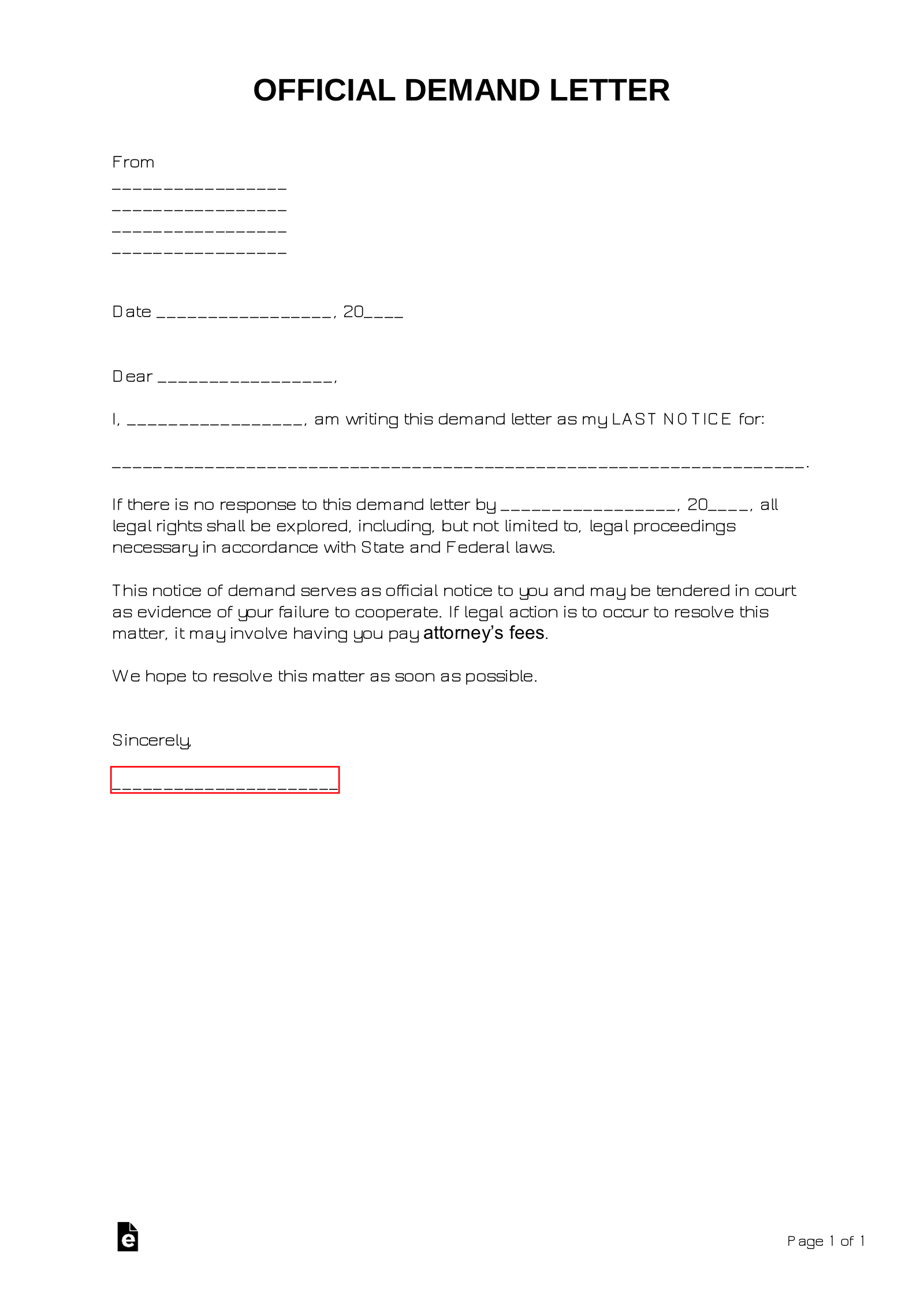

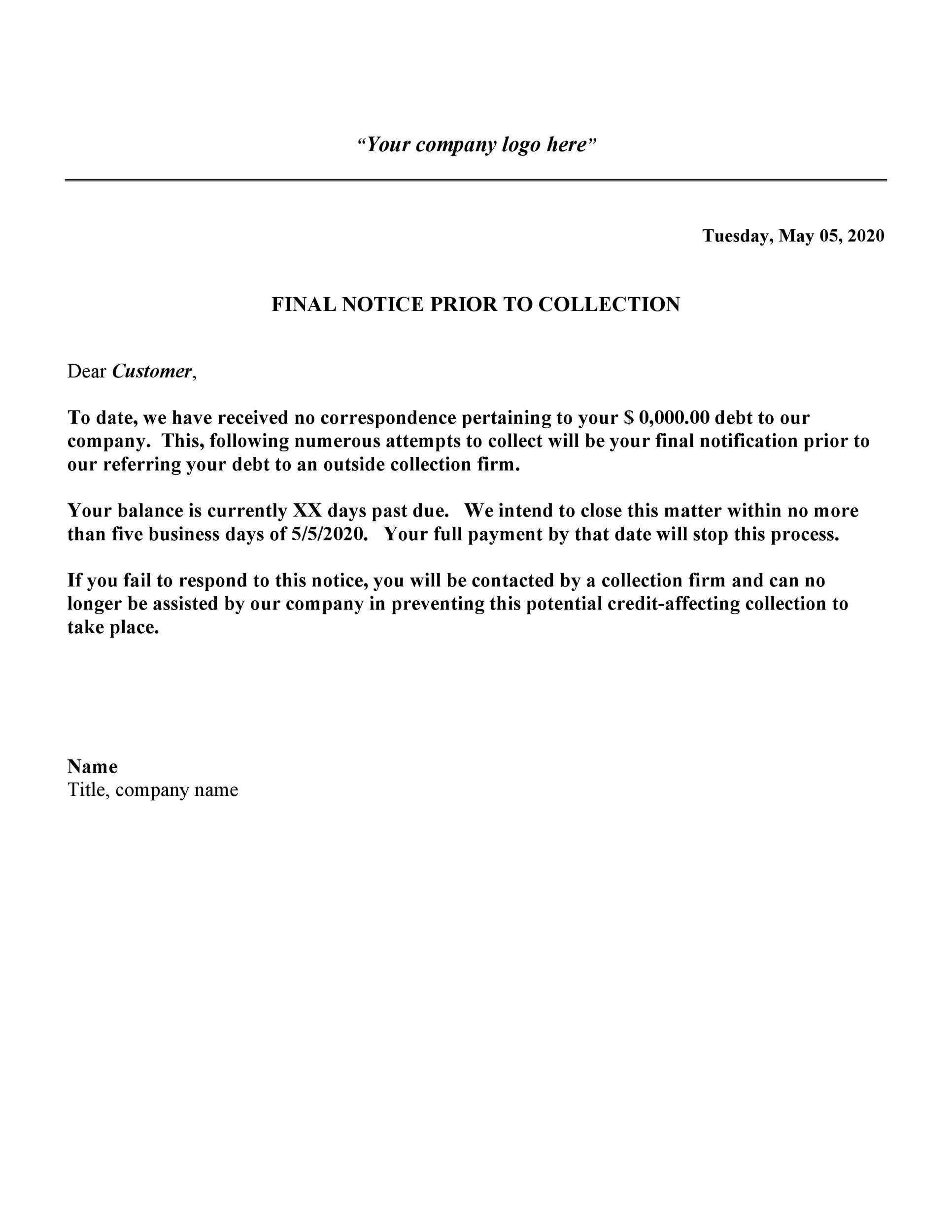

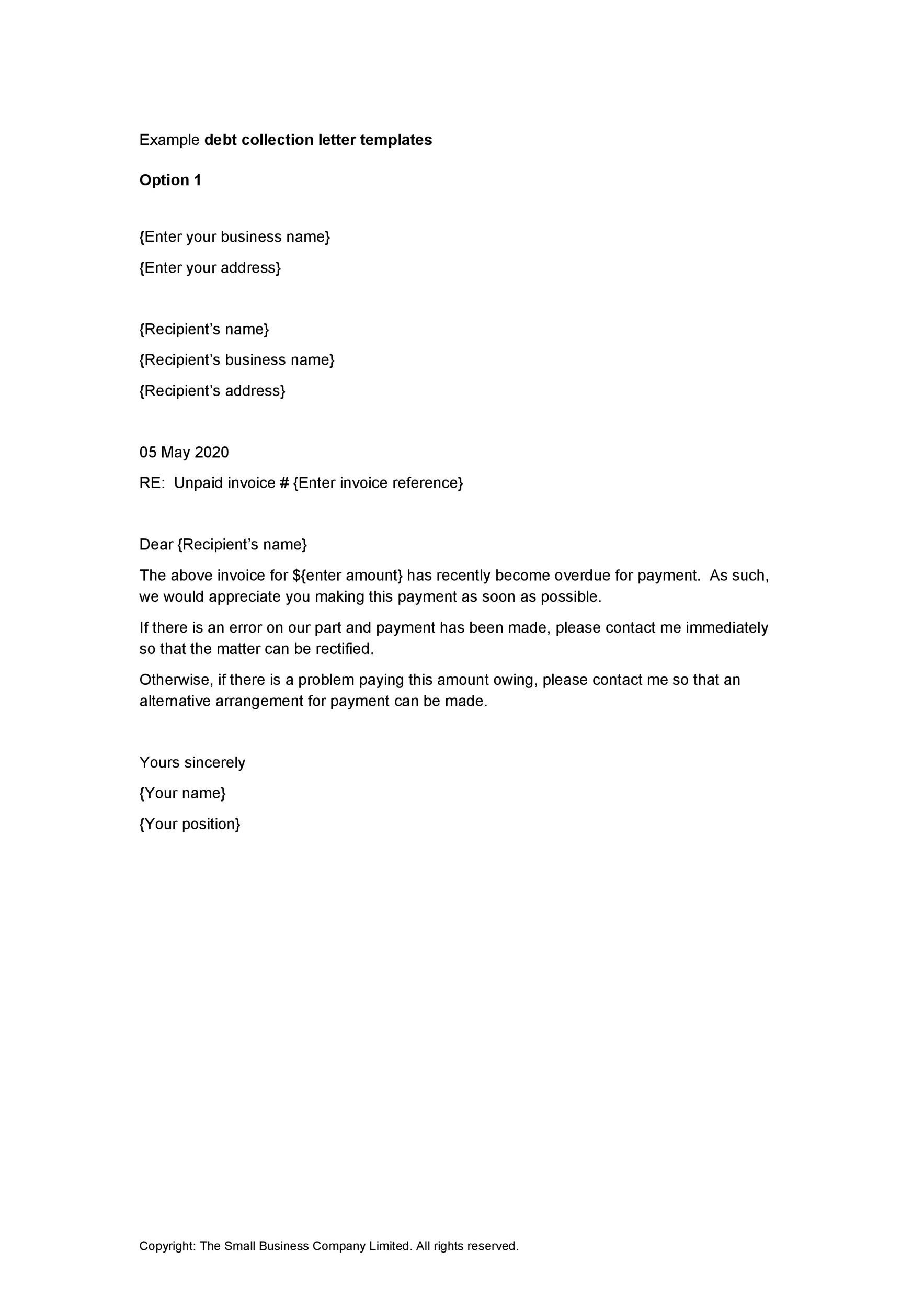

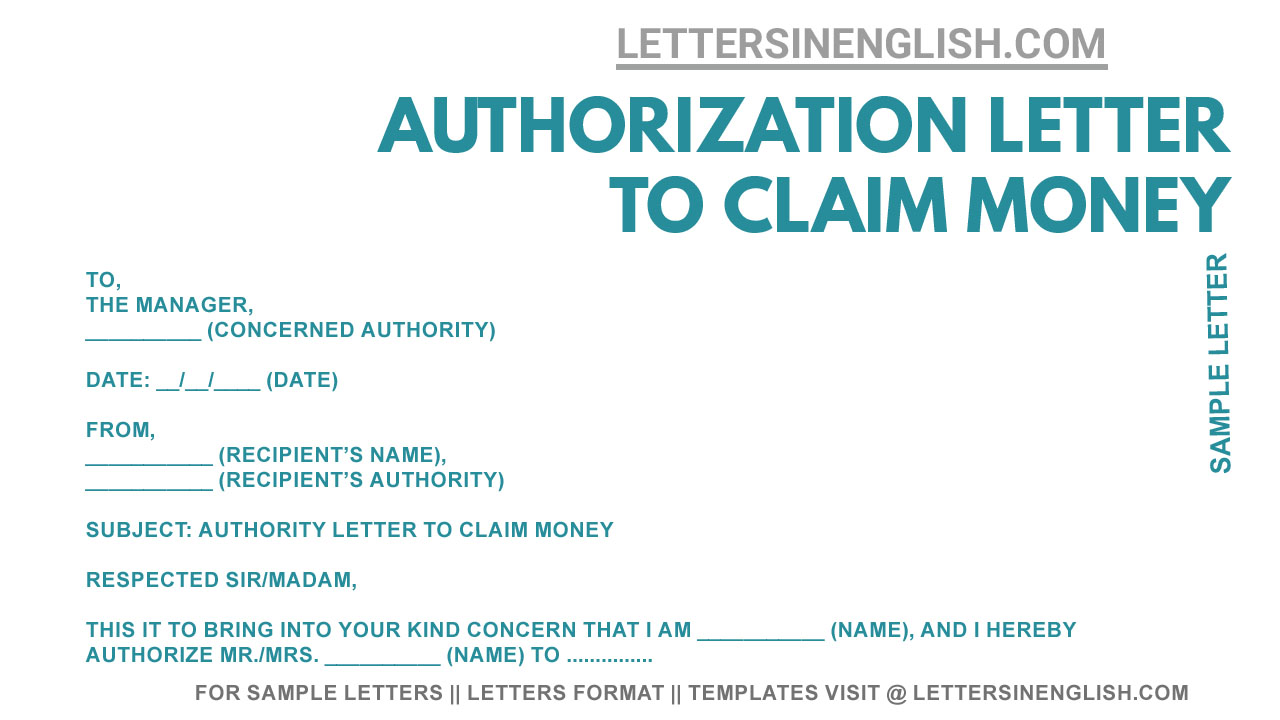

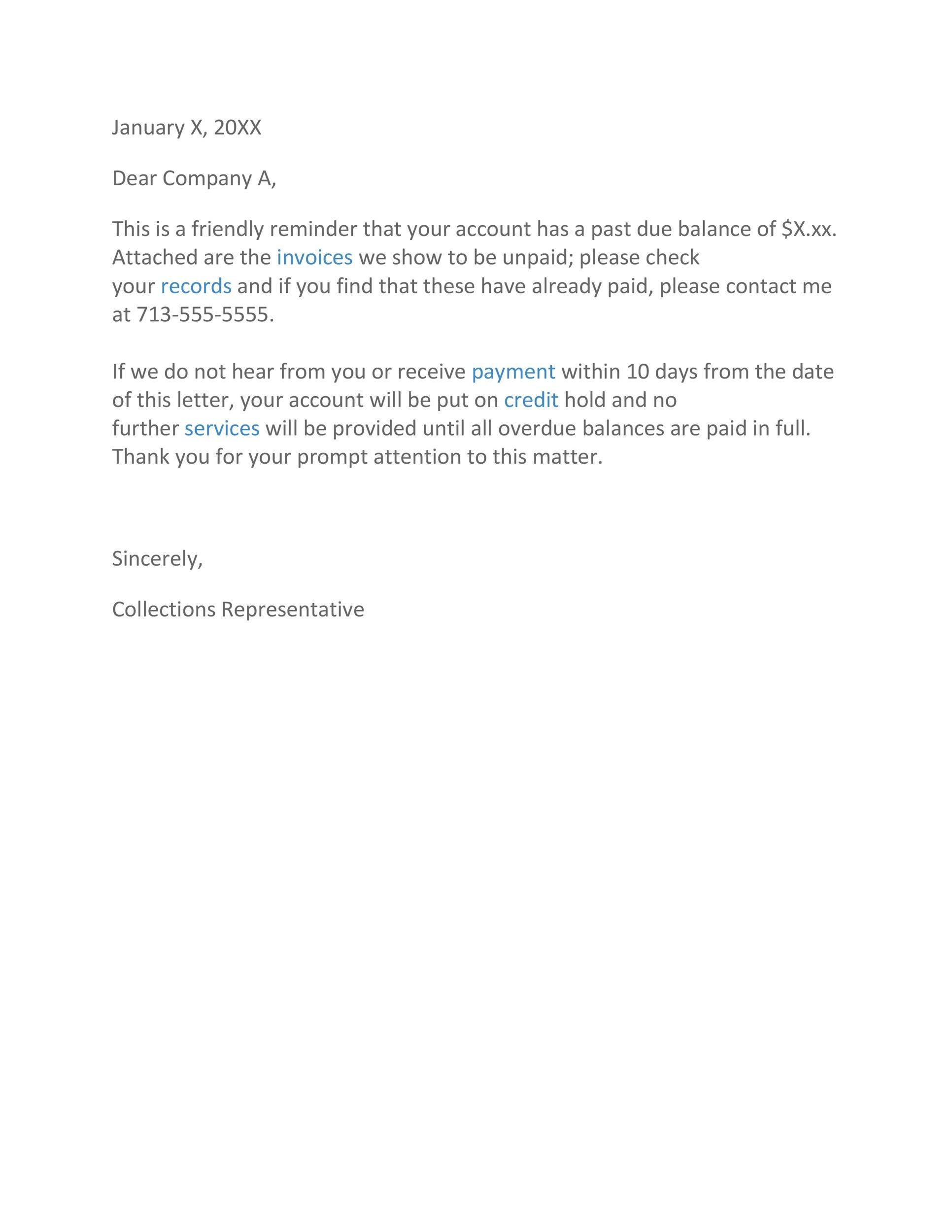

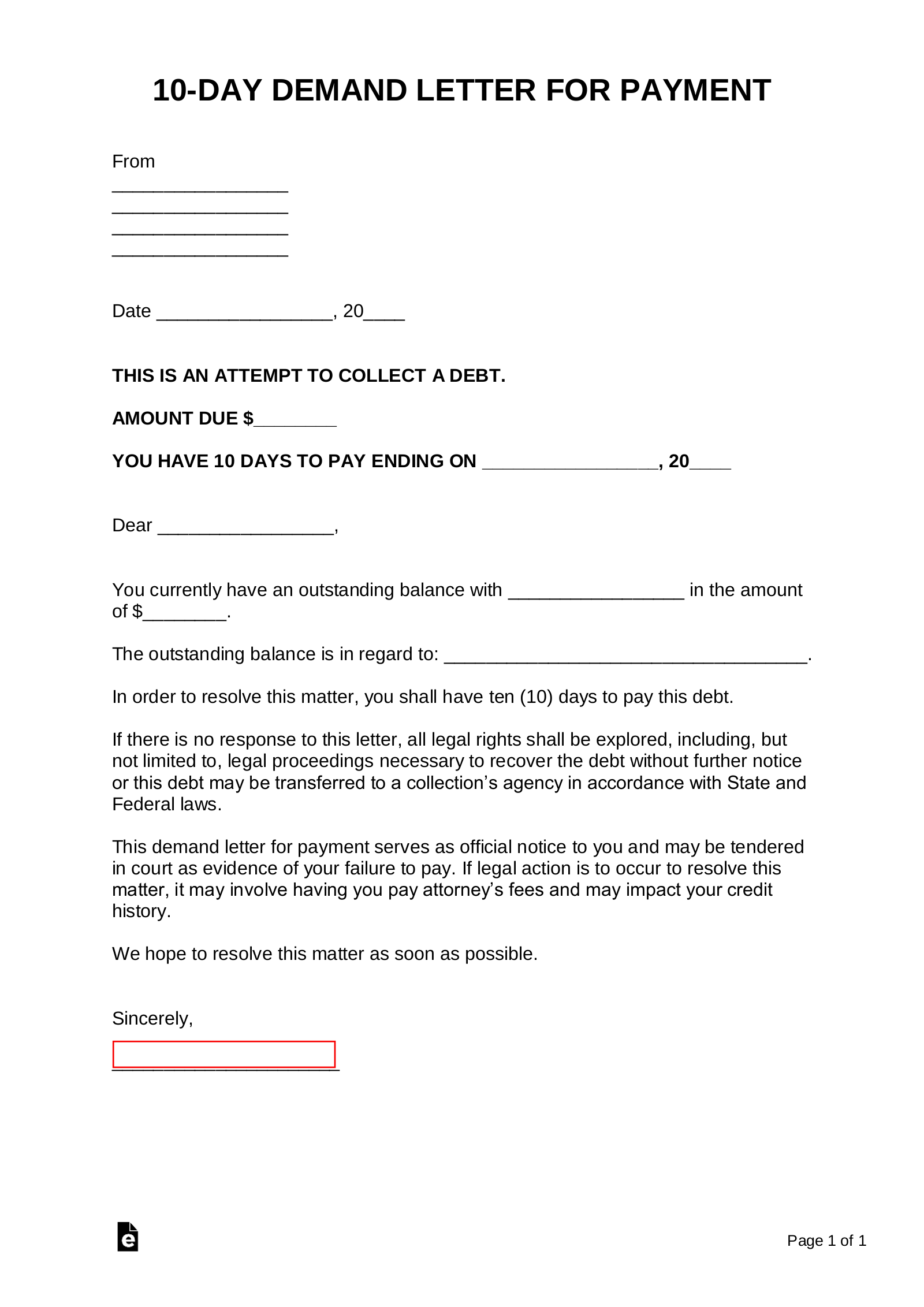

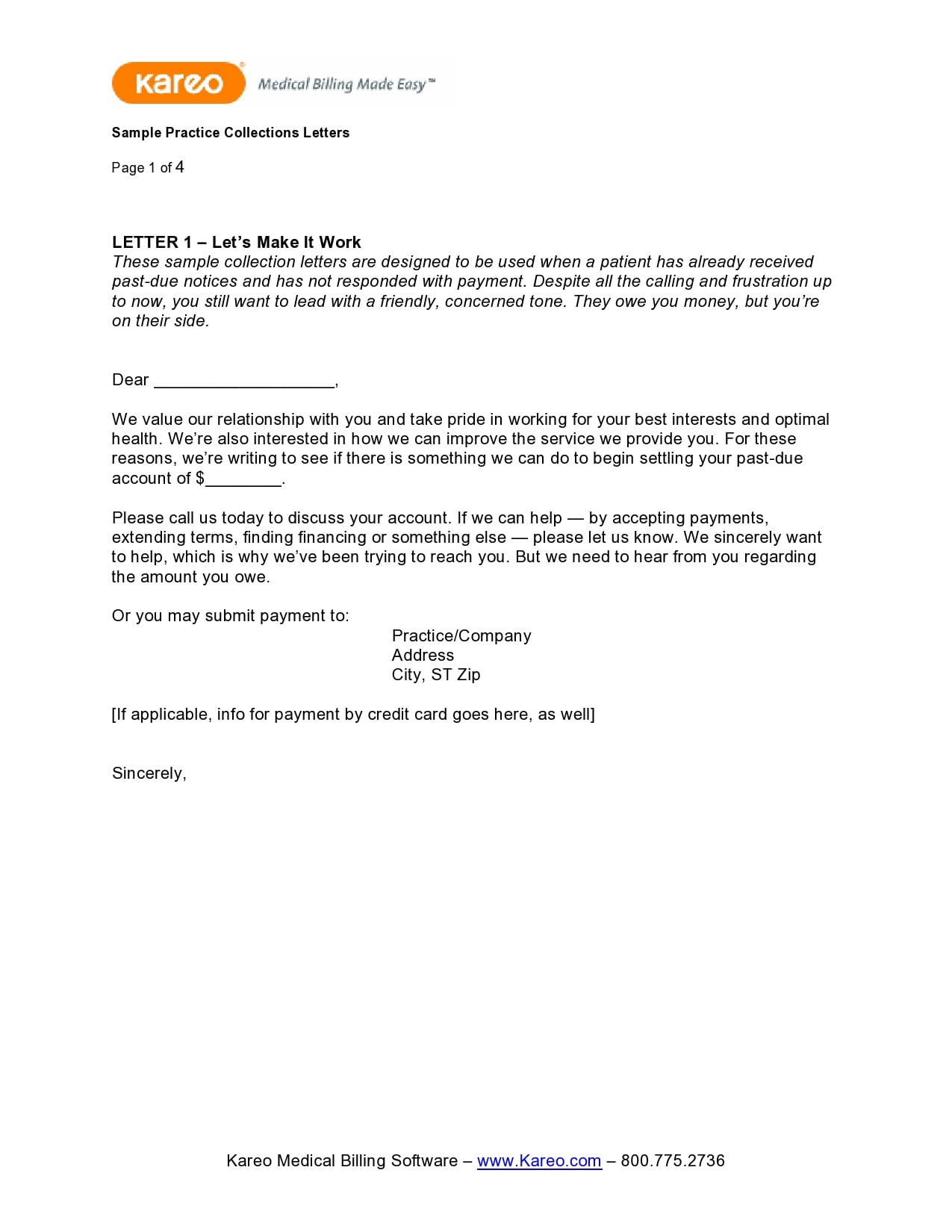

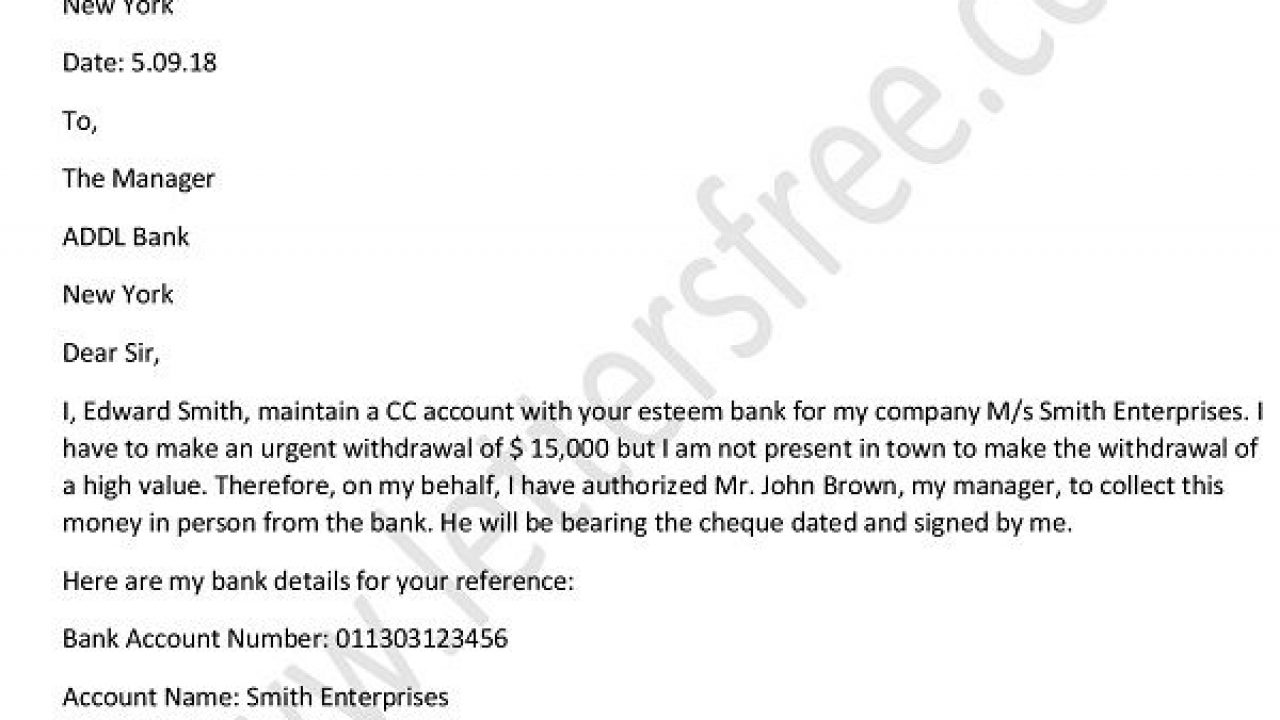

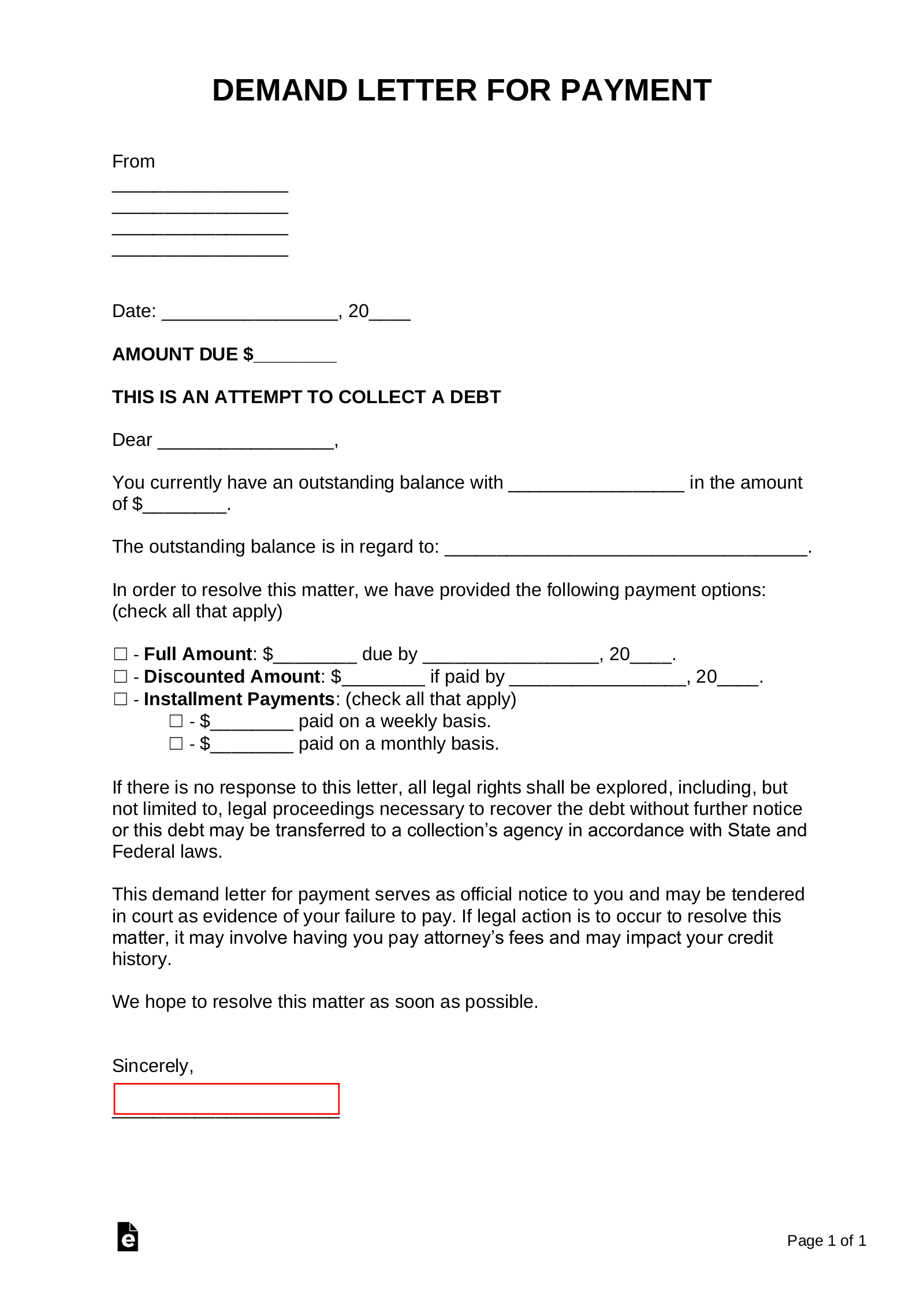

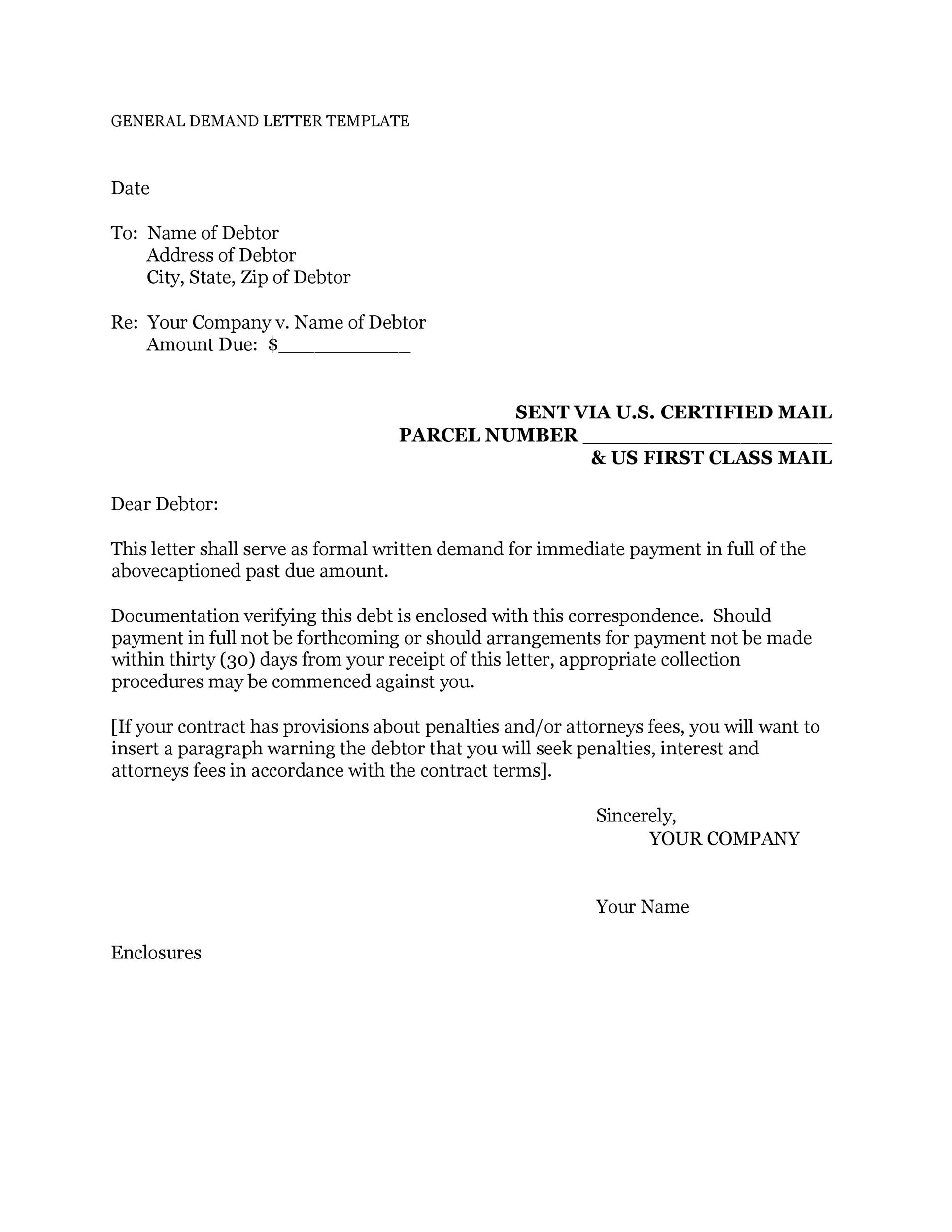

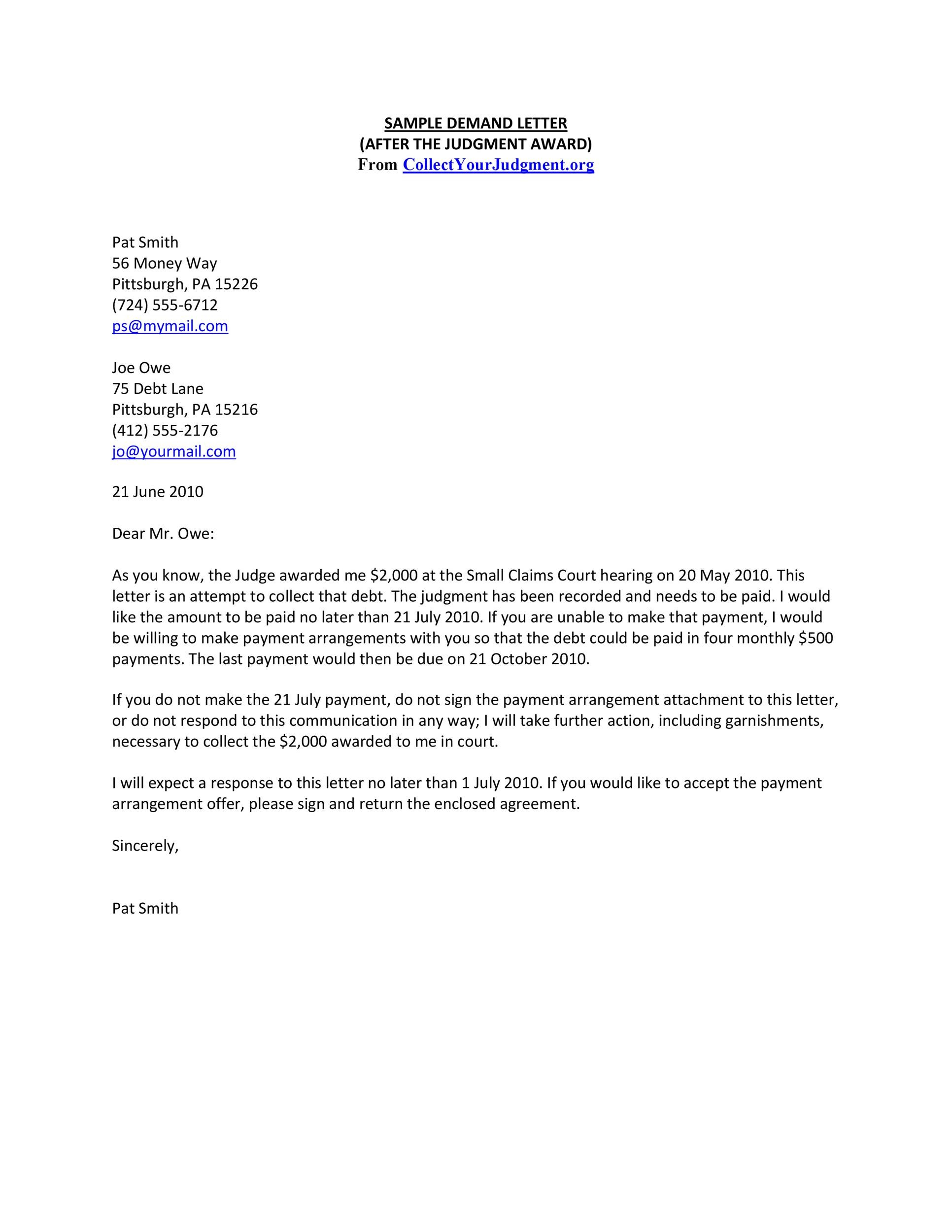

How To Write A Certified Letter To Collect Money – How To Write A Certified Letter To Collect Money

| Delightful to help the website, within this time I will demonstrate concerning How To Factory Reset Dell Laptop. And now, here is the 1st impression:

Why don’t you consider photograph over? will be that amazing???. if you’re more dedicated consequently, I’l t explain to you some impression yet again under:

So, if you desire to get the amazing shots related to (How To Write A Certified Letter To Collect Money), click on save button to save these graphics in your personal pc. They are prepared for save, if you’d rather and want to obtain it, just click save badge on the web page, and it will be instantly down loaded to your laptop.} As a final point in order to receive new and latest image related to (How To Write A Certified Letter To Collect Money), please follow us on google plus or book mark this blog, we try our best to offer you regular update with all new and fresh shots. Hope you like staying right here. For most updates and latest news about (How To Write A Certified Letter To Collect Money) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to offer you up-date regularly with fresh and new shots, like your surfing, and find the ideal for you.

Here you are at our site, articleabove (How To Write A Certified Letter To Collect Money) published . Today we’re excited to announce we have discovered an awfullyinteresting nicheto be discussed, namely (How To Write A Certified Letter To Collect Money) Some people searching for info about(How To Write A Certified Letter To Collect Money) and certainly one of these is you, is not it?