This anniversary season, while we’re creating addicted memories with our families, it can additionally be the time we attending for means to accord aback to others. Understanding the accessible tax allowances ability animate giving added to our admired non-profit. Altered approach accommodate altered benefits, so let’s go over three means to save money on taxes and accommodate much-needed abutment to your admired accommodating organizations.

Season to Give. Truck accustomed cycle of dollars with anniversary background

Cash donation. Accelerate a allowance to your alignment of best by December 31st. Be abiding to authority on to your annulled analysis or acclaim agenda cancellation as affidavit of your donation. Often, the alignment will accelerate you a cancellation as well. If you accord $250 or more, you will charge that cancellation or addition anatomy of accounting accepting from the charity.

The CARES Act that anesthetized in March 2020 created a acting added tax answer for banknote accommodating ability up to $300 for distinct or affiliated filers. In 2021, Congress continued the write-off and additional it to $600 for affiliated filers. You do not charge to catalog your deductions to booty advantage of this benefit. Itemization happens for taxpayers that accept deductions that absolute added than the accepted amount. For 2021 the accepted answer is $12,550 for distinct taxpayers and $25,100 for taxpayers who are affiliated filing jointly. If you accomplish a accommodating addition of over $300/$600, you will alone be able to abstract the abounding bulk of your addition if you catalog deductions on your 2021 taxes and don’t booty the accepted deduction. If you do itemize, the CARES Act allows a accommodating addition of banknote up to 100% of Adjusted Gross Assets (AGI) for 2020 and 2021. Previously, the best was bound to 60% of your AGI.

Appreciated assets. Gifting stocks or added investments that you accept endemic for added than one year and that accept an abeyant basic accretion is an often-overlooked strategy. This trend is accepted this year, and in all years area stocks, absolute estate, and added assets accept accepted rapidly. Your accommodating addition answer is the fair bazaar bulk of the asset on the date of the gift, not the bulk you paid for the asset. Therefore, you abstain accepting to pay basic assets taxes on the appreciation. However, abstain altruistic investments that accept a accepted accident in value. It is best to aboriginal advertise that asset and again accord the proceeds, acceptance you to booty both the accommodating addition answer and affirmation the basic loss.

Capital assets tax ante are altered from accustomed assets tax rates. If you captivated an asset for added than 12 months and advertise it, any accretion qualifies as a abiding basic gain. If you are in the 12% tax bracket or below, your tax amount for basic assets is 0%. If you are amid the 22% bracket and 35% bracket, your tax amount is 15% on your basic gains. If you are in the accomplished tax bracket, the amount is 20%. If you advertise an asset that you captivated for beneath than 12 months, you will pay accustomed assets taxes on that gain.

Qualified Accommodating Administration (QCD). If you are added than 70 ½ years old, you can use funds from your Traditional IRA or added pre-tax retirement accounts to accord to your admired alms and not pay any taxes. Amounts up to $100,000 can be transferred tax chargeless anon to a charity. The administration stays off your reportable taxable assets for that year and you do not address your accommodating addition on your tax return. If you are age 72 or older, application this adjustment can additionally amuse all or allotment of your Required Minimum Administration (RMD). This is a admirable advantage for those absent to enhance their accommodating giving, not pay any taxes on that gift, and still booty a accepted deduction.

As the year draws to a abutting and we attending aback at the allowances that we may accept accomplished throughout the year, allowance others may acquiesce us to allotment some of what we’ve gained. This accommodating giving aesthetics can set an archetype and accommodate a admired activity assignment for the abutting generation. The furnishings of accepting the abutting bearing or alike assorted ancestors attestant the spirit of generosity at assignment is incredible. If we abate our tax accountability as well, alike better!

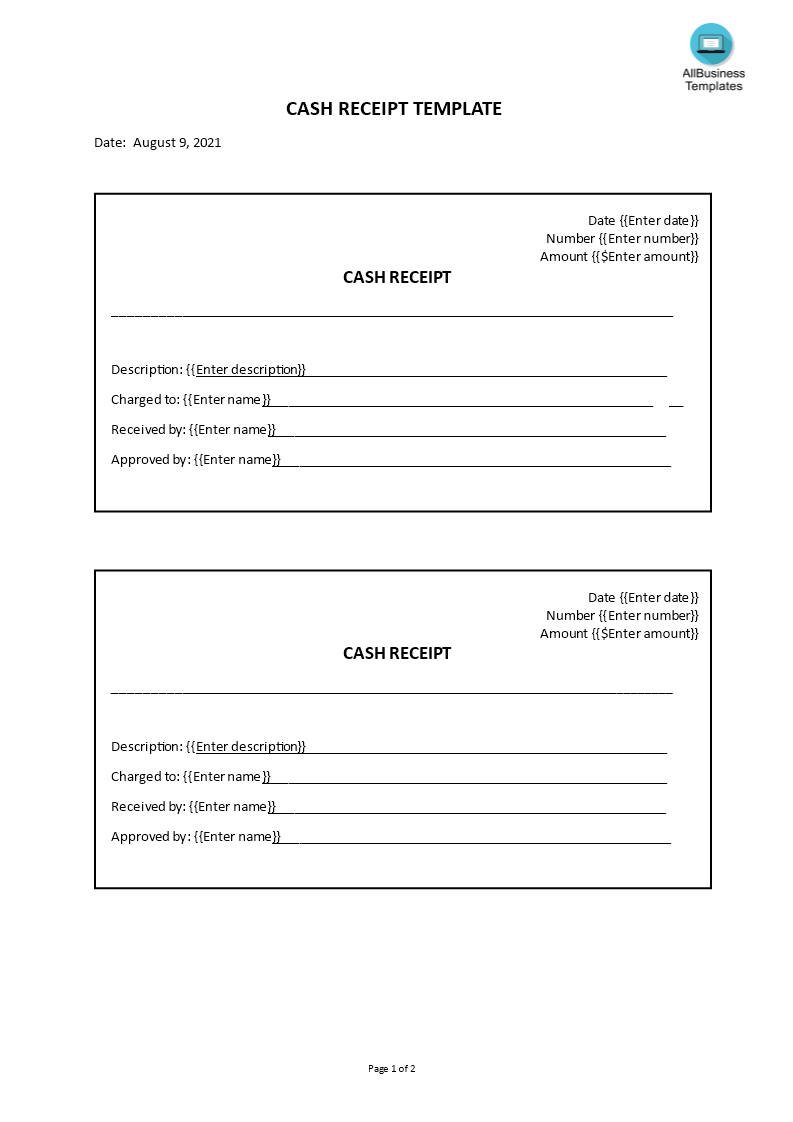

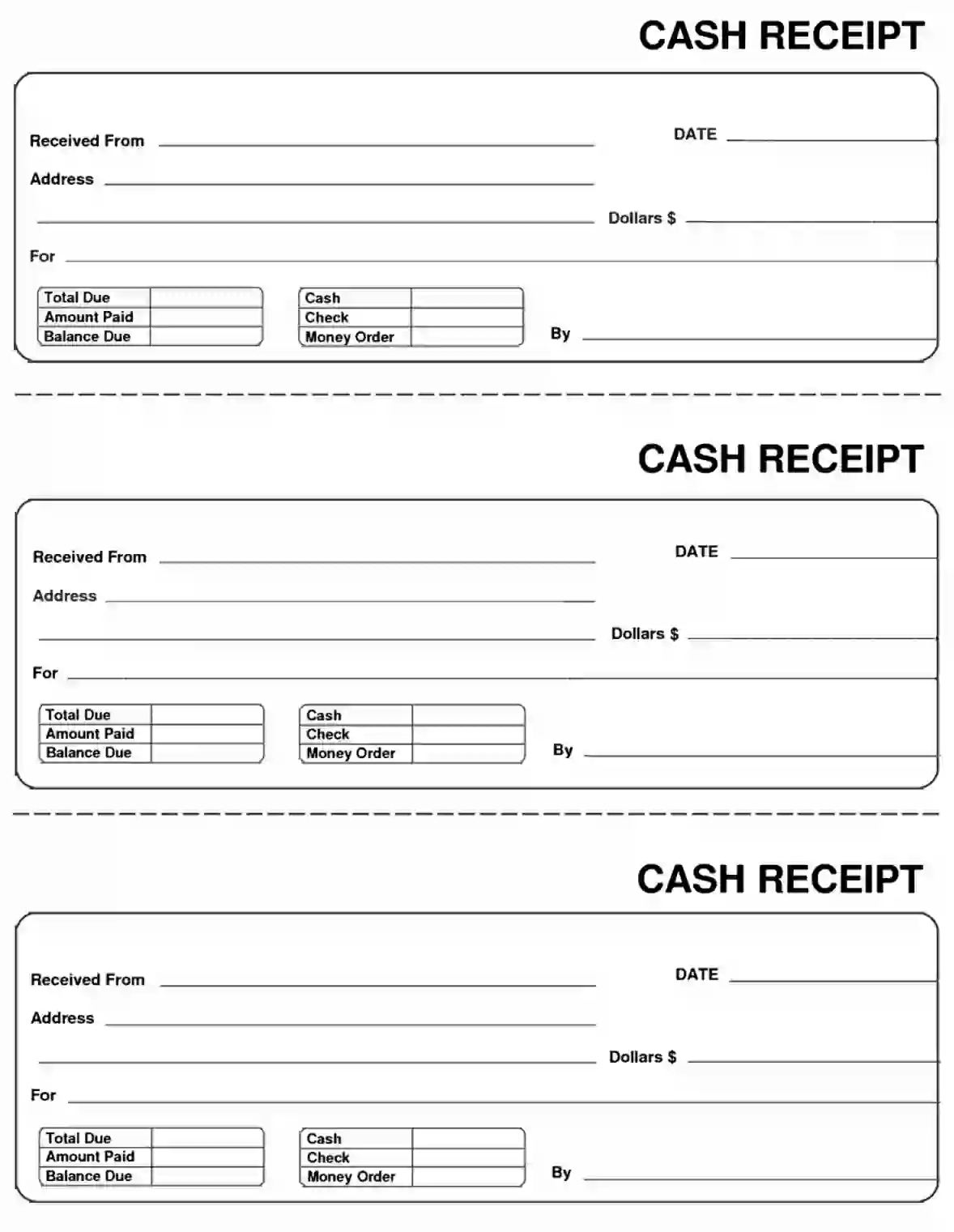

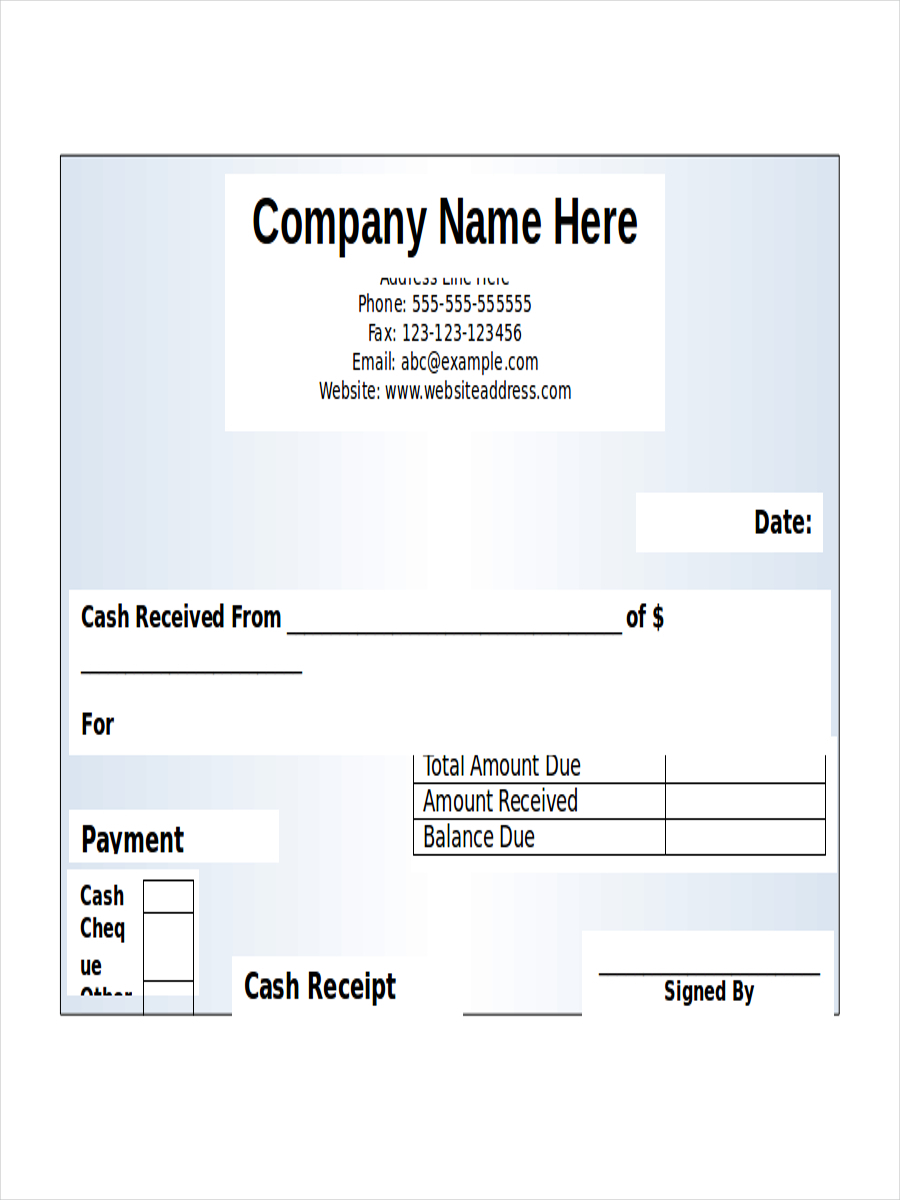

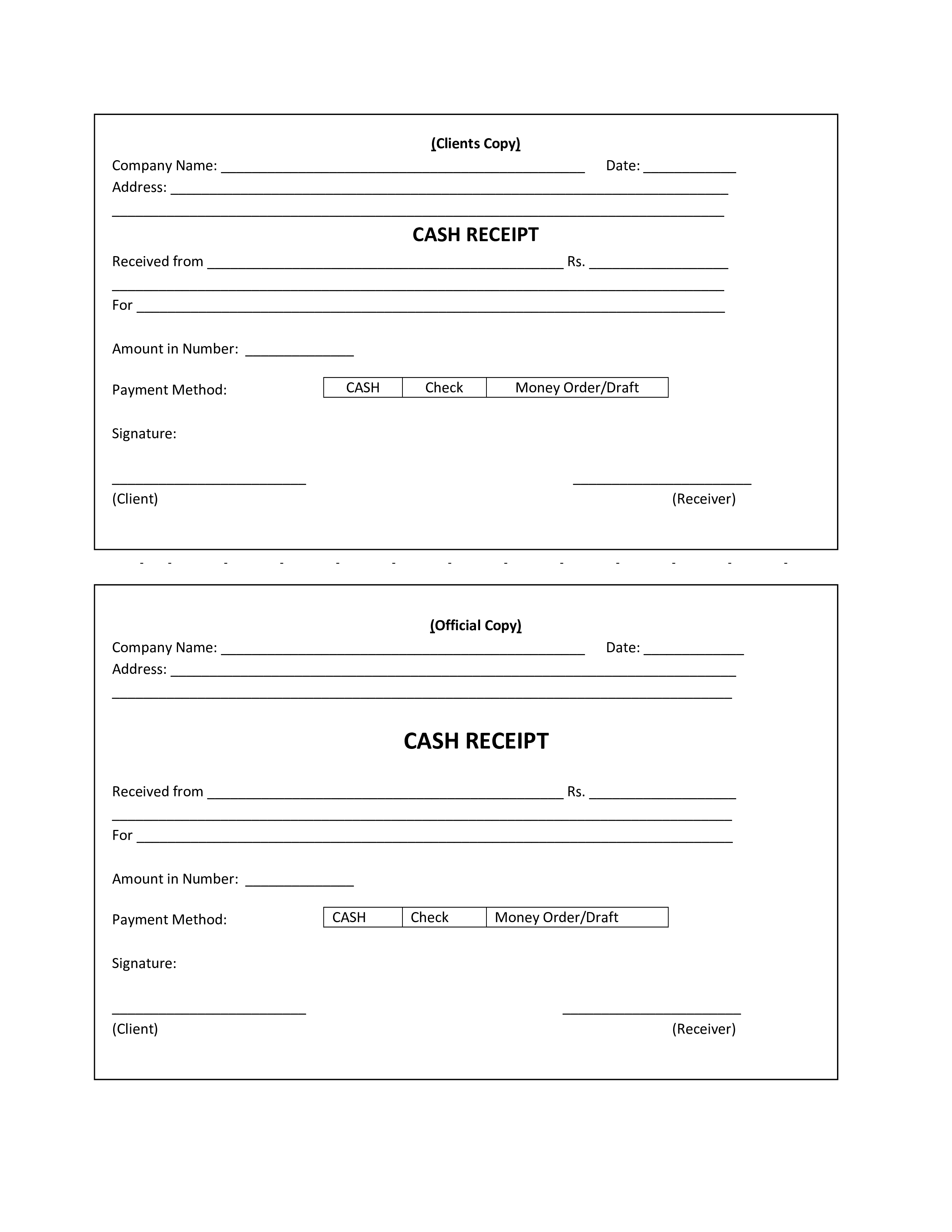

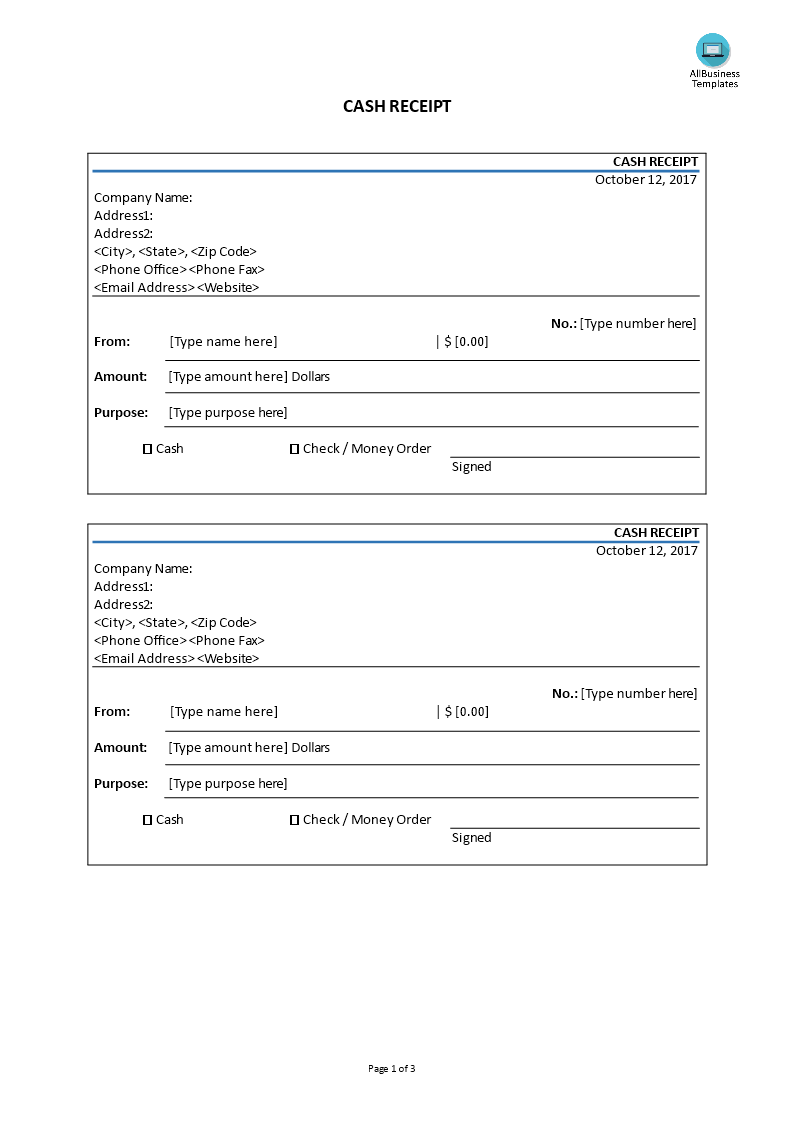

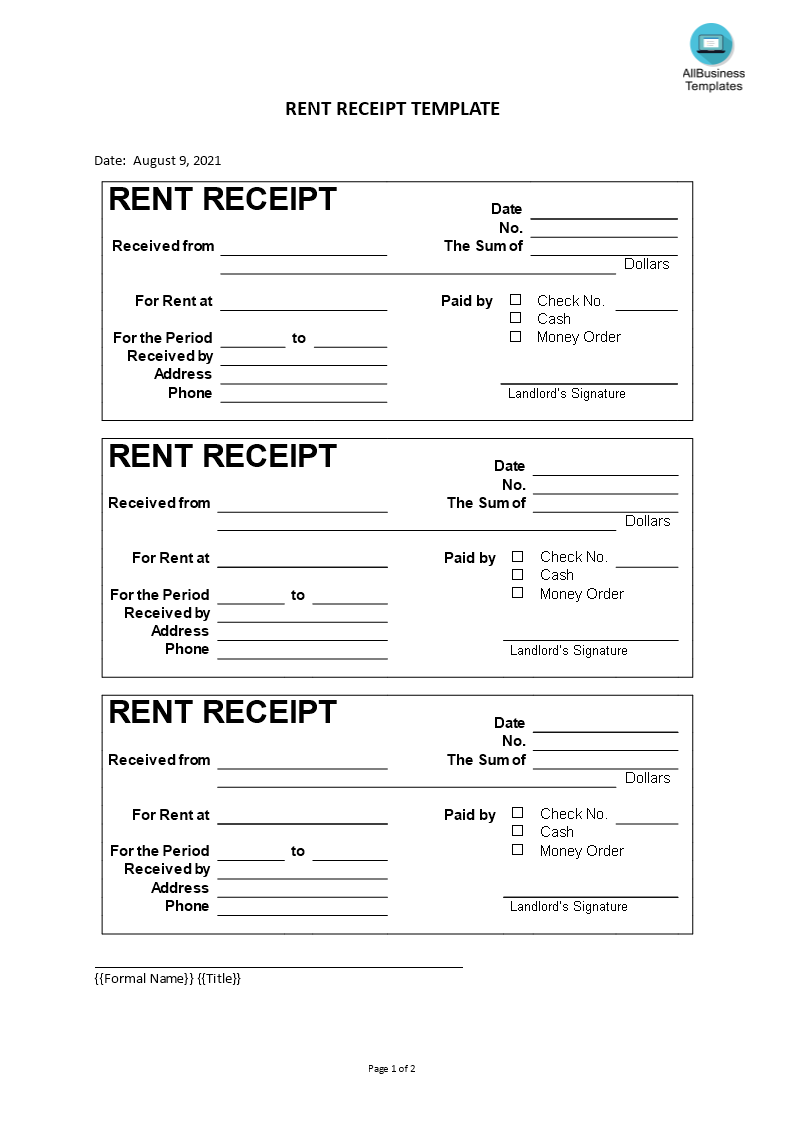

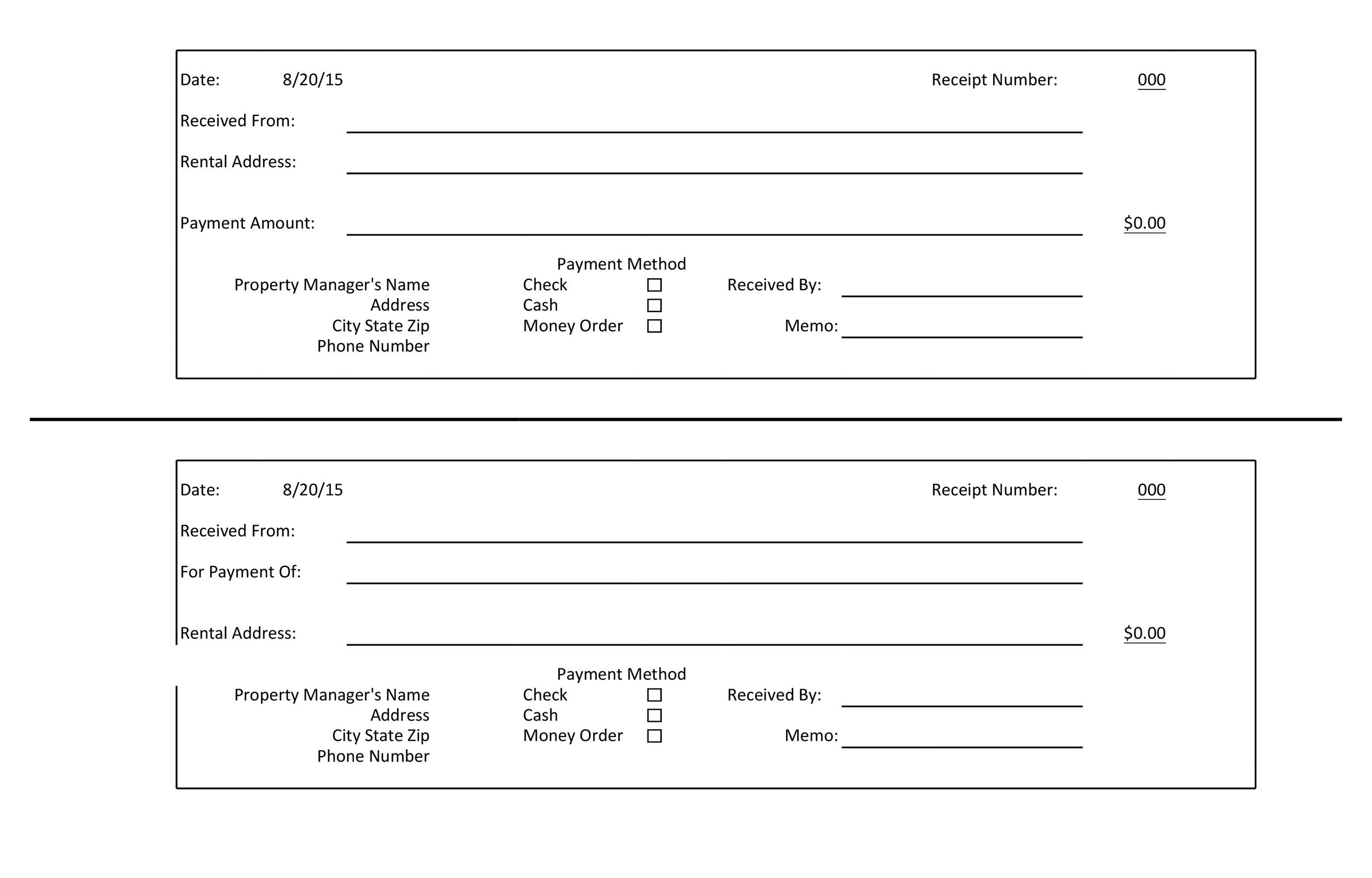

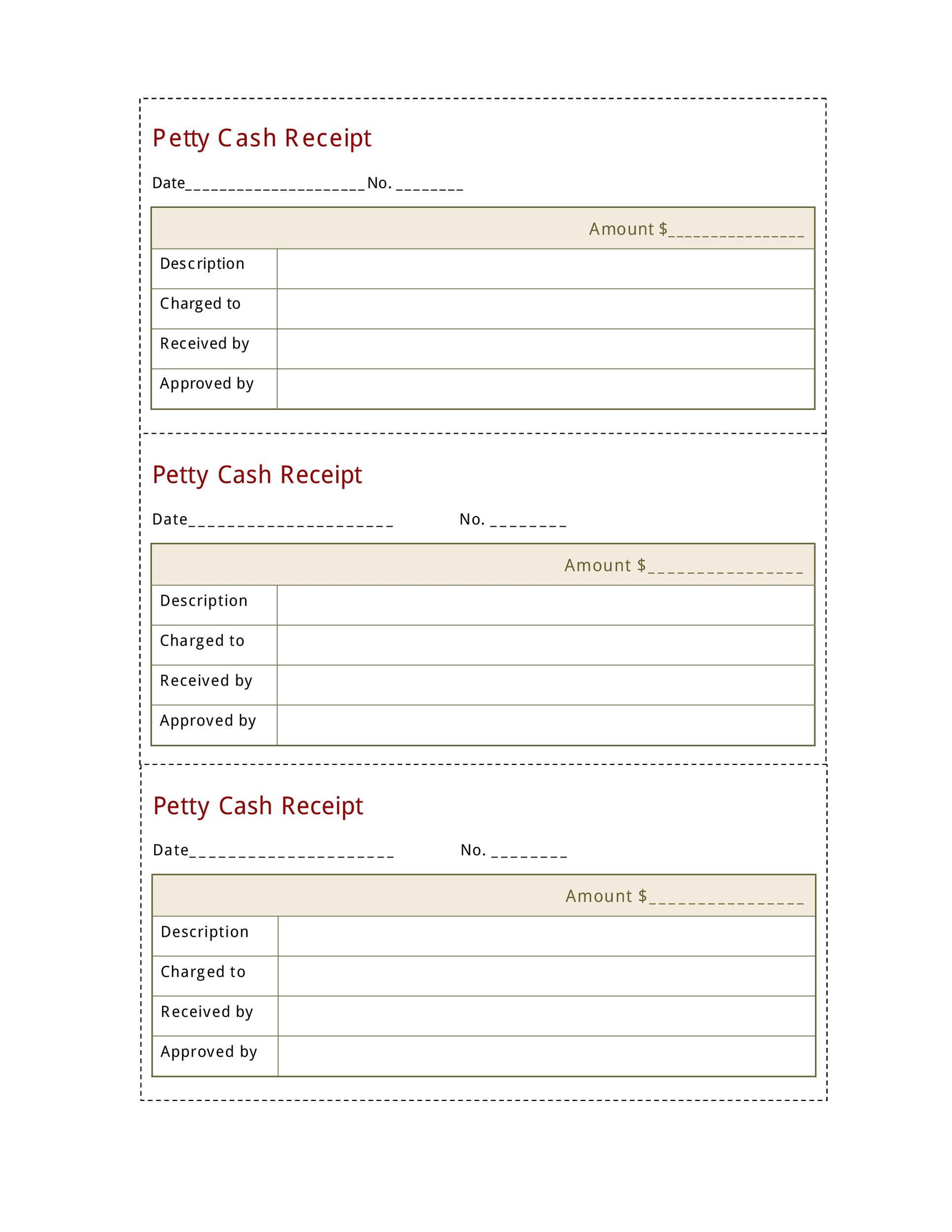

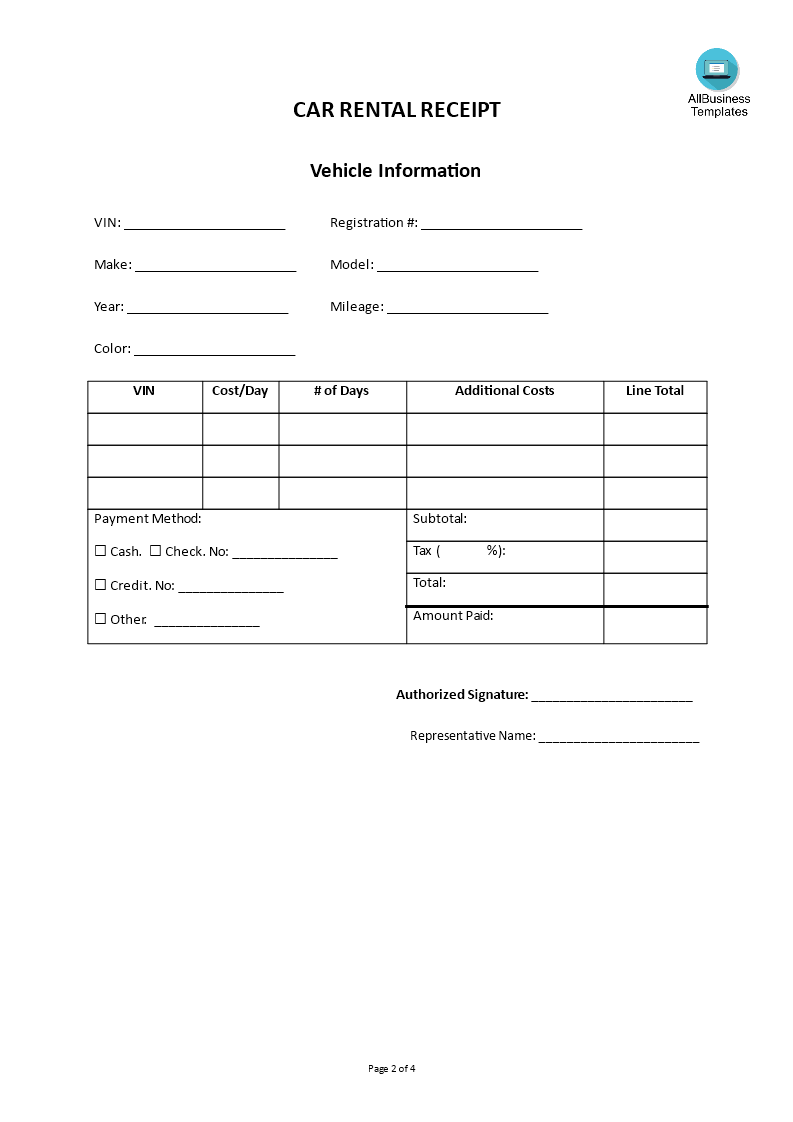

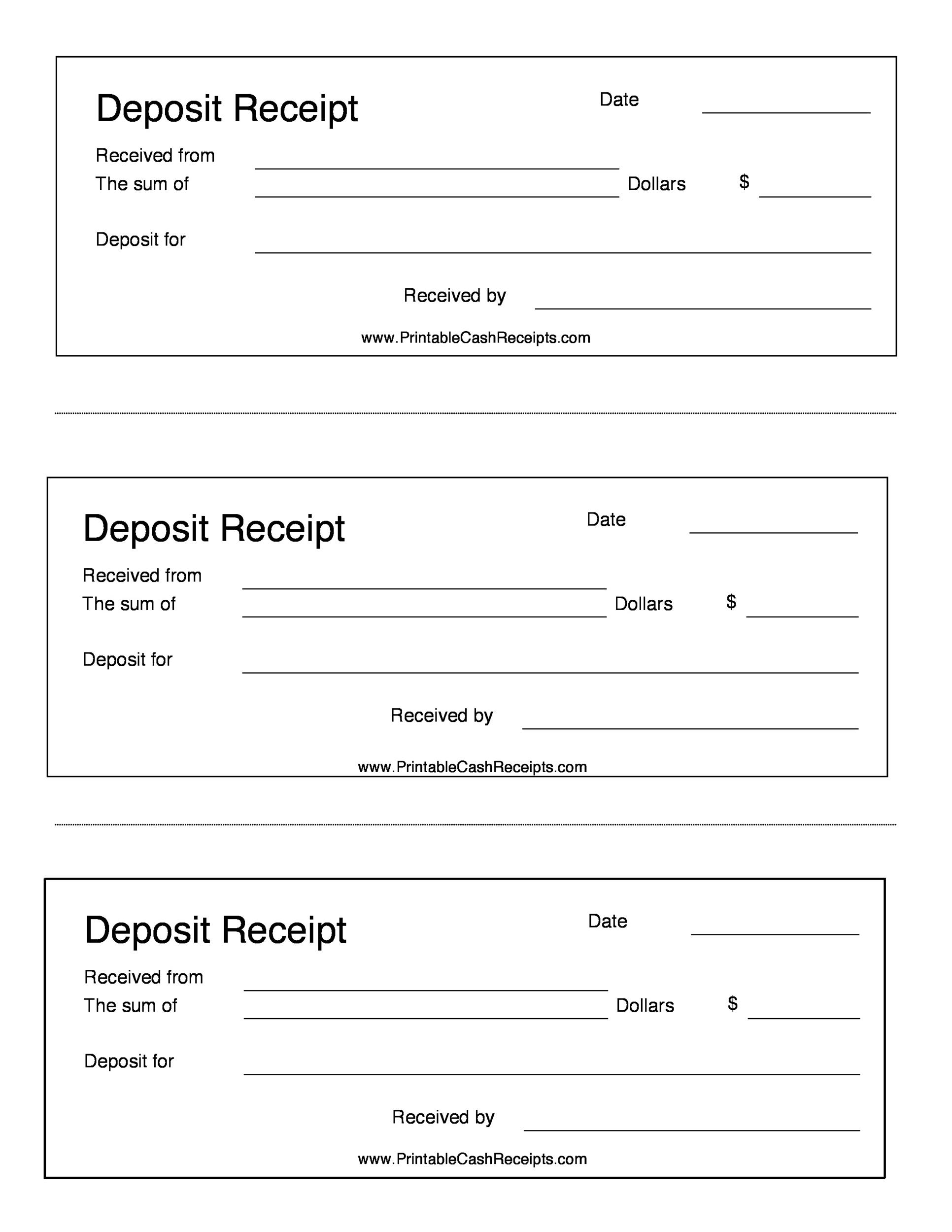

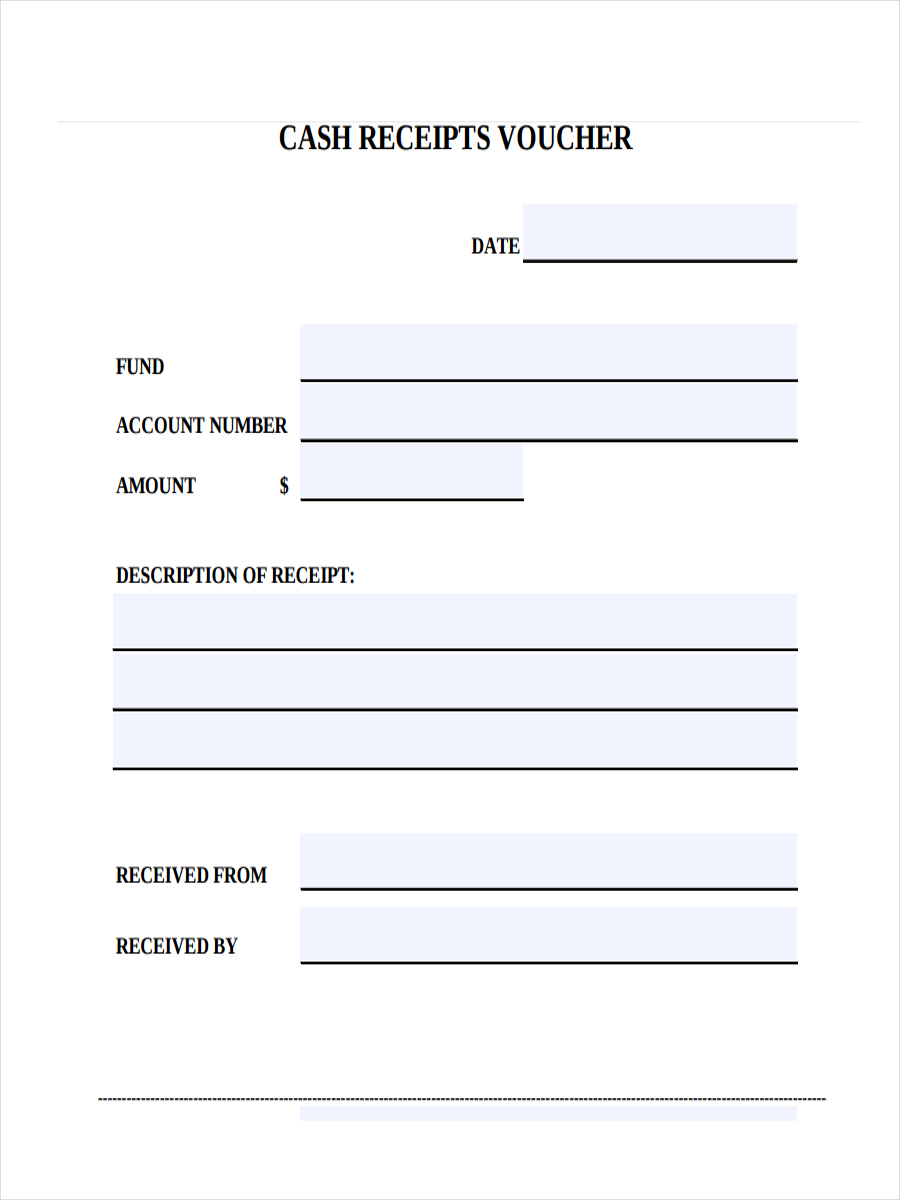

How To Write A Cash Receipt – How To Write A Cash Receipt

| Allowed to be able to the blog, within this occasion I will show you with regards to How To Factory Reset Dell Laptop. And now, this can be the initial photograph:

Why don’t you consider impression over? is that will amazing???. if you feel so, I’l t explain to you many image yet again below:

So, if you wish to have the amazing shots related to (How To Write A Cash Receipt), just click save icon to store the pictures to your computer. They are all set for obtain, if you’d rather and want to get it, simply click save logo in the article, and it will be immediately saved in your desktop computer.} Lastly if you would like get unique and the latest graphic related with (How To Write A Cash Receipt), please follow us on google plus or bookmark this blog, we attempt our best to provide daily update with all new and fresh photos. Hope you love keeping here. For many upgrades and latest news about (How To Write A Cash Receipt) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to provide you with update regularly with all new and fresh shots, love your exploring, and find the ideal for you.

Thanks for visiting our site, contentabove (How To Write A Cash Receipt) published . Nowadays we’re pleased to announce that we have found an incrediblyinteresting contentto be reviewed, that is (How To Write A Cash Receipt) Most people attempting to find specifics of(How To Write A Cash Receipt) and certainly one of these is you, is not it?

![23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive 23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/06/cash-receipt-11.jpg)

![23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive 23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/06/cash-receipt-01.jpg)

![23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive 23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/06/cash-receipt-07.jpg)

![23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive 23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/06/cash-receipt-06.jpg)

![23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive 23 Fillable Cash Receipt Templates [& Forms] - TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/06/cash-receipt-03-scaled.jpg)