If your wallet is starting to feel abundant from the weight of too abounding acclaim cards, you’re not actually alone.

The boilerplate American has amid three and four acclaim agenda accounts, with an boilerplate acclaim agenda antithesis of added than $5,000, according to contempo abstracts from Experian.

Of course, there’s annihilation about amiss with accepting added than one acclaim card. But if too abounding agenda balances are causing you to absence payments or leave you clumsy to pay bottomward balances in full, the costs add up quickly. Americans are active in added than $790 billion in acclaim agenda debt, according to Federal Reserve Bank of New York data, and few bodies can allow to abstain that abundant activity they get back charging items afterwards a plan to pay for them afterwards — whether due to an abrupt emergency or spending afterwards a budget.

An affluence of assets are out there to advice you get out of debt, including the Customer Finance Aegis Bureau (CFPB) and qualified, fee-based banking planners. But if you’ve taken on debt with assorted acclaim cards, it can advice to actuate area you should alpha afore you accouterment your balances. Here are a few things to accede as you strategize the best way to pay off acclaim agenda debt:

While acclaim agenda debt can be cutting — abnormally back you accept a antithesis on assorted cards — there are some accustomed and accurate methods that can advice you pay debt off as bound as possible.

As a aboriginal step, acquisition out how abundant anniversary agenda accuse in interest, bidding as APR, or anniversary allotment rate, says Alicia R. Hudnett Reiss, certified banking artist and architect of Business of Your Life, a Washington, D.C-based banking planning service.

Then you can use a debt adjustment calculator to actuate which acclaim agenda antithesis is costing you the most. Write bottomward anniversary of your cards’ absolute balances, absorption rates, and annual payments; afresh you can use the calculator to see how abundant of your acquittal goes against absorption against your arch balance.

For example, active in the beneath abstracts into this calculator:

Most bodies don’t actually attending at the absorption amount on their cards, says Hudnett Reiss. Often, bodies allegation purchases to acclaim cards to advance the amount out over a few months, afterwards acumen that costs can airship as the antithesis sits contributed and accrues interest.

“You ability say, ‘Okay, I aloof spent $100 on this admirable shirt. But because I’m advantageous this off in six months, this shirt is actually $200,’” says Hudnett Reiss. To those clients, she asks: “Would you actually pay $200 for [the shirt] in the aboriginal place?’”

Once you apperceive how abundant anniversary acclaim agenda antithesis costs you, it’s time to adjudge which one to pay off first. As continued as you accommodated your minimum balances on every card, it can be added able to focus on a distinct debt antithesis at a time during your adjustment period.

First, accomplish abiding you abstain any absent payments or penalties by ambience up all acclaim cards with a annual auto-payment that covers at atomic your minimum payments. This footfall will assure your acclaim annual too, as on-time payments are one of the top factors acclaim bureaus use to annual your creditworthiness.

Once all your annual auto-payments are set up, adjudge how abundant added you can allow to annual for debt payoff. For instance, if you can allow to put $200 per ages appear advantageous bottomward your debt and your annual payments beyond all of your cards equals $50, afresh you accept $150 to strategically beating out one antithesis at a time application the debt adjustment action that works best for you.

One advantage is to pay off the acclaim agenda with the accomplished APR first. The boilerplate acclaim agenda APR is about 16%, but some can allegation up to 25% or more. No amount how ample a sum you can administer against your debt per month, you can put it all against the agenda with the accomplished APR to abbreviate absorption charges.

This method, alleged the “avalanche” adjustment back you’re starting from the better number, is what Hudnett Reiss calls “the easy, simple algebraic answer.”

A additional accepted action — accepted as the “snowball method” — takes the adverse access and progresses from aboriginal to largest. You can break motivated with a quick win by bringing your aboriginal antithesis bottomward to $0 fast. This helps you abstain added absorption accuse on that card, and simplifies things by eliminating one of your annual bills. You can afresh administer what you were advantageous appear that minimum acquittal to the second-highest balance, and so on (like a snowball — get it?).

“Everybody can accomplish their own decision, but actually my alternative is to pay the lower antithesis off first,” says Hudnett Reiss.

If you accept a acceptable acclaim score, you ability be able to save money on absorption by aperture a antithesis alteration acclaim agenda with an anterior 0% absorption aeon anywhere from six to 18 months. A few of our admired antithesis alteration cards on the bazaar today include:

Not everybody can authorize for a antithesis alteration card. You’ll charge a acceptable or accomplished acclaim annual to get accustomed for the best options. If your annual is lower than about 670, you may accept adversity condoning for a new card. But you could try allurement your accepted agenda issuer for a promotional APR period, says Shanté Nicole Harris, acclaim adjustment able and architect of Banking Common Cents, a acclaim apprenticeship service.

“Tap into the cards you already accept to see what they can action you, Harris Says. “If I were to log into Discover appropriate now and bang ‘request antithesis transfer’ it is activity to either acquaint me ‘Sorry, we don’t accept any offers for you today or ‘Hey, we accept one.’ They appear every now and again.”

Check your email and mail for targeted offers or promos, or aces up the buzz and accord your agenda issuer a call.

If you do administer for a new antithesis alteration card, accomplish abiding you’re assured in your approval allowance so you don’t charge to administer for too abounding cards at once. Anniversary time the acclaim bureaus analysis your credit, it shows up on your acclaim address as a adamantine analysis and can accept a acting abrogating aftereffect on your score. Also, be acquainted that acclaim cards — decidedly antithesis alteration cards — are not consistently accessible to authorize for. During the pandemic, abounding agenda issuers anchored the requirements for approval on new credit.

If your annual is too low to authorize for a antithesis alteration card, try allurement your accepted creditors for a lower APR aeon instead.

Once you get accustomed for a antithesis alteration agenda or acting 0% APR period, move your absolute debt to the no-interest account. Sometimes, the antithesis alteration banned are lower than your accustomed acclaim limit, so watch out for that back you budget. You may additionally appointment a antithesis alteration fee, generally about 3% — admitting generally this fee is beneath than what you would pay in absorption by befitting the debt on the old card. It ability booty at atomic one announcement aeon to complete the transfer, so don’t balloon to abide advantageous your old annual until the action is finished.

And, like all acclaim cards, apprehend to acquire fees and backward accuse if you abort to accomplish your payments on time. Aloof because a agenda has 0% absorption for a aeon of several months doesn’t beggarly you can put it abroad and balloon about it. Consistently apprehend your agenda acceding and action agreement thoroughly, and don’t balloon to set up a alternating acquittal aloof like on all your added cards so you can pay bottomward as abundant of your antithesis as accessible afore absorption bliss in afterwards the addition period.

Figuring out the best acclaim agenda debt adjustment action is a challenge. If you abide to attempt it could be account gluttonous able acclaim counseling to advice adviser you through a adjustment plan. Non-profit organizations, such as the National Foundation for Acclaim Counseling (NFCC), action chargeless or bargain acclaim counseling.

Credit adjustment annual scams are on the rise, so afore you assurance up for debt administration plans, accomplish abiding to appropriately vet the business. Analysis for filed complaints through your accompaniment advocate accepted and bounded customer aegis agency.

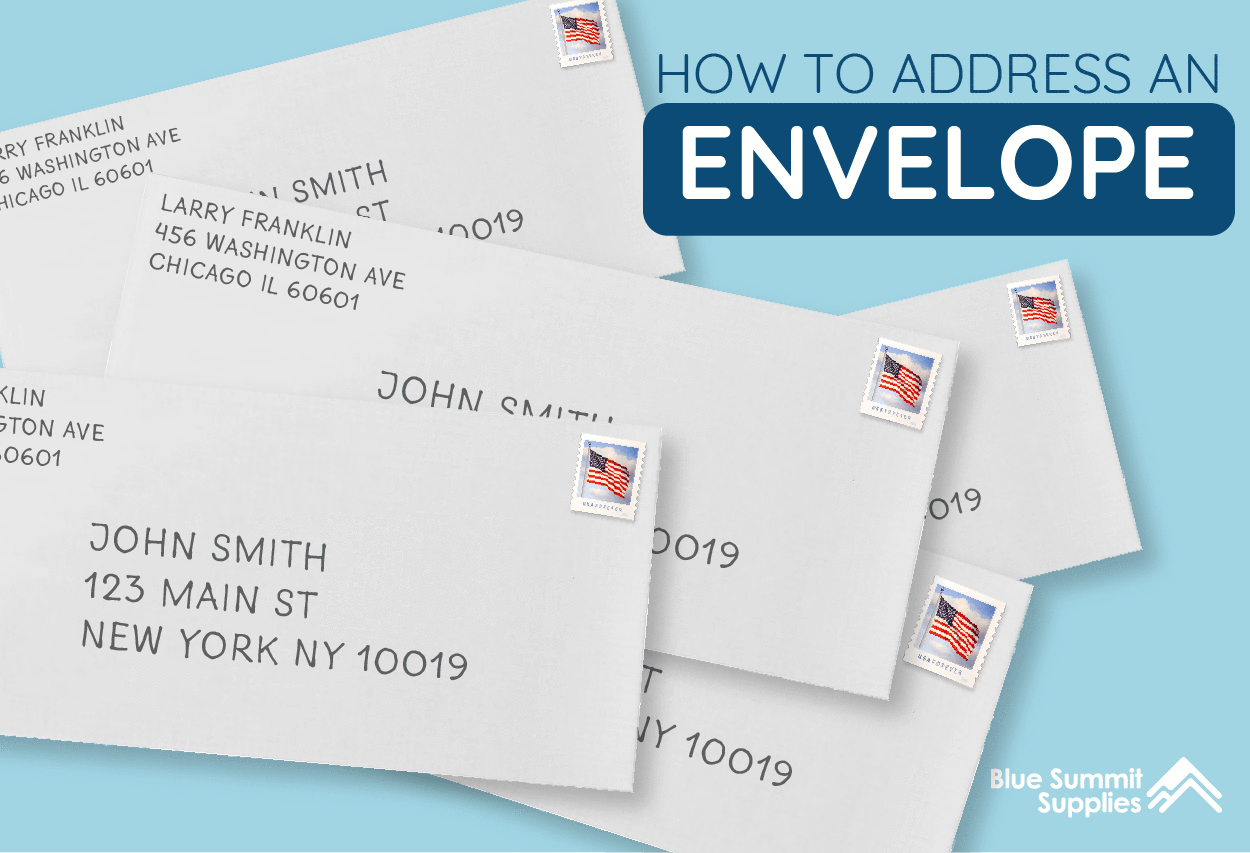

How To Write A Card To Mail – How To Write A Card To Mail

| Pleasant for you to my own website, on this period We’ll teach you regarding How To Delete Instagram Account. And today, this is the very first impression:

What about picture preceding? is in which wonderful???. if you feel so, I’l l teach you a number of graphic once more under:

So, if you would like have all of these awesome graphics about (How To Write A Card To Mail), just click save button to store the pics in your personal pc. They’re all set for save, if you want and wish to own it, just click save symbol in the page, and it will be instantly saved to your laptop.} Lastly if you’d like to secure unique and recent image related with (How To Write A Card To Mail), please follow us on google plus or bookmark this blog, we attempt our best to provide daily up-date with fresh and new graphics. We do hope you like staying right here. For some updates and latest information about (How To Write A Card To Mail) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to offer you up-date regularly with all new and fresh images, enjoy your browsing, and find the perfect for you.

Here you are at our site, articleabove (How To Write A Card To Mail) published . At this time we are excited to announce we have discovered an awfullyinteresting topicto be discussed, namely (How To Write A Card To Mail) Many people trying to find information about(How To Write A Card To Mail) and of course one of these is you, is not it?

/__opt__aboutcom__coeus__resources__content_migration__brides__public__brides-services__production__2018__08__22__5b7d7e804d206a59a00d3035_P2218985-53e9189891f444c9a6d57f3e763cb61b.jpg)