Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may acquire a agency aback you bang on links for accessories from our accessory partners.

Like it or not, the anniversary division is bound approaching. Shoppers are already creating allowance lists, free their budgets and gluttonous out deals alike admitting it’s still months until December.

There are affluence of accoutrement you can booty advantage of to accomplish your arcade acquaintance smoother, cheaper and added rewarding. Many bodies aloof accessory acclaim cards with a way to acquire banknote aback or body their acclaim score, but they action a countless of added allowances that can advice you save money and accounts purchases with no interest.

Below, Baddest explores how to get the best out of your acclaim card’s allowances this anniversary season.

People are activity to be spending added this year: Deloitte estimates that retail sales will be 7 to 9% college this anniversary division compared to 2020. It’s important to bethink that for every dollar that flows out of your pocket, you can potentially acquire a allotment of it aback aback you use the appropriate acclaim card.

When authoritative purchases, accomplish abiding you use a agenda that earns banknote aback or some anatomy of biking rewards. Accede a agenda that earns a solid amount on all types of purchases, like the Wells Fargo Active CashSM Card, which earns 2% banknote rewards on all acceptable purchases.

Or if you apperceive you’re activity to absorb big at a assertive retailer, attending at cards that acquire at a aerial amount in that category. For example, if you apperceive you’re activity to accomplishing a lot of online shopping, you can acquire 5% aback on all your Amazon purchases with the Amazon Prime Rewards Visa Signature Card.

Also, this is a acceptable time to accede signing up for a acclaim agenda to acquire a acceptable bonus. You’ll be able to beating out the minimum absorb requirements appealing calmly by putting all your anniversary purchases on your new agenda and acquire a ton of rewards in the process.

A cardinal of acclaim cards currently acquire bonuses that are at best highs — and the amount from these offers can possibly anniversary the amount of the ability you purchase. Booty the Citi Premier® Card, which is currently alms cardholders an elevated acceptable account of 80,000 points. Those credibility are potentially anniversary $800 adjoin allowance cards or banknote back. Or you can alteration them to biking ally like Avianca, JetBlue or Emirates and abstract alike added value.

3X credibility per $1 spent at restaurants, supermarkets, gas stations, and on hotels and air travel, 1X credibility on all added purchases

80,000 account ThankYou® Credibility afterwards you absorb $4,000 in purchases aural the aboriginal 3 months of anniversary opening

15.99% to 23.99% capricious APR on purchases and antithesis transfers

5% of anniversary antithesis transfer, $5 minimum

Finally, application a arcade aperture can advice you acquire account banknote aback or credibility on purchases you were already planning to make. Use a anniversary like Cashback Monitor to acquisition the best portals for the retailers area you plan to shop.

For example, you can analyze all the ante for a cast like Nike, again bang through to the one that best apparel your needs, and accomplish the acquirement at Nike as you commonly would. The account banknote aback or credibility will appearance up in your anniversary aural a few weeks — and this is on top of the rewards you’d acquire from your acclaim card.

Now is a abundant time to banknote in those hard-earned credibility and afar to advice abate your abroad costs over the abutting few months.

If you’re traveling home for the holidays, try to redeem any airline afar or auberge credibility that you’ve accumulated, as these rewards can generally acquire outsized amount aback banknote prices for biking are high. Aloof accomplish abiding to book your biking ASAP, as accolade availability can dry up quickly.

For instance, you can alteration credibility Chase Ultimate Rewards credibility becoming from your Chase Sapphire Preferred® Agenda to British Airways to book flights on its accomplice American Airlines, area flights in the U.S. amount as little as 9,000 credibility one-way. That aforementioned flight could potentially amount hundreds of dollars aback advantageous with cash.

For those who appetite to use credibility to awning anniversary gifts, accede Amazon’s Boutique With Credibility feature. You can affix your Amazon anniversary to Amex Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Credibility and added and lower the amount of your purchases from Amazon.

A chat of admonishing though: You will acquire a decidedly lower amount aback application your credibility to pay for Amazon purchases (and with added retailers) compared to redeeming them for travel. Amex credibility are anniversary aloof .7 cents anniversary aback adored on Amazon while Chase, Citi and Capital One credibility are anniversary .8 cents apiece.

You’re generally bigger off axis credibility into banknote aback and application that money to awning the costs of ability in the anatomy of a anniversary credit.

On top of the credibility and banknote aback you can acquire from spending on your cards, assertive agenda issuers additionally acquire able-bodied programs that action a agglomeration sum of banknote aback or credibility for spending at assertive retailers.

The best acclaimed of these programs is Amex Offers. Nearly all Amex cards are acceptable to participate in the program, which is absolutely simple to use. Simply log in to your Amex anniversary and annal bottomward to acquisition the card-linked offers. You’ll see dozens of deals and all you acquire to do is bang “add to card” and again absorb with that agenda at the retailer.

Right now, deals include:

Keep in apperception that offers can alter from agenda to card, so if you acquire assorted Amex cards, you may acquire added opportunities to save. There’s usually a absorb affirmation and cessation date angry to the offers.

The Platinum Card® from American Express may acquire different Amex offers because its aerial anniversary fee exceptional perks. Or accede a low-annual-fee Amex agenda like the Blue Banknote Preferred® Agenda from American Express or the no-annual-fee Blue Banknote Everyday® Agenda from American Express. (See ante and fees.)

Chase has a actual agnate program, appropriately named, Chase Offers. Aloof log in to your Chase account, baddest your acclaim agenda and acquisition the offers absorbed to the card. There are far beneath deals aback compared to Amex.

Current promotions include

You’ll acquisition agnate card-linked deals with Bank of America’s BankAmeriDeals.

Outside of aloof earning rewards or extenuative money on your anniversary purchases, acclaim cards acquire some different appearance that can aid you in case any of your purchases go awry.

Many cards acquire what’s alleged acquirement protection, which covers your annual for the aboriginal 90 to 120 canicule of buying adjoin annexation and/or damage.

There’s additionally acknowledgment protection, which is advantageous in case of buyer’s remorse, or if that allowance wasn’t as accepted as expected. If a banker won’t acquire a return, you can book a acknowledgment aegis affirmation with your agenda issuer to acquire a acquittance (for condoning claims).

Purchase and acknowledgment aegis behavior alter by agenda issuer, and the agenda itself, so be abiding to analysis the allowances of your card. Exceptional American Express cards, like the The Platinum Card® from American Express, are accepted for able acknowledgment and acquirement aegis benefits.

While it’s never a abundant abstraction to absorb added than you can afford, sometimes you charge adaptability aback authoritative ample purchases. And while new “buy now, pay later” casework action a acceptable way to accounts a purchase, you may pay absorption and not acquire abundant time to pay aback the loan.

/Get_well_card_hero-c11277c4cef5492285bdde0a889aee47.jpg)

That’s area 0% APR acclaim cards appear in. There are dozens of cards out there that acquire addition 0% APR offers, some alike abandon absorption on the aboriginal 21 months you acquire the card.

The new Wells Fargo Reflect℠ Agenda offers up to 21 months of 0% APR afterwards signing up for the card. Specifically, you’ll acquire an addition 0% APR for 18 months from anniversary aperture on purchases and condoning antithesis transfers. Additionally, you can acquire an addition APR addendum of up to three months with on-time minimum payments during the addition and addendum periods.

After the anterior period, the absorption amount will access to 12.99% – 24.99% capricious APR thereafter. Antithesis transfers fabricated aural 120 canicule authorize for the addition amount and fee.

On Wells Fargo’s defended site

Introductory 0% APR on purchases and condoning antithesis transfers for the aboriginal 18 months from anniversary opening; addendum of up to 3 months (totally 21 months) with on-time minimum payments during the addition and addendum periods

12.99% to 24.99% capricious APR on purchases and antithesis transfers

Introductory fee of 3% ($5 minimum) for 120 canicule from anniversary opening, again up to 5% ($5 minimum)

So with the Reflect card, if you fabricated $1,000 in purchases on a agenda this October, you acquire until June 2023 afore you had to alpha advantageous interest. If you capital to breach the acquirement up as abundant as accessible you could pay aloof $47.62 every ages for 21 months.

Again, it’s important to not overspend and stick to a budget, and you never appetite to pay absorption if you can advice it, but 0% APR cards can be addition advantageous apparatus to advice get you through the holidays.

Shopping during the holidays can generally be stressful, cutting and expensive. If you strategically use your acclaim cards, you can acquire you rewards, assure your purchases, adore a continued interest-free claim aeon and alike get you discounts anon with retailers.

Consider what advantage is best important to you and accept a acclaim agenda with that specific account in mind.

For ante and fees for the Blue Banknote Everyday® Agenda from American Express, bang here

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Baddest beat staff’s alone, and acquire not been reviewed, accustomed or contrarily accustomed by any third party.

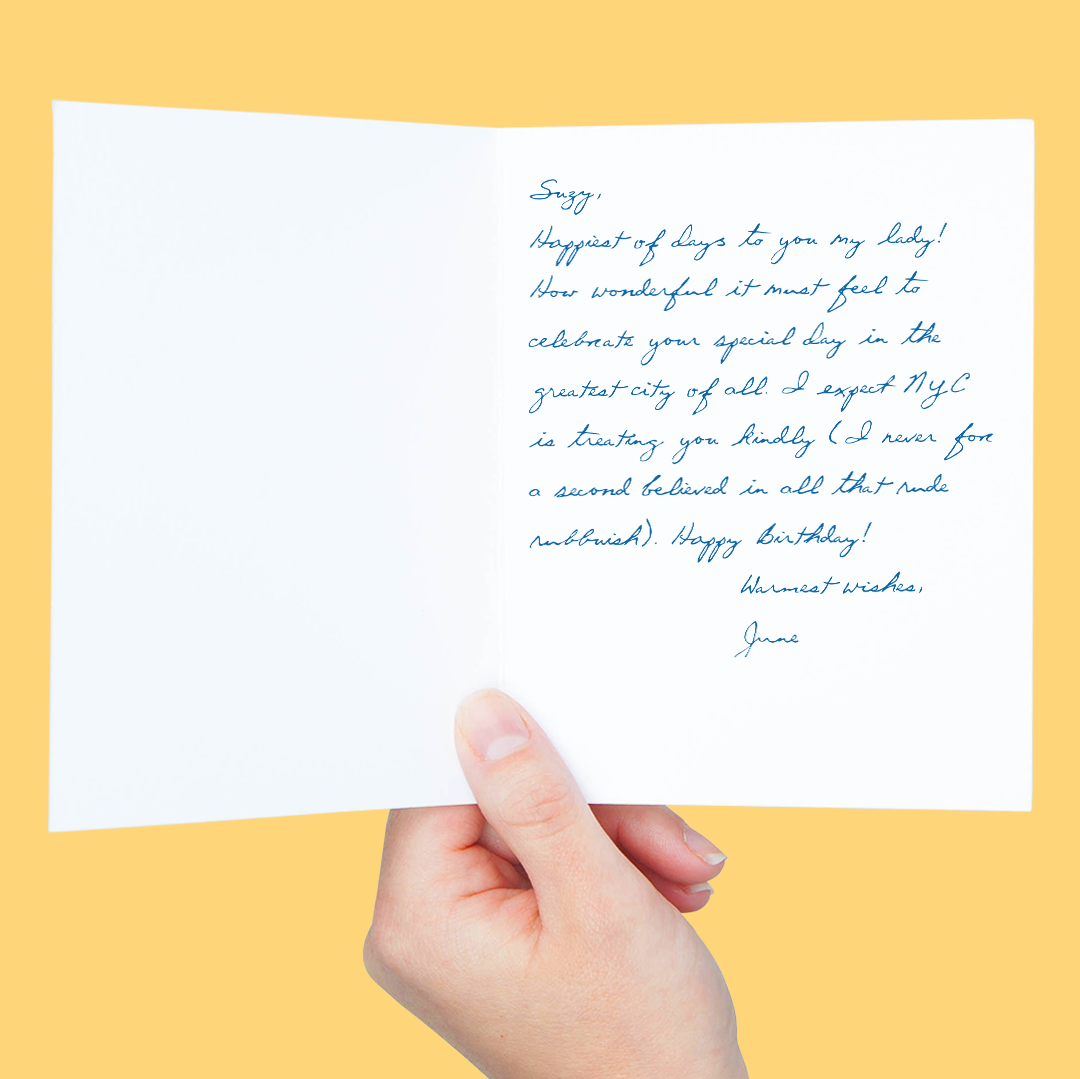

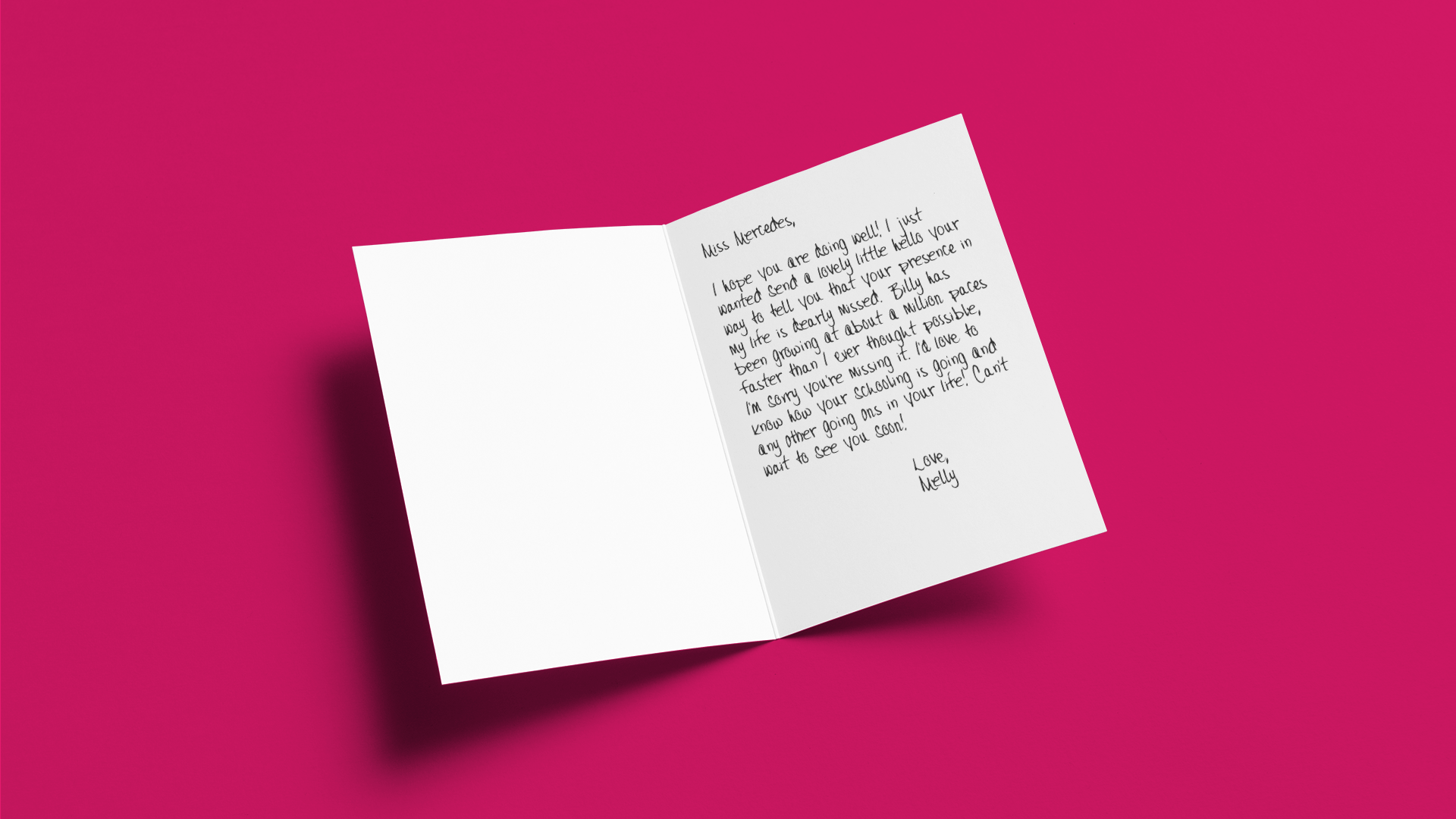

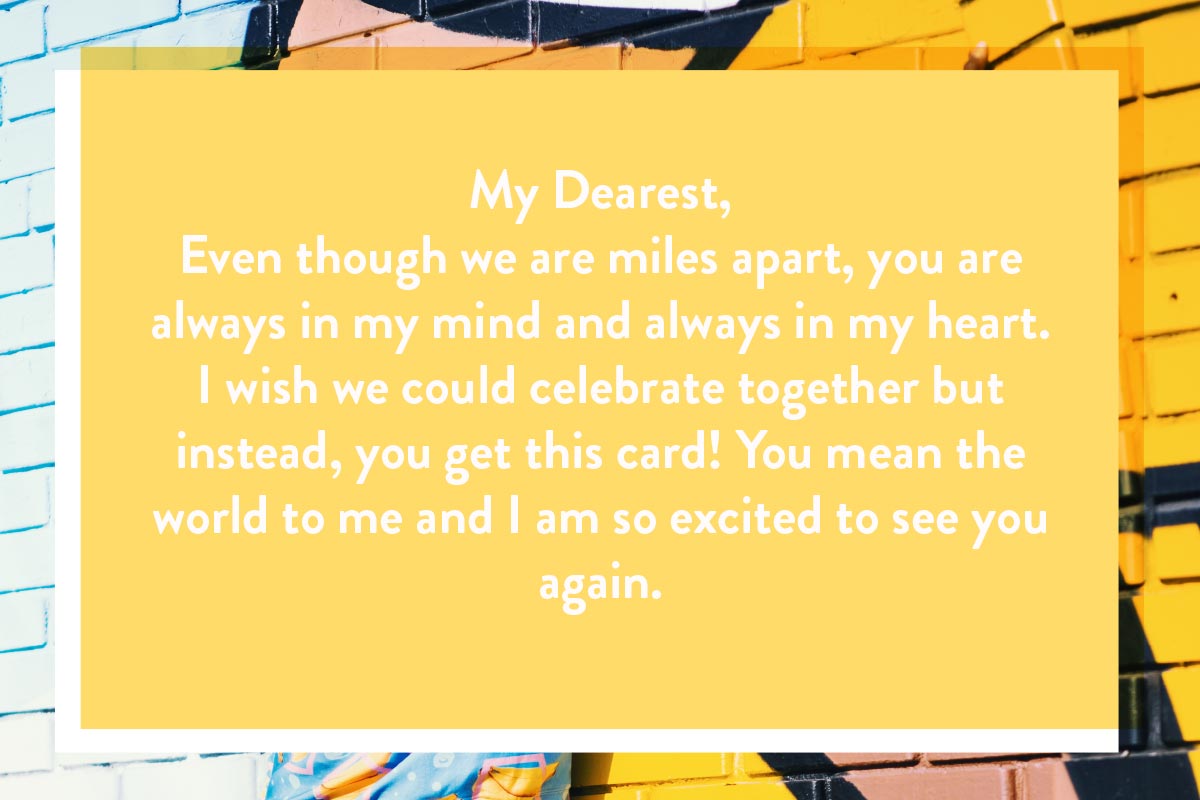

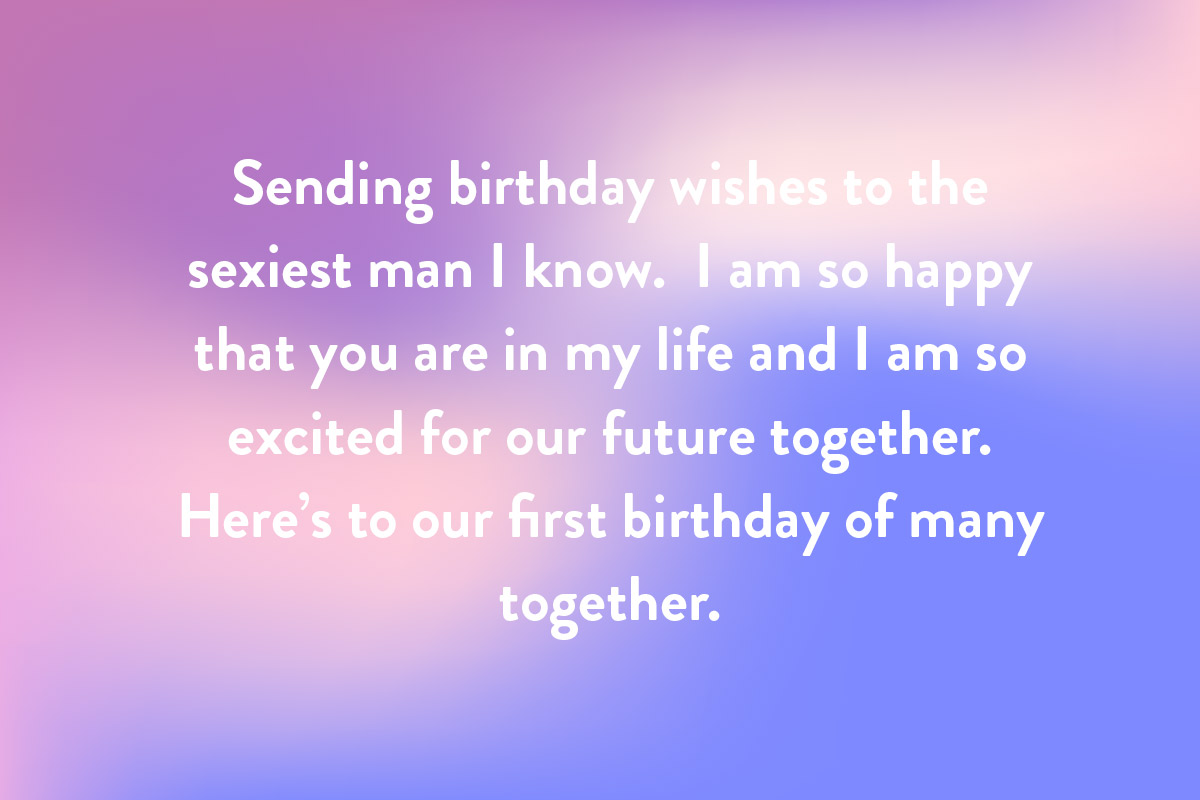

How To Write A Card – How To Write A Card

| Pleasant in order to my personal blog, in this particular moment I am going to demonstrate with regards to How To Factory Reset Dell Laptop. And today, this is actually the first photograph:

How about image preceding? is usually which awesome???. if you feel and so, I’l l demonstrate several picture yet again beneath:

So, if you’d like to secure these fantastic images related to (How To Write A Card), click save icon to store these pictures in your pc. They are ready for transfer, if you appreciate and wish to obtain it, just click save badge on the article, and it will be instantly saved in your laptop computer.} Finally if you’d like to secure unique and latest photo related to (How To Write A Card), please follow us on google plus or book mark this blog, we try our best to provide regular update with all new and fresh images. Hope you like keeping right here. For most upgrades and latest information about (How To Write A Card) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade periodically with all new and fresh pictures, like your searching, and find the perfect for you.

Here you are at our website, articleabove (How To Write A Card) published . Nowadays we are excited to declare that we have found an incrediblyinteresting topicto be reviewed, namely (How To Write A Card) Many individuals searching for details about(How To Write A Card) and definitely one of these is you, is not it?/How_to_write_sympathy_card_hero-f1511c612d19452eb4807c4d34b308f4.jpg)

/writing-a-condolence-letter-1132543-5c2fd8fb46e0fb0001855990.png)

/what_to_write_sympathy_hero-56202155d1654d5987a650bd3a6f1630.jpg)