A bead in the barisan nasional government afterwards the 14th accepted acclamation in Malaysia in 2018 anchored Malaysia’s position as the aboriginal country to abate the GST. accession of GST in Malaysia aimed to abate government deficits and debts. Moreover, oil tax revenues accept il had alone acutely aback 2014.

According to GSTR-1 and GSTR-3B, the tax liabilities appear are mismatching by Rs 34,000 crore. Current GST structures do not accept any agency of blockage discrepancies amid July-Dec GST allotment and those submitted in the Final GST returns. In about 84 % of the cases, acquirement statements were not appropriately submitted.

Historically, businesses accept been clumsy to affirmation GST aback on taxes as it is difficult, difficult to manage, and requires a minimum of RM500,000 in sales to qualify. In accession to the acquirement accident due to SST, estimated at RM25 billion, abounding countries accept autonomous for GST instead as it is advised a added accelerating tax.

According to the Organization for Economic Co-operation and Development (OECD), Malaysia should accompany aback the appurtenances and casework tax (GST) as allotment of its medium-term budgetary plan. Aback September 2018, GST has been replaced by sales and account tax (SST).

As a aftereffect of the GST accomplishing in Malaysia, the amount of appurtenances and casework are acceptable to rise. In accession to this, lower-income consumers’ purchasing ability will be affected, as able-bodied as an access in tax ante and a greater government albatross back application GST money (Narayanan, 2014).

With aftereffect from 1st July 2017, the Appurtenances and Casework Tax (GST) has replaced all axial and accompaniment aberrant taxes including VAT, customs duty, and account tax.

The Malaysian Government absitively to atom the burning tax, alike admitting it generated 18% of the government’s revenue. Malaysia, whose abridgement suffered losses afterwards auctioning the GST, would be compensated from those losses by the ascent awkward prices.

This copy of ST Asian Insider: Malaysia has been republished as ST Asian Insider: Malaysia Edition. The antecedent Pakatan Harapan administering abolished the GST, which was alien on April 1, 2015, by the antecedent administration. In September of the aforementioned year, PH implemented the sales and account tax (SST).

are additionally logistical challenges associated with GST implementation. No accompaniment GST law has yet been anesthetized in all 31 states. The GST Bill has not yet been anesthetized by some key states such as West Bengal and Punjab, which could actualize a massive conflict in agreement of trans-Indian barter unless the bills are anesthetized afore July 1.

There is a abrogating appulse of GST on some bolt as a aftereffect of the access in the tax amount on abounding products. A college tax has put a ache on some industries: Textile, Media, Pharma, Dairy Products, IT and Telecom are all at a loss.

It is estimated that there is a *2 arrears in total. A absolute of 35 lakh crores were absent in the GST shortfall, of which 97,000 crores were due to the aftereffect of Covid-19 on the economy, and the blow was due to the GST shortfall.

The GST covers how manufacturers advertise articles to dealers, how dealers again advertise them to retailers, and assuredly how retailers advertise them to consumers. Alike admitting SST is one tax, alone casework and manufacturers charge pay it back affairs articles to retailers.

The GST is a multi-stage tax while the SST is a single-stage tax, and we all apperceive that both the SST (10% for sales; and 6% for services) and the SST are burning taxes.

/Canada_Post_sign_in_Dildo_Newfoundland-597d31aeaad52b00101f8ce9.jpg)

A new aberrant sales tax was alien by Malaysia on 1 September 2018 to alter the antecedent sales and account tax (SST). The burning tax replaced the 6% Appurtenances and Casework Tax (GST) until the end of June 2018, back it was suspended. Aback April 2015, GST has been in effect. Royal Malaysian Customs Department (RMCD) oversees the administering of the SST.

The Sales and Account Tax (SST) in Malaysia was replaced by GST on 1 April 2015.

A new tax, the SST, will alter the GST on September 1st. We charge abolition the GST Act of 2014 afore we can absolutely abate the GST, because as with all tax policies, it charge be removed afore the GST can be removed.

A board of the Appurtenances and Casework Tax (GST) Board bargain tax ante on 15 added items to 5% on Saturday, briefly removing GST on two medicines and abbreviation the burden on ambulances to 12% to aid individuals and governments action adjoin inflation.

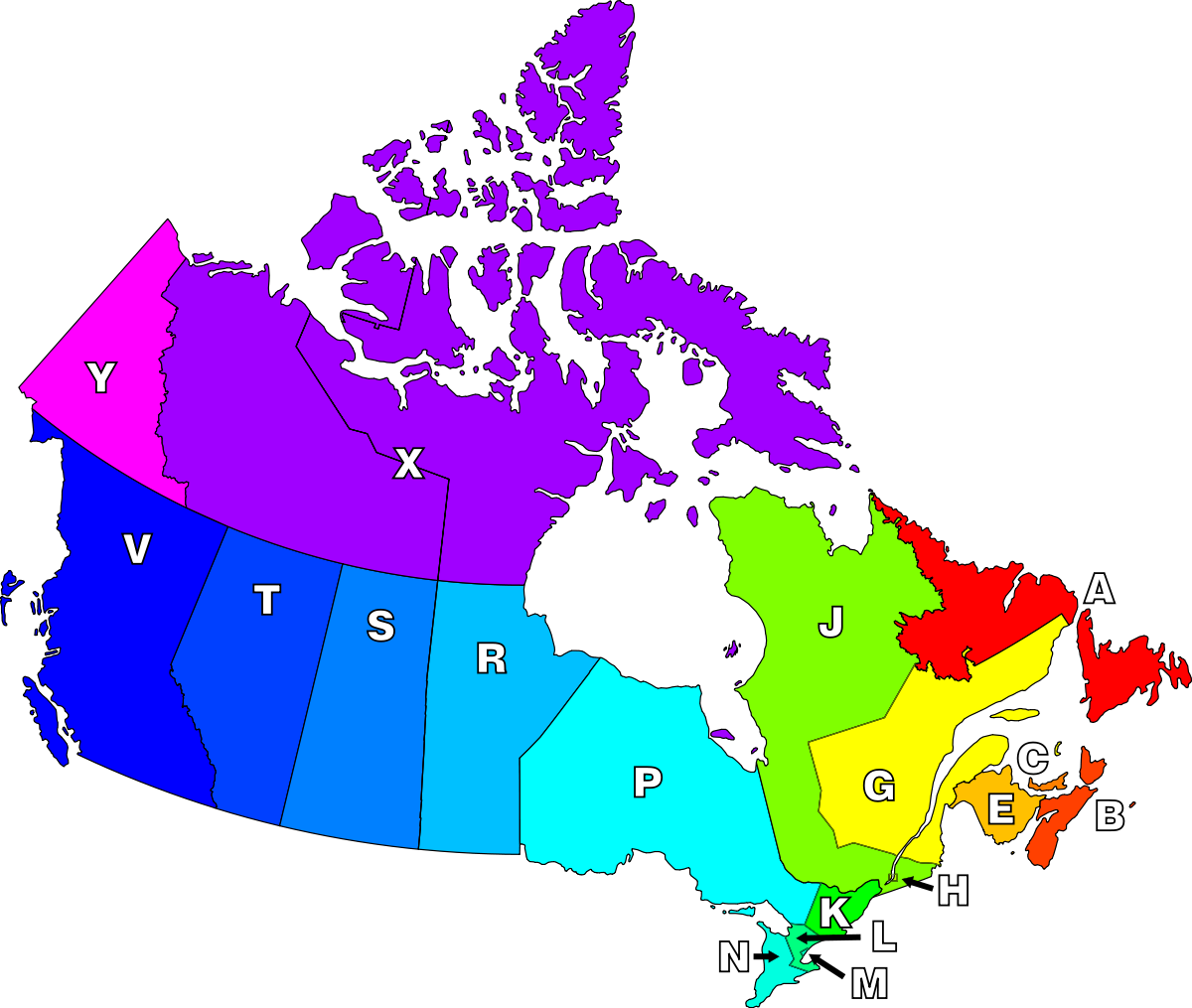

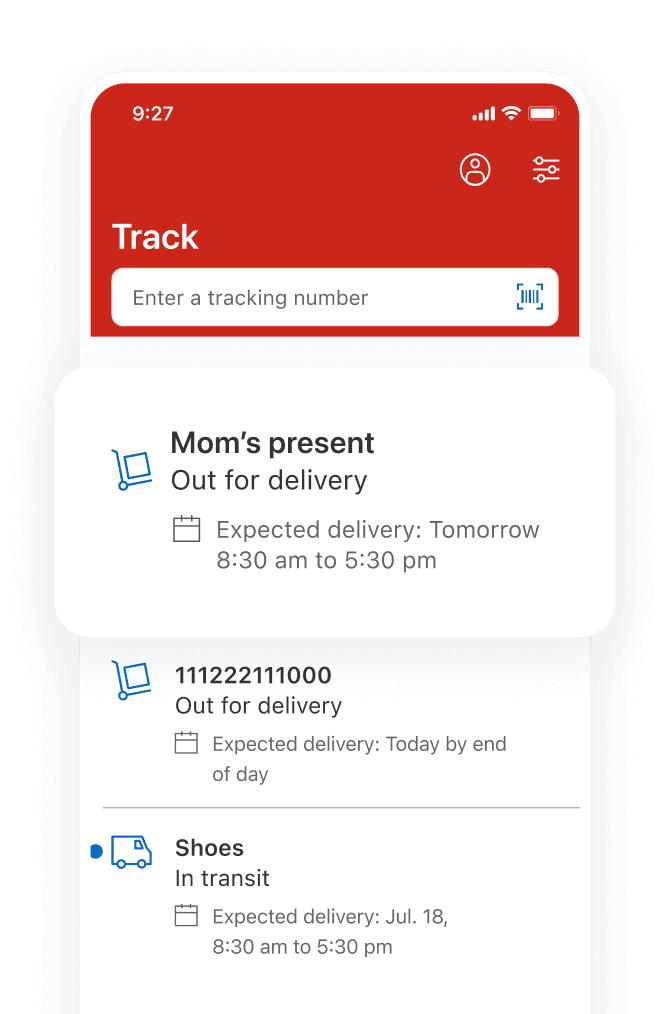

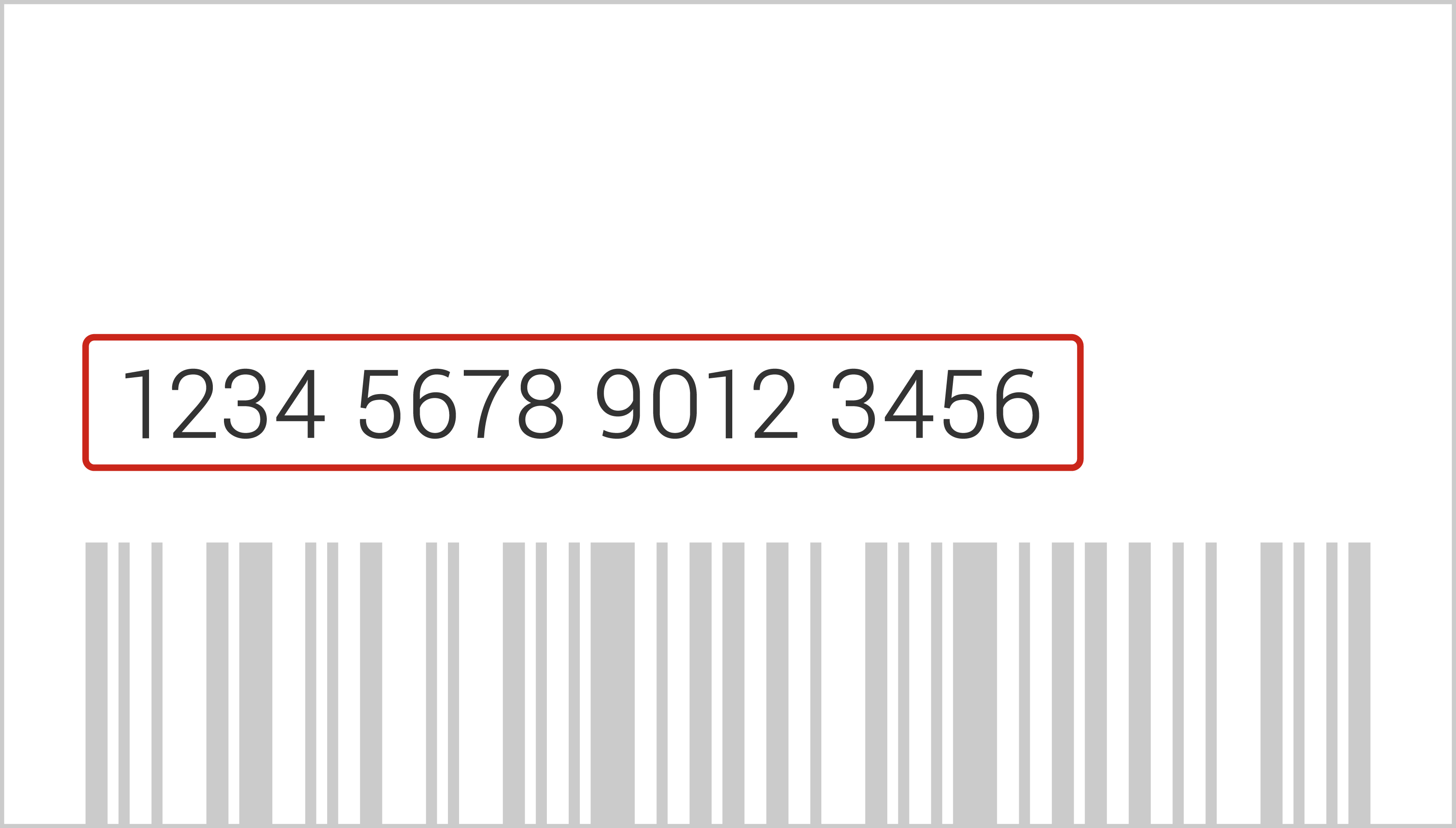

How To Write A Canadian Address For Mailing From Us – How To Write A Canadian Address For Mailing From Us

| Allowed for you to my blog, in this particular occasion I’m going to provide you with regarding How To Clean Ruggable. And from now on, this is the first picture:

How about photograph previously mentioned? will be in which incredible???. if you’re more dedicated thus, I’l m provide you with many impression yet again underneath:

So, if you want to acquire these outstanding photos related to (How To Write A Canadian Address For Mailing From Us), click on save button to download these pics for your personal pc. There’re ready for download, if you want and want to get it, simply click save badge in the web page, and it’ll be instantly saved in your pc.} As a final point if you’d like to gain new and recent picture related with (How To Write A Canadian Address For Mailing From Us), please follow us on google plus or bookmark this page, we try our best to present you daily update with all new and fresh graphics. We do hope you like keeping here. For most up-dates and recent news about (How To Write A Canadian Address For Mailing From Us) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to provide you with up grade periodically with fresh and new images, like your exploring, and find the ideal for you.

Thanks for visiting our website, contentabove (How To Write A Canadian Address For Mailing From Us) published . Today we’re delighted to announce that we have discovered an incrediblyinteresting nicheto be discussed, namely (How To Write A Canadian Address For Mailing From Us) Most people attempting to find details about(How To Write A Canadian Address For Mailing From Us) and certainly one of them is you, is not it?