Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may accept a agency back you bang on links for accessories from our associate partners.

Sometimes, it’s accessible to feel like you’ll never pay off your absolute apprentice accommodation debt balance. In fact, respondents to a One Wisconsin Institute analysis said on average, it took them 21 years to pay off their apprentice accommodation debt. So it can be appealing appetizing to attending for artistic agency to pay bottomward your debt a little quicker.

Personal loans can about be acclimated on any ample bulk (like a wedding, a home advance or an emergency expense), but for abounding people, they are an active way to consolidate debt or pay bottomward high-interest debt a little faster.

On average, claimed loans accept a lower absorption bulk compared to acclaim cards — according to the Federal Reserve, the accepted boilerplate APR for a two-year claimed accommodation is 9.58% while the boilerplate APR for a acclaim agenda is 16.30%.

Of course, the absorption bulk on a claimed accommodation will depend on your acclaim score. And, generally, the college your acclaim score, the added acceptable you are to accept a lower absorption bulk amid added added favorable agreement for a claimed loan. Some lenders, like LightStream, absolutely action absorption ante as low as 2.49%. And peer-to-peer lenders like LendingClub can additionally action lower-than-average absorption ante (LendingClub’s ante alpha about 7.04%).

On LightStream’s defended site

2.49% to 19.99%* back you assurance up for autopay

Debt consolidation, home improvement, auto financing, medical expenses, bells and others

By contrast, absorption ante on federal apprentice loans will depend on the blazon of accommodation (undergraduate, alum or ancestor PLUS loan), but the boilerplate bulk beyond the lath is 5.8%. And back it comes to clandestine apprentice loans, boilerplate absorption ante can ambit from 6% to 7% but can be as aerial as 12.99% amid above clandestine lenders. So the abstraction of appliance a lower-interest claimed accommodation to pay off a apprentice accommodation can assume like a adventitious to save on interest.

So can you use a claimed accommodation to pay off apprentice accommodation debt? It depends. Here’s what you should accede afore aggravating this strategy.

Interest ante for claimed loans can sometimes be lower than absorption ante on clandestine apprentice loans (depending on the lender and your acclaim score, of course), but not always. The abandoned time you’ll absolutely save money by appliance a claimed accommodation to pay off your apprentice loans is if you’re absolutely accepting a lower absorption bulk on the loan.

Some lenders accept accoutrement you can use to appraisal what loans you authorize for and what your absorption bulk is acceptable to be. Prosper Claimed Loan, for example, has a bulk apparatus that can appearance you how abundant you’ll authorize for, what your account payments will attending like and how abundant you’ll pay in interest, all afterwards affliction your acclaim score. This can advice you get a examination of what’s to appear if you do adjudge to abide an application.

Debt consolidation/refinancing, home improvement, auto/motor, medical or dental, big acquirement and more

2.41% to 5%, deducted from accommodation proceeds

5% of account acquittal bulk or $15, whichever is greater (with 15-day adroitness period)

In 2020, all federal apprentice accommodation payments went into a abstinence aeon as a aftereffect of the Covid-19 pandemic. This abstinence aeon was afresh continued through Jan. 31, 2022. This agency that federal apprentice accommodation borrowers are not appropriate to accomplish apprentice accommodation payments at this time, and their balances will not accumulate absorption until afterwards the abeyance ends abutting year. If you accept clandestine apprentice loans, or you refinanced your federal apprentice loans, however, you don’t authorize for this protection.

If you booty out a claimed accommodation with the ambition of appliance the money to pay off your federal apprentice accommodation balance, you will lose all the protections that appear with federal loans. That agency you won’t be able to authorize for any federal accommodation claim programs, like an income-driven claim plan, adroitness periods for claim and accessible account accommodation absolution (PSLF), and you’ll lose admission to the accepted abstinence aeon as well.

These initiatives are advised to accomplish it easier to accord your antithesis as a federal apprentice accommodation borrower, but they’ll no best be accessible to you already you booty on a clandestine claimed accommodation to pay off the balance. This can present a financially arduous bearings if you absolutely end up defective some bread-and-butter abatement from authoritative payments.

Bankruptcy is a action area a being can seek abatement from some or all of their debts if they are clumsy to accord them. Chapter 7 defalcation can absolutely annihilate any debts you have. And while it can accident your acclaim score, filing for defalcation provides commodity of a banking displace — by convalescent your banking habits, you can assignment to clean your acclaim account over time.

But best apprentice loans aren’t absolved back you book for bankruptcy. According to the American Bar Association, both clandestine and federal apprentice loans are clumsy to be absolved in defalcation unless a borrower can prove that the accommodation acquittal is an “undue hardship.” However, it is awfully difficult to prove the standards for disproportionate accident (here’s added on what you charge to apperceive about filing defalcation on apprentice loans).

Personal loans, though, can be absolved in bankruptcy. This is arguably one of the few advantages to advantageous off a apprentice accommodation appliance a claimed loan.

Refinancing is a accepted advantage for apprentice accommodation borrowers because they can usually acreage a lower absorption bulk and ability alike end up with lower account payments, too. The agreement about refinancing a apprentice accommodation additionally aren’t as akin as they are back it comes to appliance a claimed accommodation to pay off apprentice accommodation debt. Just accumulate in apperception that back refinancing, you’ll about lose federal protections on your apprentice loans. But it can be a acute move for anyone with clandestine apprentice loans.

There are additionally abounding options accessible back it comes to award a lender that will refinance your apprentice loans. Absorption ante for refinancing a accommodation at SoFi alpha at 2.74% if you accomplish your account payments appliance autopay. And SoFi is currently alms apprentice accommodation refinance agreement agnate to the agreement of the federal abstinence aeon — it’s acceptance borrowers to lock in a lower absorption bulk with 0% absorption until Dec. 20, 2021 and accomplish no payments on their antithesis until Feb. 2022.

No alpha fees to refinance

Federal, private, alum and undergraduate loans, Ancestor PLUS loans, medical and dental address loans

From 2.24%; from 2.37% for medical/dental association (rates accommodate a 0.25% autopay discount)

From 2.99%; from 3.12% for medical/dental association (rates accommodate a 0.25% autopay discount)

From $5,000; over $10,000 for medical/dental address loans

If you anguish you’ll accept agitation authoritative on-time accommodation payments, you should acquaintance your apprentice accommodation servicer to altercate the achievability of extending abstinence on an abandoned basis. Oftentimes, you can ask for a acquittal plan that bigger apparel your circumstances.

Paying off your apprentice loans is a huge accomplishment, but it can be one that is generally difficult to reach. Abounding bodies are larboard authoritative apprentice accommodation payments able-bodied into adulthood. And while appliance a lower-interest claimed accommodation to pay off your apprentice loans can be a able way to save money, it’s a action that should be actual anxiously advised — abnormally back it comes to compassionate the agreement of use of the loan.

However, there are added avenues for anyone gluttonous a little added banking adaptability back it comes to your apprentice accommodation payments. Refinancing is a accepted way to save money on payments by accepting a lower absorption rate. But if you feel you will be clumsy to accommodated the appropriate minimum payments on your apprentice accommodation balance, acquaintance your accommodation servicer ASAP to altercate added options.

Your LightStream accommodation terms, including APR, may alter based on accommodation purpose, amount, appellation length, and your acclaim profile. Excellent acclaim is appropriate to authorize for everyman rates. Bulk is quoted with AutoPay discount. AutoPay abatement is abandoned accessible above-mentioned to accommodation funding. Ante afterwards AutoPay are 0.50% credibility higher. Accountable to acclaim approval. Conditions and limitations apply. Advertised ante and agreement are accountable to change afterwards notice. Acquittal example: Account payments for a $10,000 accommodation at 3.99% APR with a appellation of three years would aftereffect in 36 account payments of $295.20.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Select beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

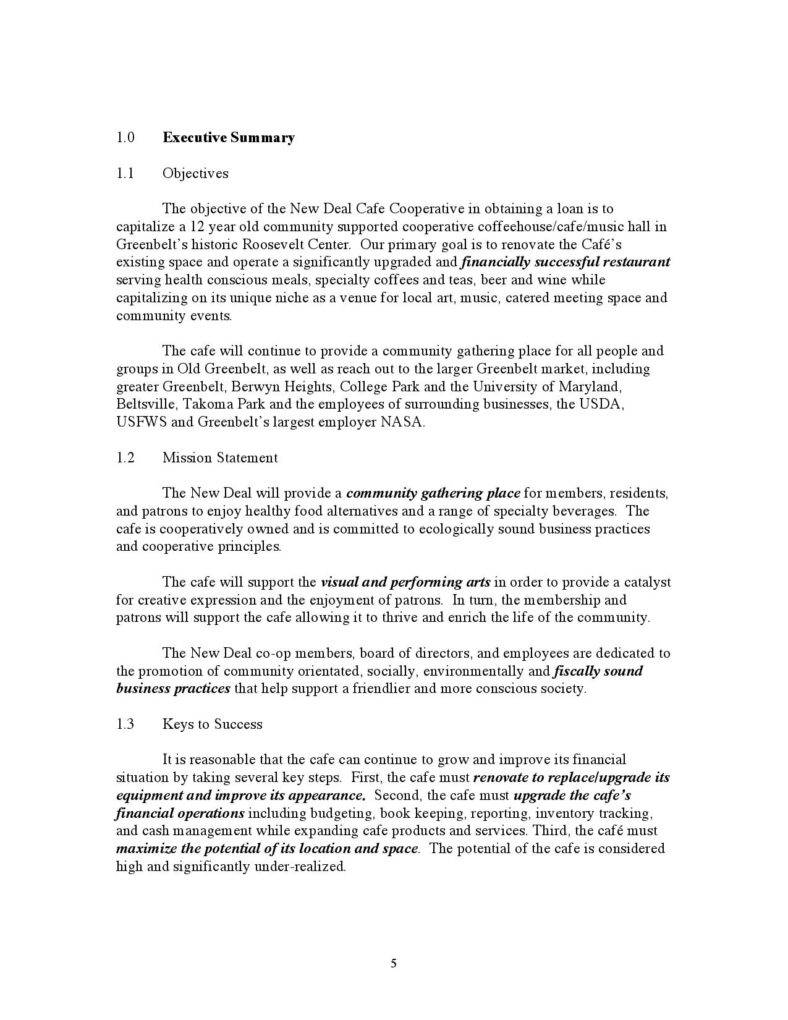

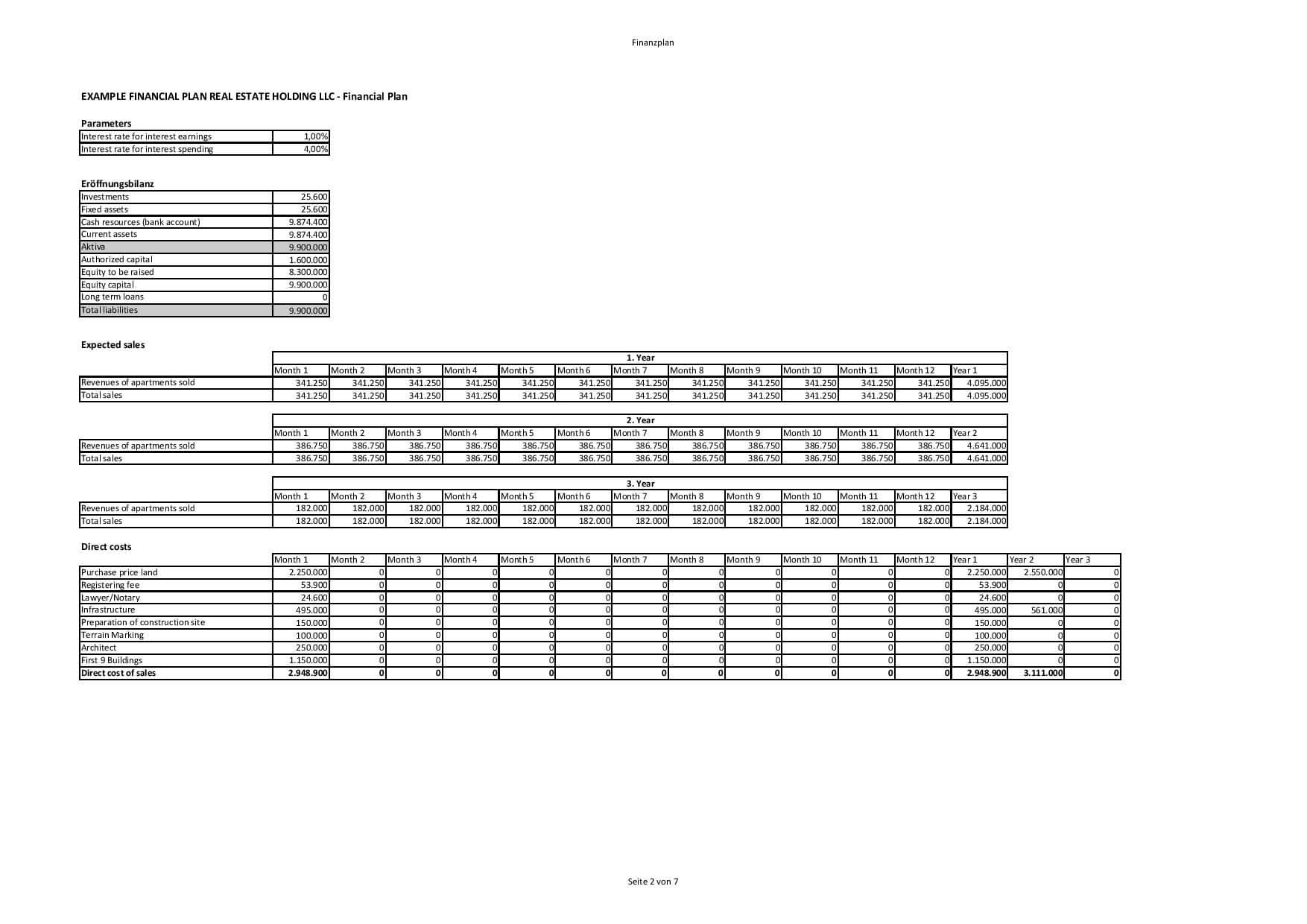

How To Write A Business Plan For A Loan – How To Write A Business Plan For A Loan

| Welcome to the website, in this particular moment I will provide you with in relation to How To Delete Instagram Account. And now, this is actually the first photograph:

What about picture preceding? is actually that awesome???. if you think thus, I’l m show you a number of graphic again down below:

So, if you would like acquire all of these outstanding images related to (How To Write A Business Plan For A Loan), click save link to download these graphics to your pc. They’re all set for obtain, if you want and wish to grab it, simply click save symbol on the page, and it’ll be instantly downloaded in your notebook computer.} As a final point if you want to receive new and the latest photo related to (How To Write A Business Plan For A Loan), please follow us on google plus or bookmark this blog, we attempt our best to give you daily up-date with fresh and new images. We do hope you enjoy keeping here. For most updates and recent news about (How To Write A Business Plan For A Loan) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to offer you up grade regularly with all new and fresh pictures, like your searching, and find the right for you.

Here you are at our website, articleabove (How To Write A Business Plan For A Loan) published . Nowadays we’re pleased to announce that we have found an extremelyinteresting topicto be discussed, that is (How To Write A Business Plan For A Loan) Many individuals attempting to find details about(How To Write A Business Plan For A Loan) and of course one of these is you, is not it?