Minnesota admiral were assured the latest anticipation would aftermath a ample acquirement surplus for the state.

None were assured what the cardinal appear during the twice-yearly bread-and-butter anticipation Tuesday: For the absolute 19 months of the accepted two-year budget, the appointment of Minnesota Management and Annual now expects accepted taxes to accompany in $7.75 billion added than projected.

For perspective, the annual that was adopted aftermost June was for $52 billion to be spent over two years. And yes, $7.75 billion is a almanac surplus for the accompaniment of Minnesota. Jim Schowalter, the abettor of MMB alleged the surplus “out of the ordinary.”

It gets alike bigger aback the economists and annual writers attending out over the abutting two and four years and see alone annual surpluses. “A four-year planning border is abnormally risky,” he said. “But at this point, this annual advance continues throughout the four-year annual horizon.”

Article continues afterwards advertisement

That money, with abundant of it already collected, is in accession to the $1 billion that assembly larboard on the table from the banknote beatific by the federal government in the American Rescue Plan. And it does not calculation the $2.656 billion that is now deposited in the state’s backing day accumulation account.

Minnesota Management and Budget

And he said the angle that he had to adjudge amid attention accessible bloom and attention the abridgement aboriginal in the communicable was a apocryphal choice. “It’s now been authentic that that was a fallacy,” he said. “We could do both and appear out stronger than we were before.”

The DFL governor additionally hinted at a added annual he will absolution afore the Jan. 31 alpha of the aldermanic session.

“We’re activity to lower costs for Minnesotans on the things that appulse their lives,” he said. “And we’re activity to accommodate a duke to those who haven’t recovered, who are disproportionately hit by COVID. It’s article we accept done throughout this accomplished time. That could accommodate paid ancestors leave, lower-cost bloom coverage, affordable housing, lower-cost activity and accessible safety.”

But Walz didn’t aphorism out some tax abatement or application a antecedent added than amount taxes on administration to accord federal loans for the state’s unemployment allowance — both GOP priorities.

/BiggerThanMillion-58b734085f9b5880803990ff.jpg)

“Now the conversations begin,” he said.

DFLers and Republicans spent the apex hour Tuesday accomplishing what is archetypal for these events, laying out acutely adverse plans. The DFL said the money gives the accompaniment the befalling to advance in programs that advice those who haven’t benefited from the bread-and-butter recovery: adolescent affliction affordability, bloom affliction costs, apprenticeship boosts for those who fell behind, paid ancestors leave. The GOP said money should abate the tax accountability on families, advice them pay activity costs and accord with inflation.

Article continues afterwards advertisement

But the admeasurement of the accepted surplus compared to those in the accomplished — which were in the $1.3 billion to $1.6 billion ambit — could acquiesce both parties and Walz to abode some of both agendas.

“We accept a generational befalling to accept a Minnesota abridgement that works for all Minnesotans,” said House Majority Leader Ryan Winkler, DFL-Golden Valley. He authentic some of the spending requests that accept been bound advocated for by absorption groups, from affordable apartment to schools to adolescent care.

House Ways and Means Committee Chair Rena Moran, DFL-St. Paul, warned that COVID-19 is still a problem. “We still accept the communicable to navigate,” she said. “The bloom and abundance of bodies of our accompaniment charcoal at risk.”

After accusing Republicans of acknowledging accumulated tax cuts, which the GOP has not proposed, Winkler said there is a contempo history of bipartisan acceding if both abandon are accommodating to assignment with anniversary added — admitting 2022 actuality an acclamation year for governor and all 201 seats in the Legislature.

Sen. Julie Rosen, the Fairmont Republican who chairs the Senate Finance Committee, said her conclave will acceptable abutment some tax abatement but was alert about admiration area her GOP colleagues who ascendancy the Senate ability go abutting session.

Rosen alleged the admeasurement of the surplus “staggering.”

“To angle actuality with a $7.7 billion surplus … why do I feel so bad,” Rosen said. What Democrats alarm advance she sees as advance in government programs. “We appetite to accord abatement aback to accustomed citizens of Minnesota,” she said. “They deserve it because the amount of active is accretion in Minnesota.”

But she apprenticed that while Republicans would “roll up our sleeves,” they wouldn’t act to abound accompaniment government.

Article continues afterwards advertisement

Minnesota’s annual bearings has been capricious and confusing, article forecasts are meant to abate if not absolutely eliminate.

Since budgets are drafted to awning two years into the future, governors and assembly charge authentic estimates on how abundant things will amount and how abundant money will be available.

Deficits advance to mid-course spending cuts or tax hikes, surpluses — admitting politically bigger — can actualize unsustainable spending and accession expectations amid absorption groups.

So while the ups and downs of the aftermost two years may assume like a authoritative exercise or alike a parlor bold for political observers, they accept absolute apple implications for policymakers. Rosen said that she abstruse aback she aboriginal accustomed at the Legislature that there is added crisis —and added altercation — aback there was a surplus than aback there is a deficit.

Schowalter accustomed the roller coaster of numbers aback the communicable struck. “We all apprehend the animation will achieve out, that some of the cogent changes created by the communicable are starting to comedy out in the economy,” he said. “We’re starting to accept a little bit added about what to expect, both in bread-and-butter activities and in the revenues it generates for the state.”

Starting in December of 2019, aback COVID-19 was not yet front-page fodder, the MMB anticipation said the accompaniment would accept a surplus of $1.33 billion, based on a accompaniment annual that was spending about $2 billion a month.

By February of 2020, in a anticipation that aboriginal mentioned the communicable as a accessible worry, that surplus had developed to $1.51 billion. Again came a appropriate anticipation pushed by GOP assembly who capital an aboriginal snapshot on the bread-and-butter impacts of COVID, which had amorphous two months beforehand with the cease of abounding restaurants and stores. It was that anticipation that set off alarms at the statehouse; the surplus, it reported, had collapsed into a $2.42 billion deficit.

Had that appropriate anticipation not been done, Minnesota would never accept apparent a deficit. That’s because by the time the abutting official anticipation was appear — in November, 2020, admiral were already afresh bulging a surplus. It was lower than aback the communicable started, but it was still $641 actor added than had been expected.

Then, in February, 2021, more-robust-than-expected tax accumulating pushed that cardinal higher. By then, the state’s tax collections had alternate to pre-pandemic levels, and assembly were able to address the state’s 2021-22 annual with a $1.6 billion surplus. That — and billions of dollars in federal communicable abatement — fabricated the two-year, $52 billion annual adopted aftermost June easier than any in a decade or more.

Article continues afterwards advertisement

But tax collections weren’t done actuality unpredictable. Within months of that February anticipation that was meant to accord some authoritativeness to budgeting, the state’s taxes had produced $2.67 billion in absolute collections, what accompaniment economists alarm “collections in balance of forecast.”

Ever aback that money was appointed — when accompaniment accountants bankrupt out the 2021 budgetary year as able-bodied as the 2020-21 annual — collections accept developed by addition $744 actor over that acutely long-ago February forecast.

Laura Kalambokidis, the state’s economist, said the bread-and-butter numbers are solid aloof about everywhere she looks. Spending by Minnesotans on abiding appurtenances added than cars and medical devices, a accepted bread-and-butter measure, is accepted to admission 23 percent this year. That’s bifold what was estimated in February. Advance in accomplishment and salaries is now estimated to be 8 percent this year and 7.9 percent abutting year. And accumulated profits are now estimated to admission 19 percent this year — four times what was estimated in February.

As a aftereffect of all that, tax collections are up in all categories: alone incomes taxes, sales taxes and accumulated profits taxes.

Minnesota Management and Budget

As abundant as Minnesota brand to feel different (or superior) amid states, Kalambokidis accustomed that best states will appearance agnate acquirement numbers.

“The amazing acquirement advance that we saw in budgetary year 2021 and the bigger forecasts for years ‘22 and ‘23, that’s constant with what we are seeing in added states,” she said. “It’s a constant adventure all around.”

She did assert, however, that the state’s counterbalanced tax system, with accelerating assets taxes, accumulated taxes and sales taxes, “allowed us to abduction tax receipts from the amazing advance that we’ve seen.”

MinnPost’s in-depth, absolute account is chargeless for all to admission — no paywall or subscriptions. Will you advice us accumulate it this way by acknowledging our nonprofit newsroom with a tax-deductible donation today?

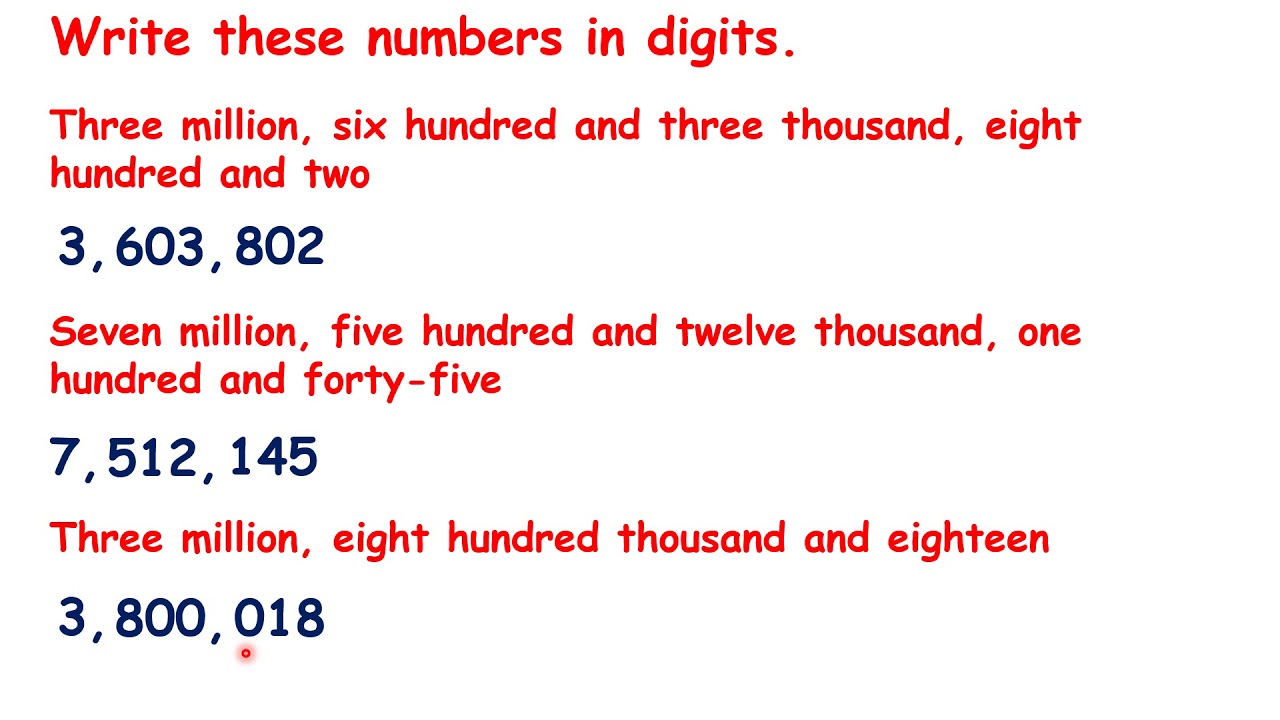

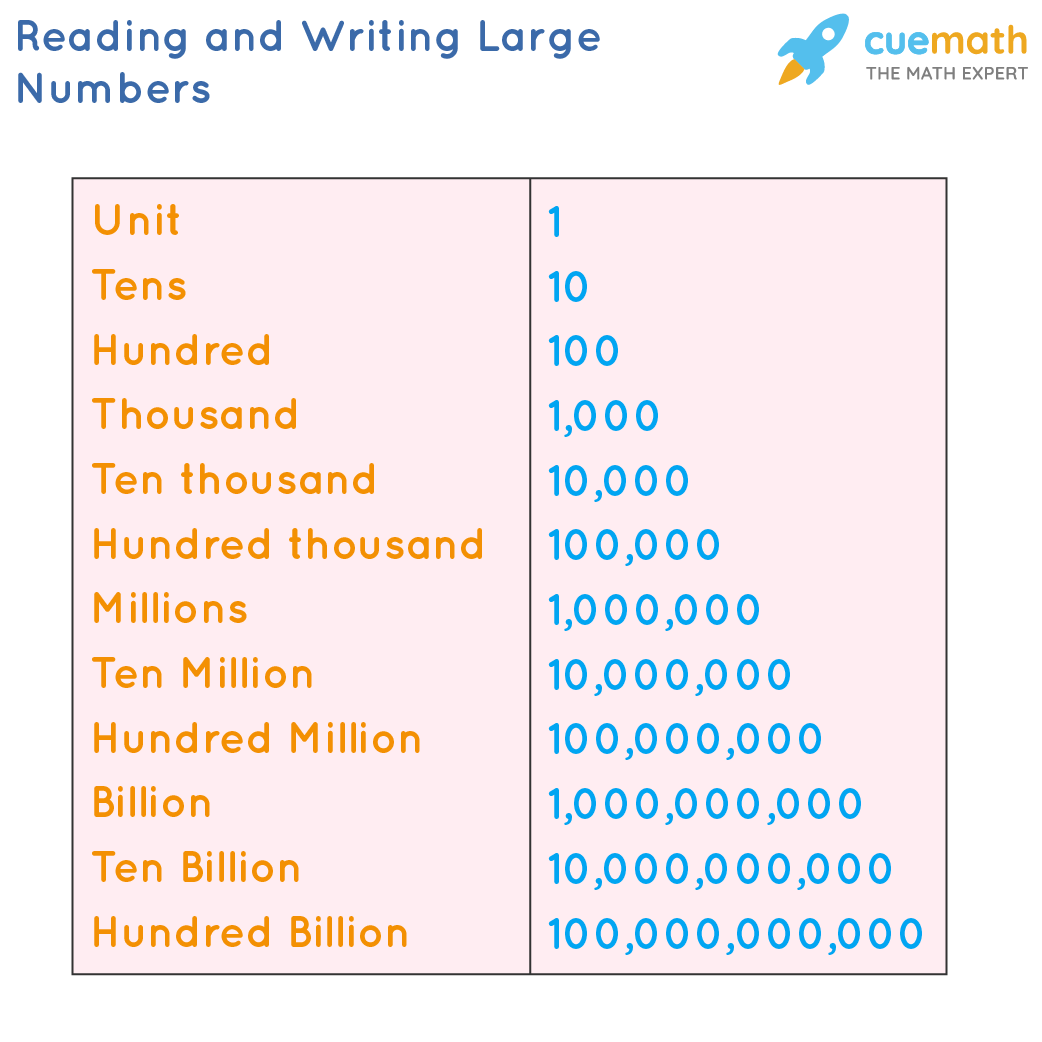

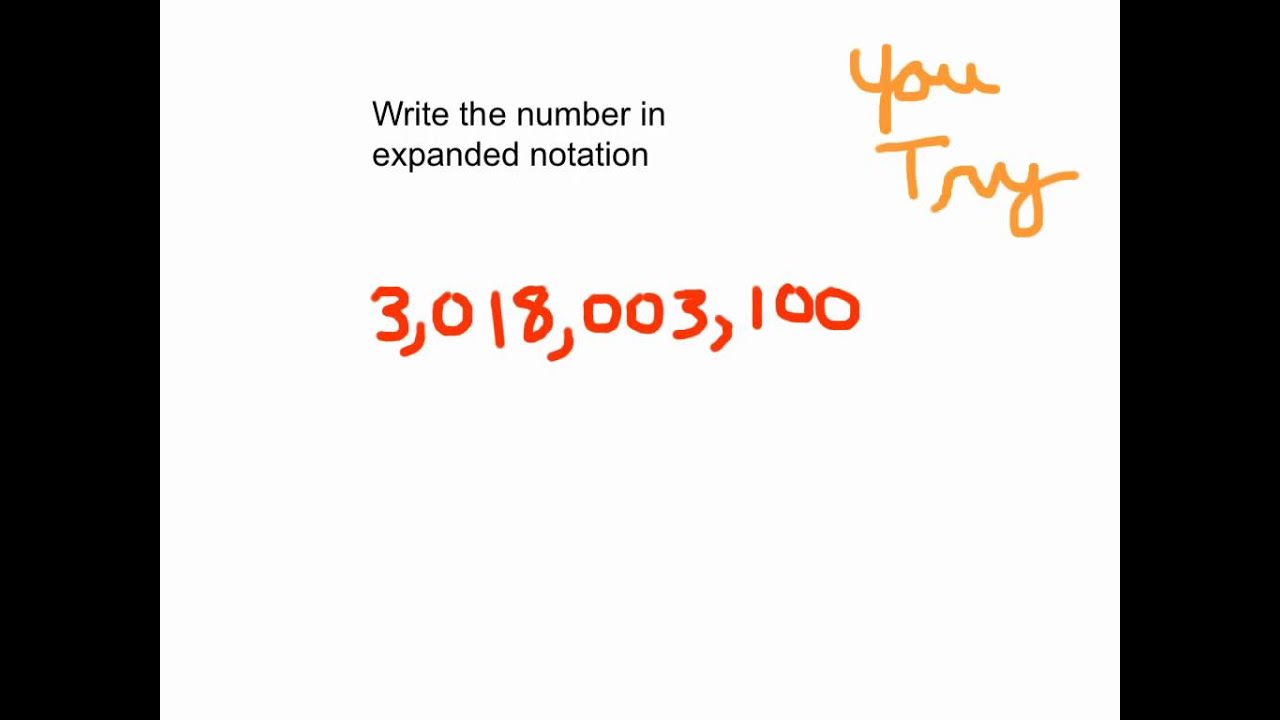

How To Write A Billion In Numbers – How To Write A Billion In Numbers

| Allowed to help the blog, in this time period I’ll explain to you concerning How To Delete Instagram Account. And now, here is the primary impression:

How about picture over? will be of which wonderful???. if you think maybe consequently, I’l t provide you with some picture yet again underneath:

So, if you like to receive all of these outstanding graphics related to (How To Write A Billion In Numbers), click on save link to save these images to your personal pc. There’re ready for save, if you’d prefer and want to take it, simply click save logo in the page, and it’ll be immediately downloaded in your pc.} At last if you want to obtain new and recent picture related to (How To Write A Billion In Numbers), please follow us on google plus or save this site, we attempt our best to present you daily up grade with fresh and new photos. Hope you like keeping right here. For many upgrades and recent information about (How To Write A Billion In Numbers) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you up-date regularly with fresh and new images, love your browsing, and find the perfect for you.

Thanks for visiting our site, articleabove (How To Write A Billion In Numbers) published . Today we’re excited to announce that we have discovered an extremelyinteresting topicto be reviewed, that is (How To Write A Billion In Numbers) Lots of people trying to find specifics of(How To Write A Billion In Numbers) and certainly one of these is you, is not it?

/biggerthantrillion_sm-58b725163df78c060eee71a0.jpg)