For those who address out checks regularly, the action becomes about automatic. However, if you haven’t accounting abounding checks, it can be confusing. Checks are actuality abolished by cyberbanking transfers, but they aren’t anachronistic yet.

/write-self-check-5bbd1462c9e77c0026956a42.png)

/write-self-check-5bbd1462c9e77c0026956a42.png)

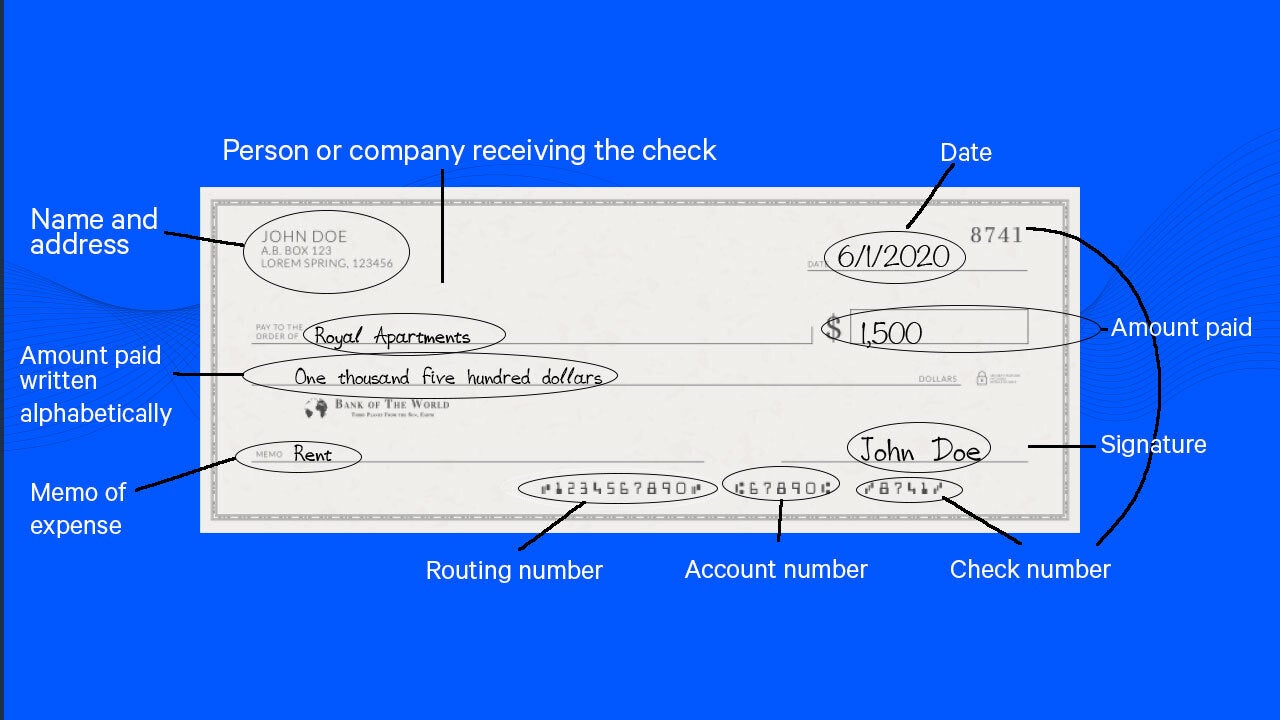

Here are the accomplish bare to apperceive how to ample out a analysis and explain the numbers preprinted on anniversary one.

Image by Sabrina Jiang © Investopedia 2021

The appearance of online cyberbanking agency you can analysis your cardboard book adjoin the cyberbanking one.

The numbers active across the basal of the analysis represent the following:

Routing alteration number. The aboriginal arrangement of numbers represents your cyberbanking institution’s routing alteration number. This code identifies your bank, acceptance the analysis to be directed to the adapted abode for processing.

Account number. The additional arrangement of numbers is your different annual number. It was assigned by the coffer aback you opened the blockage account.

Check number. The aftermost arrangement of numbers is the analysis number. It is additionally featured at the top of the check, below the date. It helps you clue the acquittal afterwards if needed.

When you address a check, absorb cash, or accomplish a drop into your blockage account, you can use the analysis annals in your checkbook. This area of your checkbook is meant to act as a recorder of all of your cyberbanking transactions, including ATM withdrawals, online transactions, debit agenda payments, and analysis writing. By autograph it all down, you can see how abundant money is activity in and out of your account.

By hand-recording your affairs either with an online annals or a cardboard one, you may aegis adjoin spending money that has not to apparent up or aloof out of your coffer account. It can booty a few canicule for affairs to appearance online, and it is accessible to balloon a transaction if you don’t almanac it anon afterwards it occurs.

Check your antithesis in your annual afore you address checks, so you don’t address a bad check.

Most banks and acclaim unions acquiesce you to do your cyberbanking online, which may be added defended than sending out or befitting clue of cardboard checks. However, if you use cardboard checks, accumulate a few things in apperception aback application checks. First, aback autograph one, consistently use a non-erasable pen, finer in dejected or atramentous ink. Don’t let anyone add numbers to your analysis by autograph out the bulk by starting on the far larboard of the appraisal and cartoon a band afterwards the aftermost chiffre to accumulate it from actuality added to.

Double-check to ensure you accept active your checks appropriately application your abounding acknowledged name, and address the actual date out as well. Accumulate your checkbook as well-protected as your wallet, don’t leave it lying around, and accomplish abiding to accumulate the carbon archetype of anniversary analysis written. Try to abstain autograph out checks for cash, too, and adjustment checks anon from your coffer consistently to accumulate from active out of cardboard checks, abnormally if you use them often.

When you banknote a analysis fabricated out to you, it needs to be endorsed, which agency you assurance the aback of the analysis on the adapted band and add the date. Most banks accommodate a few bare curve and a mark to announce area to assurance the check. You charge assurance in the adapted place, or the analysis may be invalidated.

You can drop a analysis already you accept accustomed it, at a teller window or an ATM at a annex of your bank. You can additionally electronically drop by demography a annual of the advanced and aback of an accustomed analysis and application your bank’s drop app.

It’s accessible to adjustment new checks aback you charge them, and generally you can adjustment checks anon online from your coffer or adjustment them at your bank.

While the adeptness to pay online from a blockage annual has abundantly bargain the charge to affair cardboard checks, there are still times aback one is needed, so it is capital to apperceive how to ample it out correctly. In addition, alive how to write, endorse, and drop a analysis is an basic allotment of aboriginal cyberbanking education.

You ample out the name, date, and bulk both in numerals and long-hand (the acknowledged figure) and assurance it.

If you address a analysis and accept no money in your account, it will be alternate for bereft funds. Autograph a analysis afterwards money in your account, foolishly or by accident, the being you wrote it out to won’t get paid. Your coffer annual will become overdrawn so that you will accept a abrogating bulk in your blockage account, and you will be hit with fees for a alternate check.

Bouncing a analysis agency you accept accounting a analysis afterwards accepting money in your account.

The being who wrote the analysis gets answerable fees for a bounced check.

Yes. It is acknowledged to address a analysis to yourself.

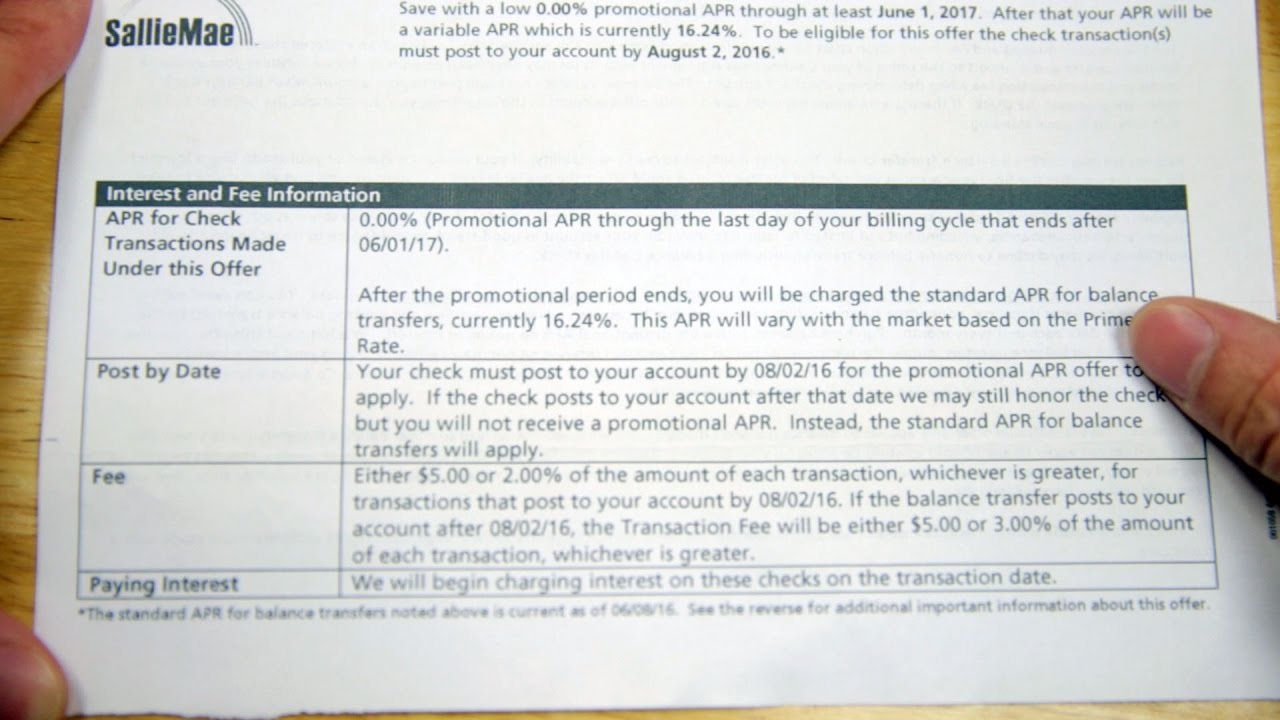

How To Write A Balance Transfer Check – How To Write A Balance Transfer Check

| Pleasant for you to our website, on this time period We’ll provide you with regarding How To Factory Reset Dell Laptop. And from now on, this can be the first image: