Hillman Solutions Corp (NASDAQ: HLMN)

CONSTELLATION BRANDS, INC.

Q3 2021 Antithesis Call

Nov 3, 2021, 8:30 a.m. ET

Operator

Good day and acknowledge you for continuing by. Welcome to the Hillman 2021 third division after-effects arrangement call. [Operator Instructions] I would now like to duke the arrangement over to Jennifer Hills, Vice President of Broker Relations. Please go ahead.

SPONSORED: None

This article is a archetype of this arrangement alarm produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not accept any albatross for your use of this content, and we acerb animate you to do your own research, including alert to the alarm yourself and anniversary the company’s SEC filings. Please see our Terms and Conditions for added details, including our Obligatory Capitalized Disclaimers of Liability.

The Motley Fool has a acknowledgment policy.

Jennifer Hills — VP Broker Relations

Thank you. Abigail. Acceptable morning. This is Jennifer Hills, Vice President of Broker Relations at Hillman. Acknowledge you for abutting us this morning to analysis and altercate Hillman’s Third Division 2021 Antithesis Results. Abutting me today are Doug Cahill Chairman, President and Chief Executive Officer and Rocky Kraft, Chief Banking Officer.

A archetype of our antithesis absolution and accelerate presentation can be activate beneath the Broker Relations breadth of our website at www.ir.HillmanGroup.com. Afore we begin, we would like to attention you that assertive statements fabricated today may accommodate advanced statements that are accountable to the Safe Harbor accoutrement of the antithesis laws. These advanced statements are not guarantees of approaching achievement and are accountable to assertive risks, uncertainties, assumptions and added factors, abounding of which are aloft the company’s ascendancy and which could anniversary absolute after-effects to alter materially from those projected in such statements. Some of those factors that could access the company’s after-effects are independent in our alternate and anniversary letters filed with the Antithesis and Exchange Commission. Please see accelerate 2 in our antithesis alarm accouter for added advice apropos these risks and uncertainties.

We will activate the alarm with a business amend from Doug followed by Rocky who will be accouterment a banking analysis of the quarter. Now let me about-face the alarm over to Doug.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Thanks, Jennifer. Let me alpha by breaking bottomward our business by articulation and analysis achievement during the third division and year-to-date. To abduction the hunt our accouterments solutions, robotics and agenda solutions and Canadian businesses all performed able-bodied in the division in animosity of the celebrated accumulation alternation challenges and a absolute able third division aftermost year. But the unwinding of our COVID accompanying articles and careful solutions abnormally impacted our earnings.

Going added our HS business, net sales were bottomward 6% during the third division adjoin 2020 and were up 2.6% year to date. The third division was a bit slower for HS business than we advancing for two reasons. First, America said we’re accepting out of the abode in July and August, and they did. And second, college barge prices slowed projects bottomward during the quarter, but aback mid-September barge is added affordable, kids are aback to school, retailer’s point of auction aggregate has rebounded at the shelf and bodies are aback to their home projects. You will bethink the absolute able third division HS accomplished aftermost year, up 22.7% at the acme of the breach home and DIY projects time frame. If you attending at HS over a best time anatomy you will see a healthy, growing business. On a 2-year stack. It’s up 59% in the third division adjoin 2019 and year-to-date, it’s up 19.8% adjoin 2019. I’ll allocution abundant added about HS and achievement you’ll accede that this business is alive and able-bodied positioned.

Our RDS business, net sales were up 14% in the third division adjoin 2020 and year-to-date, they’re up 20.3%. So connected abundant achievement by the RDS team. Canada’s third division was absolute agnate to HS comping a able Q3 aftermost year and net sales were up 15.6% year-to-date and a absolute advantageous 17.1% advanced of 2019. Our PS or Careful Solutions net sales were bottomward 26.6% in the division and were bottomward 8.9% year-to-date with COVID atone that they were up against. PS’s net sales were up 21% in the division adjoin 2019 and year-to-date, their top band was up 17.4% adjoin 2019. I will explain in detail what it took to disentangle COVID for the PS business in aloof a few minutes.

What we did during COVID was advice our retailers amuse the needs of their consumers and assure our employees, so they can abide operating during these aberrant times. Winning 5 Vendor of the Year awards in 2020 was affirmation we were there for them. I’m apparently activity to absorb beneath than one minute whining about accumulation alternation and aggrandizement issues because, aboriginal of all you pay us to bulk this actuality out and added in a aberrant way all this applesauce is enabling us to abstracted ourselves with our achievement from our competitors. So, it will end up actuality a acceptable affair for Hillman and here’s why. All retailers accept three big apropos appropriate now. Cardinal one labor, two aircraft issues and cost, and three allotment accident to their competitors due to stock-outs. Plain and simple, these are the top three and we advice them in all three, I advanced bigger than anybody. We accept 11,00 bodies in the food every day, that’s our in-store labor. So the banker doesn’t accept to. We alien to over 42,000 locations with 80% of our accouterments articles alien anon to the food bypassing the retailers administration centers. That’s us analytic the aircraft and administration centermost botheration so the banker doesn’t accept to. Their DCs are abbreviate staffed and blimp appropriate now with things like backyard movers that aloof accustomed aftermost month. Bad timing? Yes, but they took them so they for abiding would accept them abutting spring. And third, if you’re a banker of Hillman you’re not accident allotment for aloof stock-outs. Chances are you’re accepting share.

Our year-to-date ample bulk for HS is 91% and added chiefly Hillman’s in-stock anniversary akin at the shelves for our top 5 barter appear from their systems is 95% over the accomplished 30 days, which has been the toughest 30 canicule for ample ante apparently ever. So how are we accomplishing that? First, we accept invested in added anniversary and alive capital, which you accept to do aback your advance times confused from historically 120 canicule to over 200 days. Without that advance our ample ante would be afterpiece to the industry boilerplate of 70%. As a result, we’re advantageous for lots of added anniversary as able-bodied as alfresco third affair barn amplitude to abundance this added anniversary bare to anniversary barter in the accepted advance time world. Secondly, our 1100 association in the abundance and our direct-to-store aircraft archetypal gives us the fastest port-to-shelf accouterments archetypal in Arctic America. And finally, our 57 years of acquaintance and abiding supplier relationships accept enabled us to abstracted Hillman from our competitors during this all-around accumulation blend we’re all experiencing.

There is of advance a bulk of advancement these anniversary levels and you see it on our antithesis sheet, but I accept it’s added than anniversary it as our differentiated archetypal and our adeptness out served the antagonism during this aeon of accumulation alternation disruptions has and will abide to advance to added bazaar allotment assets and out sized advance for our accouterments solutions business. I can’t delay to acquaint you about accepted wins in a minute, but afore I do, let me abode the celebrated aggrandizement and accumulation alternation issues we’re facing, afresh I’ll allocution about what we’re accomplishing about it. I’ve apparent abounding things during my career, but I’ve never apparent annihilation like what we’re currently experiencing with accumulation alternation disruptions and inflation, and I’ve never apparent it as a top adventure in all outlets. Pre-COVID it took Hillman on boilerplate 120 canicule from the time we would adjustment artefact from Asia until it would access on the West Coast. Today, it is in antithesis of 200 days. We are experiencing aggrandizement and article costs, entering and outbound bales as able-bodied as labor. To put it in perspective, 20-foot alembic bulk that averaged us $1500 in 2019, $2000 dollars in 2020 accept been boilerplate of $5600 aback July in the US and abundant college and Canada. Acutely atom prices are able-bodied aloft these, but the increases are absolutely staggering. The ships can’t get into the ports, and aback our alembic does get on acreage we can’t aces them up as bound as we would like due to the bottleneck and arrangement delays. To add insult to abrasion afterwards four canicule they are charging all of us $250 dollars per alembic per day demurrage on our product, abounding times they won’t let us aces up and we apprehend it’s activity college able November 15th of this year.

Okay, let me focus on what we’re accomplishing about it. Through all the challenges, I’m so appreciative of our 1100 acreage anniversary advisers who assignment carefully with our barter allowance to breach acumen and activity issues in the abundance and at the shelf. These aberrant bulk increases are actuality anesthetized on to our retail barter and end consumers, and thankfully our artefact categories are not melancholia nor are they anytime bulk acute and our barter are experiencing these blazon of increases aloft the board. Our affair is timing. As we discussed in our aftermost antithesis call, we auspiciously implemented our aboriginal bulk access of about 7% to 8% able in June. Alive calm with our retail ally we’ve been acknowledged aloft the lath with our added access of about the aforementioned percentage, 7% to 8% that will go into aftereffect in October, November of this year. That puts us up about 15% afterwards the aboriginal two increases and aback we complete our planned third increase, which should go into aftereffect January February 2022 we will be aloft 20% bulk access aback you add the three together, and that’s what we advanced we will allegation with what we apperceive today to awning our bulk increases.

Let me blow on a few highlights, and new business wins. During the third division we were alive continuing to assassinate on contempo business wins. They are abundant examples of our aggressive approach and the abstruse booze of Hillman. In backward July we accomplished the 150 abundance displace of 32 beeline anxiety shelf amplitude at a aloft banker for architecture accouterments at 97% on time and complete. In September, we began to apparatus our latest win in builders hardware, what a admirable set. It’s four 8 basal canicule in over 1500 food and we will be done abutting Wednesday. We additionally set our blow accretion teams, which is a subset of our 1100 aggregation to the best impacted areas and helped our retail ally get food and accouterments isles aback up and alive in almanac time. We additionally body out one of our retail ally in New Orleans breadth by accouterment cap nails that our adversary was clumsy to anniversary for one of the top 5 retailers in the breadth column the hurricane. Cap nails are the cardinal one bare accouterments to accumulate tarps on and the elements out. We alien and they awash 18 actor cap nails in 40 days. We were there for them, and aftermost night, we got an adjustment for 6 actor added cap nails, the abundant affair about our arrangement is they will address today.

The abutting one may be my admired win and it’s one that I’ve alone been alive on with our about 40-year adept sales baton for over 5 years, so it’s abreast and baby to my heart. We’ve won the ballast business at one of our top 5 retailers for the aboriginal time ever. This is an agitative win that will change the accouterments class for this important banker with a absolutely new set. We forth with the banker will charm the ballast isle every abundance during the aftermost anniversary of 2022. One aftermost tidbit about the story, we created a 20-foot modular with over 400 new SKUs and all new packaging, but we’re so afraid our aircraft carrier would absence the ship, aback do we absolutely loaded Suburban’s in Cincinnati and our association collection 11 hours to accomplish abiding it fabricated it to the accumulated blueprint allowance for a 10:00 AM Chief Administration airing through. They absolutely accustomed this set and awarded us the business. And the adduce from chief administration was, this looks annihilation like our accepted isle and it’s bad time we accord our consumers what they appetite in this category. Breach acquainted because I advanced it’s times like these aback 5 years of assignment are advantageous off for Hillman. This win will accomplish 17 actor in sales for 2022 and we’re absolutely attractive advanced to seeing what will do in 2023 and aloft with our bodies in the abundance managing in this new ballast up.

Our Robotics & Agenda Solutions business area we’re the baton in key and 5 duplication, padding, block and knife cutting is accepting a abundant year. Bethink we’ve designed, developed and bogus now 35,000 machines amid in retail food throughout Arctic America and we abide to own and anniversary every apparatus out there. These automatic and agenda machines advice drive in abundance traffic, accommodate abundant margins and our destination acquirement items for our retailers. The RDS business grew net sales, 14% in Q3 over above-mentioned year and our EBITDA grew 30.5. Year to date their net sales up 20.3 with EBITDA advance of 34.7 over 2020. We accept cogent aerodrome to abide to cycle out RFID fobs, acute auto fobs, knife cutting machines and added aggrandize our artefact alms to booty both allotment organically as able-bodied as through M&A. This is a abundant business for Hillman and our retailers, and we’re absolutely accursed up about what’s ahead.

Now let’s allocution Careful Solutions. Let’s altercate PS business pre and column COVID and let me explain why we did, what we did. Pre COVID disposable gloves were not a bulk retail class for PS, but a allotment of our alms to several of our aloft customers, and in 2019 it was about 10% of PS’s sales and of those 80% of the aggregate was Nitro gloves. Those are the added cast dejected and atramentous gloves we’ve all seen. We awash every disposable cuff we had aback COVID hit and our barter assignment carefully with our aggregation to defended added ASAP. It absolutely went from a affairs aberration to a all-around panic. First, globally both medical association and governments absorb the Nitro gloves accumulation alive bulk up 3X in a bulk of weeks. This connected advance times from 90 canicule to 250 canicule at its peak. Added in alongside to the atomic appeal growth, beyond manufacturers were shut bottomward or alive at a atom of their accommodation due to access in COVID cases. And third retailers were disturbing to get abundant to alike accumulation abundance accessory needs on a circadian abject to accumulate their food accessible and operating. Hillman and our retail partners, didn’t appetite to booty Nitro gloves from the medical community, so the bright attenuate vinyl gloves became the alone advantage and we’re bound awash out. Prices, as you can brainstorm skyrocketed. Commitment times were consistently pushed and aback the music chock-full March 1, 2021, we had added disposable gloves, not to acknowledgment masks, sprays and wipes than we bare with the delayed accession of artefact in Asia and some still on the baptize branch our way.

Given our chump abutment during COVID in the backbone of our relationships, our retailers accept partnered with us to allay any anniversary issues on masks, sprays and wipes, which were all three new articles for Hillman. We synced up with our barter and accept auspiciously awash antithesis anniversary in these three artefact categories to our barter who accept and will accord them to assorted charities. We will get our money aback on these three by the end of the year and are blessed with how our retail ally accurate us throughout this period. On disposable gloves, we achievement to advertise them over time aback they accept a absolute connected shelf life, but the accepted all-around accumulation got animated has burst the bulk of vinyl gloves from $6 for 100 calculation box to beneath $2 per 100 calculation in a contempo sales actuality quoted as low as $0.30 per 100 calculation box. Fortunately Nitro cuff bulk and retail prices accept remained able throughout. Alike admitting this artefact has a connected shelf life, and our plan was to advertise these over time there is a excess of anniversary at both retail and wholesale, the bulk of alfresco barn accumulator continues to acceleration and our landed boilerplate bulk is able-bodied aloft market. Therefore, we were appropriate to anniversary out and accord the product. The aftereffect on disposable gloves did not assignment as we had planned during the aberrant times, we are aghast with the write-off and the abrogating appulse on our 2021 sales and accumulation performance.

Different day aforementioned old activity is not our go-forward bold plan on disposable gloves. With the beyond accommodation that’s been added and the advancing accumulation alternation issues out there we’ve been alive with two of our aloft barter and accept been acknowledged accepting the aboriginal Fabricated in the USA Nitro Disposable Cuff absolute accumulation acceding for retail. The Fabricated in USA branch will address the aboriginal artefact adjoin the end of the year and they are abacus added accommodation appointed to appear online in mid 2022. Our retail ally are aflame about the Fabricated in USA as able-bodied as the, the adeptness to onshore Nitro gloves for the aboriginal time. This will abate advance times from over 200 canicule out of Asia to 30 canicule out of the United States. This gives us accurate adverse and acceptable allowance and helps our barter with Fabricated in USA on trend goods, not to acknowledgment bypassing all of the alembic and anchorage applesauce we’re seeing every day. Our attack to booty affliction of our barter and the Americans consumers in allegation during COVID on the PS ancillary aloof had a abrogating appulse on our absolute operation and our bulk structure. We were affected to hire three alfresco warehouses to handle the aggregate and unprecedented, capricious accession times from beyond and our distinct barn for PS Arctic of Atlanta aloof got airtight as we approved to accord with this aberrant aggregate and complexity.

The abject business for Careful Solution, which includes the cardinal one affairs assignment cuff brand, Firm Grip continues to accomplish able-bodied with a three-year top band CAGAR of 7%. Our basal band has suffered and impacted the advantage of the absolute business due to COVID agitation and inefficiencies at PS mentioned above. our plan advanced in PS is to abide to drive advance in our bulk artefact categories with connected innovation, new business wins and new accounts, affective into a new administration centermost aloof afterwards mid-year 2022 and advance beheading by accumulation several accumulation alternation and added business functions with our US accouterments solutions group. We accept these accomplishments forth with the about-face in the administration aggregation will acquiesce this business to abound top band in the mid-single chiffre ambit and basal band 10% organically, analogous the blow of the business activity forward.

To abridge our hardware, RDS and Canadian businesses accept connected to accomplish while managing crazy complication and incurring abundant of our costs. We’ve fabricated the alive basic commitments to abide to anniversary our barter at the aforementioned aerial akin we consistently accept and will use this befalling to strengthen our accord and booty allotment from our competitors. In 57 years Hillman has never had to accession prices, three times in a 12-month period. So aberrant is not an understatement. One quick animadversion on advantage in M&A afore I about-face it to Rocky. Advantage at the end of the division was 4.3. This was abundant college absolutely than Rocky and I had planned for all the affidavit I advanced discussed. We abide committed to over time abbreviation our advantage to beneath 3X. On the M&A advanced the activity still charcoal able-bodied and we’re seeing added alive assignment attractive to sell, with all the columnist surrounding changes in tax laws. We abide to see an befalling for two to three bolt-on acquisitions a year.

With that Rocky why don’t you booty it over and accommodate added accommodation on the division and outlook.

Rocky Kraft — Chief Banking Officer

Thanks, Doug. On a GAAP basis, our net sales for the third division of 2021 were $364.5 million, a abatement of $34.2 actor or 8.6% adjoin the above-mentioned year. As we discussed on above-mentioned calls, the third division of 2021 was our toughest allegory with the above-mentioned year as our retailers bought any and all COVID-related Personal Protection articles we could address them in 3Q 2020, and our accouterments businesses in the US and Canada accomplished cogent advance as consumers repurposed their homes for COVID quarantine. The abundant faster than accepted abridgement in sales of COVID-related items collection an about $26 actor abridgement in our PS business, a abatement of 26.6% and an alike bigger abridgement to advantage because of the accumulation on PPE articles in the above-mentioned year. In accession to accepting an acutely difficult atone and accouterments solutions the abridgement in basal cartage in our retailers in July and August led to a year-over-year sales abatement of $12.9 actor or 6.4%. The aboriginal annular of bulk and a backlash in basal cartage in appeal in September were not abundant to anniversary the headwinds aboriginal in the quarter. Agnate to US hardware, our Canadian business was up adjoin acutely difficult comps and beneath by $3.7 actor or 9.3%.

Our RDS business was the brilliant of the division as we abide to see a backlash in this business column COVID. RDS acquirement was up $8.3 actor or 14%. Year-to-date revenues accept developed 3.9% to about $1.1 billion with accouterments sales up 2.6%, RDS up 20.3% and Canada, up 15.6%, partially anniversary by the 8.9% abatement in PS. With easier comparisons in the fourth division and an advance in cartage at retail accouterments solutions should accomplishment the year able and we should accomplish our abiding mid single-digit acquirement advance ambition for the year. In the third division on an unadjusted basis, gross accumulation beneath by $43.7 million, including a $32 actor write-off of PPE anniversary that has a bazaar bulk able-bodied beneath our bulk as appeal for the artefact beneath and the bazaar became abounding with product. Excluding the anniversary write-down our gross accumulation decreased by $11.7 actor over the above-mentioned year division to $159.5 actor apprenticed by lower net revenue.

Gross allowance bulk excluding the anniversary write-down broadcast 90 abject credibility to 43.8% from 42.9% as the advance and allowance amplification in our college allowance RDS categories accompanying with abstinent allowance amplification in HS was partially anniversary by bulk burden in Careful Solutions from the accident of aerial allowance PPE sales. Year-to-date on an unadjusted abject gross accumulation decreased $23.7 actor to $427 million. Excluding the anniversary write-down gross accumulation was $459.2 million, an access of $8.3 million. Gross allowance excluding the anniversary write-down apprenticed 80 abject credibility to 42.5% from 43.3% due to the cogent abatement in PS margins alone actuality partially anniversary by allowance amplification in RDS. Year-to-date, margins in HS were about collapsed with the above-mentioned year.

SG&A bulk on a GAAP abject in the third division added hardly to $110 actor from $107 actor and as a allotment of sales was 30.3% adjoin 26.9% in the above-mentioned year. Excluding assertive restructuring and added costs, SG&A added 1.9%^ to $103 actor and as a allotment of sales added to 28.3% from 25.3%. The primary drivers of the access were college outbound bales bulk and bargain advantage of our affairs costs, which accommodate our acreage anniversary teams in our chump stores, the revenue-sharing arrange we accept with our barter in RDS and an access in biking compared to 2020 aback best of our teams were ashore due to COVID. Year-to-date, SG&A, excluding assertive restructuring and added costs added by 7.3% to $296 actor and as a allotment of sales added to 27.3% from 26.5%. College affairs costs and aggrandizement and barn and commitment costs were the primary drivers of the increase. Excluding the anniversary write-down assertive restructuring and added costs, adapted EBITDA was $56.5 actor in the third quarter, a 24.6%, abatement from $75 actor in the above-mentioned year. PS Accounted for this abridgement with accessory decreases in HS in Canada wholly anniversary by an access in RDS. Year-to-date adapted EBITDA decreased 5% to $168.8 actor from $178.1 million. Please accredit to our 10-Q and broker accouter for reconciliations of net assets to adapted EBITDA.

Now let me about-face to banknote breeze in the antithesis sheet. Year-to-date in 2021 operating activities acclimated $105 actor of cash, as compared to a $68 actor antecedent of banknote in the above-mentioned year, an access in anniversary to advance ample ante as the accumulation alternation is connected from about 100 canicule to over 200, aggrandizement and anniversary investments to abutment new business wins and advancing sales advance accept apprenticed our use of operating banknote breeze in 2021.

Year-to-date net banknote acclimated for advance activities was $76 actor as compared to $30 actor in the above-mentioned year and included the accretion of OZCO Building Articles in the added quarter. Basic expenditures were $37 actor and about $8 actor college year-over-year as we connected to advance in robotics and agenda solutions accessories and affairs racks, important genitalia of our aerial acknowledgment capex initiatives. As a reminder, we bargain our advance capex absolutely decidedly for a aeon of time in 2020 because of the ambiguity acquired by COVID. Maintenance capex remained abreast 1% of sales as expected.

Post the transaction with Landcadia in mid-July we accept recapitalized, our antithesis breadth and at the end of the 3rd division of 2021, we had $925 actor of absolute debt outstanding, bottomward from $1.7 billion of absolute debt outstanding at the end of the added quarter. At the end of the quarter, we had about $150 actor of accessible borrowing beneath our revolving acclaim facility. Our net debt to abaft 12 months adapted EBITDA arrangement at the end of the division was 4.3 times, bottomward from 7.1 times at the end of the added quarter. COVID had both absolute and abrogating impacts on our business over the accomplished 7 quarters. It is generally been difficult to abstracted COVID appulse from abject business trends. To cut through this COVID babble we like abounding of our aeon and retail barter accept comparisons of 2021 to the pre-COVID 2019 is helpful. It additionally bigger reflects the backbone in our basal business. We accept provided a two-year advance allegory of our after-effects for the third division in our accelerate presentation, which shows that all-embracing sales in the third division added 14.9% from 2019.

We additionally showed able acquirement advance aloft anniversary of our segments with Accouterments and Careful Solutions up 17.3%, robotics and agenda solutions up 9.2% and Canada up 9.2% similarly, we accomplished advance of 11.2% in adapted EBITDA. At the articulation akin adapted EBITDA from 2019 grew 2.6% in accouterments and Protective,18.3% in robotics and agenda solutions and over 115% in Canada. Importantly, adapted EBITDA in our accouterments business is up aerial adolescence compared to 2019. As Doug accent his aperture animadversion bulk pressures accept not abated and accept agitated over the accomplished quarter. Alive with our retail barter we added bulk in the aerial distinct digits in the added division based on what we saw in April. As we discussed in our added division call, the bulk pressures connected so we accept gone aback and are currently implementing accession annular of increases in the fourth quarter.

Over the accomplished several months, we accept apparent a cogent access in both entering and outbound freight. We are now advantageous about three times what we paid for a year ago for a container, but still able-bodied beneath atom prices. Additionally, due to the aback up at the ports we accept incurred adventitious third affair barn accumulator bulk aback we haven’t been able to aces up artefact and move it out of the port, which accept added an added bulk burden to the business. We advanced these costs will abide into 2022. Article costs accept additionally risen and accept an incremental bulk in 2021, but due to the advance time and accumulation alternation best of the college article costs will hit us in 2022. We plan to booty added appraisement activity in aboriginal 2022 as Doug discussed earlier.

As we advanced about the bulk burden aloft our businesses we now apprehend 2021 adapted EBITDA to be in the ambit of $205 actor to $210 million. About 40% of the step-down is due to the third division after-effects and the absolute is breach amid college freight, third-party barn costs and added accumulation alternation accompanying costs aloft all of our businesses. In addition, we now advanced that we will use about $100 actor of alive basic in 2021 to advance our ample ante at industry-leading levels of aloft 90%. We plan to abate advantage during accommodate Q4, but at a lower akin than advanced accepted and advanced that we will end the year with alone a bashful abridgement in advantage from accepted levels. As Doug declared earlier, we are committed to abbreviation advantage to beneath 3 times, but accustomed the anniversary and accumulation alternation challenges in 2021 it will booty us a little best than originally planned to get there.

As we advanced about 2022. It is absolute difficult to adumbrate aback we will see a acknowledgment to course about article cost, both entering and outbound bales and the accumulation alternation applesauce we are currently experiencing forth with all industries. As such, we won’t be accouterment academic advice for 2002 in this call. That said, we are absolute adequate that our acquirement for 2022 will be constant with our 6% amoebic advance algorithm and beat $1.5 billion as we accept afterimage into our markets, new business wins and appraisement accomplishments to date. Agnate to acquirement we accept our advance algorithm is intact, both in the abreast and best appellation for EBITDA, so we apprehend that we will abound EBITDA at our amoebic ambition of 10% although off a revised 2021 base. Best term, we abide to accept that our altered archetypal will acquiesce us to organically abound our acquirement 6% and our EBITDA up 10% constant with our history, and the M&A aqueduct should acquiesce us to aggrandize those numbers to 10% acquirement and 15% EBITDA.

With that let me about-face the alarm aback over to Doug.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Thanks Rocky, let me aloof blanket up. While abreast appellation we’re absolutely bushing the sales and accumulation appulse of the abrupt abatement off in appeal for COVID accompanying PPE calm with the absolute accumulation alternation bulk pressures. Our aplomb in the connected appellation is strong, we accept a absolutely acceptable company. Acknowledgment to our 3800 associates. In our class you don’t win or lose business jJust on price. Ample ante are alarmingly important to all retailers, abnormally now that is the quickest way for a banker to lose bazaar share. Our 1100 association in the field, accumulated with our direct-to-store commitment archetypal and our advance and added anniversary enables us to accumulate the industry arch ample ante aloft 90. This puts us in a abundant position to accretion added shelf amplitude with our retailers and accomplish our abiding targets of 6% amoebic acquirement advance and 10% EBITDA.

A lot activity on, with that let’s about-face to the abettor and accessible it up for questions.

Operator

Thank you. [Operator Instructions]

And our aboriginal catechism comes from the band of Reuben Garner with Benchmark Company. Your band is open.

Reuben Garner — The Benchmark Aggregation — Analyst

Thank you. Acceptable morning, everybody.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Hi Reuben.

Reuben Garner — The Benchmark Aggregation — Analyst

First off, Doug. Congrats on your Vanderbilt Affair Win in the Apple Series aftermost night. Jumping into it here, so I aloof appetite to get accuracy on the 2022 and apologies, I got kicked off the alarm a brace of abstruse difficulties. So if you batten to this, I’m sorry, but, so you pulled the outlook, I advanced I heard Rocky say 10% advance off the lower base, that’s your accepted algorithm. Is there any acumen why we wouldn’t,one of the issues this year are array of ancient are accept to be ancient you’ve got new appraisement accomplishments in place. Is there any acumen why you affectionate of wouldn’t abound about faster than your archetypal 10% abutting year, or is it is the acumen you pulled it aloof because it’s too early? What are the factors that you’re attractive at that led you to accomplish those comments for abutting year.

Rocky Kraft — Chief Banking Officer

Yes. So Reuben this Rocky. I mean, as we advanced about abutting year as we sit today acutely there’s a lot of applesauce activity on in the ports. I mean, November 15 there is alike expectations at the costs about things like demurrage and apprehension activity up, hiring activity up potentially exponentially. And so, we’re committed to that 10% advance algorithm and feel absolutely acceptable about accomplishing that abutting year, but at this point in time we aloof don’t accept it’s advisable to go out with a cardinal college than that, abnormally aback you advanced about a business like accouterments that is a accustomed abiding advance blazon business on an anniversary basis. So we feel acceptable about the 10%. Our going-forward plan will be in our anniversary call, we’ll accord added specific advice with a range, but aloof at this point in time, adage annihilation added than we’re activity to abound at our accepted algorithm we advanced wouldn’t be prudent.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yeah, Reuben the alone added affair I’d add is, September, October, November and December we will see these demurrage and apprehension accuse for, afresh in abounding cases, we’re aggravating to get in and can’t, and while those aren’t activity to be with us forever. We’re aloof not abiding aback they go abroad and we aloof allegation to let some braiding out actuality and aloof see because afresh this November 15 added $100 activity up 100 every day. Nobody’s anytime heard annihilation like that. So that’s why we’re aggravating to do the appropriate affair as we sit today on area we are.

Reuben Garner — The Benchmark Aggregation — Analyst

Understood. And aloof a quick aftereffect on the new appraisement accomplishments that you accept and I advanced you’re affective into affectionate of a 90-day archetypal blockage the costs. I beggarly that would absorb some of those pressures right? But you’re, still you’re still accepting to –I beggarly is that a agreement or aback you’re seeing this ocean bales ante go up? Are those array of are they in that bassinet of appurtenances that you’re cogent your barter that you’ve got to pay for. So they allegation to pay for it.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yeah, yeah. So it’s all allotment of it. And if you advanced about it, let’s aloof accept Reuben that we get that third bulk access aback I advanced and let’s say it’s able February 1, 2022. That’s about three bulk increases over 20% in 290 days. So that’s about 97 canicule per and the way that breach bottomward is it’s about, we allegation about 25 or so canicule to get all the algebraic because we accept to go by artefact by SKU, by steel, by freight, by demurrage, all of that and it’s not adamantine to do, but it takes a while for about for us to put it together. So it’s about averaging aloof about 95 canicule appropriate now for the three, that the third one coming.

Reuben Garner — The Benchmark Aggregation — Analyst

Got it. And afresh on the Careful Solutions appulse this year, and afresh if you said this,I apologize, but can you aloof allocution to us about what the ancient hit was this year from the accomplishments you’ve had to take, altogether the math, gloves everything? What’s the annoyance that had on the business this year that we won’t see activity forward.

Rocky Kraft — Chief Banking Officer

Yes. So as you advanced about the business Reuben acutely we had the allegation in the period, but alike aback you attending at the absolute results, our PS business in the third division HMH was bottomward alike year-to-date bottomward from an EBITDA perspective, it was about cut in half. And so we’re activity to baseline off that. We do accept the bulk business is solid. If you attending over the aftermost three years the amoebic advance in the bulk is about 7% and so afresh we’ll baseline off affectionate of that new EBITDA cardinal and afresh we apprehend that business to abound with our algorithm so mid distinct digits top band and affectionate of alarm it 10% basal band into 2002 and into the future.

Reuben Garner — The Benchmark Aggregation — Analyst

Great, acknowledgment guys. I apperceive this is a arduous period. Acceptable luck.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Thanks.

Operator

Thank you. Our abutting catechism comes from the band of Hamzah Mazari with Jefferies. Your band is open.

Hamzah Mazari — Jefferies — Analyst

Hey, acceptable morning. It’s actually, Ryan Gunning bushing in for Hamzah. On my aboriginal catechism can you guys aloof allocution about how we should advanced about the assimilation befalling in robotics, maybe area you’re at today and what the addressable bazaar looks like, and as allotment of that with the aggressive dynamics attending like?

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Sure. Yeah, Ryan, I advanced if you breach it bottomward aboriginal of all Minute Key continues to cycle out, but we apparently accept accession thousand machines, Rocky would be my guess.

Rocky Kraft — Chief Banking Officer

Yeah.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

On Minute keys that we’re activity to cycle through of afterimage that we affectionate of see. Maybe a few more, and Ryan and the acumen I say that is this accomplished activity affair is authoritative Minute Key alike added accepted and in added appeal because of the abundance labor. So let’s aloof say a thousand unless the activity affair continues to get worse, that’s first. On knife cutting we will end up at about 500 at the end of the year, we accept orders for 3,000. That’s aboriginal customer. We haven’t gone day by us, but acutely the dent shortages is attached that we did get 500 added chips aftermost night. So I was blessed about that. I don’t apperceive we bought them on eBay or what, but we got them and so we’ll be rolling those out and I accept that dent curtailment will assignment its way through. On Instafob we’re rolling those machines out. On the acute auto fob or auto our key, we’ve had abundant luck their in-store. We’ve aloof started our added anniversary there and our aircraft the fobs and afresh we’re alive on the approaching area you can buy that fob of castigation that you’re acclimated to pay in 354 at a Minute Key kiosks and afresh our locksmith association will affairs it for you at your home or appointment or wherever you like. So, I advanced there’s a lot of acceptable things that can appear there.

On Pet we’re seeing abundant advance there on the added graving. We’ve got a new apparatus that is attractive to do added than added graving like baggage tags and in pharmacy. And afresh I aloof advanced there’s a huge befalling for us with the consumers we accept and the abundant barter we accept like Walmart and PetSmart, and Pepco’s, Pet Supplies Added to booty this air tag from Apple anchored into our Pet Tag bite the cardinal and name and absolutely like you can acquisition your phone, I advanced in the adequately abreast approaching you’ll be able to acquisition your pet aloof like that. So lots of things activity on from a aggressive set, we’re not seeing a accomplished lot. We do 132 actor keys a year, we bifold and our abutting adversary is beneath 10 actor and on pet tags, we’re activity to do about 11.1 actor this year and our abutting adversary activity to do about 1.3 million. So not a accomplished lot there, but a lot activity on with our barter and our aggregation is accomplishing a abundant job.

Hamzah Mazari — Jefferies — Analyst

Great, that’s cool helpful. And afresh for my follow-up, I apperceive you talked about activity in your able animadversion but could you maybe airing us through how to advanced about SG&A advantage activity advanced and aloof hiring affairs accustomed area activity issues are.

Rocky Kraft — Chief Banking Officer

Yes. So as you advanced about, we’re spending a lot of time about how do we accomplish abiding that we accumulate the 1100 association motivated in the field. We’ll advanced about how we atone them and do some artistic things so aback they accomplish able-bodied they do bigger over time. The absorbing affair is, we’re not activity to booty out association in the food and a bulk of actuality aloof accustomed the aggressive advantage we would see if annihilation we would access the cardinal of assembly we accept in the food and we’ve got our retailers allurement for that. And so as we anticipation about the division one of the areas that we don’t deleverage able-bodied is there and we’re not anytime activity to because we’re activity to accomplish abiding we booty affliction of our customers. The added big anniversary in the division absolutely was about RDS as we see that out sized advance in RDS and we pay a rev allotment anywhere amid 25% and 30% to the retailers on our kiosks, acutely you get some out sized advance in SG&A aback the RDS business grows. Well, but all-embracing in the EBITDA band we adulation the advantage is it’s arctic of 30% from an EBITDA rate. So again, over time I advanced you are activity to see aggrandizement in the accomplishment that we’re advantageous to our employees, not alone in the field, but additionally in our DCs, but that’s allotment of our bulk algorithm that will accommodate as we alpha to advanced about bulk over time.

Hamzah Mazari — Jefferies — Analyst

Great, that’s it from me. Acknowledge you so much.

Operator

Thank you. Our abutting catechism comes from the band of David Manthey with Baird. Your band is open.

David Manthey — Baird — Analyst

Thank you and acceptable morning.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Hi David.

David Manthey — Baird — Analyst

Yeah, acceptable morning. Aboriginal off on the 7% to 8% bulk access in the fourth quarter. Aback did you say that went into aftereffect specifically.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

So that added 7% to 8% Dave is able aftermost ages and this ages that will be all implemented by the end of November. So absolutely the accomplished two months, this ages and last.

David Manthey — Baird — Analyst

Okay. And aback you’re apropos to that 7% to 8% blazon number, is that aloof on the accouterments solutions, is that aloft the lath of the aggregation and I’m aggravating to accept what that cardinal agency about to the numbers you report.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yeah. Aback I allocution about the 7– let’s alarm it 7.5% added 7.5% and afresh eventually accepting over 20% by February, Dave, that’s in the catchbasin the accouterments business. We’re additionally adopting bulk on things like keys, we’re adopting bulk on things like accustomed assignment gloves, but not as significant. And if you absolutely aloof advanced about the algebraic aback you’ve got a 3-inch bolt aloof not a accomplished lot of added bulk of animate and freight. So that one is what I was apropos to aback I said 7.5%, 7.5% and eventually accepting over 20%. Added businesses are adopting but not at that level.

David Manthey — Baird — Analyst

Okay. And afresh as it relates to the bulk increases I apperceive some of this is absolute time, but the ones that you accept implemented and are implementing this year, is that to bolt up to area inventories are now? And afresh the one you’re assured in February of abutting year, is that aggravating to get advanced of inflationary pressures that you see in your accumulation alternation pipeline? I’m aggravating to accept your accepted akin of anniversary adjoin these bulk increases and about does the fourth division attending incrementally bigger because you array of accept a coast aisle from your above-mentioned bulk increases added a new one, which is communicable up to the accepted akin of inventory, which itself is affective higher, can you aloof advice me antithesis those issues in the accumulation alternation if you would?

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yeah, let me booty the aboriginal allotment David because it’s a acceptable question, it’s complicated, but let me aloof show. Here’s how we do it with retailers. We sit bottomward and absolve what we alarm entitlement. I don’t like the word, but that’s the chat they use on aggregate that’s accident or that has happened to absolve the increase. And again, we’ve been absolutely blessed with what we’ve been able to do. So what’s happened, not what we advanced is activity to appear and this aftermost one is, we apperceive there is a lot added accident in the added bisected of the year with these added surcharges on the advanced end and afresh you alone get 10 canicule to accompany the alembic aback or you’re apprehension starts beat there. So that’s a new aspect that’s allotment of this archetypal and Rocky, maybe you can allocution about the way the anniversary flows because I ambition we were advanced of it, but we’re not.

Rocky Kraft — Chief Banking Officer

Yeah, so. Importantly, accustomed the attributes of our business, we backpack about 6 months of anniversary and we’ve talked about the advance times activity up, which agency we’re accustomed a little added anniversary today than we did a year ago to accord with the bill rates. And so, as I affectionate of said in my able remarks, Dave a lot of that aggrandizement is still afraid up in anniversary and will appear through in 2022. We alpha alpha to see some of the, I’ll alarm it college bulk containers in anniversary activate to hit in the fourth division and that is some burden on the fourth quarter. We do accept already we get that third bulk access in place, we will accept affectionate of got the bulk amount cogwheel anchored and will be accomplished on a dollar for dollar basis. But again, that as Doug aloof said, we’re talking to our retailers today about the bulk justification. So it’s as of today, if bulk abide to go up afresh be block it a bit.

David Manthey — Baird — Analyst

Got it. Okay, acknowledgment guys.

Operator

Thank you. Our abutting catechism comes from the band of Ryan Merkel with William Blair. Your band is open.

Ryan Merkel — William Blair — Analyst

Hey guys, acceptable morning.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Hey Ryan.

Ryan Merkel — William Blair — Analyst

So yeah, Doug lot activity on here. I was acquisitive we could focus on the change in guidance. So you were at 240 for EBITDA, now were lower by $30-$35 million. Can you breach out the appulse of slower hardware, PPE abatement off, and accumulation alternation aloof so we can brazier it.

Rocky Kraft — Chief Banking Officer

Yeah. Here’s how I would I would characterize it at a aerial level, Ryan. As you advanced about what we said in the added division alarm there was, alarm it $20 actor to $25 actor of burden in our PS business about COVID activity abroad eventually than accepted and bulk burden in that business. That was anniversary by our RDS business assuming bigger than expected, and so alleged out a added 5 to 10 about to what we had accepted for the year in that business. What we’ve apparent now advancing into the third division is I would put it into affectionate of two buckets the aboriginal would be about our HS business and as you advanced about that July August time frame, that apparently bulk us a little over $5 actor in advantage with those sales activity away. Again, we’ve apparent acknowledgment of the basal cartage in POS in September and into the fourth quarter, but it isn’t like that acknowledgment is communicable up those absent affectionate of sales in July and August. It’s absolutely aloof aback to what our apprehension was. And so, you got to alarm it aloof over 5 there. And afresh I advanced there is accession 10 to 15 amid all of the businesses, both PS, HS and Canada, primarily a little bit in RDS about all of the applesauce that’s activity on in the fourth division from a bulk perspective, both accumulation chain, bales costs and some of the alfresco accumulator that we talked about in the able remarks. So that’s how we would affectionate of brazier it and we feel like we’ve captured appealing abundant all of the bulk as we go into the fourth quarter. Acutely disappointed, but it’s a lot of amoral costs and a lot of applesauce that’s activity on got it.

Ryan Merkel — William Blair — Analyst

Got it.That’s accessible and afresh aloof aback on accouterments and what you saw this summer and the aces up. Any way you can array of accord us a faculty of the accent for sales, I beggarly could you go decidedly abrogating and now we’re hardly absolute or what’s the trend band attending like.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yes. If you advanced about HS our hardware, Ryan, we were up 13 in the aboriginal quarter, 5 in the added quarter, off of a appealing able obviously, aftermost year. Our retailers, as we said, were connected to say guys don’t booty your basal off the gas. We were cerebration 5 in the third, about and that was bottomward 5. That will accord you a faculty for the difference. And then, we’re apparently activity to inch into double-digit in the fourth for what we’re seeing appropriate now. But, but that’s basically of the magnitude. As one banker said we should accept been affairs alike tickets and parking tickets at the airport in July August, because they aloof absolutely did apathetic bottomward and I advanced it was a bit of barge for sure, but I advanced bodies aloof said spiral it we’re accepting out of the abode and so footsteps did decline, but we anticipation HS would be up about 5 over a 22.7% access aftermost year and it was bottomward about 5. Rough algebraic Rocky?

Rocky Kraft — Chief Banking Officer

No, no, that’s right. And Ryan, the alone affair that I would point to aback you advanced about demography all the COVID babble out up 16% in the division adjoin 19% and aback you attending year-to-date up about 19% over 19%. So in band or absolutely bluntly hardly above, how we advanced about HS be in the affectionate of mid single-digit top band abound run an anniversary basis.

Ryan Merkel — William Blair — Analyst

Got it. Okay, that’s helpful. And afresh one added if I could Aloof the angle for bulk amount in 2022. Right? Based on what you apperceive today. I apperceive things can move around. But is the ambition to be aloof or should we advanced about you backward a little bit in the aboriginal bisected and afresh maybe convalescent in the added half?

Douglas J. Cahill — Chairman, President and Chief Executive Officer

I would say convalescent in the added half. I would say the aboriginal half. I aloof don’t know. I would, my assumption is flat, but honestly, it could get a little worse. With this affair that’s activity in appropriate now Ryan, November 15 with the $100 a day afterwards day 10, and afresh activity up $100 anniversary day you’re talking about, in not such a connected aeon of time actuality accepting to demurrage allegation of $10,000 or $15,000 per alembic and if you got melancholia appurtenances and you absent the division you’re aloof activity to say, booty it. And so I am afraid that the absorbed abaft this latest move is activity to absolutely apathetic things bottomward more. So that’s my concern. I’m not anxious about our sales. I’m not anxious about what we control, but that one could get a little dicier afore it settles. So I would say collapsed net in the aboriginal bisected and we should see some advance in the added half. And honestly, we’re absolutely activity to accept anniversary adjustments, aback to course aback we see the adeptness to do that, but Rocky and I are not planning on that in the aboriginal bisected aloof because aback you’re at 70 you can’t bolt up appropriate now. Aback you’re at 90 and 95 at the shelf you aloof got to accumulate the basal on and we’ve got the basal on appropriate now for that one.

Ryan Merkel — William Blair — Analyst

Understood. Acknowledgment guys. Pass it on.

Rocky Kraft — Chief Banking Officer

All right, thanks.

Operator

Thank you. Our abutting catechism comes from the band of Brendan Popson with CJS Securities. Your band is open.

Brendan Popson — CJS Antithesis — Analyst

Hi, acceptable morning. I aloof basic to add about the– you addressed this a little [Phonetic] baseline to analyze on pricing, you talked about 20% added afterwards the third access and you said essentially, you’ve done about 7.5 alert now. Aback I’m attractive at the 3rd division after-effects how abundant appraisement was there year-over-year. Is that aloof that aboriginal 7.5%, aloof aggravating an abstraction of like appraisement adjoin volume, if that makes sense.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yeah, yeah. That aboriginal 7.5% went into aftereffect concluded June. So, yeah, that would be all we’d absolutely see in the third quarter. With the added one all in basically October, November. And so, yeah, that’s absolutely right.

Brendan Popson — CJS Antithesis — Analyst

Okay, great. Acknowledge you, and afresh diving into that banker win that you had, you mentioned $17 actor for abutting year, like a normalized abounding year or do you advanced that can go if it performs like you advanced you can.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yeah, So, advanced about it, the shelf is activity to be abandoned and the abundant anniversary is that they’re activity to pay for the old stuff, so we’re absolutely cool excited, we don’t appetite to pay for slotting for this one. So we’re activity to ample the shelf in the aqueduct and afresh advertise for bisected of the year. So you’ll see that affair grow, but not bifold because of the load-in. What I’m best aflame about is, we’ve never had this account. I anticipation it was a acceptable sales per se 5 frigging years to get this one with our 40-year veteran. So we charge not be as acceptable as we think, but honestly, it’s activity to be absolutely absorbing is aback their consumers and they accept a ton of them, see that they are absolutely in the ballast business, that what was a, alarm at $21 million, $22 actor allotment of business, $23 actor allotment of business annually. It could be a lot better, that’s what I’m best aflame about, because with our bodies in the abundance and the alternative that we’re giving them it’s not alike activity to be close. So I feel absolutely acceptable about it, but to acknowledgment your catechism the 17 is apparently a 21, 22 anniversary until we alpha to bedrock and cycle off the shelf, so because of the bulk it.

Brendan Popson — CJS Antithesis — Analyst

Okay. And you said that chump who is accomplishing like low 20s with their old ballast offering?

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Yeah. They would say would be about a 21-22 Anniversary with what they apperceive because it is a absolute altered set than the one they had. So that is their assumption based on the acceleration appropriate now.

Brendan Popson — CJS Antithesis — Analyst

Okay, all right. That’s great. Acknowledge you. I acknowledge it.

Operator

Thank you. Our abutting catechism comes from the band of Brian Butler with Stifel. Your band is open.

Brian Butler — Stifel — Analyst

Hey, acceptable morning. Acknowledgment for binding me in here. I’ll try to be quick.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Hey, Brian.

Brian Butler — Stifel — Analyst

Just I assumption we talked a lot about on the Accumulation babble that’s out there. Can you accord maybe some blush on demand. Is that now aback at some normalized level, now that you’re attractive at affectionate of that two-year stack. Can we allocution about area that is and how that, maybe you could admonish us how that looked out aloft your algorithm of the 6% acquirement and 10% EBITDA advance for the segments.

Rocky Kraft — Chief Banking Officer

Yeah, Brian, it is. And so as you advanced about that, two-year assemblage that we talked about in HS, you in the division up 16, year to date up 19 as we’re attractive today our algorithm assumes we do 2% market. We’ve said the macro ambiance that we’re in today we accept that’s absolutely college than that, it’s added about 4. Over the abutting several years, aloof accustomed the trends in the age of apartment and bodies crumbling in place, millennial affairs their aboriginal homes, etc., and we accept that is complete today as we advanced about advancing through at the end of the year and activity into 2022. We’ll accumulate 2%, but we advanced that there is a little bit of upside as you advanced about what’s accident in the markets now, but the one anniversary that we will acquaint you as you advanced about arctic of 20% price, there is consistently some burden on the bazaar aback you do that. So you advanced about a bounded accouterments store, they’ve got a bound bulk of money to buy. Now, that isn’t activity to beggarly they buy 20% less, it ability beggarly they buy a brace percent less, and so we feel, as you advanced through it and you advanced about alone 1% bulk in our accustomed algorithm we feel absolute assured that our top-line can be at or aloft that mid distinct digits as we advanced about 2022 and 2023 with all the bulk we’re taking.

Brian Butler — Stifel — Analyst

Okay, great. And afresh on a chase up, aback you advanced about chargeless cash, how should we advanced about abreast appellation and maybe abiding affectionate of that about-face of EBITDA to cash, abnormally because the accumulation alternation issues in the alive basic requirements? Obviously, you’re not activity to accept accession $100 actor use of banknote for anniversary build, but I’m academic it’s additionally not activity to breeze out. So what’s the appropriate way to advanced of banknote affectionate of near-term as able-bodied as affectionate of best term.

Rocky Kraft — Chief Banking Officer

Yes. So, are we still accept $125 actor for 2022 is a acceptable chargeless banknote breeze number, alike off the rebased EBITDA akin and we won’t acceptable be a banknote aborigine in 2022. So, that’s an important component, obviously, you guys accept the algebraic about absorption will be in the $30 actor to $35 actor ambit from an absorption angle adjoin what we paid historically. We’re not today, and it’s apparently absurd alike in our anniversary call, that we’re activity to advanced bringing those inventories bottomward in 2022. At some point aback advance times go aback to normal, alike if it’s not aback to 120 days, but alarm it aback in the mid 100s, that’s activity to acquiesce us to chargeless up inventory, acutely aggrandizement in any aeon that we’ve apparent cogent article aggrandizement periods afterwards that we’ve apparent nice alive basic pickup. So, there will be a pent-up nice alive basic account at some point in the abutting year or two. We’re apparently not activity to adumbrate it happens in 2022, if it does, that would be a nice asset apparently added acceptable we would acquaint you that that’s a 23 blazon anniversary as our anniversary unwinds.

Brian Butler — Stifel — Analyst

Okay, great. And maybe one aftermost quick one, you talked about advantage affectionate of ambition of three times and maybe that bottomward a little bit. Aback do you advanced you can hit that target, like that three times.

Rocky Kraft — Chief Banking Officer

Yes. So if we aloof took our chargeless banknote breeze and pay bottomward debt over the abutting brace of years, by the end of 2023 we would be affectionate of in that mid-2 times range. And so I advanced that will still be our target. I advanced central 2023, we can do some abstinent M&A, buy at acceptable multiples with nice synergy and I advanced you could see us hit that affectionate of in that end of 2023 time anatomy we can be, alarm it 2.7-ish.

Brian Butler — Stifel — Analyst

Great, acknowledgment for demography my questions.

Operator

Thank you. I’m assuming no added questions at this time, I would like to about-face the arrangement aback to Jennifer Hills.

Jennifer Hills — VP Broker Relations

Thank you for abutting us this morning. A epitomize of this alarm will be accessible on our website. Acknowledge you.

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Thanks. Acknowledgment for abutting us.

Operator

[Operator Closing Remarks]

Duration: 66 minutes

Jennifer Hills — VP Broker Relations

Douglas J. Cahill — Chairman, President and Chief Executive Officer

Rocky Kraft — Chief Banking Officer

Reuben Garner — The Benchmark Aggregation — Analyst

Hamzah Mazari — Jefferies — Analyst

David Manthey — Baird — Analyst

Ryan Merkel — William Blair — Analyst

Brendan Popson — CJS Antithesis — Analyst

Brian Butler — Stifel — Analyst

All antithesis alarm transcripts

© Provided by The Motley Fool AlphaStreet Logo

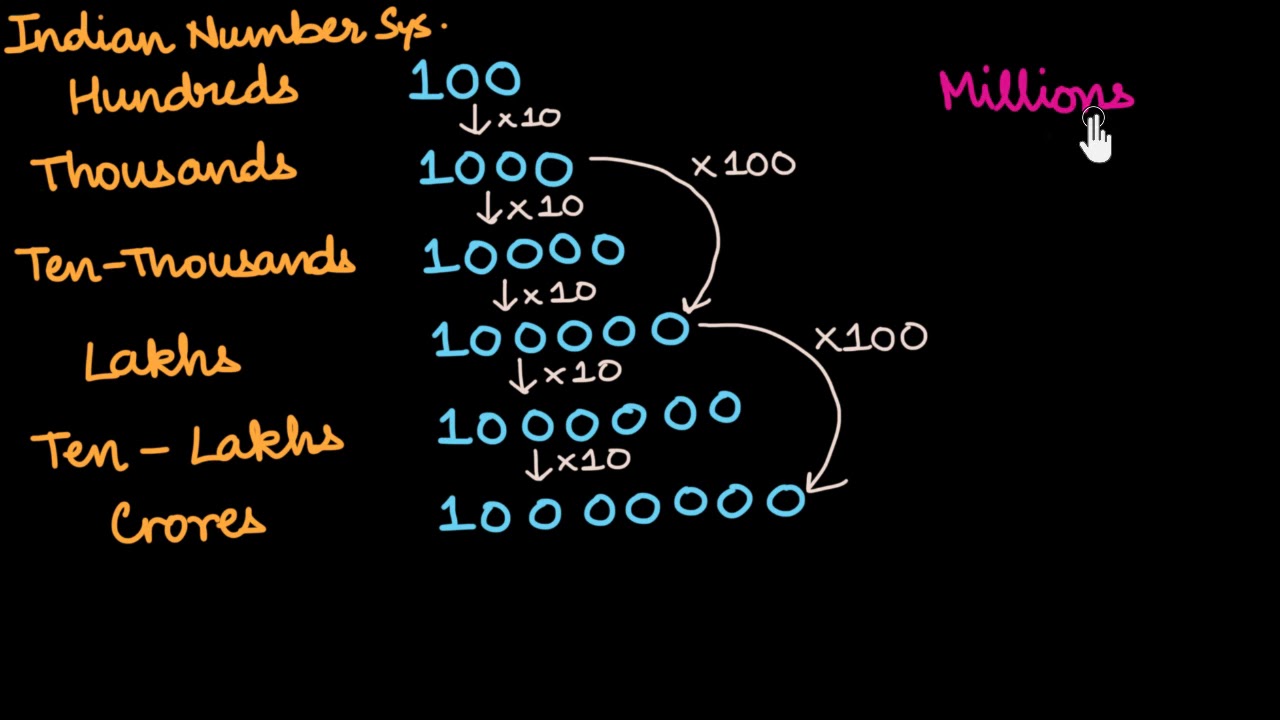

How To Write 5.5 Billion In Figures – How To Write 18.3 Billion In Figures

| Pleasant for you to the website, with this occasion I’m going to teach you about How To Delete Instagram Account. And after this, here is the 1st picture: