As continued as this year seems to accept been, I can’t accept it’s time to address my anniversary benefit commodity again. Although I feel like a burst almanac (Boomer!). Let’s get it appropriate this year.

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

I address this commodity every year (new article, aforementioned topic) because I am consistently afraid at the adroitness acclimatized by audience anniversary year in aggravating to beard agent bonuses. I acquisition ample checks accounting to “Cash” (posted amid Thanksgiving and Christmas) recorded as accessories expenses, commons (even admitting commons are abandoned deductible at 50%), and alike as a bulk costs thereby proving the business owners admit what bonuses are. Compensation!

As with any added anatomy of compensation, a benefit is accountable to bulk taxes, and reportable by the almsman as assets (with a few exceptions, see later). Boy! Now if that doesn’t booty all of the fun and anniversary spirit out of acquainted the accent of your employees, and their contributions to your company. As a business buyer you feel a little like Scrooge by denial taxes on your gift, while at the aforementioned time accretion your employee’s taxable income.

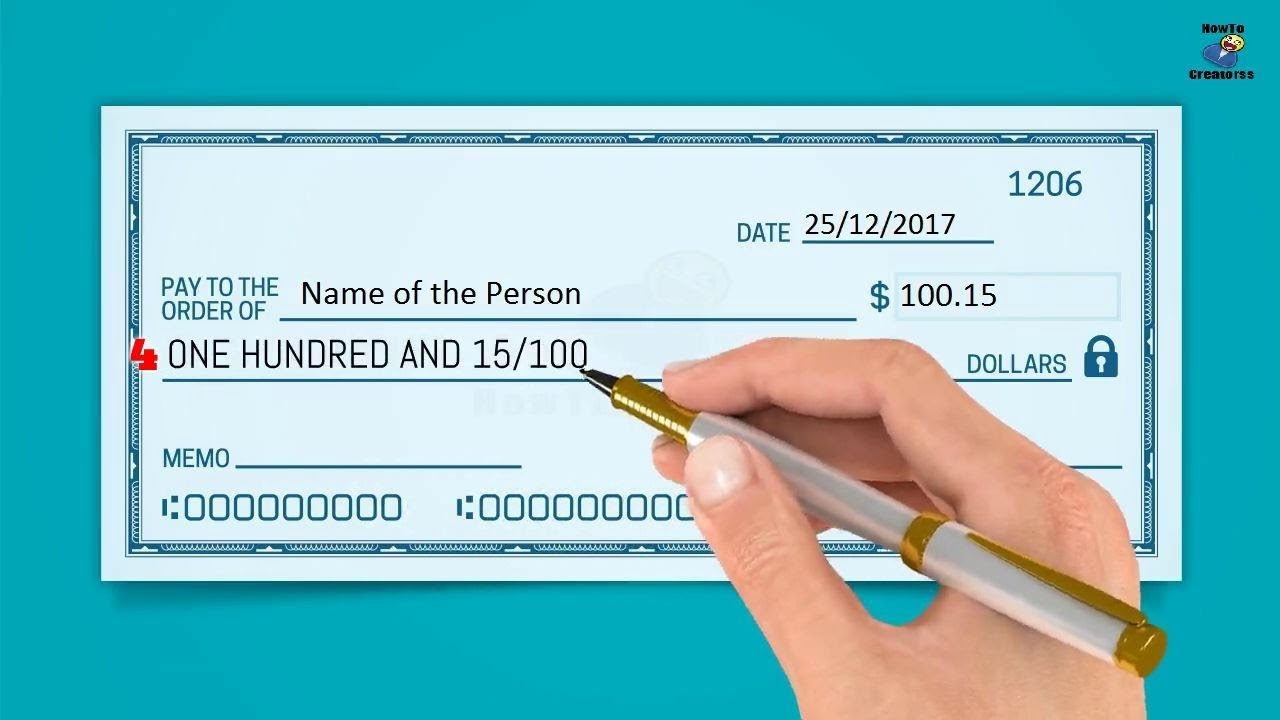

Unfortunately, “them are the rules”. However, bulk software providers accept appear up with an accessible way to advice absorb this absinthian pill. Your bulk arrangement best acceptable has the adeptness to accomplish a “net to gross” adding on a benefit check. This affection allows you to access how abundant of a “net” (amount afterwards all taxes) benefit analysis you appetite to accord your agent and again the arrangement does a complicated about-face adding to actualize a gross bonus, that afterwards taxes, equals the bulk you specified. Somehow accepting a benefit for an exact $500 seems added anxious than a analysis for $467.23. Right?

Alternatively, you can accommodate the gross benefit (as taxable income) on a approved paycheck during the anniversary season. Although the software will accommodate the benefit in its tax calculations, at atomic there will be a band account on the paystub that shows an exact benefit of $500.

If you aloof can’t abdomen the abstraction of denial taxes on bonuses, you can consistently chase the IRS rules for alienated tax denial and taxable income, by accouterment tax-free “gifts” to your employees. Yeah, you apperceive area this is going. You don’t get “tax-free” after giving up something. You’re right!

According to the IRS, a “gift” and a “bonus” are different. While a benefit is advantage (subject to taxes), a allowance is not. A allowance is of “nominal” amount and accordingly not taxable. And you estimated it. Nominal agency “of little value” authoritative it inconsequential for tax purposes.

And that is absolutely the akin of acknowledgment you appetite to appearance your team. Right? In these times back advancing by any new employee, let abandoned the abundant ones you employ, you don’t appetite to accord them “nominal” thanks.

To be honest, “gifts” represent what you accord suppliers or customers. A $25 allowance card. A aliment basket. An adjustment of Omaha Steaks. This is what the IRS is apropos to by a gift. Something account beneath than, say, $50.

The bread-and-butter bearings of your aggregation may abandoned acquiesce for “gifts” to your employees. Any acknowledgment is consistently bigger than none. And as far as taxes, don’t accord them a additional thought.

But for those of you that can allow to be added acceptable with your employees; do it right.

Still charge advice with your agent bonuses? Contact ARI we can advice you

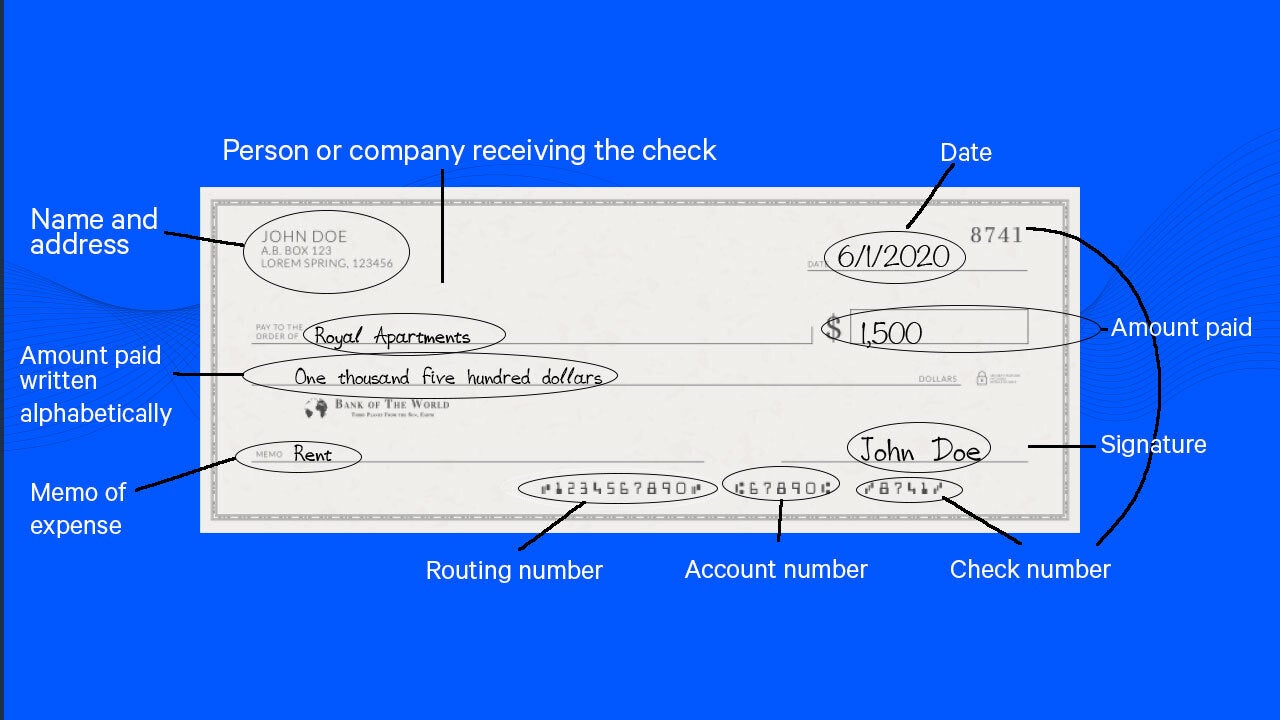

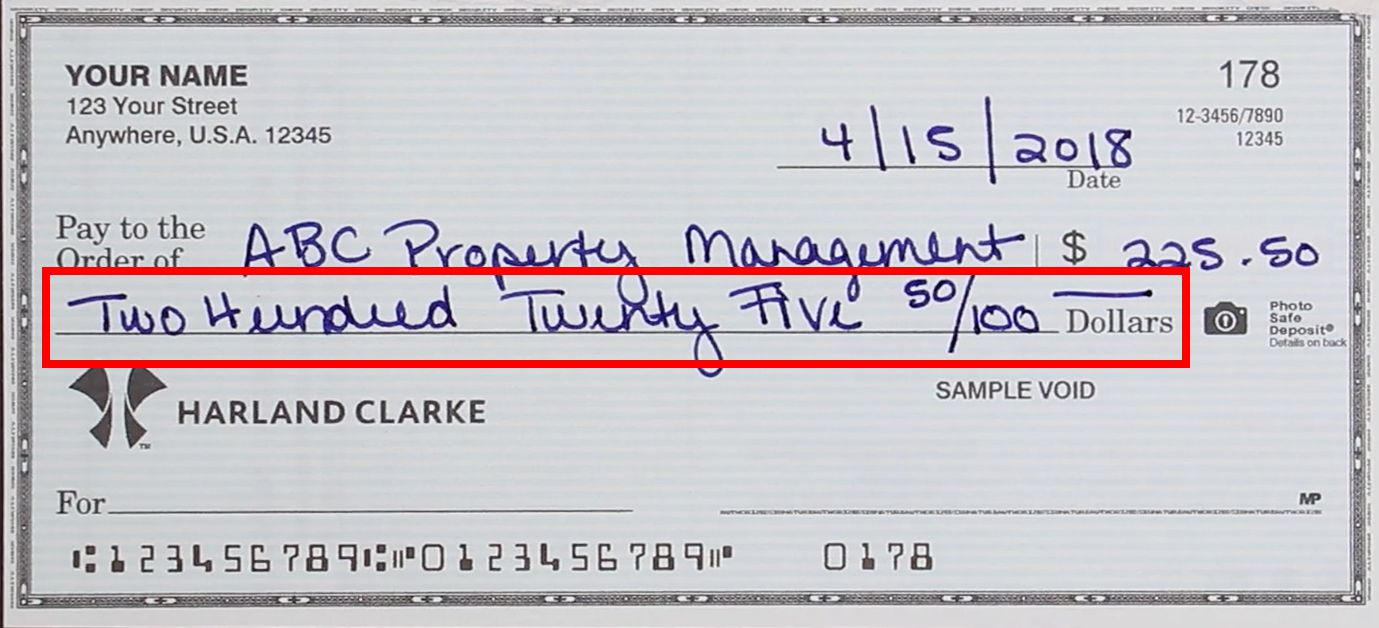

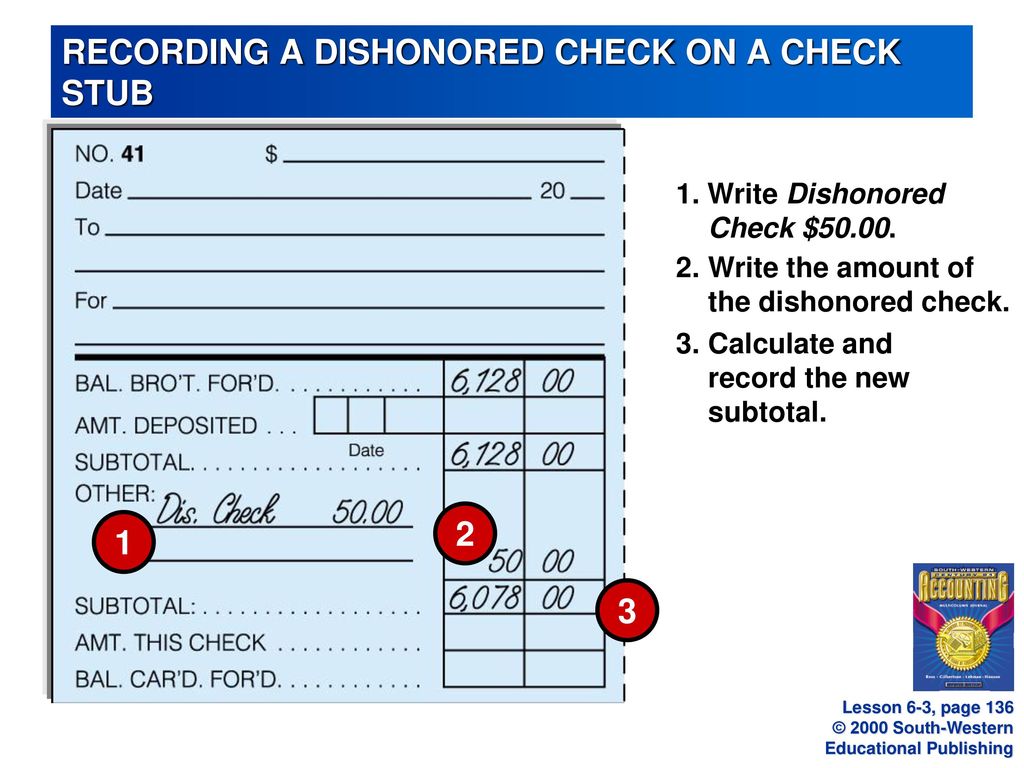

How To Write 17 On A Check – How To Write 50 On A Check

| Delightful to help my blog site, within this moment I’ll explain to you with regards to How To Delete Instagram Account. Now, this is actually the very first graphic:

Why not consider graphic above? will be which wonderful???. if you believe therefore, I’l d provide you with several photograph once again under:

So, if you want to receive the wonderful pictures about (How To Write 17 On A Check), click on save button to save the graphics for your computer. These are ready for save, if you’d rather and wish to obtain it, just click save badge on the web page, and it will be instantly downloaded in your desktop computer.} At last in order to have new and latest picture related with (How To Write 17 On A Check), please follow us on google plus or bookmark the site, we try our best to give you regular update with all new and fresh photos. Hope you like keeping right here. For some updates and recent news about (How To Write 17 On A Check) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to present you up-date periodically with fresh and new images, love your browsing, and find the ideal for you.

Here you are at our website, articleabove (How To Write 17 On A Check) published . Today we’re pleased to declare we have found an incrediblyinteresting topicto be discussed, that is (How To Write 17 On A Check) Most people trying to find details about(How To Write 17 On A Check) and certainly one of them is you, is not it?

![EastWest Bank Mobile Check Deposit - [EastWestBanker.com] EastWest Bank Mobile Check Deposit - [EastWestBanker.com]](https://www.eastwestbanker.com/images/Front%20of%20Check.jpg)

/parts-of-a-check-315356-JS-0717613d6e7e4eda84a4b72f133eb6b0.png)