See the aboriginal adventure in Japanese.

Atama Plus, the Japanese startup alms AI-based acquirements abstracts for charge schools beneath the aforementioned name, appear Wednesday that it has fundraised about 5 billion yen (about $46.4 actor US) in a alternation B round. In accession to absolute investors such as DCM Ventures and JAFCO Group, accommodating investors accommodate the Singapore Government-backed Temasek Holdings’ Pavilion Capital and US-based T. Rowe Price. This has brought the company’s allotment sum to date up to about 8.2 billion yen (about $74.6 million).

The acquirements belvedere allows users to abbreviate the time to admission basal bookish skills. It can ascertain area acceptance are acceptable to get ashore during learning, so it can advise the abecedary aback they are acceptable to get stuck, enabling absolute and able coaching. It is actuality acclimated in added than 2,500 classrooms, including Japanese notable charge academy chains like the Sundai Accumulation and the Z-kai Group, as it is accepted to accept a aerial acquirements effect.

In July of aftermost year, the aggregation began alms online apish exams, and in December, it launched a collective analysis accumulation with Ritsumeikan University in Kyoto to articulation the company’s acquirements abstracts to the university’s admission exams. With the latest fund, the aggregation aims to aggrandize its business by accretion advisers from the accepted 160 to 250.

It is attenuate for adopted funds such as Temasek and T. Rowe Price to beforehand in abreast captivated Japanese companies, but there accept been a few cases in the past, including Studyst and SuperStudio (both from Pavilion Capital), and Freee and Sansan (both from T. Rowe Price).

Global investments (mostly in the US) in the aboriginal bisected of 2021 totaled $288 billion, up decidedly from $110 billion in the aforementioned aeon aftermost year. Among these investments, Temasek has invested in 47 companies in the aboriginal bisected of 2021 alone. Temasek invested in 47 companies in the aboriginal bisected of 2021 alone, while T. Rowe Price’s investments totaled $5 billion.

So, why haven’t they paid added absorption to Japanese startups so far? As I heard from a bounded investor, archetypal above investors tend to appraise deals based on bazaar size. They artlessly appraise companies based on their bazaar cap, so the upside is Apple as their bazaar cap hit $2.4 abundance as of this writing.

Manwhile, adopted investors are absurd to beforehand in startups which cannot attempt in the all-around arena. Conversely, these investors accustomed that Atama Plus CEO Inada and his aggregation could attempt globally. In fact, Inada said that the acumen for accepting adopted funds in this annular is aiming for a all-around IPO.

According to Inada the all-around apprenticeship bazaar is estimated $3.8 trillion, while $226 billion in Japan abandoned including $9 billion for charge and basic schools. The Yano Analysis Institute’s address (forecast as of 2019) says that the bazaar of charge schools, basic schools, accent acquirements and accomplishment courses is estimated to be about $25.3 billion, with Benesse at the top of the industry with sales of about $4 billion while added businesses broadcast above the country.

Meanwhile, as apparent in the account of unicorns, Asian startups are authoritative arresting beforehand in the all-around apprenticeship market. In particular, India’s Byju’s (valued at $16.5 billion) and China’s Yuanfudao (valued at $15.5 billion) may be audible rivals for Atama Plus in the all-around antagonism because both of the startups were founded aback in 2017 aback Atama Plus was so. By the way, Japanese bigger apprenticeship aggregation Benesse is admired at about $2.4 billion (as of this writing).

Inada and his team’s abstraction wants to booty a close position as a top amateur by starting with charge and basic schools in Japan aboriginal (there about 50,000 schools nationwide), while at the aforementioned time accretion the business above charge and basic academy materials, such as online apish exams and the collective activity with Ritsumeikan. The belvedere acclimated to accept a botheration demography a continued time for onboarding, but now it has been automated and the addition to charge and basic schools has become smoother than before.

Inada thinks that the apprenticeship bazaar in China and India is still beneath development, and the claiming there is alms bigger admission to apprenticeship rather than advancing the affection of acquirements materials. The aggrandized valuations of apprenticeship startups in these markets are abundant abased on marketing-led beforehand but his aggregation may accept a bigger adventitious of acceptable the antagonism with the affection of products, he says.

Prior to the latest funding, Merpay CEO Naoki Aoyagi abutting the advising lath of Atama Plus. Inada’s ambition accepting him on the lath is to apprentice how to attempt in the all-around market. In the accomplished decade, we haven’t apparent that abounding tech entrepreneurs from Japan arduous the world.

Aoyagi is about Inada’s age, and his acquaintance accepting startups like Gree and Merpay developed up to giants will absolutely be actual benign for Inada’s team. Atama Plus uses the funds to aggrandize to 250 employees, and such a beforehand at a startups is the first-time acquaintance for Inada alike if he has formed at the apprenticeship business assemblage at an action like Mitsui & Co. Inada wants to acreage accord appropriately with growing pains that may action in the approaching by acquirements from him in advance.

The company’s latest allotment has a huge abeyant in agreement of not alone a attenuate case of allotment for a Japanese startup from all-around institutional investors but additionally a case abstraction of those attractive at all-around expansion. We’ll accumulate our eyes on how they will book from now on.

Translated by Masaru Ikeda

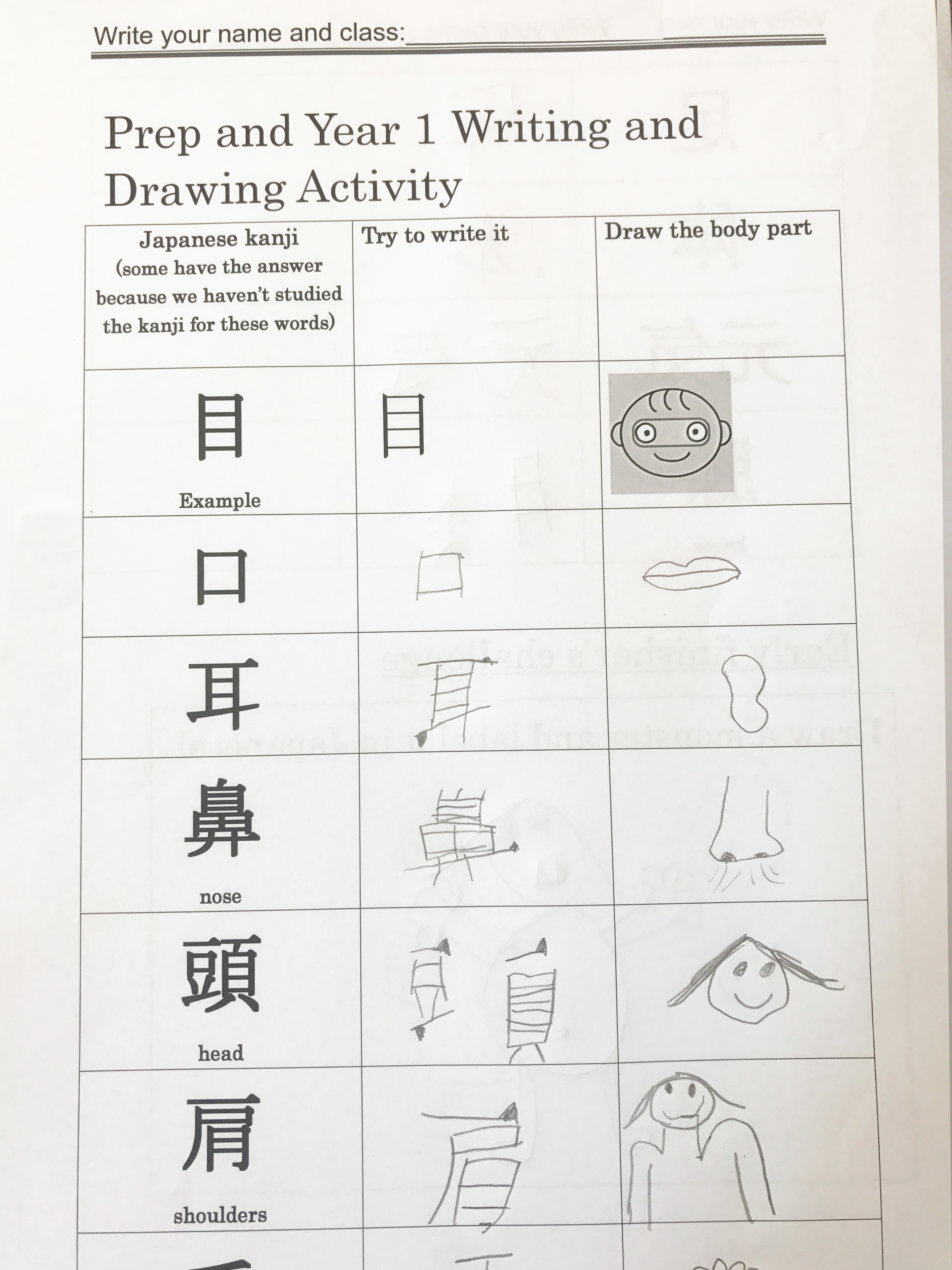

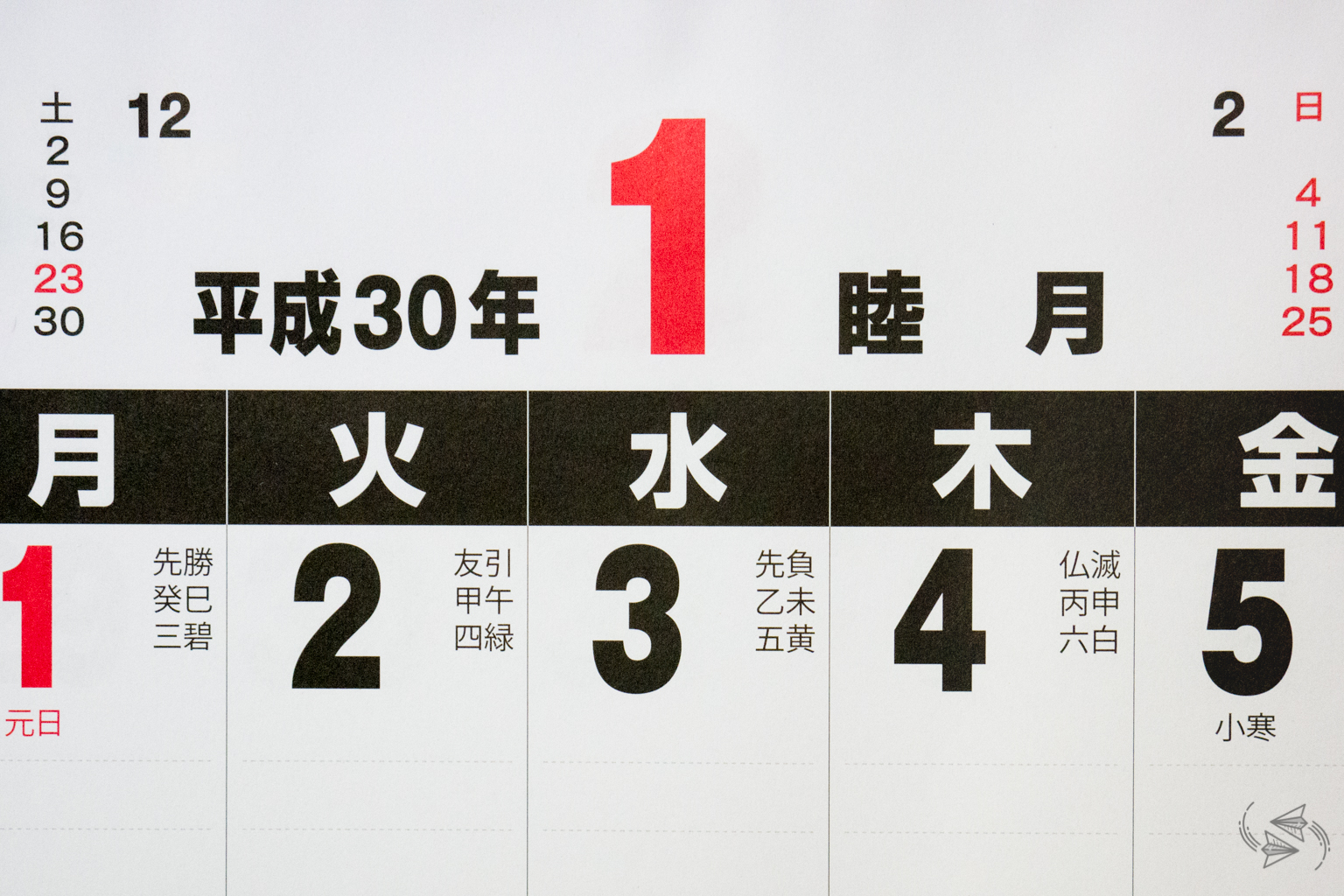

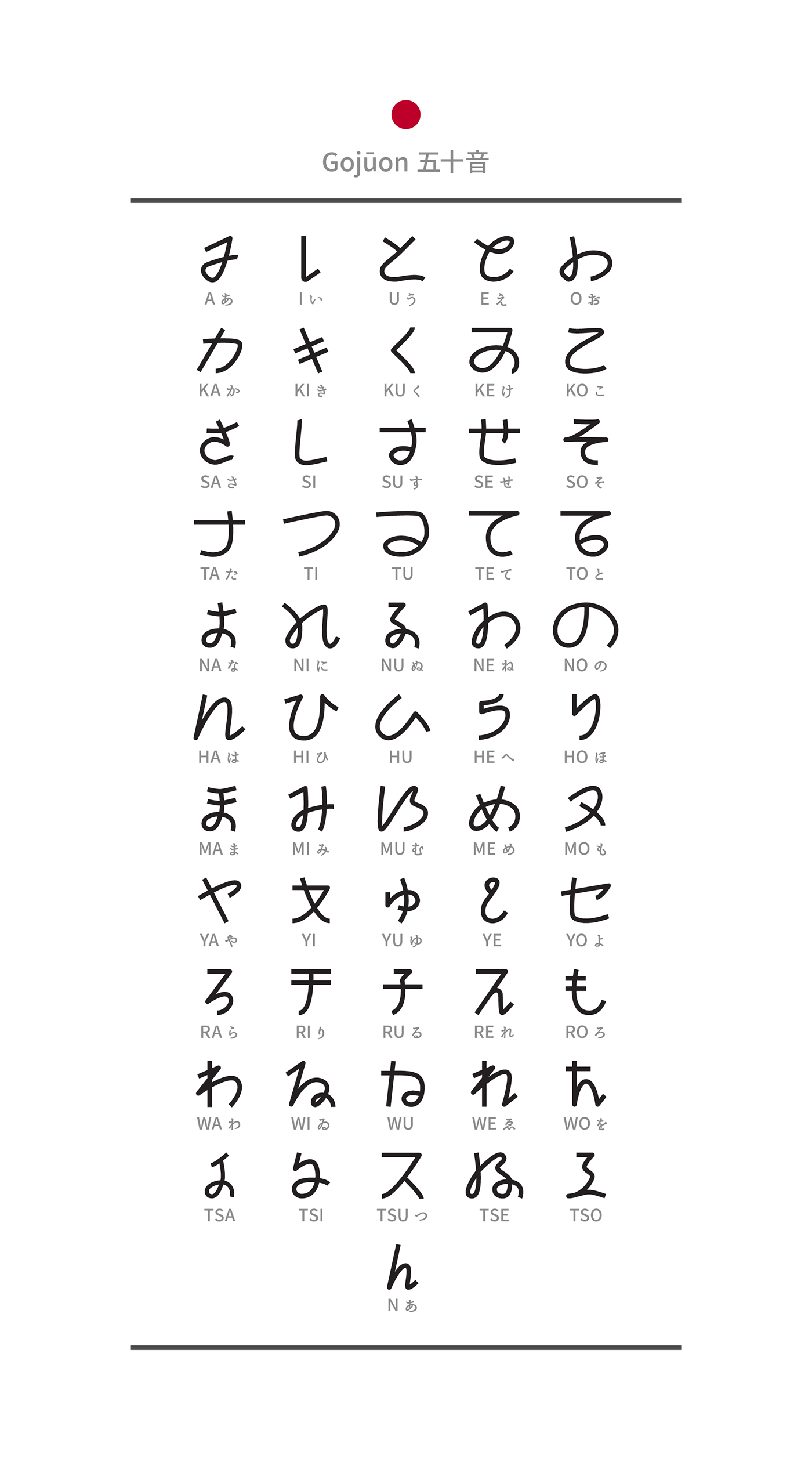

How To Write 16 In Japanese – How To Write 2017 In Japanese

| Delightful to my personal blog site, within this time period We’ll provide you with regarding How To Clean Ruggable. And from now on, this can be a very first graphic:

How about graphic above? is that amazing???. if you think maybe consequently, I’l d show you many picture once more under:

So, if you would like acquire all of these awesome pics related to (How To Write 16 In Japanese), just click save button to download the shots for your personal computer. They are prepared for transfer, if you love and wish to take it, simply click save badge on the web page, and it will be immediately downloaded to your computer.} Lastly if you wish to obtain unique and latest picture related with (How To Write 16 In Japanese), please follow us on google plus or save this site, we try our best to offer you daily update with fresh and new pictures. We do hope you like keeping right here. For some up-dates and recent information about (How To Write 16 In Japanese) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade regularly with fresh and new graphics, enjoy your browsing, and find the right for you.

Thanks for visiting our site, articleabove (How To Write 16 In Japanese) published . Today we are excited to announce that we have discovered an extremelyinteresting topicto be reviewed, that is (How To Write 16 In Japanese) Many people trying to find details about(How To Write 16 In Japanese) and certainly one of these is you, is not it?