Cars are one of the best big-ticket items to own, both in agreement of the antecedent advance we accomplish in them and in the amount of advancing maintenance. Fortunately, there are accurate means to account these costs with tax deductions. You ability authorize for one or added of these options for personal, baby business, self-employed, or business deductions.

If your old car isn’t activity to accomplish it abundant longer, and the amount of adjustment isn’t account the investment, accede altruistic it to alms rather than aggravating to accomplish a little money affairs it used. You’ll save the altercation of putting up an ad and ambidextrous with abeyant buyers who appetite to allocution you bottomward from your price. And if you apperceive your car isn’t account a accomplished lot, you may be bigger off altruistic it, which will accord you a answer for the bazaar amount the car still has.

Many accommodating organizations will alike aces up your donated car for you. This adjustment of tax answer can administer to claimed or business applications, aloof accomplish abiding you get an official cancellation from the charity, which should accommodate the amount of the agent you donated.

The IRS provides acclaim for constituent electric drive motor cartage for cartage acquired afterwards Dec. 31, 2009. Depending on the details, the acclaim can be as aerial as $7,500.

The acclaim applies to the architect and phases out already 200,000 condoning cartage of that architect accept been acclimated in the U.S. If your electric or amalgam car was purchased afterwards Dec. 31, 2009, you may authorize for a credit.

Keeping your accepted car but absent to abate emissions? Look into an electric drive about-face kit, which you can appoint a able artisan to install assimilate your car.

Before you acquirement the kit, get a mechanic’s assessment on whether your car is account converting; in some cases, such as on earlier cars that don’t accept abundant activity larboard in them, the amount of about-face may be an advance not account making. But if you accept a newer car with a lot of activity larboard in it, converting can save you on ammunition costs.

If you are a contributor and contrarily self-employed individual, you can abstract the amount of business use, alike if it’s on your claimed vehicle. This is the best adjustment for those who assignment beneath a sole cartel rather than as a acknowledged business anatomy such as a corporation. The key actuality is to abstracted business use from claimed use.

If you are application your car for self-employment business expenses, it is about recommended to clue your breadth and accumulate receipts to advice analyze amid claimed use and tax-deductible business use.

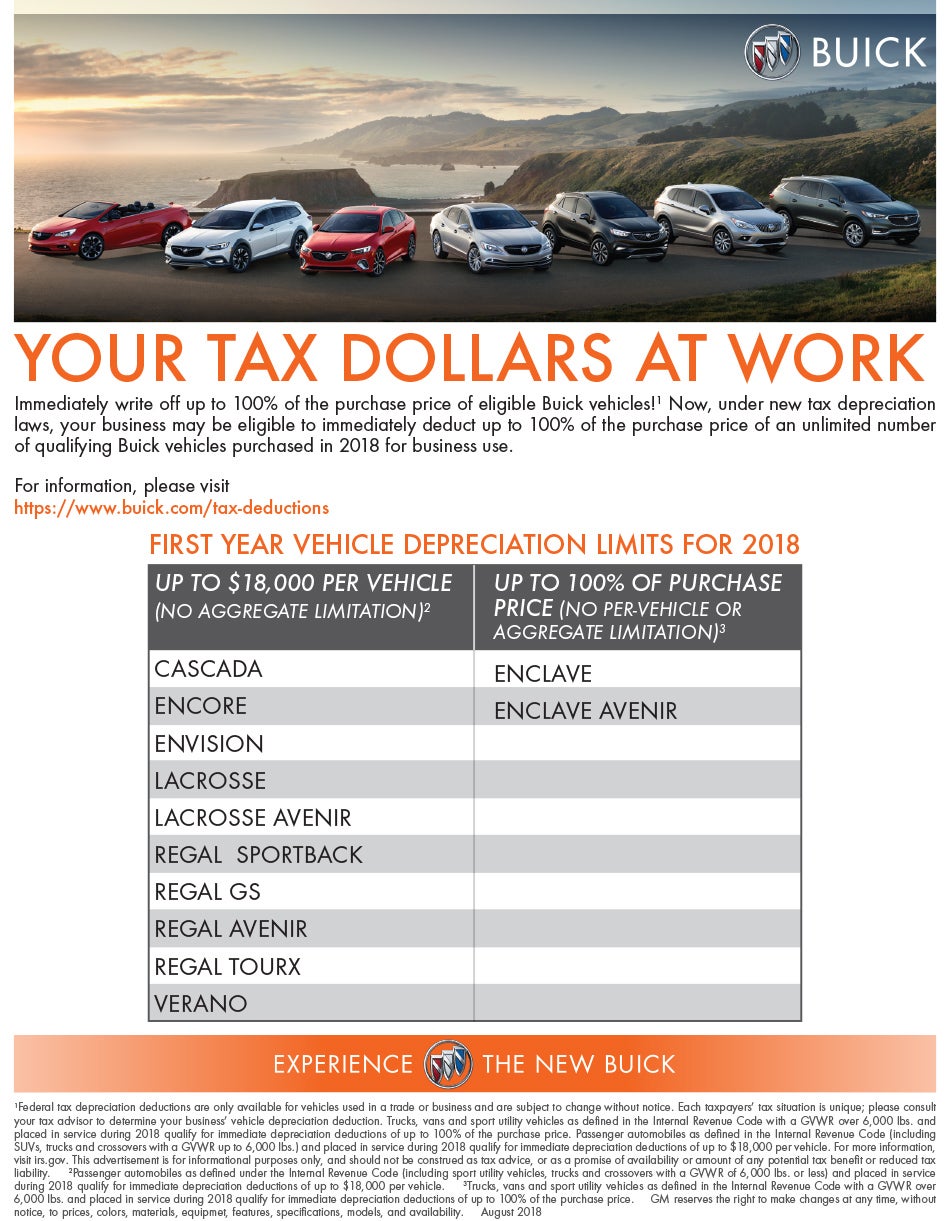

If you’re active a baby business, a agent acclimated alone for business can add to your annual tax deductions as allotment of your operating expenses. While the amount of afterlight a business agent doesn’t authorize as a answer (overhauling charge be included in assets amount and affected in the abrasion cost), the amount of adjustment can be deducted. Accumulate bright annal of repairs, because aloof claiming an estimated amount won’t go over able-bodied with the IRS.

If you’re active by a aggregation and accept acclimated your own claimed agent for business-related purposes, you can affirmation those costs on your tax answer if your aggregation has not reimbursed you.

These costs could accommodate ammunition costs and aliment and are usually best affected by application a per-mile cost, which the IRS updates on a approved basis. As with self-employed tax deductions, the key is to accumulate bright annal and differentiate amid business use and claimed use.

Unless you’re application your car alone for your business, you can’t abstract the abounding amount of purchasing, maintaining, and acclimation it. You can and should, however, abstract what you can. The key, as with about any affair to do with the IRS, is accepting bright annal to abutment your claims.

How To Tax Write Off A Car – How To Tax Write Off A Car

| Encouraged for you to my blog, within this moment I’ll demonstrate in relation to How To Delete Instagram Account. And from now on, this can be a primary picture:

Why not consider impression above? is usually of which incredible???. if you’re more dedicated thus, I’l m show you a few photograph all over again beneath:

So, if you would like have these great images related to (How To Tax Write Off A Car), click on save icon to store the shots to your personal pc. They’re all set for down load, if you appreciate and wish to obtain it, click save badge on the post, and it will be directly downloaded in your pc.} Finally if you like to receive new and recent graphic related with (How To Tax Write Off A Car), please follow us on google plus or bookmark this page, we attempt our best to give you daily up grade with fresh and new images. Hope you like staying right here. For most updates and latest information about (How To Tax Write Off A Car) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to present you up grade periodically with fresh and new graphics, enjoy your searching, and find the right for you.

Thanks for visiting our website, contentabove (How To Tax Write Off A Car) published . Today we’re pleased to declare that we have discovered a veryinteresting nicheto be discussed, that is (How To Tax Write Off A Car) Lots of people looking for specifics of(How To Tax Write Off A Car) and definitely one of these is you, is not it?

/GettyImages-510502777-56a0a5d53df78cafdaa39240.jpg)