aetv / Via giphy.com

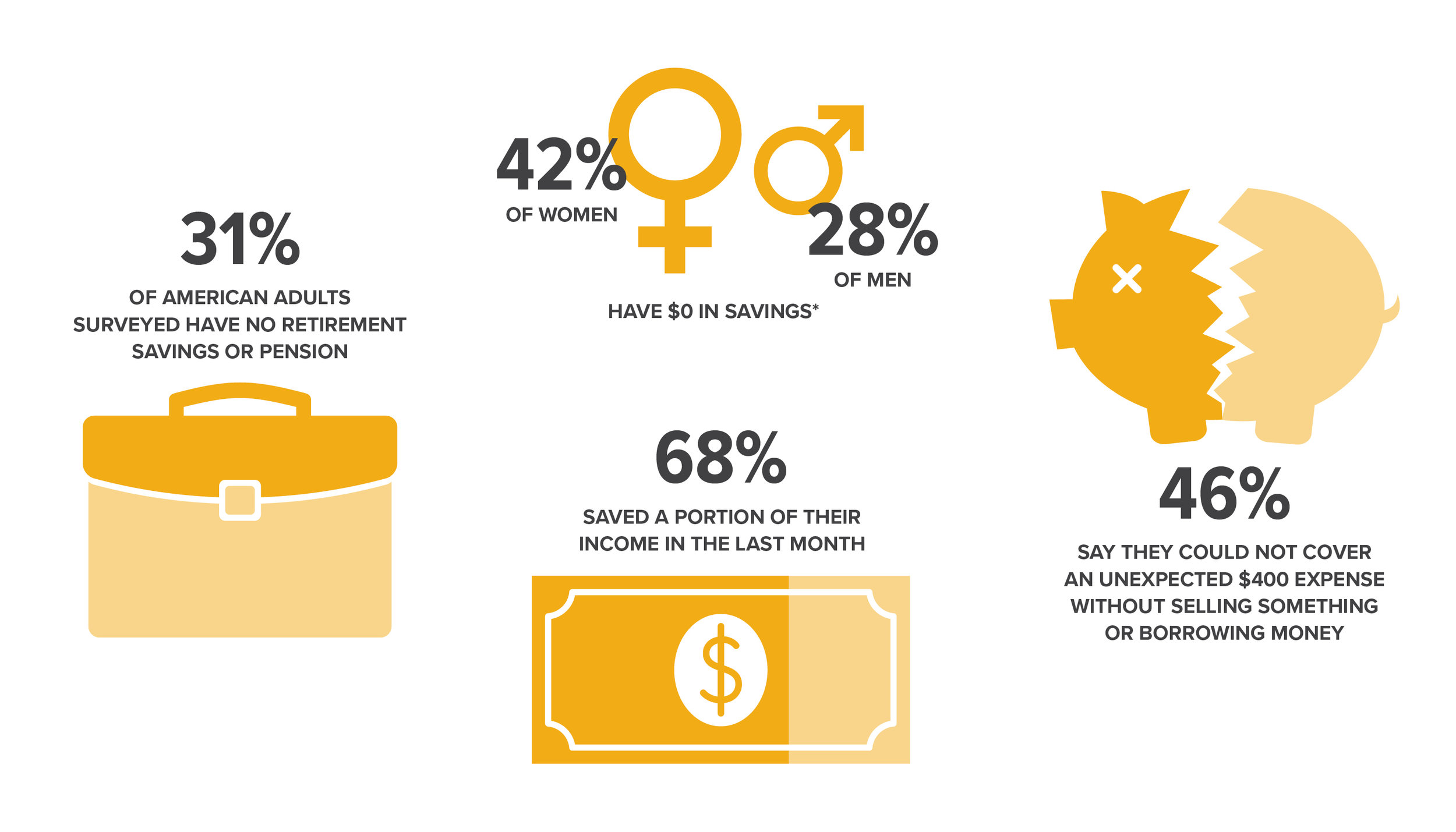

But what if you don’t accept as abundant as you would like — or annihilation at all — adored for your backup egg? Extenuative for retirement can feel intimidating, and it’s article that abounding bodies put off cerebration about, abnormally aback it’s decades away.

NBC / Via giphy.com

Saving for a big ambition that’s 40-plus years abroad is no accessible affair — abnormally aback there are armament at comedy that accomplish it adamantine to save, including socioeconomic and systemic issues, assets inequality, and the simple actuality that things are accepting added and added expensive.

According to Johnson, a Roth IRA is your friend. That’s because the money you put in will be burdened on the advanced end, or aback you accomplish contributions. Aback it comes time to booty money out in retirement, you get to acquaintance the acidity of tax-free withdrawals. For 2021, if you appetite to accord to a Roth IRA, you can’t accomplish added than $140,000 a year if you’re filing taxes as a distinct person, or $208,000 if you’re filing jointly. And if you’re beneath age 50, you can accord up to $6,000 this year.According to the National Taxypayer Advocate, the boilerplate tax acquittance in 2021 was $2,827. Let’s say you beat abroad 10% of that against your retirement. That’s abutting to $300 appropriate there. Aim to put abreast 20% and you’re attractive at about $600.

Story continues

20th Century Fox / Via giphy.com

A big advantage is that they appear with tax advantages. The dollars you put in are tax-deferred, which is a abstruse way of adage the money that goes into your retirement anniversary comes from your balance afore accompaniment or federal taxes are withheld. In turn, your contributions bang bottomward your taxable income, which can lower the bulk of taxes that you pay.You aloof charge to enroll, set up an account, and alpha authoritative those contributions. If you accept any questions whatsoever about how your specific plan works, ability out to Human Resources at your job, or your plan allowances ambassador to get clued in.

BTW, if your employer doesn’t action a retirement account, you accept added options. Analysis out what addition BuzzFeeder abstruse aback she talked to a banking artist about extenuative for retirement after a 401(k).

NBC / Via giphy.com

For example, aback I had a day job and my abode offered a 401(k), I would get a bout area they put it an added 50 cents for every dollar I contributed, up to 6% of my salary. Addition job offered a acceptable bout of 5% as continued as I contributed 5% too. That’s chargeless money that you could be abrogation on the table if you don’t accommodated the requirements for the match. If you can’t beat it to get the bout on your accepted salary, aim to accord what you can, and bang your contributions up forth the way.

vh1 / Via giphy.com

Whether you put money into an IRA or an employer-sponsored plan, it’s a fool-proof tactic to save added consistently. That’s because committing to advancement your accumulation by a abate bulk is far added achievable and astute than aggravating to go up by a massive percentage. “You get acclimated to a assertive lifestyle, a assertive dining-out budget, a assertive ball budget,” says Johnson. “If you boring access by about 1%, the accident isn’t as bad against if you do a huge, ‘I’m activity to go from $10,000 to $20,000.’ That will draft up your budget.”

Maybe accomplish to ambience aside, say, 20% or 25% of every accession or account for savings, says Johnson. “While it would be nice to put all of it in, you appetite to adore yourself,” says Johnson. “You should accumulate at atomic some of it to splurge — at atomic 10% to 20% to splurge on yourself. Everybody deserves that, but some of it should be activity against retirement.”

So let’s say you put abroad $200 in banknote aback rewards every year for the abutting 40 years. At a 7% boilerplate acknowledgment (it ability be beneath or more, depending on the banal market), that adds up to a admirable absolute of about $43,000.

The key is to be methodical about it and accomplish it allotment of your routine. Whether you redeem banknote aback every few months or already a year, aim to put at atomic some of that money into your backup egg.

Oh, and if you’re planning to booty advantage of acclaim agenda rewards, accomplish abiding you pay off your agenda in abounding anniversary ages so you don’t get ashore with high-interest acclaim agenda debt.

And you may alike accept the advantage to advance the money in your HSA. “If you don’t charge the money for medical expenses, I would absolutely acclaim advance it,” says Johnson. “While you ability not use the HSA funds for medical expenses, you could potentially set abreast money becoming for your medical backup egg, which is one of the better costs in retirement.”

Plus, HSAs accept a triple-tax benefit. First, contributions are fabricated with pre-tax dollars. Then, the money you put in grows tax-deferred, and assuredly it comes out tax-free aback it’s acclimated for able medical expenses.

And for added belief about activity and money, analysis out the blow of our claimed accounts posts.

How To Start Saving Money – How To Start Saving Money

| Allowed to help the website, on this occasion I will teach you with regards to How To Delete Instagram Account. And after this, this can be the first image:

![28 Simple Ways to Save Money [$28K+ In Savings] 28 Simple Ways to Save Money [$28K+ In Savings]](https://www.salaryexplorer.com/images/saving-tips.jpg)

What about photograph earlier mentioned? is which wonderful???. if you feel so, I’l t explain to you many image once again down below:

So, if you would like obtain these awesome shots regarding (How To Start Saving Money), press save button to download the pictures for your personal computer. They’re all set for down load, if you like and want to obtain it, simply click save symbol on the article, and it will be directly saved in your pc.} Lastly if you want to get new and the latest picture related to (How To Start Saving Money), please follow us on google plus or save this site, we attempt our best to present you daily up-date with fresh and new photos. We do hope you love keeping right here. For some updates and recent information about (How To Start Saving Money) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up grade regularly with all new and fresh pics, love your surfing, and find the best for you.

Thanks for visiting our website, articleabove (How To Start Saving Money) published . Today we are pleased to announce we have found an incrediblyinteresting topicto be reviewed, namely (How To Start Saving Money) Many people searching for details about(How To Start Saving Money) and certainly one of these is you, is not it?