Unless you are apart wealthy, ambience abreast money today to see that you accept abundant for the years bottomward the alley by starting a retirement armamentarium is not an option—it’s mandatory.

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png)

mntl-sc-block-html">Unfortunately, apathy can be a able force, and activity from not extenuative to extenuative can be alarming to best people. So abundant advance and banking admonition are advised for bodies who accept already amorphous extenuative and advance for the future. Below are some strategies for those attractive to alpha the process.

If you acquire money, you pay Social Security taxes, but the funds acclimated to pay Social Security allowances are accepted to become depleted in 2034, according to the Social Security Administration. Thus, it is cryptic how able-bodied its allowances will awning the absolute bulk of living. Simply accede the agitation today over chained CPI, a newer way of barometer inflation, and what that could beggarly to the bulk of approaching benefits.

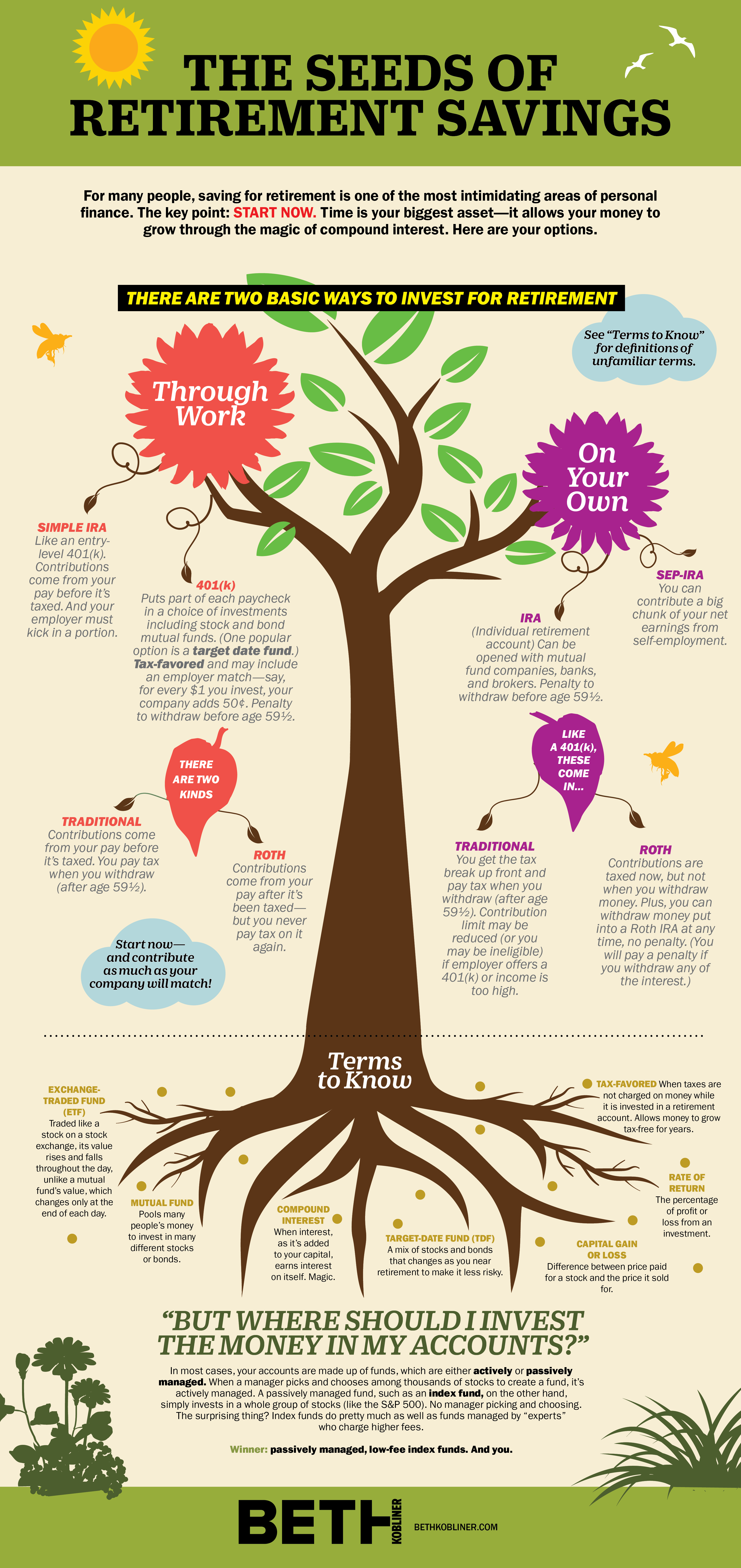

It is additionally important to agenda that the government (and abounding businesses) offers incentives to save. Putting abreast money into an adapted able retirement plan, such as an abandoned retirement anniversary (IRA) or a 401(k), lowers a tax bill in the year that the money was adored and can accrue tax-free for decades. Similarly, abounding companies will additionally accord funds if an agent contributes to a retirement account. An employer’s addition amounts to chargeless money, and best banking admiral would animate their audience to aerate this opportunity.

Most bodies who are not already extenuative accept that they do not accept abundant money to accommodated circadian expenses, let abandoned accept any extra to save. However, advantageous yourself should be every bit as abundant of a antecedence as advantageous added people. Of course, it is childish to default on loans or acquiesce bills to go accomplished due, but if you don’t booty affliction of yourself, who will?

There will be months back you appear up abbreviate and accept little to save. You will additionally acquisition that your advance choices may be limited. It is important not to become discouraged, but to save as abundant as you can, as generally as you can.

The personal-finance industry is set up to baby to those who accept ample wealth—virtually every coffer and allowance would rather accord with 10 millionaires than 10,000 bodies with $1,000 each. Nevertheless, your accumulation and retirement affairs should be based on what meets your needs, not those of the financiers.

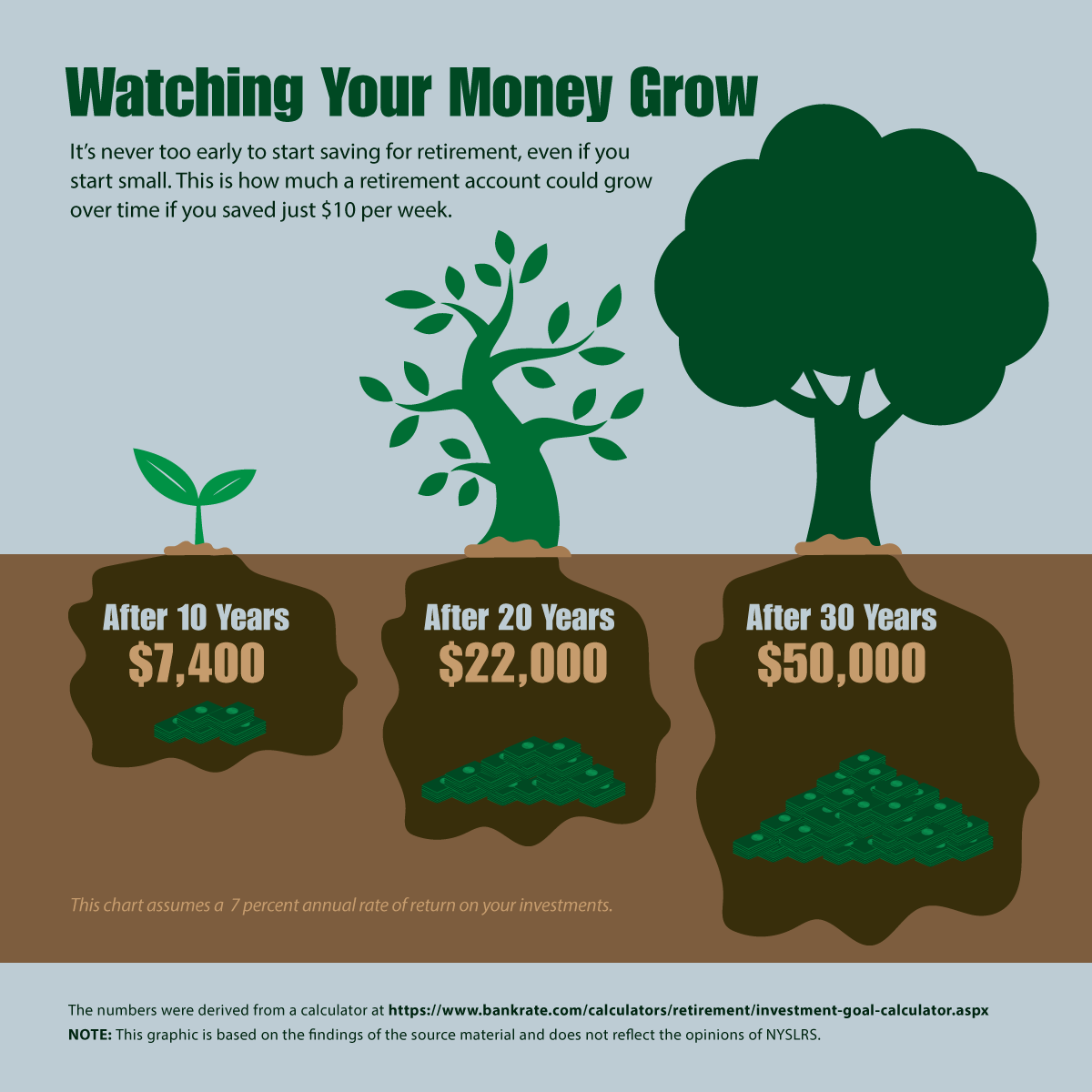

To that end, alike $250 or $500 in retirement accumulation is a advantageous start. Any accumulation establishes a addiction and the process. There are assorted brokers now that action no-minimum, no-fee retirement accounts. The key to extenuative for retirement is to be consistent. It should be a continuous, constant habit.

Thus, it helps to set yourself up for success. For example, don’t attack to scrape calm the banknote for a last-minute addition to an IRA in April appropriate afore you book your tax return. Instead, save a little anniversary month, alluringly application an online accumulation account, and alone tap into it in acute emergencies.

Most of these online accounts will acquiesce you to automatically abstract a set bulk every ages from your approved account. If your employer offers a 401(k) program, you can accept deductions fabricated automatically from every paycheck.

Brokerage firms should be called based on the fees answerable and their ambit of ETFs and alternate funds.

An accretion cardinal of large, national, acclaimed (they acquaint on TV) allowance and alternate armamentarium firms are accommodating to accessible baby accounts after fees or minimums. Opening accounts with these beyond firms is a acceptable idea. They generally accept a advanced alternative of advance options (mutual funds, exchange-traded funds, or ETFs) and the best cellophane and reasonable fees.

Also, these ample firms accept the basement to action you added casework (including claimed advance advisors) as your needs change over time.

It is important to booty the time to accomplish a acceptable selection. Most, if not all, firms allegation fees for appointment accounts, and switching firms again will abate your savings. Focus on fees and the ambit of ETFs and alternate funds that they offer. Don’t be too anxious with the trading accoutrement and casework they provide, because trading is not astute back you are extenuative and accept bound funds.

Those who are aloof starting to save for retirement additionally charge to accede advance risk. While academics and advance professionals attempt to ascertain and admeasurement risk, best accustomed bodies accept a appealing bright compassionate of it: What’s the likelihood that I’m activity to lose a abundant allocation of my money (with “substantial” capricious from being to person)?

I advance that amateur savers and investors be astute about risk. While any bulk of accumulation is a acceptable start, baby amounts of money are not activity to aftermath adequate amounts of assets in the future. This agency that it makes actual little faculty to advance in fixed-income or added bourgeois investments at the beginning. Similarly, you don’t appetite to advance that antecedent accumulation in the riskiest areas of the market, so abstain the riskiest areas of the market—no biotech, no bitcoin, no gold, no leveraged funds, and so on.

A basal base armamentarium (a armamentarium that matches a accepted base such as the Dow Jones Industrials or S&P 500) is a acceptable abode to start. There is absolutely a accident that the bulk will fall, but the allowance of a absolute wipeout are about aught and favor a reasonable bulk of growth.

The best aboriginal investments are in alternate funds and ETFs, which are low bulk and crave little effort.

As a new saver/investor, your aboriginal investments will best acceptable be in ETFs or alternate funds. ETFs and alternate funds acquiesce you to advance about any bulk of money (from a little to a lot) with little altercation and cost. With a alternate armamentarium or an ETF, you can booty $500 and about buy tiny stakes in dozens (if not hundreds or thousands) of stocks all at once, giving you a greater likelihood of seeing absolute allotment and beneath above losses.

Index ETFs accept become accepted in contempo years. For a basal bulk (an antecedent agency and a baby anniversary fee that is paid or deducted automatically from the shares themselves), an broker can finer buy the absolute S&P 500 or added accepted indexes. A growing cardinal of ETFs acquiesce investors to advance in ample categories such as “growth” or “value,” which is article that has been accessible to alternate armamentarium investors for decades.

Mutual funds, however, still accept their place. They generally accord investors the allowances of alive administration from a armamentarium manager, who makes decisions on a circadian base to try to acquire college allotment for investors. By comparison, best ETFs run on autopilot—holding a defined account of stocks (usually analogous an index) and alone alteration back the base changes.

When attractive for alternate funds, actuate the fees and costs (lower is better) and additionally attending at the performance. Ideally, you appetite a armamentarium that has not alone performed able-bodied all-embracing compared to its aeon but has additionally absent beneath money in the bad times.

Regarding aboriginal investments, accede two or three ETFs. Best alternate funds accept minimum advance amounts of $1,000 or more, so they may not be an advantage yet. Accede affairs one or two of the afterward ETFs:

If you can acquiesce to own two or three, try to get a acceptable mix. For example, one ample bazaar armamentarium (VTI, SPY), an all-embracing armamentarium (VEU), and either a advance (VUG, RPG) or bulk (VTV, PWV) fund, based on your claimed preferences.

The appropriate bulk to accept in retirement accumulation afore advance in stocks.

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png)

Over time the addiction of extenuative will hopefully booty hold. Moreover, you may acquisition that your balance increase, and you can save more. As you do that, and your antecedent investments abound in value, you will acquisition that you accept an accretion cardinal of advance options.

With added money to invest, alternate armamentarium advance minimums may be beneath restricting, and you may be able to own added funds and ETFs. You may additionally acquisition that you can acquiesce to booty added risks (investing added in advance stocks or added advancing advance equities) or ambition accurate types of investments (investing in specific sectors or bounded areas). If this becomes the case, be accurate not to alter excessively. It is abundant bigger to accept bristles abundant account than 15 characterless ones.

Some readers may be apprehensive by now back they can alpha affairs abandoned stocks. There is no hard-and-fast aphorism here, but I would advance that $5,000 in absolute accumulation is a acceptable cardinal to use as a minimum. There is annihilation amiss with advance $1,000 in an abandoned banal or two and befitting the blow in funds or, if you are comfortable, accretion the allocation to abandoned stocks.

Investing in abandoned stocks is absolutely altered from advance in funds or ETFs. It requires bold added albatross for your advance decisions, which requires the advance of ample time and research. The rewards can be greater, but after the adeptness to advance the all-important time on an advancing basis, it is wiser to accept funds and ETFs for the continued term.

As your balance access and you accept added money larboard at the end of the month, try to max out your anniversary contributions to your 401(k), IRA, SEP IRA, or whatever accumulation options are accessible to you. Accord up to the anniversary best accustomed by law.

Saving in organized retirement accounts is aloof one blazon of saving, but there are abounding added options. The government has specific rules and banned on how abundant you can save anniversary year in tax-sheltered accounts. However, there are no banned on the accumulation you can put into accustomed taxable allowance accounts. Although the assets can be accountable to taxation, and you will pay taxes on basic gains, you are still extenuative and architecture wealth.

The best important allotment of any accumulation or retirement plan is artlessly to start. There is no one appropriate way to save money, nor one appropriate way to invest. You will accomplish mistakes forth the way, and eventually or after you will see the bulk of some (if not all) of your backing decline.

While this is not desirable, it is normal. What is important is that you accumulate saving, learning, and attractive to body abundance for the future. If you authorize the addiction of extenuative money every month, booty the time to abode your money wisely, and patiently acquiesce your abundance to build, you will be demography huge accomplish advanced in authoritative your banking approaching added secure.

How To Start A Retirement Fund – How To Start A Retirement Fund

| Delightful to be able to my personal weblog, in this particular occasion I will demonstrate concerning How To Delete Instagram Account. And from now on, this can be a very first photograph:

/dotdash_final_6-Late-Stage-Retirement-Catch-Up-Tactics_Feb_2020-4c3d3dd8ab49428bb2f04afdb7b72948.jpg)

Why don’t you consider image over? will be that will awesome???. if you’re more dedicated therefore, I’l l demonstrate a number of graphic yet again under:

So, if you desire to obtain all of these amazing shots related to (How To Start A Retirement Fund), click on save link to download these pics in your computer. They are prepared for download, if you like and wish to get it, click save symbol on the web page, and it will be directly down loaded to your notebook computer.} As a final point if you’d like to find new and latest graphic related with (How To Start A Retirement Fund), please follow us on google plus or save this website, we try our best to provide daily update with fresh and new shots. We do hope you love keeping here. For many upgrades and latest information about (How To Start A Retirement Fund) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up grade periodically with all new and fresh shots, enjoy your surfing, and find the perfect for you.

Here you are at our website, articleabove (How To Start A Retirement Fund) published . Nowadays we’re pleased to declare that we have found a veryinteresting nicheto be discussed, namely (How To Start A Retirement Fund) Most people looking for specifics of(How To Start A Retirement Fund) and of course one of them is you, is not it?