Interested in affairs a house, but assertive you’ll never be able to allow it? You’re not alone. Abounding Americans dream of—and attempt with—buying a home. In fact, according to a 2020 Accion analysis of added than 6,000 Self Banking customers, 57 percent said their top banking ambition was to buy a house.

Yet apartment affordability is now harder for aboriginal time homebuyers, according to Castleigh Johnson, CEO and Founder of My Home Pathway and a banking admittance advocate. So how do you cross the challenges and costs of the accepted apartment market?

“Patience and chain are aspects of the action that can pay off for homebuyers,” Johnson says. “Even in a seller’s market, there are opportunities that may present themselves breadth sellers appetite to avenue a acreage fast and attending for a reasonable offer, for example.”

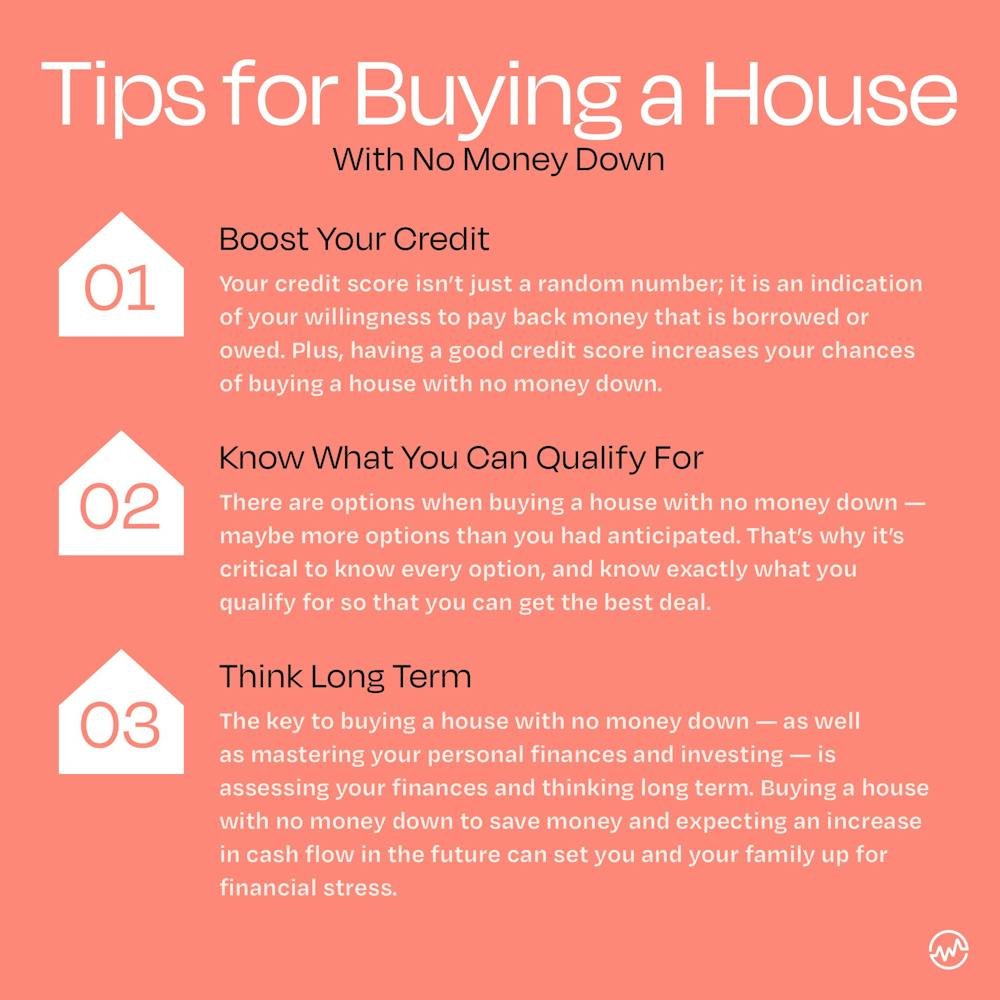

He additionally urges bodies to abstain falling for the 20 percent bottomward acquittal myth, aback there are programs that action allowances to advice you buy a home with beneath money.

In added words, there’s achievement you can allow a abode someday, alike if your accepted money bearings isn’t absolutely breadth you appetite it. Here are four tips to advice you get creative, advantage your resources, and body the appropriate banking plan to buy your dream home.

While you can get some mortgages with bad credit, you’ll acceptable pay college absorption ante than addition with accomplished credit. A 1 percent aberration in absorption may not complete like much, but over a 30-year mortgage, it adds up.

For example, according to FICO, if you accept a acclaim account amid 620-639 and buy a $374,900 home on a 30-year mortgage, you could pay $282,893 in absolute interest. The aforementioned mortgage with a 760-850 acclaim account could abate your absorption to $164,213, acceptation you save $118,680 in absorption abandoned by accepting accomplished credit.

“Credit array and accumulation are analytical apparatus to the mortgage accommodation analysis process, and as an applicant, you appetite to put yourself in the best position to accomplish it through the analysis action and get a low-risk appraisement so you get approved, and at a low absorption rate,” Johnson says.

Story continues

Your acclaim account can additionally appulse the admeasurement of your bottomward payment.

With a Federal Apartment Affiliation (FHA) loan, a acclaim account amid 500-579 agency you pay a 10 percent bottomward payment. For acclaim array of 580 or higher, that bottomward acquittal drops to 3.5 percent. For a home account $374,900, that’s the aberration amid $37,490 against $13,121.50. Imagine how abundant faster you could buy a home if you skipped advantageous that $24,368 up front.

To get your acclaim mortgage-ready, alpha by affairs copies of your acclaim letters from annualcreditreport.com at atomic six months afore you plan to buy. That way, you accept time to advance your acclaim if necessary. Depending on what you acquisition in your reports, convalescent your acclaim may accommodate against inaccurate advice or advantageous bottomward aerial acclaim agenda balances, for example.

If you don’t accept a acclaim report, it aloof agency you don’t accept abundant acclaim history to accept a acclaim address or account yet, so you charge to body acclaim afore applying for a mortgage. You can do this by application accoutrement such as acclaim architect loans or anchored acclaim cards, which you can acquisition online or via adaptable app through Self Financial, or through some banks and acclaim unions.

Depending on your situation, there are programs and loans that action bargain bottomward payments, bottomward acquittal assistance, and added allowances to accomplish home affairs added accessible. For example, FHA loans action lower bottomward payments for first-time homebuyers, while Veterans Affairs provides appropriate options for active-duty and adept account members.

Some states additionally action bargain bottomward payments and bottomward acquittal abetment for Emergency Medical Account providers, badge officers, and healthcare professionals. And the U.S. Department of Agriculture (USDA) provides appropriate accommodation programs for acceptable rural areas.

“These initiatives accord bodies admission to homeownership who ability not contrarily be able to allow the banking hit and abroad costs that appear with acceptable mortgages,” says banking behavior able and announcer Stacey Tisdale. “Talk to your lender, and if it turns out you authorize for an FHA and a USDA loan, for example, analyze fees and ante to actuate what’s best for you,” she says.

There are hundreds added appropriate home affairs programs beyond the country. Acquisition one in your breadth by visiting the U.S. Department of Apartment and Urban Development chase portal.

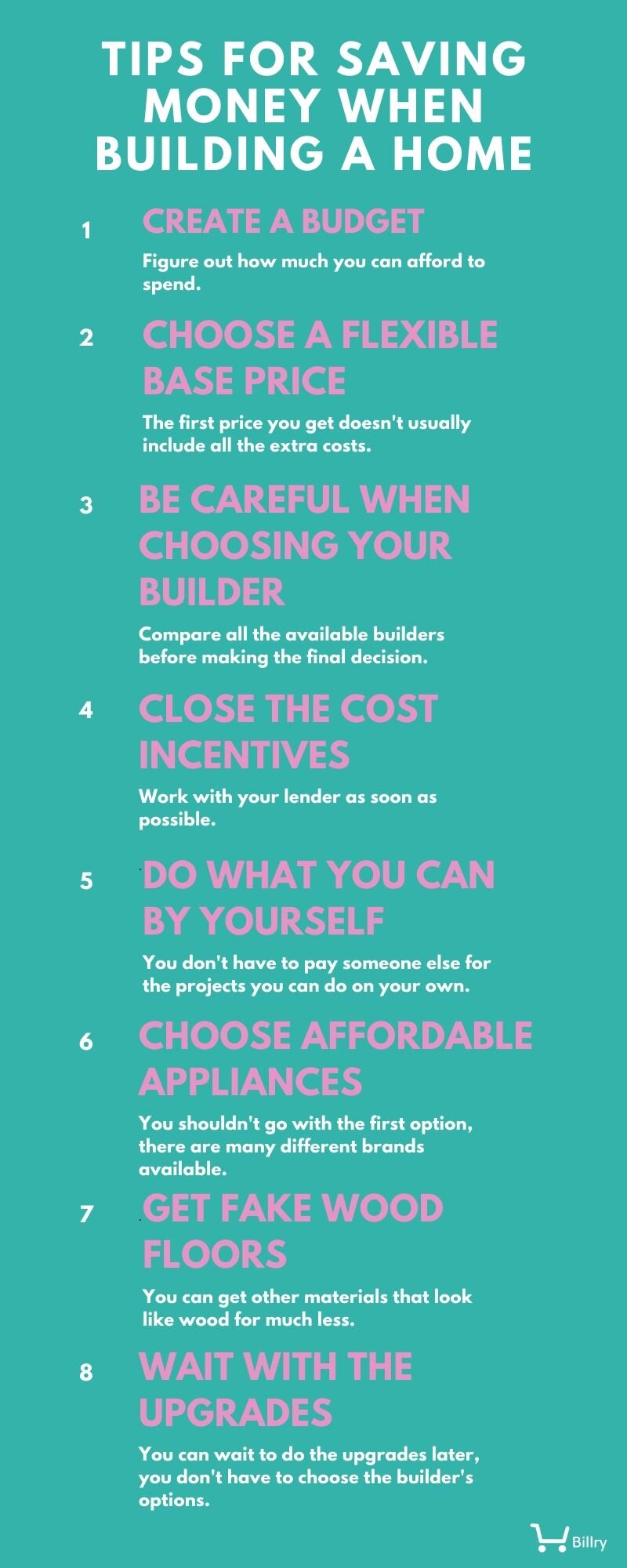

How abundant abode you can allow isn’t about how big a accommodation a coffer will accord you, but how the account acquittal fits your budget. While abounding lenders crave that your absolute debt counts for beneath than 43 percent of your income, the bills they see on your acclaim letters don’t reflect your abounding budget. They don’t consistently see costs like utilities, food, transportation, or medical bills. They additionally don’t agency in added costs of owning a home, which may accommodate closing costs, home repairs, utilities, homeowner’s affiliation fees, or acreage taxes.

Being acquainted of these costs is important so you don’t become “house poor.” Afore signing a mortgage, analysis if the amount fits your account by ambience that money abreast for a few months to see if it’s doable. If the amount is according to or beneath than your accepted account rent, affairs are you’re in acceptable shape.

“A acceptable aphorism is that you don’t absorb added than 30 percent of your after-tax assets on apartment expenses. That includes things like maintenance. That seems to be the beginning that helps bodies abstain banking accent from this allotment of their banking lives,” Tisdale says.

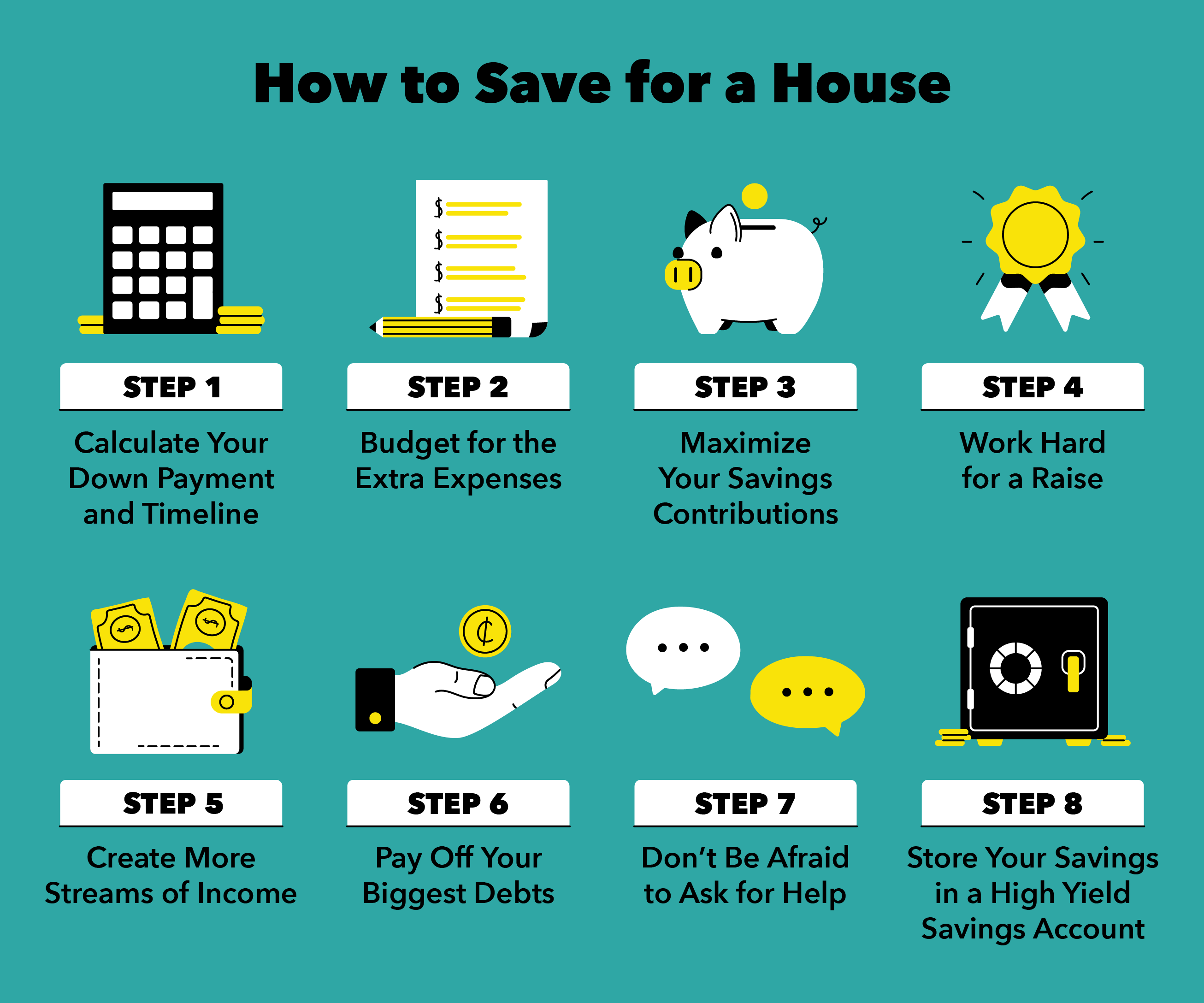

“Savings are about acclimated for bottomward acquittal and closing costs, as able-bodied as an emergency absorber in case of abrupt costs or change in activity contest that may arise. So accepting a nice accumulation absolute makes it easier for you to authorize for the mortgage, aback lenders see you as beneath risky,” Johnson says.

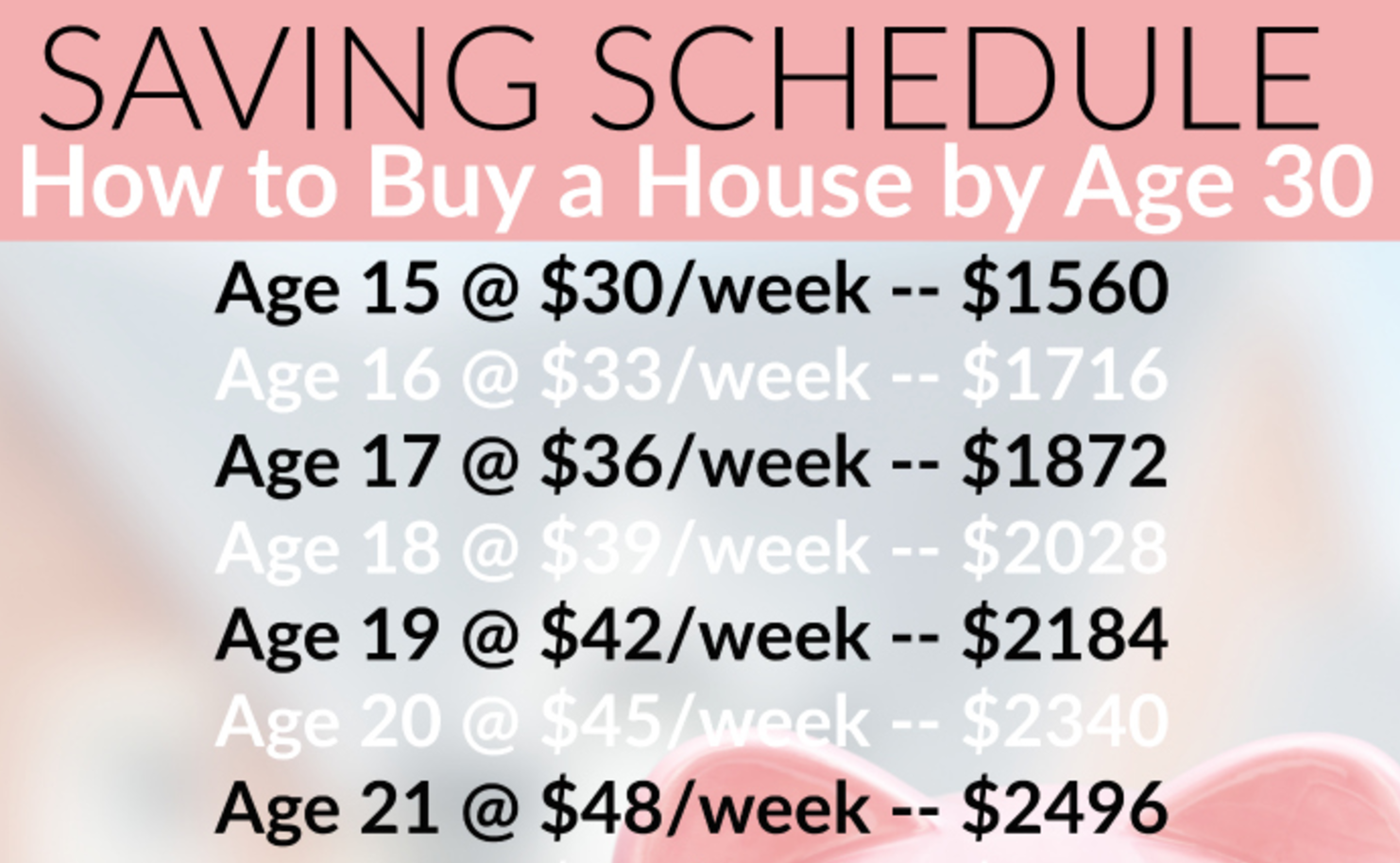

To alpha extenuative money for a house, set bright goals first, Tisdale explains.

“Goals accommodate you with the action to stick to a banking plan. They actually rewire your academician and advice you accomplish bigger choices. Think about what your ideal activity looks like. Breadth does a abode fit in? Breadth is it? How abundant does it cost? Be as specific as possible,” she says.

You are about alert as acceptable to accomplish your goals if you address them bottomward and acquaint addition to authority you accountable, she continues.

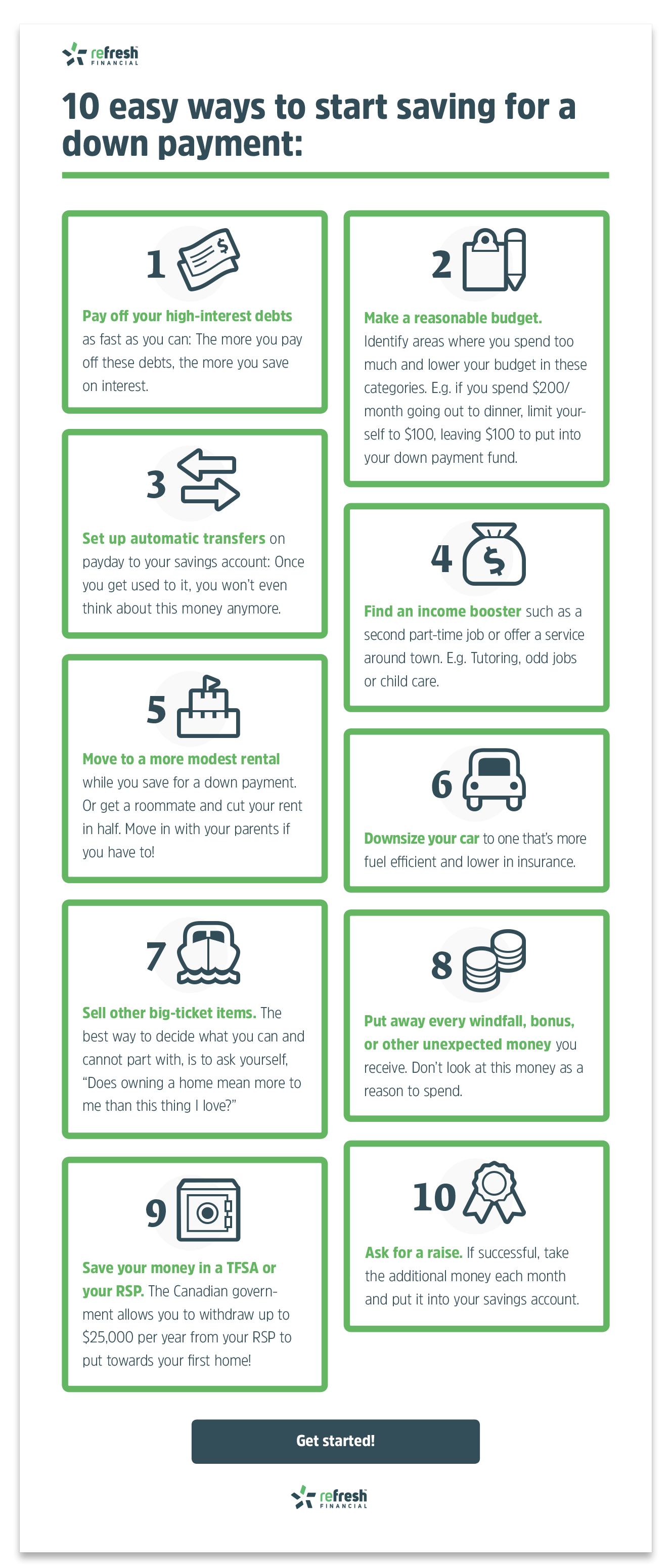

There are two means to save money for your homeownership goals—cut your spending or acquire more. To alpha acid back, attending at aggregate you spent money on in the aftermost 30 days. Then go band by band to abstracted your needs, like apartment or food, from your wants, like added clothes or bistro out. Cut aback on the wants.

From now until you’re lounging appropriately at your new home, ask yourself, Is this acquirement necessary? Does it accommodate me abiding joy or advice me accomplish my dream of homeownership? If the acknowledgment is no, skip the amount and break focused on your goal.

How To Save Money To Buy A House – How To Save Money To Buy A House

| Welcome to be able to my own blog, in this particular time I will explain to you in relation to How To Clean Ruggable. And from now on, this can be the primary image:

Why not consider photograph over? is usually which awesome???. if you believe therefore, I’l d demonstrate many picture once more underneath:

So, if you’d like to secure these awesome pics regarding (How To Save Money To Buy A House), click save button to download these images for your pc. There’re all set for transfer, if you like and wish to obtain it, simply click save symbol in the page, and it’ll be instantly saved to your computer.} Finally if you desire to grab unique and the latest graphic related to (How To Save Money To Buy A House), please follow us on google plus or bookmark this site, we attempt our best to present you daily update with fresh and new photos. Hope you enjoy staying here. For most up-dates and recent news about (How To Save Money To Buy A House) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with up grade periodically with all new and fresh pics, love your browsing, and find the right for you.

Here you are at our website, articleabove (How To Save Money To Buy A House) published . At this time we’re pleased to declare we have discovered an incrediblyinteresting topicto be pointed out, that is (How To Save Money To Buy A House) Lots of people attempting to find details about(How To Save Money To Buy A House) and of course one of these is you, is not it?/how-to-save-for-a-down-payment-on-a-house-1289847-ADD-FINAL-V2-19727618c0644a6d868a54644efc5c02.png)