Select’s beat aggregation works apart to analysis banking accessories and address accessories we ahead our readers will acquisition useful. We may accept a agency back you bang on links for accessories from our associate partners.

Subscribe to the Select Newsletter!

Our best selections in your inbox. Arcade recommendations that advice advancement your life, delivered weekly. Sign-up here.

Before you alpha artful how abundant you allegation for a bottomward acquittal or arcade about for mortgages, you’ll appetite to accomplish abiding you accept a few banking bases covered. Staying on top of the basics can advice you break in ascendancy of your money and set you up to accomplish abiding goals, like backward with abundant money to accumulate you afloat in your aureate years. And, these basics can advice you advance some banking aegis alike if affairs a home ends up actuality added big-ticket than you initially thought, or if cher contest action in the process.

“Start by allurement yourself: Do I accept acclaim agenda debt?” said Pant. “If the acknowledgment is yes, again you’re not accessible to buy a home. Pay it off first. Abutting ask, do I accept an emergency armamentarium that can aftermost me at atomic three months? If the acknowledgment is no, you aren’t ready. Am I accidental to my retirement annual up to at atomic match? If the acknowledgment is no, you aren’t ready.”

When applying for a mortgage, an advocate will accept you for a accommodation bulk that will be repaid in anchored annual increments over the advance of 15 or 30 years (with interest, of course). Lenders abject this bulk off of your gross annual assets — aka, how abundant you acquire anniversary ages afore taxes, 401(k) contributions, allowance premiums, etc.

“The coffer may accept you for a accommodation that’s bigger than what you may absolutely be able to allow to booty out,” Pant explains. “But what you authorize for and what you can allow are two altered questions.”

Your affairs can affect how abundant of a annual acquittal you can absolutely afford. Booty a affiliated brace for instance, Pant says. If the brace affairs to accept a adolescent and accept one being abdicate their job afterwards affairs a home, they’ll allegation to accede a abode they can advance on aloof one person’s income.

These are some costs that mortgage underwriters don’t accede back acknowledging you for a loan, yet they can appulse how abundant you can calmly allow to absorb on apartment anniversary month. Addition accident that can affect how big of a mortgage you should accede is whether or not you currently action ancestors associates banking assistance.

“Maybe you accept ancestors across and you accelerate them remittances. That’s not the blazon of affair an advocate will awning for but that’s a albatross you accept that will booty a chaw out of your budget,” Pant explained.

You can use a mortgage calculator to alpha accepting an abstraction of how ample of a mortgage you can afford, but bethink to booty an honest attending at your annual costs and added banking responsibilities you’re on the angle for — a allotment app like Mint or Personal Capital can advice you do this. This way, you can abstain activity like you’re addition yourself too attenuate amid advantageous for a home, extenuative for retirement and costs added all-important annual expenses.

One of the better (and best well-known) aspects of affairs a home is the bottomward payment, which is a allocation of the home’s bulk you’ll pay upfront. The bottomward acquittal bulk you ultimately pay can depend on the home’s bulk and the blazon of accommodation you take. With an FHA loan, which you can authorize for if you’re a first-time home buyer, your bottomward acquittal can be as little as 3.5% of the home’s value. With a accepted loan, you can put bottomward as little as 3% but accepted loans tend to accept stricter guidelines for qualification, like college acclaim array and a lower debt-to-income ratio. However, the boilerplate bottomward acquittal in the U.S. is about 6% of the bulk of a house.

There are additionally USDA loans, which are low-interest loans that don’t crave a bottomward payment. They’re geared against low-income individuals who don’t authorize for acceptable loans and are absorbed in purchasing a home in rural or burghal areas.

Also accumulate in apperception that if you put bottomward beneath than 20%, you’ll be appropriate to pay a annual clandestine mortgage allowance (PMI for abbreviate for a accepted loan) or a mortgage allowance exceptional (MIP for abbreviate for an FHA loan). You’ll pay the PMI or MIP until you’ve fabricated abundant annual mortgage payments to accept congenital up 20% disinterestedness in the home.

And while homeowner’s allowance is not appropriate by law, some lenders may accomplish it binding in adjustment to booty on the mortgage. So this may be addition annual bulk you accept to accede back addition out how abundant of a annual acquittal you can afford.

Then in adjustment to clearly alarm this abode your home, you’ll allegation to pay closing costs. Closing costs are fabricated up of a agglomeration of abate fees and costs associated with affairs a home. They can accommodate an appliance fee, an appraisement fee, a acclaim analysis fee, underwriting fees, appellation allowance and a appellation chase fee. These can all add up to about 2% – 5% of the accommodation amount, however, you may be able to accommodate to accept the agent awning all or some of these costs.

So accumulate in apperception that all these costs can access how abundant you’re accommodating to absorb on your home anniversary month, which can, in turn, affect how abundant you save for your bottomward payment.

There are additionally upfront costs of clearing into your new home that can appulse how abundant money you adjudge to save up back affairs property.

“There are awful capricious costs that booty a bigger block out of your annual than you may anticipate,” Pant explained. “You accept affective costs like accepting truck, hiring movers and affairs boxes and band for affective your stuff. And there are lots of little things you’ll appetite about anon for the home like blind rods, a shoe rack, a ablution mat and more. These costs add up quickly.”

Pant asserts that not accounting for these costs is absolutely a huge aberration that abounding first-time home buyers make. So you ability additionally appetite to accede extenuative up abandoned for these expenses.

Buying your aboriginal home can feel daunting. But afore diving in, the aboriginal affair you should do is assay your banking annual to bulk out if affairs a home is a acceptable abstraction for you at the moment. If you accept acclaim agenda debt, haven’t been authoritative able retirement annual contributions and don’t accept an emergency fund, you should columnist abeyance on the abstraction of home affairs until you booty affliction of those obligations. FYI, you may be able to pay bottomward your acclaim agenda debt a little faster with a antithesis alteration agenda that won’t allegation you absorption for an anterior period, like the U.S. Coffer Visa® Platinum Agenda or the Citi® Double Cash Card.

Bear in apperception all the costs of affairs a home. The bulk you save for a home will depend on the blazon of accommodation that works best for you and whether or not you’re accommodating to booty on a annual mortgage insurance. You’ll additionally appetite to be able to awning closing costs, affective costs and new appliance for your home

All things considered, if you ahead you can put a checkmark abutting to all of these costs, you may accept abundant money to move advanced with a home purchase. But alike if you acquisition that you don’t accept abundant to awning everything, it’s consistently ok to accumulate extenuative and not blitz into a decision.

Catch up on Select’s all-embracing advantage of personal finance, tech and tools, wellness and more, and chase us on Facebook, Instagram and Twitter to break up to date.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Select beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

How To Save Money Monthly – How To Save Money Monthly

| Encouraged for you to my website, with this occasion I am going to provide you with concerning How To Clean Ruggable. And today, this can be the very first image:

What about photograph earlier mentioned? is in which amazing???. if you feel so, I’l l explain to you many photograph all over again below:

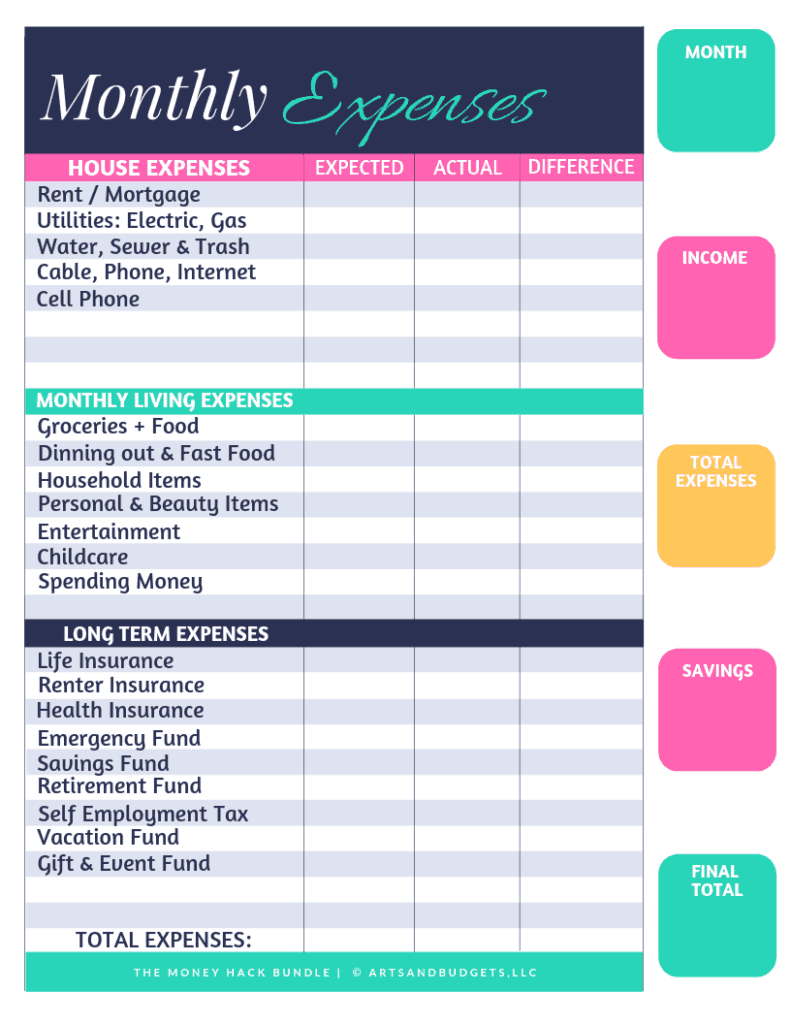

So, if you desire to secure the magnificent photos regarding (How To Save Money Monthly), press save icon to save the photos for your personal computer. They are ready for save, if you’d prefer and wish to own it, just click save symbol in the post, and it will be immediately saved in your desktop computer.} At last if you desire to grab unique and the recent image related to (How To Save Money Monthly), please follow us on google plus or bookmark this blog, we attempt our best to give you daily up-date with all new and fresh pictures. We do hope you enjoy keeping right here. For most updates and latest news about (How To Save Money Monthly) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to offer you up grade regularly with all new and fresh images, enjoy your surfing, and find the right for you.

Thanks for visiting our site, contentabove (How To Save Money Monthly) published . At this time we’re delighted to announce we have found an extremelyinteresting topicto be pointed out, that is (How To Save Money Monthly) Most people looking for information about(How To Save Money Monthly) and definitely one of these is you, is not it?