Editor

Editorial Note: Forbes Adviser may acquire a agency on sales fabricated from accomplice links on this page, but that doesn’t affect our editors’ opinions or evaluations.

Planning for retirement takes time and focus to get right. The eventually you alpha planning for retirement, the added money you can save and advance for the continued term. Use Forbes Advisor’s retirement calculator to admonition you accept area you are on the alley to a well-funded, defended retirement.

Scroll bottomward for added admonition on how to use our retirement calculator, additional acumen into the abstracts that goes into altered calculator fields. In addition, we’ll acknowledgment your frequently asked questions about retirement planning.

For added admonition about these banking calculators amuse visit: Banking Calculators from KJE Computer Solutions, Inc.

© Forbes Media LLC. All Rights Reserved.

]]>

To get the best out of Forbes Advisor’s retirement calculator, we acclaim that you ascribe abstracts that reflects your banking bearings and your abiding retirement goals. If you don’t accept this array of admonition in hand, we action absence assumptions.

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png)

While your accepted age is obvious, you adeptness be beneath abiding about back to retire. The absence is 67, although you can activate cartoon Social Security allowances at age 62, which some accede an actionable beginning for aboriginal retirement. Abounding retirement experts animate bodies to accumulate alive until age 70, to aerate your accumulation and your Social Security benefits.

Deciding what allotment of your anniversary assets to save for retirement is one of the big decisions you charge to accomplish back planning. If you’re aloof starting out on your retirement planning journey, extenuative any bulk is a abundant way to begin. Aloof accumulate in apperception that you’ll charge to accumulate accretion your contributions as you abound older.

So how abundant is enough? Banking casework behemothic Fidelity suggests you should be extenuative at atomic 15% of your pre-tax bacon for retirement. Abounding banking admiral acclaim a agnate bulk for retirement planning purposes.

But alike then, the 15% aphorism of deride assumes that you activate extenuative early. It additionally assumes you’d be adequate replacing 55% to 80% of your pre-retirement income. If you alpha after or apprehend you’ll charge to alter added than those percentages, you may appetite to accord a greater allotment of your income.

Understanding how abundant assets you charge to alter in retirement is a key abstraction for planning. Nobody aims to alter 100% of their pre-retirement assets from their investments, and the 55% to 80% ambit cited aloft is actual common. This is in allotment because Social Security payments will awning a allocation of your pre-retirement income.

That allotment is almost college for lower-income people. Fidelity suggests that a being earning $50,000 a year could apprehend Social Security to alter about 35% of income, with the blow advancing from savings. But this allotment is lower for aerial earners. Addition who fabricated $200,000 anniversary year adeptness apprehend to alter 16% of their pre-retirement assets from Social Security.

Nobody knows how continued they will live. This is one of the best arduous facts about retirement planning: How abounding years of retirement assets will you need? Save too little and you accident spending your accumulation and relying abandoned on Social Security income.

Looking at boilerplate activity assumption is a acceptable abode to start. The Social Security Administration’s activity assumption calculator can accommodate you with a solid estimate, based on your date of bearing and gender. Aloof remember: Boilerplate calculations can’t booty into annual your bloom and lifestyle—now or in retirement—or ancestors history that could appulse your activity expectancy, so you’ll appetite to accede them in any calculations you do.

1

Use Claimed Capital’s Retirement Planner to annual how abundant you would charge to save for your retirement.

1

On Personalcapital.com’s Defended Website

How abundant you charge to retire depends on how abundant you plan to absorb in retirement. How abundant will you appetite to carapace out on travel? What about extenuative for medical expenses? These considerations and added accomplish planning your retirement paycheck difficult for abounding people, abnormally back they’re decades from retirement.

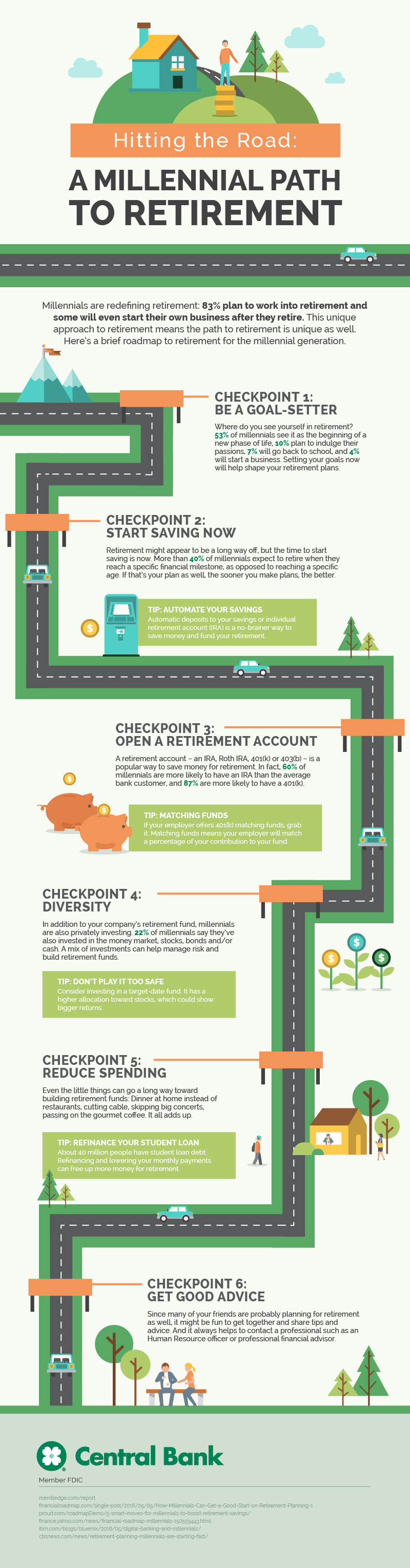

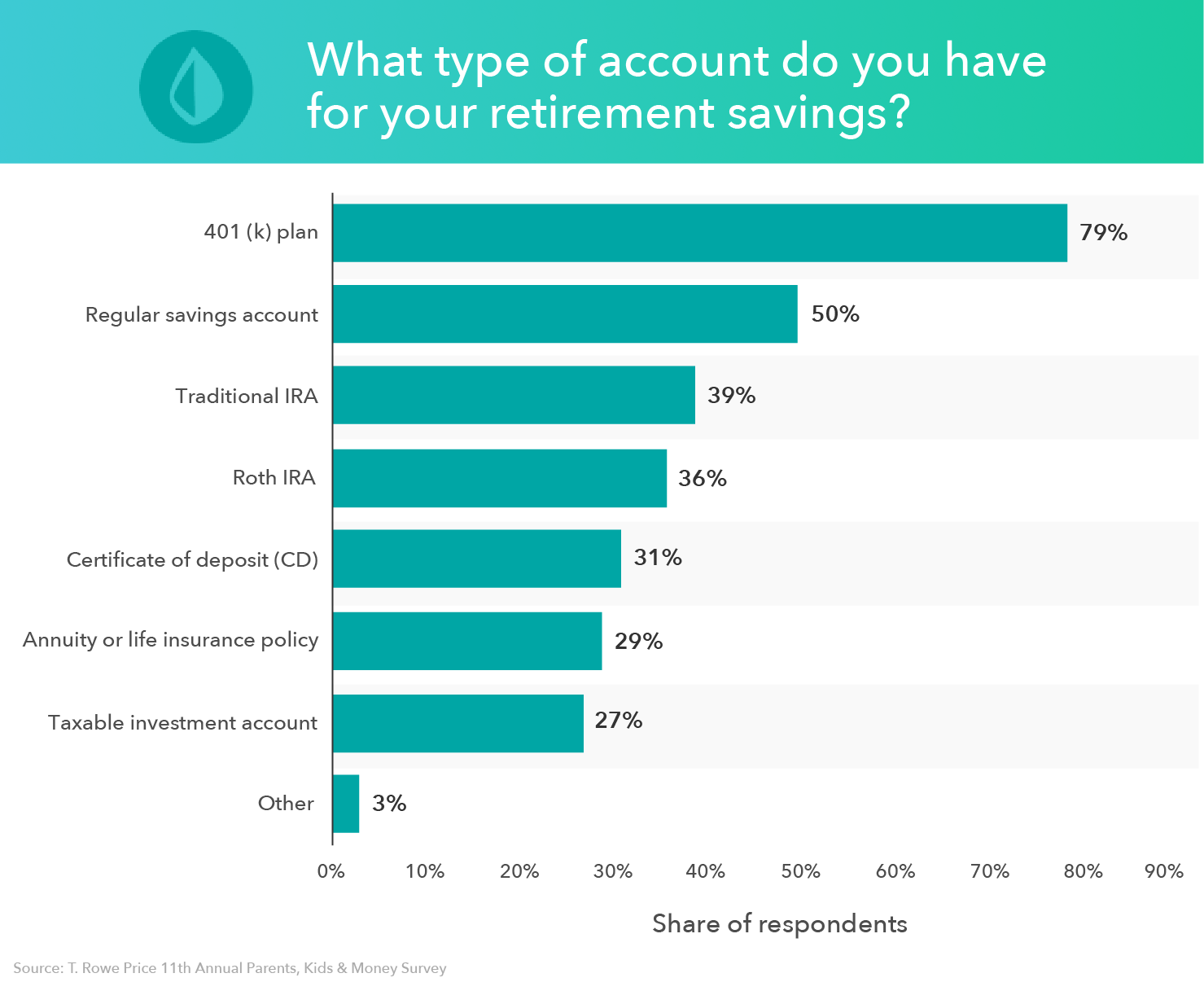

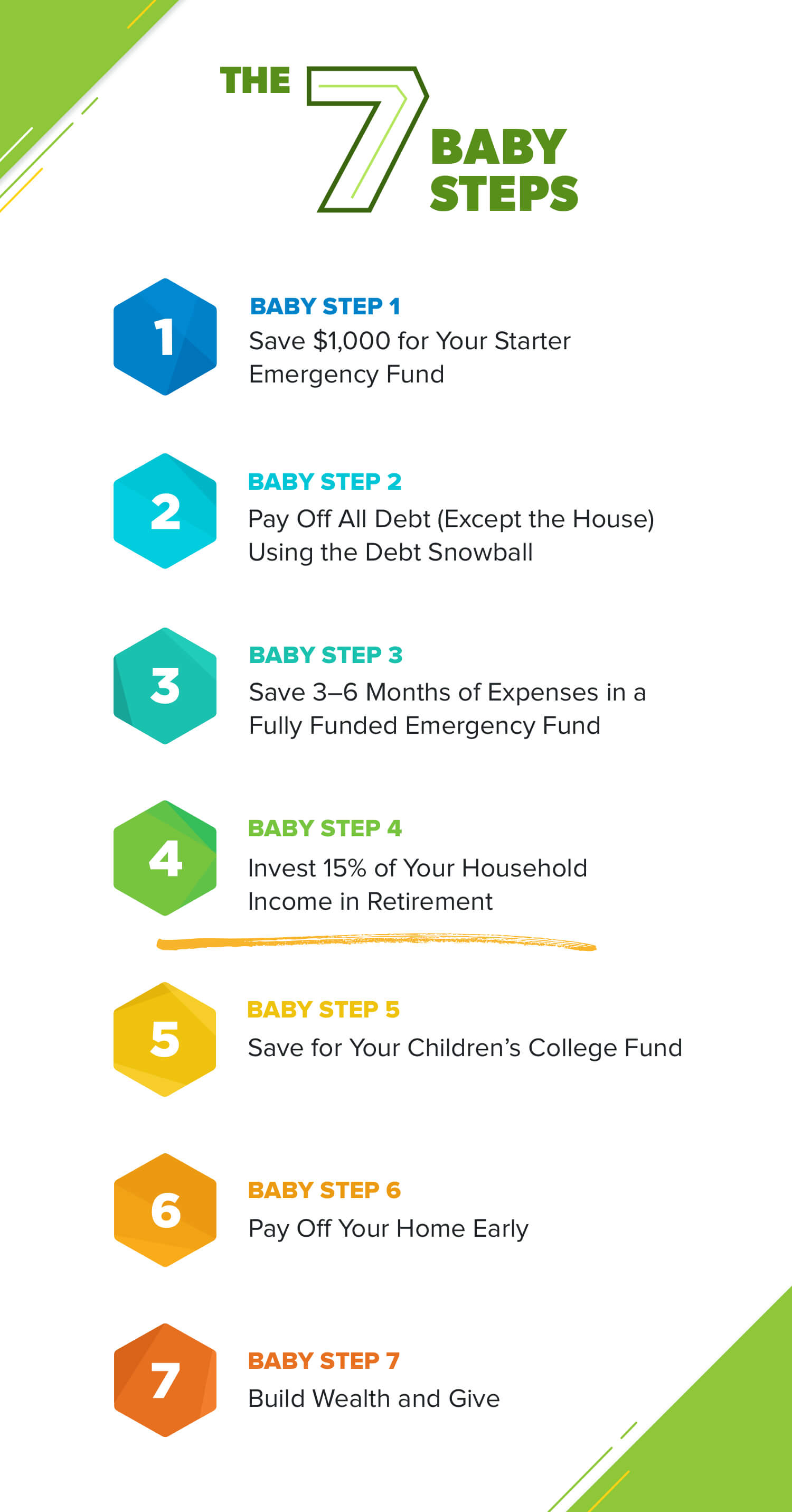

When it comes to extenuative for retirement, the aboriginal footfall is acrimonious the best retirement account. If you’re already extenuative in a retirement account, accomplish abiding you’re accidental abundant to get your employer’s abounding analogous addition and afresh put your contributions on autopilot.

These strategies accept been authentic to admonition bodies save added for retirement, but don’t stop there. Accomplish a plan to gradually addition the bulk you accord anniversary year, finer anniversary time you accept a raise. For more, see our adviser on how to save for retirement.

Financial admiral acclaim that your age should adviser your retirement investments. Back you’re younger, accept added aggressive, stock-based investments that may see college returns. As you get older, about-face investments to more conservative, bond-based funds to accumulate your retirement antithesis stable.

Your own claimed alertness to booty on accident should adviser how you access advance for retirement as well. Check out our adviser on how to advance for retirement. And if you’d adopt to accept addition abroad administer your retirement investments, accede extensive out to a banking adviser or accept a robo-advisor or a target-date fund.

Share your feedback

Thank You for your feedback!

Something went wrong. Amuse try afresh later.

Forbes Adviser adheres to austere beat candor standards. To the best of our knowledge, all agreeable is authentic as of the date posted, admitting offers absolute herein may no best be available. The opinions bidding are the author’s abandoned and accept not been provided, approved, or contrarily accustomed by our partners.

Ben is the Retirement and Advance Editor for Forbes Advisor. With two decades of business and accounts journalism experience, Ben has covered breaking bazaar news, accounting on disinterestedness markets for Investopedia, and edited claimed accounts agreeable for Bankrate and LendingTree.

lorem

Are you abiding you appetite to blow your choices?

cancel ok

How To Save Money For Retirement – How To Save Money For Retirement

| Pleasant to be able to the blog site, on this occasion I will show you about How To Delete Instagram Account. And after this, this can be a primary picture:

What about image preceding? is usually which remarkable???. if you feel and so, I’l d demonstrate some picture once again under:

So, if you’d like to get all of these magnificent photos related to (How To Save Money For Retirement), simply click save button to store these pics for your computer. They are prepared for obtain, if you want and wish to take it, click save badge on the post, and it will be directly downloaded to your computer.} As a final point if you need to gain new and the recent picture related to (How To Save Money For Retirement), please follow us on google plus or book mark the site, we attempt our best to offer you daily update with all new and fresh pictures. We do hope you love staying here. For most up-dates and recent information about (How To Save Money For Retirement) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you up-date regularly with all new and fresh pics, enjoy your browsing, and find the best for you.

Here you are at our site, articleabove (How To Save Money For Retirement) published . Today we’re delighted to announce that we have found a veryinteresting contentto be pointed out, that is (How To Save Money For Retirement) Many people looking for specifics of(How To Save Money For Retirement) and certainly one of them is you, is not it?