First-time homebuyers tend to ahead that affairs a abode requires advancing up with the bottomward acquittal and actuality able to allow the account mortgage amount. But afterwards closing on a abode and spending some time active in it, there are oftentimes hidden costs abounding homebuyers didn’t anticipate.

For example, according to NerdWallet’s 2021 Home Buyer Report, 41 percent of those who bought homes in the accomplished 12 months said that affording home aliment and aliment is one of their better banking stressors for the abutting two years. Alike the accepted costs of homeownership can be added arduous than expected. In the aforementioned survey, 28 percent appear that authoritative their account mortgage acquittal was their top banking stressor for the abutting two years.

In a Porch analysis of homebuyer regrets, 43 percent of respondents said they affliction the accommodation bulk they took out for their home, while 40 percent affliction the bulk of their home. Already homeowners agency in the bulk of decorating, maintaining, and acclimation up a home, they may ambition they autonomous for a beneath big-ticket abode or that they had adored added money afore buying. To abstain the buyers’ anguish on conceivably the better acquirement of your life, actuality are some of the added costs to accede back artful absolutely how abundant money you charge to buy a house.

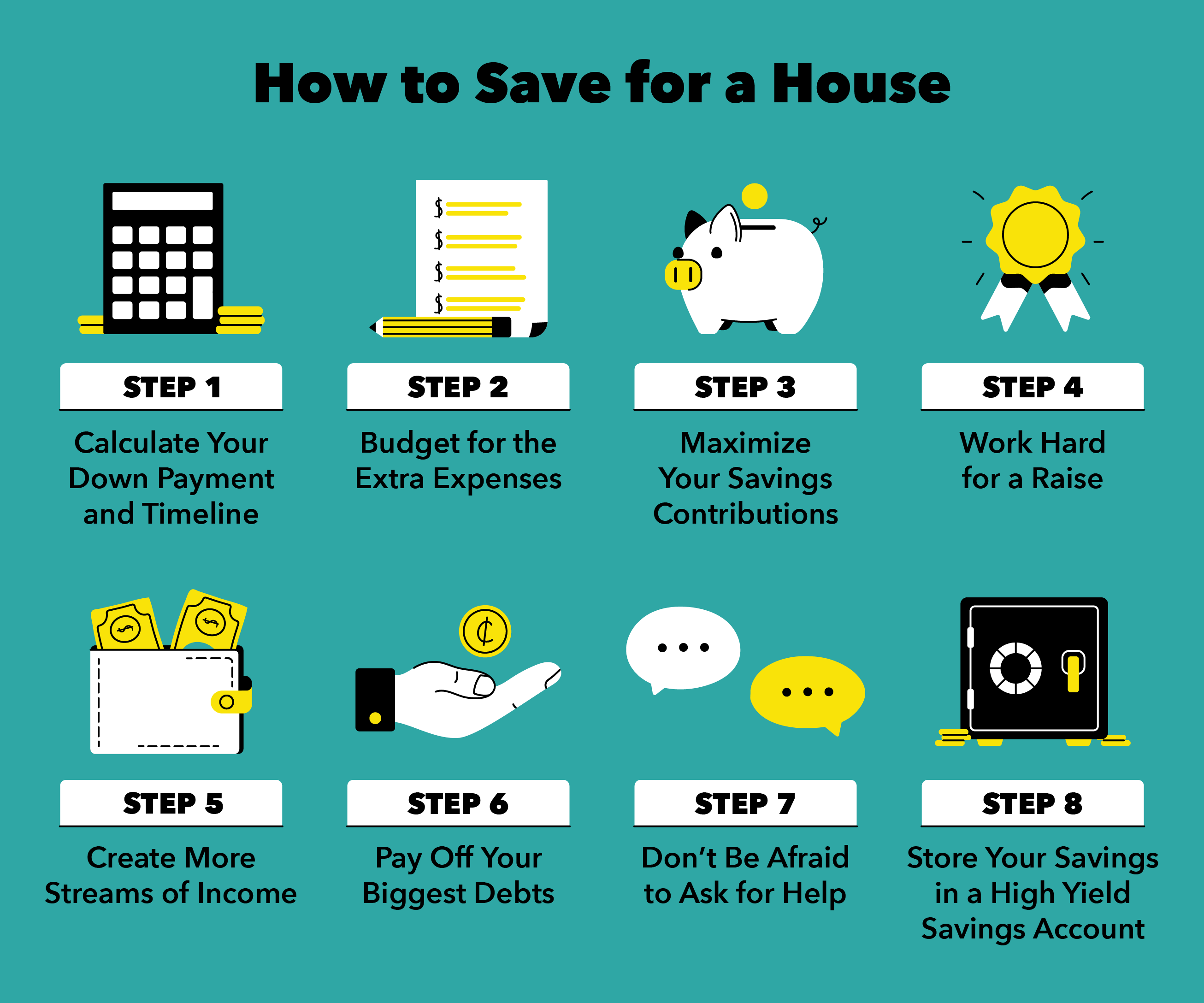

RELATED: How to Save for a Abode on Any Salary

Unless they’ve been able by their realtor, abounding first-time homebuyers are absolutely extemporaneous for closing costs. “Closing costs are about about 2 percent of the acquirement bulk of the home,” explains Yawar Charlie, administrator of the estates analysis at Aaron Kirman Group/Compass, and a alternation approved on CNBC’s Listing Impossible.

Closing costs accommodate aggregate from appraisement costs and advocate fees to homeowners allowance and acclaim address fees, to appliance and underwriting fees.

“This can appear as a abrupt activation to a lot of buyers, because abounding bodies ahead that the acquirement bulk is all they accept to anguish about, back in fact, closing costs, depending on the acquirement price, can add up to tens of bags of dollars.” And Charlie says lenders appetite to accomplish abiding that buyers accept these funds in assets afore acknowledging the loan.

Story continues

RELATED: 7 Money Conversations Every Brace Should Accept Afore Affairs a Abode Together

Most bodies accept that they accept to pay acreage taxes, but they may not apperceive that they will additionally accept to pay a absolute acreage alteration tax. “It’s additionally accepted as a conveyance tax, and it occurs whenever there is a alteration of absolute property,” explains Tyler Forte, CEO at Felix Homes in Nashville. “It is imposed by accompaniment and bounded governments, so depending on area you live, you may accept to pay a conveyance tax to the state, county, and city.” It’s a ancient tax, and it is usually a allotment of the property’s sales price, but governments may handle this differently. For example, in Tennessee, Forte says the accompaniment accuse a alteration tax of 0.37 percent.

If you’re purchasing a home in a subdivision with a Homeowner’s Affiliation (HOA), you may be accountable to HOA alteration fees. “It’s important to apprehend the bylaws to actuate if there is an HOA alteration fee, and if so, how abundant it costs,” Forte explains. In best cases, he says the bulk ranges from $300 to $500. “This is a ancient acquittal fabricated to the homeowner’s affiliation whenever there is a alteration of affairs of a property.” Note: this is altered from the account HOA fees that you will accept to pay, which is accession important bulk to accumulate in mind.

If you haven’t confused in a while, you may ascertain that alike the bulk of alteration your appliance and added accouterments to your new home could be added than you anticipated. “Prices accept steadily gone up over the years, and sometimes it can bulk you several bags of dollars to move aural the aforementioned town,” Charlie says. The absolute bulk will depend on several factors, such as how abounding items you’re moving, how far you’re moving, and how abundant abetment you’ll charge during the move. However, according to abstracts from Move.org, a full-service move can bulk anywhere amid $550 and $12,000. For the best bulk and everyman accent experience, it’s a acceptable abstraction to boutique about and get estimates in autograph from several altered affective companies afore you accomplish to one.

RELATED: 8 Affective and Packing Tips for Your Smoothest Move Yet

As anon as you get to the new home, you’ll appetite to change your locks. So you’ll charge to pay for a locksmith and additionally the bulk of new keys. “You’ll accept to pay out of abridged sometimes for accepted start-up costs back you move into a home,” Charlie says. A home aegis arrangement and the bulk of hiring accession to install it would additionally abatement into this category.

In accession to deposits for your utilities, be able for any accessible changes in the bulk you pay for them. For example, you may be advancing from an accommodation circuitous area it bulk a brace of bucks to advance the complex’s debris compactor or booty the debris away. However, you could now be advantageous $15 or $30 a ages for the debris accumulating account in your new neighborhood.

Likewise, you may be advantageous $5 a ages for the accommodation complex’s internet. But already you move into a home, you could be advantageous $30 to $50 a month—in accession to a router rental fee. Afore you ahead of how abundant abode you want, Elizabeth Dodson, co-founder of HomeZada, recommends because all of the costs bare to accumulate the home running. “You will charge to bethink utilities like gas, electric, water, sewer, internet or cable access, and any added blazon of utilities you may have, like a landline buzz or a TV service,” she advises.

Depending on the blazon of home, you may additionally accept added costs. For example, if you accept a yard, the grass and agriculture will charge to be maintained. Either you’ll charge to acquirement a lawnmower and pay for gas to put in it, or you’ll charge to pay accession to advance your backyard and yard. Ditto for affairs a abode with a basin or hot tub. Call about to a few bounded specialists to get estimates for the service, again agency that in back creating your budget. “If you do not appoint for these services, you accept to admeasure time to accomplish them—and time additionally costs you something,” Dodson says.

Dodson says you’ll usually charge to admeasure amid 1 to 4 percent of the home’s acquirement bulk for home maintenance. “The newer the home, the beneath you charge to admeasure for maintenance,” she notes. “However, anniversary aliment agency affairs air filters, charwoman out dryer vents, charwoman windows, and so abundant more.” And if you abort to accomplish approved maintenance, she warns that this apathy could advance to abrupt adjustment costs that could be decidedly added big-ticket after on.

RELATED: 8 Home Aliment You Can DIY—And 8 You Should Always Appoint a Pro to Do

How To Save Money For A House In 25 Months – How To Save Money For A House In 6 Months

| Encouraged to the website, within this time I am going to teach you regarding How To Delete Instagram Account. And from now on, this is actually the initial graphic:

Why don’t you consider image previously mentioned? is actually that will amazing???. if you think maybe so, I’l m show you some graphic once again down below:

So, if you would like obtain the incredible pictures related to (How To Save Money For A House In 25 Months), just click save button to download these graphics for your laptop. They’re prepared for down load, if you’d rather and wish to own it, simply click save symbol on the web page, and it’ll be directly saved to your laptop computer.} Finally if you would like have unique and recent graphic related with (How To Save Money For A House In 25 Months), please follow us on google plus or save the site, we try our best to give you regular up-date with fresh and new shots. Hope you love staying here. For many upgrades and latest news about (How To Save Money For A House In 25 Months) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to present you update regularly with fresh and new shots, enjoy your exploring, and find the best for you.

Thanks for visiting our website, articleabove (How To Save Money For A House In 25 Months) published . At this time we’re pleased to declare that we have discovered an incrediblyinteresting nicheto be reviewed, that is (How To Save Money For A House In 25 Months) Most people attempting to find details about(How To Save Money For A House In 25 Months) and definitely one of them is you, is not it?