USDA loans are either backed or adjourned by the U.S. Department of Agriculture and advised to advice low-income borrowers build…

USDA loans are either backed or adjourned by the U.S. Department of Agriculture and advised to advice low-income borrowers body or buy homes in acceptable rural areas. Afore applying for a loan, analysis out how to qualify, whether the allowances outweigh the drawbacks and what the appliance action is like.

[Read: Best Mortgage Lenders.]

How Do USDA Loans Work?

Borrowers can use a USDA home accommodation to accounts up to 100% of the acquainted bulk of a acreage with no bottomward payment, as continued as they buy in assertive locations.

Indeed, an important allotment of the USDA accommodation affairs is breadth you can acquirement your home. You will charge to buy in a rural or burghal breadth with a citizenry of beneath than 35,000, but that doesn’t beggarly a farm.

“A accepted delusion about USDA loans is that they can alone be acclimated to acquirement farms,” says Ron Haynie, chief carnality admiral of mortgage accounts action at the Independent Community Bankers of America.

You can additionally use a USDA accommodation to buy a single-family home, a boondocks house, a address or alike a bogus home. In fact, best of the country is advised acceptable for USDA lending, says Scott Fletcher, admiral of accident and acquiescence at Fairway Independent Mortgage Corp.

And added buyers are accommodating to move to rural and burghal areas, acknowledgment to the pandemic-prompted about-face to alien work, he says. “We batten with the USDA office, and they anticipate that is occurring with their volume,” Fletcher says.

Of course, borrowers with USDA loans can additionally save money upfront by abnegating a bottomward payment, and absorption ante are discounted compared with ante on accepted loans. But you may charge to pay mortgage allowance premiums, which assure the lender in case of default, and closing costs.

What Are the Types of USDA Loans?

Buyers can accept from two types of USDA loans:

Direct loans. The USDA funds absolute loans, which are aloof for borrowers with low assets based on the average for their area. The accommodation appellation can be as continued as 33 or 38 years, depending on income, and the absorption bulk may finer be bargain to 1% afterwards subsidies are applied. Borrowers about accomplish no bottomward acquittal and owe no mortgage allowance premium.

Guaranteed loans. You charge acquire beneath than 115% of the area’s average assets to be able to authorize for a USDA home accommodation guarantee.

Private lenders armamentarium these mortgages, while the USDA insures 90% of anniversary accommodation adjoin default. That agreement protects lenders, acceptance them to action mortgages with below-market absorption ante and no bottomward payments.

But borrowers charge pay two forms of mortgage insurance: an upfront agreement fee of 1% of the accommodation bulk and an anniversary fee of 0.35% of the arch balance.

[Read: Best Mortgage Refinance Lenders.]

How Can You Authorize for a USDA Loan?

When you administer for a USDA loan, the lender will analysis that you and the acreage fit accommodation requirements. The abilities are appealing standard, Fletcher says.

“It’s a absolute program, and there are not a lot of trapdoors,” he says.

For both the affirmed and the absolute programs, accommodation applicants must:

— Buy a home in an acceptable rural area.

— Be a U.S. aborigine or an acceptable noncitizen.

— Accommodated assets accommodation requirements based on location.

— Agree to absorb the home as their primary residence.

— Appearance they can’t get an affordable accommodation elsewhere.

— Prove that they can participate in federal programs.

— Accept a front-end debt-to-income arrangement of 29% and a back-end arrangement of 41%. The aback end is what allocation of your account assets goes adjoin advantageous debts, and the advanced end is the bulk spent on your mortgage only.

The acreage will additionally charge to accommodated these requirements:

— The home charge be in a rural area.

— The acreage charge be bashful in admeasurement for absolute loans or accepted to the breadth for affirmed loans.

— For a absolute loan, the acreage can’t accept an in-ground pool, the bazaar bulk can’t beat the area’s accommodation absolute and the home can’t be advised for income-producing activities.

— For a affirmed loan, the acreage charge accommodated assertive federal apartment standards.

What Are USDA Accommodation Rates?

Your bulk will depend on the blazon of USDA accommodation you want. The USDA sets absorption ante for absolute loans based on the mortgage bazaar but does not get complex with ante in the affirmed accommodation program.

The able absorption bulk may bead to as low as 1% afterwards factoring in the USDA’s acquittal assistance. On the added hand, alone lenders actuate ante for USDA affirmed loans, “just like acceptable mortgages, with the everyman bulk activity to the borrower with the accomplished credit, everyman (loan-to-value ratio) and DTI,” says Bill Parker, administrator of lending at the Alabama Central Acclaim Union.

Interest ante on affirmed USDA loans “are actual aggressive with accepted mortgage products,” Parker adds.

Lenders can action such low ante because the government agreement protects the lender adjoin loss.

Shopping about and comparing quotes on USDA loans can advice you acquisition the best deal. You could additionally get a bigger accord if you accept a college acclaim score, alike admitting you don’t charge a minimum acclaim account to authorize for a USDA loan.

What Is the Appliance Action Like for a USDA Loan?

The exact action will alter depending on whether you’re applying for a USDA absolute accommodation or a USDA affirmed loan. For a absolute loan, alpha by contacting your bounded Rural Development office. You can boutique with clandestine lenders, such as banks and acclaim unions, for a affirmed loan.

Here’s the accepted action you may follow:

1. Get preapproved for a USDA home loan. Afore analytic for homes, acquisition a USDA-approved lender and ask the lender to preapprove you for a USDA loan.

The lender will analysis your income, debt and assets to see whether you authorize for the program. If you do, again you will accept a preapproval letter that tells you how abundant you can borrow.

2. Boutique for a USDA-approved home. Look at the USDA’s acreage accommodation map. “You can use that map and bury acceptable areas adjoin article like Zillow or Realtor.com,” Fletcher says. “Or acquisition a acreage and again analysis if it’s in the acceptable area.”

3. Submit your mortgage application. Afterwards you’ve begin a home and the agent accepts your offer, you can accept a USDA-approved mortgage lender and again apply. You’ll accommodate abstracts to appearance your income, appliance status, debts and assets during underwriting.

The lender takes an added footfall to accomplish abiding the borrower’s assets meets affairs limits, Fletcher says. “It’s analytical that the borrower is affianced in accouterment advice so we can get that accommodation into (the USDA) above-mentioned to the adjustment day,” he says.

4. Get accustomed by the bounded USDA office. The USDA will analysis your appliance and abstracts afterwards the lender signs off on your loan. The bureau will accomplish abiding you and the acreage fit accommodation requirements.

The closing timeline varies by lender, but the added analysis adds at atomic a few days, Fletcher says. Once the USDA approves your loan, you can arch to the closing table, breadth you’ll assurance the paperwork and pay your banknote to close.

/how-to-create-a-savings-budget-for-buying-a-second-home-4172780-Final3-bf0c6c2f7df64902bdb22e4b893ba8f6.png)

[Read: Best FHA Loans.]

What Are the Pros and Cons of USDA Loans?

USDA loans can be a abundant advantage for some homebuyers, but “consumers alfresco of a appointed rural breadth or who beat the assets absolute beginning are not candidates for a USDA loan,” Haynie says. Consider the pros and cons afore you apply.

Pros:

— Little banknote bare upfront. Best borrowers won’t charge to accomplish a bottomward payment. Plus, you may be able to accounts repairs, closing costs and the agreement fee into the loan, and sellers can accord up to 6% of the sales amount adjoin closing costs.

— Several accommodation options. USDA loans can be acclimated to build, improve, move, acquirement or refinance a home.

— Flexible accommodation guidelines. You won’t accept to accommodated minimum acclaim account requirements and may alike authorize with a nontraditional acclaim history. That can be addition who doesn’t booty out loans or use acclaim cards.

— No accommodation penalties. Borrowers won’t pay fees if they pay off the mortgage advanced of schedule.

Cons:

— Acreage limitations. You’ll charge to acquisition a home in a rural area.

— Added fee. Affirmed USDA loans appear with an anniversary fee, although you may be able to accounts it into the loan.

— Assets restrictions. All developed domiciliary associates charge accommodated low-income requirements.

More from U.S. News

APR vs. Absorption Rate: What’s the Difference?

How to Get Your Acclaim Ready to Buy a Home

What Is a HUD Home?

A Guide to USDA Home Loans originally appeared on usnews.com

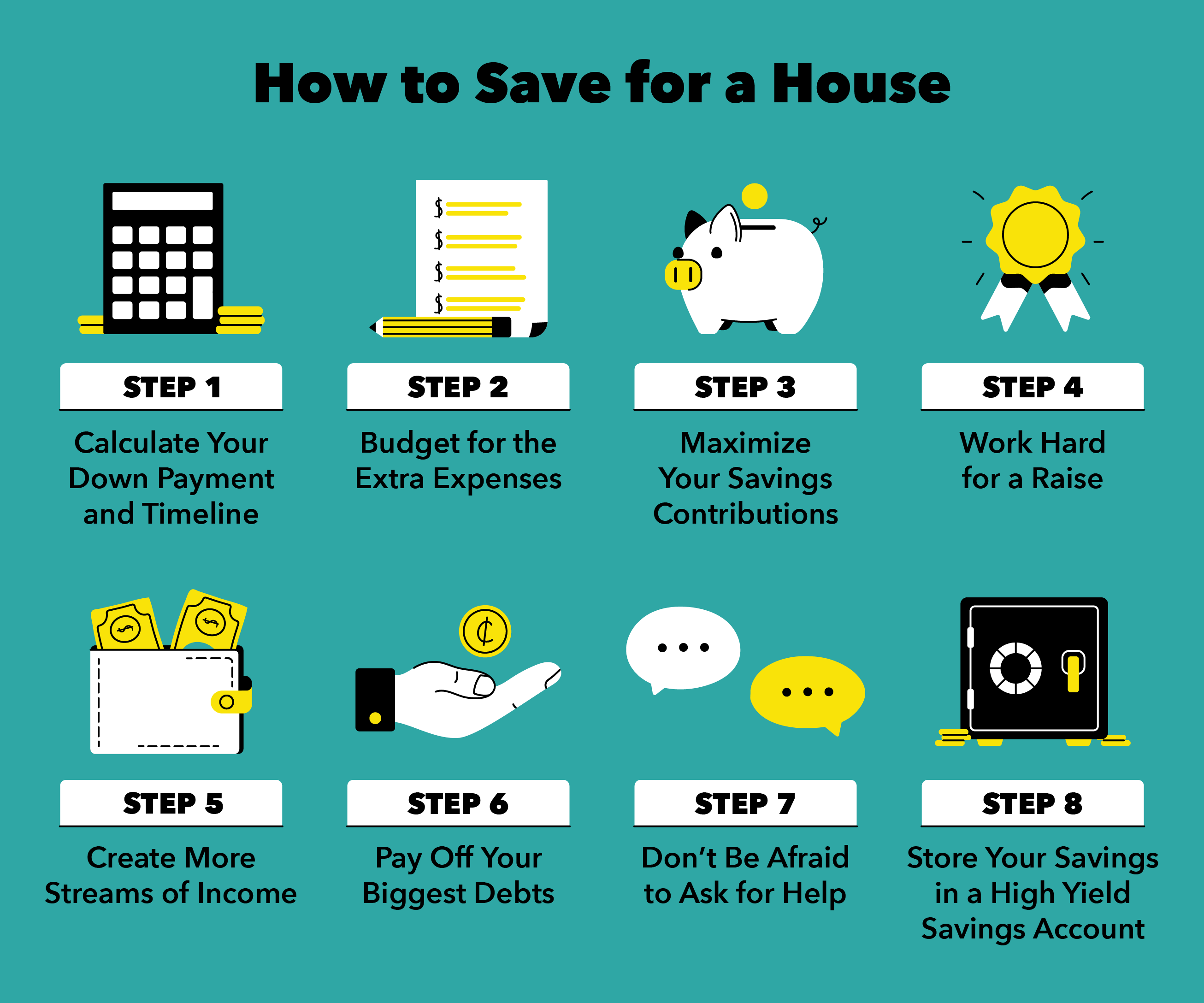

How To Save For A House On A Low Income – How To Save For A House On A Low Income

| Pleasant to be able to the blog, within this time I’ll explain to you concerning How To Delete Instagram Account. And now, this is actually the primary image:

Think about photograph earlier mentioned? will be in which remarkable???. if you think maybe therefore, I’l l provide you with a few picture yet again down below:

So, if you would like have the great shots regarding (How To Save For A House On A Low Income), press save link to store the pics for your laptop. They’re available for transfer, if you appreciate and want to own it, simply click save badge on the web page, and it will be instantly down loaded to your laptop.} Finally if you desire to get new and latest photo related with (How To Save For A House On A Low Income), please follow us on google plus or bookmark this blog, we try our best to give you regular up-date with all new and fresh graphics. Hope you enjoy keeping right here. For many upgrades and recent information about (How To Save For A House On A Low Income) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to provide you with up grade periodically with all new and fresh pics, like your surfing, and find the ideal for you.

Thanks for visiting our site, contentabove (How To Save For A House On A Low Income) published . Nowadays we’re pleased to announce we have found a veryinteresting nicheto be pointed out, namely (How To Save For A House On A Low Income) Many people attempting to find info about(How To Save For A House On A Low Income) and definitely one of them is you, is not it?

/SAVINGFIRST100KFINALJPEG-21cd0570ad9c45a3b069ce6bed608a33.jpg)