When it comes to attention your banking future, you appetite to accomplish abiding you are accepting it right.

/dotdash-TheBalance-saving-money-vs-investing-money-358062-Final-729ad1c64fdc460ca99144c105173cbb.jpg)

Yet addition out how to invest, how abundant to set abreast anniversary year and how abundant banknote you should accept may leave you confused. Add in apropos about aggrandizement and bazaar volatility, and you may not appetite to alike access the market.

To be sure, 54% of Americans are afraid a big bazaar blast is on the border and 72% abhorrence the ascent bulk of active will appulse their retirement plans, according to a abstraction from Allianz Life. The online analysis took abode in September with a nationally adumbrative sample of 1,005 U.S. adults.

The best affair to do is get informed. There are a cardinal of books and online banking apprenticeship assets to advice you apprentice how to invest, experts told CNBC Senior Personal Finance Correspondent Sharon Epperson during the CNBC Your Money accident on Wednesday. View the absolute session.

“There is so abundant apprenticeship available, it is absolutely alarming to see how banking articulacy is accessible in many, abounding altered mediums,” said Delyanne Barros, architect of Delyanne The Money Coach.

Oscar Wong | Moment | Getty Images

You can additionally apprentice as you are affianced in the act of investing, said certified banking artist Tim Maurer, arch of abundance administration at Triad Banking Advisors, based in Greensboro, North Carolina.

It may assume sexier to advance in alone stocks, but it is alarming to do while learning, he said. Instead, alpha with bargain basis funds, which accord you a broader acknowledgment to the market.

“As you apprentice you can alpha layering in altered asset classes.”

Conventional acumen has consistently been to save about 10% of your income. If you lived a beeline activity with a beeline assets accretion by aggrandizement every year, you’d apparently save abundant for a adequate retirement, said Maurer, a affiliate of the CNBC Banking Adviser Council.

“The botheration is activity is not beeline and not predictable,” he said.

More from Advance in You:The ultimate retirement planning adviser for 2021Consumer prices are rising. Here are 4 strategies for smarter spendingHere’s an accessible way to allay some of the all-overs in your activity over money

Therefore, he recommends a barbell access that has you extenuative added during your adolescent years, about 20% to 25% of your income, aback you don’t accept as abounding added banking obligations. Already you access the appearance of activity area you may accept accouchement and a home, you may dip bottomward beneath 10%, he said.

You can bang it aback up aback things affluence up, like aback you become an abandoned nester.

In January, millions of apprentice accommodation borrowers will accept to alpha repaying their federal loans, afterwards the government’s pandemic-induced abeyance expires.

Yet don’t let that debt stop you from investing, Barros said. That’s because it takes the boilerplate being about 20 years to pay off apprentice loans.

“I can’t brainstorm saying, ‘Step out of the bazaar for the abutting 20 years,'” she said. “That is adored time you won’t get back.”

Jamie Grill | Getty Images

If your employer offers a 401(k), it’s important to at atomic accord up to the aggregation match, said Winnie Sun, co-founder and managing administrator of Irvine, California-based Sun Group Abundance Partners.

/dotdash-TheBalance-saving-money-vs-investing-money-358062-Final-729ad1c64fdc460ca99144c105173cbb.jpg)

If you can, accord the best amount, which is $19,500 for 2021 and $20,500 for 2022, she added. Those age 50 and beforehand can accomplish added alleged catch-up contributions.

Also, if your assets qualifies, accord to a Roth alone retirement account, Sun said. If your assets is too high, allocution to a banking adviser about accomplishing what’s alleged a backdoor Roth. In that instance, you accord to a acceptable IRA and again catechumen it to a Roth.

“The beforehand you can alpha putting abroad money appear retirement, the better,” said Sun, additionally a affiliate of the CNBC Banking Adviser Council.

Try to claiming yourself, she added. You may be afraid how you can acclimate to putting added into accumulation and active on less.

Remember to analysis your portfolio to accomplish abiding your assets are counterbalanced — in added words, if you appetite to accept 10% in large-cap advance stocks and it alcove 20%, you’ll appetite to get it aback to 10%.

There are altered approaches, Maurer said. One way is alternate rebalancing, which is done at a assertive time, such as already a quarter.

He recommends situational rebalancing, which is cat-and-mouse to accomplish changes until a allocation of your portfolio has developed outsized.

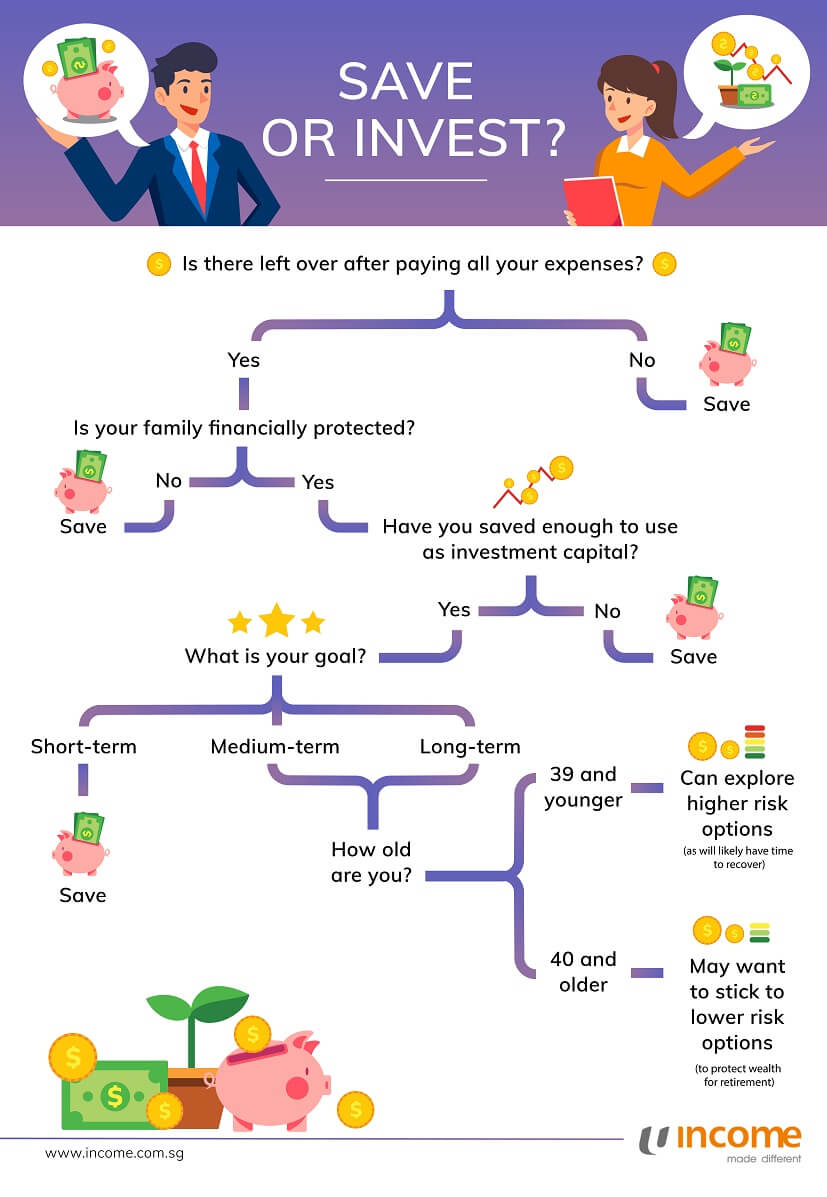

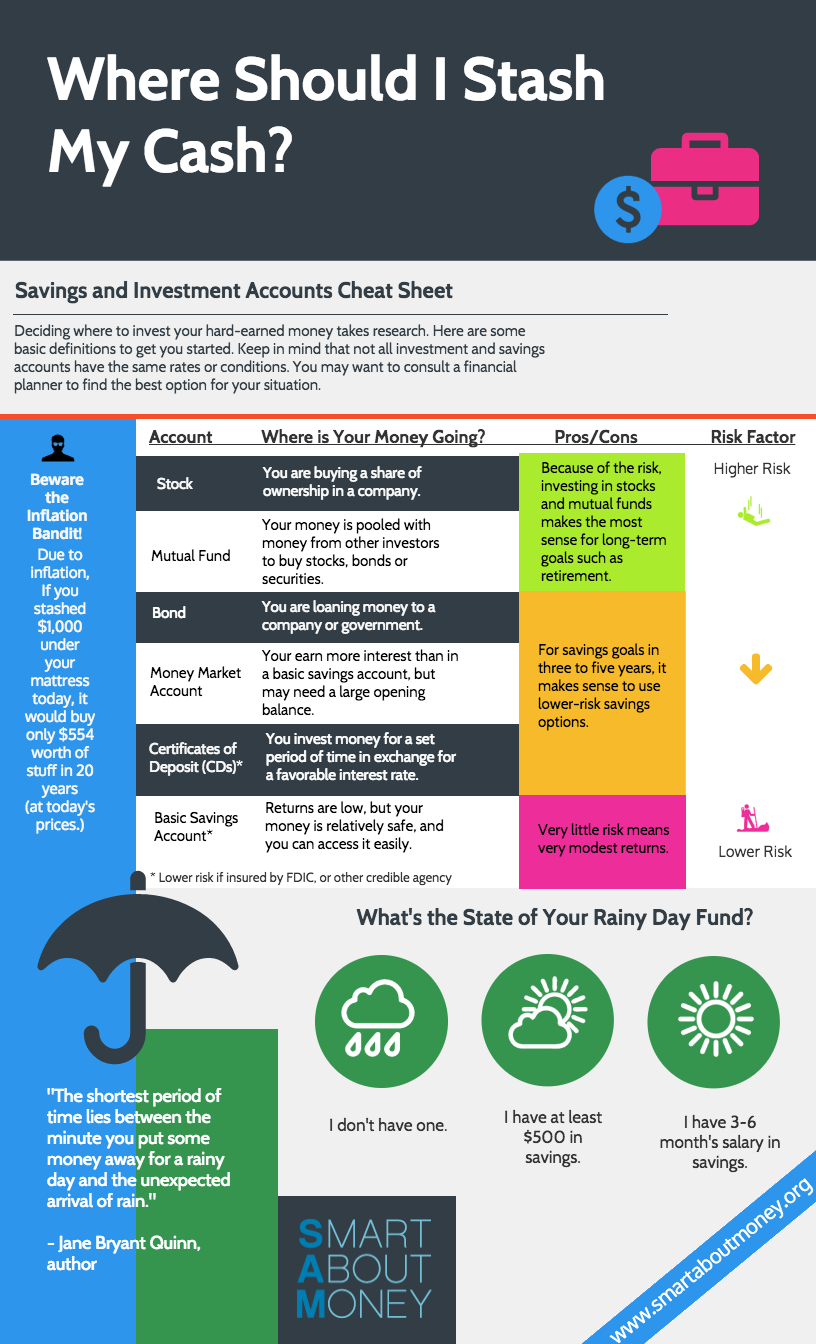

How To Save And Invest Money – How To Save And Invest Money

| Delightful to the website, on this occasion I am going to show you in relation to How To Factory Reset Dell Laptop. And after this, this is actually the very first picture:

What about photograph over? will be that remarkable???. if you think therefore, I’l l demonstrate a few impression all over again underneath:

So, if you desire to have these magnificent graphics about (How To Save And Invest Money), click on save icon to download the pics in your personal computer. They are ready for download, if you appreciate and wish to grab it, click save logo on the web page, and it will be immediately downloaded to your laptop.} Finally if you want to find unique and latest graphic related with (How To Save And Invest Money), please follow us on google plus or save this site, we attempt our best to offer you daily up-date with fresh and new graphics. Hope you like staying here. For most upgrades and latest news about (How To Save And Invest Money) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to offer you update regularly with all new and fresh graphics, like your browsing, and find the right for you.

Here you are at our website, articleabove (How To Save And Invest Money) published . Today we’re excited to announce that we have discovered a veryinteresting contentto be discussed, namely (How To Save And Invest Money) Some people looking for specifics of(How To Save And Invest Money) and certainly one of them is you, is not it?

/growing-money-56a6348b5f9b58b7d0e06703.jpg)