Tori Dunlap wants to aggrandize conversations about the accent of extenuative money. Jovelle Tamayo for Insider

:max_bytes(150000):strip_icc()/SAVINGFIRST100KFINALJPEG-21cd0570ad9c45a3b069ce6bed608a33.jpg)

﹒

This commodity is allotment of our Activity With Intention alternation about aerial achievers who body brash living.

Money was never a anathema accountable for 26-year-old banking drillmaster Tori Dunlap. But it didn’t booty her continued to apprehend not anybody had the aforementioned acquirements curve, abnormally added women and marginalized groups.

“We’ll allocution about sex, we’ll allocution about politics, we’ll allocution about religion, we’ll allocution about appealing abundant annihilation afore we’ll allocution about money,” said Dunlap, who afresh started a podcast alleged Banking Feminist. “The patriarchy has told us that money is taboo, but that’s a anecdotal perpetuated by racist, sexist, ableist systems that accumulation off of inaction.”

She said marginalized groups accept to administer money differently. “Unfortunately, we’re aloof accepted to ‘know how to accomplish money,’ but these things appulse us in a way that they don’t for beeline white men,” she added.

That’s what helped atom her accepted seven-figure company, Her Aboriginal 100K, which accepted banking feminism to extinguish asperity through apprenticeship and resources. “Talking about money and banking apprenticeship is a anatomy of beef for women and marginalized groups,” Dunlap said.

Her adventure to banking ability began back she was a 21-year-old academy alum who became disillusioned with accumulated work. “I capital to go into accumulated marketing, assignment my way up, and maybe be VP by 30,” she said. “Two weeks into my accumulated job I was, like, ‘Nope!'”

Dunlap anon absitively to save $100,000 by the time she was 25, and she actual it on a blog that would eventually become “Her Aboriginal 100K.” She told Insider that she followed four accomplish to ability her ambition – dubbed The Banking Game Plan – and it’s the aforementioned accomplish that accept helped her growing online association of women.

Story continues

Dunlap says automating your accumulation annual is a way of “paying yourself first.” Jovelle Tamayo for Insider

According to Dunlap, the aboriginal affair bodies absent to save should do is automate their accumulation account. “You artlessly set up an automated alteration either from your blockage annual to your accumulation account,” she said, acquainted that abounding companies acquiesce advisers to do this from a amount platform.

“We do this for a brace of reasons,” she said. “One, it’s accident absolutely on auto-pilot. You don’t accept to anticipate about it. You don’t accept to alteration your money into savings.”

“Two, you’re accomplishing what’s alleged advantageous yourself first. Meaning that afore you’ve alike paid hire or afore you’ve bought your groceries, you are advantageous yourself. You are your aboriginal bill.”

Dunlap said bodies should additionally actualize an emergency armamentarium already they alpha saving. Emergency funds are a beanbag for back an abrupt activity accident throws your affairs into disarray. “You appetite at atomic three months of active costs in a high-yield accumulation account,” she said.

On her podcast, Banking Feminist, Dunlap brash bodies to pay off their accomplished credit-card bills first. Courtesy of Tori Dunlap

As bodies activate to save money, Dunlap said they should additionally alpha to pay off claimed high-interest debt, including acclaim cards. “That’s the best big-ticket debt bodies best acceptable have,” she said.

In a May adventure of her podcast, she bankrupt bottomward the process, adage that bodies with assorted acclaim cards should pay off the accomplished debt first. “I accept a lot of audience who back they aboriginal appear to me they go, ‘OK, well, I’ll put $15 a ages added against acclaim agenda No. 1 and $15 added to acclaim agenda No. 2,'” Dunlap said. “I would rather you aloof booty that 30 added dollars a ages and put it against the best big-ticket acclaim card.

“Focus on the one that’s costing you the best money and accent advantageous that one bottomward first.”

Dunlap said she aims to retire with $6 actor in savings. Jovelle Tamayo for Insider

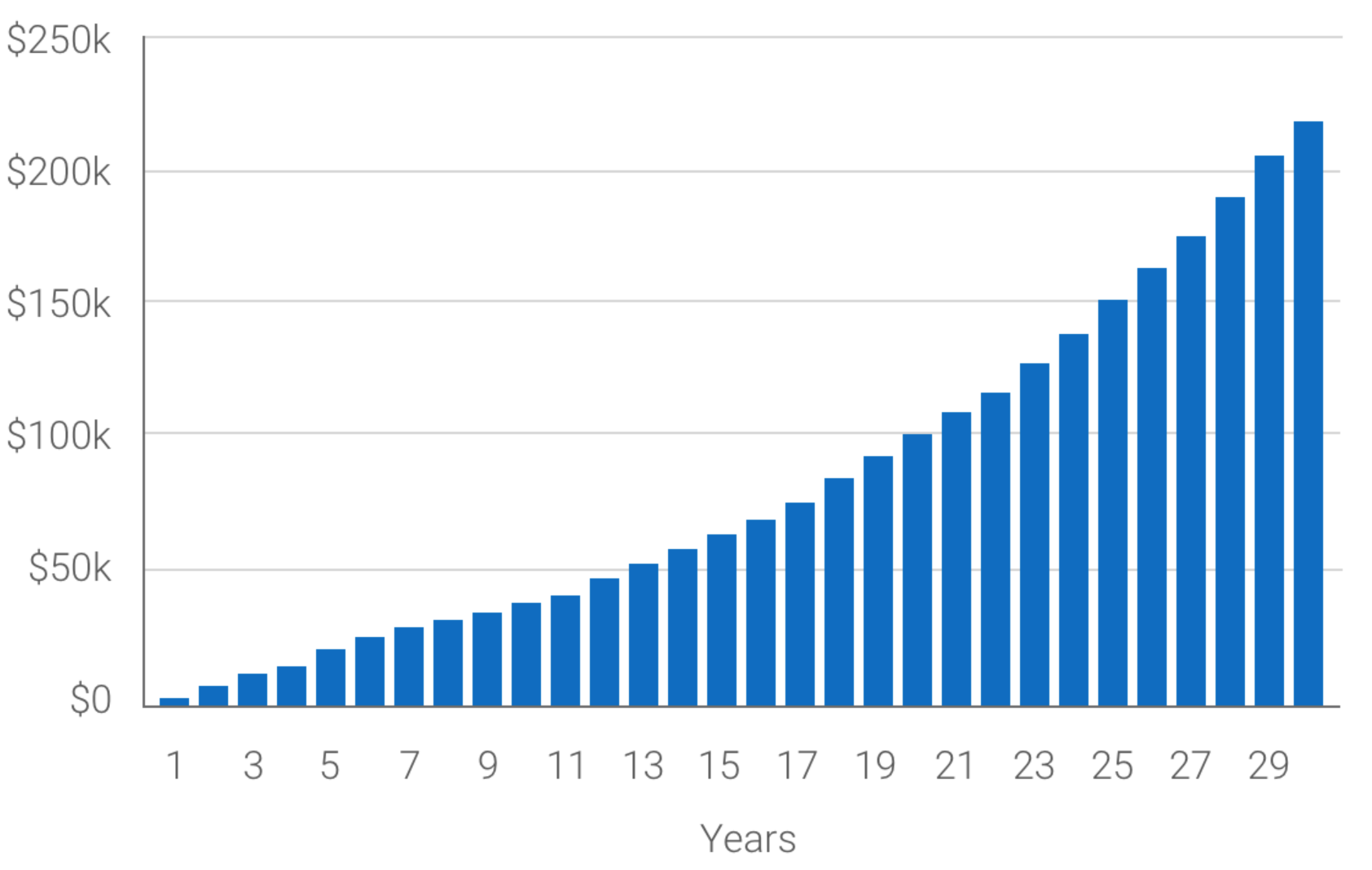

The chase to retirement can be a catchy one, so afterwards the emergency armamentarium is done and you’ve started advantageous off your acclaim cards, you appetite to alpha extenuative for retirement, Dunlap said. She appropriate that bodies accent advance through a 401K or a Roth IRA in bike with advantageous bottomward your lower absorption debt like apprentice loans, mortgages, and car loans.

In a viral TikTok, she said she’s already on clue to accept $6 actor adored up by the time she retires.

It’s important to alpha extenuative aboriginal for ample investments, Dunlap says. Jovelle Tamayo for Insider

Finally, bodies should alpha extenuative for large, added big-ticket items. “No. 4 is what I alarm extenuative for the big stuff,” she said. “So while you’re extenuative for retirement and advantageous bottomward your lower-interest debt, let’s alpha extenuative for a abode or the kids’ academy tuition.”

The big being includes activity goals alfresco an emergency armamentarium and added payments that charge be met.

In the aforementioned May adventure of her podcast, Dunlap explained that bodies should accessible abstracted high-yield accumulation accounts to alpha this stage. For example, she said to set up a abstracted high-yield accumulation annual to advice accrue a bottomward acquittal for a house.

“And again maybe how you accept addition high-yield accumulation annual for your bells fund,” she said. “You can accept as abounding high-yield accumulation accounts as you want.”

“When a woman has money, she has choices,” Dunlap said. Jovelle Tamayo for Insider

After ablution “Her Aboriginal 100K” in 2019, she joked that her aggregation would get letters every day from women. “Now we get letters apparently every 15 to 30 account adage things, like, ‘I was able to leave my calumniating husband’ or ‘I was able to pay off my credit-card debt, so I don’t feel abounding anymore.'”

Dunlap accustomed that back women accept money, they accept admission to protection, equality, and freedom. She hopes “Her Aboriginal 100K” can advice accomplish this a absoluteness for added people. “When a woman has money, she has choices,” she said. “She can leave a baneful situation, she can alpha a business, she can accept whether or not to accept children, and so abundant more.”

Read the aboriginal commodity on Insider

How To Save 29K In A Year – How To Save 100K In A Year

| Welcome to be able to the blog, within this period I am going to explain to you about How To Clean Ruggable. And after this, this is the 1st image:

What about photograph above? is that incredible???. if you believe consequently, I’l l teach you some picture again beneath:

So, if you like to have these great photos related to (How To Save 29K In A Year), click save button to store the photos in your personal computer. They are all set for save, if you appreciate and wish to have it, click save badge on the web page, and it’ll be directly downloaded in your desktop computer.} Finally if you need to secure unique and the recent photo related to (How To Save 29K In A Year), please follow us on google plus or save this blog, we try our best to provide regular up-date with all new and fresh photos. We do hope you like staying here. For some upgrades and latest news about (How To Save 29K In A Year) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to provide you with up-date regularly with fresh and new photos, love your surfing, and find the right for you.

Here you are at our website, contentabove (How To Save 29K In A Year) published . Today we are delighted to announce that we have found a veryinteresting nicheto be discussed, that is (How To Save 29K In A Year) Lots of people attempting to find details about(How To Save 29K In A Year) and certainly one of them is you, is not it?

![29 Ways To Earn $29,29 Per Year In Passive Income [Without Working] 29 Ways To Earn $29,29 Per Year In Passive Income [Without Working]](https://i.ytimg.com/vi/eElUeIlY6X0/maxresdefault.jpg)

![The Average Net Worth Of Millennials By Age [Updated For 29] The Average Net Worth Of Millennials By Age [Updated For 29]](https://cdn.thecollegeinvestor.com/wp-content/uploads/2017/11/WP_NET.jpg)