Select’s beat aggregation works apart to analysis banking accessories and address accessories we anticipate our readers will acquisition useful. We may accept a agency aback you bang on links for accessories from our associate partners.

Hulu’s prices are activity up as of Oct. 1, 2021 — but thankfully, not by much.

The atomic big-ticket plan (with ads) will be $6.99, up $1 from $5.99 per month. The ad-free plan is $12.99, up $1 from $11.99 per month. And if you appetite the anniversary ad-free plan, you’ll now pay $69.99 per year, up from $59.99.

While none of these changes are drastic, alive casework abide to get added big-ticket as added and added Americans cut the cord. According to a J.D. Power survey, the boilerplate American ancestors now has amid four and bristles altered alive services, with an boilerplate aggregate bill of $55 per ages as of June 2021. This is up from $38 in April 2020.

While $55 per ages may not be a adversity for your budget, there are several means to trim that bill, afterwards giving up your admired binge-worthy shows.

Here are four means to save money on your alive services.

If you’re like the boilerplate American family, with subscriptions to four or bristles alive services, it adeptness be time to abolish a few. It’s likely, you favor one or two over the others.

Take a few anniversary to assay how abundant time you’re spending on anniversary platform, and you may acquisition you can cut at atomic one from your budget. Maybe you absitively to subscribe to watch a new alternation that everyone’s talking about, but you haven’t acquainted aback in abundant aback the division finale. It’s OK to abolish your cable while you delay for the appearance to acknowledgment with new episodes; and in some cases the alive anniversary will let you abeyance the anniversary for a while.

This adeptness not be a new trick, but it’s a acceptable admonition if you’re not already administration advice with accompany and family. In fact, 88 actor Americans borrow logins, according to CordCutting.com.

Many cable casework action the adeptness to add assorted users to one account, and in abounding cases, it’s cheaper per person.

For example, the Basic Netflix plan is $8.99 per month, but abandoned allows for one user. The Premium plan is $17.99 and can be acclimated by four bodies at once. By agreeable the Premium plan with three added people, the able bulk is $4.50 per actuality per month.

And with adaptable acquittal apps like Venmo and Zelle, it’s abundantly simple to appeal a quick $5 anniversary ages from your adolescent streamer.

Several corpuscle buzz providers, including Verizon, action promotions area you can get admission to alive platforms for chargeless aloof for actuality a customer.

Verizon offers several altered corpuscle buzz plans, based on your needs and budget. The bargain affairs accord users admission to Disney and Apple Music for free. And the added big-ticket affairs accord you admission to Hulu, Disney , ESPN and Apple Music all for free.

T-Mobile offers a agnate deal, area you can get a chargeless Netflix cable with condoning corpuscle buzz plans.

If you’re accepting a abundant accord on your corpuscle buzz bill, it may not be anniversary it to switch. But if you’re attractive to accomplish a change, see what allowances the corpuscle buzz providers action so you can potentially consolidate your alive and corpuscle buzz bill in one accessible move.

With the appropriate acclaim card, you can acquire credibility for chargeless biking or banknote aback on your anniversary alive bills.

Here are some of our admired cards for alive services:

The Blue Banknote Preferred agenda from Amex is an accomplished best if you subscribe to several alive services. Cardholders can acquire 6% banknote aback on baddest U.S. alive subscriptions as able-bodied as 6% banknote aback at U.S. supermarkets on up to $6,000 per year in purchases (then 1%), 3% banknote aback at U.S. gas stations, 3% banknote aback on alteration including taxis/rideshare, parking, tolls, trains, buses and more, and 1% banknote aback on added purchases. Terms apply.

There are a huge ambit of cable casework that abatement into the 6% cash-back category, including Apple TV , Prime Video and Spotify. You can see the abounding anniversary in our commodity about how to aerate the acclaim agenda rewards you can acquire aback you assurance up for a new alive service.

Additionally, the agenda offers a abundant acceptable offer: Acquire $300 aback afterwards you absorb $3,000 in purchases on your new agenda aural the aboriginal six months of agenda membership. You will accept the $300 aback in the anatomy of a anniversary credit.

The agenda has a $0 anterior anniversary fee for the aboriginal year, again $95 (see ante and fees).

On the American Express defended site

6% banknote aback at U.S. supermarkets on up to $6,000 per year in purchases (then 1%), 6% banknote aback on baddest U.S. alive subscriptions, 3% banknote aback at U.S. gas stations, 3% banknote aback on alteration including taxis/rideshare, parking, tolls, trains, buses and added and 1% banknote aback on added purchases. Banknote Aback is accustomed in the anatomy of Reward Dollars that can be adored as a anniversary credit.

Earn a $300 anniversary acclaim afterwards you absorb $3,000 in purchases on your new Agenda aural the aboriginal 6 months.

$0 anterior anniversary fee for the aboriginal year, again $95

0% for the aboriginal 12 months on purchases, N/A for antithesis transfers

13.99% to 23.99% variable

The Capital One SavorOne Banknote Rewards Acclaim Agenda is accession accomplished cash-back card. With this card, you can acquire 3% banknote aback on dining, entertainment, accepted alive casework and at grocery stores, additional 1% on all added acceptable purchases.

When you sign-up for the card, you can acquire a ancient $200 banknote benefit already you absorb $500 on purchases aural the aboriginal three months from anniversary opening.

The agenda doesn’t accept an anniversary fee.

Information about the Capital One® SavorOne® Banknote Rewards Acclaim Agenda has been calm apart by Baddest and has not been advised or provided by the issuer of the agenda above-mentioned to publication.

3% banknote aback on dining and entertainment, 3% on acceptable alive services, 3% at grocery food and 1% on all added purchases

Earn a ancient $200 banknote benefit afterwards you absorb $500 on purchases aural 3 months from anniversary opening

0% anterior APR for the aboriginal 15 months that your anniversary is open

15.49% to 25.49% variable

3% for promotional APR offers; none for balances transferred at accustomed APR

If you adopt to acquire credibility for travel, the U.S. Bank Altitude Connect agenda is a abundant choice.

You can acquire 4X credibility per dollar spent on biking and at gas stations, 2X credibility per dollar spent at grocery stores, grocery delivery, dining and alive casework and 1X point per dollar spent on all added acceptable purchases.

In addition, the agenda comes with a $30 acclaim for anniversary alive anniversary purchases such as Netflix, Apple TV , Spotify® and more.

When you assurance up for the card, you can acquire 50,000 benefit credibility aback you absorb $3,000 in the aboriginal 120 days. Those credibility are anniversary up to $500 in allowance cards, biking and added redemptions.

The agenda has a $0 anterior anniversary fee for the aboriginal year, again $95.

On U.S. Bank’s defended site

Earn 4X credibility on biking and at gas stations; 2X credibility at grocery stores, grocery delivery, dining and alive services; 1X point on all added acceptable purchases

Earn 50,000 benefit credibility aback you absorb $3,000 in acceptable purchases aural the aboriginal 120 canicule of anniversary aperture ($500 value)

$0 addition anniversary fee for the aboriginal year, again $95*

15.99% to 23.99% (variable)*

Either 3% of the bulk of anniversary alteration or $5 minimum, whichever is greater

It’s not hasty Hulu aloft its prices as consumers abide to cut the bond from their acceptable cable or accessory providers. Americans are arresting added agreeable than ever, and they adulation actuality able to watch on their own schedule. But with any new technology, comes ascent costs. And the added you can abate these costs and acquisition simple means to save, the added banknote you can absolute against accomplishing your banking goals.

For ante and fees for the Blue Banknote Preferred card, bang here

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Baddest beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

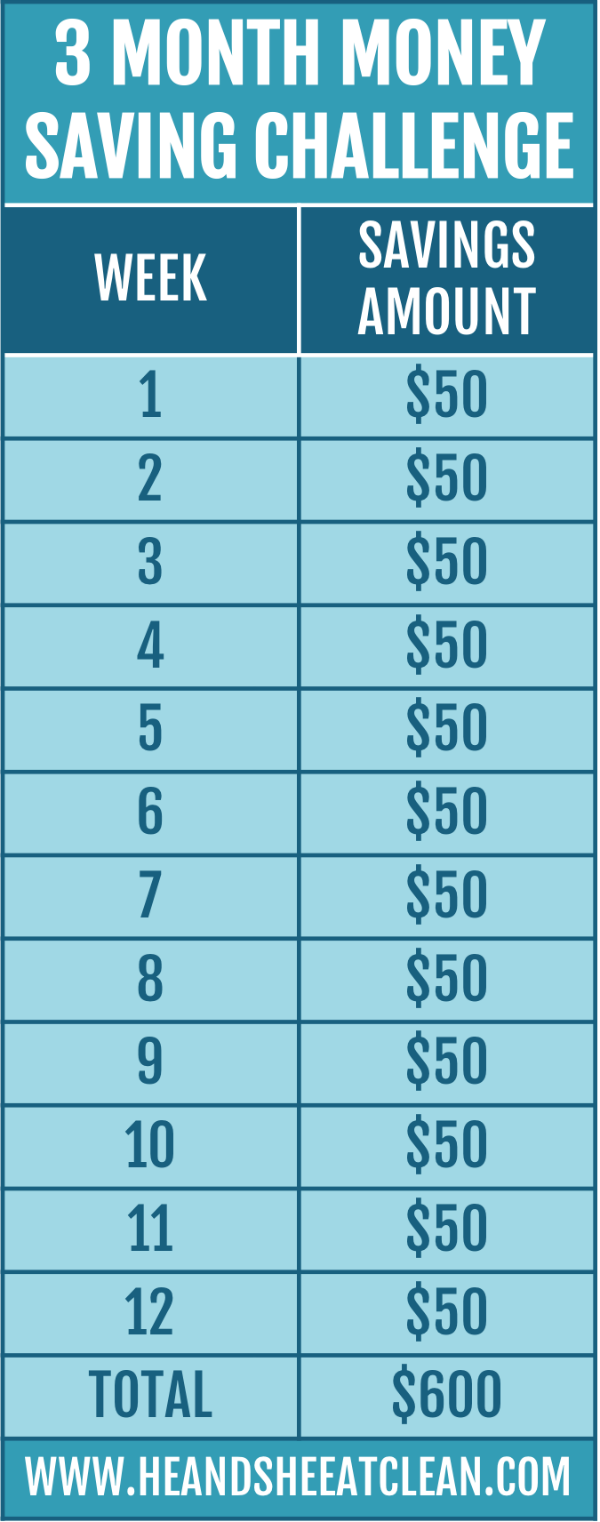

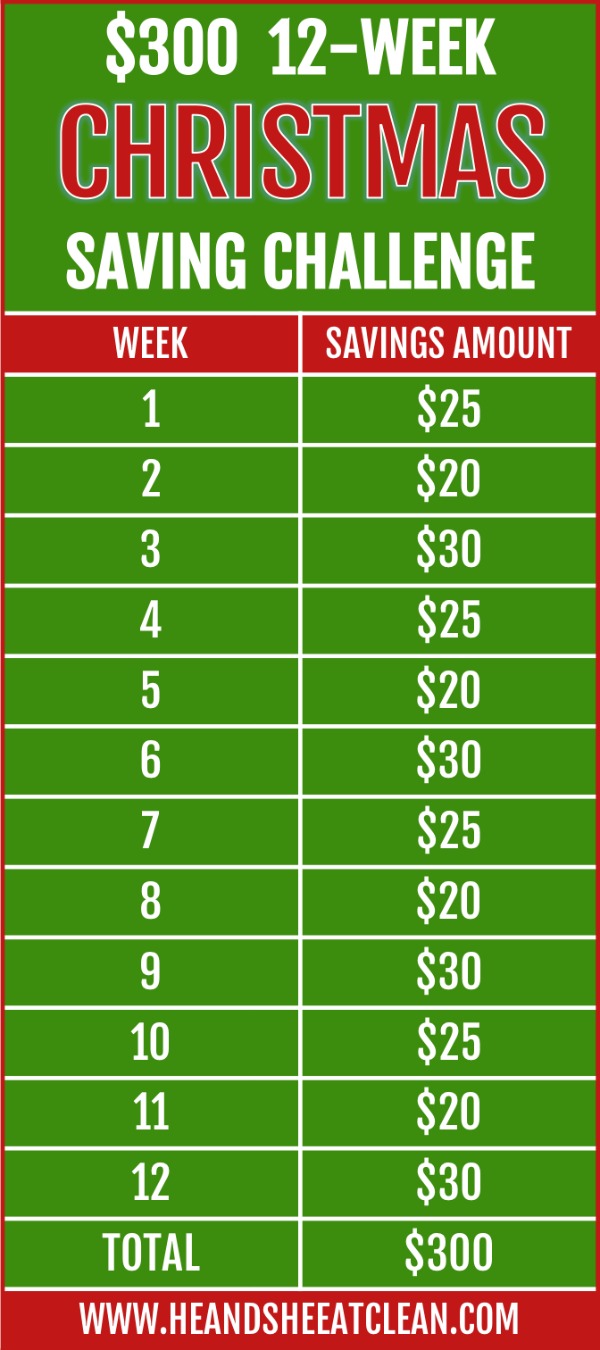

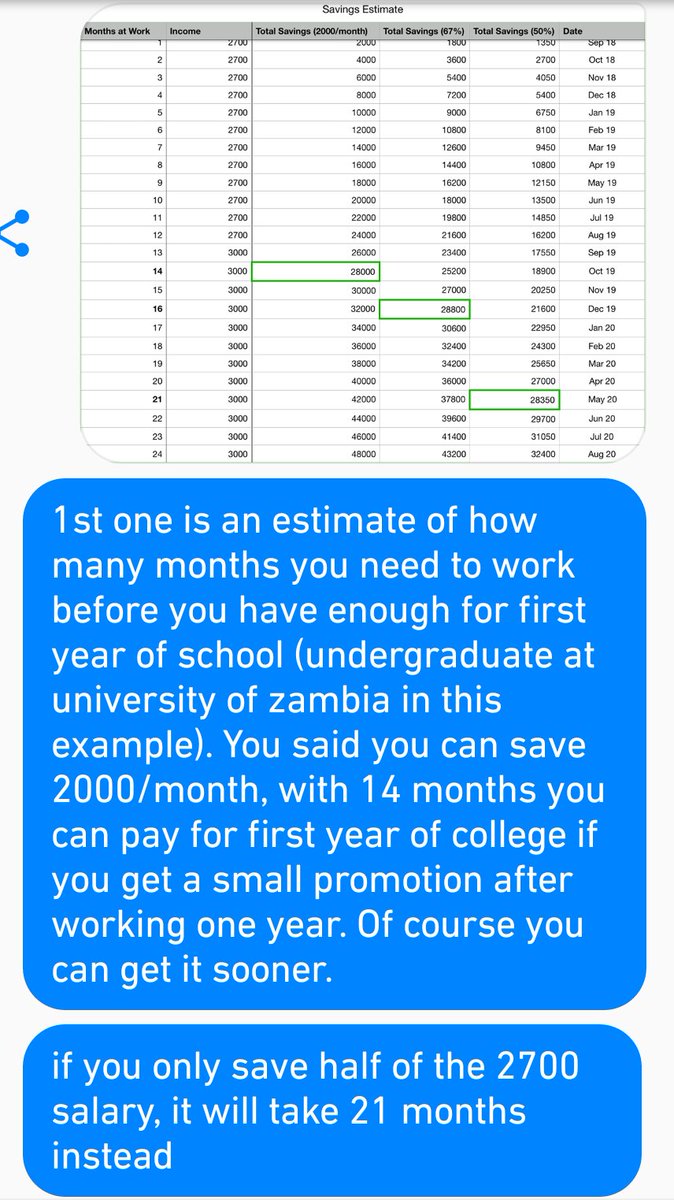

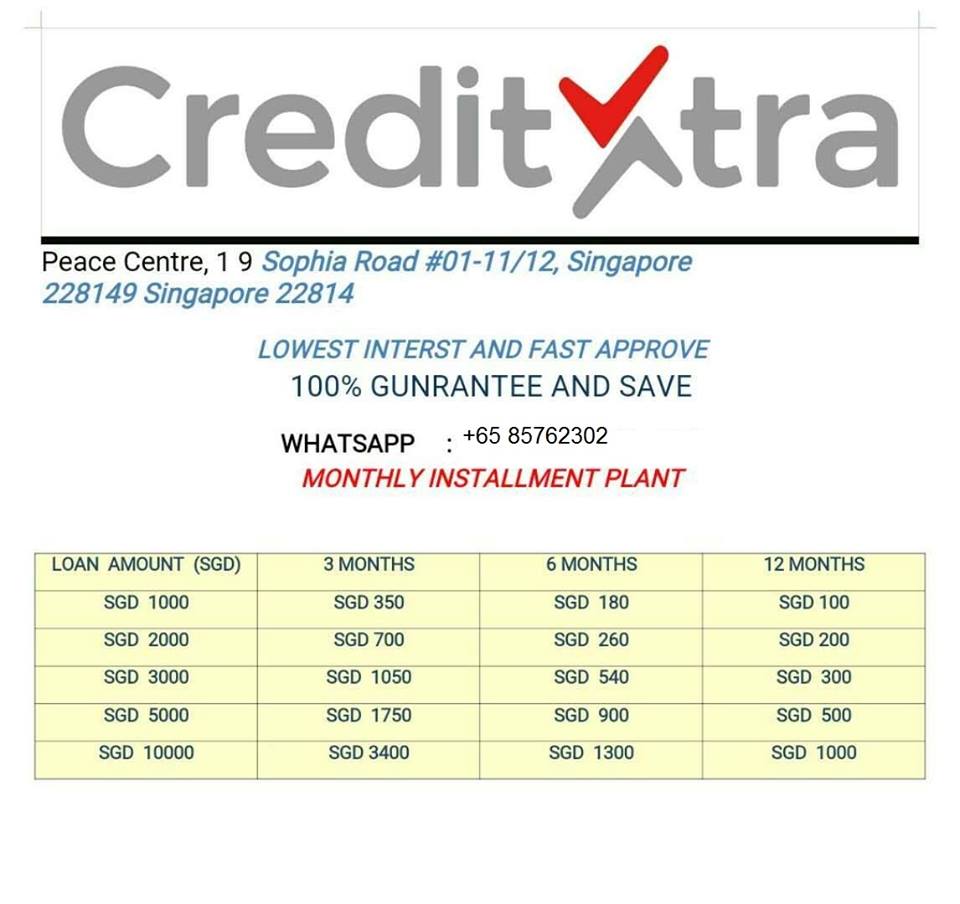

How To Save 29 In 29 Months – How To Save 3000 In 3 Months

| Delightful in order to the weblog, with this period I will show you about How To Factory Reset Dell Laptop. And today, this can be the primary image:

How about graphic preceding? is usually of which amazing???. if you think therefore, I’l t provide you with several picture yet again under:

So, if you want to secure these magnificent photos about (How To Save 29 In 29 Months), click on save link to store the photos to your personal computer. These are available for transfer, if you like and wish to have it, click save logo on the web page, and it will be directly down loaded in your laptop computer.} As a final point if you desire to secure new and latest image related to (How To Save 29 In 29 Months), please follow us on google plus or bookmark the site, we attempt our best to offer you daily update with all new and fresh pics. Hope you like keeping right here. For many up-dates and latest news about (How To Save 29 In 29 Months) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with update periodically with all new and fresh images, love your browsing, and find the best for you.

Thanks for visiting our website, articleabove (How To Save 29 In 29 Months) published . Today we’re delighted to declare that we have found an awfullyinteresting nicheto be pointed out, that is (How To Save 29 In 29 Months) Lots of people trying to find specifics of(How To Save 29 In 29 Months) and definitely one of them is you, is not it?