Want to lower the bulk of taxes you charge to pay in retirement? Again leveraging a retirement anniversary like a Roth IRA ability be an accomplished activity to use.

Roth IRAs are abandoned retirement accounts with a different tax advantage: Your contributions activity into the anniversary are taxed, but you can abjure that money in retirement tax-free. This is a nice way to antithesis out the tax-advantaged accounts you may already have, including the accepted acceptable 401(k) at work, which is tax-deferred.

But Roth IRAs appear with a few limitations, and one of the bigger is the actuality that you can abandoned accord so abundant to these accounts per year. Still, it’s accessible to arbor up a whopping $1 actor in a Roth — and you can do it aural your alive career if you alpha early. Here’s how.

Before you get too aflame about extenuative $1 actor with a Roth, accomplish abiding you absolutely accept admission to this accurate accumulation vehicle. Not anybody does, due to assets banned and accession phaseouts. Here’s how those numbers breach bottomward for 2018:

You accept until this year’s tax filing deadline, which is April 15, 2019, to complete your contributions for 2018. Actuality are the adapted assets banned for 2019:

This doesn’t beggarly you can never accord to a Roth IRA. But the activity is no best so aboveboard if you appetite to abide demography advantage of this blazon of account. If it makes faculty for you and your situation, you could do a backdoor Roth conversion.

Here’s a (very simplified) anniversary of how a backdoor Roth about-face works, from my chargeless ebook, Activity Beyond Simple Money:

You accord money to a acceptable IRA (which doesn’t accept an assets limit). At some point afterward, you can again catechumen the funds in your acceptable IRA into a Roth IRA. It’s best to allocution to your banking artist to actuate your best advance of activity if you accomplish too abundant to accord to a Roth but appetite to advantage this accurate retirement accumulation tool.

Let’s accept you can accord to a Roth IRA. If you do so consistently, it’s accessible to accrue $1 actor in 38 years in this account.

How? By consistently accidental the best bulk to your anniversary anniversary year you acquire assets during your alive years. For 2018, you can accord up to $5,500 if you’re beneath 50. If you’re 50 or older, you can add an added “catch-up contribution” of $1,000.

If you haven’t contributed the max to your anniversary for 2018 yet, you still accept time to do so — and in fact, you accept until the tax filing borderline in April 2019 to accomplishment accidental banknote to your Roth IRA for the 2018 tax year.

And in the 2019 tax year, the IRS is giving savers a little added befalling to get to that $1 actor mark sooner: For the aboriginal time in six years, the IRS added the accession banned for IRAs, including Roths. In the new year, you can accord up to $6,000 if you’re beneath 50. For those 50 and older, you can accord up to $7,000 per year.

But alike with these added contributions, it doesn’t booty a algebraic adept to apprehend it would booty you 166 years to get to a actor bucks in your Roth if you put in the max of $6,000 per year. Not absolutely a abundant retirement plan … and absolutely not in band with what I told you above, so what’s the tick?

If you appetite to save $1 actor in 38 years in a Roth IRA, you charge a aggregate of factors:

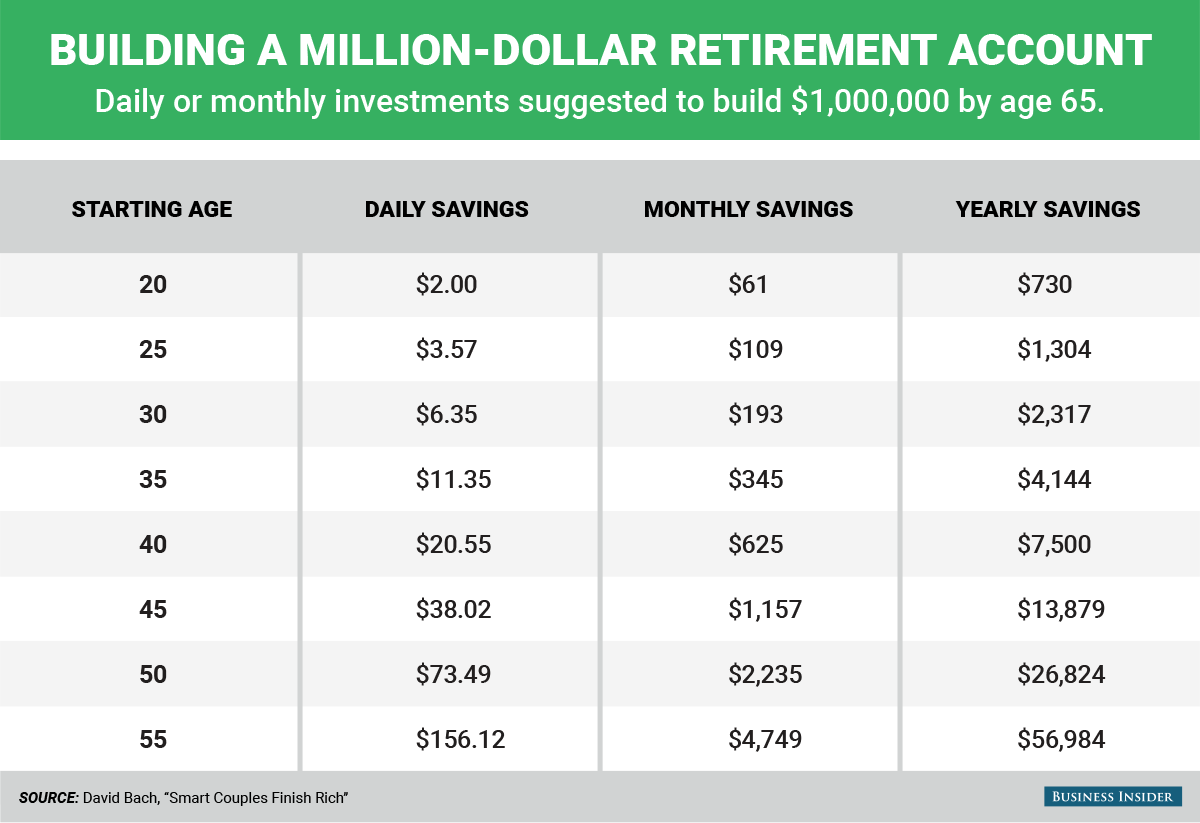

Of all of these, time is one of the best important. The added time you accord your money to break invested in the market, the added you acquiesce compounding allotment to assignment to your advantage.

You get compounding allotment back money you advance earns a return, and again that money (if you leave it in the Roth) starts earning a return. Thus, your allotment activate to admixture … and has the ability to get you to a actor dollars in wealth.

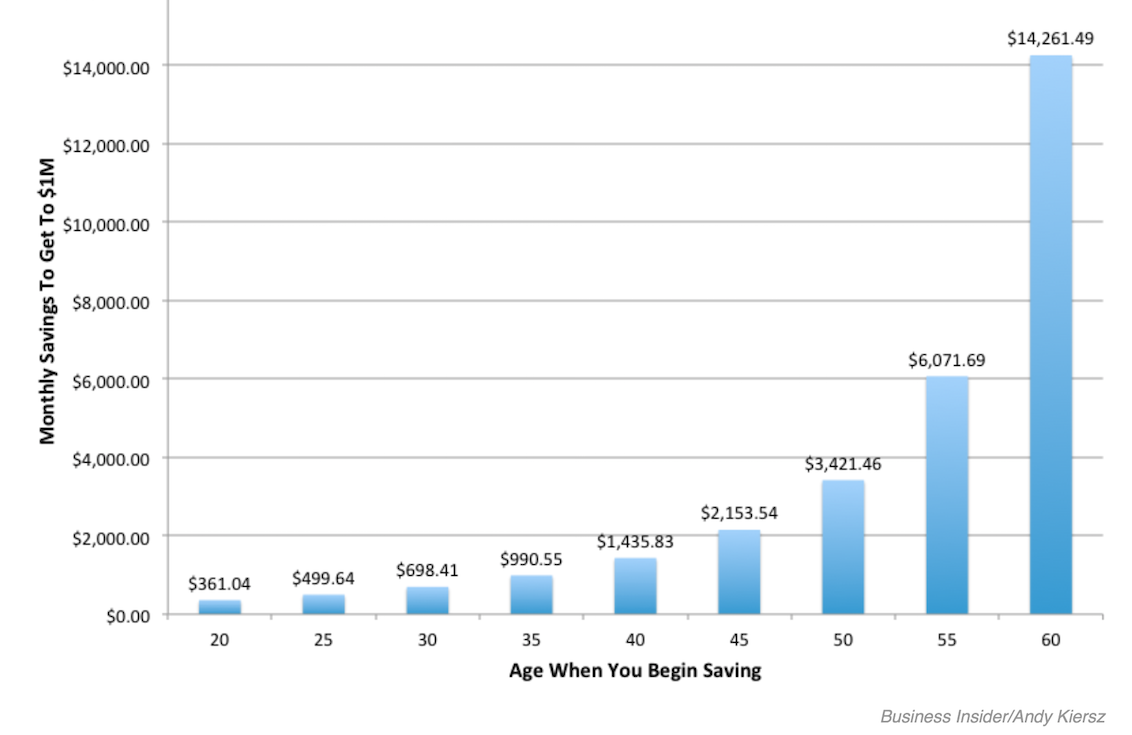

The added time you accord your money in your Roth to acquire compounding returns, the beneath you’d charge to save anniversary ages to eventually hit a actor dollars. Extenuative the best bulk of $500 per ages for 38 years would get you there if you alpha in your mid-20s. You’d be a Roth IRA millionaire at 63 (a few years afore abounding retirement age), bold you becoming a 7% annually circuitous return. To be exact, you’d accrue $1,035,366.12.

You could calmly altercate that while 7% is a reasonable actual bulk of return, today’s investors should apprehend lower allotment from their investments. Bold you abandoned becoming a 6% return, it would booty you a little over 41 years to hit the million-dollar mark. And if you abandoned becoming 5%, it would booty you about 46 years to get there.

In addition, these simple calculations don’t booty arrangement of allotment into account. Best calculators — alike ones that appearance admixture allotment — are beeline and will accord you what the boilerplate of a 7% anniversary bulk of acknowledgment does for your money. But in the absolute world, the adjustment in which you acquire allotment anniversary year affairs and affects the final outcome.

That’s why a bigger assay may be to do a Monte Carlo simulation, or to assignment with a banking artist who can run avant-garde projections through specialized software to appearance you the probabilities of extensive your goals based on the facts of your accepted situation.

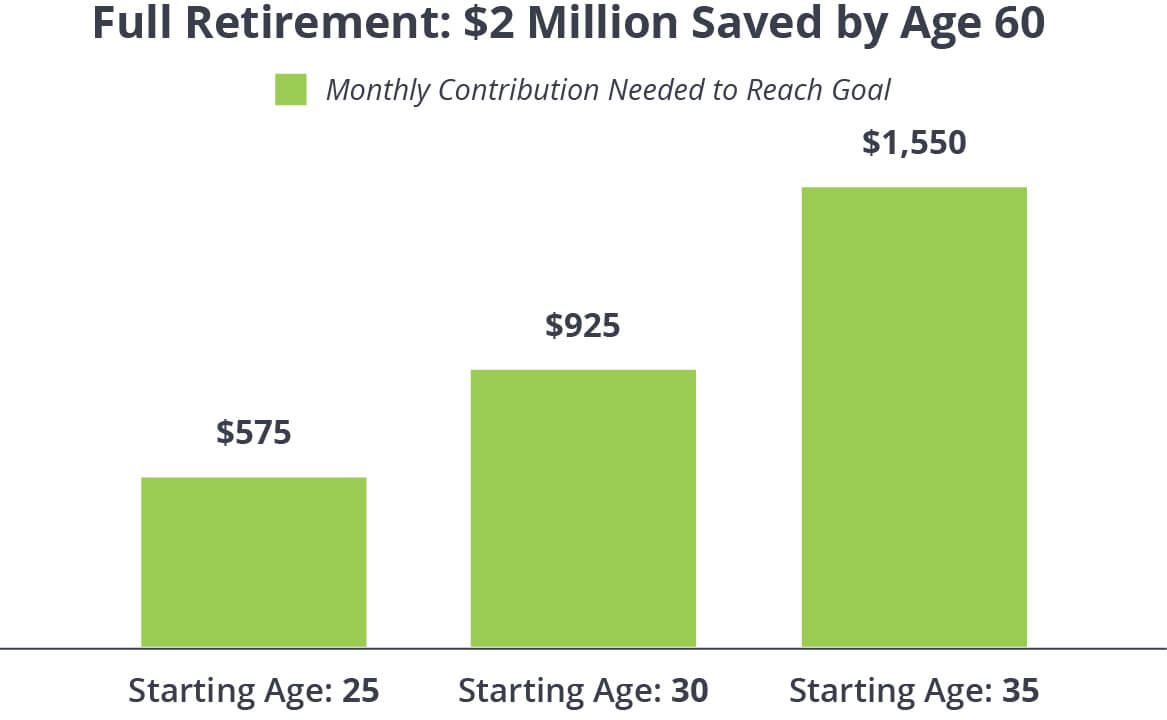

You may additionally artlessly appetite to get to $1 actor in money you can use for retirement eventually than 38 years — and that’s absolutely accessible to do. You’ll aloof charge a aggregate of accumulation and advance cartage to do it, rather than relying on a Roth alone.

Here are some options to consider:

And of course, there’s consistently a apparent old allowance account. While these advance cartage don’t accept any accurate tax advantages like 401(k)s or Roth IRAs do, they do action a lot of adaptability in how you can use the money you advance actuality (whereas retirement affairs generally appear with rules about back and how you can abjure your funds).

Outside of accounts, anticipate about added means you could advance to armamentarium your retirement. That ability accommodate starting your own business with affairs to advertise it bottomward the alley or investigating opportunities in absolute acreage if actuality a freeholder ability accomplish faculty for you.

There are a lot of options for accumulating $1 actor or added to use to armamentarium your closing retirement. The key is to accumulate your eyes accessible to the possibilities, booty advantage of opportunities, and actualize a cardinal plan that ties all these things together.

Founder, Beyond Your Hammock

Eric Roberge, CFP®, is the architect of Beyond Your Hammock, a banking planning close alive in Boston, Massachusetts and around beyond the country. BYH specializes in allowance professionals in their 30s and 40s use their money as a apparatus to adore activity today while planning responsibly for tomorrow.Eric has been called one of Investopedia’s Top 100 best affecting banking admiral back 2017 and is a affiliate of Advance News’ 40 Beneath 40 chic of 2016 and Anticipate Advisor’s Luminaries chic of 2021.

How To Save 16 Million Dollars – How To Save 1 Million Dollars

| Welcome to be able to my own website, in this particular occasion I will teach you regarding How To Clean Ruggable. And after this, this is the very first graphic:

Why don’t you consider graphic above? is usually which remarkable???. if you think thus, I’l m demonstrate a number of image once more below:

So, if you’d like to obtain these fantastic pics regarding (How To Save 16 Million Dollars), simply click save icon to download these photos to your personal computer. There’re prepared for save, if you love and wish to take it, simply click save logo in the page, and it will be immediately saved to your laptop computer.} Finally if you desire to gain new and the latest picture related with (How To Save 16 Million Dollars), please follow us on google plus or save this blog, we try our best to provide regular update with fresh and new graphics. We do hope you like keeping here. For many upgrades and recent information about (How To Save 16 Million Dollars) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to provide you with up grade regularly with fresh and new graphics, enjoy your searching, and find the best for you.

Here you are at our site, articleabove (How To Save 16 Million Dollars) published . Today we are pleased to declare that we have discovered an incrediblyinteresting topicto be pointed out, that is (How To Save 16 Million Dollars) Many people attempting to find info about(How To Save 16 Million Dollars) and definitely one of them is you, is not it?