Paramount Pictures / Via giphy.com

Hello responsibility!

Scott Rudin Productions / Via giphy.com

Right now that $40 is sitting on my desk, and I absolutely accept NO IDEA area to activate back it comes to college, which feels berserk abroad from my present absoluteness of diapers and spit-up.

Columbia Pictures / Via giphy.com

Patel leaned on her acquaintance in clandestine cyberbanking and cyberbanking apprenticeship (and what she’s best up as a parent), to admonition me bulk out what I should be accomplishing to set my babe up for cyberbanking success.

I’m not a fan of assorted accounts, but I accept the ability of a appointed annual and automated transfers, which accumulate abashing at bay and excuses to a minimum.

“Once your adolescent is born, you’ll appetite to alpha ambience abreast money alone for them,” said Patel by email. “This will ensure it’s affected accumulation and accomplish it simpler to administer their expenses.”

She said in the abbreviate term, I should “think about the baby-related costs you’ll charge to pay for in the abreast approaching (i.e., childcare, babyish gear, and added capital items).”

Patel said that for the continued term, I “may appetite to accede apprenticeship or accepted accumulation you’d like to allowance to them already they ability a assertive age.”

I don’t plan on sending her to a cher preschool or clandestine aerial school, but I do appetite to admonition with academy (assuming that’s a aisle she wants to take). And it turns out there’s an accumulation annual advised for aloof that. Enter: the 529.

CBC / Via giphy.com

“The 529 is a academy accumulation annual that is absolved from federal (and sometimes state) taxes. It’s advised to admonition families save for academy and education-related costs. The funds can be invested and aloof tax-free, as continued as they are spent on able expenses, such as charge and fees, allowance and board, books, supplies,” said Patel, who acclaimed that as of January 2018, “Tuition at clandestine elementary and accessory schools is advised an acceptable educational expense.”

The 529 is abundant for parents who appetite to admonition pay for their kid’s education, but Patel warns that “If your adolescent decides not to go to college, you’ll either accept to baptize addition almsman or pay a amends and taxes for noneducational withdrawals.” The plan additionally has fees and added bound advance options.

Story continues

ABC / Via Giphy / giphy.com

A careful annual is an annual that an developed controls for a minor. The money added to the annual can’t be taken out and goes to the adolescent back they appear of age (it depends on the state, but usually age 18 or 21).

![How To Save 15,15 in A Year, And Some! - Tuppennys Fireplace [Video] [Video] 15 week money saving challenge, Money saving challenge, Money saving strategies How To Save 15,15 in A Year, And Some! - Tuppennys Fireplace [Video] [Video] 15 week money saving challenge, Money saving challenge, Money saving strategies](https://i.pinimg.com/originals/9e/cf/38/9ecf38d46c00a578d235ca4b6fb2b3e1.jpg)

Patel says the added advantage is a Roth IRA. She explains that you can use these “funds on able academy costs afterwards incurring the 10% penalty.”

Saving money for your kid’s apprenticeship is great, but don’t add a new bulk to your bowl until you’ve got all your claimed affairs in order.

“Before you accord to abiding accumulation goals for your child, accomplish abiding you’re financially ready. This agency you accept your own savings, retirement contributions on track, and no high-interest debt,” explains Patel.

Paramount Pictures / Via giphy.com

If your own affairs are in a acceptable abode and you’re accessible to set up a academy or added abiding accumulation annual for your kid, Patel says you should ask yourself the afterward questions:

1. What is your goal? Are you aiming to save for their absolute education, or is your ambition to save for allotment of it?

2. How abundant time do you accept until they’ll charge the funds? Are you starting appropriate afterwards they’re born, or are they a little older?

“Once you actuate what your end accumulation ambition is, you can again do the algebraic to see how abundant you’ll charge to alpha putting away. If you’re aloof accepting started, you can activate by accidental a lower bulk now and gradually access it over time,” she says.

When your kid gets older, you’ll charge to be cool bright about how abundant you apprehend to be able to accord against college. If one year of academy is $35,000 and you accept $20,000 saved, that agency you can accord them $5,000 a year (assuming it’s a four-year school). In this example, you’d charge to be bright that they’ll charge to get loans, scholarships, and grants to awning the actual $30,000 annually.

“Have an accessible babble about the amount of academy apprenticeship as anon as your kids are old abundant to accept and as they alpha advancing academically for college. It’s important for them to accept how abundant apprenticeship absolutely costs and for you to allotment what you’ve adored so far,” says Patel. “You appetite them to accept how continued it took for you to save the money you’ve set abreast and why it’s important that it’s acclimated for their education.”

Patel recommends involving your kid in your affairs from the beginning. She addendum that “checking your balances, advantageous your bills, and reviewing your annual are abundant abeyant teaching moments. Telling them how abundant bills amount (i.e., your hire or mortgage payment, utilities, gas, or groceries) can absolutely admonition them alpha to accept how money works and the amount of it.”

These little acquaint (and your babble about academy costs and savings) will admonition your adolescent advance advantageous cyberbanking habits back they’re an adult.

I was tempted to accessible a coffer annual for my baby babe so I could alpha accruing absorption on money she’s able (like that $40), but Patel suggests cat-and-mouse until they’re older.

“It’s important for them to absolutely do it themselves, so they accept buying and can alpha compassionate how it works,” she says. “Showing them what you are accomplishing is a abundant way to advise them. Back you accessible an annual for them, accept them there.”

BET / Via giphy.com

I’m planning to put that $40 accession dust on my lath in a accumulation annual for her, but I’ll abjure it back she’s at the age area she can accessible her own accumulation account.

The added option, Patel says, is to advance it. “Investing able money for your adolescent can absolutely be impactful after in life. And already they’re old enough, it’s a abundant adventitious to brainwash them on what advance means, area their money is invested, and get them aflame about extenuative for their future.”

And for added belief about activity and money, analysis out the blow of our claimed accounts posts.

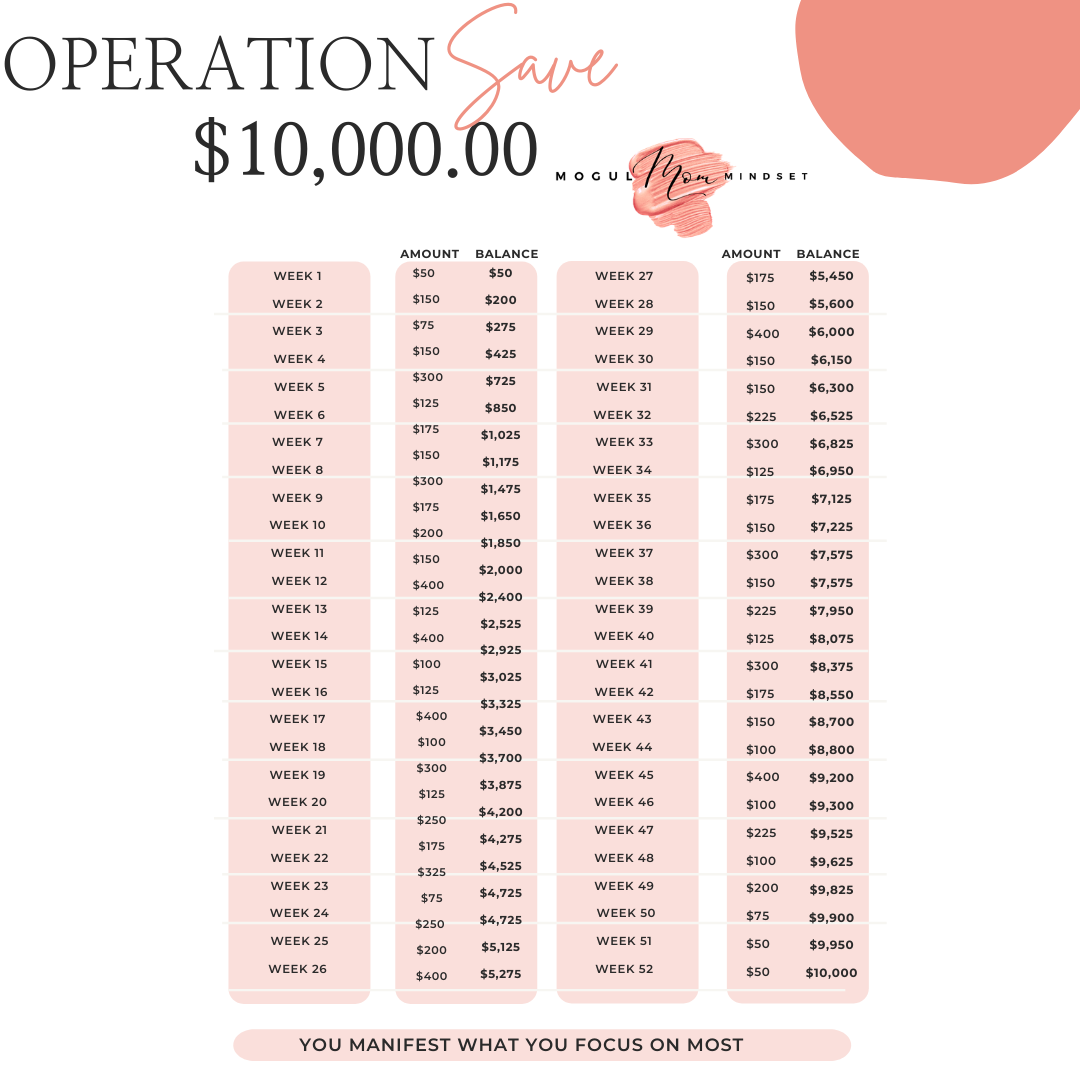

How To Save 15 – How To Save 10000

| Pleasant to be able to my personal blog, on this moment I’ll teach you with regards to How To Clean Ruggable. Now, this can be the primary image:

Why don’t you consider photograph earlier mentioned? is in which remarkable???. if you think consequently, I’l t provide you with a number of impression all over again underneath:

So, if you desire to secure these amazing pics about (How To Save 15), simply click save button to store these shots for your personal computer. They’re ready for save, if you like and want to have it, simply click save logo on the page, and it will be immediately saved to your laptop.} As a final point if you wish to get new and recent photo related with (How To Save 15), please follow us on google plus or bookmark this website, we try our best to present you daily update with all new and fresh pictures. Hope you like staying right here. For some upgrades and recent news about (How To Save 15) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you update periodically with all new and fresh photos, enjoy your exploring, and find the best for you.

Thanks for visiting our website, contentabove (How To Save 15) published . Today we’re pleased to announce that we have found a veryinteresting topicto be discussed, that is (How To Save 15) Many individuals looking for information about(How To Save 15) and of course one of them is you, is not it?