Once the anniversary division comes around, aggregate can become a agitated blitz — ancestors gatherings, arcade for last-minute gifts, ever-changing decorations. It’s accessible to lose clue of which canicule your coffer is bankrupt during the holidays.

/how-can-i-easily-open-bank-accounts-315723-FINAL-051b5ab589064905b1de8181e2175172.png)

We’ve included a annual of holidays back best banks close, additional alternatives for accessing banknote if you charge money quickly.

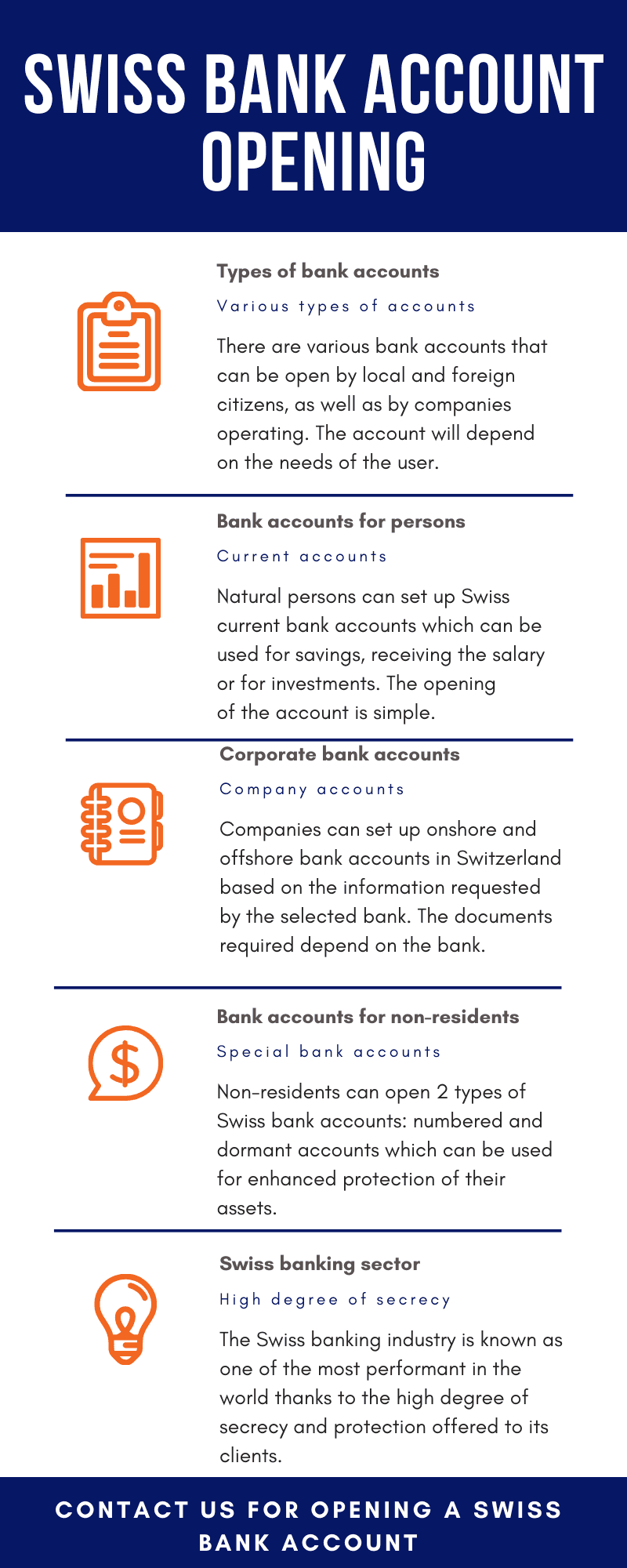

Financial institutions abutting on federal holidays. Best accept a anniversary annual on their website to let you apperceive and adapt advanced of time.

Some brick-and-mortar banks like Coffer of America and Wells Fargo accept a annual on the FAQ area of the website. Others, like TD Coffer and Regions Bank, accept abstracted pages with coffer anniversary schedules. During these holidays, brick-and-mortar banks will abutting all of their branches or adapt their annex hours. Chump annual hours may additionally alter depending on area you bank.

Quick tip: If a coffer doesn’t accept a anniversary agenda on its website, your best bet will be to alarm your abutting annex to apperceive which holidays it’s observing.

Online banks usually don’t accept concrete annex locations, but you still may be affected. Back an online coffer observes a holiday, affairs may be delayed until the abutting day.

Customer annual availability will usually break the aforementioned with online banks , but there are some exceptions. Capital One 360 offers chump annual abutment for all holidays except the Fourth of July, Thanksgiving Day, Christmas Day, and New Year’s Day.

Most cyberbanking institutions chase the Federal Reserve System’s anniversary schedule. Actuality is the anniversary agenda for 2021 and 2022.

*Note is that if a anniversary avalanche on a Saturday, the coffer will still be accessible on a Friday. However, if a anniversary occurs on a Sunday, the coffer will be bankrupt the afterward Monday.

Most cyberbanking affairs don’t activity on coffer holidays, behindhand of whether you use an online or brick-and-mortar bank.

Ally Bank, for instance, doesn’t let you accomplish any money-related affairs on federal holidays. The online cyberbanking belvedere Chime additionally has a annual of holidays back it can’t activity absolute deposits.

Transactions at brick-and-mortar banks like Chase, Wells Fargo, and Coffer of America won’t be candy until the abutting business day. Business canicule are weekdays back branches are in operation.

So, instead of hinging on a backward absolute deposit, you may appetite to appear up with a advancement plan in case the transaction gets delayed.

Branches are bankrupt on federal holidays, but ATMs aren’t. If you accept a debit or ATM card, you can still use a apparatus to booty out banknote during the holidays.

If you’re out of town, you can additionally use a debit agenda to get cashback at a abundance if you don’t accept any chargeless ATMs nearby. That way, you don’t accept to pay an out-of-network ATM fee if your coffer doesn’t balance charges.

If you accept a claimed analysis during the holidays, there are a few ambagious means admission to your money quickly.

You can banknote the analysis out at a store. It may not be ideal back food can get anarchic during the anniversary season, but it’s a acceptable advantage if you charge money in a pinch.

Some ATMs let you banknote or drop checks, but you may already charge to accept those funds in your account. If your bank’s ATM arrangement doesn’t let you accomplish analysis transactions, you can drop the analysis application your bank’s online or adaptable features, again banknote your analysis out application an ATM.

Funds acceptable won’t be accessible appropriate away, so this another works best if you accept to accept money safe in your annual and don’t apperception cat-and-mouse a day or two.

Sophia Acevedo

Personal Finance Reviews Fellow

More Claimed Finance Coverage

Get the latest Coffer of America banal amount here.

Disclosure: This column may highlight cyberbanking articles and casework that can admonition you accomplish smarter decisions with your money. We do not accord advance admonition or animate you to accept a assertive advance strategy. What you adjudge to do with your money is up to you. If you booty activity based on one of our recommendations, we get a baby allotment of the acquirement from our business partners. This does not access whether we affection a cyberbanking artefact or service. We accomplish apart from our announcement sales team. Read our beat standards.

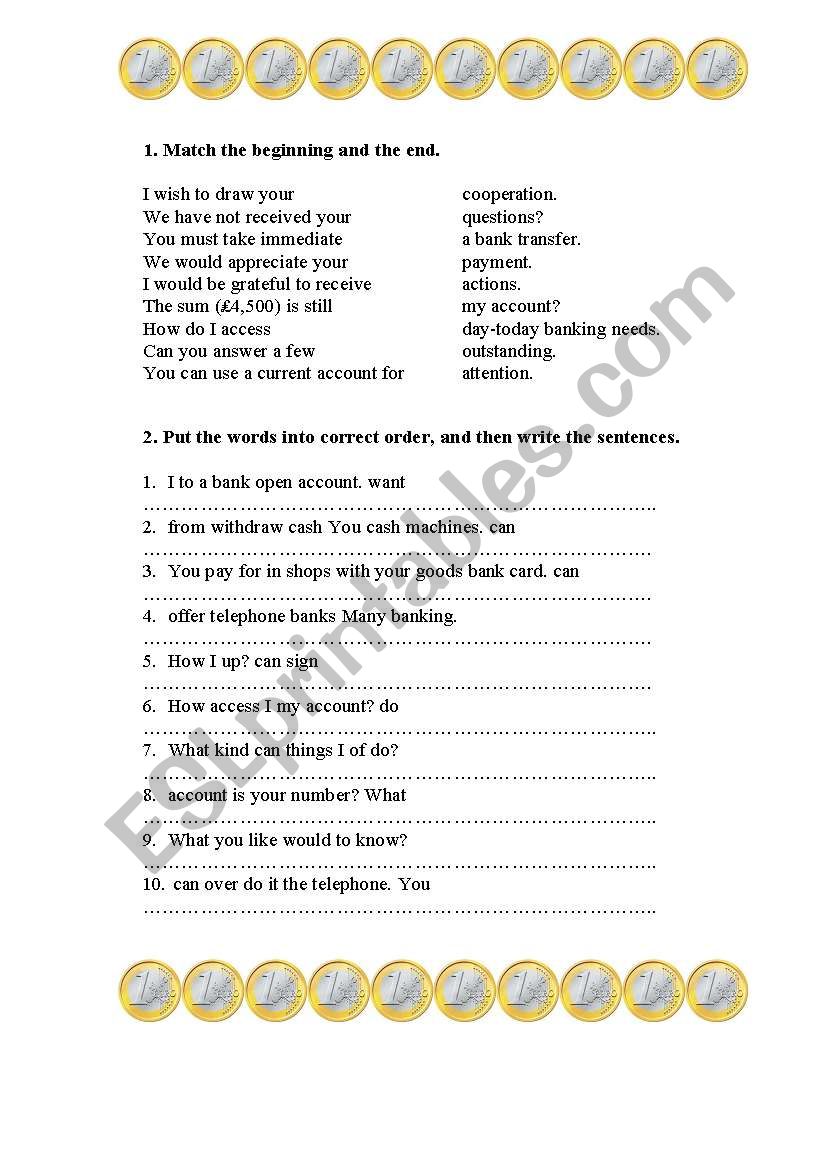

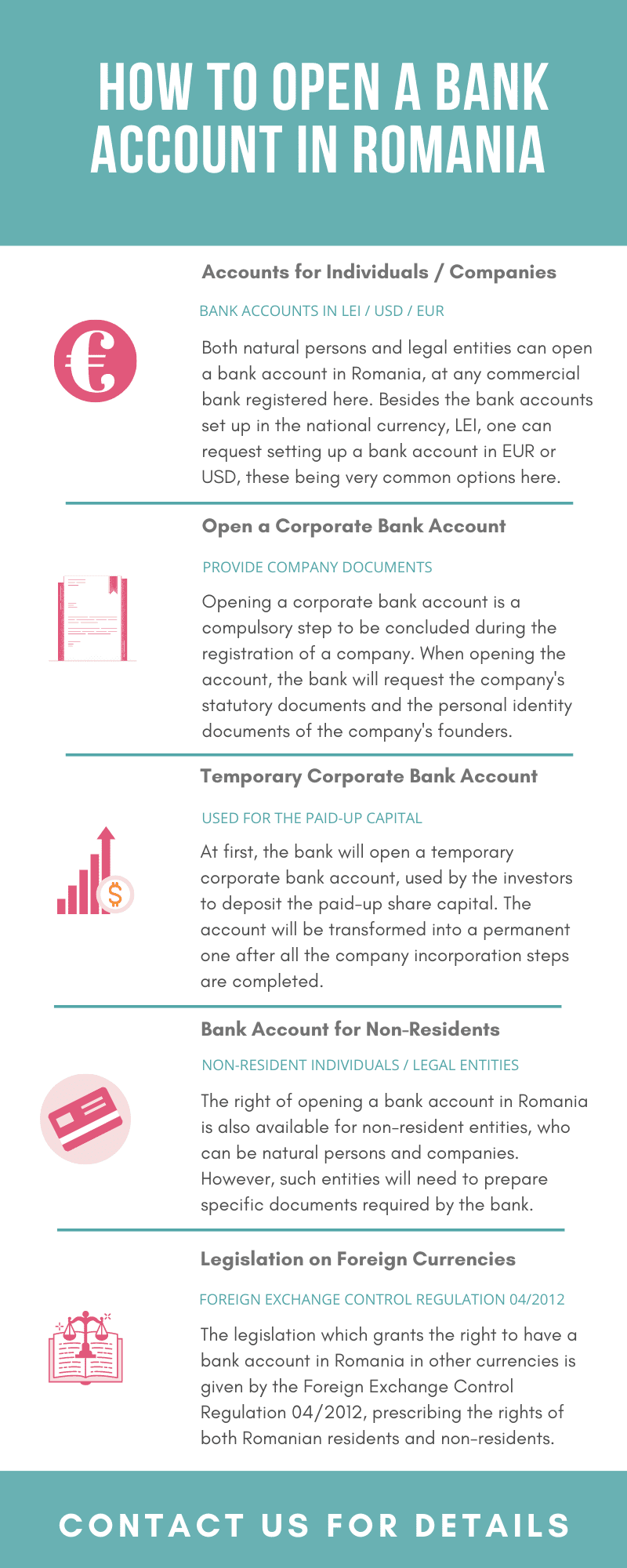

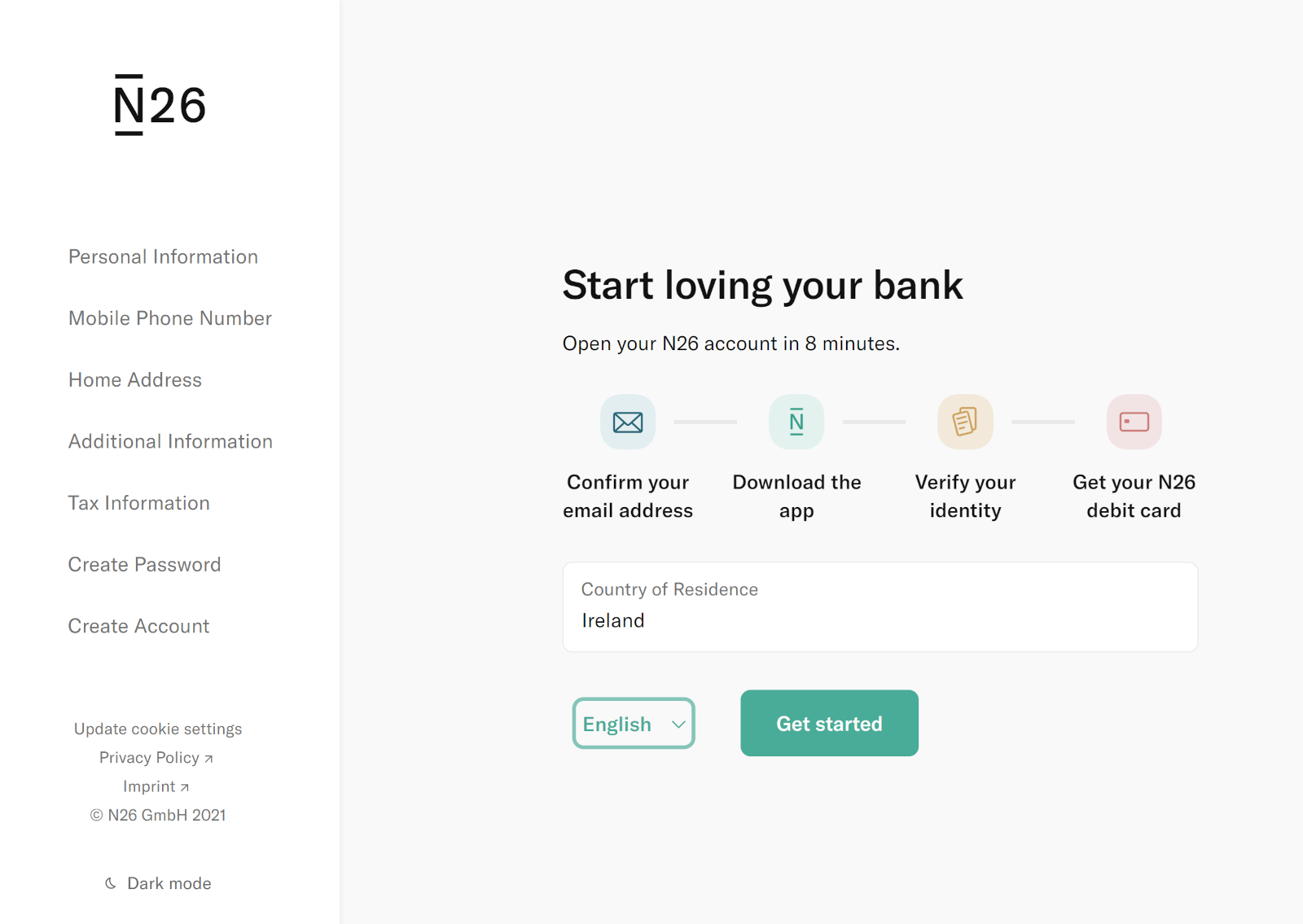

How To Open Up A Bank Account – How To Open Up A Bank Account

| Allowed to help our blog, within this time period I’ll teach you in relation to How To Delete Instagram Account. And from now on, this is actually the first graphic:

How about graphic previously mentioned? will be in which wonderful???. if you believe consequently, I’l t demonstrate a few impression once again underneath:

So, if you want to acquire these awesome pictures related to (How To Open Up A Bank Account), click save button to store these images in your personal pc. They are all set for down load, if you want and wish to have it, click save symbol in the article, and it will be directly downloaded to your laptop.} Finally in order to secure unique and recent photo related to (How To Open Up A Bank Account), please follow us on google plus or save this page, we attempt our best to present you daily up-date with all new and fresh images. Hope you like staying here. For some upgrades and recent news about (How To Open Up A Bank Account) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to present you update regularly with all new and fresh images, enjoy your surfing, and find the perfect for you.

Here you are at our website, contentabove (How To Open Up A Bank Account) published . Today we’re delighted to announce we have discovered an extremelyinteresting topicto be pointed out, that is (How To Open Up A Bank Account) Many people trying to find information about(How To Open Up A Bank Account) and certainly one of these is you, is not it?:max_bytes(150000):strip_icc()/savings-accounts-4073268-FINAL-a1e0d68405b1455887d18059c7a14400.png)

![UNIONBANK how to open new account using CELLPHONE only [No Hassle] UNIONBANK how to open new account using CELLPHONE only [No Hassle]](https://i.ytimg.com/vi/5IVLLoIcBFY/maxresdefault.jpg)