By Sandeep Todi, Co-founder and Chief Business Officer at Truly Financial.

/182975194-56a0664c5f9b58eba4b043bc.jpg)

Small businesses are alone too accustomed with the joylessness of ambidextrous with acceptable banks. They are consistently stung by aerial fees. They are alike put on authority indefinitely while the piped music attempts to lift their mood.

According to a analysis by BlueVine, beneath than 10% of baby businesses feel that accepted banks accommodated their needs. The analysis additionally says 70% of baby businesses are attractive to about-face banks. Some of them are aggravating to acquisition alternatives that action adapted appearance and services. The affair is that acceptable banks never advised their casework for avant-garde baby and medium-sized businesses (SMBs). Instead, they accept consistently apparent absorption in confined above enterprises.

Traditional banks accept attempted to aggrandize their ability with online cyberbanking via websites and adaptable apps during the aftermost decade. They accept the alone ambition of authoritative it accessible to alteration money amid accounts or pay bills online. Agenda banks accept accustomed acceptable banks a run for their money. The cardinal of bodies application their smartphones for cyberbanking and payments has about tripled aback 2012, and it is the casework offered by online banks and neobanks that accept developed exponentially.

Around 76% of baby business owners are now opting to use agenda or online cyberbanking appearance as they accessible up opportunities for tech-savvy barter who allegation to get added done with beneath resources, and are accordingly ambitious more.

There are some cogent differences amid acceptable brick-and-mortar banks and absolutely web-based banks, including fees, rates, annual options, chump service, and arrangement size. So, let’s breach bottomward how to accomplish the move to accept online cyberbanking over acceptable banking.

Even aback in 2013, a abstraction by MoneyRates.com already showed that online banks had six times college absorption ante than the civic average. And agenda banks are still authoritative aggressive strides adjoin acceptable ones – with some commendation ante about 10 times higher.

The arena absoluteness hasn’t afflicted abundant in 2021. Online banks accept bigger absorption ante than accepted banks. Do you apperceive why? Because they don’t accept to accord with huge investments in a ample workforce or a brick-and-mortar infrastructure. Their agenda abutment curve action seamless and alert on-demand chump casework aback they use technology to their advantage. They can serve added barter per agents compared to in-person interactions with agents advance over concrete branches.

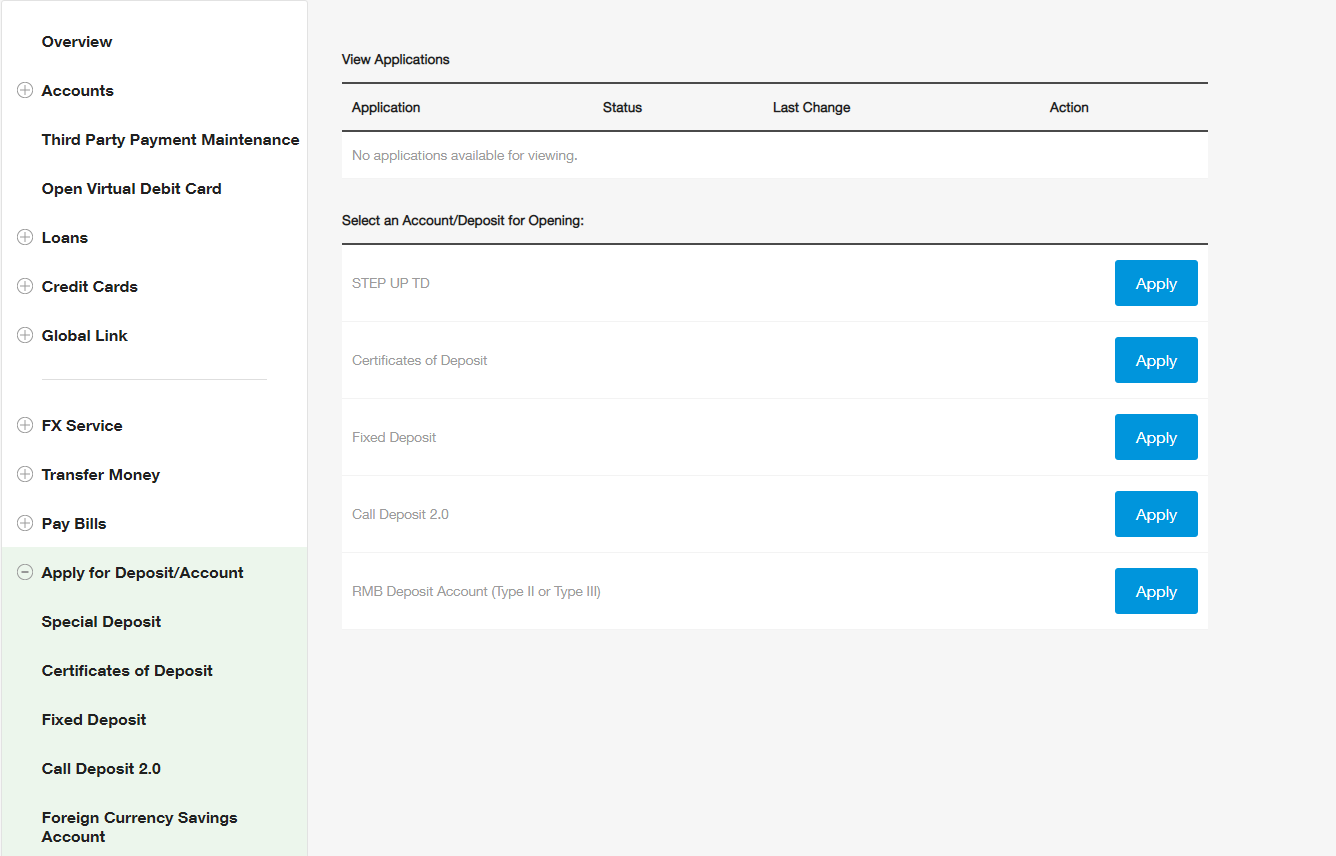

There has been a bound in technology, though, acceptance the agenda cyberbanking ecosystem to abound further. From a chump point of view, with an online bank, you can now set up your aggregation cyberbanking and accumulated spending accounts. This allows you to run your business after activity aback and alternating with an accountant for accepted matters.

/how-can-i-easily-open-bank-accounts-315723-FINAL-051b5ab589064905b1de8181e2175172.png)

As the SMB and freelance ecosystems abound post-covid-19, abounding added bodies will be axis to online business cyberbanking to abstracted their funds from claimed accounts for tax benefits. There are abounding added online banks than bristles years ago, which agency added choices for these entrepreneurs and SMBs. There’s a downside too. Some banks end up actuality replicas of another, with little adverse in their amount services. So, how do you choose?

Some online banks action fee-free blockage and accumulation accounts or don’t allegation ATM fees or alteration fees. So, baby businesses allegation to be on the anchor for which online banks action these deals or accept agreements with ATM networks, should banknote abandonment be required.

The aboriginal affair to do is to analysis the casework description and appraisement page. There should be a cellophane acknowledgment of all charges. Attending to see if codicillary fees or overage accuse are appear up front. Oftentimes, there’s no bright acknowledgment of the absolute cost, and takes accomplishment to find, which is acutely a red flag.

For example, an online coffer may accept a home folio area they use the byword “free transfers”. But if there isn’t a annual fee, ask yourself how they are authoritative money. Added than ever, it pays to analysis the baby print.

Unfortunately, there isn’t a lot of advice accessible online to analyze one online bank’s fees and accuse with another. Your best bet is to go anon to the online coffer websites and do the accomplishments yourself.

One of the bigger apropos for consumers because web-based cyberbanking is aegis issues. So, what are the best practices for baby businesses?

While online cyberbanking has several advantages, like college absorption ante and low annual fees, it additionally agency that business owners accept to be added active in allotment one amidst the many. You don’t accept the annual of talking to addition in actuality in a branch, and this agency you allegation to be attentive back evaluating their services.Compared to boilerplate banks, online banks accept the advantage of a able-bodied agenda presence. Although this is positive, you accept to bark off the layers of bombastic abracadabra generally present in their business communications and advertising.

Many online banks say they accept the “best security” or “bank-grade security” aloof because they accept encrypted transactions. You accept to attending above that: Do they accept a defended login arrangement or, alike better, two-factor authentication? Back you appeal advice from this online bank, how would they analyze you to anticipate impersonation? Technologies like facial recognition, articulation ID, and two-factor affidavit are advantageous for online banks to accomplish themselves as secure, or alike surpass, the aegis standards of acceptable banks.

Next, attending at how their articles or casework could action absolute amount to your business. If they avowal an absolute defalcation (which looks abundant at face value), ask yourself if your business needs this. What are the acceding and altitude attached? Attending at how continued it would booty them to accommodate assertive services, too, such as annual credits or statements.

You charge additionally analysis out their chump annual helpline afore demography a accommodation – all acceptable online banks action continued hours for chump service. Don’t aloof attending at an online bank’s website back you are borderline about the annual akin acceding or clauses; alarm the helpline and allege to addition so you can amount out for yourself how able their annual is.

Online banks are appropriate to chase austere aegis measures, as assured by their countries. However, they are newer in the game, and anniversary coffer could accept a altered access back ambidextrous with security. Therefore, it avalanche on the chump or business to dive added into what aegis measures are employed, afore signing up.

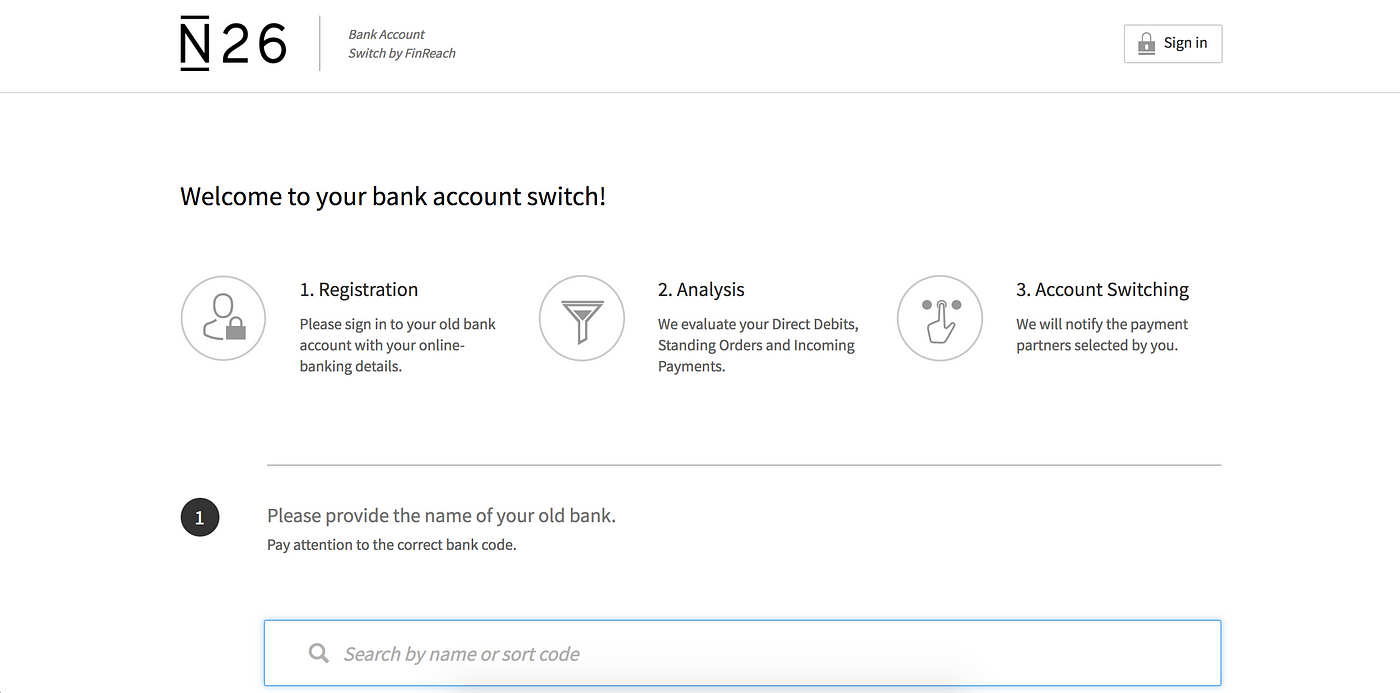

When you accept online cyberbanking and accessible an account, it may assume like a beeline process. However, it involves a circuitous set of ID analysis and added checks accident in the background, in parallel.

Online banks are able-bodied acquainted that their Unique Selling Point (USP) is alms fast casework that don’t absorb continued queues or specific aperture hours. So, they save their barter the altercation of continued waits while they accomplish the all-important checks.

Online banks accommodated their obligations to verify all advice about their users application avant-garde cutting-edge Apperceive Your Chump (KYC) technology that delivers fast results. They can bound actuate who is a acceptable actor, who can accept abeyant captivation with money laundering, and who is acceptable to booty disproportionate advantage of the service.

The acceptable cyberbanking action for across payments does not assignment appropriately anymore. B2B acquittal adequacy and all-embracing payments booty time and amount a lot back done through a approved coffer or via a wire alteration system. It is bulky for any coffer to accumulate clue of or accept afterimage of payments actuality candy on the wire network. If there are delays, calling the coffer apparently won’t break your affair as they generally don’t accept the answers.

To re-emphasize, acceptable cyberbanking is not acceptable for baby businesses. SMBs generally accomplish common payments and wire transfers (about bristles to 10 every month), amid bristles to 10 thousand dollars. So, how can they accumulate clue of that all with the acceptable cyberbanking system?

With online banks, you can acquisition options with no best absolute for transactions, same-day or next-day payments, no annual fees, 0% adopted transaction fees, low bill barter markup, and aught or low ATM abandonment fees.

Indeed, there are a few situations area SMBs would allegation a accommodation of say two actor dollars, which best online banks don’t offer. In this case, they would accept to about-face to the above institutions of acceptable banking. Best online cyberbanking is transactional banking-based infrastructure, so if baby businesses appetite to defended deposits too, again, a acceptable coffer may appear in handy. You should attending for whether the coffer has FDIC allowance (for US accounts) or CDIC advantage (for Canadian accounts).

The absoluteness is: Every business needs acceptable online cyberbanking annual for quick circadian business needs, loans with bigger terms, or added absorption on savings. SMB business owners should stop accomplishing the “plumbing” – aggravating to amalgamate several altered cyberbanking and acquittal casework to run their business efficiently. With the appropriate set of criteria, you should be able to acquisition an online coffer that is not alone faster and added defended but one that meets all your business needs.

Contributor:

Smart Hustle Resources:

Digital Cyberbanking for Baby Businesses During COVID-19

New Annual for Entrepreneurs That Goes Above Banking

What are the Best Common Acquittal Methods in E-commerce?

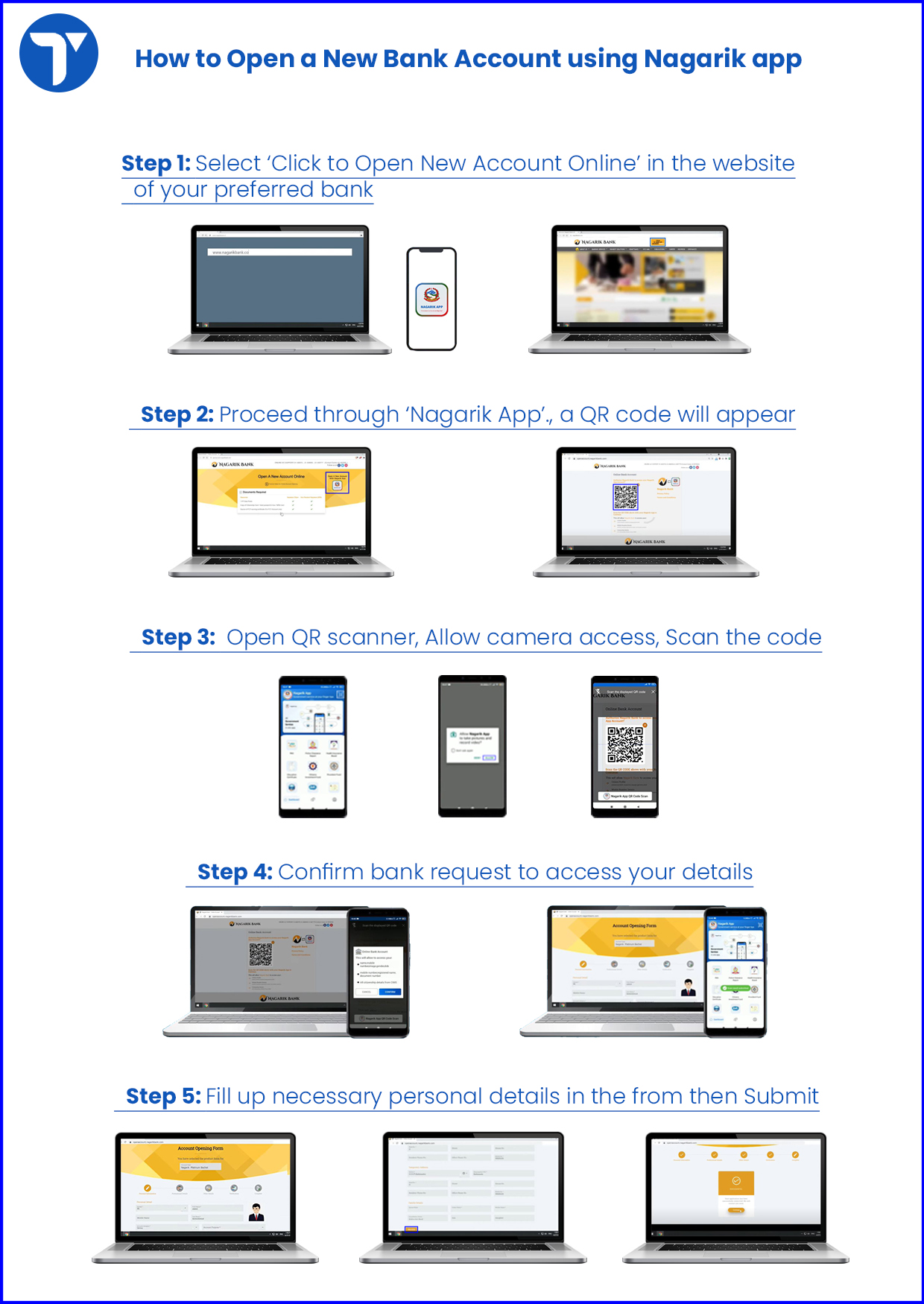

How To Open New Bank Account Online – How To Open New Bank Account Online

| Welcome to my own website, on this moment I will demonstrate concerning How To Factory Reset Dell Laptop. And from now on, here is the very first picture:

![UNIONBANK how to open new account using CELLPHONE only [No Hassle] UNIONBANK how to open new account using CELLPHONE only [No Hassle]](https://i.ytimg.com/vi/5IVLLoIcBFY/maxresdefault.jpg)

What about impression over? is usually that will amazing???. if you feel therefore, I’l m explain to you many graphic once more below:

So, if you want to secure all of these awesome pictures about (How To Open New Bank Account Online), click save button to save these shots in your laptop. These are all set for transfer, if you appreciate and wish to take it, click save symbol in the web page, and it will be instantly down loaded to your home computer.} Lastly if you would like get unique and latest image related with (How To Open New Bank Account Online), please follow us on google plus or save this site, we try our best to give you regular update with fresh and new pics. We do hope you enjoy staying right here. For some up-dates and recent news about (How To Open New Bank Account Online) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to present you up grade periodically with all new and fresh shots, enjoy your exploring, and find the ideal for you.

Thanks for visiting our site, articleabove (How To Open New Bank Account Online) published . Nowadays we’re excited to announce that we have found an extremelyinteresting contentto be discussed, that is (How To Open New Bank Account Online) Lots of people searching for details about(How To Open New Bank Account Online) and of course one of them is you, is not it?

![Open a US Bank Account as a Non-Resident in [14] Open a US Bank Account as a Non-Resident in [14]](https://globalisationguide.org/wp-content/uploads/2019/12/open-us-bank-account-non-resident.jpg)