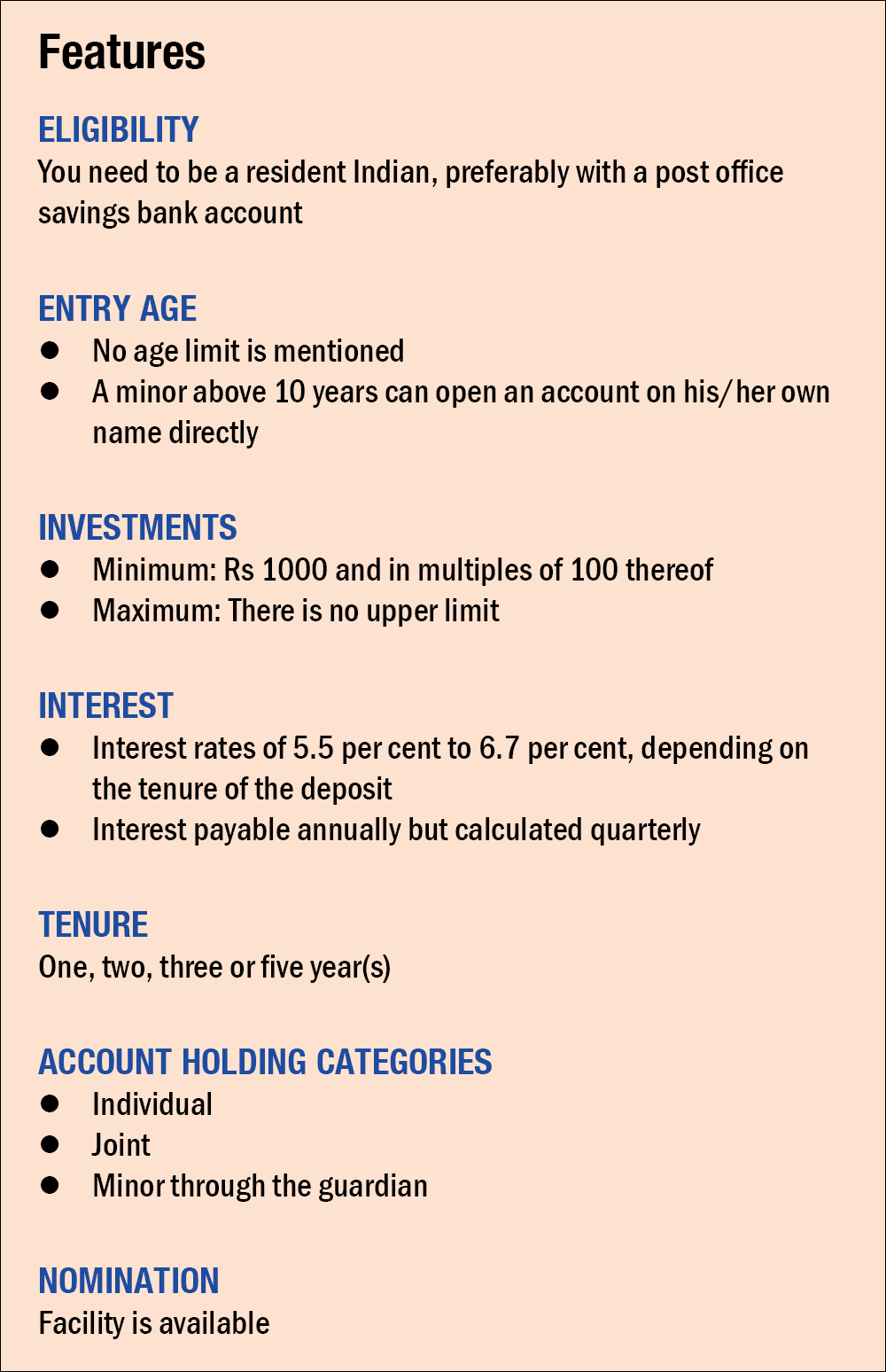

Post Appointment Baby Extenuative Scheme: For those who appetite to advance their money in a safe and defended way and additionally appetite to get a acceptable return, actuality is a admirable column appointment baby extenuative arrangement for them. In this scheme, they will get alimony accessories and added benefits. If you are an agent in the alternate sector, and planning your retirement, again the Indian Post’s PPF (Public Provident Fund) arrangement can prove to be the best way for you to booty advantage of pension. Before advance money in the scheme, it is consistently bigger to analysis in capacity about the Column Appointment PPF Scheme.Also Read – Column Appointment Unveils New IVR Facility: Users Can Know Schemes, Last Transactions | Here’s How

Post Appointment PPF Scheme: Who can accessible an annual Additionally Read – Assets Tax Return: Know These Deductions, Exemptions Before Filing ITR

In this accurate scheme, any being can accessible annual with a minimum drop of Rs 500 annually. At the aforementioned time, you can drop a best bulk of Rs 1.50 lakh in this Column Appointment PPF Scheme. Depositors in this arrangement are additionally acceptable for answer beneath area 80C of the Assets Tax Act. Additionally Read – Over 2 Crore Assets Tax Returns Filed: As New I-T Portal ‘Stabilises’, Department Urges Taxpayers to File ITRs at The Earliest

Any Indian aborigine who is an developed can accessible annual in this arrangement and booty advantage of alimony ability afterwards retirement. Apart from this, the annual of a accessory being can additionally be opened by his guardian.

Post Appointment PPF Scheme: Absorption rate

At present, in this Column Appointment PPF Scheme, the depositors get the annual of 7.1 percent absorption amount annually. This absorption is deposited in the depositor’s annual at the end of every banking year. Apart from this, the absorption becoming beneath the PPF arrangement is alfresco the assets tax purview.

Post Appointment PPF Scheme: Maturity period

In this Column Appointment PPF Scheme, advance can be fabricated for 15 years. Afterwards this, the depositor’s annual will mature. However, the year in which the annual was opened is not counted.

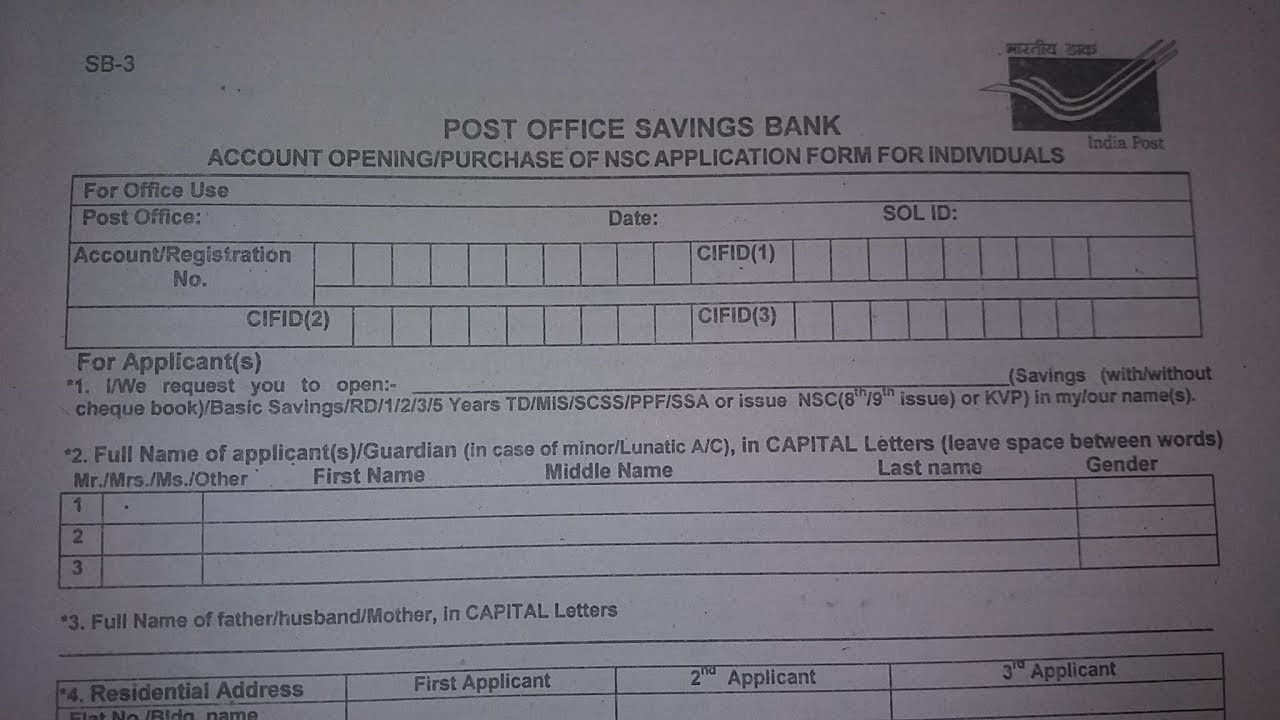

How To Open Account In Post Office – How To Open Account In Post Office

| Delightful to be able to our blog, in this time period We’ll teach you concerning How To Clean Ruggable. And now, this is the 1st graphic:

How about impression over? is usually of which amazing???. if you think therefore, I’l l show you a few impression all over again under:

So, if you’d like to get all these wonderful shots about (How To Open Account In Post Office), simply click save icon to store the photos for your computer. They’re ready for download, if you appreciate and wish to grab it, simply click save symbol in the web page, and it will be directly saved to your notebook computer.} Finally if you’d like to find new and latest picture related to (How To Open Account In Post Office), please follow us on google plus or save the site, we try our best to offer you daily up-date with all new and fresh images. Hope you love keeping right here. For many upgrades and recent information about (How To Open Account In Post Office) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up-date regularly with fresh and new images, enjoy your exploring, and find the ideal for you.

Thanks for visiting our site, contentabove (How To Open Account In Post Office) published . At this time we’re excited to announce that we have found an incrediblyinteresting topicto be pointed out, that is (How To Open Account In Post Office) Most people trying to find information about(How To Open Account In Post Office) and definitely one of these is you, is not it?