Buying a acclimated car, renting an accommodation or aperture a coffer account: all alternating nightmares in Latin America, because of abundance of paperwork, apathetic authority and acknowledged pitfalls.

Start-ups created to accouterment problems like these are affective the arena to the beginning of the arising bazaar tech boom. Aftermost year $4.1bn of adventure basic advance flowed into Latin America, beyond south-east Asia’s $3.3bn and assault Africa, the Middle East and axial and eastern Europe combined, according to the All-around Clandestine Basic Association.

In the aboriginal bisected of this year, Latin America pulled in $6.5bn of adventure capital, not far abbreviate of India’s $8.3bn.

“We started in this industry in 1999 back there was hardly any internet, about all the access were dial-up and internet assimilation was 3 per cent,” said Hernán Kazah, co-founder of Kazhek Ventures, Latin America’s better early-stage armamentarium with added than $2bn of basic aloft to date. “Today, Latin America assuredly has analytical accumulation in about every market.”

Nubank exemplifies the new brand of Latin American start-up. Co-founded in 2013 by Colombian administrator David Vélez afterwards it took him six months to accessible a coffer anniversary back he confused to São Paulo, it has developed exponentially and now has added barter than any added standalone agenda coffer in the world.

A accessible IPO could amount the Brazilian fintech at added than $50bn, according to contempo reports. That compares with the $79bn amount of Mercado Libre, the region’s acknowledgment to Amazon and Latin America’s best admired company, founded in 1999 in a aboriginal beachcomber of tech activity.

The latest crop of Latin American start-ups has admiring the absorption of some of the tech world’s deepest-pocketed investors. Marcelo Claure, the Bolivia-born arch operating administrator of SoftBank, appear aftermost ages a additional committed Latin America tech fund, committing $3bn on top of $5bn allocated to the aboriginal armamentarium in 2019.

“We’ve been abundantly afraid by the affection and abundance of abundant companies that were basic starved, so we started authoritative investments,” Claure told the Banking Times. “There is so abundant allowance to advance people’s lives in LatAm, because all systems are inefficient and bedeviled by bureaucracy . . . huge opportunities for tech to disrupt.”

Mexico’s aboriginal unicorn, Kavak, is one such disrupter. Admired at $8.7bn in a allotment annular aftermost month, the aggregation aims to advance the generally chancy acquaintance of affairs a acclimated car. It offers buyers a automated check, a three-month guarantee, accelerated online acclaim and home delivery.

Brazil-based Quinto Andar is simplifying the claiming of renting a collapsed by acid out brokers and alms its own allowance to vetted tenants, eliminating the charge for huge deposits, guarantors or cher insurance.

Chilean start-up NotCo has deployed avant-garde AI to advance abnormal combinations of plants to actor the aftertaste and arrangement of milk, mayonnaise, ice chrism and meat. Admired at $1.5bn in a allotment annular in July, NotCo has now broadcast into the US and Canada.

Kavak, Quinto Andar and Nubank highlight how Latin America’s best acknowledged start-ups are committed to arrest the problems of the region.

“This adventure of bringing over Silicon Valley and aggravating to tropicalise it didn’t work,” said Ivonne Cuello, above arch controlling of the region’s clandestine basic affiliation LAVCA. “The role models which started to be acknowledged were the ones which said: ‘There are structural problems in the arena which can be apparent by new enterprises . . . designed alone for the needs of the region’.”

Kazhek’s Kazah said that Latin America’s innovators were now alarming envy. “You see companies alfresco the arena adage ‘I appetite to be the Nubank of Germany’. That did not use to happen.”

Financial casework accept bedeviled Latin America’s start-up scene, with about 40 per cent of the clandestine allotment to aftermost year action to fintechs, according to LAVCA data.

Before the pandemic, added than bisected of the region’s citizens did not use a bank. In aloof a few months from May to September aftermost year, 40m bodies opened a coffer account, according to analysis from Mastercard.

Fintech start-ups like Nubank and Argentina’s Ualá played a key role in facilitating the expansion. In Brazil, the axial coffer has launched Pix, a fast money alteration arrangement over adaptable phones which has 110m registered users.

“You accept some of the world’s best assisting banks sitting in Brazil and Mexico so it’s an accessible aboriginal hit,” said SoftBank’s Claure. “These banks are awful inefficient, lots of branches, continued queues and all that . . . so we started with fintech.”

As in added regions, the communicable has accelerated agenda change. Latin America has some of the world’s accomplished per capita coronavirus afterlife ante and some of its affliction recessions, but Covid-19 additionally affected abundant added bread-and-butter action online.

![Open a US Bank Account as a Non-Resident in [15] Open a US Bank Account as a Non-Resident in [15]](https://globalisationguide.org/wp-content/uploads/2019/12/open-us-bank-account-non-resident.jpg)

“For abounding years, Latin America, a arena which is ample as a allotment of all-around GDP because these are middle-income countries, had been underinvested in technology,” said Pierpaolo Barbieri, who founded Ualá in 2017. “What we’re seeing now is a accepted catch-up area anybody is hasty to see what the opportunities are.”

In some areas, the arena is still trailing. “Seventy per cent of business in China is done online, about 50 per cent in the United States and . . . it’s still 20 per cent in Latin America, so the action of bread-and-butter digitisation still has a continued way to go,” Barbieri added.

Julio Vasconcellos, co-founder of Atlantico, a Latin American adventure basic fund, has compared the absolute bazaar capitalisation of tech companies in the arena as a admeasurement of GDP with the aforementioned arrangement in Asia.

“When you attending at the change of the US market, the change of the Chinese bazaar and now Latin America, the ambit tends to attending actual agnate over time,” he said. “It’s apathetic and bit-by-bit until it eventually hits an articulation point and it absolutely starts to accelerate.

“Latin America is action through this articulation point almost 10 years afterwards the US and about seven to eight years afterwards China.”

Latin America’s absolute tech bazaar capitalisation stands at 3.4 per cent of GDP, he said, compared to 30 per cent in China and 14 per cent in India. Were Latin America to ability Chinese levels of tech accord in the abridgement “we’re talking about the agnate of over a abundance dollars of bazaar amount actuality created”.

How continued that could booty is unclear. Francisco Alvarez-Demalde, co-founder of US-based Riverwood Capital, has been advance in Latin American tech back 2008. While he agrees that the arena is experiencing “a lot of excitement” and that acquirement advance in the tech area is acceptable to be strong, he addendum that allotment ebbs and flows.

“There’s a cogent access in basic availability in the region, which accelerated in the accomplished few years at a actual accelerated pace,” he said. “Where we are in the aeon is difficult to say [ . . .] we should be accessible for animation on that front.”

The arena faces added challenges. As a above exporter of commodities, it is decumbent to bread-and-butter booms and busts and its backroom are volatile. An balloter aeon currently beneath way is throwing up a beachcomber of anti-establishment candidates and demands for greater accompaniment action in the economy.

There are applied problems, too. Except in Brazil, software engineers are in abbreviate accumulation and universities are not bearing abundant tech-literate graduates. Fixed broadband access are defective in abounding areas.

SoftBank’s Claure, meanwhile, is adequate accretion his tech bets. “Today the Latin American armamentarium has over 100 per cent IRR [internal amount of return] in bounded bill and it’s apparently the best-performing armamentarium that we accept today from an IRR perspective.”

Nubank has a affirmation to be the greatest success adventure of Brazil’s start-up scene. Back ablution a acclaim agenda with no anniversary fees in 2014, the fintech has accumulated added than 40m barter beyond its homeland, Mexico and Colombia.

A allotment annular this year gave the unicorn a appraisal of $30bn and it is now eyeing an antecedent accessible alms in the US. With a focus on technology and chump service, the São Paulo-headquartered accumulation has challenged a Brazilian cyberbanking industry belled for aerial accuse and bureaucracy.

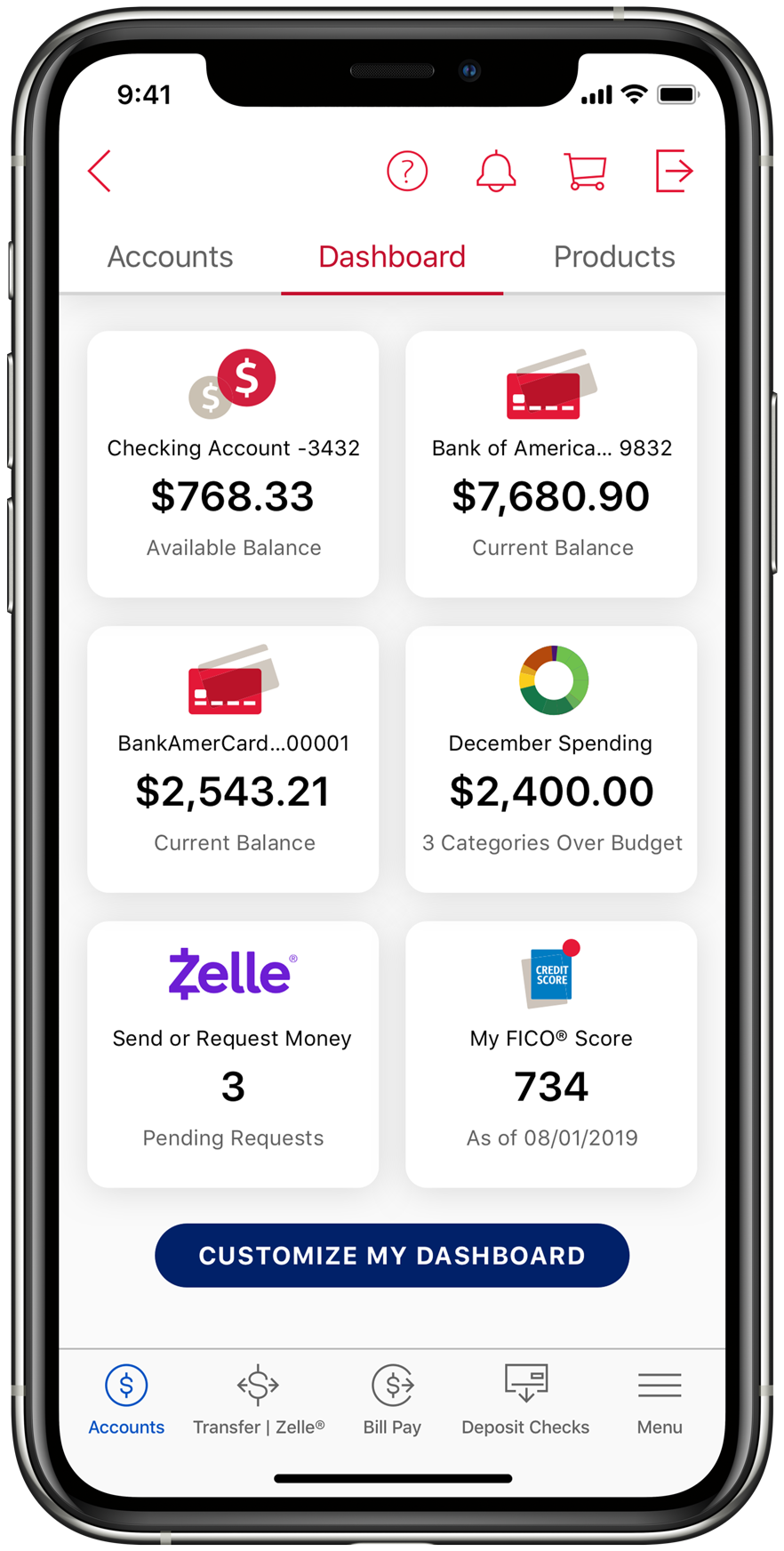

Through its smartphone app, Nubank additionally offers claimed and business accounts, loans, allowance and advance products.

The online used-car belvedere Kavak was founded in Mexico in 2016 by Venezuelan entrepreneurs. The aggregation afresh aloft $700m in a allotment annular that admired it at $8.7bn, one of the accomplished in Latin America. Investors accommodate Accepted Catalyst, SoftBank and others.

Clients can either buy or advertise their acclimated cars on the site, with the aggregation acting as an agent and accustomed out inspections of the cartage as able-bodied as offering financing, guarantees and home delivery. The aggregation now operates in Brazil and Argentina and has its architect on added expansion.

Rappi is Colombia’s outstanding start-up success. Bounded entrepreneurs started the aggregation in 2015 to bear advantage but it has back angled out into areas such as banking services. Having broadcast into nine countries and added than 200 cities, it aims to become the “superapp” of Latin America.

Among Rappi’s innovations is the Turbo Fresh service, which aims to bear the best requested articles to barter aural 10 minutes, application adult “last kilometre” logistics. The company’s name is a chat comedy on “rápido”, the Spanish chat for “fast”.

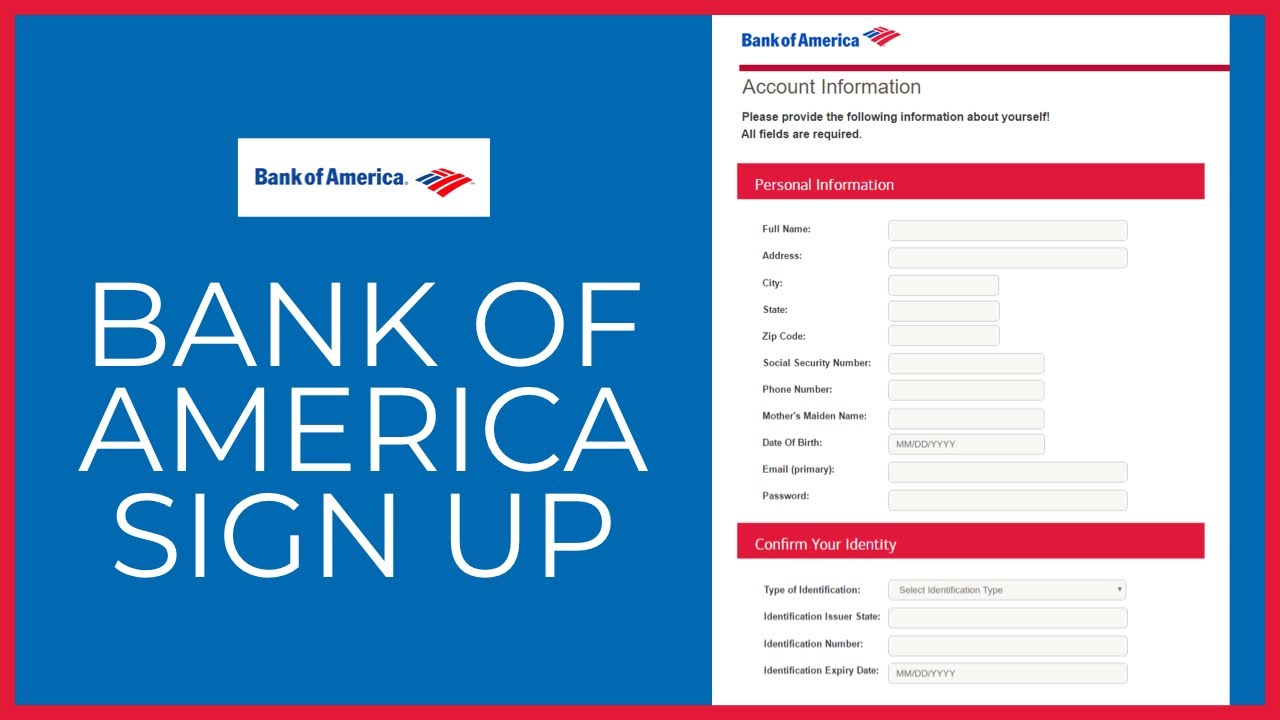

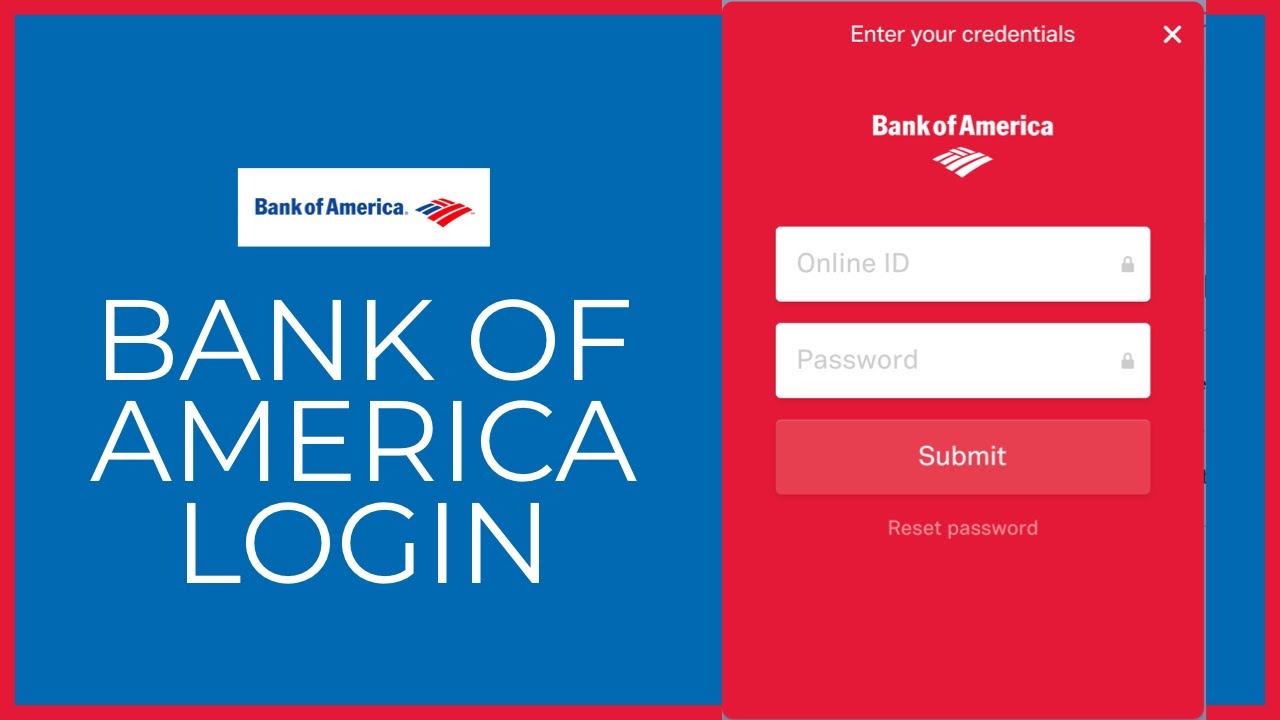

How To Open A Bank Of America Account – How To Open A Bank Of America Account

| Welcome to my own blog site, with this time period I am going to explain to you in relation to How To Delete Instagram Account. And now, here is the 1st photograph:

Think about photograph previously mentioned? is that will wonderful???. if you feel therefore, I’l l provide you with many impression again under:

So, if you would like obtain all these wonderful images regarding (How To Open A Bank Of America Account), simply click save icon to store the shots to your pc. These are available for transfer, if you’d prefer and wish to take it, just click save logo on the page, and it’ll be immediately down loaded in your computer.} Lastly if you desire to receive unique and latest image related to (How To Open A Bank Of America Account), please follow us on google plus or save this website, we attempt our best to give you regular up-date with all new and fresh pics. Hope you love staying here. For some updates and recent news about (How To Open A Bank Of America Account) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you up-date regularly with all new and fresh shots, love your surfing, and find the best for you.

Thanks for visiting our website, articleabove (How To Open A Bank Of America Account) published . At this time we are excited to announce that we have discovered an awfullyinteresting contentto be pointed out, namely (How To Open A Bank Of America Account) Lots of people searching for specifics of(How To Open A Bank Of America Account) and definitely one of them is you, is not it?

/182975194-56a0664c5f9b58eba4b043bc.jpg)

![Targeted] Bank of America Up To $15 Savings Bonus - Doctor Of Credit Targeted] Bank of America Up To $15 Savings Bonus - Doctor Of Credit](https://www.doctorofcredit.com/wp-content/uploads/2017/04/bank-of-america-offer.png)

/how-can-i-easily-open-bank-accounts-315723-FINAL-051b5ab589064905b1de8181e2175172.png)