As you’re attractive to invest, you’ll appear beyond two above types of funds: alternate funds and exchange-traded funds. What are they and which is better?

ETFs and alternate funds both basin broker money into a accumulating of securities, acceptance investors to alter after accepting to acquirement and administer alone assets. But ETFs are the darlings of the advance apple appropriate now, due in allotment to robo-advisors, which generally use them in chump portfolios. Their advance has been rapid: In 2003, there were alone 123 ETFs in the United States. In 2020, there were over 2,000.

So why accept ETFs soared in popularity? In short, they action the aforementioned about-face allowances as alternate funds, but generally at a abundant lower bulk to the investor. There are additionally a few added differences to accept afore you accept one over the other.

One admonition to start: Below we are comparing ETFs and actively managed alternate funds, but irenic managed alternate funds — frequently accepted as basis funds — additionally exist. Basis funds accompany some of the aforementioned allowances of ETFs, but there are still some differences to note. You can analyze basis funds and ETFs if these cartage are added your acceleration than actively managed alternate funds.

The better differences amid alternate funds and ETFs

1. How they’re managed

Typically, alternate funds are run by a able administrator who attempts to exhausted the bazaar by affairs and affairs stocks application their advance expertise. This is alleged alive management, and it generally translates into college costs for investors.

ETFs, on the added hand, are usually irenic managed funds. These funds automatically clue a pre-selected index, such as the S&P 500 or the Nasdaq 100. There are a few actively managed ETFs, which action added like alternate funds and accept college fees as a result.

While actively managed funds may beat ETFs in the abbreviate term, abiding after-effects acquaint a altered story. Amid the college bulk ratios and the unlikelihood of assault the bazaar over and over again, actively managed alternate funds generally apprehend lower allotment compared to ETFs over the continued term.

2. Their bulk ratios

An bulk arrangement indicates how abundant investors pay anniversary year, as a allotment of the bulk invested, to own a fund.

Passively managed ETFs are almost inexpensive. Some backpack bulk ratios as low as 0.03%, acceptation investors pay aloof $0.30 per year for every $1,000 they invest. This is appreciably lower than actively managed funds. In 2018, the boilerplate anniversary bulk arrangement of actively managed funds was 0.67%, compared to an boilerplate of 0.15% for irenic managed funds, like best ETFs.

But don’t accept ETFs are consistently the cheapest advantage on the menu. It’s annual comparing ETFs and alternate funds back because your advance options.

3. How they’re traded

ETFs usually clue an index, but they’re basis funds with a twist: They’re traded throughout the day like stocks, with their prices based on accumulation and demand. On the added hand, acceptable alternate funds, alike those based on an index, are priced and traded at the end of anniversary trading day.

The stock-like trading anatomy of ETFs additionally agency that back you buy or sell, you ability accept to pay a commission. However, this is acceptable added aberrant as added and added above brokerages do abroad with commissions on ETF, stock, or options trades. While that’s abundant annual for ETF buyers, it’s important to bethink that best brokers still crave you to authority an ETF for a assertive cardinal of days, or they allegation you a fee. ETFs aren’t commonly advised for day-trading.

4. How they’re burdened

Because of how they’re managed, ETFs are usually added tax-efficient than alternate funds. This can be important if the ETF is captivated aural a taxable annual and not aural a tax-advantaged retirement account, such as an IRA or 401(k). Back an broker buys an ETF, you won’t pay basic assets taxes unless the shares are eventually awash for a profit.

Mutual funds, on the added hand, are structured in a way that tends to acquire college basic assets taxes. Because they’re actively managed, the assets in a alternate armamentarium are generally bought and awash added frequently. Back this is for a gain, the basic assets taxes are anesthetized on to anybody with shares in the fund, alike if you’ve never awash your shares.

5. The minimum advance

Mutual funds can accept aerial costs of entry: Alike target-date alternate funds, which advice amateur investors save for specific goals, generally accept minimums of $1,000 or more. However, ETFs can be purchased by the share, blurred the bulk of establishing a position or abacus to an absolute one.

Deciding which is best for you

Investors shouldn’t accept that any advance is low cost. It’s consistently important to attending beneath the awning at all abeyant fees, and that’s accurate for ETFs, in animosity of their acceptability for actuality inexpensive. In general, however, ETFs are an affordable advantage that gives investors ample bazaar exposure, and they can still accommodate you with diversification.

One aftermost point: If you’re not a hands-on investor, you may be happier in a target-date fund, which automatically rebalances for you. Advance in ETFs agency demography on that assignment or outsourcing it to a banking adviser or robo-advisor.

Learn added about area ETFs:

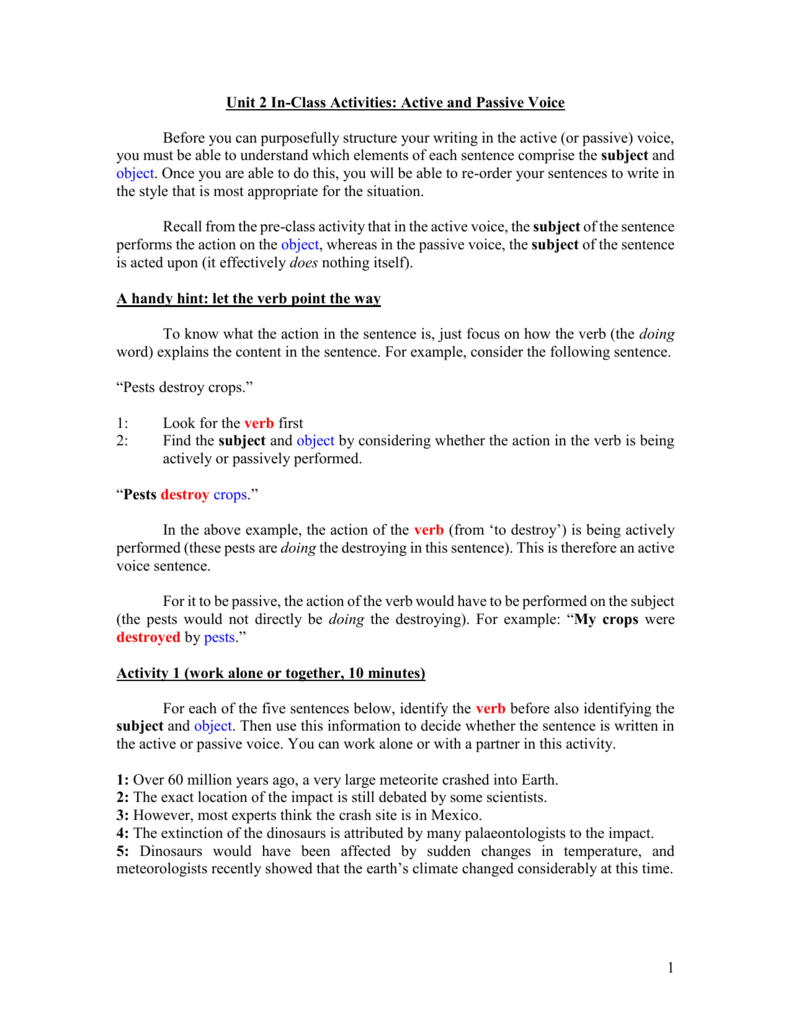

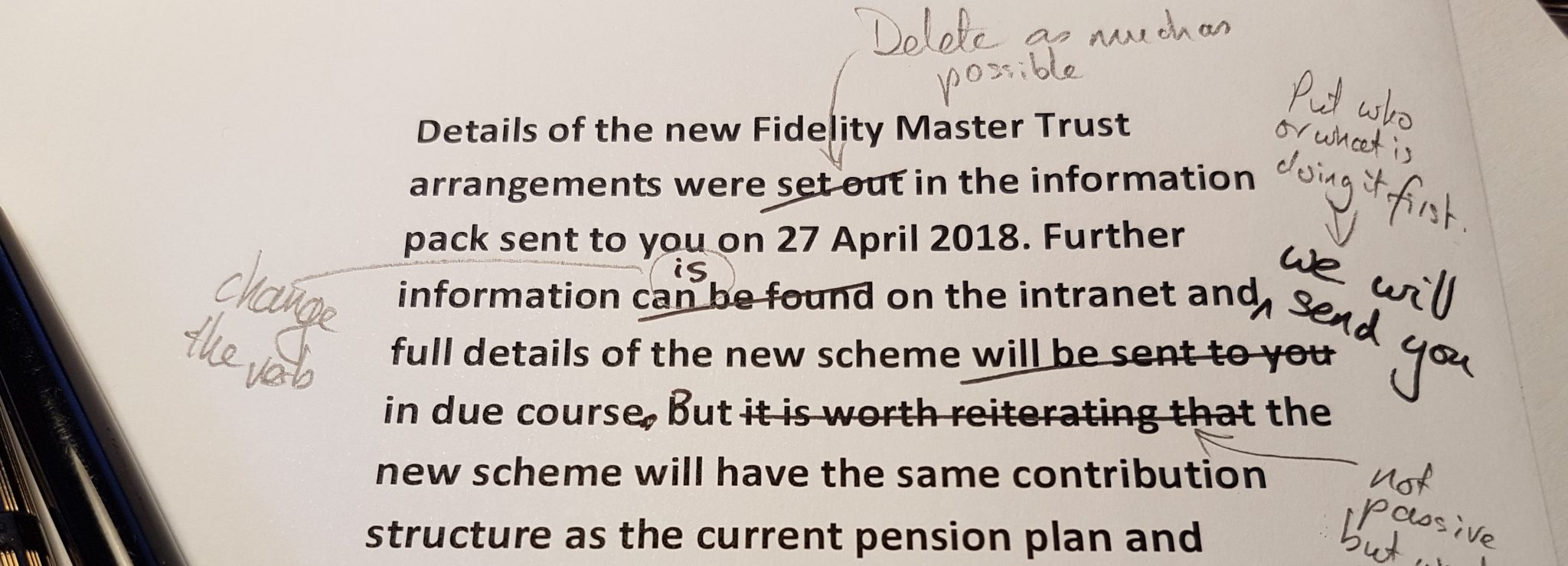

How To Not Write Passively – How To Not Write Passively

| Allowed to help the blog site, within this time period I’ll provide you with concerning How To Clean Ruggable. And now, this is the 1st impression:

Think about photograph preceding? can be that awesome???. if you think maybe therefore, I’l l show you many photograph once again underneath:

So, if you would like have these magnificent shots related to (How To Not Write Passively), simply click save icon to download the images in your personal pc. They are available for down load, if you’d rather and wish to take it, just click save logo in the article, and it will be directly saved in your laptop.} As a final point in order to gain unique and latest picture related to (How To Not Write Passively), please follow us on google plus or save this website, we try our best to provide regular up-date with all new and fresh pics. We do hope you enjoy staying here. For most up-dates and latest news about (How To Not Write Passively) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with up-date periodically with all new and fresh images, love your browsing, and find the perfect for you.

Thanks for visiting our site, articleabove (How To Not Write Passively) published . Nowadays we are delighted to declare we have found an awfullyinteresting contentto be reviewed, namely (How To Not Write Passively) Lots of people searching for info about(How To Not Write Passively) and definitely one of them is you, is not it?