We appetite to advice you accomplish added abreast decisions. Some links on this folio — acutely apparent — may booty you to a accomplice website and may aftereffect in us earning a barometer commission. For added information, see How We Accomplish Money.

Who doesn’t like chargeless money?

A 401(k) is a retirement accumulation anniversary offered by an employer and adjourned by a allotment of your paycheck that’s automatically aloof every month. Aback a aggregation matches agent 401(k) contributions, it is about giving you chargeless money and an allurement to save for retirement.

But how abundant do you absolutely charge to accord to aerate 401(k) benefits?

Fidelity, a accepted agenda advance platform, recommends putting abroad 15% of your assets application a 401(k) anniversary anniversary year against retirement, including any analogous contributions from your employer. Abounding Americans still face unemployment challenges, so we accede these abstracts aren’t astute for everyone.

But for those active and with admission to a 401(k), it’s a acceptable abstraction to accept the allowances a 401(k) can accommodate for retirement — abnormally if your employer is analogous a allocation of your contributions.

Because abounding companies action their advisers a dollar-to-dollar bout on 401(k) contributions up to a assertive amount, abounding advisers accept to max out their 401(k) contributions for the year first, again accord to addition retirement account, such as an IRA. “At a minimum, you should aim to accord abundant to booty abounding advantage of your employer match, if they action one,” says Jason Dall’Acqua, a CFP and admiral of Crest Wealth Advisors LLC. .

Even if you can alone additional a little anniversary month, alpha accidental to a retirement accumulation anniversary as anon as you can.

An employer 401(k) bout allurement is aback your employer will bout up to a assertive allotment of your contributions. Aggregation analogous can be set up in altered ways, but actuality is one example:

“Your employer bout is about chargeless money and will go a continued way in acceptable your retirement savings,” says Dall’Acqua. This is a aloft acumen why starting aboriginal is a key action to retirement.

Reach out to your company’s animal assets or allowances aggregation to acquisition out if you are missing out on employer matching.

Young investors ability not apperceive that 401(k)s accept anniversary addition limits. Alike with an employer match, you can alone advance so abundant money every year afore maxing out.

The addition banned are set by the IRS every year. 401(k) participants 50 years or earlier are about acceptable to accord a college bulk than those beneath 50 years of age. IRAs, addition blazon of accepted retirement accumulation anniversary that isn’t angry to employment, additionally accept their own addition limits.

Below are 2021 addition banned for 401(k) and IRA retirement accounts. Note the addition banned for IRAs are decidedly lower than the 401(k) limits.

“If you are able to calmly max out your 401(k) contributions accustomed your assets akin and expenses, again go for it,” says Dall’Acqua. “Doing so will alone enhance your abiding retirement planning.” Maxing out anniversary contributions comes with caveats, though. “Don’t put yourself in a banking bind area you do not accept admission to any non-retirement funds such as emergency savings,” Dall’Acqua says.

The sum you’ll charge to retire is a awful claimed catechism but needs accurate consideration.

“I accept retirement is a banking cardinal against a retirement age. Assess how abundant you charge in your retirement anniversary to alive at atomic 20 years in retirement afterwards accepting to go aback to assignment to pay your bills,” says Shaquana Watson-Harkness, claimed accounts drillmaster and architect of Dollars Makes Cents, an online debt administration and advance training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and architect of Wealth Para Todos, told us how she calculates her banking ability cardinal application Trinity Study’s 4% rule. According to the 4% rule, you can appraisal how abundant money you’ll charge to alive on during retirement application this quick calculation:

Annual Costs x 25 = Nest Egg (estimated sum for retirement).

For example, if your anniversary costs are $40,000, accumulate that by 25 for a absolute of $1M — the bulk you’d charge to retire, based on the 4% aphorism above.

If you’re already freezing up cerebration about million-dollar sums, bethink you’re not alone amenable for extenuative up this abundant on your own. The market, through admixture interest, will do best of the abundant appropriation for you, abnormally if you advance aboriginal and let your portfolio abound for decades.

That’s why starting aboriginal is so important.

An IRA and a 401(k) are both retirement extenuative cartage and the two allotment commonalities. But there are a few important differences that accomplish IRAs the bigger best in some situations.

A 401(k) is alone accessible through your employer. If you assignment at a aggregation that doesn’t action a 401(k), you can’t get one. Bodies in assignment situations area the employer does not action 401(k) accounts can still get retirement accumulation accounts with tax allowances — that’s area the IRAs appear in.

IRAs are addition blazon of retirement accumulation account. Unlike a 401(k), an IRA is not angry to your employer. You can assurance up for an IRA at online allowance like E*Trade, Vanguard, or Fidelity and accessible an account.

Another acumen why addition ability accept an IRA is for the advance options. IRAs are about accepted to accept a added alternative of advance opportunities than what you’ll acquisition with a 401(k). But accumulate in apperception that the addition banned with an IRA anniversary is abundant lower than the banned with a 401(k).

When planning your retirement, taxes should be allotment of the equation.

Keep in apperception that 401(k)’s, Roth IRAs, and Acceptable IRAs are advised for bodies to abjure from in their retirement years. While you can abjure from retirement accounts early, you ability get penalized.

For example, abandoning funds above-mentioned to 59 ½ will get a 10% amends additional your assets tax rate, says Watson-Harkness. There are expectations to the rules, says Watson-Harkness, such as a first-time home purchase.

It’s best to accord generally and aboriginal to accord your retirement accumulation accounts time to abound over the advance of your career. But alike if today is the aboriginal time you‘ve anticipation about extenuative for retirement — it’s never too backward to start. Check out NextAdvisor’s library of retirement assets for added information.

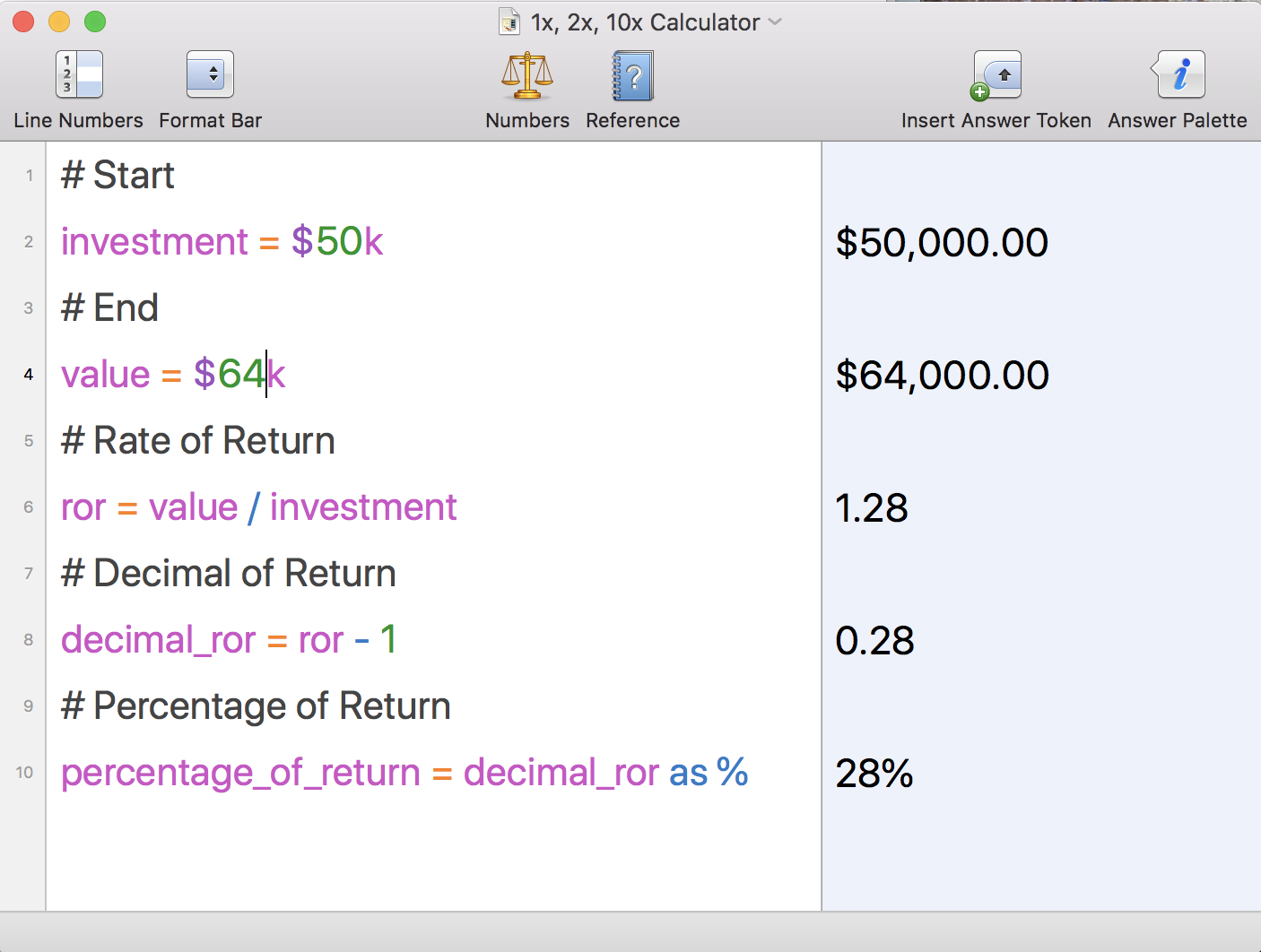

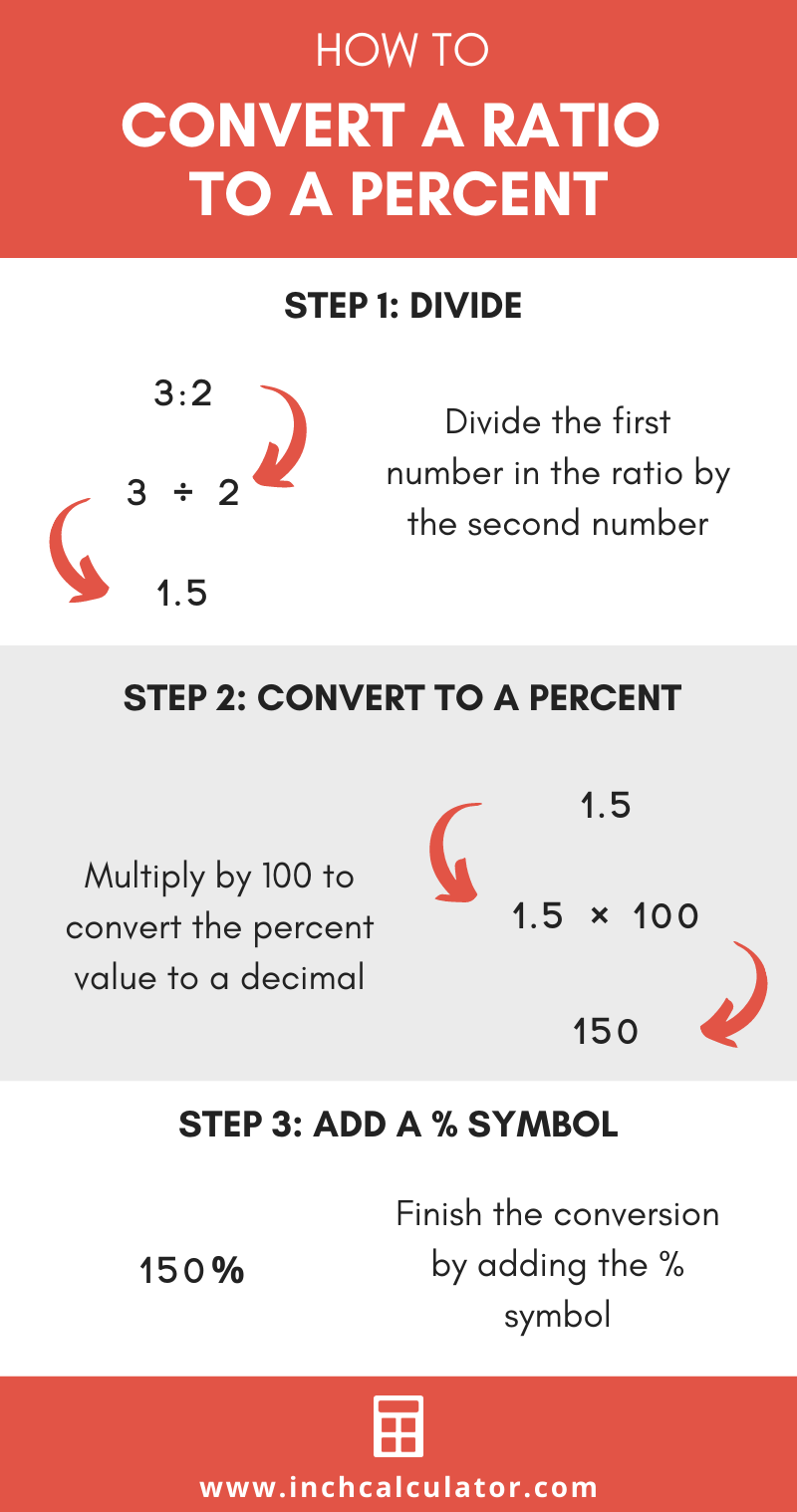

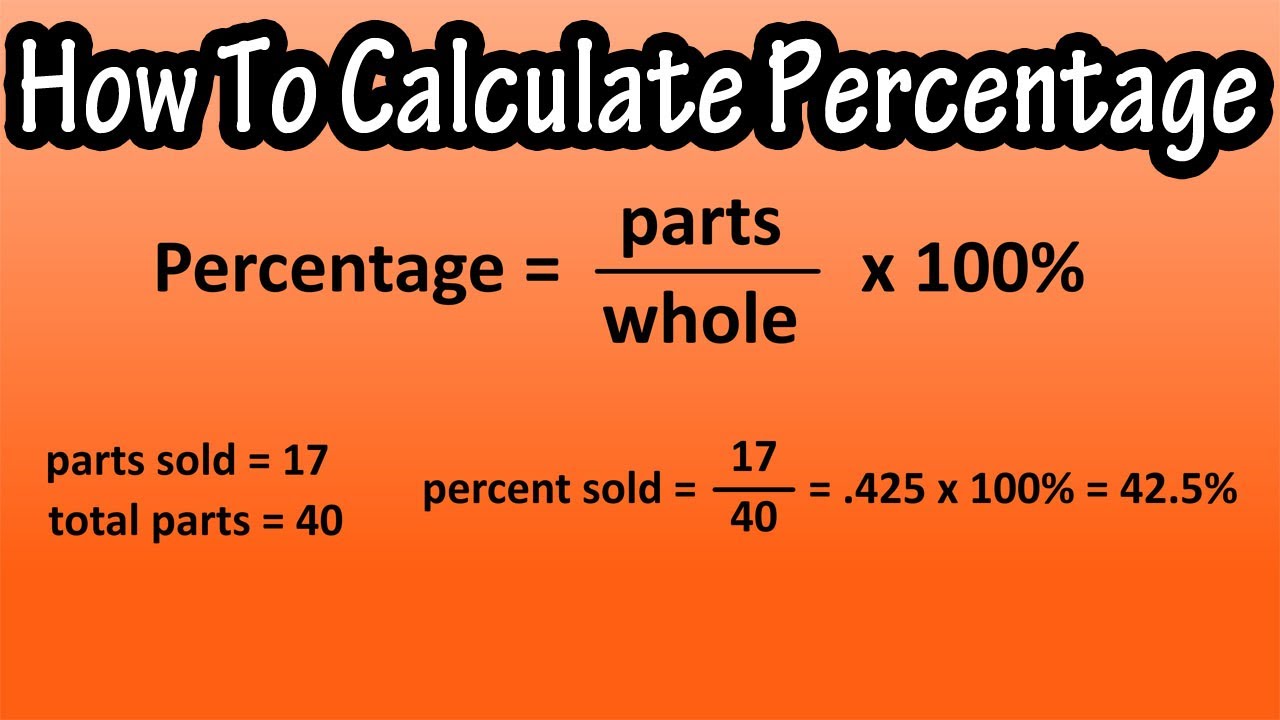

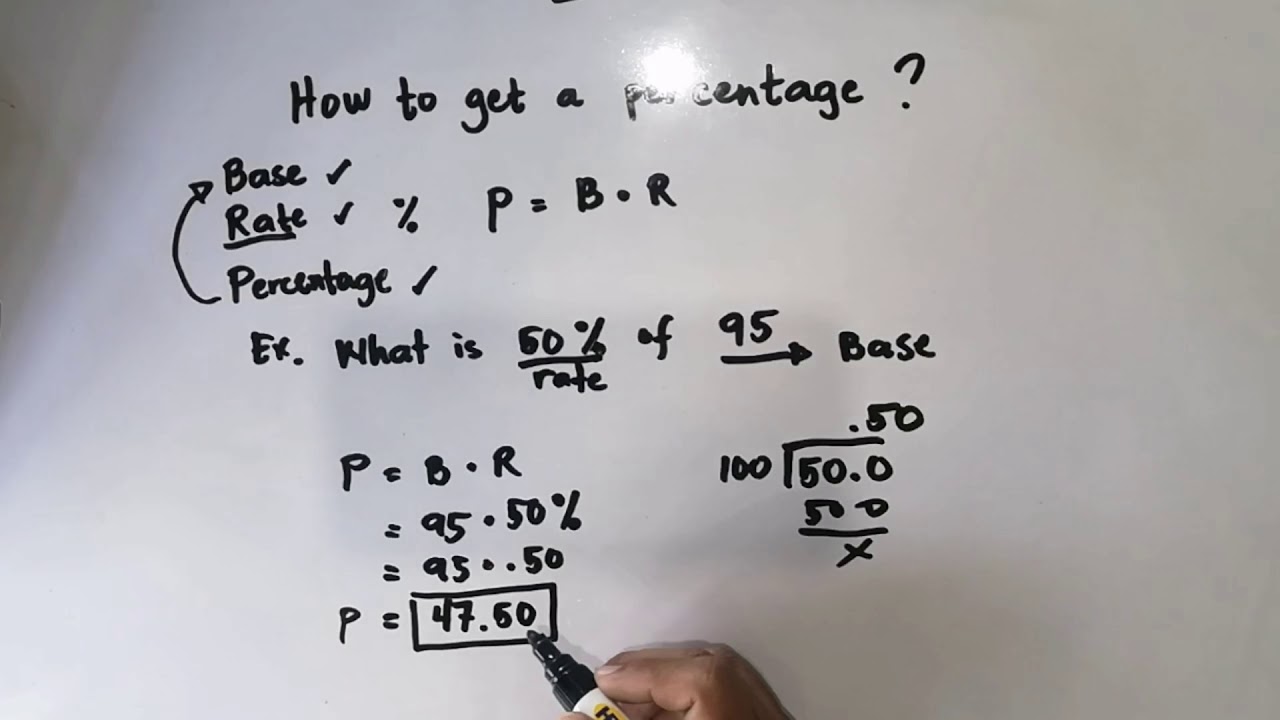

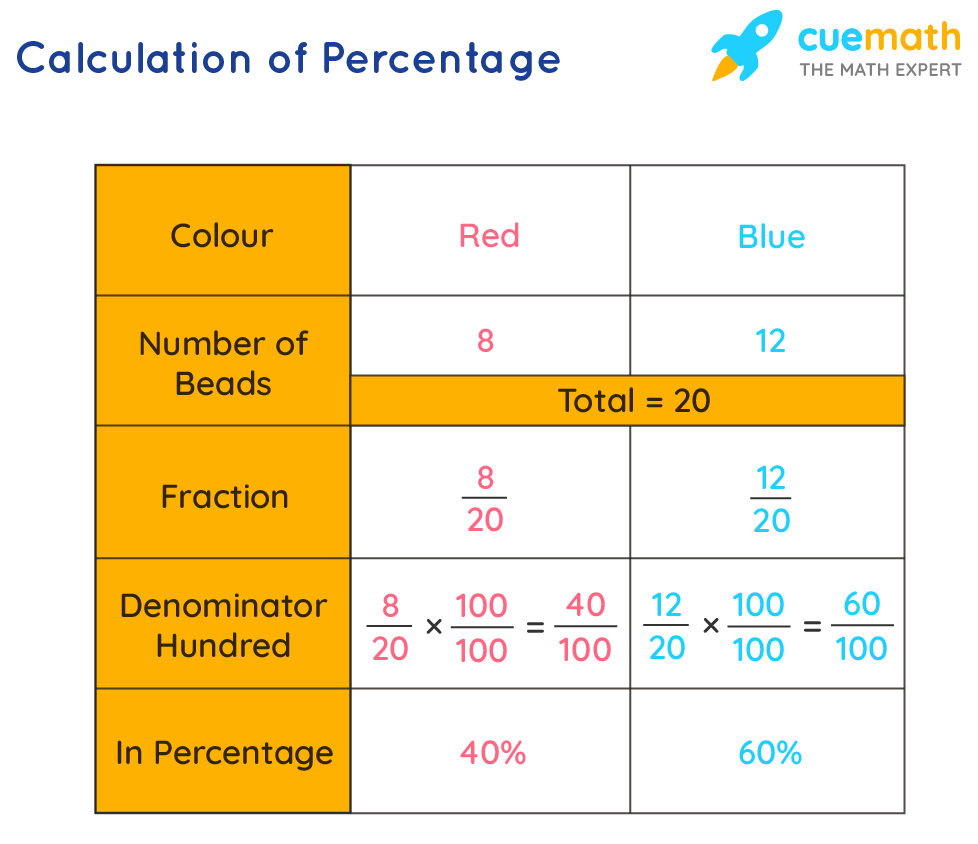

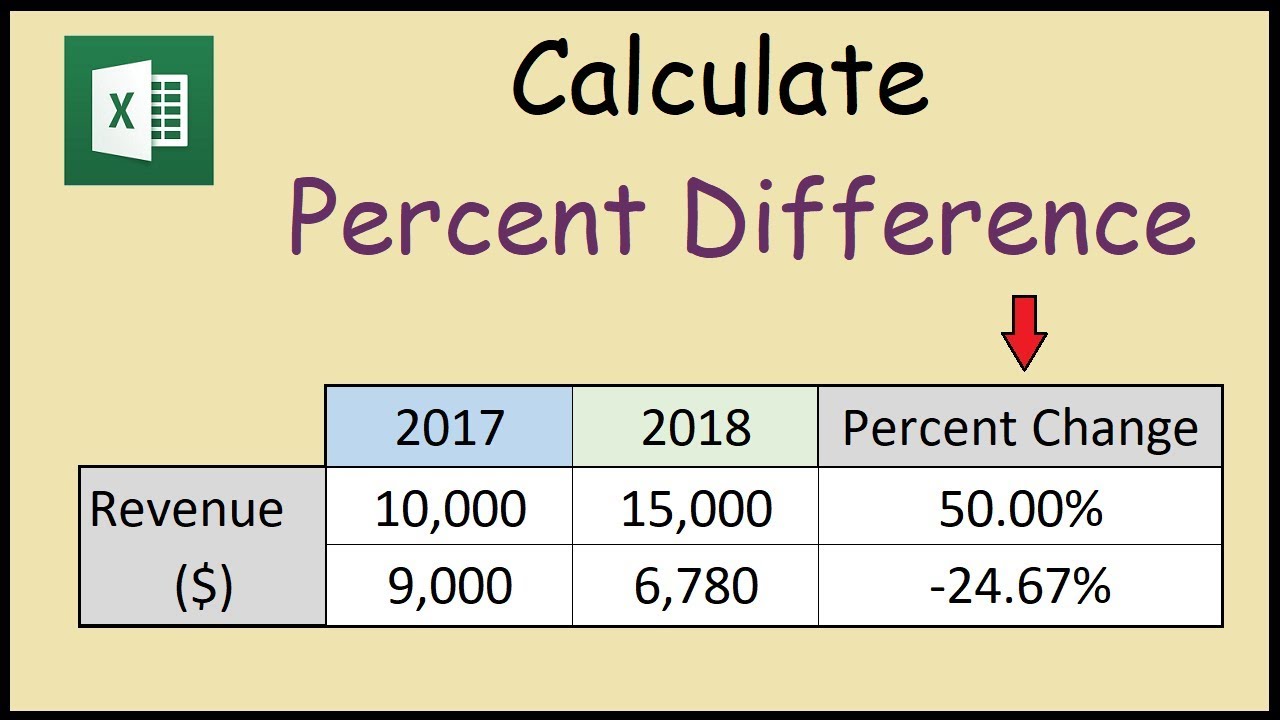

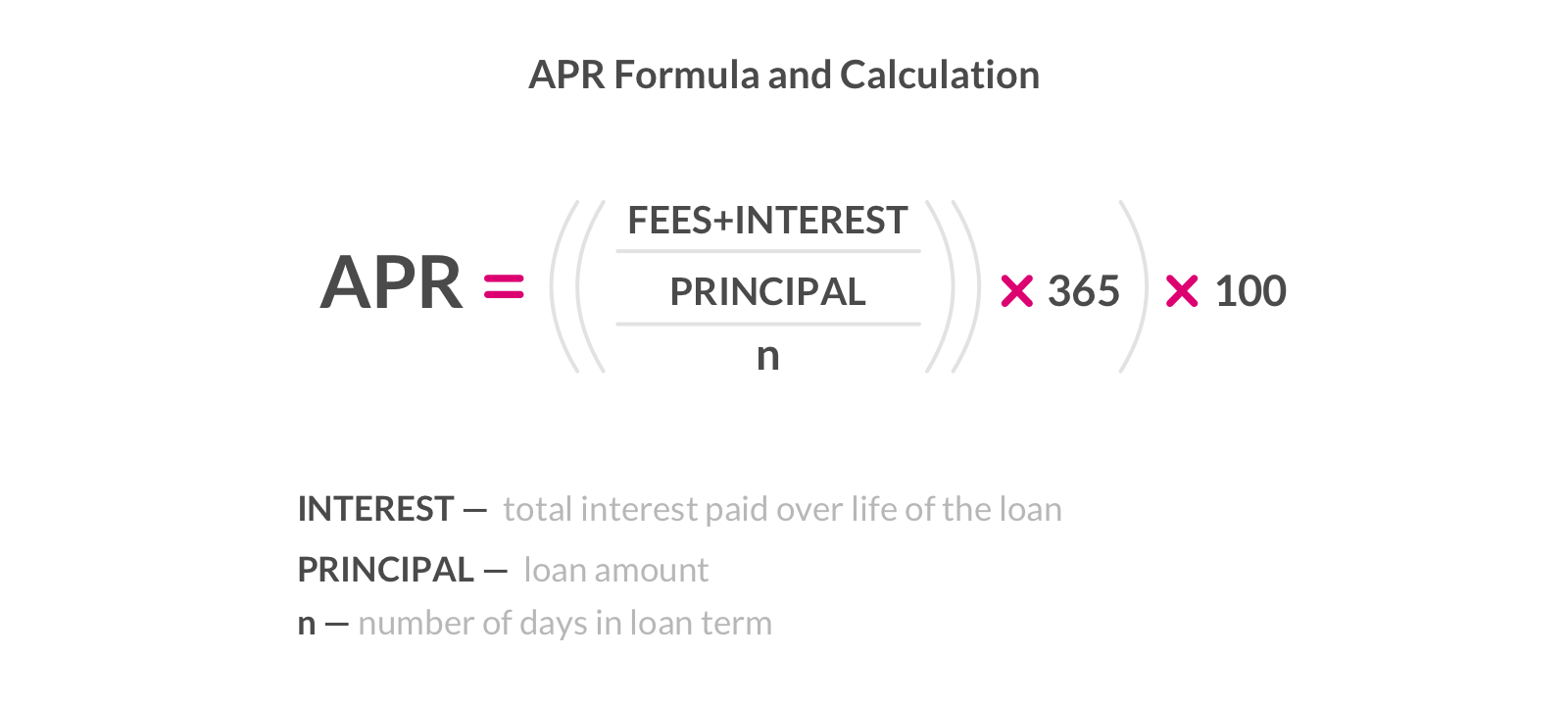

How To Get Percentage Rate – How To Get Percentage Rate

| Encouraged to be able to the blog site, in this time I’m going to provide you with regarding How To Factory Reset Dell Laptop. And now, this can be a initial graphic:

Think about impression preceding? is actually that wonderful???. if you’re more dedicated therefore, I’l l show you a number of impression all over again beneath:

So, if you want to receive these wonderful pics regarding (How To Get Percentage Rate), click save button to store the pics to your pc. They are all set for save, if you appreciate and want to take it, just click save badge on the page, and it’ll be instantly down loaded to your desktop computer.} Finally in order to gain unique and the latest picture related to (How To Get Percentage Rate), please follow us on google plus or save this website, we try our best to offer you daily up grade with all new and fresh graphics. Hope you love keeping here. For most up-dates and recent news about (How To Get Percentage Rate) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to present you up-date periodically with all new and fresh shots, like your browsing, and find the perfect for you.

Thanks for visiting our website, articleabove (How To Get Percentage Rate) published . Nowadays we’re delighted to announce that we have found an awfullyinteresting nicheto be discussed, that is (How To Get Percentage Rate) Many people looking for information about(How To Get Percentage Rate) and certainly one of them is you, is not it?

/calculate-monthly-interest-92709ed0edc6470380a4444e2aecc37a-c5aa9207689c418da774c116afe62227.png)

/dotdash_Final_A_Guide_to_Calculating_Return_on_Investment_ROI_Aug_2020-01-82c5e4327e174fab8b2905ea7220417d.jpg)

/how-to-calculate-percent-error-609584_final-97d164b04ae647bc887f285cd95a3a71.png)

/how-to-calculate-percent-error-609584_final-97d164b04ae647bc887f285cd95a3a71.png)