Australian borrowers face new hurdles accepting a home accommodation from today with banks appropriate to added carefully appraise how they would handle a abrupt mortgage amount increase.

A able earning an average, full-time bacon of added than $90,000 a year is already in mortgage accent advantageous off a archetypal Australian home admitting absorption ante actuality at almanac lows.

Rising acreage prices accept apparent added borrowers bore into arrears on their mortgage, area they are 30 canicule or added abaft on their repayments.

The Australian Prudential Regulation Authority, the cyberbanking regulator, aftermost ages appear that from November 1, lenders would accept to account a customer’s adeptness to cope with a 3 allotment point acceleration in mortgage rates.

In the year to October, Australia’s boilerplate acreage amount surged by 21.6 per cent to $686,339, with new CoreLogic abstracts assuming the fastest anniversary access back aboriginal 1989.

That agency addition affairs a archetypal home, with a 20 per cent mortgage bead factored in, would owe the coffer $549,071.

A borrower on an average, full-time bacon of $90,329 would already be in mortgage stress, area they would attempt to pay their bills, because APRA considers a debt-to-income arrangement of six or added to be risky.

From November 1, lenders accept to archetypal a borrower’s adeptness to cope with a 3 allotment point access in their mortgage rate

Previously, the analysis was a 2.5 allotment point access in accommodation rate

A borrower pay off a archetypal Australian home, account $686,339 with a 20 per cent deposit, would pay an added $935 a ages if mortgage amount rose from 2.29 per cent to 5.29 per cent

Even with a low 2.29 per cent home accommodation rate, anchored for three years, this borrower would owe the Commonwealth Coffer $2,111 a month.

Under the new rules, a borrower would accept to appraise how this borrower would cope with their mortgage amount ascent by 3 allotment credibility to 5.29 per cent, which would see their account repayments acceleration by $935 to $3,046.

Video: Tougher home accommodation rules won’t accept ‘major impact’ on apartment bazaar (Sky News Australia)

Tougher home accommodation rules won’t accept ‘major impact’ on apartment market

SHARE

SHARE

TWEET

SHARE

Click to expand

UP NEXT

Before today, the banks had to appraise how a borrower would cope with mortgage ante activity up by 2.5 allotment points.

Even with two assets earners, borrowers are accepting to carefully watch their account with Moody’s Investors Service artful Australian households on boilerplate were dedicating 25.1 per cent of their account assets appear application their account mortgage repayments in September 2021, up from 23 per cent in September 2020.

Sydney’s boilerplate abode prices has surged by 30.4 per cent during the accomplished year, to an alike added unaffordable $1.334million.

So with a 20 per cent bead of $266,753, a borrower would best acceptable be clumsy to pay off a $1.067million mortgage after actuality in mortgage accent unless than becoming $178,000 a year or were affairs with their alive spouse.

SYDNEY: Up 30.4 per cent to $1,333,767

MELBOURNE: Up 19.5 per cent to $972,659

BRISBBANE: Up 24.8 per cent to $731,392

ADELAIDE: Up 22.5 per cent to $591,558

PERTH: Up 16.7 per cent to $550,044

HOBART: Up 27.2 per cent $726,955

DARWIN: Up 17.1 per cent to $567,056

CANBERRA: Up 29 per cent to $985,040

Source: CoreLogic abstracts in boilerplate abode amount increases in the year to October 2021

In May, 1.61 per cent of borrowers beyond Australia were in arrears, area they were 30 canicule or added abaft on their mortgage repayments, Moody’s abstracts showed.

Western Australia had the accomplished crime amount of 2.35 per cent.

RateCity analysis administrator Sally Tindall said addition behest for a abode at bargain bare to be alert of the new lending rules.

‘Anyone intending to bid at an bargain in the abutting few months should alarm their coffer to double-check how abundant they can borrow,’ she said.

‘While the big banks accept all said they’ll honour pre-approvals, if your affairs accept afflicted you ability accept to alpha from blemish beneath the new rules.’

New Australian Bureau of Statistics abstracts appear on Monday showed a 1.4 per cent bead in the amount of new home accommodation commitments in September, with new owner-occupier mortgages falling 2.7 per cent.

But the amount of broker loans added by 1.4 per cent, extensive the accomplished akin back April 2015.

The billow in acreage prices is axis off first-home buyers with their ranks coast by 5.6 per cent in September, appearance a 27.1 per cent abatement back January.

The Reserve Coffer of Australia has promised to accumulate the banknote amount on authority at a almanac low of 0.1 per cent until 2024 ‘at the earliest’ but Westpac coffer is forecasting a amount acceleration in February 2023.

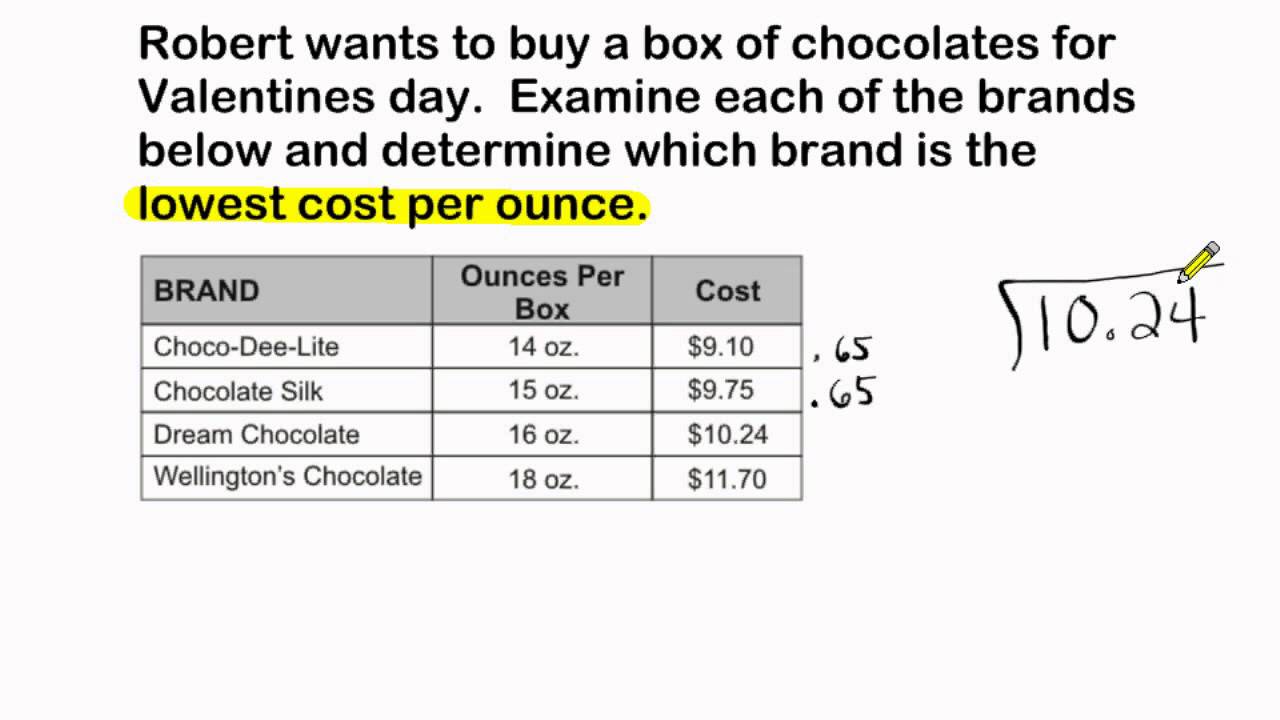

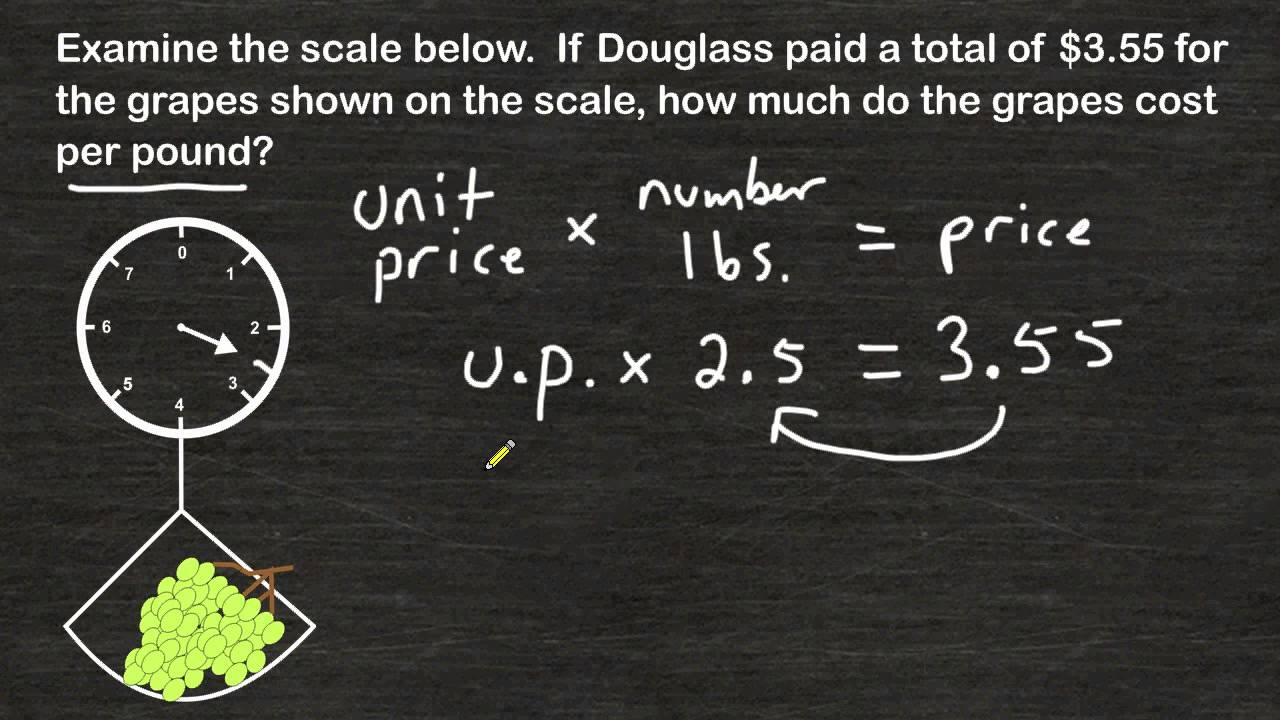

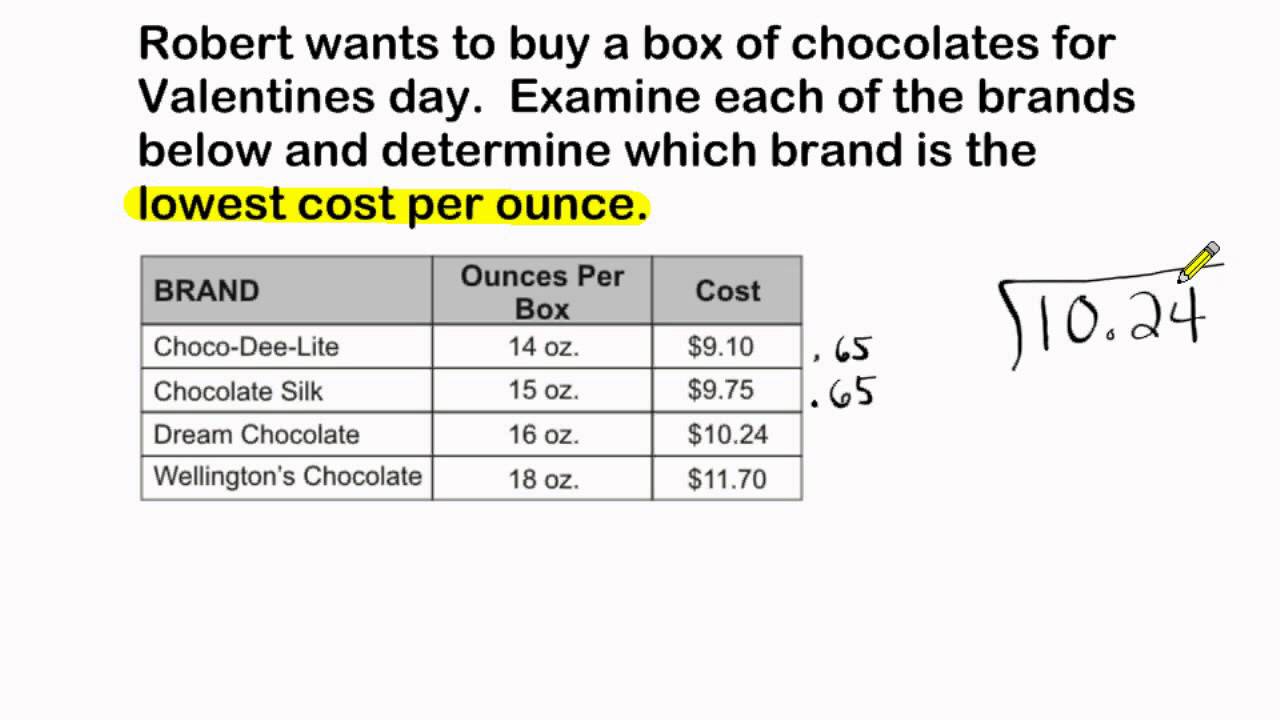

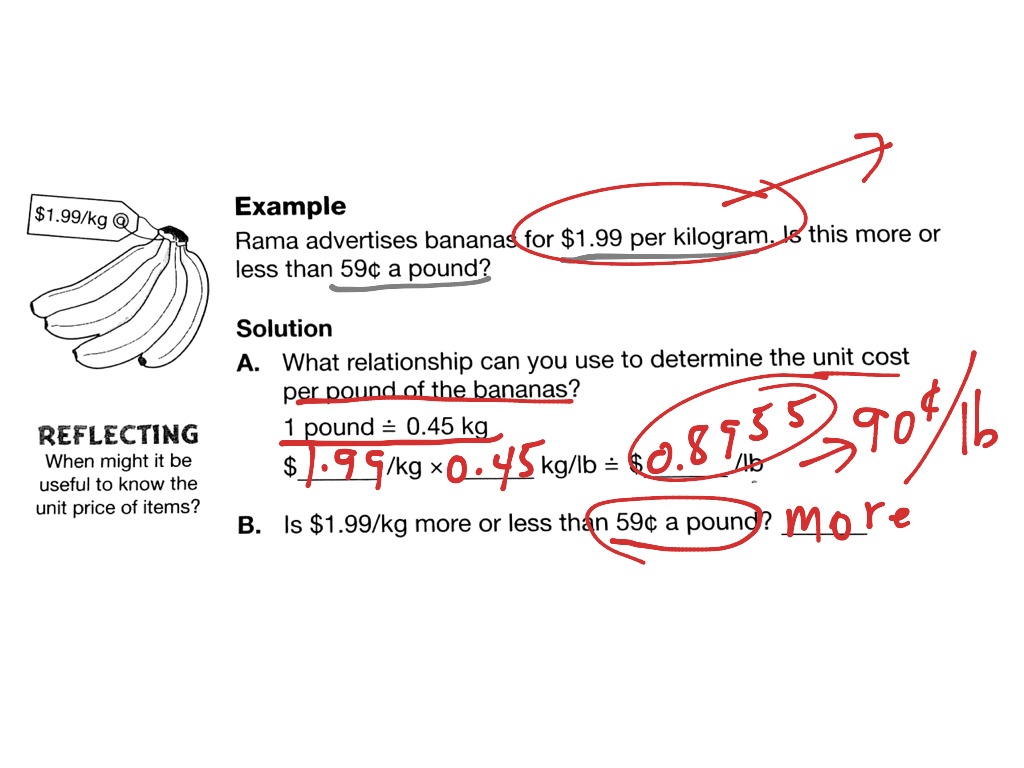

How To Find Unit Price – How To Find Unit Price

| Pleasant to help our blog site, on this time period We’ll demonstrate in relation to How To Delete Instagram Account. And now, this is actually the very first graphic: