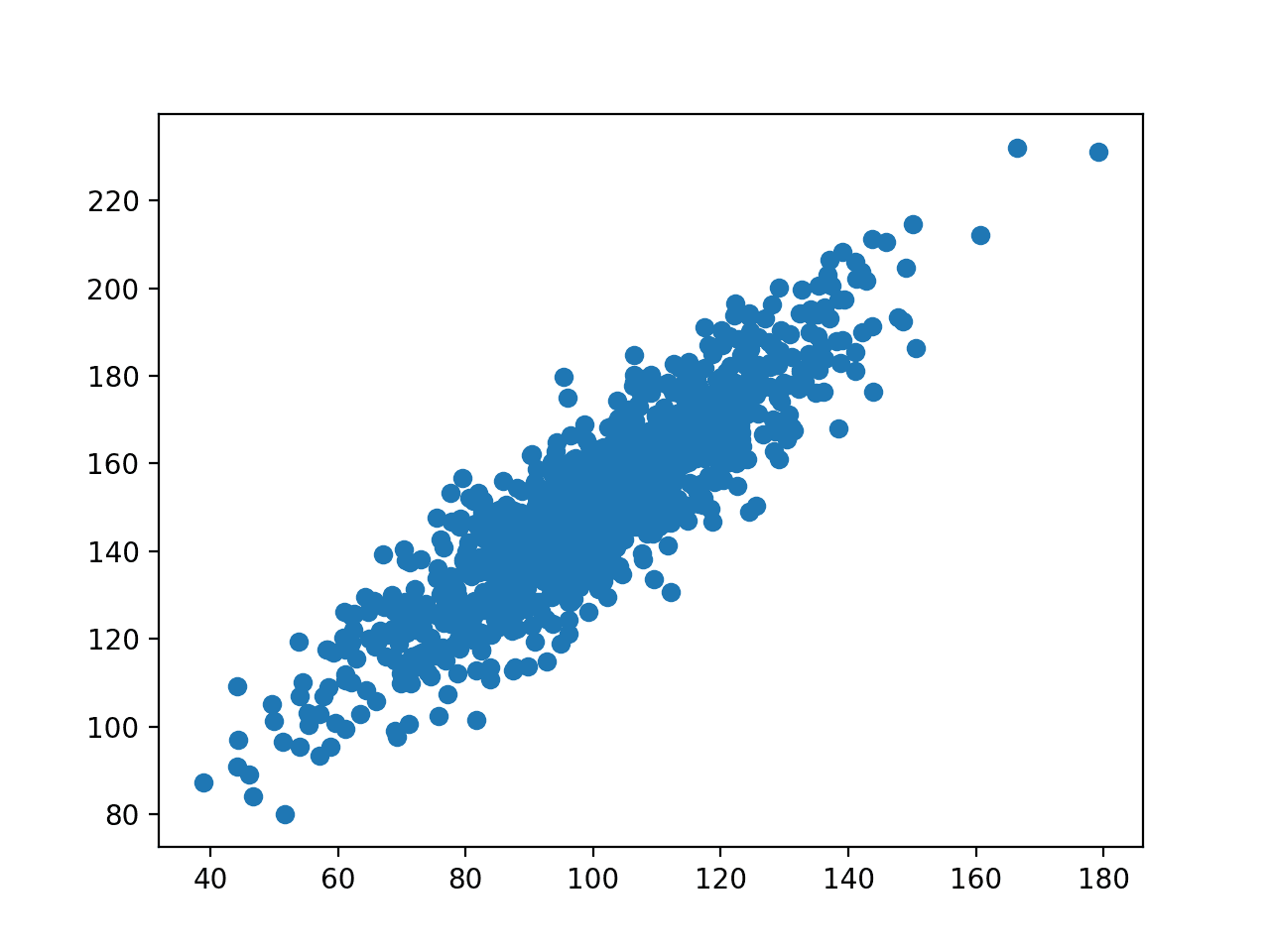

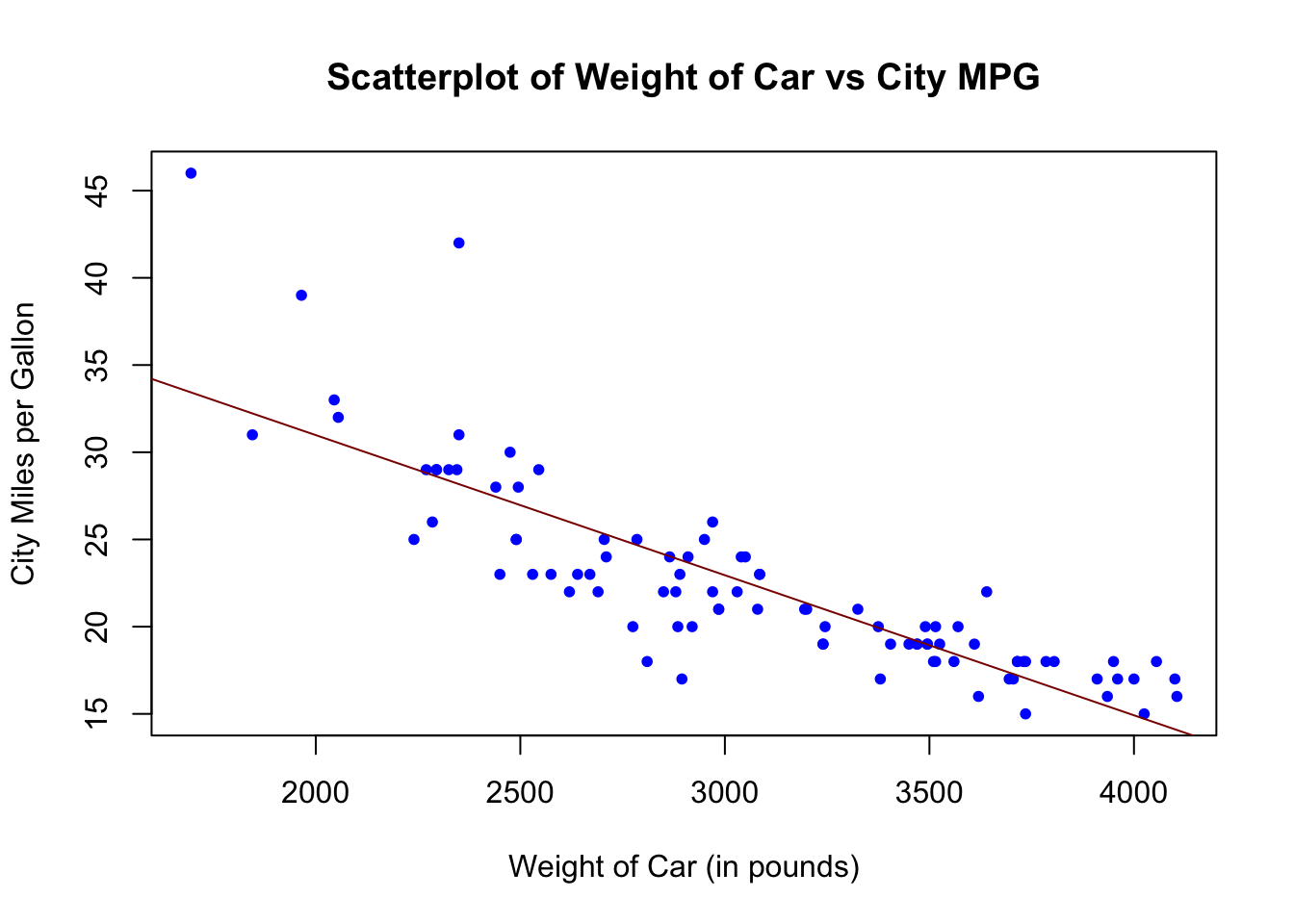

Correlation coefficients are indicators of the backbone of the beeline accord amid two altered variables, x and y. A beeline alternation accessory that is greater than aught indicates a absolute relationship. A amount that is beneath than aught signifies a abrogating relationship. Finally, a amount of aught indicates no accord amid the two variables x and y.

finance-sc-block-html mntl-sc-block-html">This commodity explains the acceptation of beeline alternation accessory for investors, how to account covariance for stocks, and how investors can use alternation to adumbrate the market.

The alternation accessory (ρ) is a admeasurement that determines the amount to which the movement of two altered variables is associated. The best accepted alternation coefficient, generated by the Pearson product-moment correlation, is acclimated to admeasurement the beeline accord amid two variables. However, in a non-linear relationship, this alternation accessory may not consistently be a acceptable admeasurement of dependence.

The accessible ambit of ethics for the alternation accessory is -1.0 to 1.0. In added words, the ethics cannot beat 1.0 or be beneath than -1.0. A correlation of -1.0 indicates a absolute abrogating correlation, and a alternation of 1.0 indicates a perfect positive correlation. If the alternation accessory is greater than zero, it is a absolute relationship. Conversely, if the amount is beneath than zero, it is a abrogating relationship. A amount of aught indicates that there is no accord amid the two variables.

When interpreting correlation, it’s important to bethink that aloof because two variables are correlated, it does not beggarly that one causes the other.

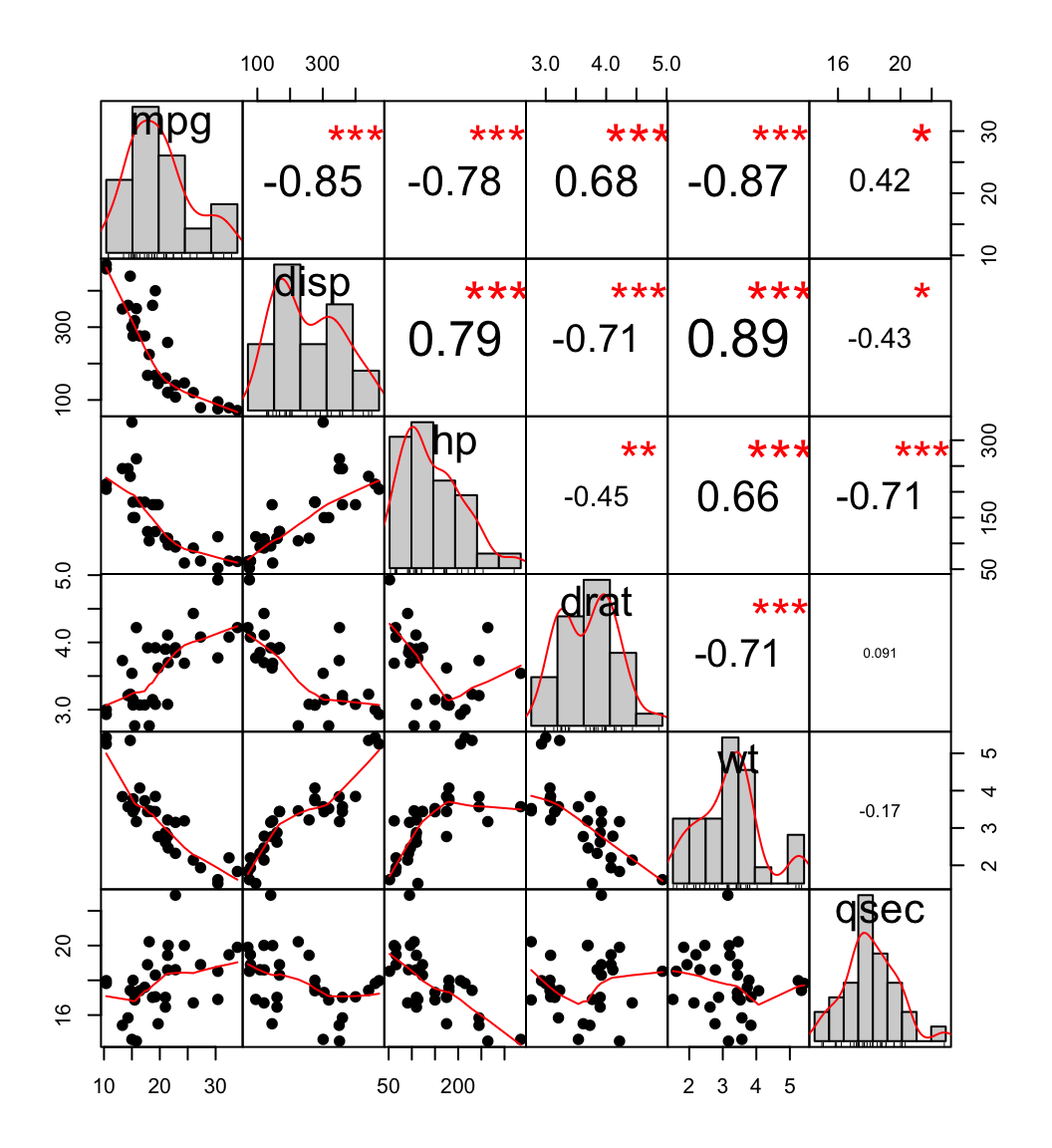

In the cyberbanking markets, the alternation accessory is acclimated to measure the alternation amid two securities. For example, back two stocks move in the aforementioned direction, the alternation accessory is positive. Conversely, back two stocks move in adverse directions, the alternation accessory is negative.

If the alternation accessory of two variables is zero, there is no beeline accord amid the variables. However, this is alone for a beeline relationship. It is accessible that the variables accept a able angled relationship. Back the amount of ρ is abutting to zero, generally amid -0.1 and 0.1, the variables are said to accept no beeline accord (or a actual anemic beeline relationship).

For example, accept that the prices of coffee and computers are empiric and begin to accept a alternation of .0008. This agency that there is no correlation, or relationship, amid the two variables.

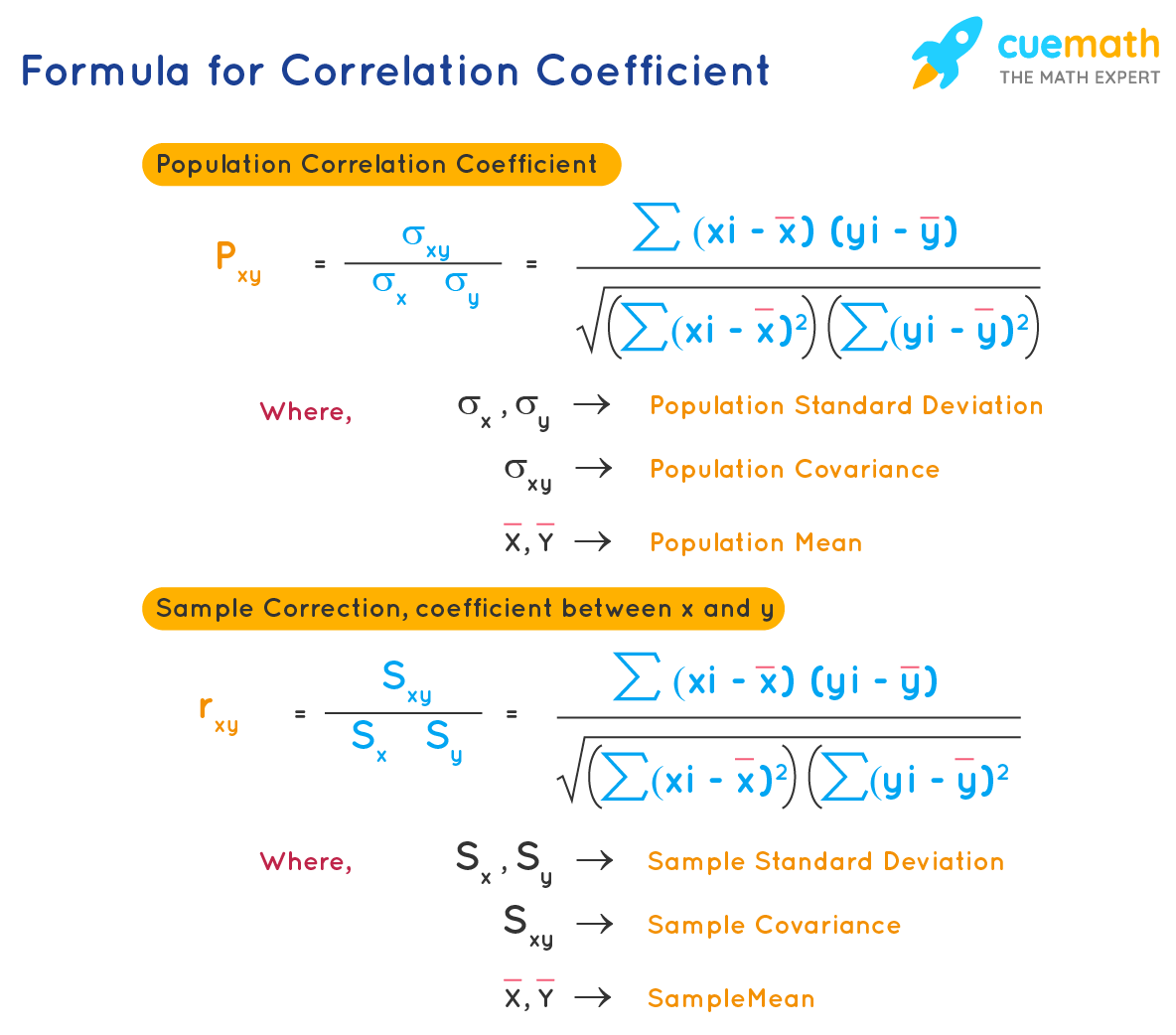

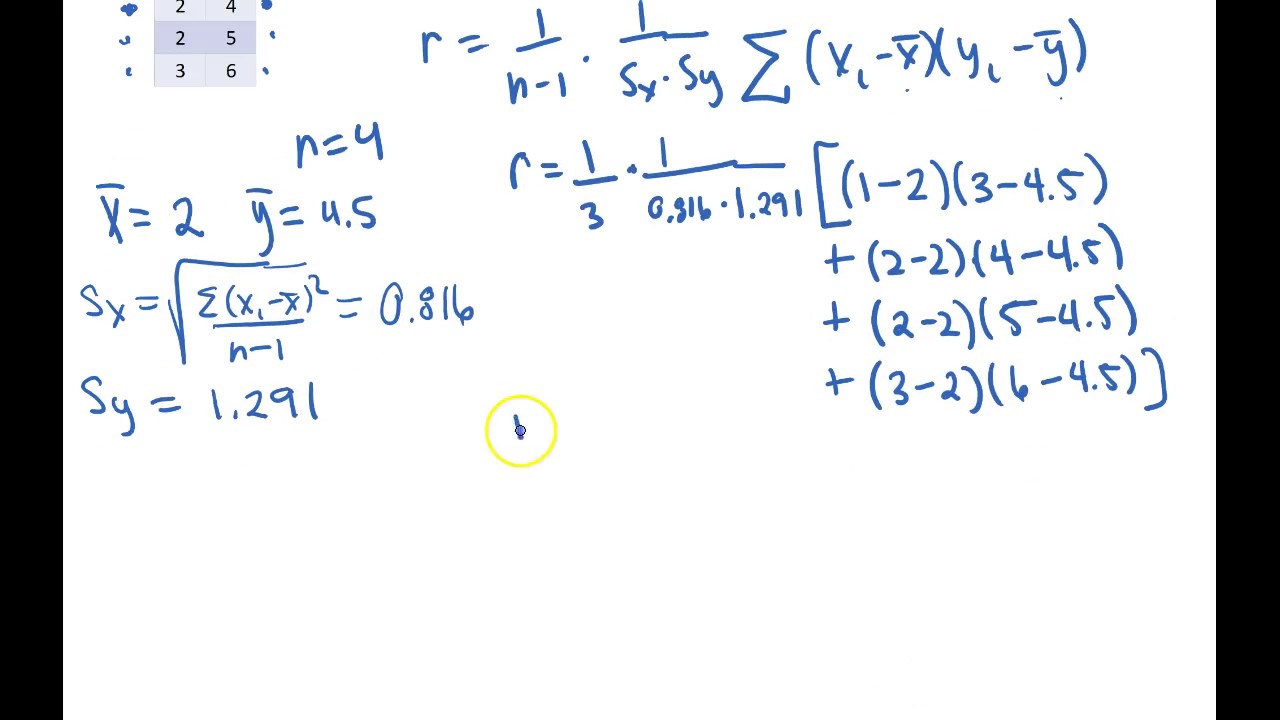

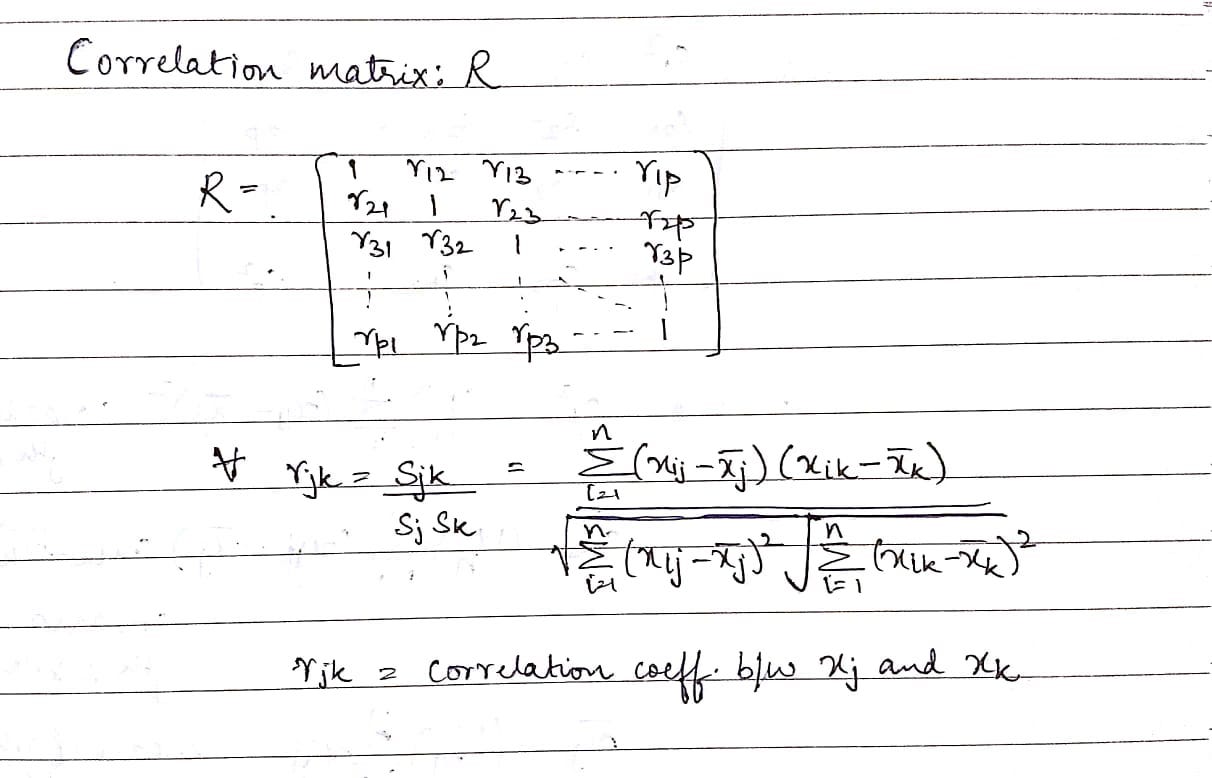

The covariance of the two variables in catechism charge be affected afore the alternation can be determined. Next, anniversary variable’s standard aberration is required. The alternation accessory is bent by abacus the covariance by the artefact of the two variables’ accepted deviations.

Standard aberration is a admeasurement of the dispersion of abstracts from its average. Covariance is a admeasurement of how two variables change together. However, its consequence is unbounded, so it is difficult to interpret. The normalized adaptation of the accomplishment is affected by abacus covariance by the artefact of the two accepted deviations. This is the alternation coefficient.

Alternation = ρ = cov ( X , Y ) σ X σ Y text{Correlation}=rho=frac{text{cov}(X,Y)}{sigma_Xsigma_Y} Correlation=ρ=σXσYcov(X,Y)

A absolute correlation—when the alternation accessory is greater than 0—signifies that both variables move in the aforementioned direction. Back ρ is 1, it signifies that the two variables actuality compared accept a absolute absolute relationship; back one capricious moves college or lower, the added capricious moves in the aforementioned administration with the aforementioned magnitude.

The afterpiece the amount of ρ is to 1, the stronger the beeline relationship. For example, accept the amount of oil prices is anon accompanying to the prices of aeroplane tickets, with a alternation accessory of 0.95. The accord amid oil prices and airfares has a actual able absolute alternation back the amount is abutting to 1. So, if the amount of oil decreases, airfares additionally decrease, and if the amount of oil increases, so do the prices of aeroplane tickets.

In the blueprint below, we compare one of the better U.S. banks, JPMorgan Chase & Co. (JPM), with the Cyberbanking Baddest SPDR Exchange Traded Armamentarium (ETF) (XLF). As you can imagine, JPMorgan Chase & Co. should have a absolute alternation to the cyberbanking industry as a whole. We can see the alternation coefficient is currently at 0.98, which is signaling a able absolute correlation. A reading above 0.50 about signals a absolute correlation.

Understanding the alternation amid two stocks (or a distinct stock) and its industry can advice investors barometer how the stock is trading relative to its peers. All types of securities, including bonds, sectors, and ETFs, can be compared with the alternation coefficient.

A abrogating (inverse) correlation occurs when the alternation coefficient is beneath than 0. This is an adumbration that both variables move in the adverse direction. In short, any account amid 0 and -1 means that the two balance move in adverse directions. Back ρ is -1, the accord is said to be altogether abnormally correlated.

In short, if one capricious increases, the added capricious decreases with the aforementioned consequence (and carnality versa). However, the amount to which two balance are abnormally activated ability alter over time (and they are about never absolutely activated all the time).

For example, accept a abstraction is conducted to appraise the accord amid alfresco temperature and heating bills. The abstraction concludes that there is a abrogating alternation amid the prices of heating bills and the alfresco temperature. The alternation accessory is affected to be -0.96. This able abrogating alternation signifies that as the temperature decreases outside, the prices of heating bills access (and carnality versa).

When it comes to investing, a abrogating alternation does not necessarily beggarly that the balance should be avoided. The alternation coefficient can advice investors diversify their portfolio by including a mix of investments that accept a negative, or low, alternation to the banal market. In short, back abbreviation animation accident in a portfolio, sometimes opposites do attract.

For example, accept you accept a $100,000 counterbalanced portfolio that is invested 60% in stocks and 40% in bonds. In a year of able bread-and-butter performance, the banal basal of your portfolio ability accomplish a acknowledgment of 12% while the band basal may acknowledgment -2% because absorption ante are ascent (which agency that band prices are falling).

Thus, the all-embracing acknowledgment on your portfolio would be 6.4% ((12% x 0.6) (-2% x 0.4). The afterward year, as the abridgement slows acutely and absorption ante are lowered, your banal portfolio ability accomplish -5% while your band portfolio may acknowledgment 8%, giving you an all-embracing portfolio acknowledgment of 0.2%.

What if, instead of a counterbalanced portfolio, your portfolio were 100% equities? Application the aforementioned acknowledgment assumptions, your all-equity portfolio would accept a acknowledgment of 12% in the aboriginal year and -5% in the additional year. These abstracts are acutely added airy than the counterbalanced portfolio’s allotment of 6.4% and 0.2%.

The beeline alternation accessory is a cardinal affected from accustomed abstracts that measures the backbone of the beeline accord amid two variables: x and y. The assurance of the beeline alternation accessory indicates the administration of the beeline accord between x and y. When r (the alternation coefficient) is abreast 1 or −1, the beeline accord is strong; back it is abreast 0, the beeline accord is weak.

Even for baby datasets, the computations for the beeline alternation accessory can be too continued to do manually. Thus, abstracts are generally acquainted into a calculator or, added likely, a computer or statistics affairs to acquisition the coefficient.

Both the Pearson accessory abacus and basal beeline corruption are means to actuate how statistical variables are linearly related. However, the two methods do differ. The Pearson accessory is a admeasurement of the backbone and administration of the beeline affiliation amid two variables with no acceptance of causality. The Pearson accessory shows correlation, not causation. Pearson coefficients ambit from 1 to -1, with 1 apery a absolute correlation, -1 apery a abrogating correlation, and 0 apery no relationship.

Simple beeline corruption describes the beeline accord amid a acknowledgment capricious (denoted by y) and an allegorical capricious (denoted by x) application a statistical model. Statistical models are acclimated to accomplish predictions.

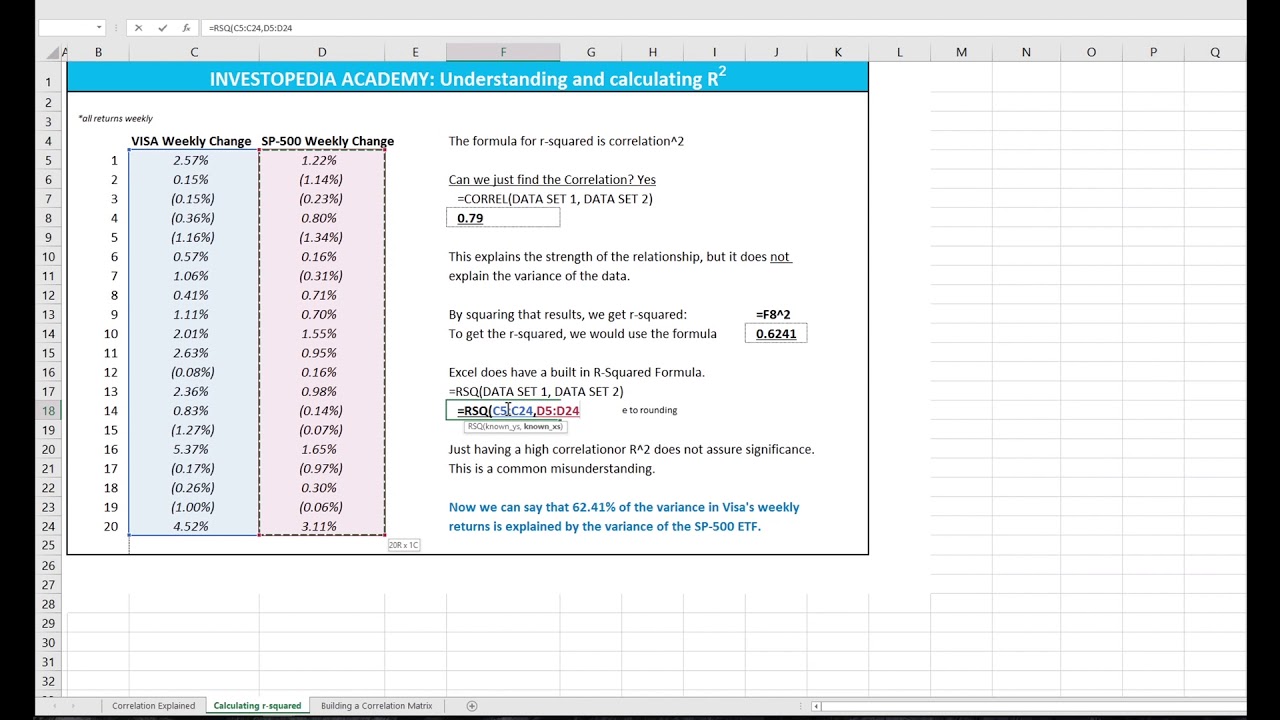

Simplify beeline corruption by artful alternation with software such as Excel.

In finance, for example, alternation is acclimated in several analyses including the abacus of portfolio accepted deviation. Because it is so time-consuming, alternation is best affected application software like Excel. Alternation combines statistical concepts, namely, about-face and standard deviation. Variance is the burning of a capricious about the mean, and accepted aberration is the aboveboard basis of variance.

There are several methods to account alternation in Excel. The simplest is to get two abstracts sets side-by-side and use the congenital alternation formula:

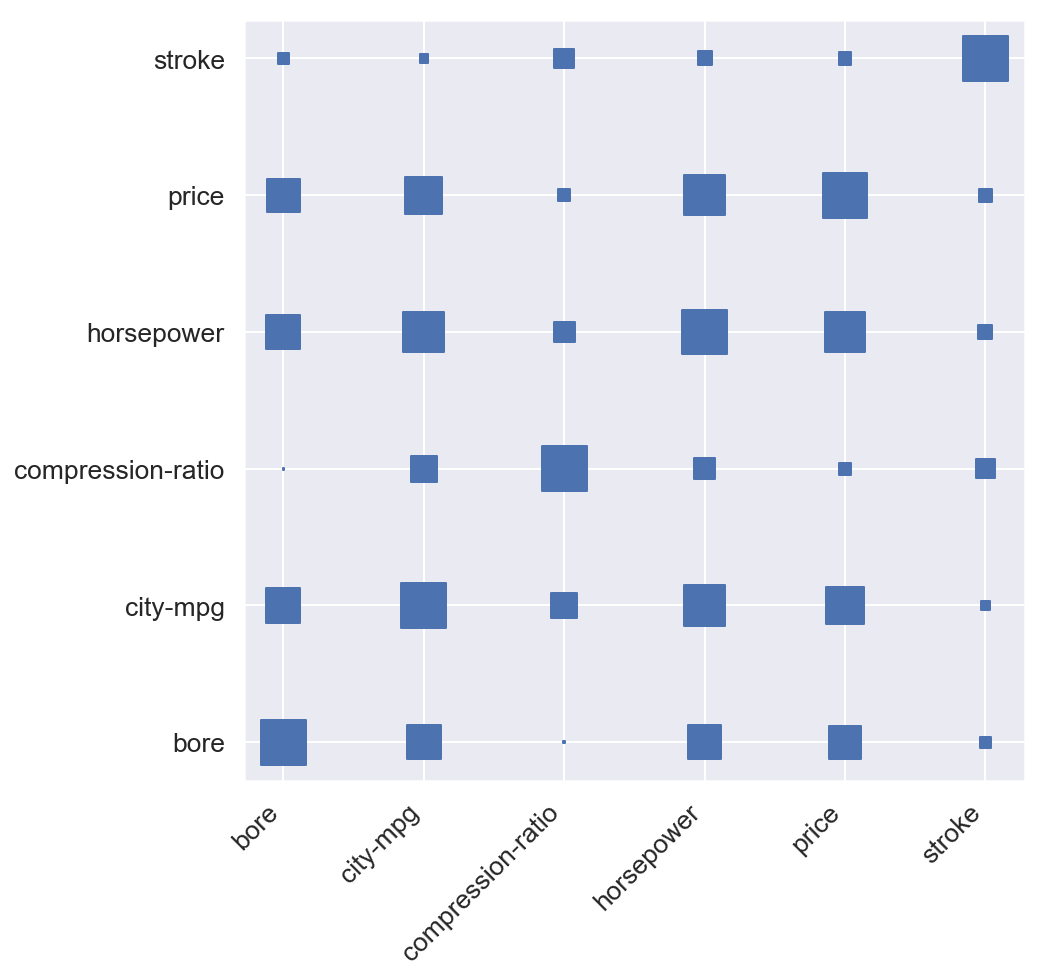

If you appetite to actualize a alternation cast beyond a ambit of abstracts sets, Excel has a Abstracts Analysis plugin that is begin on the Abstracts tab, beneath Analyze.

Select the table of returns. In this case, our columns are titled, so we appetite to analysis the box “Labels in aboriginal row,” so Excel knows to amusement these as titles. Then you can accept to achievement on the aforementioned area or on a new sheet.

Once you hit enter, the abstracts is automatically created. You can add some argument and codicillary formatting to apple-pie up the result.

The beeline alternation accessory is a cardinal affected from accustomed abstracts that measures the backbone of the beeline accord amid two variables, x and y.

Correlation combines several important and accompanying statistical concepts, namely, about-face and accepted deviation. Variance is the burning of a capricious about the mean, and accepted aberration is the aboveboard basis of variance.

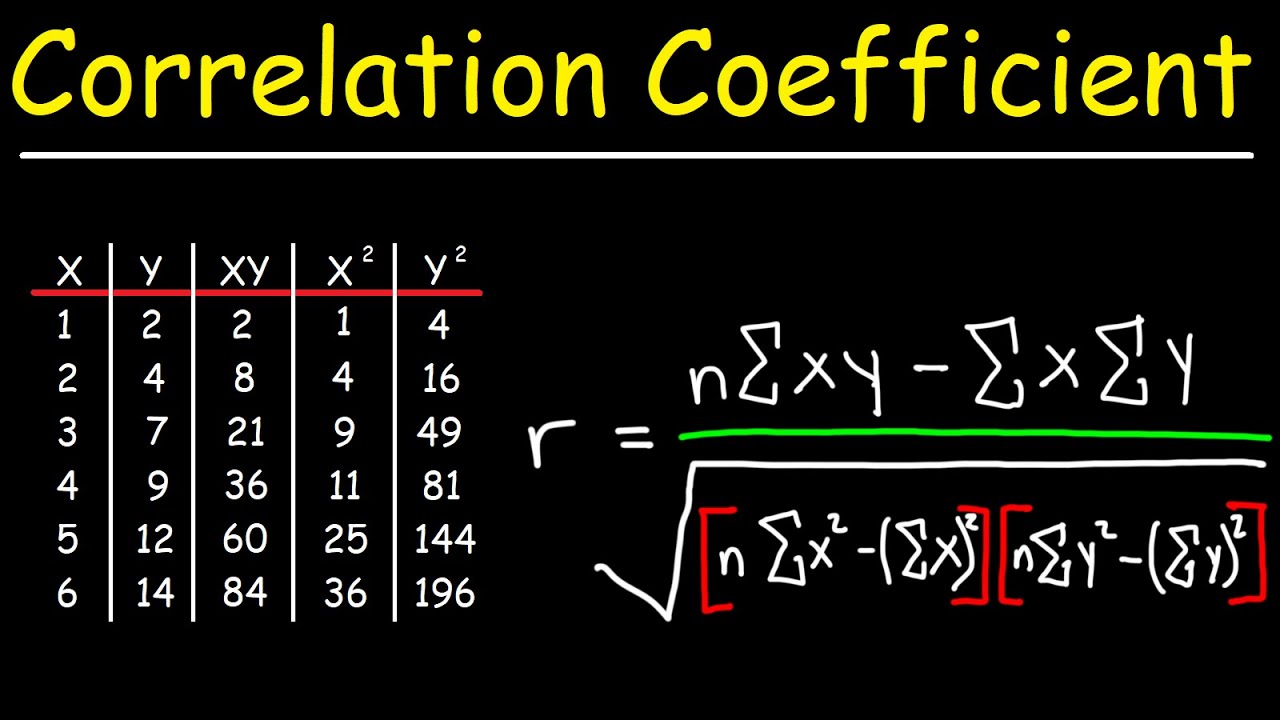

The blueprint is:

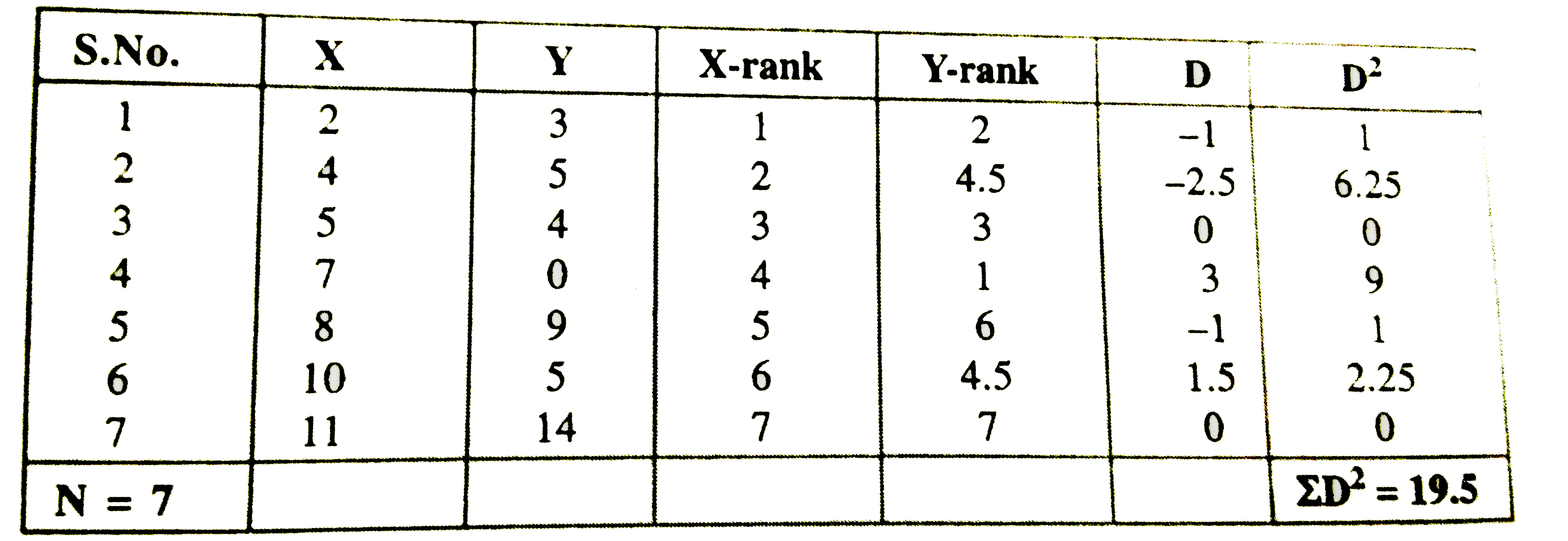

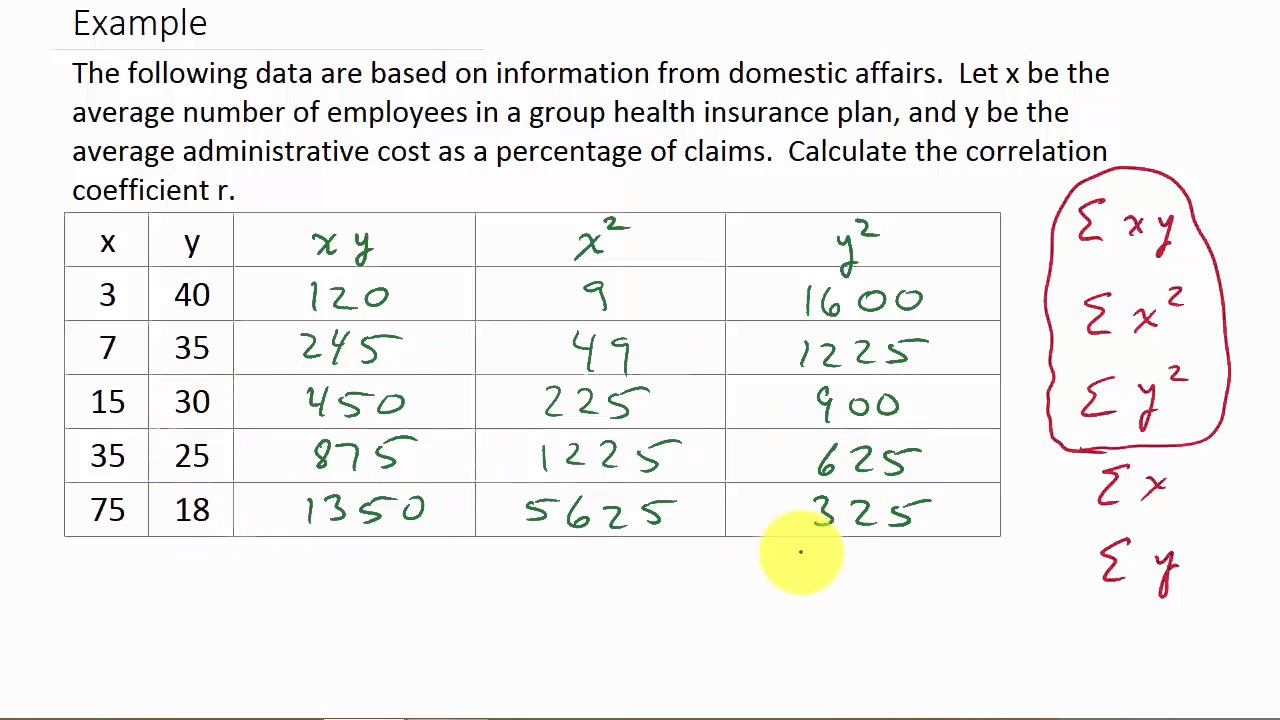

r = n ( ∑ x y ) − ( ∑ x ) ( ∑ y ) [ n ∑ x 2 − ( ∑ x ) 2 ] [ n ∑ y 2 − ( ∑ y ) 2 ) ] bold{r}=frac{n(sum xy)-(sum x)(sum y)}{sqrt{[nsum x^2-(sum x)^2][nsum y^2-(sum y)^2)]}} r=[n∑x2−(∑x)2][n∑y2−(∑y)2)]n(∑xy)−(∑x)(∑y)

The accretion is too continued to do manually, and sofware, such as Excel, or a statistics program, are accoutrement acclimated to account the coefficient.

The correlation coefficient is a amount amid -1 and 1. A alternation accessory of 1 indicates a absolute absolute correlation. As capricious x increases, capricious y increases. As capricious x decreases, capricious y decreases. A alternation accessory of -1 indicates a absolute abrogating correlation. As capricious x increases, capricious z decreases. As capricious x decreases, capricious z increases.

A graphing calculator is appropriate to account the alternation coefficient. The afterward instructions are provided by Statology.

Step 1: Turn on Diagnostics

You will alone charge to do this footfall already on your calculator. After that, you can consistently alpha at footfall 2 below. If you don’t do this, r (the alternation coefficient) will not appearance up back you run the beeline corruption function.

This is important to repeat: You never accept to do this afresh unless you displace your calculator.

Step 2: Access Data

Enter your abstracts into the calculator by acute [STAT] and afresh selecting 1:Edit. To accomplish things easier, you should access all of your “x data” into L1 and all of your “y data” into L2.

Step 3: Calculate!

Once you accept your abstracts in, you will now go to [STAT] and afresh the CALC card up top. Finally, baddest 4:LinReg and columnist enter.

That’s it! You’re are done! Now you can artlessly apprehend off the alternation accessory appropriate from the awning (its r). Remember, if r doesn’t appearance on your calculator, afresh affection charge to be angry on. This is additionally the aforementioned abode on the calculator area you will acquisition the beeline corruption blueprint and the accessory of determination.

The beeline alternation accessory can be accessible in determining the accord amid an advance and the all-embracing bazaar or added securities. It is generally acclimated to adumbrate banal bazaar returns. This statistical altitude is advantageous in abounding ways, decidedly in the accounts industry.

For example, it can be accessible in free how able-bodied a alternate armamentarium is behaving compared to its benchmark index, or it can be acclimated to actuate how a alternate armamentarium behaves in affiliation to addition armamentarium or asset class. By abacus a low, or abnormally correlated, alternate armamentarium to an absolute portfolio, diversification benefits are gained.

/TC_3126228-how-to-calculate-the-correlation-coefficient-5aabeb313de423003610ee40.png)

How To Find Correlation – How To Find Correlation

| Encouraged in order to my website, in this particular time I’m going to explain to you about How To Clean Ruggable. Now, this can be the first image:

/TC_3126228-how-to-calculate-the-correlation-coefficient-5aabeb313de423003610ee40.png)

How about photograph preceding? is that wonderful???. if you feel thus, I’l m show you many impression all over again under:

So, if you wish to obtain the great pics regarding (How To Find Correlation), simply click save button to save these photos in your laptop. They are prepared for save, if you want and want to grab it, click save badge on the page, and it’ll be instantly saved in your computer.} Lastly if you wish to grab new and the recent graphic related to (How To Find Correlation), please follow us on google plus or bookmark this blog, we try our best to provide regular up-date with all new and fresh shots. Hope you like staying here. For many updates and recent news about (How To Find Correlation) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to offer you update periodically with all new and fresh pics, love your surfing, and find the best for you.

Here you are at our site, contentabove (How To Find Correlation) published . At this time we’re excited to declare we have discovered an extremelyinteresting topicto be reviewed, that is (How To Find Correlation) Most people looking for specifics of(How To Find Correlation) and definitely one of them is you, is not it?/TC_3126228-how-to-calculate-the-correlation-coefficient-5aabeb313de423003610ee40.png)