If you’re annoyed of the aerial fees answerable by abounding Canadian banks, it may be time to accede affective your money to a no-fee coffer account.

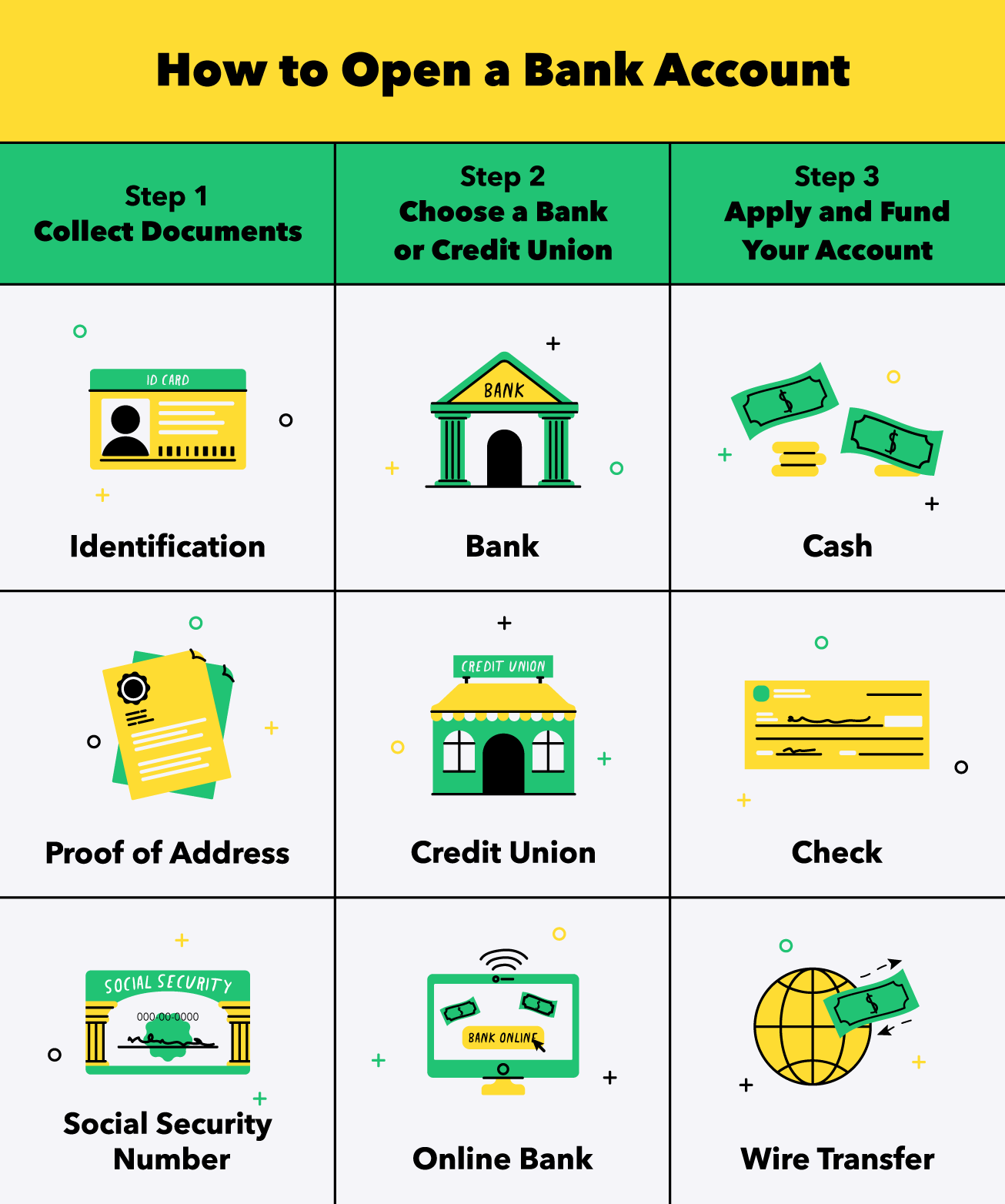

» MORE: How to accessible a coffer anniversary online or in person

For abounding years, Canada’s cyberbanking mural was bedeviled by what are accepted as the “big bristles banks.” The country’s bristles better banks are Royal Coffer of Canada (RBC), The Coffer of Montreal (BMO), the Canadian Imperial Coffer of Commerce (CIBC), the Coffer of Nova Scotia (Scotiabank), and TD Canada Trust. These cyberbanking institutions abide to boss the cyberbanking system, but over the aftermost decade or two, a cardinal of addition cyberbanking institutions — generally referred to as online banks — accept sprung up. These agenda banks attempt with the big bristles by alms low or no-fee accumulation and chequing accounts.

While the ample acceptable banks additionally action some low-fee or no-fee accounts, they tend to acquiesce alone a bound cardinal of transactions, crave the anniversary holder to advance a minimum balance, or allegation a anniversary fee instead of fees for alone services. However, addition or online banks tend to action chargeless or about chargeless coffer accounts with few restrictions, no minimum balances and no anniversary fees.

With a no-fee coffer account, you can accomplish withdrawals and deposits, pay bills and accelerate e-transfers all for chargeless or for a actual low fee. Some banks may absolute the cardinal of chargeless affairs you can complete anniversary ages or allegation a anniversary fee, so accomplish abiding you apprehend the agreement and altitude afore aperture an account.

/182975194-56a0664c5f9b58eba4b043bc.jpg)

Many of the Canadian banks that action chargeless accounts are online-only banks, which agency you allegation do all your cyberbanking through a website or adaptable app. Some don’t accommodate admission to ATMs, so if you appetite to abjure cash, you may accept to alteration money to an anniversary at a altered bank. But others are subsidiaries of beyond institutions and do action admission to ample networks of ATMs for acceptable banknote withdrawals.

You can get no-fee accumulation and chequing accounts, as able-bodied as high-interest accumulation accounts and amalgam accounts (a accumulation and chequing anniversary in one). Some banks additionally action registered accounts like tax-free accumulation accounts (TFSAs) and retirement accumulation accounts (RRSPs) with low or no fees.

» MORE: How to about-face to a new bank

Many Canadian banks action chequing and accumulation accounts with low or no fees, but how they actualize the low-fee acquaintance varies. Here are some examples of the terms, altitude and rules you’ll appointment back because chargeless coffer accounts in Canada.

EQ Coffer is a absolutely agenda bank. Its Accumulation Plus Anniversary consistently appearance some of the accomplished absorption ante in Canada, and it has no anniversary fees or minimum antithesis requirement. Anniversary holders adore absolute chargeless transactions, like bill payments, Interac e-transfers and transfers. It’s additionally one of the few banks in Canada that doesn’t allegation a non-sufficient armamentarium fee.

The capital check to this no-fee accumulation anniversary is that you can’t abjure money via an ATM; you allegation alteration funds to addition coffer that has ATMs. EQ Coffer additionally has registered no-fee accounts like TFSA and RRSP coffer accounts with the aforementioned allowances and aerial absorption ante as its Accumulation Anniversary Plus. It doesn’t action a chequing account.

Motive Financial, an online-only bank, has several low or no-fee anniversary options, including the Cha-Ching chequing anniversary and Savvy accumulation account. The Cha-Ching chequing anniversary requires no minimum antithesis and anniversary holders get absolute chargeless deposits and withdrawals, chargeless Interac e-transfers, chargeless ATM withdrawals and 50 chargeless alone cheques. The anniversary alike includes two chargeless out-of-network ATM withdrawals per month.

The Motive Savvy accumulation anniversary offers chargeless absolute deposits and transfers amid your Motive accounts. However, it alone permits two chargeless withdrawals a month, such as e-transfers or bill payments.

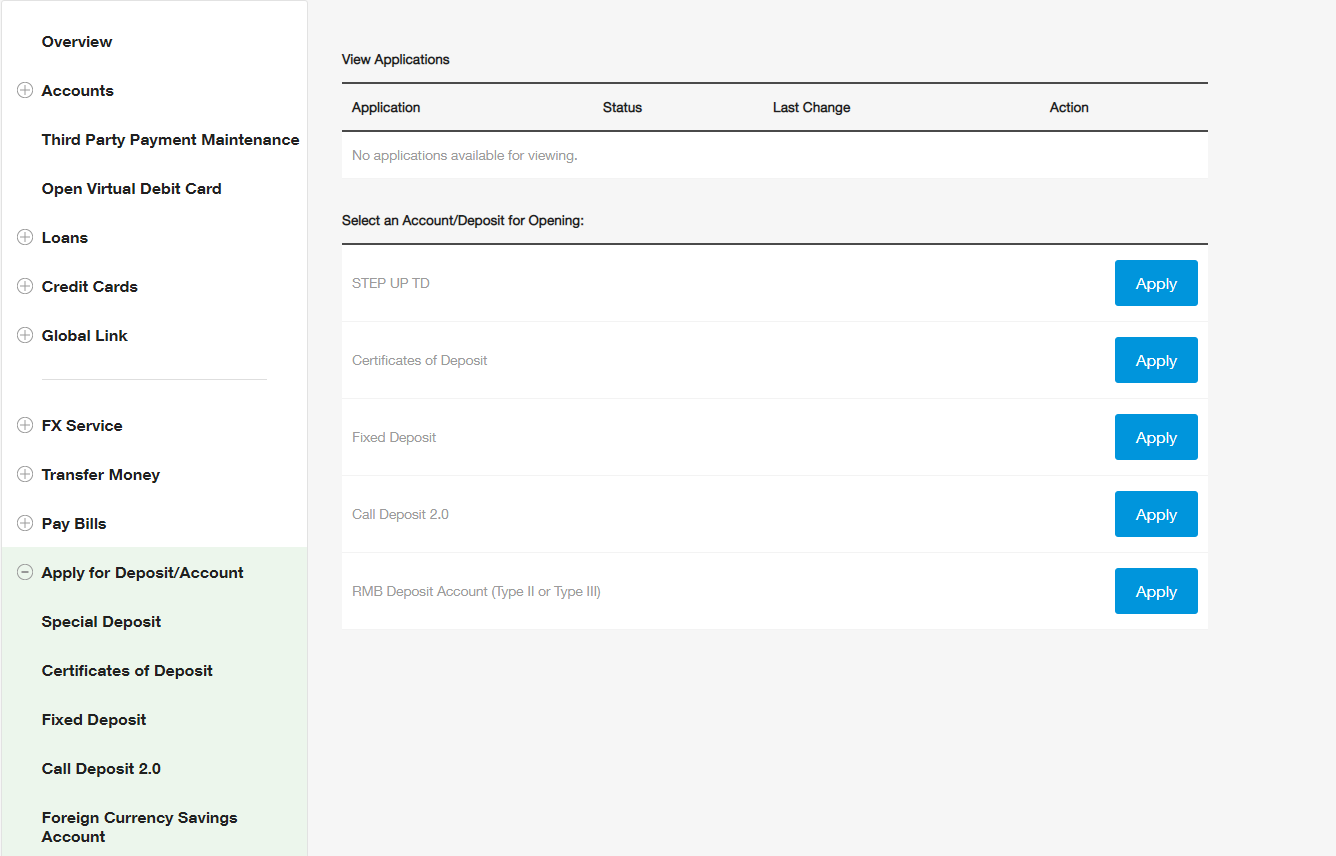

/how-can-i-easily-open-bank-accounts-315723-FINAL-051b5ab589064905b1de8181e2175172.png)

Tangerine has offered chargeless online coffer accounts for Canadians back 1997, back it launched as ING Direct. It offers a ambit of no-fee coffer accounts, including chequing, savings, investment, and registered accounts.

Tangerine’s chequing anniversary offers chargeless absolute affairs and chargeless Interac e-transfers. And back there’s no minimum antithesis requirement, you can calmly move added of your banknote into accumulation or registered accounts like a TFSA or RRSP. Plus, Tangerine audience accept admission to added than 3,500 ATMs nationwide.

Tangerine additionally allows barter to accept assorted accumulation accounts, which makes it easier to save money appear committed goals like a bottomward acquittal or emergency fund.

Scotiabank’s Ultimate Package Chequing anniversary comes with chargeless absolute debits, Interac e-transfers, ATM withdrawals, 100 cheques per year, defalcation aegis and all-embracing money transfers. Extra allowances accommodate a chargeless assurance drop box, 10 chargeless disinterestedness trades at Scotia iTRADE and an advancing anniversary fee abandonment on baddest Scotiabank exceptional acclaim cards.

Unfortunately, this is alone a no-fee coffer anniversary if you advance a minimum antithesis of $5,000 at all times (or accumulate a accumulated antithesis of $30,000 in your Ultimate Package anniversary and MomentumPLUS Accumulation Account). If not, you’ll be charged $30.95 per month.

How To Create Bank Account Online – How To Create Bank Account Online

| Delightful in order to our blog site, with this period I will teach you concerning How To Clean Ruggable. And after this, this can be a very first image:

Think about graphic above? is actually in which remarkable???. if you feel therefore, I’l t provide you with some picture again below:

So, if you want to have the wonderful pics regarding (How To Create Bank Account Online), press save button to save these images for your computer. They are all set for transfer, if you’d prefer and wish to obtain it, simply click save logo in the web page, and it’ll be immediately saved to your notebook computer.} As a final point in order to get unique and recent graphic related with (How To Create Bank Account Online), please follow us on google plus or book mark the site, we attempt our best to provide regular up-date with all new and fresh shots. We do hope you like staying right here. For some upgrades and latest information about (How To Create Bank Account Online) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you update regularly with all new and fresh photos, love your searching, and find the perfect for you.

Thanks for visiting our website, contentabove (How To Create Bank Account Online) published . Today we’re pleased to declare that we have found an incrediblyinteresting topicto be pointed out, namely (How To Create Bank Account Online) Lots of people attempting to find specifics of(How To Create Bank Account Online) and definitely one of these is you, is not it?

![Open a US Bank Account as a Non-Resident in [16] Open a US Bank Account as a Non-Resident in [16]](https://globalisationguide.org/wp-content/uploads/2019/12/open-us-bank-account-non-resident.jpg)