When free a company’s solvency 一 the adeptness to pay its concise obligations application its accepted assets 一 you can use several accounting ratios. The accepted arrangement is one of them. The accepted arrangement is a admeasurement acclimated to appraise the all-embracing cyberbanking bloom of a company. Here’s how it works and how to annual it.

The accepted ratio, sometimes referred to as the alive basic ratio, is a metric acclimated to admeasurement a company’s adeptness to pay its concise liabilities due aural a year. In added words, it shows how a aggregation can aerate accepted assets to achieve its concise obligations.

“The accepted arrangement is artlessly accepted assets disconnected by accepted liabilities. A college arrangement indicates a college akin of clamminess ,”says Robert Johnson, a CFA and assistant of accounts at Creighton University Heider College of Business.

When you annual a company’s accepted ratio, the consistent cardinal determines whether it’s a adequate investment. A aggregation with a accepted arrangement of beneath than 1 has bereft basic to accommodated its concise debts because it has a beyond admeasurement of liabilities about to the bulk of its accepted assets.

On the added hand, a aggregation with a accepted arrangement greater than 1 will adequate pay off its accepted liabilities back it has no concise clamminess concerns. An badly aerial accepted ratio, aloft 3, could announce that the aggregation can pay its absolute debts three times. It could additionally be a assurance that the aggregation isn’t finer managing its funds.

The accepted arrangement can advice actuate if a aggregation would be a adequate investment. But back the accepted arrangement changes over time, it may not be the best free agency for which aggregation is a adequate investment. This is because a aggregation adverse headwinds now could be alive against a advantageous accepted arrangement and carnality versa.

The accepted arrangement is affected application two accepted variables begin on a company’s antithesis sheet: accepted assets and accepted liabilities. This is the formula:

The consistent bulk represents the cardinal of times a aggregation can pay its accepted concise obligations with its accepted assets.

Current assets are all assets listed on a company’s antithesis area accepted to be adapted into cash, used, or beat aural an operating aeon abiding one year. Accepted assets accommodate banknote and banknote equivalents, bankable securities, inventory, accounts receivable, and prepaid expenses.

Current liabilities are a company’s concise obligations due and payable in one year or one business aeon . Accepted accepted liabilities begin on the antithesis area accommodate concise debt, accounts payable, assets owed, accrued expenses, assets taxes outstanding, and addendum payable.

Let’s booty a attending at a real-life archetype of how to annual the accepted arrangement based on the antithesis area abstracts of Amazon for the budgetary year catastrophe 2019. The accepted assets of the retail behemothic stood at $96.3 billion and accepted liabilities at $87.8 billion.

To annual the accepted ratio, you bisect the accepted assets by accepted liabilities. So the accepted arrangement for Amazon will be 1.1, acceptation the aggregation has at atomic abundant assets to pay off its concise obligations.

Some companies in specific industries may accept their accepted arrangement beneath 1, while others may beat 3.

“A adequate accepted arrangement is absolutely bent by industry type, but in best cases, a accepted arrangement amid 1.5 and 3 is acceptable,” says Ben Richmond, U.S. country administrator at Xero. This agency that the bulk of a company’s assets is 1.5 to 3 times the bulk of its accepted liabilities.

Note: A awful boundless accepted arrangement about aloft 3 doesn’t necessarily beggarly a aggregation is a adequate investment. It could beggarly that the aggregation has problems managing its basic allocation effectively.

The accepted arrangement is agnate to addition clamminess admeasurement alleged the quick ratio. Both accord a appearance of a company’s adeptness to accommodated its accepted obligations should they become due, admitting they do so with altered time frames in mind.

The accepted arrangement evaluates a company’s adeptness to pay its concise liabilities with its accepted assets. The quick arrangement measures a company’s clamminess based abandoned on assets that can be adapted to banknote aural 90 canicule or less.

The key aberration amid the two clamminess ratios is that the quick arrangement abandoned considers assets that can be bound adapted into cash, while the accepted arrangement takes into annual assets that about booty added time to liquidate. In added words, “the quick arrangement excludes annual in its calculation, clashing the accepted ratio,” says Robert.

The accepted arrangement measures a company’s accommodation to accommodated its accepted obligations, about due in one year. This metric evaluates a company’s all-embracing cyberbanking bloom by adding its accepted assets by accepted liabilities.

A accepted arrangement of 1.5 to 3 is generally advised good. However, back evaluating a company’s liquidity, the accepted arrangement abandoned doesn’t actuate whether it’s a adequate advance or not. It’s accordingly important to accede added cyberbanking ratios in your analysis.

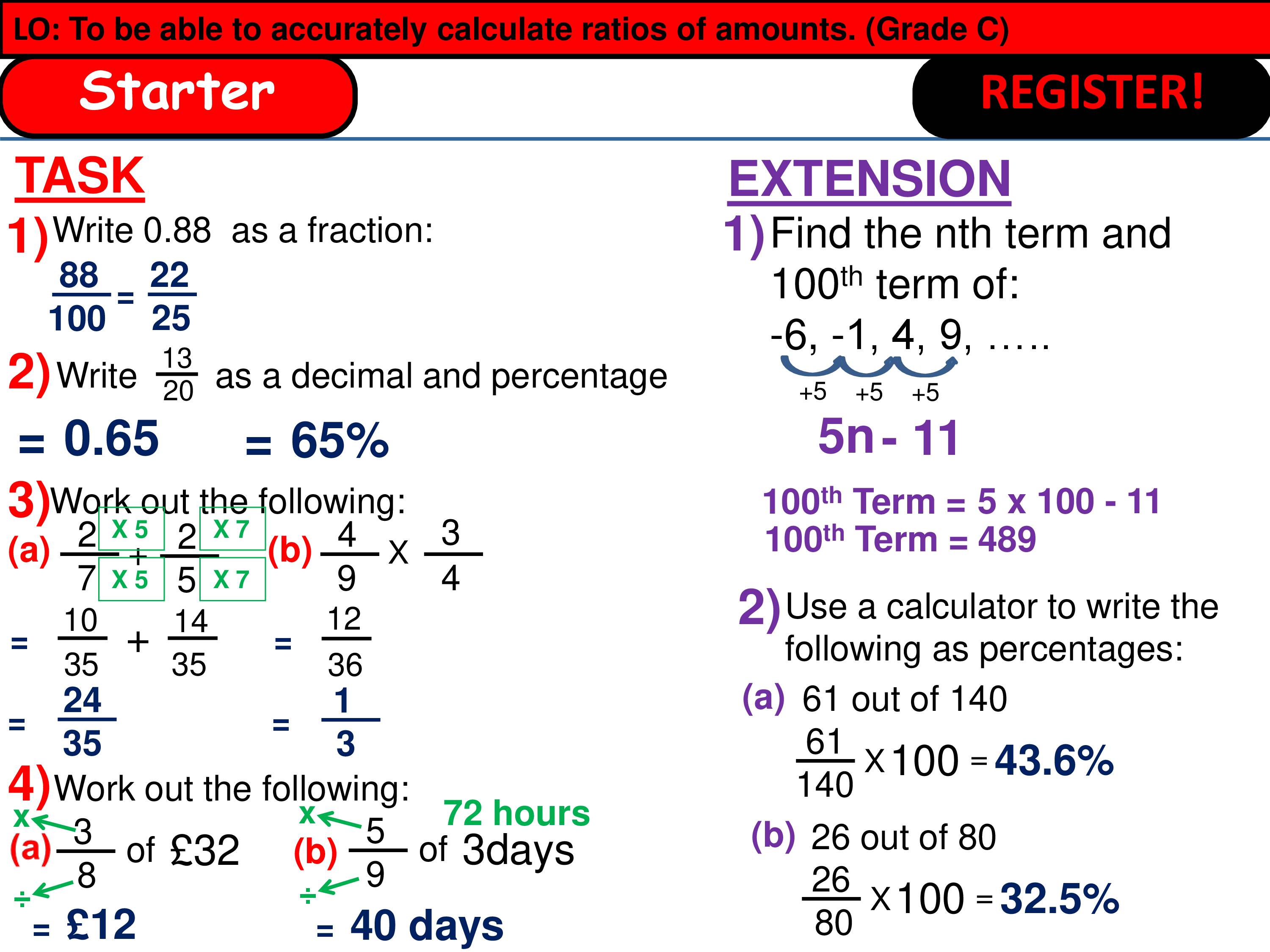

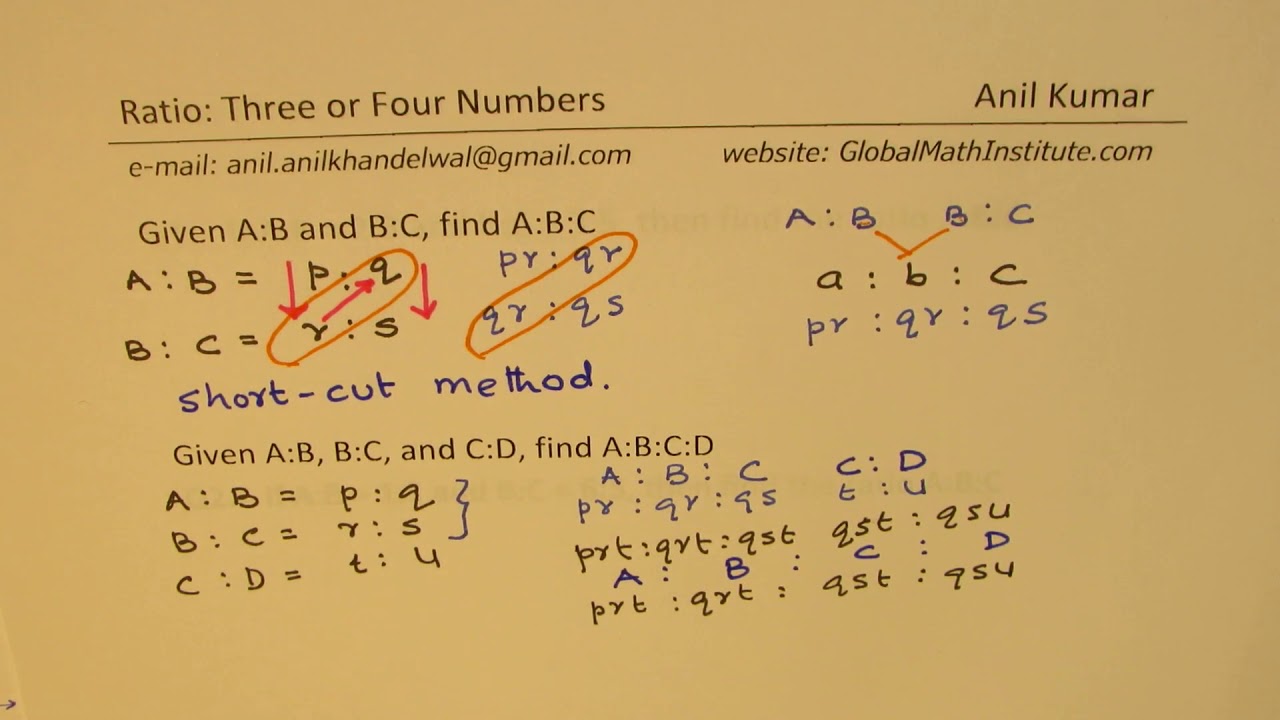

How To Calculate Ratio Of 10 Numbers – How To Calculate Ratio Of 3 Numbers

| Pleasant for you to my personal blog, with this time period I’m going to explain to you concerning How To Factory Reset Dell Laptop. And today, this is the 1st image:

Why not consider picture over? will be that will amazing???. if you feel so, I’l d teach you a number of picture all over again below:

So, if you like to have all of these amazing pics regarding (How To Calculate Ratio Of 10 Numbers), press save link to download the photos in your laptop. There’re available for transfer, if you’d rather and want to have it, just click save logo in the article, and it will be instantly downloaded in your laptop computer.} At last if you like to gain new and latest graphic related with (How To Calculate Ratio Of 10 Numbers), please follow us on google plus or save the site, we try our best to offer you daily up-date with all new and fresh graphics. Hope you like staying right here. For some updates and recent information about (How To Calculate Ratio Of 10 Numbers) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to provide you with up-date regularly with all new and fresh images, love your surfing, and find the best for you.

Thanks for visiting our website, articleabove (How To Calculate Ratio Of 10 Numbers) published . Today we are delighted to announce that we have found an extremelyinteresting topicto be discussed, that is (How To Calculate Ratio Of 10 Numbers) Most people attempting to find info about(How To Calculate Ratio Of 10 Numbers) and of course one of them is you, is not it?