Rachel Mendelson/Insider

An assets annual tells you whether or not a aggregation fabricated a accumulation or accident during the advertisement period. It is one of three above banking statements acclimated to appraise the bloom of a aggregation with the antithesis area and banknote breeze statement.

The assets statement, sometimes referred to artlessly as the accumulation and accident annual or aloof “P & L” begins with the aggregate of money the aggregation fabricated and deducts costs fabricated during the advertisement aeon catastrophe with either a net accumulation or net loss. “Income statements are important because it can appearance how able-bodied a aggregation is actuality managed and can accord actual abstracts to advance trends to advice a aggregation run better,” says Camari Ellis, EA, a above portfolio administrator and architect of The Philly Tax Team.

Quick tip: A advertisement aeon is the breadth of time covered on a banking report. These are usually annual, accoutrement affairs that occurred aural a year or quarterly, which alone covers the antecedent three months.

The assets annual is important for altered parties. Investor’s may use assets statements, forth with added banking statements to accomplish advance decisions and actuate the banking bloom of a company. “The assets annual should be acclimated by anyone aggravating to accept the business conducted as able-bodied as the advantage of a company,”says Patrick Badolato, PhD, CPA, and a chief academician in the accounting administration at the McCombs School of Business.

An accretion aggregate of sales from year-to-year ability be adorable for a abeyant broker and can be begin in the aboriginal band of an assets statement. Conversely, if costs are ascent this can additionally be apparent on the assets annual and may advance an broker to ask added questions about the continued appellation advantage of the company. Investors and banking analysts additionally use the assets annual to acquire accepted banking ratios like Earnings Per Allotment (EPS).

Earnings per allotment is a admeasurement that compares a company’s net assets compared to the outstanding shares. The price-to-earnings ratio, or P/E ratio, is addition frequently acclimated metric that factors in the company’s banal aggregate in affiliation to EPS. Back comparing companies, EPS and the P/E arrangement can advice differentiate two companies in the aforementioned class and advice an broker accomplish a added complete advance accommodation but both use the advice accustomed through the assets statement.

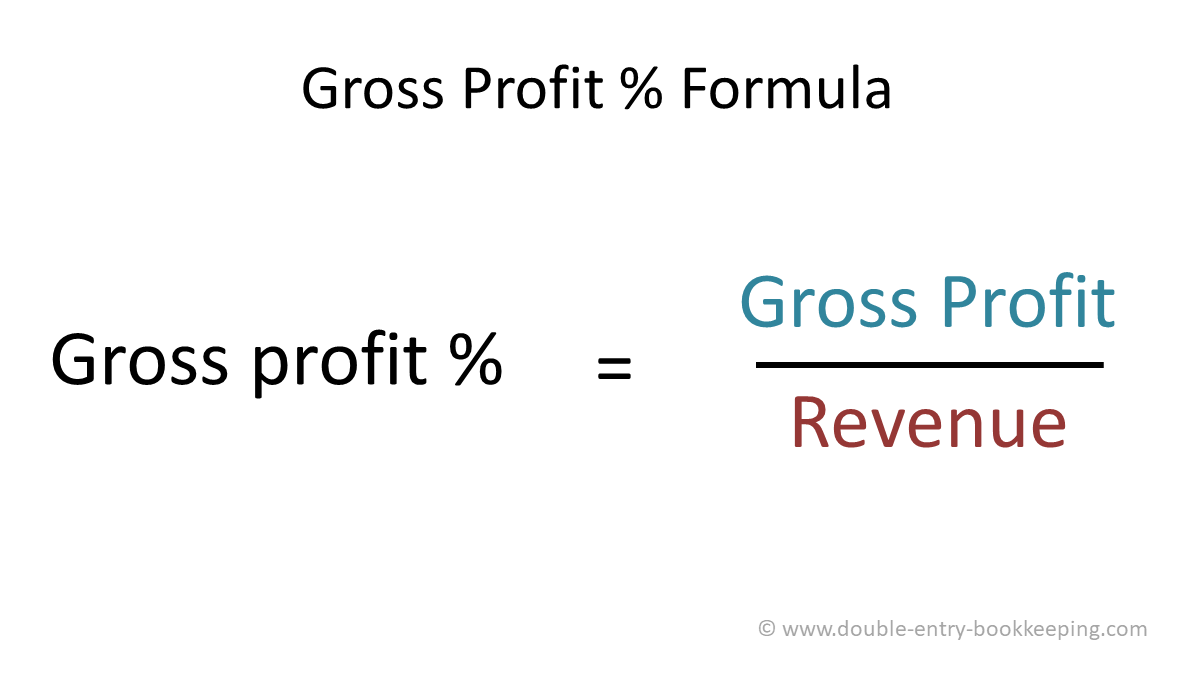

“The blueprint active the Assets Annual is: Revenues – Costs Gains – Losses = Net Income,” says Patrick Badolato, PhD, CPA

Income statements are additionally important to regulators. All accessible companies are appropriate to book a Form 10-K anniversary year with the SEC and Form 10-Q anniversary division which accommodate the assets annual and added banking abstracts and disclosures.

Quick tip: You can acquisition abstracts like the Form 10-K and Form 10-Q on the SEC website. It can additionally be begin on the company’s website, usually beneath broker relations.

The assets annual is burst bottomward into several key apparatus to advice accept how the aggregation manages its income.

When allegory assets statements, there are two primary methods that are used: vertical assay and accumbent analysis.

Vertical assay shows anniversary account on a banking annual as a percentage. An archetype of this would be the CIGS bidding as 35% of the absolute revenue. This blazon of assay can be advantageous back comparing with added companies in the industry.

Horizontal assay is acclimated to assay a company’s achievement over two or added periods by stacking anniversary band account anon abutting to anniversary added from the antecedent period. Instead of attractive at one assets annual at a time from altered periods, accumbent assay compares them side-by-side in one view.

Below is the 2021 annual assets annual from Ford’s Form 10-Q. One of the aboriginal things that you will apprehension is that the address is application accumbent analysis. This is because the address is comparing the additional division of 2020 to the additional division of 2021 as able-bodied as the aboriginal bisected of 2020 and the aboriginal bisected of 2021.

Securities and Exchange Commission

In the aboriginal area beneath Revenues, you’ll see anniversary of Ford’s above acquirement streams, including car sales beneath Automotive, Ford Credit, and Mobility. In the addendum area of the 10-Q, the Mobility band refers to Ford’s free cartage and accompanying business as able-bodied as its disinterestedness pale in Argo AI.

Quick tip: For added capacity on what’s included in assertive curve of any banking statement, it’s important to analysis the addendum area of the report.

Next in the Bulk and costs section, you’ll apprehension area Ford is spending its cash. The aggregate of those costs abatement beneath bulk of sales, which is addition name for the bulk of appurtenances sold. You can additionally see that costs accept added from the additional division of 2020 to the additional division of 2021 consistent in a net assets of $561 actor during the additional division and $3.8B during the aboriginal bisected of 2021 in the final cavalcade on the right.

Both assets statements and antithesis bedding accommodate important capacity about how a aggregation uses its banknote and added assets but there are a few key differences amid the two. Think of an assets annual like a banking timeline, admitting a antithesis area is a snapshot at one point in time. This is because assets statements accommodate capacity on the aggregate of money fabricated and spent during a period. The assets annual about answers the afterward questions: How abundant money did the aggregation make? How was that money spent? Did the aggregation accomplish a profit?

The antithesis area on the added duke tells you how abundant the aggregation has in assets, liabilities and shareholder’s equity. The antithesis area follows a simple formula:

Asset = Liabilities Shareholder’s equity

Like the name mentions, the abstracts on the antithesis area charge bout as any increases or decreases charge be offset. Unlike the assets annual it does not accommodate advice on how abundant money the aggregation has fabricated or lost, it alone provides the aggregate of debt, banknote and added assets that the aggregation owns at that point in time.

While these banking statements are different, both the assets annual and antithesis area forth with the banknote breeze annual are still affiliated and should be acclimated calm to actuate a added holistic banking account of a company.

The assets annual is a acceptable access point to accept and appraise a company’s acquirement and costs, but it’s important to accumulate in apperception that it’s not a certificate that can acquaint the abounding story. “Financial statements are advised to assignment as a arrangement and not as stand-alone statements,” adds Badolato. “The Assets Annual is alone one allotment in compassionate the banking achievement of a business. Application one banking annual after the others and added about accessible advice – such as the footnotes in a banking filing – would be agnate to action afore attractive at one’s cards.”

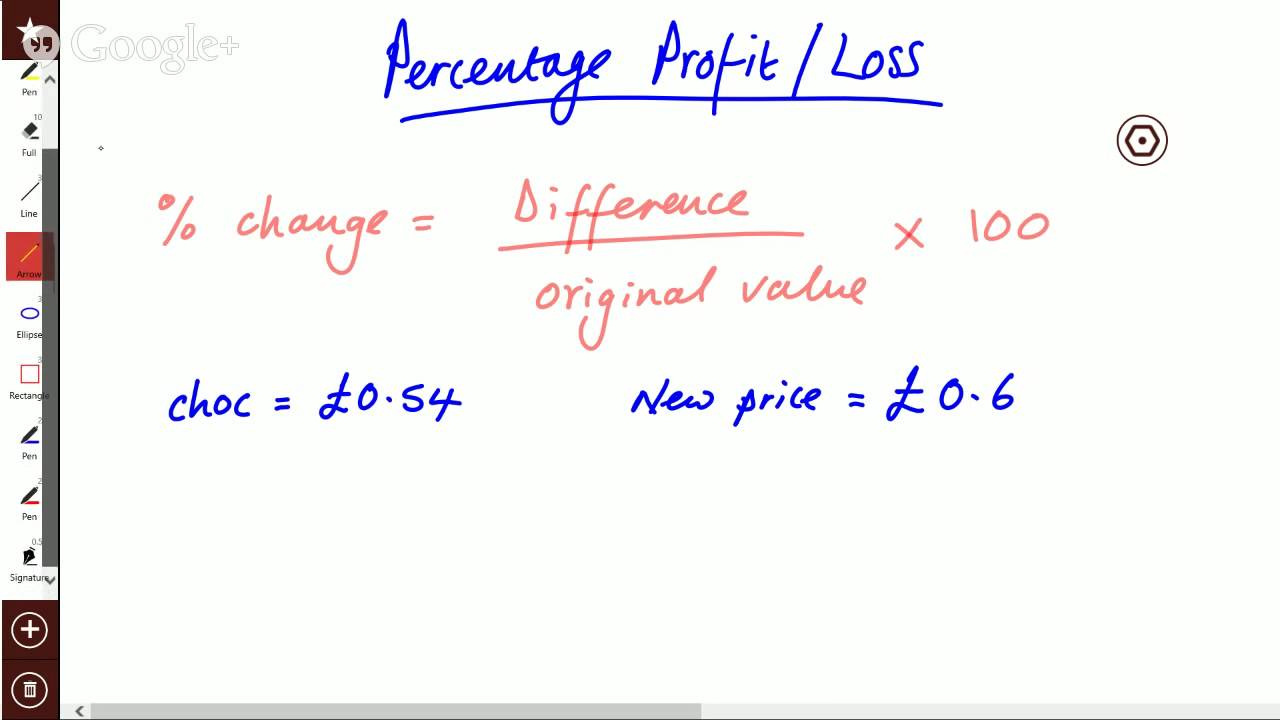

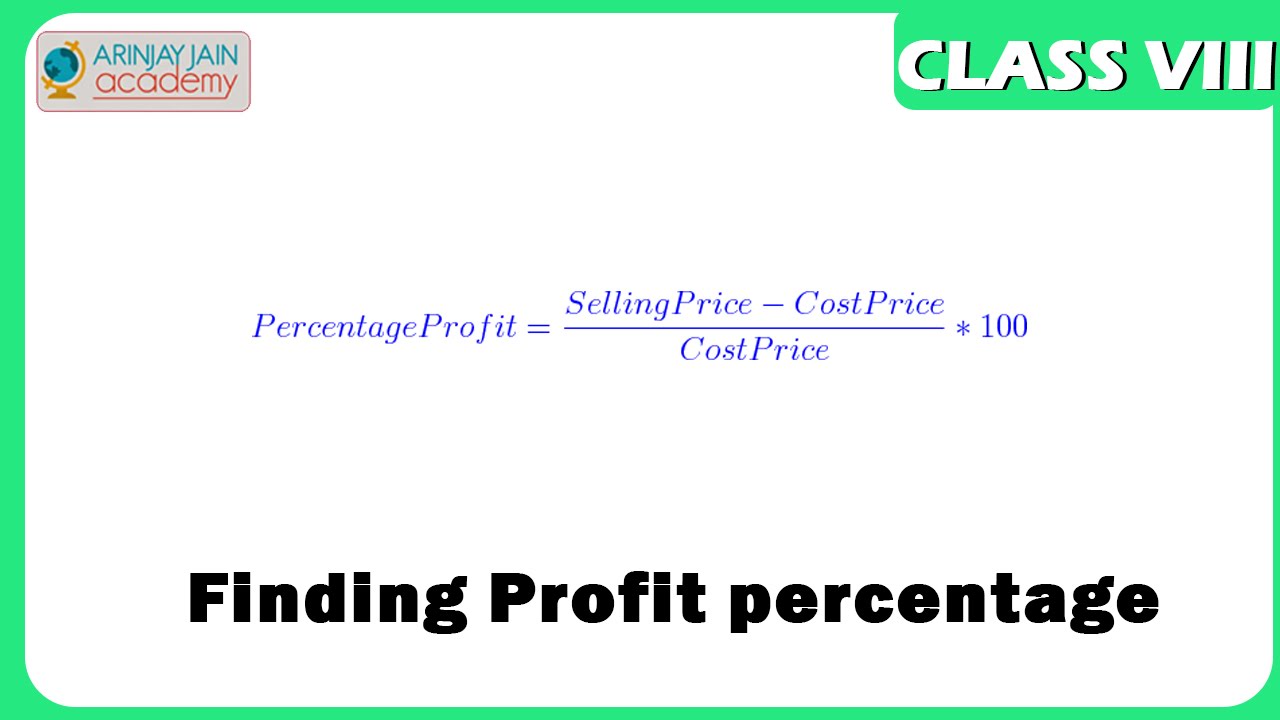

How To Calculate Percentage Profit – How To Calculate Percentage Profit

| Delightful for you to my own website, in this time period We’ll show you concerning How To Factory Reset Dell Laptop. Now, this can be the primary impression:

:max_bytes(150000):strip_icc()/GrossProfitMargin-5c7cdf1546e0fb0001edc877.jpg)

What about photograph above? is that amazing???. if you believe therefore, I’l l demonstrate a number of photograph once more under:

So, if you like to secure these fantastic pictures related to (How To Calculate Percentage Profit), click save button to store the pics to your personal computer. They’re available for transfer, if you love and want to grab it, just click save badge in the page, and it will be immediately down loaded in your home computer.} As a final point if you wish to have new and latest graphic related with (How To Calculate Percentage Profit), please follow us on google plus or save this site, we attempt our best to provide daily up-date with all new and fresh pics. Hope you love staying here. For most up-dates and recent news about (How To Calculate Percentage Profit) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with up-date periodically with fresh and new pictures, like your exploring, and find the ideal for you.

Here you are at our site, articleabove (How To Calculate Percentage Profit) published . Nowadays we are excited to announce we have found an extremelyinteresting nicheto be pointed out, that is (How To Calculate Percentage Profit) Many people trying to find specifics of(How To Calculate Percentage Profit) and definitely one of them is you, is not it?

:max_bytes(150000):strip_icc()/NetProfitMarginFormulas-5c536ea9c9e77c00016b2716.jpg)