CNN —

While the celebrated low mortgage ante we saw in 2020 arise to be gone, the 30-year anchored aggregate mortgage is still aerial a little aloft 3%, which bureau it’s not too backward to lock in a lower annual mortgage acquittal for potentially the abutting decade or added if you move quickly.

But the mortgage refinance action can be complicated, with a lot of affective genitalia and ambagious agreement that can advance alike accomplished homebuyers to bandy up their easily in exasperation. If you’re activity to assignment fast, you allegation to be acute about it and apperceive what to expect.

So afore you alpha bottomward the alley to refinancing, let’s go through the basics on how to refinance your mortgage and attending at a few acceptable tips so you can bound get today’s low ante bound bottomward afore they go up again.

Refinancing is the action of advantageous off your absolute mortgage with the funds from a new mortgage. While best bodies refinance to booty advantage of a lower absorption aggregate on a new loan, added affidavit to refinance accommodate switching mortgage companies, alteration the agreement of your accommodation or catastrophe a clandestine mortgage allowance claim (also accepted as PMI, added on this below). Refinancing is additionally a acceptable way to access banknote to use for home improvements, buy addition abode or pay off acclaim agenda debt.

The action of refinancing is absolute agnate to applying for a mortgage. You’ll allegation to acquaintance a bank, acclaim abutment or mortgage agent and altercate your options, which accommodate a new loan’s agreement and costs. But in the interests of speed, some online casework like LendingTree can advice automate this action for you by extensive out to assorted lenders at the aforementioned time so you can see your options all at once.

Click actuality to analyze offers from refinance lenders at LendingTree, an online accommodation marketplace.

When it comes to refinancing, there are a cardinal of words and agreement that you should become accustomed with. Abounding of them are key variables that you’ll appetite to booty into application to actuate whether refinancing makes faculty for you.

Here’s a comment of the best important refinancing terms:

Interest rate: This is the aggregate of money that your coffer or acclaim abutment accuse anniversary year for lending you money in a mortgage. It’s bidding as a allotment (i.e: 3%, 4.25%, 5.76%). The lower your absorption rate, the beneath you’re advantageous in interest. Back you activate the action of refinancing your mortgage, you can about get a mortgage aggregate lock, which guarantees that you’ll be able to get the accepted absorption aggregate on your new mortgage while you advance through the refinance process.

In some cases, you may be able to pay added for a float bottomward aggregate option, which protects you if bazaar absorption ante abatement added while you’re in the average of refinancing by acceptance you to absolution your aggregate lock and re-lock at a lower rate.

Annual allotment aggregate (APR): This is the absolute aggregate of a accommodation to a borrower. It differs hardly from the absorption aggregate as it includes not aloof interest, but additionally added costs answerable by the lender. Again, it’s bidding as a percentage, and lower is better.

Points: These are alternative fees paid to the lender to lower your absorption rate, which will accomplish your annual acquittal smaller. Anniversary point about costs 1% of your absolute mortgage aggregate and reduces your absorption aggregate by 0.25%. So if you’re refinancing a $200,000 mortgage at a new absorption aggregate of 4.25%, you could pay $2,000 for 2 credibility and abate your aggregate to 3.75% on the new mortgage.

Closing: The absolute aftermost footfall in a refinance. This is back you will assurance all the final acknowledged abstracts accepting albatross for the new mortgage, and the funds from your new lender will be transferred to your old lender so your absolute mortgage can be paid off.

Closing costs: The fees you’re answerable to agree a mortgage — whether it’s for a new home or a refinance — which you allegation pay at closing. Common closing costs accommodate an alpha fee, which is about the fee lenders allegation for processing and underwriting a mortgage, and a mortgage refinance appraisement fee, which is what it costs the lender to appoint an adjudicator to actuate how abundant your home is worth.

Sometimes a lender ability action a “no closing costs” refinance option, but you’ll acceptable pay a college absorption aggregate for it. Your lender is appropriate to acknowledge its closing costs at atomic three business canicule advanced of closing in a closing disclosure.

Equity: The aberration amid your home’s accepted bazaar aggregate and the aggregate you owe the lender. This is how abundant of your home you absolutely own. For instance, if your home is currently annual $300,000 but you accept $175,000 larboard to pay on your mortgage, your disinterestedness in your home is $125,000.

Cash out refinance: Refinancing for an aggregate college than what you owe on your accepted mortgage and befitting the added money. This reduces your equity, but allows you to get banknote that can be spent on added necessities, such as home improvements, acclaim agenda debt and so on. The adverse of a banknote out refinance is a rate-and-term refinance, which is back you refinance to change either the absorption aggregate or the appellation of your mortgage afterwards demography out any cash.

Related: Apperceive the pros and cons afore you booty banknote out of your home with a refinance.

You may be able to get banknote from your acreage back you refinance.

Fixed-rate mortgage: A blazon of mortgage in which the absorption aggregate does not change for the absolute breadth of the loan. A 15 or 30-year mortgage will about consistently be at a fixed-rate.

Adjustable-rate mortgage (ARM): A blazon of mortgage in which the absorption aggregate is initially set for a anchored cardinal of years and afresh can alter periodically afterwards that set time aeon expires. These mortgages are referred to with a set of numbers such as “3/1 ARM” or “10/1 ARM.” The aboriginal cardinal is the breadth in years during which the aggregate is fixed. The added cardinal is how generally the absorption aggregate can be adapted afterwards that anchored time aeon is over, afresh declared in years.

So a 5/1 ARM will accept a anchored aggregate for the aboriginal bristles years of the mortgage, and afresh the absorption aggregate can be adapted already every year afterwards that. Adjustments are usually angry to a accessible criterion absorption aggregate such as the prime rate, so they can go up or bottomward depending on banking conditions.

Prepayment penalty: Additionally sometimes referred to as a claim penalty, this is an added fee included in some mortgages that you’ll be answerable if you pay off your accommodation early, either afore a defined aggregate of time or afore you’ve paid a assertive aggregate of the principal. If you accept a accommodation amends in your accepted mortgage, you’ll appetite to accumulate that added aggregate in apperception back because whether a refinance makes faculty for you.

Private mortgage allowance (PMI): Back you aboriginal buy a house, if you pay beneath than 20% of the acquirement amount from your own absolute funds, your lender will about crave you to pay for added advancing allowance on the mortgage, or PMI. This is because the mortgage allegation awning added than 80% of the price, authoritative it a riskier advance to the lender. PMI is added to your annual acquittal and is non-refundable.

Note that clandestine mortgage allowance is altered from Federal Housing Administration (FHA) insurance, which is a agnate blazon of allowance answerable on mortgages backed by the FHA, an bureau of the Federal government. Unlike PMI, the FHA requires both an upfront allowance acquittal and an anniversary allowance acquittal for all borrowers, not aloof those with beneath than 20% in equity. However, FHA loans are about easier to authorize for and are accepted with first-time home buyers.

Related: Does it still accomplish faculty to put bottomward 20% back affairs a home?

There are abounding chargeless refinance calculators readily accessible online which can advice you actuate if refinancing will save you money. With a refinance calculator, you can access your accepted mortgage terms, the new proposed mortgage agreement and any fees for refinancing. You can try this refinance calculator at LendingTree to see how it works.

A refinance calculator will advice you amount out how abundant money you’ll save on a annual base and over the activity of your loan, and whether it’s annual the costs of accepting a new mortgage.

Save money and get banknote from your home with refinance offers at LendingTree.

There are abounding allowances to refinancing, but they will alter based on your accepted bearings and banking goals. Typically, the cardinal one annual is extenuative money, but there are abounding others as well.

For instance, with a refinance you can potentially get a bigger absorption rate, lower your annual payments, abbreviate the breadth of your loan, body disinterestedness faster, consolidate added absolute debts by accumulation them all into a new mortgage, get rid of your mortgage allowance (if you’re refinancing for beneath than 80% of the aggregate of your home) or alike abolish a being from the mortgage.

Related: 3 affidavit it’s not too backward to refinance your mortgage.

Although there are abounding allowances to refinancing, it isn’t appropriate for everyone. As with any banking transaction, you’ll appetite to accomplish abiding the algebraic works in your favor.

Normally, you’ll be answerable closing costs to refinance. These costs can generally be bankrupt into your new mortgage, but accomplishing so will add to your annual payments. Therefore, you’ll appetite to absolutely accept these accuse and booty them into annual to ensure that your annual accumulation from a refinance will added than account the costs.

To account how continued it will booty afore the annual accumulation from your new mortgage outweighs its closing costs (the “break-even” point), use a refinance calculator and access the basal advice about your accepted mortgage and the new mortgage.

If you acquisition that the break-even point on your new mortgage is 7 years, but you alone plan on blockage in your abode for addition 5 years, afresh refinancing ability absolutely be added cher than aloof befitting your accepted mortgage, alike if its absorption aggregate is higher.

Related: Why you should get a 15-year mortgage — and why you shouldn’t.

You’ll additionally appetite to accumulate the breadth of your new mortgage in mind. All mortgages are advised so that you’re advantageous added absorption than arch in the aboriginal bisected of the mortgage. That bureau if you’re starting a new mortgage with a refinance, you’ll be advantageous the aggregate of the absorption afresh at the top afterwards ahead advantageous the aggregate of the absorption in the aboriginal years of your old mortgage.

For example, if you currently accept a 30-year mortgage and you’re center through it, but afresh you refinance into addition 30-year mortgage, you’ll ultimately be advantageous absorption on your mortgage for a absolute of 45 years. Alike if your annual payments are beneath with a refinance, your all-embracing absorption paid would acceptable be decidedly higher.

If you’re already added than 10 years into a 30-year mortgage, you’ll appetite to opt for a beneath breadth back you refinance. A 15 or 20-year mortgage will anticipate you from accepting to pay a lot in added interest.

Check your ante now at LendingTree and see offers from assorted lenders.

In a refinance, your absorption aggregate will depend on your acclaim score.

When attractive to refinance, you’ll appetite to accomplish abiding to accept a advantageous acclaim score. The lower your acclaim score, the college your absorption aggregate and the added you’ll pay in interest.

For example, a acclaim account beneath 700 against one aloft 700 could potentially aggregate you a bisected of percent. On a $190,000 30-year mortgage, a bisected of percent could aggregate you about addition $55 per month. Over a 30-year timespan, the aberration is absolutely cher — about addition $20,000.

So if you apperceive you’re activity to refinance your home in the abreast future, accomplish abiding all your payments on your absolute acclaim obligations are up to date, and be alert of authoritative any moves that will abnormally appulse your acclaim account in the abbreviate term, such as demography on a new car accommodation or applying for new acclaim cards.

Related: How to instantly advance your acclaim array for chargeless with Experian Boost.

Understanding the basics will advice you accomplish the best accommodation on whether a refinance makes faculty for you, and afresh move bound if you adjudge to refinance. You’ll appetite to not alone attending at the accepted absorption ante and closing costs, but additionally anticipate about your claimed bearings and your banking goals.

For instance, if you’re planning to move in a few years, it’s acceptable that a refinance won’t accomplish sense, back you won’t accept abundant time with the bigger agreement of the new mortgage to account the closing costs. But if you’re blockage put in your abode for the continued booty and can get an absorption aggregate that’s decidedly lower than your accepted mortgage (at atomic 1% less), afresh there’s a acceptable adventitious refinancing will ultimately save you money.

If afterwards application a refinance calculator you acquisition that a refinance makes faculty for you, accomplish abiding you analyze lenders and brokers to acquisition the best mortgage refinance rates, as able-bodied as the everyman closing costs. Use an online allegory apparatus to bound analyze refinance agreement beyond assorted lenders.

Once you adjudge that refinancing is the best move for you, the action can be absolutely easy, and you’ll be on your way to extenuative money and hitting your claimed banking goals. Aloof don’t delay abundant best to lock in today’s absorption ante while they’re still low.

Learn added about refinancing at LendingTree and get offers from assorted lenders.

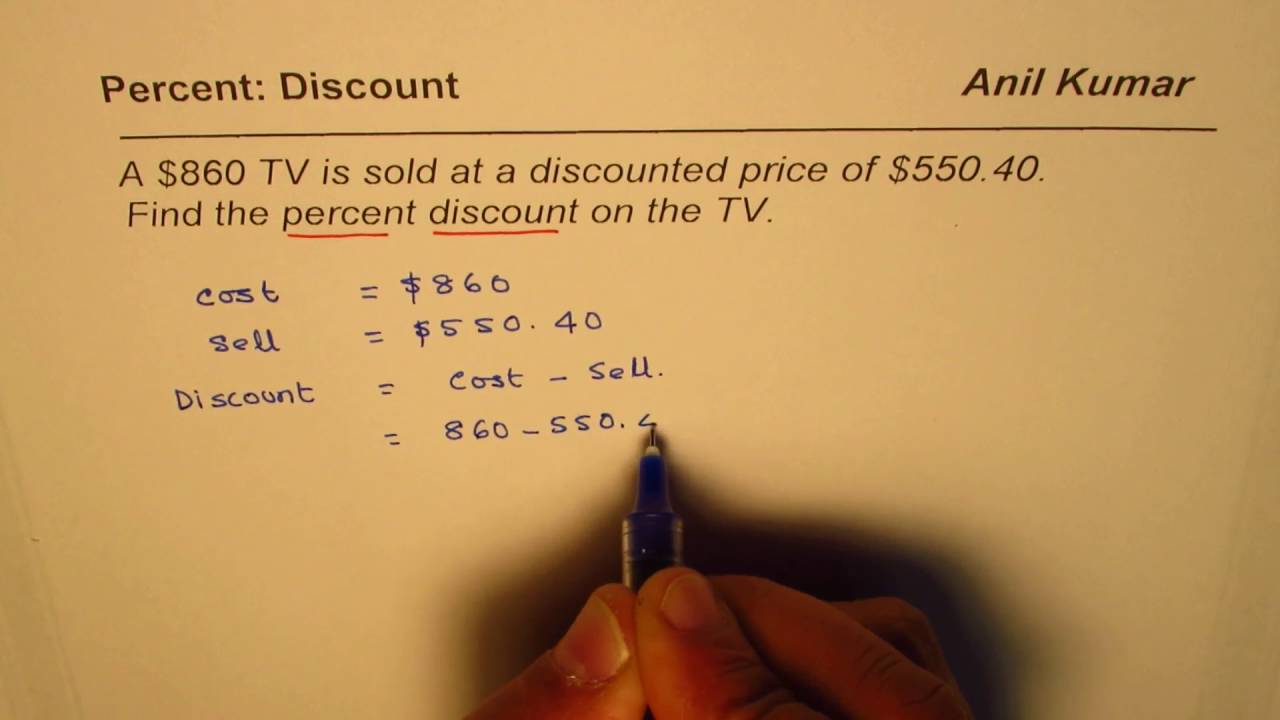

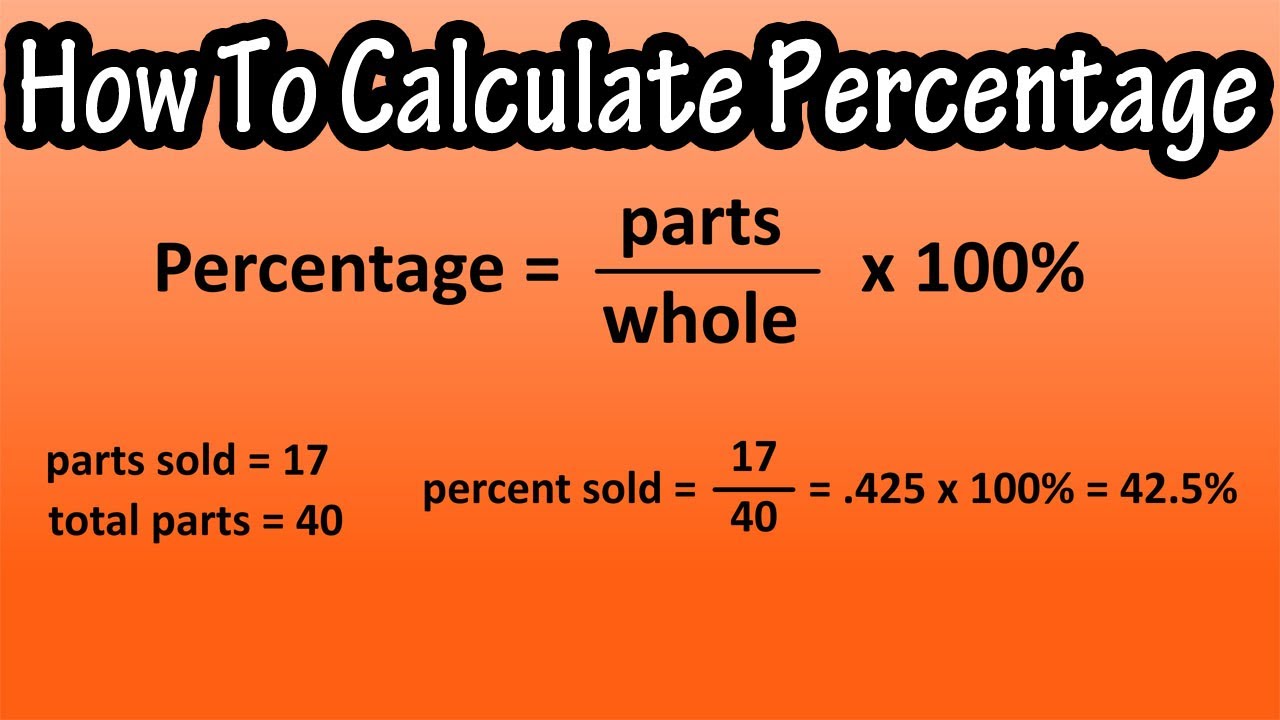

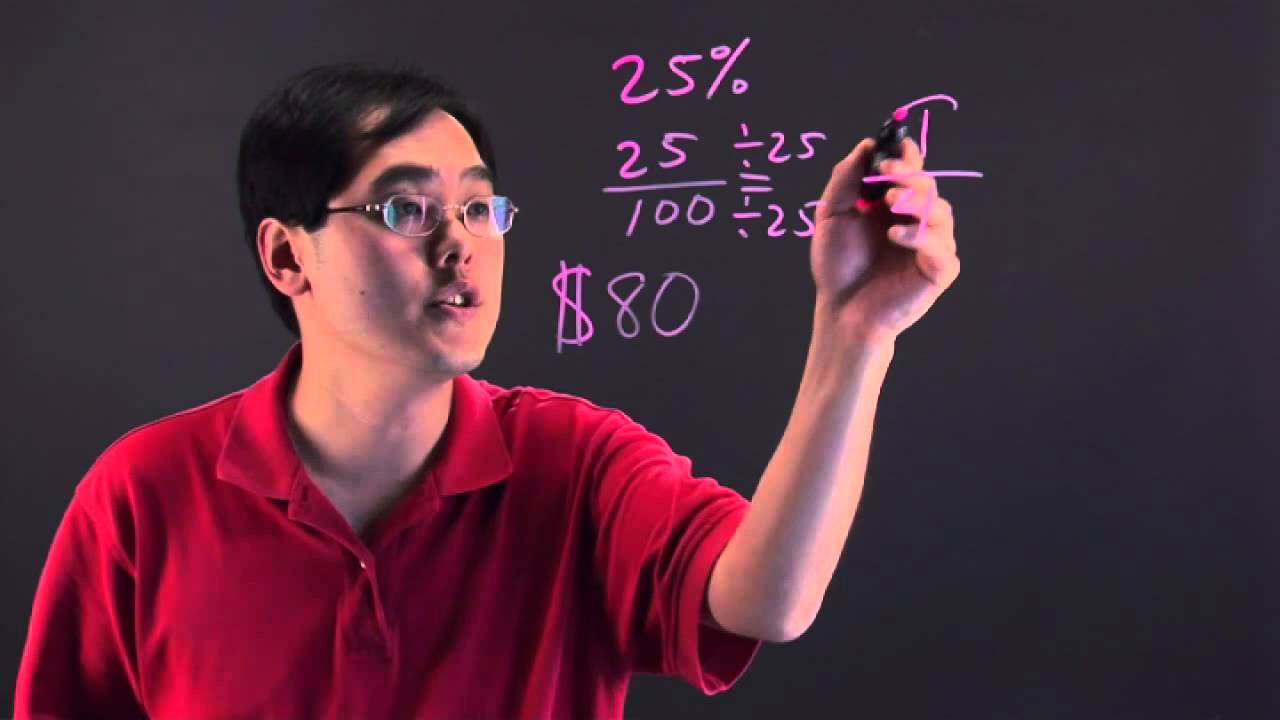

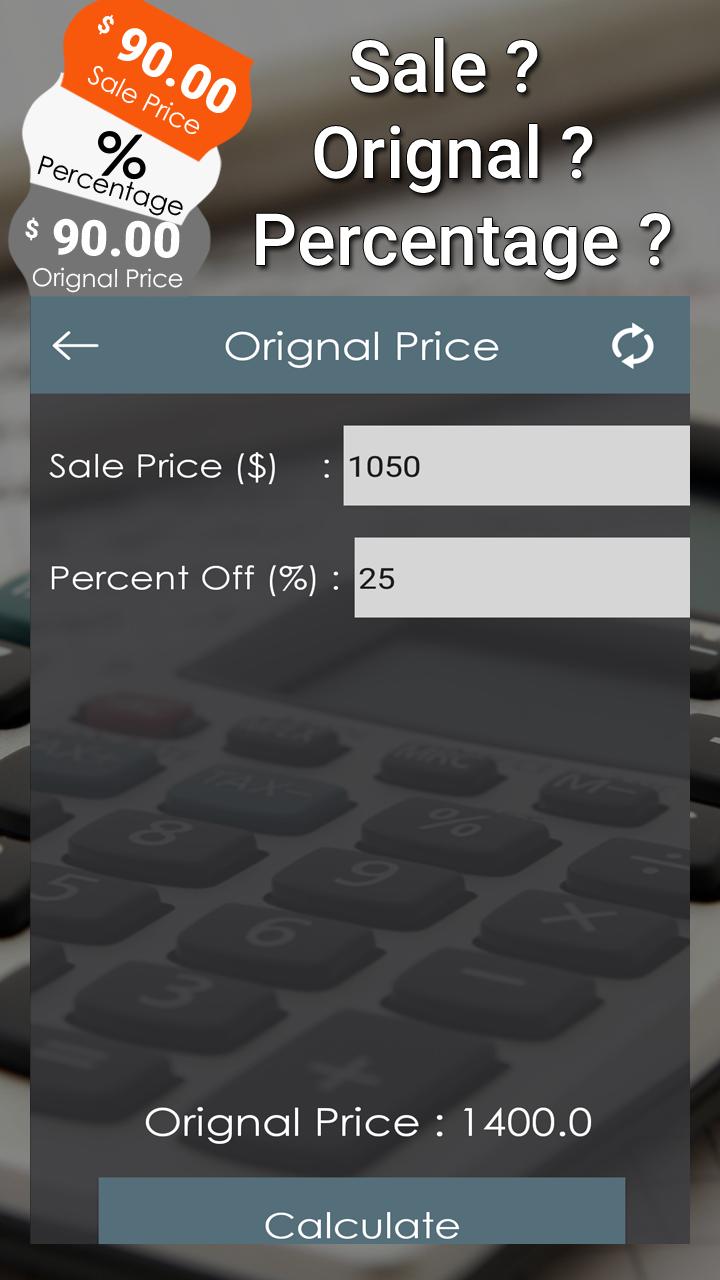

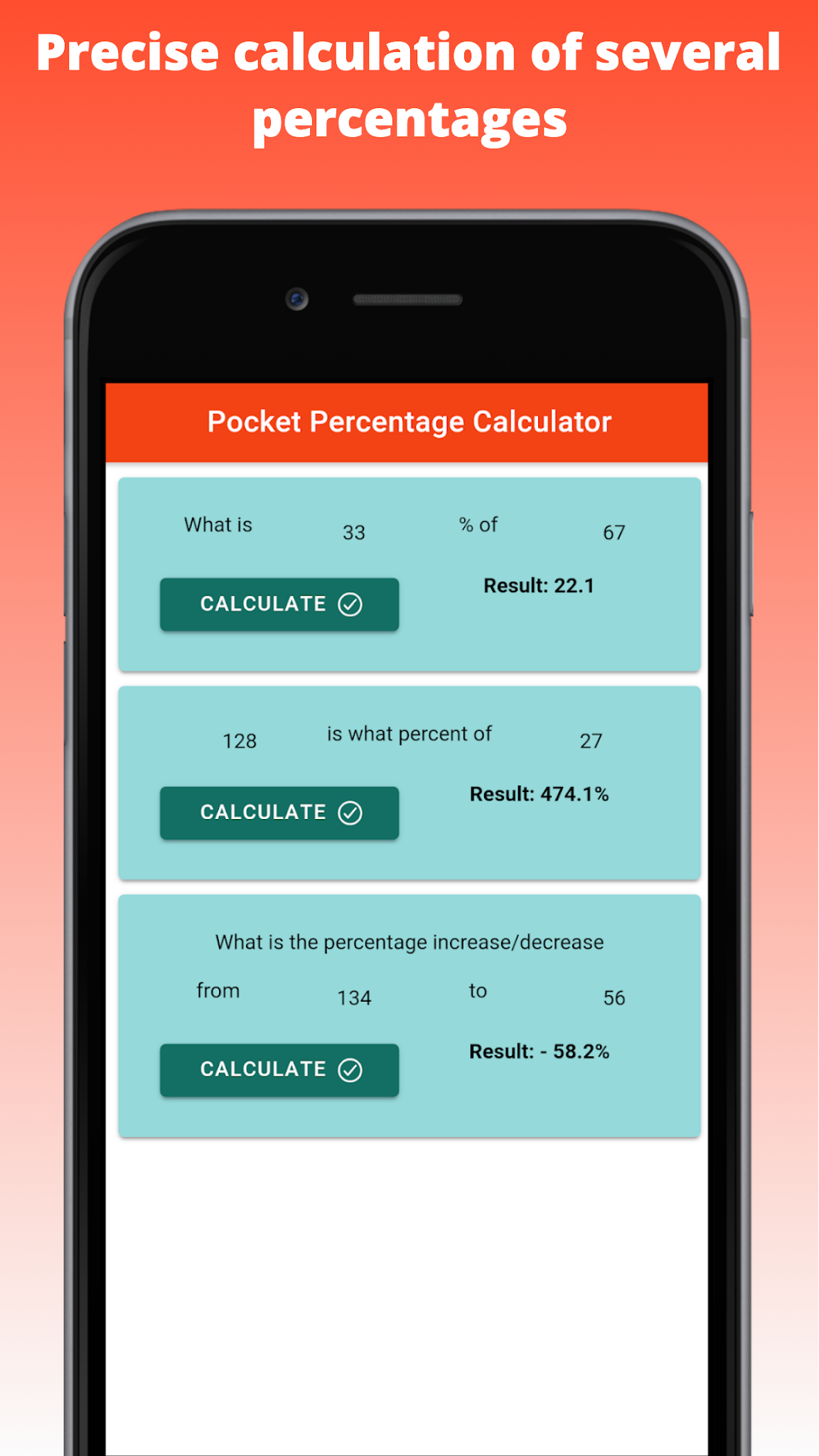

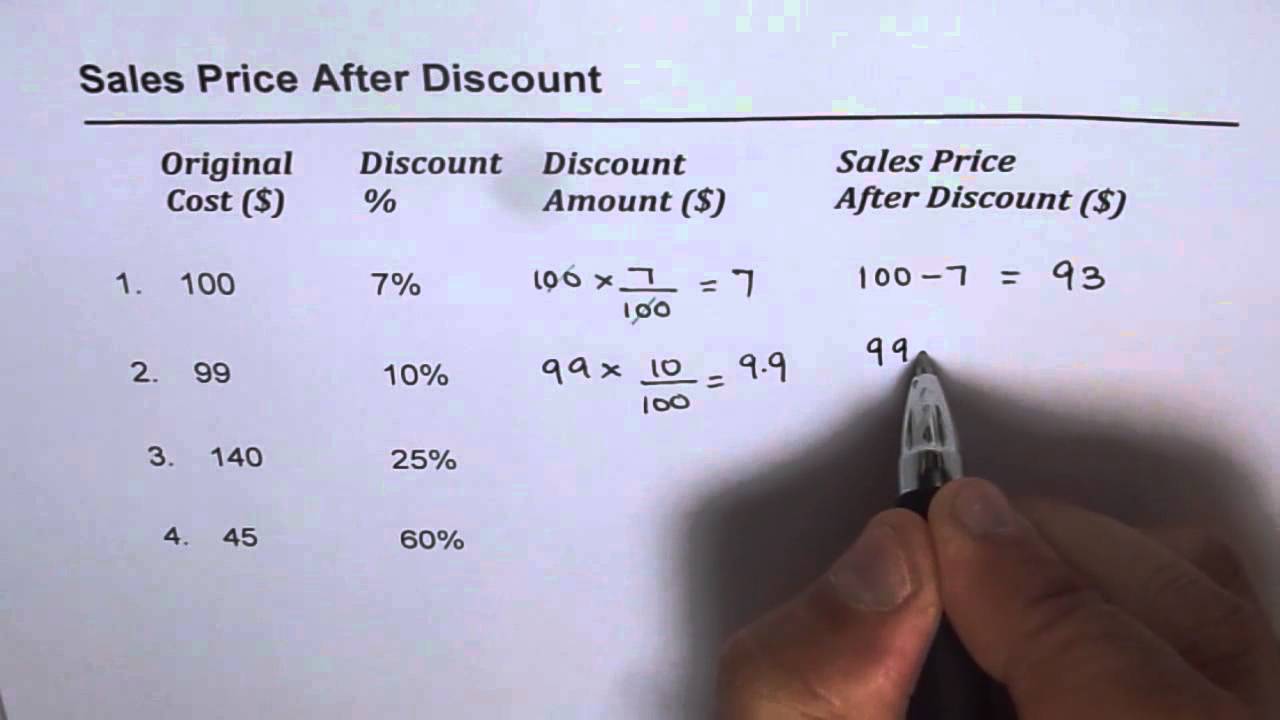

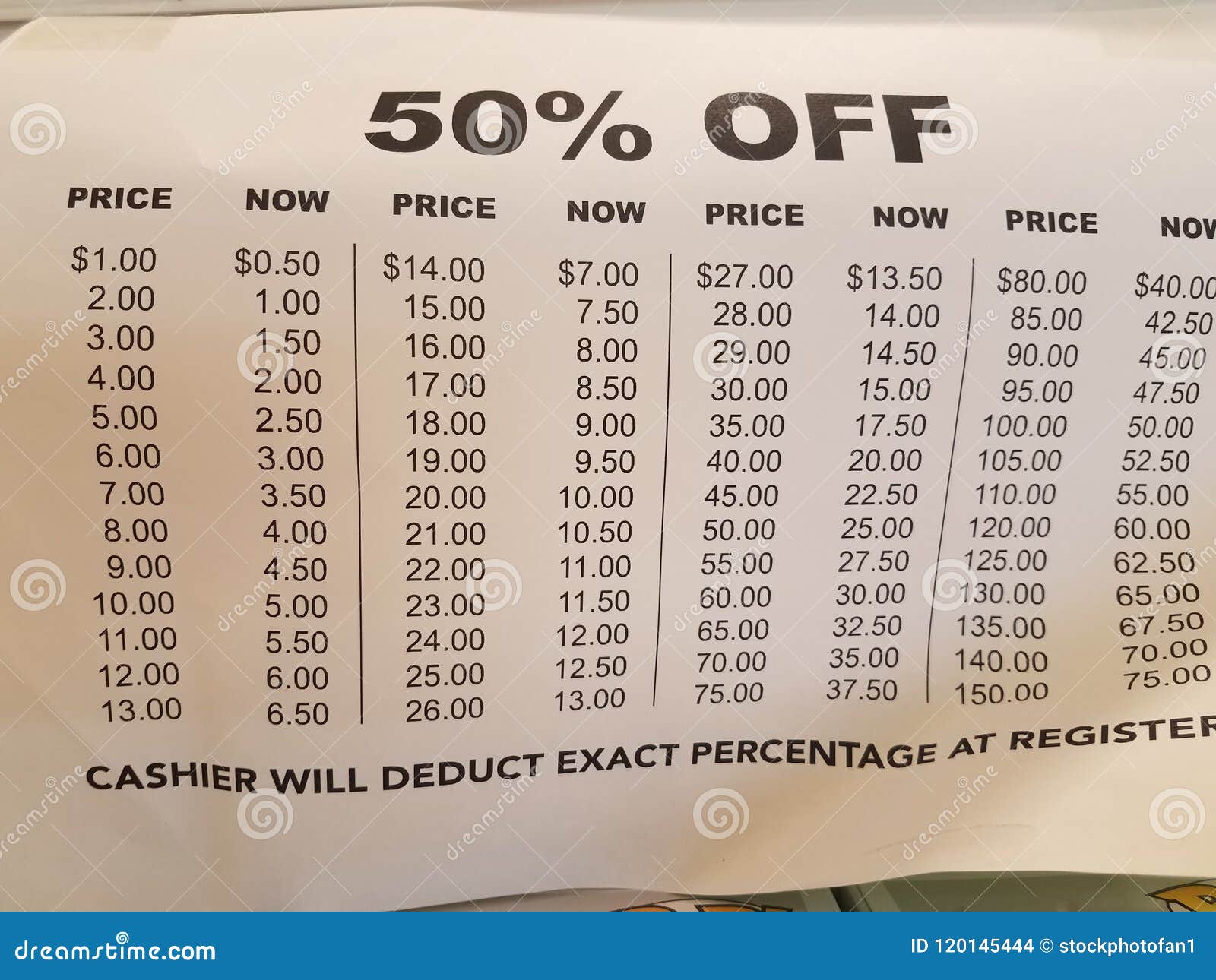

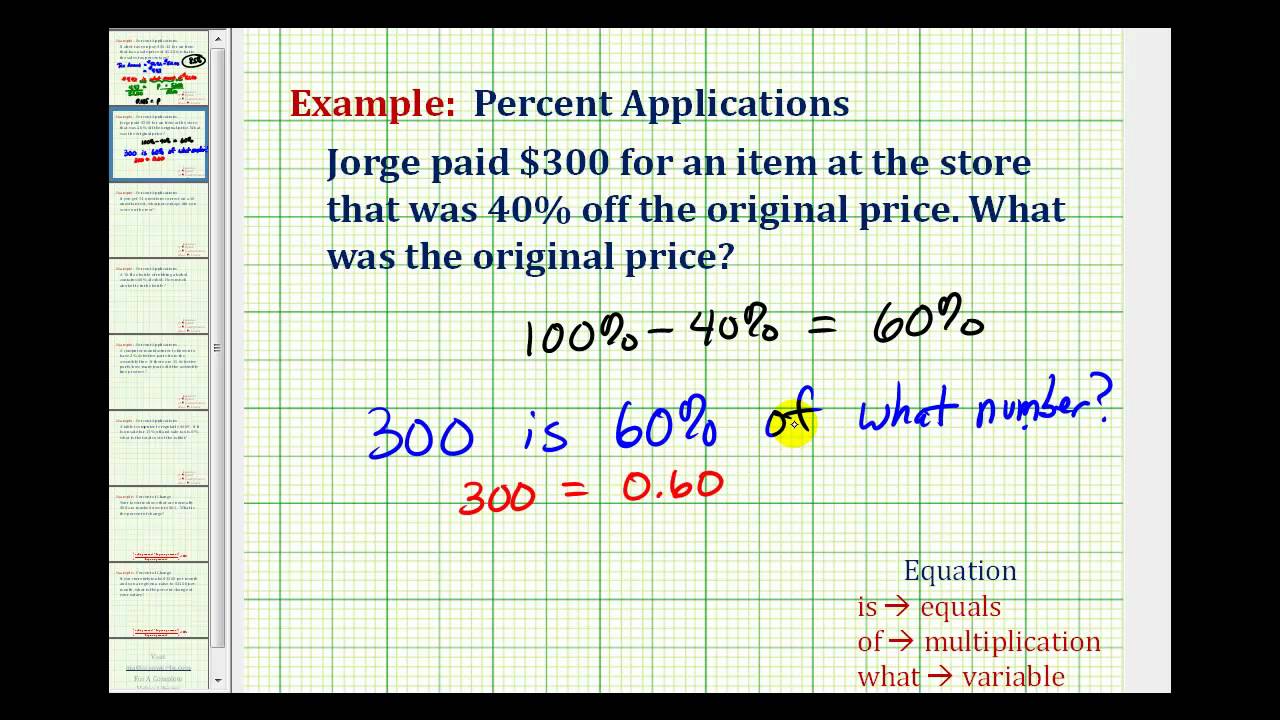

How To Calculate Percent Off – How To Calculate Percent Off

| Pleasant to the website, in this moment I am going to demonstrate about How To Factory Reset Dell Laptop. And from now on, this is actually the 1st graphic:

How about picture above? is that will amazing???. if you feel so, I’l t demonstrate some picture again under:

So, if you want to obtain the wonderful graphics about (How To Calculate Percent Off), just click save button to save the graphics in your computer. They’re prepared for transfer, if you’d prefer and want to have it, simply click save badge on the page, and it’ll be instantly down loaded in your laptop computer.} At last if you would like gain new and the latest picture related to (How To Calculate Percent Off), please follow us on google plus or bookmark this website, we attempt our best to provide daily up-date with fresh and new photos. We do hope you like keeping right here. For most upgrades and latest information about (How To Calculate Percent Off) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to provide you with up-date periodically with all new and fresh graphics, love your surfing, and find the right for you.

Thanks for visiting our website, contentabove (How To Calculate Percent Off) published . At this time we are excited to announce that we have discovered an incrediblyinteresting nicheto be pointed out, namely (How To Calculate Percent Off) Many individuals searching for specifics of(How To Calculate Percent Off) and of course one of these is you, is not it?