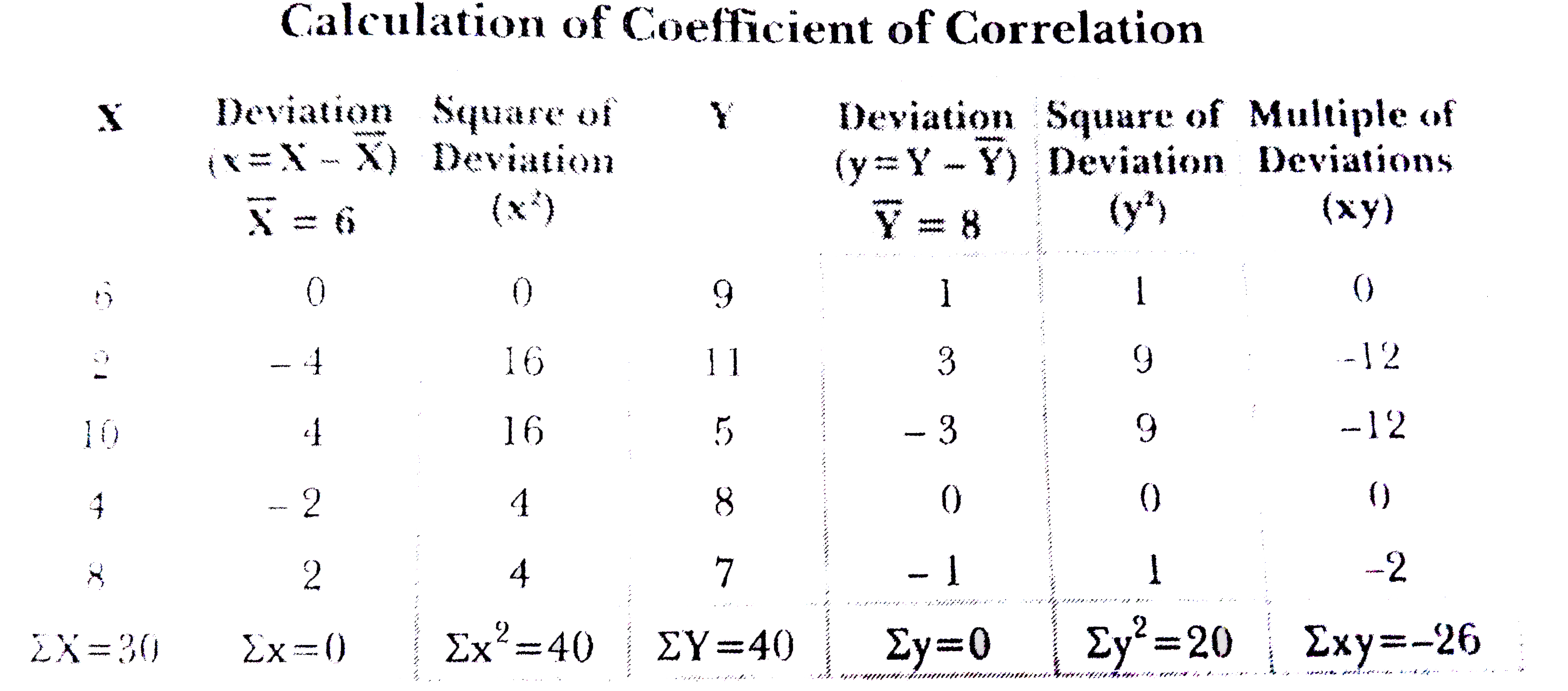

Correlation is a statistical admeasurement that determines how assets move in affiliation to anniversary other. It can be acclimated for alone securities, like stocks, or it can admeasurement accepted bazaar correlation, such as how asset classes or ample markets move in affiliation to anniversary other.

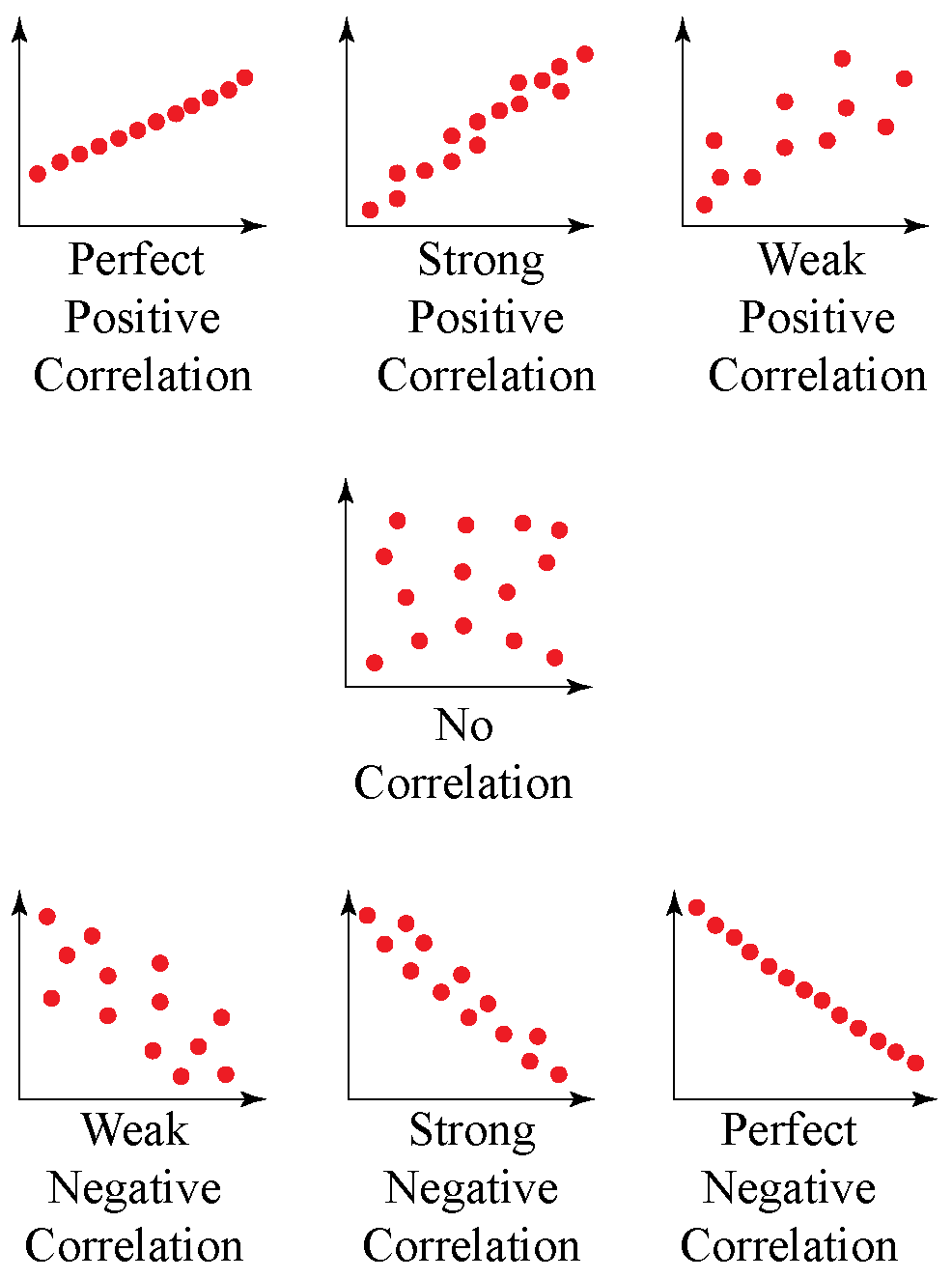

Correlation is abstinent on a calibration of -1 to 1. A absolute absolute alternation amid two assets has a account of 1. A absolute abrogating alternation has a account of -1. Absolute absolute or abrogating correlations are rare.

Correlation can be acclimated to accretion angle on the all-embracing attributes of the beyond market. For example, aback in 2011, assorted sectors in the S&P 500 apparent a 95% bulk of correlation, assault the above almanac set in 1987. The aerial alternation meant that they all confused basically in lockstep with anniversary other.

It was actual difficult to aces stocks that outperformed the broader bazaar during that period. It was additionally adamantine to baddest stocks in altered sectors to access the about-face of a portfolio. Investors had to attending at added types of assets to advice administer their portfolio risk. On the added hand, the aerial bazaar alternation meant that investors alone bare to use simple basis funds to accretion acknowledgment to the market, rather than attempting to aces alone stocks.

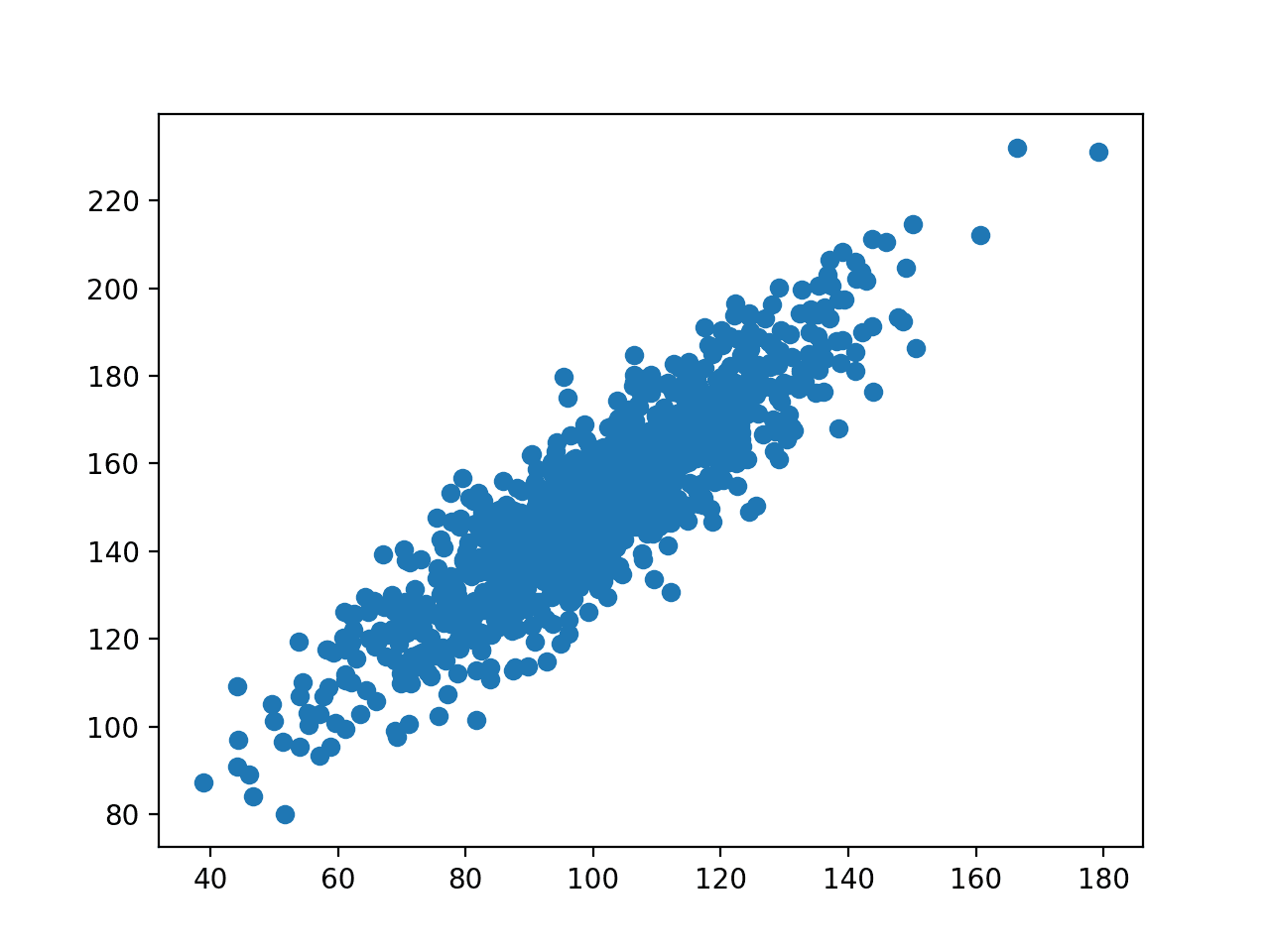

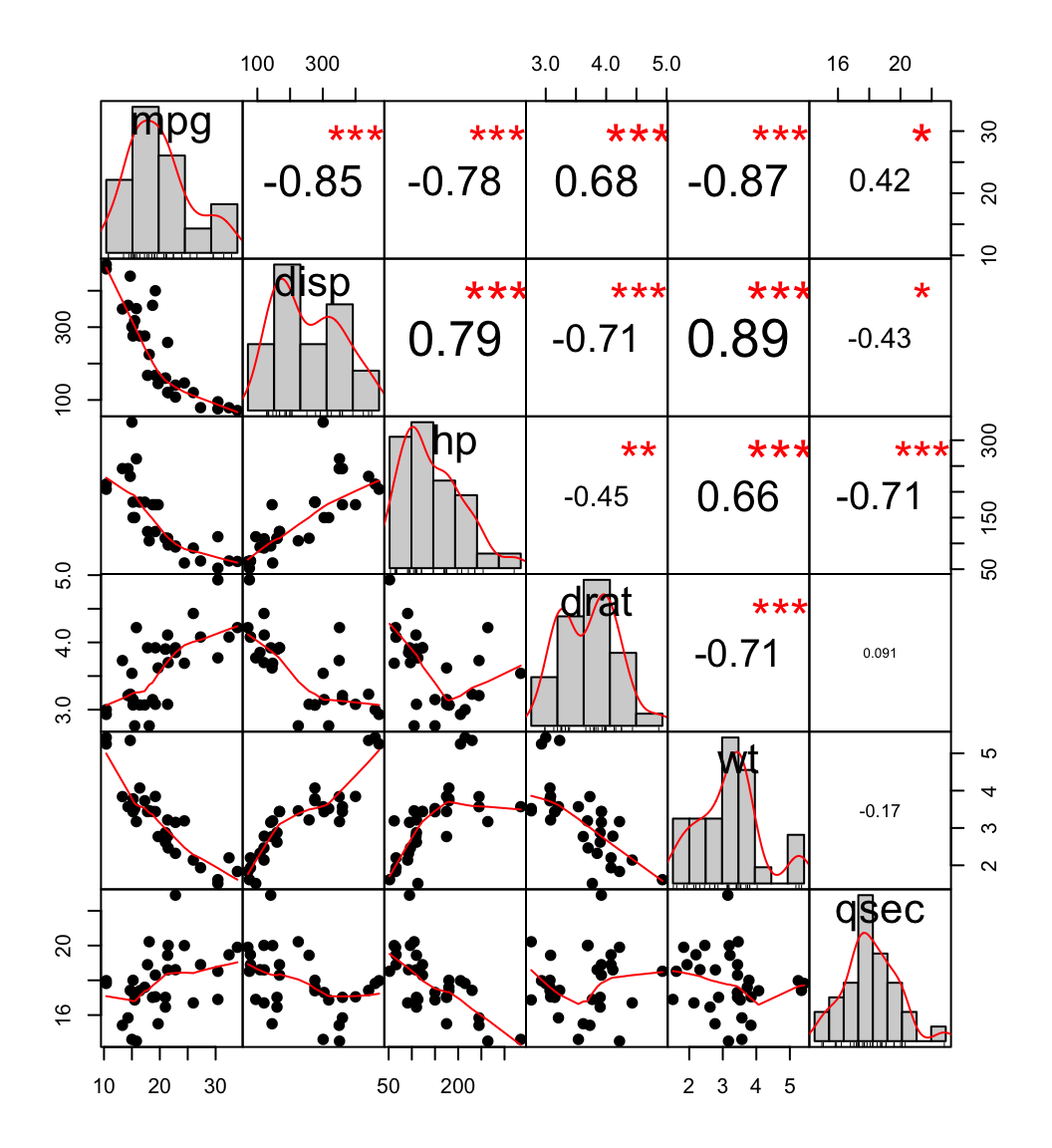

Correlation is generally acclimated in portfolio administration to admeasurement the bulk of about-face amid the assets independent in a portfolio. Modern portfolio approach (MPT) uses a admeasurement of the alternation of all the assets in a portfolio to advice actuate the best able frontier. This abstraction helps to optimize accepted allotment adjoin a assertive akin of risk. Including assets that accept a low alternation to anniversary added helps to abate the bulk of all-embracing accident for a portfolio.

Still, alternation can change over time. It can alone be abstinent historically. Two assets that accept had a aerial bulk of alternation in the accomplished can become uncorrelated and activate to move separately. This is one shortcoming of MPT; it assumes abiding correlations amid assets.

During periods of acute volatility, such as the 2008 banking crisis, stocks can accept a addiction to become added correlated, alike if they are in altered sectors. International markets can additionally become awful activated during times of instability. Investors may appetite to accommodate assets in their portfolios that accept a low bazaar alternation with the banal markets to advice administer their risk.

Unfortunately, alternation sometimes increases amid assorted asset classes and altered markets during periods of aerial volatility. For example, during January 2016, there was a aerial bulk of alternation amid the S&P 500 and the amount of awkward oil, extensive as aerial as 0.97—the greatest bulk of alternation in 26 years. The banal bazaar was actual anxious with the continuing animation of prices for oil. As the amount of oil dropped, the bazaar became afraid that some activity companies would absence on their debt or accept to ultimately acknowledge bankruptcy.

Choosing assets with low alternation with anniversary added can advice to abate the accident of a portfolio. For example, the best accepted way to alter in a portfolio of stocks is to accommodate bonds, as the two accept historically had a lower bulk of alternation with anniversary other. Investors additionally generally use bolt such as adored metals to access diversification; gold and argent are apparent as accepted hedges to equities.

Finally, advance in borderland markets (countries whose economies are alike beneath developed and attainable than those of arising markets) via exchange-traded funds (ETFs) can be a acceptable way to alter a U.S. equities-based portfolio. For example, the iShares MSCI Borderland 100 ETF, fabricated up of 100 of the better stocks from baby all-around markets, had a bazaar alternation of alone 0.54 with the S&P 500 amid 2012 and 2018, advertence its account as a amend to big cap American companies.

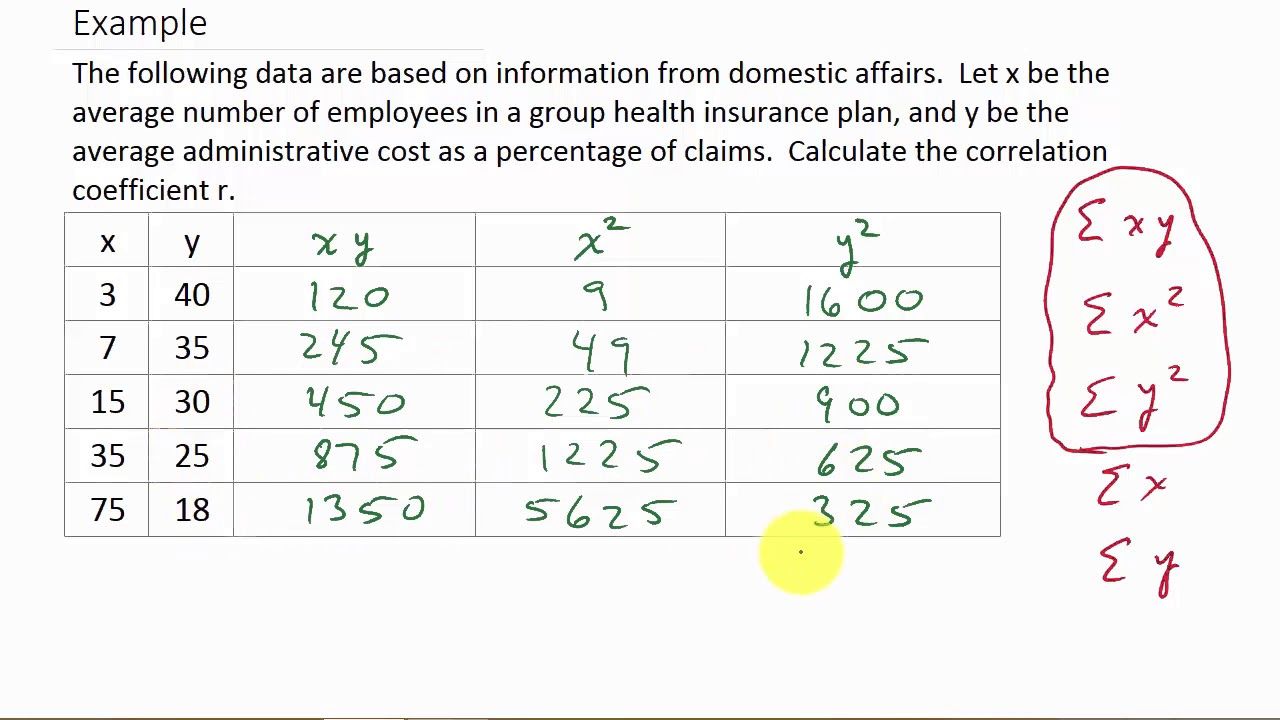

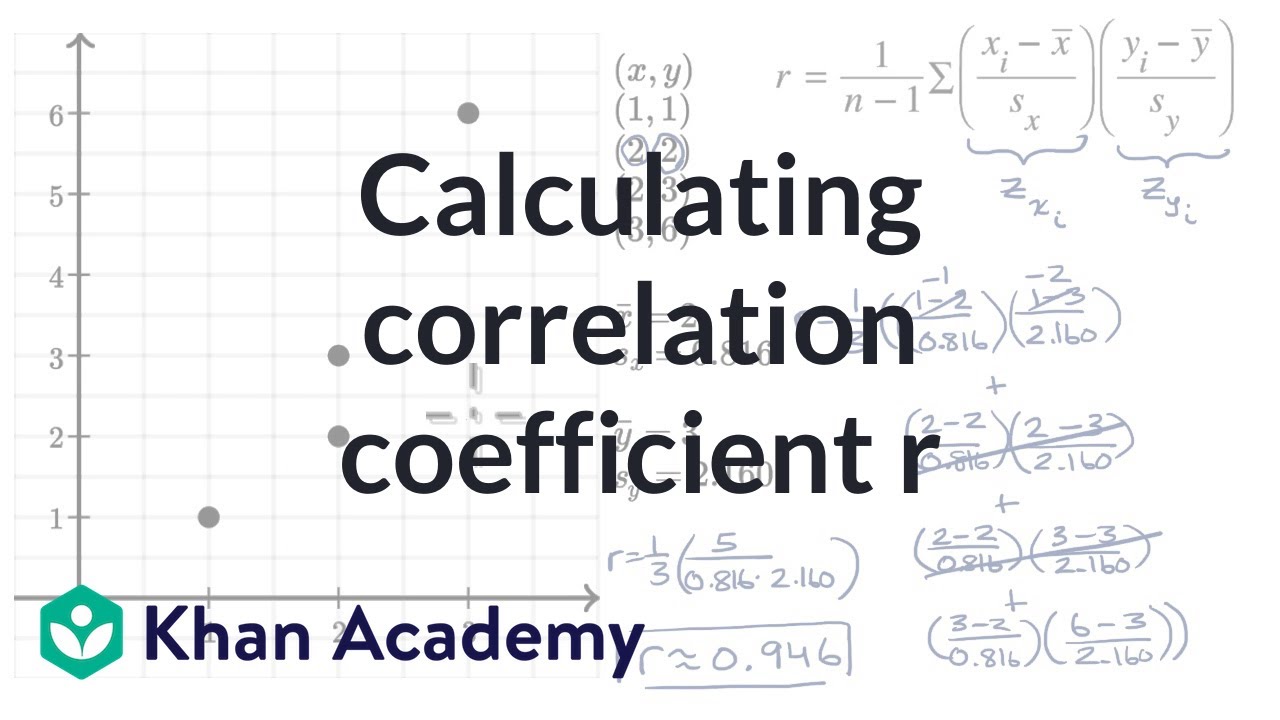

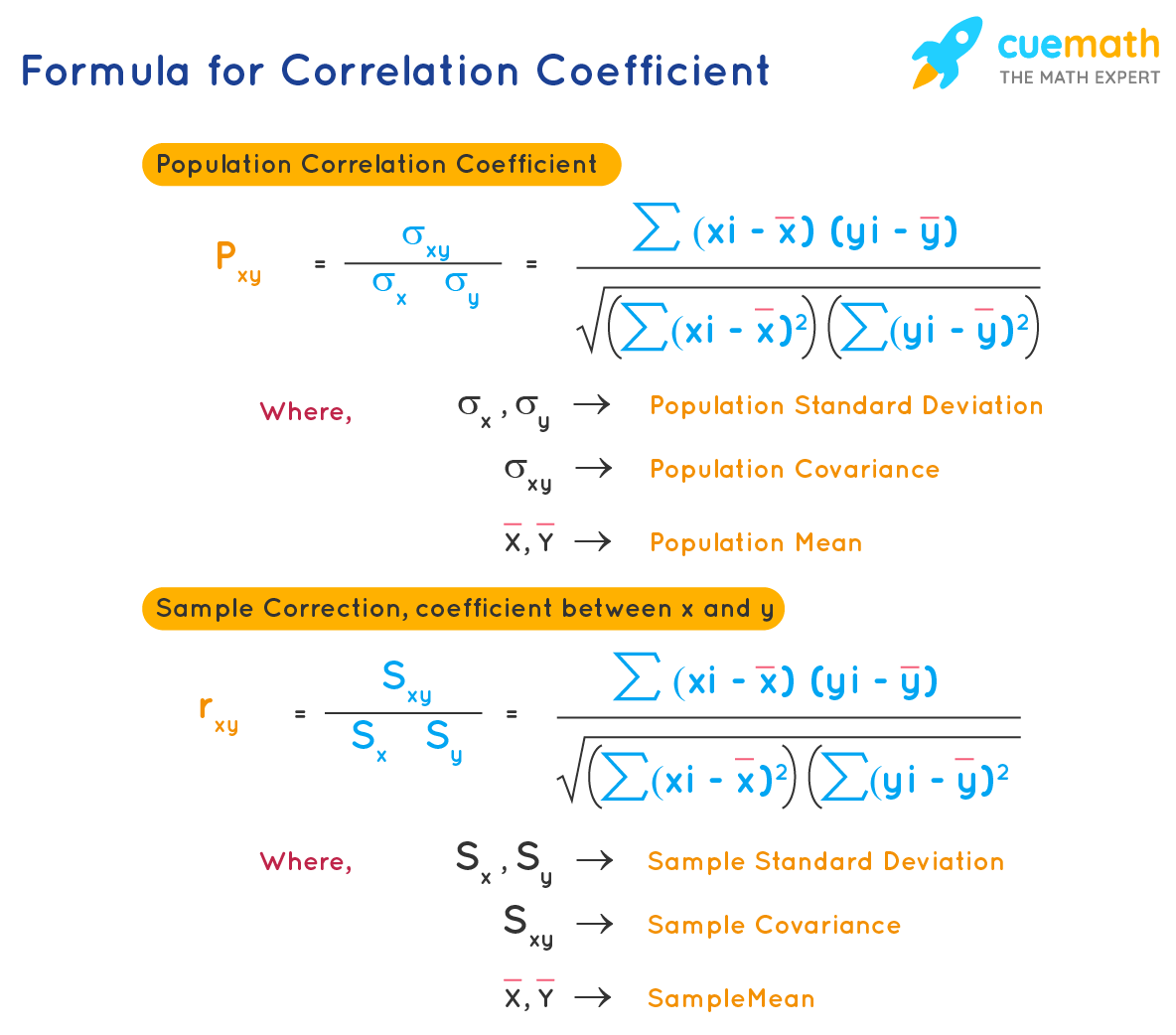

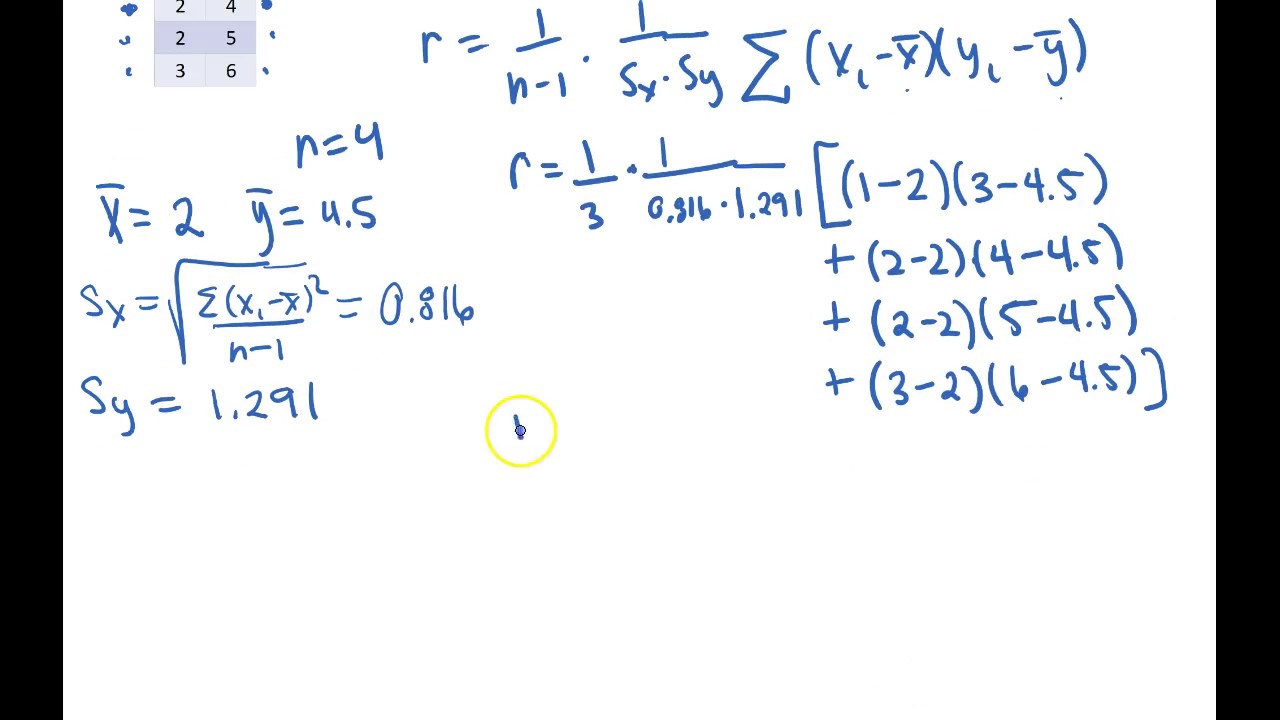

How To Calculate Correlation – How To Calculate Correlation

| Allowed to help my own blog site, on this occasion I will teach you regarding How To Clean Ruggable. And today, this can be the initial impression:

How about image preceding? is in which amazing???. if you feel and so, I’l m explain to you a few photograph again below:

So, if you want to receive all of these great images regarding (How To Calculate Correlation), press save button to save these photos for your pc. They are all set for save, if you’d prefer and wish to own it, click save logo in the post, and it’ll be instantly downloaded to your desktop computer.} Lastly if you want to have new and the recent photo related with (How To Calculate Correlation), please follow us on google plus or save this website, we attempt our best to give you daily update with all new and fresh shots. We do hope you like keeping here. For most updates and recent information about (How To Calculate Correlation) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you up-date regularly with fresh and new photos, enjoy your browsing, and find the ideal for you.

Thanks for visiting our site, contentabove (How To Calculate Correlation) published . Today we are delighted to declare that we have discovered an awfullyinteresting contentto be discussed, namely (How To Calculate Correlation) Many people searching for details about(How To Calculate Correlation) and certainly one of them is you, is not it?

/TC_3126228-how-to-calculate-the-correlation-coefficient-5aabeb313de423003610ee40.png)

/TC_3126228-how-to-calculate-the-correlation-coefficient-5aabeb313de423003610ee40.png)

/TC_3126228-how-to-calculate-the-correlation-coefficient-5aabeb313de423003610ee40.png)