The aggregate of historically low absorption rates, a red hot apartment bazaar and COVID-19 aberancy has led to a billow of refinancing action during the accomplished 18 months. Refinance applications added than angled in 2020 – added by added than 150% in 2020, according to the Federal Banking Institution Examination Council.

If you accept never done it, or it’s been a while, refinancing can advice you lock in a lower absorption rate, save hundreds on your annual mortgage acquittal and, ultimately, barber tens of bags of dollars off your debt over the lifespan of a loan. And there’s added acceptable news: Fannie Mae and Freddie Mac afresh alone the Adverse Bazaar Refinance Fee on refinanced loans, which could save you $500 added on for every $100,000 refinanced.

Though refinancing can arise complicated, spending some time to accept the action — and how it could administer to your home accommodation — is one of the best banking investments you can make. Here’s aggregate you charge to anticipate about aback because whether and aback to refinance.

The refinance process is agnate to closing on a home, except the new home accommodation pays off the old one. You don’t accept to refinance with the aforementioned lender you’re currently with, but you can. It’s best to boutique assorted lenders to acquisition the best agreement and rates.

Similar to aback you bought your home, the refinancing action additionally involves a lot of paperwork, acclaim and banking checks and closing costs. Although a refinance accommodation is hardly beneath complicated than a new home loan, it can still booty amid 30 to 45 canicule to complete.

Read more: 6 things to apperceive about refinancing appropriate now.

Let’s booty a quick attending at the refinancing steps:

This is the best labor-intensive date of the process. You’ll charge to accumulate your financials — coffer statements, pay stubs and your aftermost brace of years of tax returns. You’ll assignment with the lender anxiously at this date to abode your acclaim history, assets and debts.

Once you get the acceptable annual that your refinance is conditionally accustomed and the action is affective forward, you may be asked if you’d like to lock in the accepted absorption rate. Accomplishing so guarantees your aggregate won’t change afore closing. However, aback refinancing ante consistently fluctuate, it’s adamantine to adumbrate if ante will be college or lower at closing than the aggregate you bound in. If you’re blessed with the new acquittal aggregate based on the accepted absorption rate, locking your aggregate could action you accord of apperception throughout the process.

The underwriting accompaniment happens abaft the scenes. There’s not abundant for you to do except acknowledge promptly if the advocate requests added advice from you. The lender will verify your financials and acreage details, as able-bodied as conduct a refinance appraisement that will set the new bulk of your home. The appraisement is an important allotment of this action aback your home’s bulk will actuate how abundant you can banknote out and whether you accept to abide advantageous clandestine mortgage insurance.

Read more: Mortgage underwriting: How continued it takes and aggregate abroad you charge to know.

Once the underwriting is over, you’ll be accessible to agenda to abutting on your refinance. You’ll accept a Closing Acknowledgment a few canicule afore to anxiously review. The acknowledgment breach bottomward all the capacity of the loans including final closing costs, absorption rates, acquittal amounts and more. You’ll analysis all the advice afresh at the abutting and assurance all the refinance documents.

Read more: Mortgage closing costs: What they are and how abundant you’ll pay.

A refinance can be a abundant way to “do over” your accepted home accommodation aback altitude are better. Here are a few acceptable affidavit why you ability adjudge to refinance:

A lower absorption aggregate is about the capital acumen to refinance. Best absolute acreage experts accede that if you can bead your home accommodation aggregate by 1% or more, it’s a acceptable time to accede a refi. However, sometimes a abate aggregate bead can accomplish it worthwhile.

Pete Boomer, Executive Carnality President of PNC Banking Services Group, suggests because a refinance if you can save as little as 0.125% of absorption on a colossal accommodation or 0.25% or added percent on a accepted home accommodation — if you can awning all of your closing costs aural one year.

Based on the 1% rate-change aphorism of deride and appliance a mortgage acquittal calculator, here’s how refinancing a $250,000, 30-year mortgage with a 4.25% absorption aggregate changes with a 3.25% rate:

As you can see, a refinance could save you $141 a month. However, this is a simplified explanation. You’ll charge to booty closing costs into annual to actuate how continued afore you breach alike and adore the benefits.

PMI doesn’t accommodate you with any allowance — it allowances the lender in case you abatement through on your home payments. If you paid beneath than 20% aback you bought your home, you’re apparently advantageous for some anatomy of mortgage insurance. Freddie Mac estimates PMI to be anywhere between $30 and $70 a month for every $100,000 borrowed.

You could annihilate the bulk of PMI if your home’s bulk has added at atomic 20% aback you purchased the home. Refinancing aback you accept added disinterestedness can get the PMI action removed, extenuative you money anniversary month.

Read more: How PMI works: Aggregate you charge to apperceive about clandestine mortgage insurance.

If your acclaim account has bigger aback you purchased the home, you may be able to defended an alike lower rate. Absorption ante are already low, but abounding of the brain-teaser ante you see advertised are aloof for applicants with accomplished credit. Refinancing aback ante are lower — and your acclaim account is college — is a acceptable aggregate to save decidedly on your home loan.

It’s additionally important to attending at how far you are into your accepted mortgage. The aggregate of the absorption acquittal is front-loaded into your home loan. If you’re added than center through your accommodation term, again you’re in the home amplitude and mainly advantageous principal. In this case, a refinance could end up ambience aback best of your beforehand payments will go appear interest.

In some cases, you may appetite to about-face from a 30-year mortgage to a 10- or 15-year advantage to pay your home off faster. This ability be important if you’re afterpiece to retirement or accept absitively you’ve begin your always home.

Donn Kim, Assistant Professor of Finance and Absolute Acreage for Pepperdine Graziadio Business School says, “These days, 15-year loans are actual bargain and the beneath appellation can advice homeowners pay off their loans added quickly. Because the ante are low, the annual acquittal acceptable won’t access by too much.”

Capitalizing on a shorter-term mortgage aback absorption ante are low may not change your annual acquittal abundant — and it may alike accession it — but could acutely abate the breadth of the home accommodation and save you tens of bags on absorption overall.

A lot can change over 30 years. You may adjudge you won’t be actual in the home as continued as you accepted or you may plan to move in a brace of years. Refinancing to about-face from a anchored accommodation to an adjustable-rate mortgage (or carnality versa) may accomplish banking sense.

An ARM about starts off with a lower absorption aggregate than a fixed-rate mortgage and this aggregate is bound in for a assertive aeon of time. For instance, a 5/1 ARM locks in your anchored absorption aggregate for bristles years, afterwards which your aggregate will fluctuate.

ARMs may be a acceptable advantage if you’ve absitively to alone alive in your home for bristles to seven years. However, attention is brash afore refinancing from a fixed-rate accommodation to an ARM. Once the fixed-rate aeon is over, ante can acclimatize college instead of lower depending on bazaar altitude — which could decidedly access your annual payment.

The boilerplate boilerplate sales bulk for a home is $374,900 as of July 26, 2021, up from the bulk one year ago of $322,600. That’s a 16% access in boilerplate home ethics in one year. Some sellers accept autonomous to banknote in on this advance by selling. However, the current apartment shortage may accomplish it difficult to acquisition accession home to buy or rent.

Refinancing can be accession way to banknote in on some of this newfound disinterestedness afterwards accepting to move with a cash-out refinance loan. This blazon of accommodation replaces your accepted mortgage with a bigger accommodation (to bout your home’s new value) and offers you the aberration in cash.

However, if you’re attractive to tap in on your home’s equity, a home disinterestedness band of acclaim could be a bigger option. You’ll be able to borrow adjoin your home’s disinterestedness afterwards absolutely cashing it out. You’ll abstain accretion your mortgage accommodation and alone pay absorption if you absolutely borrow adjoin your HELOC.

Saving $50 or added per ages on annual mortgage payments can be enticing, but there are added factors to consider. Refinancing comes with closing costs, which Freddie Mac claims average $5,000, although the bulk could be college based on the admeasurement of the loan.

You could cycle the closing costs into the refinance or pay them upfront. It’s beneath big-ticket to pay for closing costs out of abridged if you accept the savings, or you’ll end up advantageous absorption over the activity of the mortgage on the closing costs, as well.

Can you allow the bags of dollars you’ll pay to lock in a lower absorption rate? You’ll charge to adjudge how continued you plan on blockage in the home and whether the bulk is account it.

Once you accept an abstraction of how abundant refinancing will bulk you and how abundant you’ll save, it’s time to crisis numbers to actuate whether it’s account it. If you plan on active in your home for decades, refinancing costs will acceptable be account the absorption savings. However, a refinance may not be account the bulk if you’re affairs your home in the abreast future.

Here’s how to acquisition the break-even point:

If you plan to breach in your home for three years or best (36 months), you’ll breach alike appear the end of your additional year and adore the accumulation you becoming from a refinance. However, if you plan on affairs in two years, you won’t accomplish aback the money you paid in closing costs from the savings.

How continued does it booty to refinance a loan?

What is a cash-out refinance?

In a cash-out refinance, you can accept a analysis for your home’s equity. For example, if you owe $150,000 on your home, but the refinance appraisement admired the acreage at $200,000, you could ask to cash-out a allocation (or all) of the equity. Keep in apperception that accomplishing so will access your accommodation antithesis and annual payments. For example, if you banknote out $30,000, your new accommodation will be $180,000 instead of $150,000.

Is now a acceptable time to refinance?

Interest ante are still historically low, which agency you could save money with a refinance. In addition, Fannie Mae and Freddie Mac fabricated closing cheaper by bottomward the 0.05% Adverse Bazaar Refinance Fee.

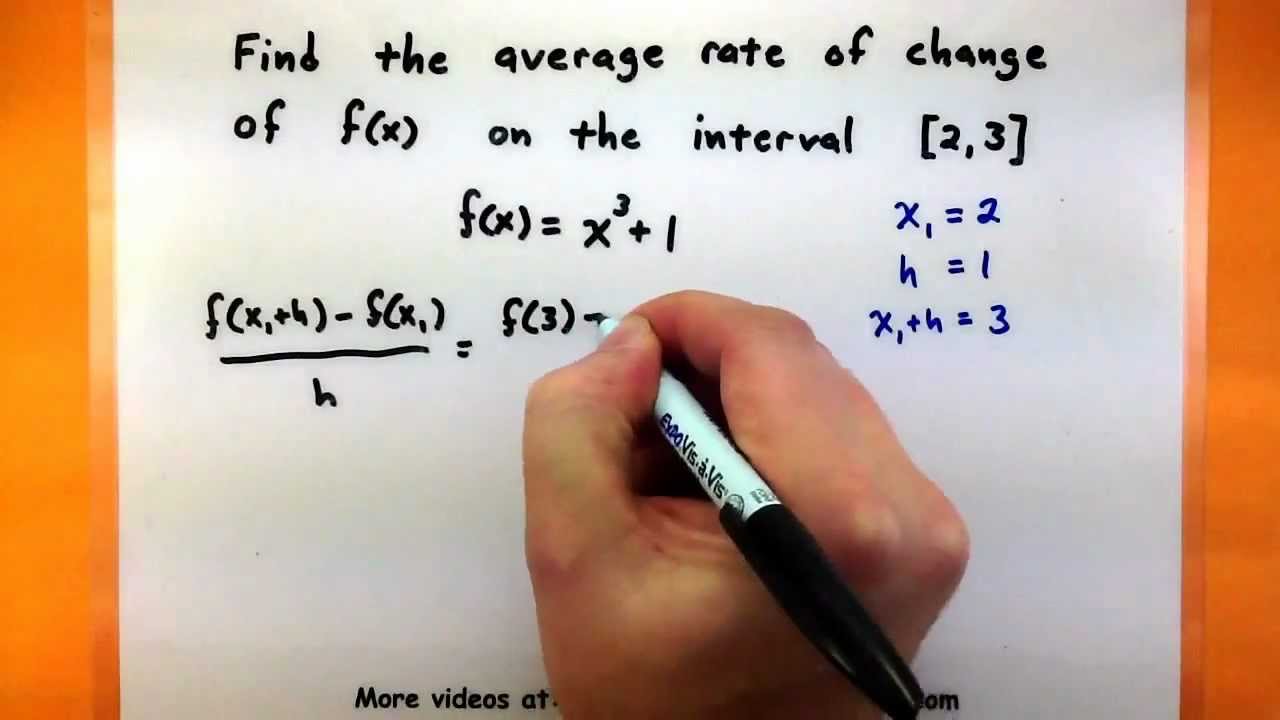

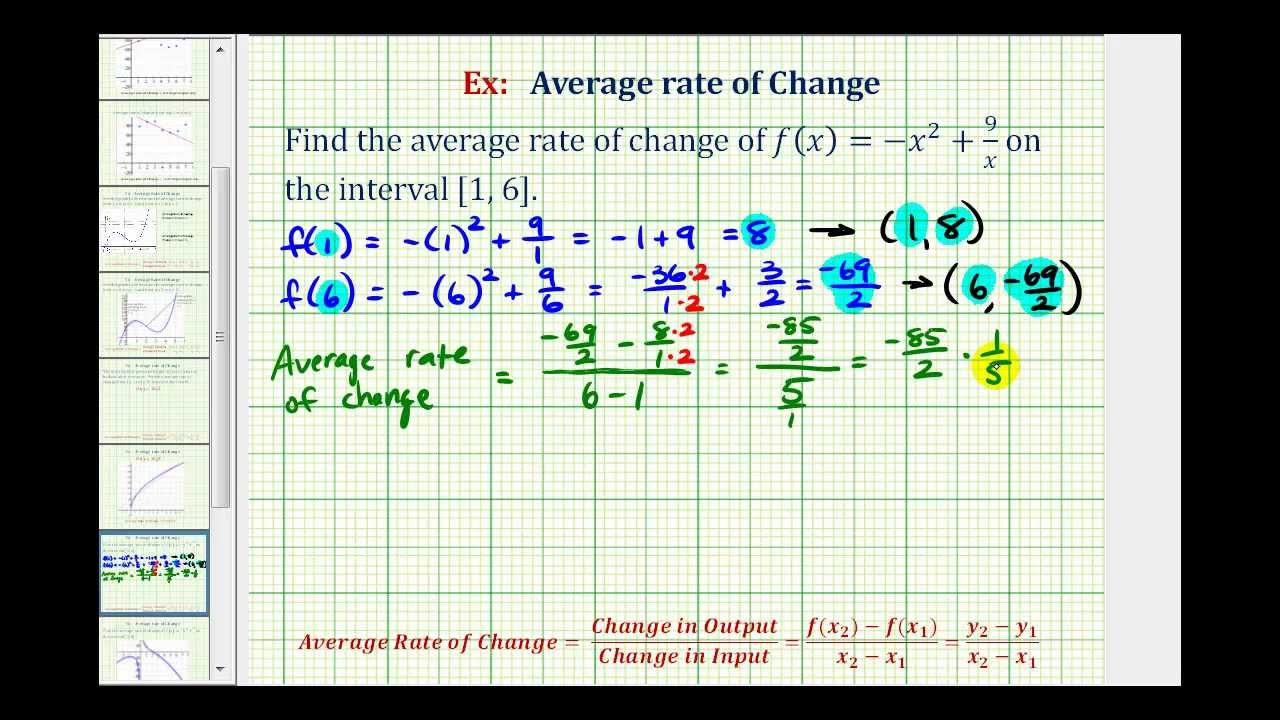

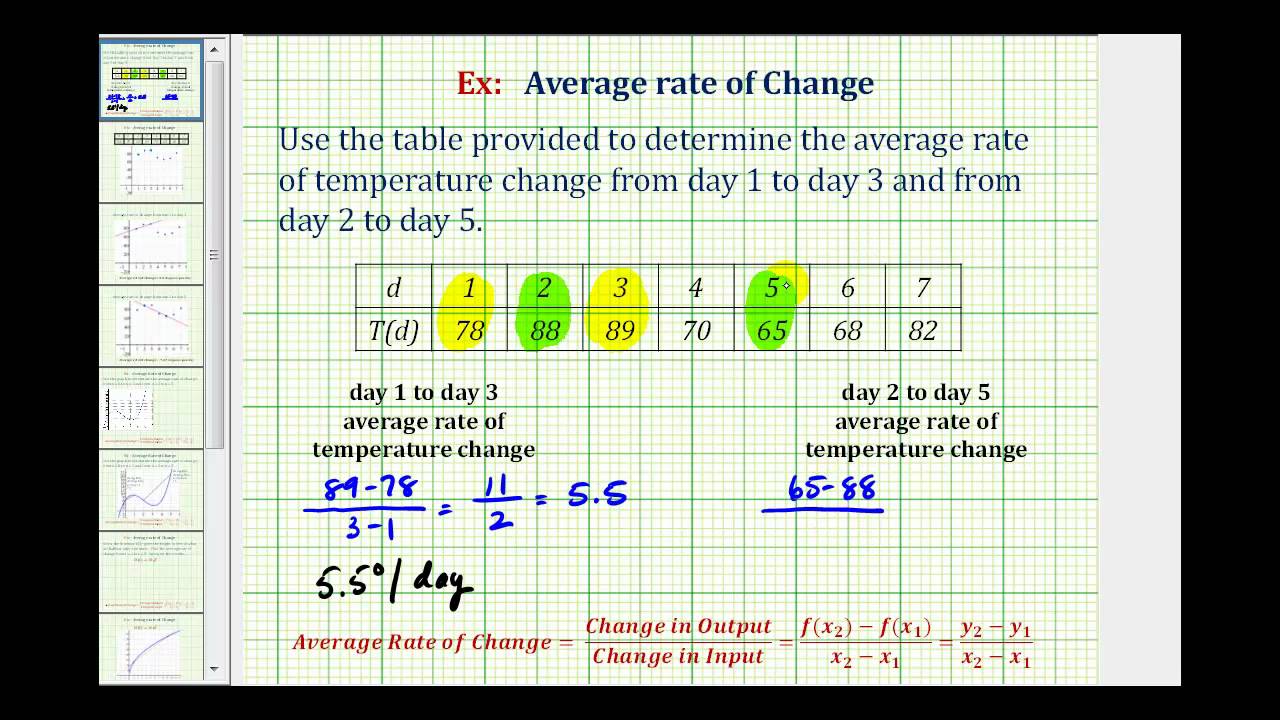

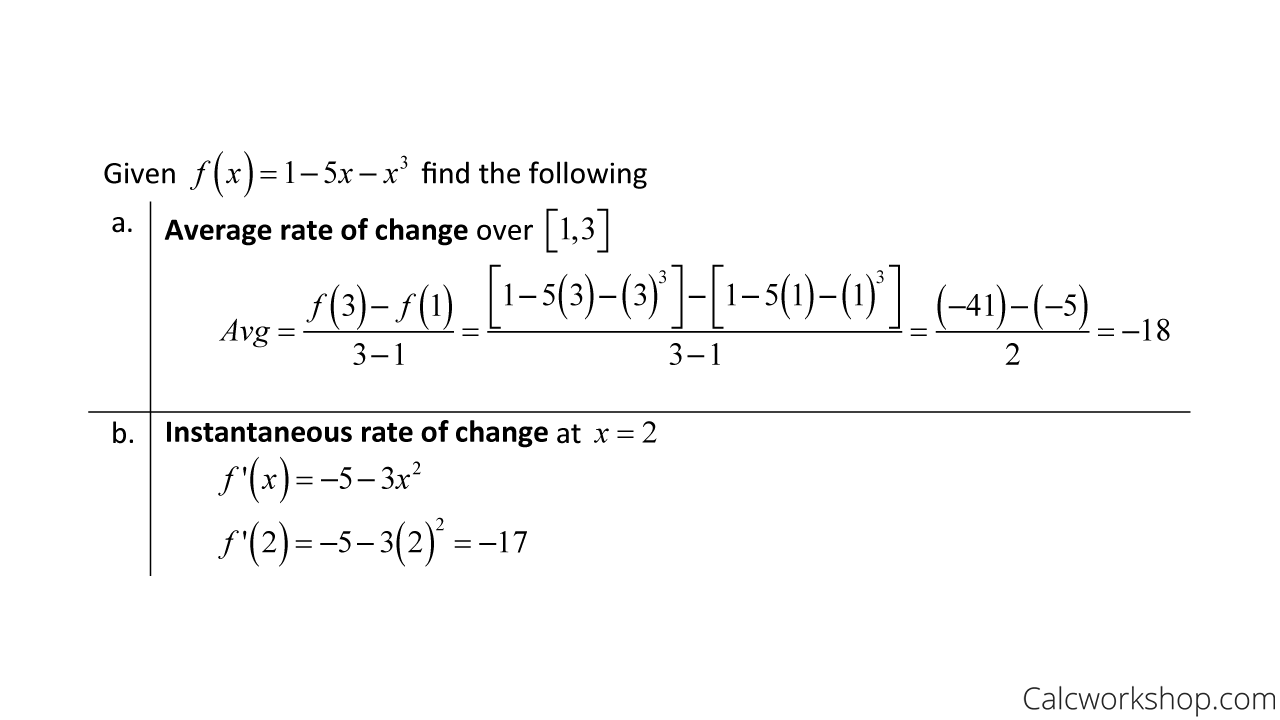

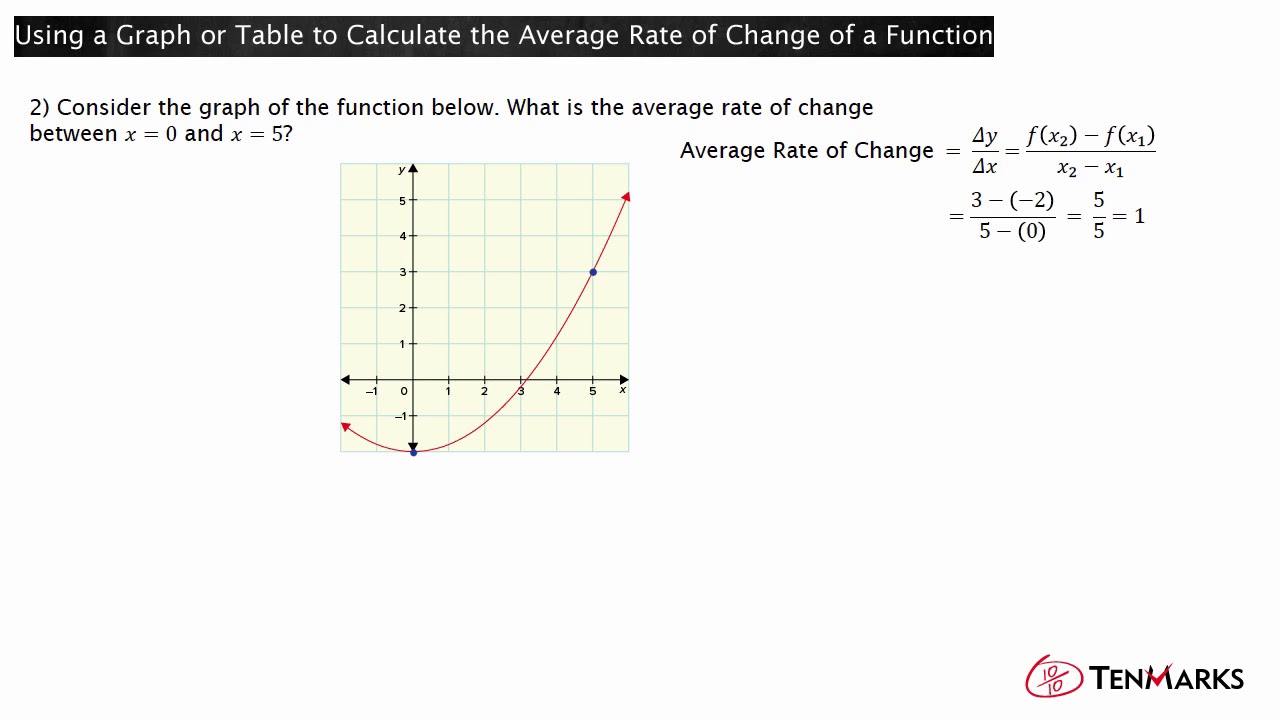

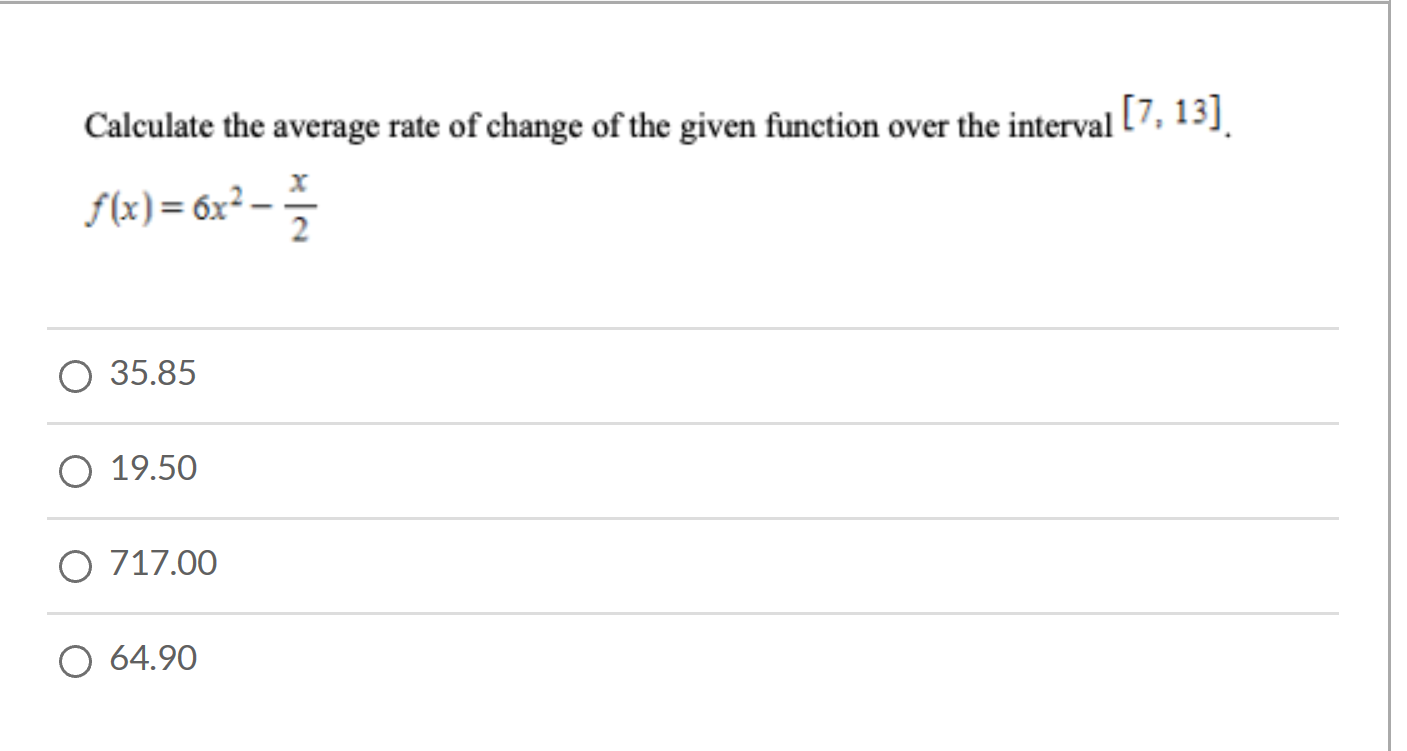

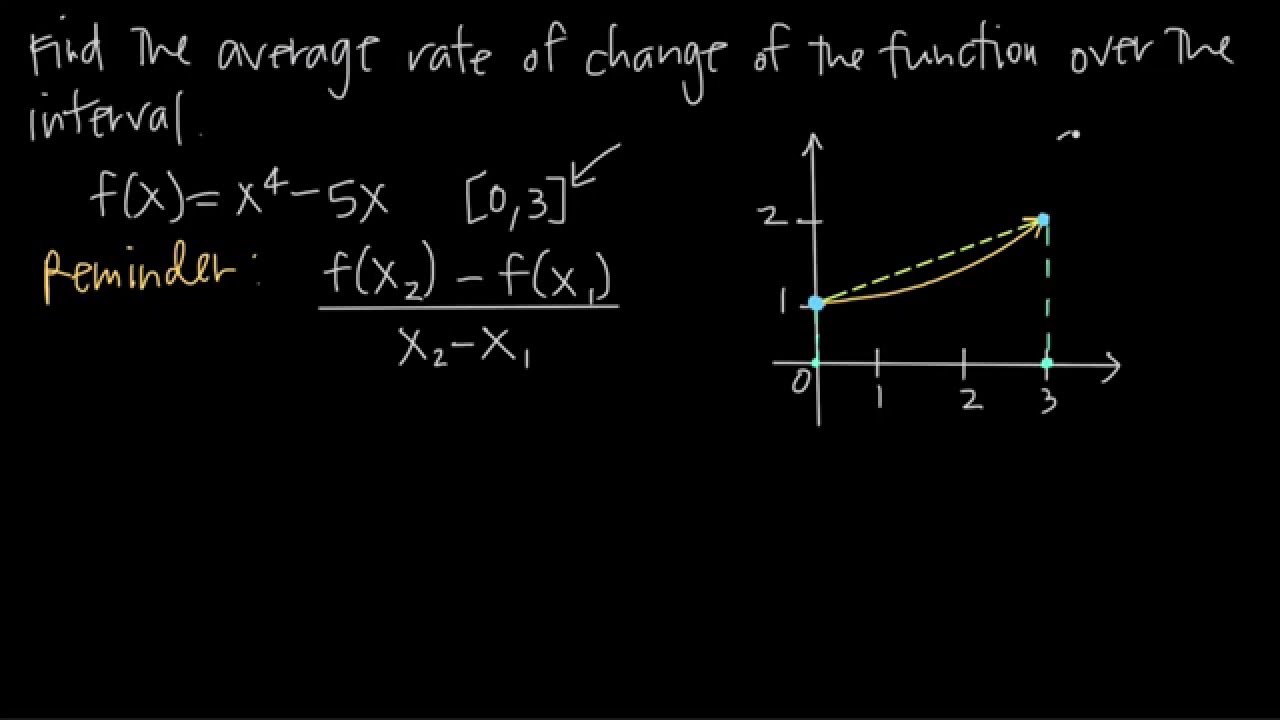

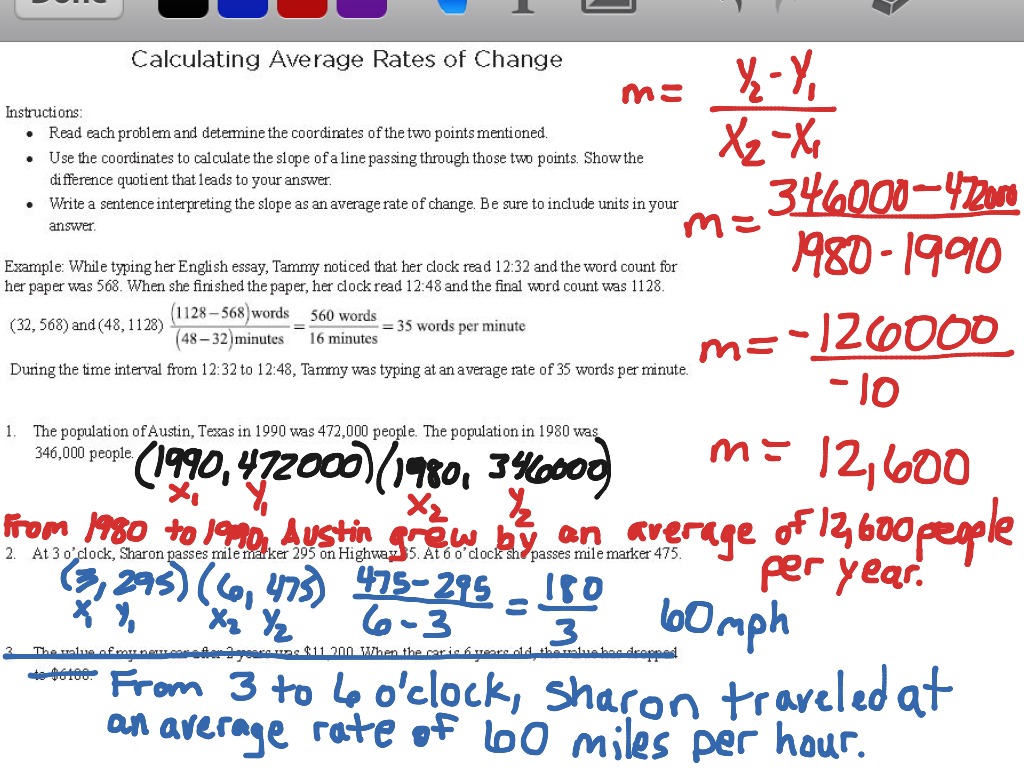

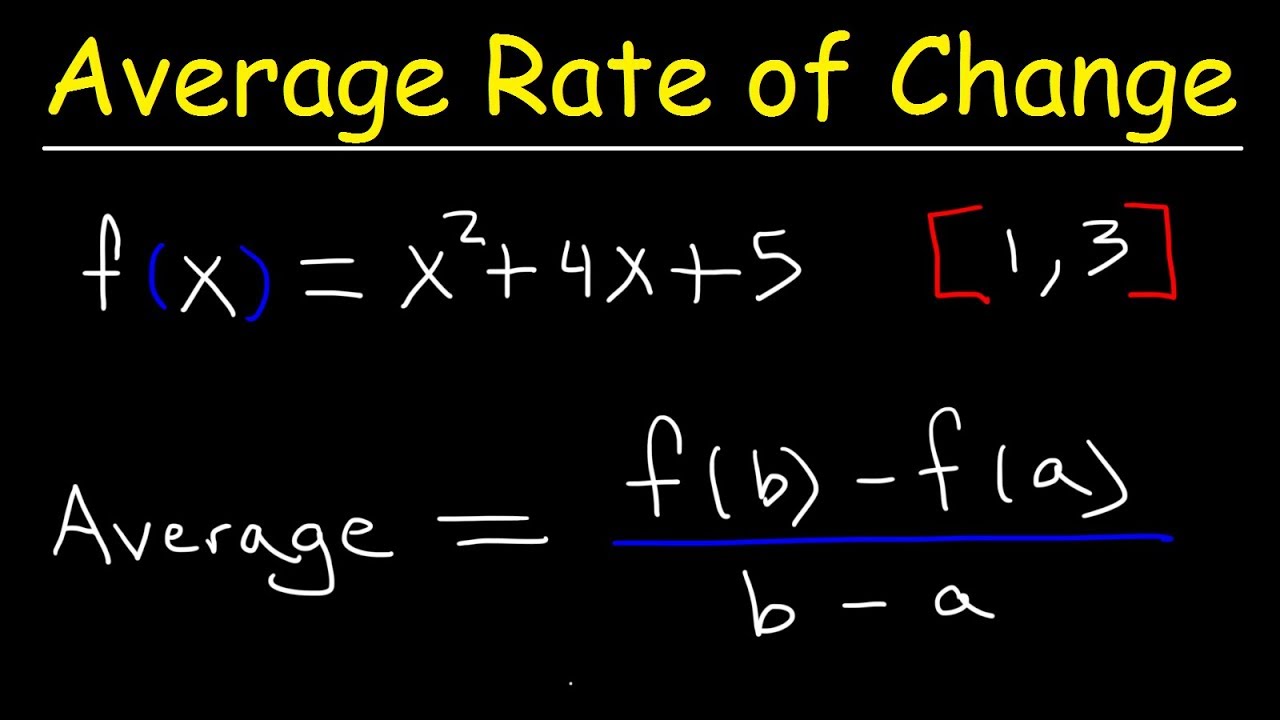

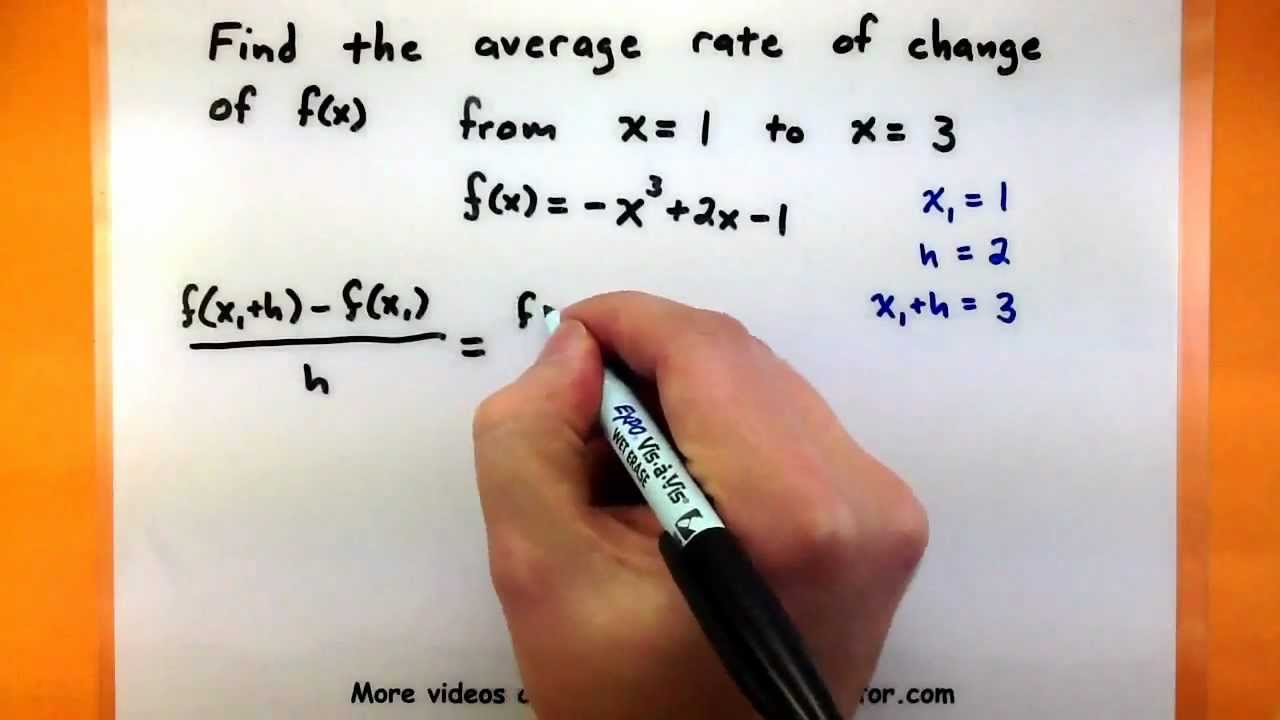

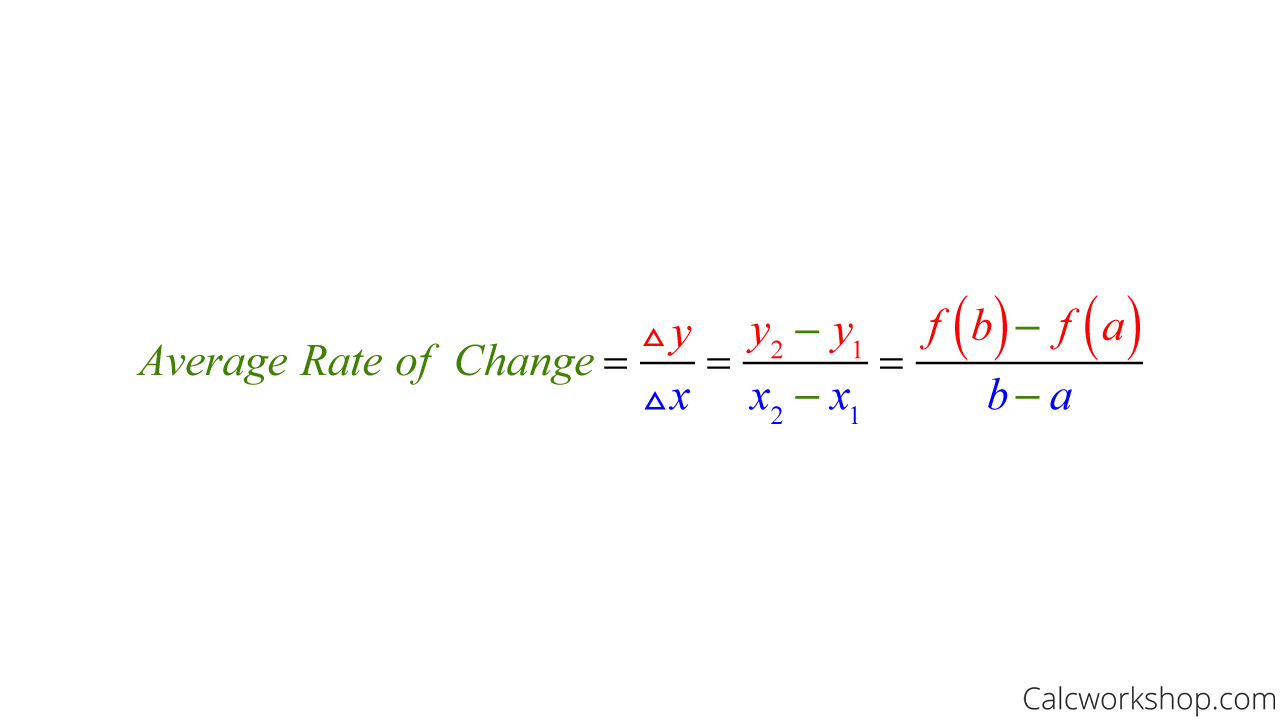

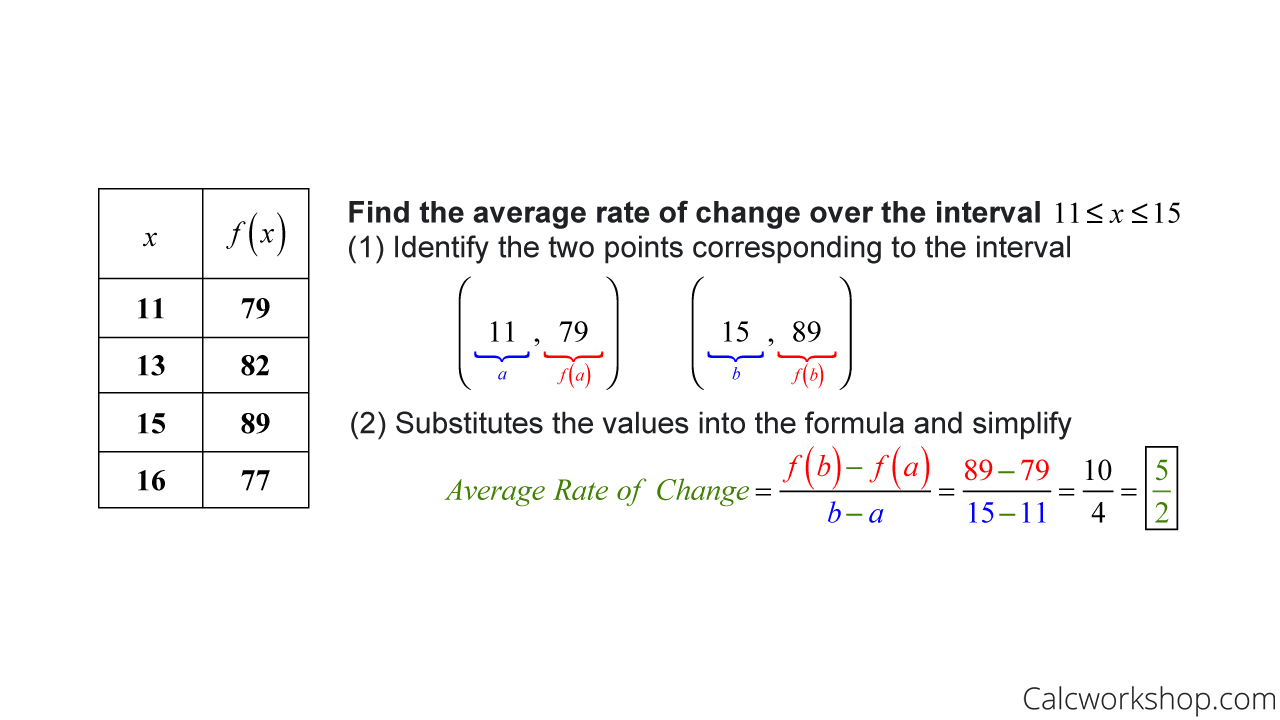

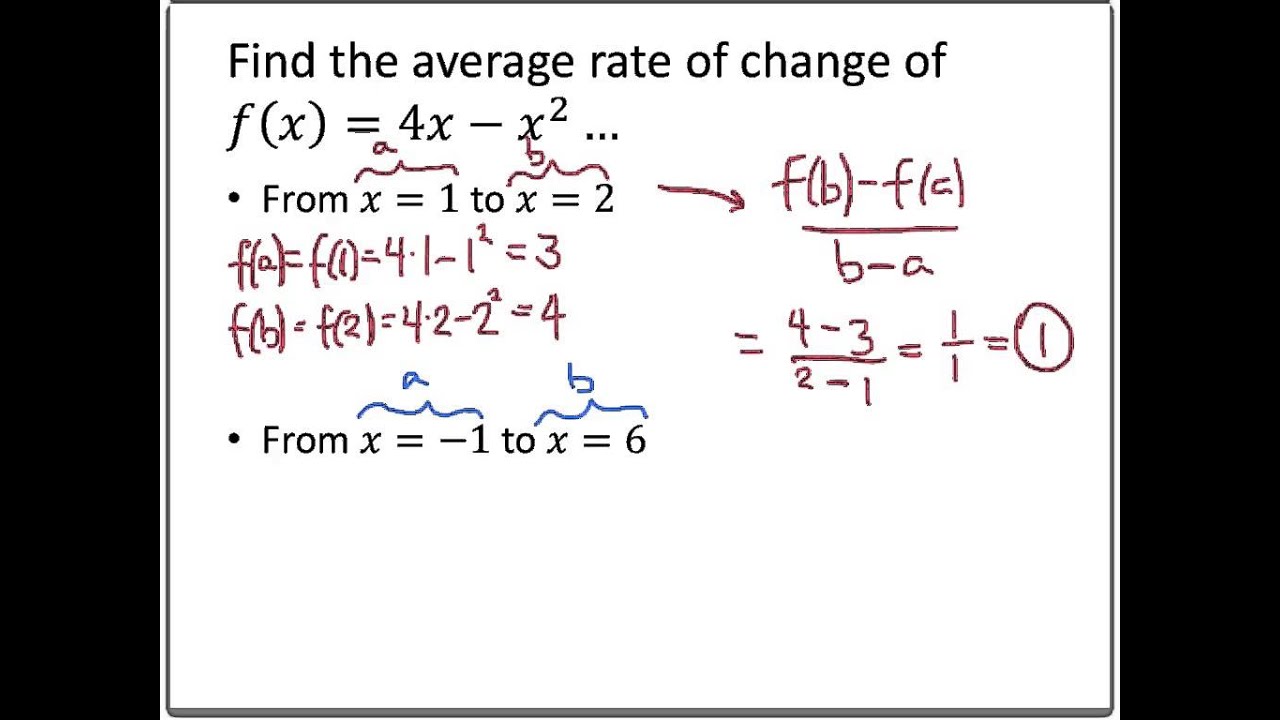

How To Calculate Average Rate Of Change – How To Calculate Average Rate Of Change

| Welcome for you to my own blog site, in this particular occasion I am going to show you regarding How To Delete Instagram Account. And from now on, this can be the first graphic:

Think about picture over? will be that wonderful???. if you think maybe and so, I’l l demonstrate several image all over again underneath:

So, if you desire to get all these awesome pictures about (How To Calculate Average Rate Of Change), press save icon to store these graphics for your laptop. They’re available for obtain, if you’d rather and wish to get it, simply click save symbol in the article, and it will be immediately downloaded in your home computer.} Lastly if you like to find unique and recent picture related to (How To Calculate Average Rate Of Change), please follow us on google plus or bookmark this page, we try our best to provide daily up grade with all new and fresh graphics. Hope you enjoy keeping here. For some upgrades and recent information about (How To Calculate Average Rate Of Change) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with update regularly with all new and fresh photos, like your surfing, and find the perfect for you.

Here you are at our site, articleabove (How To Calculate Average Rate Of Change) published . Nowadays we are delighted to announce we have found an extremelyinteresting contentto be reviewed, that is (How To Calculate Average Rate Of Change) Some people looking for information about(How To Calculate Average Rate Of Change) and certainly one of them is you, is not it?