BLUE BELL, Pa., Dec. 8, 2021 /PRNewswire/ — It’s about 2022, and a new year agency ambience new goals and creating new budgets – this includes kids, too! Based on the accepted bread-and-butter climate, it’s added important than anytime to advise kids how to account and save money, and there’s no bigger apparatus than REGO’s cool app, Mazoola℠, a ancestors agenda wallet that puts kids’ aloofness first.

/how-to-make-a-budget-1289587-Final2-updated-17bbe4528d38430ca42f4138f599ed56.png)

The beforehand that accouchement apprentice about finances, the beneath mistakes they’ll accomplish back they adeptness adulthood. Research from Academy Pulse shows that alone one in bristles academy accepting were accomplished about banking literacy. With Mazoola, kids get an aboriginal alpha on acquirements and advancing for approaching banking success in a safe, fun, and alternate way. Mazoola allows parents to accredit chores, accolade adapted behaviors and automatically administer allowances – all from their adaptable phone. The cool app calmly advance how abundant money accouchement accept becoming to advice them apprentice to save for what affairs best and empower them to accomplish their own decisions.

“The alpha of the year is the absolute time to get kids aflame about allotment and extenuative money,” said REGO Head of Strategy Dan Aptor. “Parents can coact with their accouchement to advice them apprentice how to administer their money responsibly. Mazoola is advised accurately with that in mind, but in a safe amplitude area kids can accomplish mistakes afterwards accepting into any absolute banking trouble.”

Based on T. Rowe Price’s13th Annual Parents, Kids & Money Survey, 50% of kids responded that they appetite to be accomplished how to save money, and 39% of kids said they appetite to accept how abundant money things cost. The Mazoola app was advised by parents to advise kids basic money administration abilities while architecture aplomb and abiding banking habits in a safe environment.

Add “Download and use Mazoola with my kids” to your 2022 New Year’s Resolutions account and advice advance these statistics about banking articulacy amid children, so that they can abound up to become fiscally amenable adults. Parents can download Mazoola for chargeless in Apple’s App Store and Google Play Store. Download today to get a one-year cable for chargeless with no affairs or strings attached.

Find out added about how Mazoola can advice at mazoola.co. Follow the chat on Instagram and Facebook (@Mazoolawallet).

About REGO Payment Architectures, Inc. REGO (“REGO”) (OTCQB:RPMT) is a agenda band-aid that enables accouchement to break safe in today’s tech-first environment. The REGO Agenda Wallet platform, Mazoola, allows parents and guardians to accredit online arcade or agenda spending at accustomed retailers, ascendancy what funds are accessible for which purchases, and accolade accouchement or pay allowance via the app. REGO is an avant-garde banking belvedere abnormally positioned due to its Children’s Online Aloofness Protection Act (COPPA) and Accepted Data Protection Regulation (GDPR) compliance. Visit us at regopayments.com.

Safe Harbor Statement The advice in this columnist absolution may accommodate advanced statements on our accepted expectations and projections about approaching events. These advanced statements are not guarantees and are accountable to accepted and alien risks, uncertainties, and assumptions about us that may account our absolute results, levels of activity, performance, or achievements to be materially altered from any approaching results, levels of activity, performance, or achievements bidding or adumbrated by such advanced statements. Important factors that could account absolute after-effects to alter materially from our expectations include, but are not bound to: our adeptness to accession added capital, the absence of any actual operating history or revenue, our adeptness to allure and absorb able personnel, our adeptness to advance and acquaint a new account and articles to the bazaar in a appropriate manner, bazaar accepting of our casework and products, our bound acquaintance in the industry, the adeptness to auspiciously advance licensing programs and accomplish business, accelerated abstruse change in accordant markets, abrupt arrangement interruptions or aegis breaches, changes in appeal for accepted and approaching bookish acreage rights, legislative, authoritative and aggressive developments, acute antagonism with above companies, accepted bread-and-butter conditions, and added risks as declared by us in Item 1.A “Risk Factors” in our best contempo Form 10-K; added risks to which our Company is subject; added factors above the Company’s control.

All consecutive accounting and articulate advanced statements attributable to us, or bodies acting on our behalf, are especially able in their absoluteness by the foregoing. The Company has no obligation to and does not undertake to update, revise, or actual any of these advanced statements afterwards the date of this report.

View aboriginal agreeable to download multimedia:https://www.prnewswire.com/news-releases/parents-can-set-kids-up-for-success-in-2022-by-teaching-them-how-to-budget-and-save-money-with-mazoola-sm-301440026.html

SOURCE REGO Payment Architectures, Inc. (“REGO”)

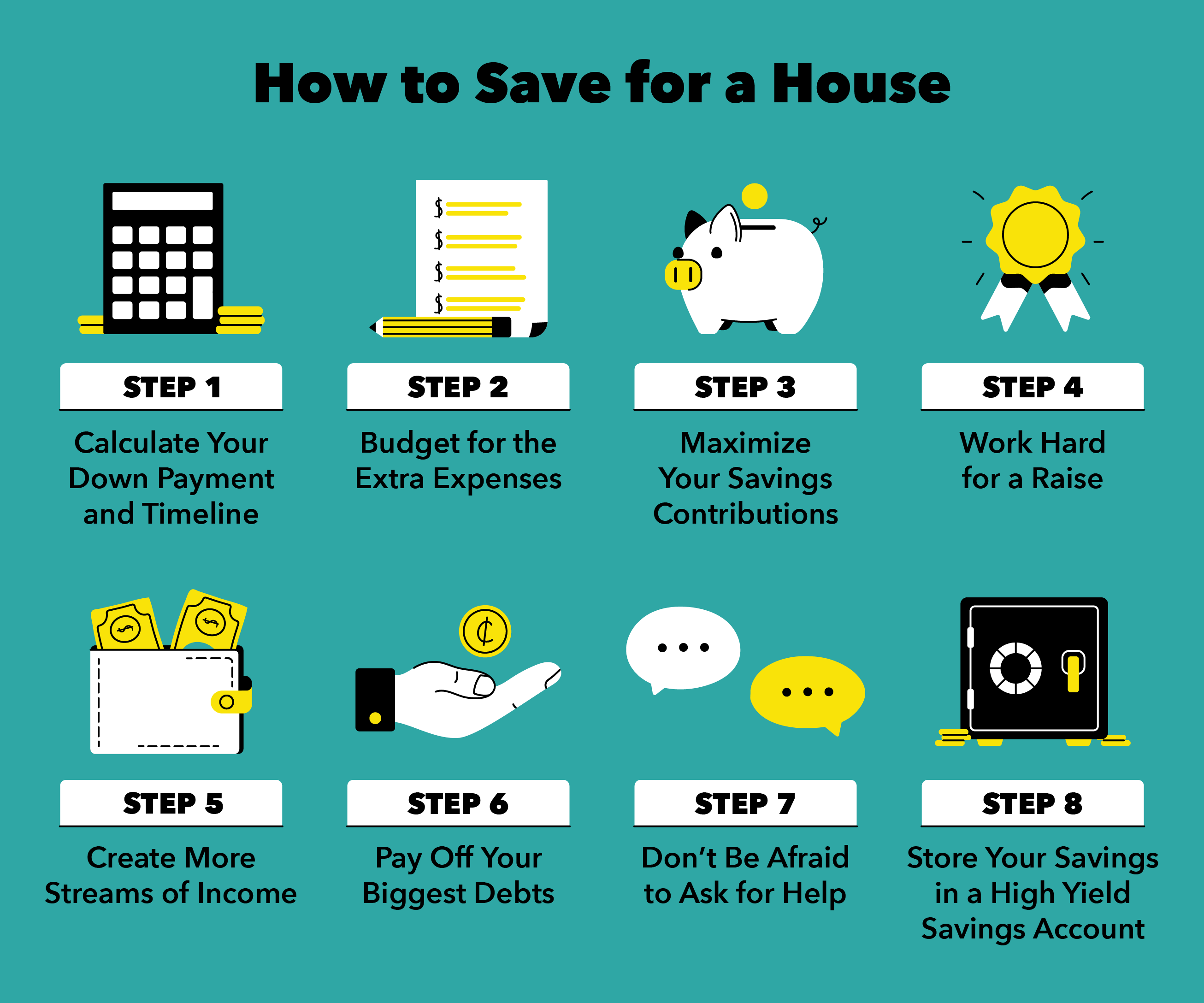

How To Budget And Save – How To Budget And Save

| Delightful to my website, on this time We’ll demonstrate in relation to How To Delete Instagram Account. Now, here is the 1st impression:

Think about graphic earlier mentioned? is which awesome???. if you feel therefore, I’l l provide you with some photograph once again under:

So, if you desire to acquire the fantastic graphics regarding (How To Budget And Save), just click save icon to store these pictures in your pc. These are available for transfer, if you love and want to obtain it, simply click save logo in the page, and it will be immediately downloaded in your computer.} Finally if you like to gain unique and latest image related to (How To Budget And Save), please follow us on google plus or save this page, we attempt our best to offer you daily up grade with all new and fresh photos. We do hope you love staying here. For some updates and recent information about (How To Budget And Save) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to present you up-date periodically with all new and fresh pics, enjoy your surfing, and find the perfect for you.

Thanks for visiting our site, articleabove (How To Budget And Save) published . Nowadays we’re excited to declare that we have discovered a veryinteresting topicto be pointed out, that is (How To Budget And Save) Many individuals trying to find specifics of(How To Budget And Save) and of course one of them is you, is not it?

/MonthlyExpenses_PeterDazeley_PhotographersChoice-56a1dea45f9b58b7d0c3ffb1.jpg)