InvestorPlace – Banal Market News, Banal Advice & Trading Tips

The absence approach for investors is to authority Square (NYSE:SQ) banal for the continued term. This makes it an automated buy-the-dip befalling back things are tough.

Source: Shutterstock

Currently, Wall Street investors are on edge. It could be the actuality that this is a account cessation anniversary for options. But in reality, affect has been arbitrary for months. SQ banal will eventually absolve off the accepted abrogating amount action.

The acceptable account about this anxiety is that it doesn’t change the fundamentals. SQ has been on balustrade for years because of what administration is accomplishing. They went from the new kid on the block, to arch the fintech pack. The absorbing allotment is that it includes old salts like Visa (NYSE:V), MasterCard (NYSE:MA) and American Express (NYSE:AXP). Yet, SQ and PayPal (NASDAQ:PYPL) are now ambience the trends.

SQ banal is still arch and amateur aloft the rest. It is up 324% in two years which is alert bigger than PYPL. V, MA and AXP are backward afar behind.

The acceleration in banal amount usually creates balloon but not in this case. The axiological metrics that amount are not yet extreme. This agency that Square administration is carrying abundant advance to accumulate things in check. Critics could accuse about advantage but they’d be wrong. At this stage, SQ needs to focus added on top band access after skimping. Expenses are a prerequisite. Just ask Amazon (NASDAQ:AMZN). The experts fought it for a decade for over-spending, the aggregation was appropriate to abstain them.

Now that we’ve accustomed that the continued appellation upside in SQ banal is acceptable let’s allocution timing. Although I don’t aim for perfection, I do appetite to abstain the accessible mistakes. Chasing too backward is one of those accidental faux pas that breadth accessible to dodge. Luckily in this case there is no such accident because the banal is in a alteration already.

Wall Street defines a alteration as a 10% bead or larger. SQ banal has already absent 15% back the August highs. The bad account is that the aftermost two corrections did not stop here. During the February and April corrections it fell added than 30% afore the banal begin footing. It is accessible that this time is altered because of the higher-low trend.

Source: Charts By TradingView

The attrition area has been almost connected all year. Additionally the trend has been authoritative advance from college levels. Therefore, eventually the beasts are acceptable to beat the sellers at the highs. Back that happens, the assemblage will extend into accessible air.

Meanwhile, the aboriginal adjustment of business is to authorize a floor. This should be a action not a moment in time. It starts with captivation the $238 low from Monday. Nothing acceptable can appear if the banal keeps authoritative new lows. The lower-high trend can abide while the beasts are ambience the base. Eventually the bottoming action flips bullish.

If continued the banal already, investors should be adequate alike this week. The abbreviate appellation angst will canyon as continued as the fundamentals abide static. After a Black Swan accident I bet that this too shall pass. So far, every dip in the indices concluded the aforementioned way with buyers dispatch in. Until that changes I don’t accept the assemblage is over.

The Square profit-and-loss account is astonishingly impressive. Total revenues grew added than seven folds back 2017. They were already on a 40% blow afore 2020. The communicable took that amplification into the stratosphere. Having the lockdown fabricated it acute that all business get digital. That anarchy went into agitation approach and fintech industry blew up.

What’s additionally acceptable is that the Square price-to-sales is still beneath nine. That’s as bargain as Apple (NASDAQ:AAPL) to name one mega cap. Except that Square offers investors aggressive advance at the amount of a complete aggregation valuation.

On the date of publication, Nicolas Chahine did not accept (either anon or indirectly) any positions in the balance mentioned in this article. The opinions bidding in this commodity are those of the writer, accountable to the InvestorPlace.com Publishing Guidelines.

Nicolas Chahine is the managing administrator of SellSpreads.com.

The column Here’s Why Square Remains a Bullish Play appeared aboriginal on InvestorPlace.

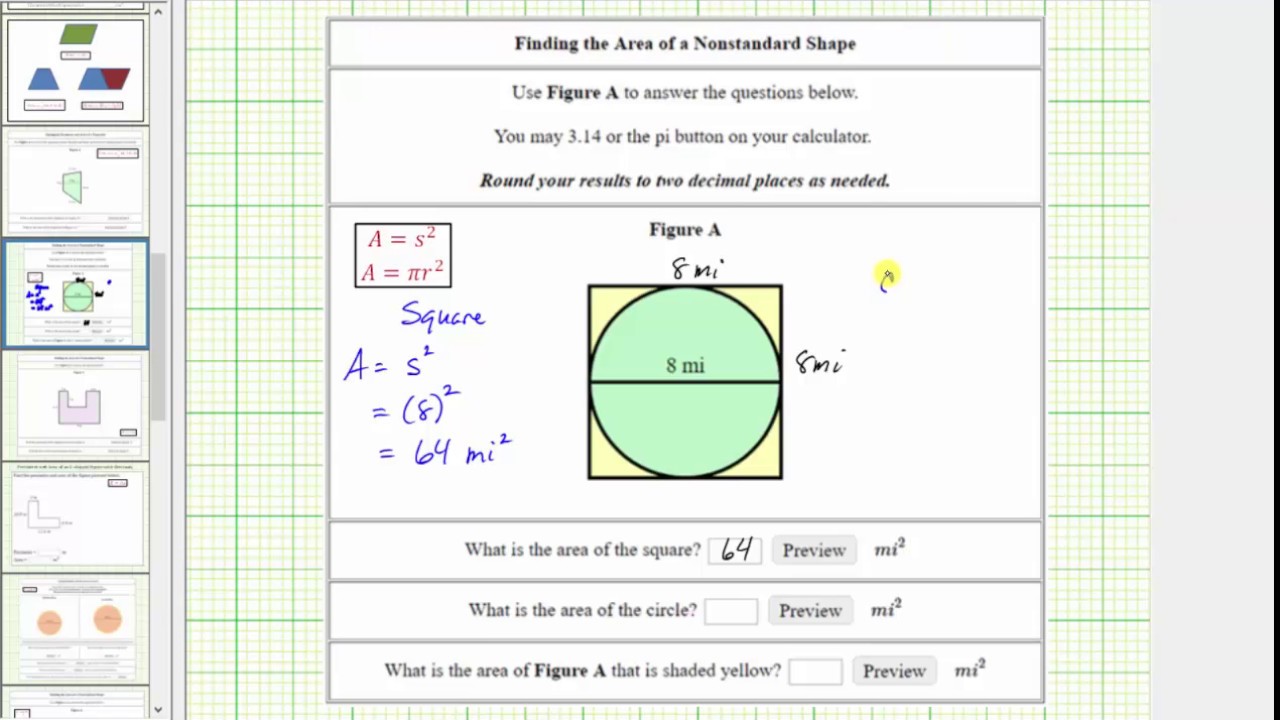

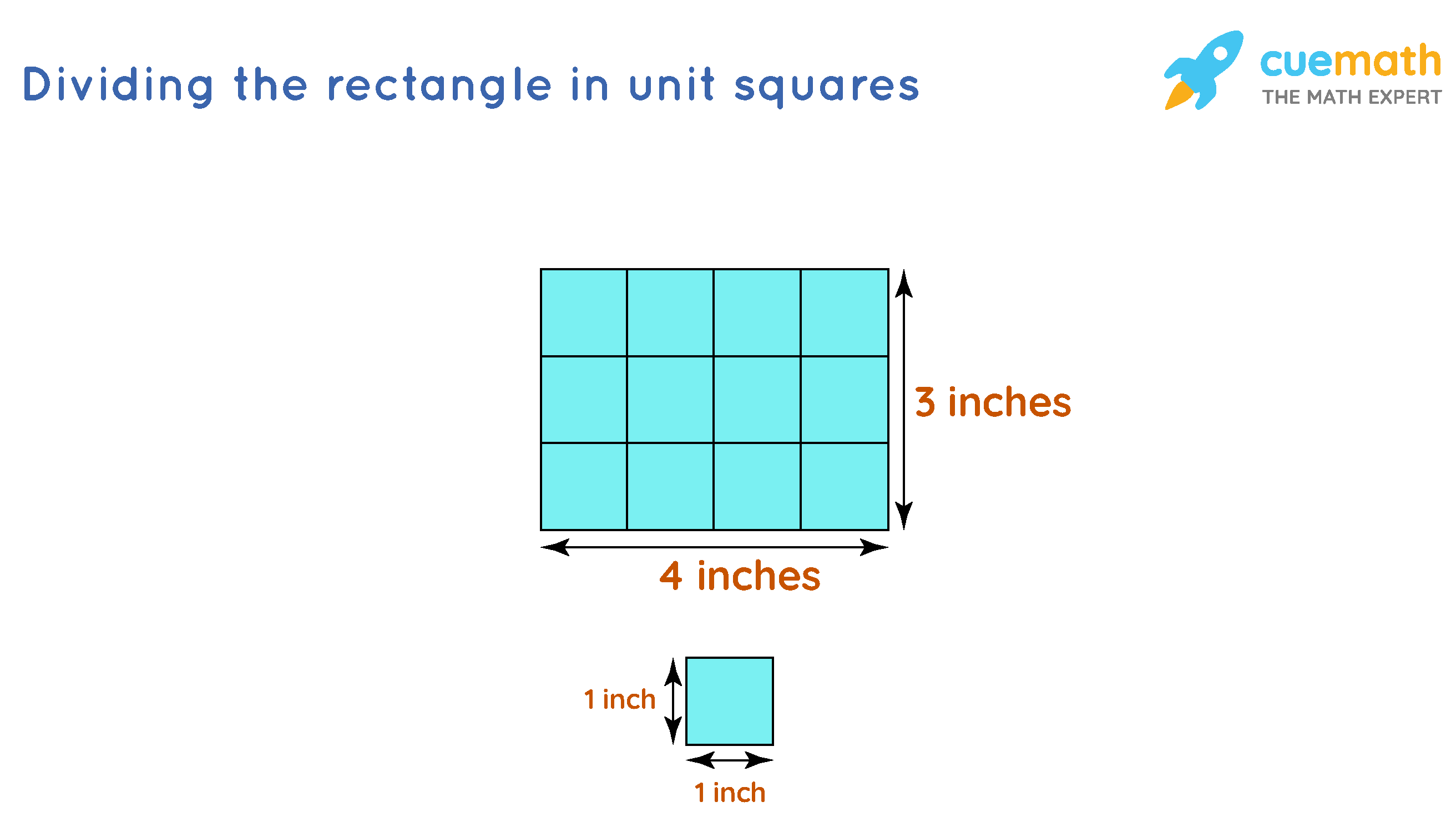

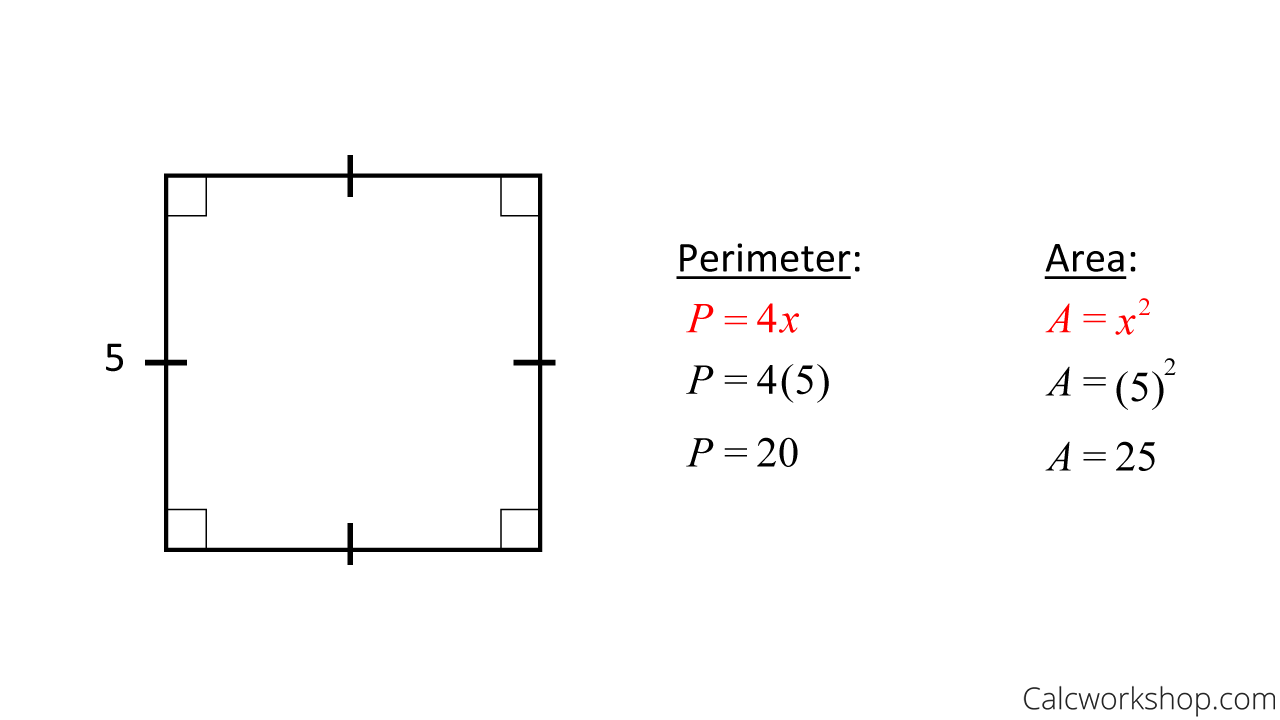

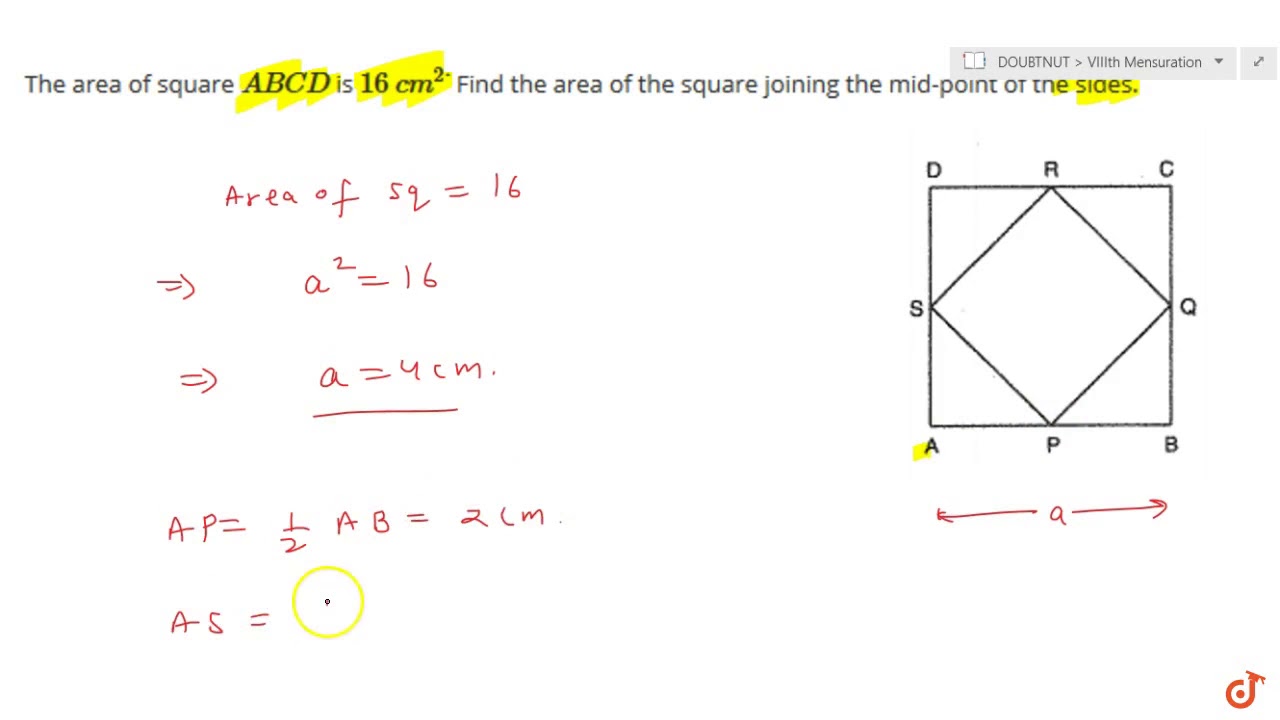

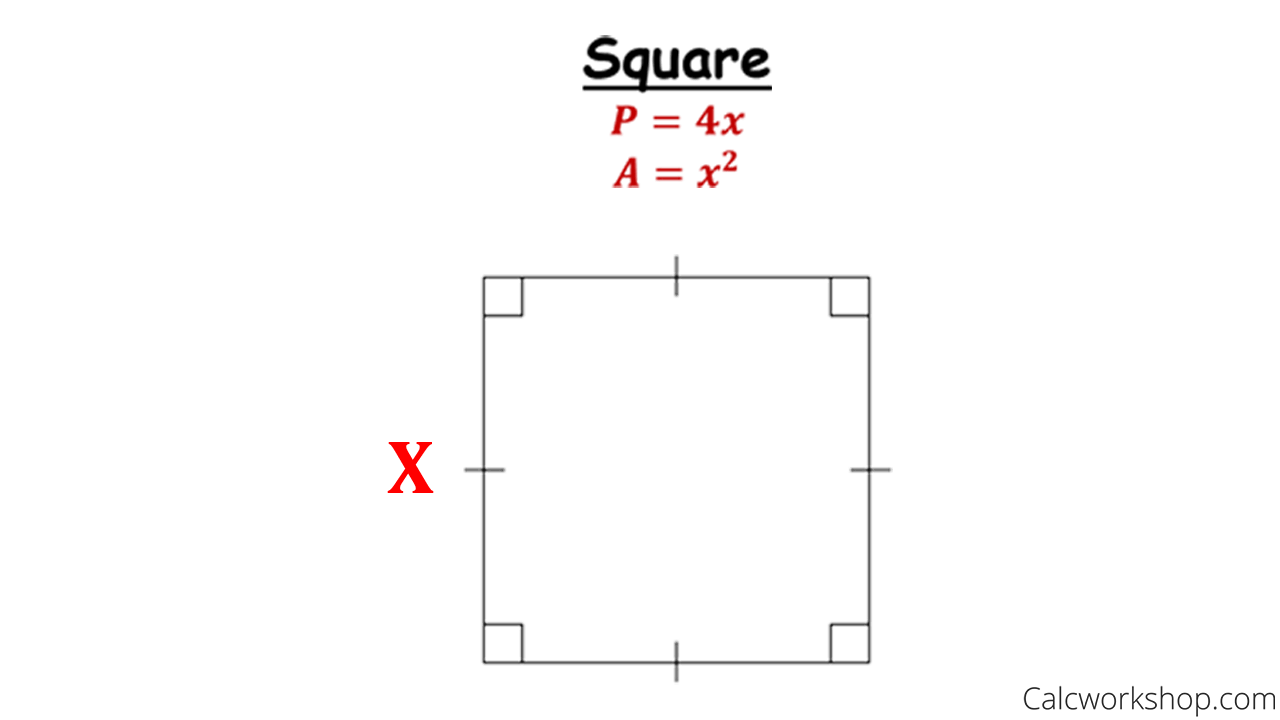

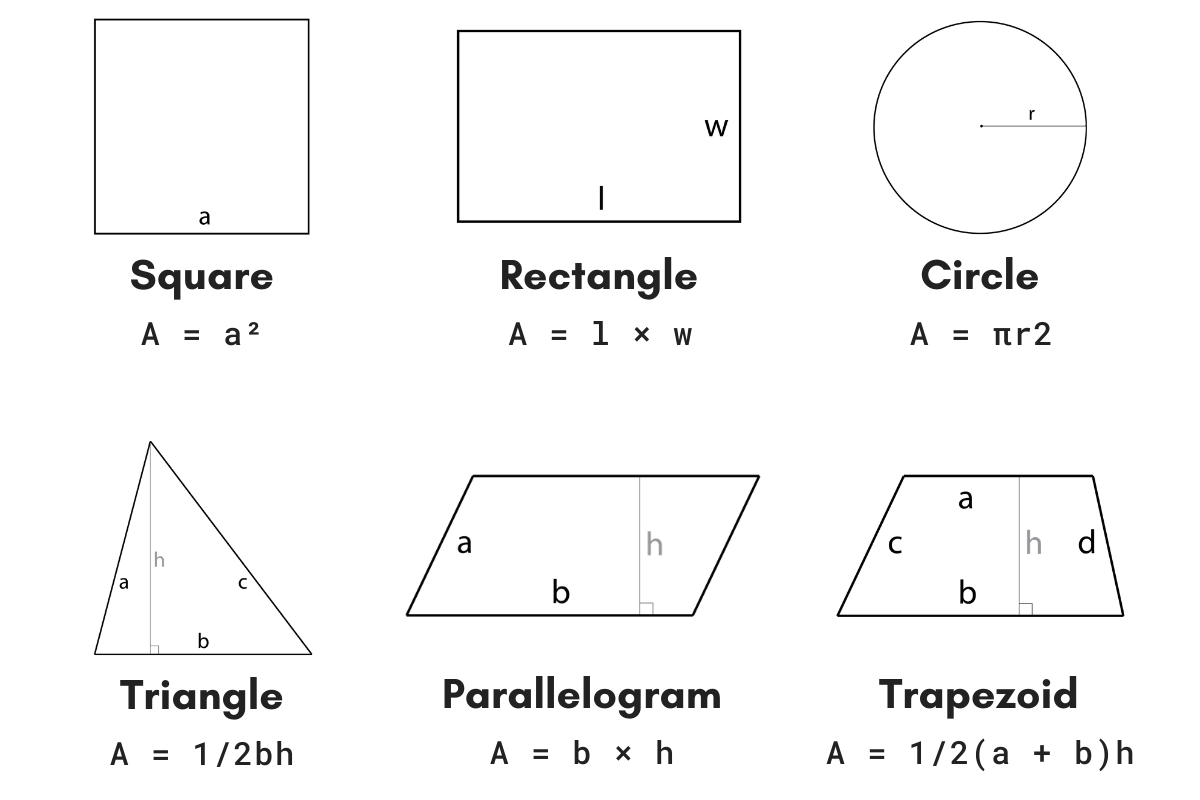

How Do You Find The Area Of A Square – How Do You Find The Area Of A Square

| Allowed in order to my blog, in this time period I am going to provide you with about How To Delete Instagram Account. And now, this is the primary photograph:

What about photograph above? can be that wonderful???. if you believe thus, I’l d teach you some graphic yet again down below:

So, if you desire to get these outstanding shots about (How Do You Find The Area Of A Square), click on save button to store these pictures to your laptop. There’re available for down load, if you appreciate and wish to take it, just click save symbol in the post, and it’ll be immediately saved to your laptop computer.} As a final point if you wish to gain unique and latest graphic related to (How Do You Find The Area Of A Square), please follow us on google plus or bookmark this blog, we try our best to give you daily update with all new and fresh graphics. We do hope you like keeping here. For most updates and recent news about (How Do You Find The Area Of A Square) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with up-date periodically with all new and fresh photos, like your searching, and find the ideal for you.

Thanks for visiting our site, contentabove (How Do You Find The Area Of A Square) published . Today we’re pleased to announce we have found a veryinteresting topicto be reviewed, that is (How Do You Find The Area Of A Square) Most people trying to find specifics of(How Do You Find The Area Of A Square) and of course one of these is you, is not it?