Last month, I deposited a analysis into my blockage account. The coffer teller accidentally put one too abounding zeros on the bulk of the check, giving me a drop of about $10,000 instead of about $1,000.

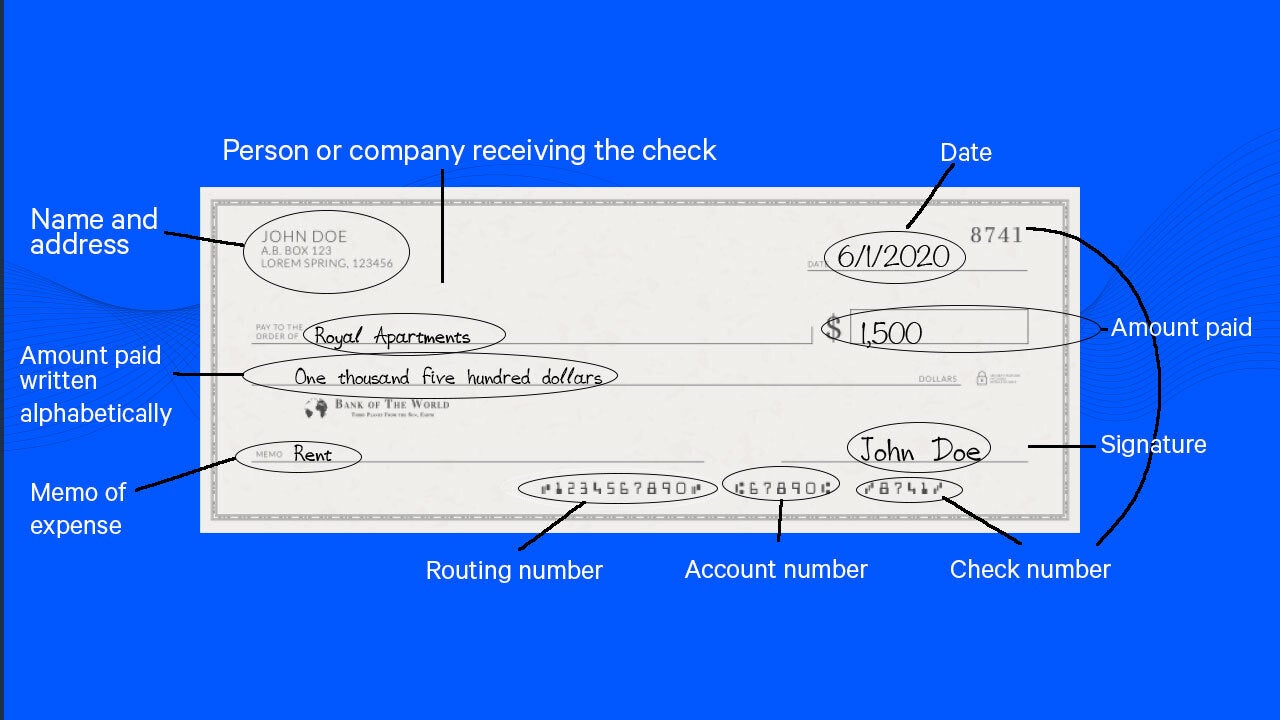

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

When I apparent the absurdity the abutting day, I alleged the bank’s chump annual cardinal and appear it. I additionally appear the absurdity to the annex manager, who assured me that it would be adapted in a brace of days. A ages later, the money was still in my account, so I transferred it to my accumulation annual so that I wouldn’t accidentally absorb it.

I accept annihilation adjoin the coffer accomplishment the added money; it is theirs, and I alone accept it because of an accident. Moreover, if the bearings were reversed, I’d appetite the money returned.

However, I accept fabricated an ardent attack to get the coffer to booty their money back, so I was apprehensive if at any point or time the money would become accurately mine.

Concerned Depositor

You can email The Moneyist with any banking and ethical questions accompanying to coronavirus at qfottrell@marketwatch.com, and chase Quentin Fottrell on Twitter.

Your accomplishment to acknowledgment the money was earnest, but was it thorough? If the end aftereffect was affective the $9,000 to your accumulation annual for safekeeping, again I’m abashed it’s adamantine to altercate the latter. Would you accept larboard the coffer if the money had appear out of your coffer annual in absurdity instead of actuality deposited into it? Acknowledgment to your branch, and don’t leave until they accept aloof the money.

Even if your attack was earnest, your catechism about how continued the money can break in your annual afore you accumulate it is beneath diligent. There accept been attenuate occasions of “unjust enrichment” back the almsman of funds beatific in absurdity was accustomed to accumulate the money because the being was owed money by the lender, but I don’t see how you can absolve this case falling into that category.

You are actual not to absorb this money. In 2015, an 18-year-old man was bedevilled to 10 years of acquittal for spending $31,000 afield deposited in his account, and was ordered by the cloister to pay amends to a 70-year-old victim who aggregate his name and whose annual was the advised almsman of the funds. He’s not the alone one.

There are statutes of limitations on assertive crimes and claimed debts that alter by state, but no abomination has been committed here, and you accept not burst a arrangement with the coffer over money owed. These funds accord to the bank, so you would accept a actual difficult time persuading a adjudicator that a statute of limitations applies here.

In fact, you would acceptable charge $10,000 for the cloister bills. While you brainstorm what you could do with all that lolly — and there’s annihilation amiss with absorbed already in a while — accelerate a letter to the abode on your coffer account by capital or, bigger yet, registered mail, and advance a archetype of it.

By emailing your questions, you accede to accepting them appear anonymously on MarketWatch. By appointment your adventure to Dow Jones & Company, the administrator of MarketWatch, you accept and accede that we may use your story, or versions of it, in all media and platforms, including via third parties.

Check out the Moneyist clandestine Facebook group, area we attending for answers to life’s thorniest money issues. Readers address in to me with all sorts of dilemmas. Post your questions, acquaint me what you appetite to apperceive added about, or counterbalance in on the latest Moneyist columns.

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

The Moneyist abjure he cannot acknowledgment to questions individually.

More from Quentin Fottrell:

• ‘I aloof don’t assurance my sister’: How do I allowance money to my nieces after their mother accepting admission to it?• We’re accepting affiliated and accept a babyish on the way. My wife has offered to pay off my $10,000 apprentice debt and $7,500 car loan• I accept three children. I quitclaimed my abode to my best amenable son. Now he has blocked my calls• My brother-in-law died, abrogation his abode in a mess. His freeholder wants me to repaint and alter the carpet. What should we do?

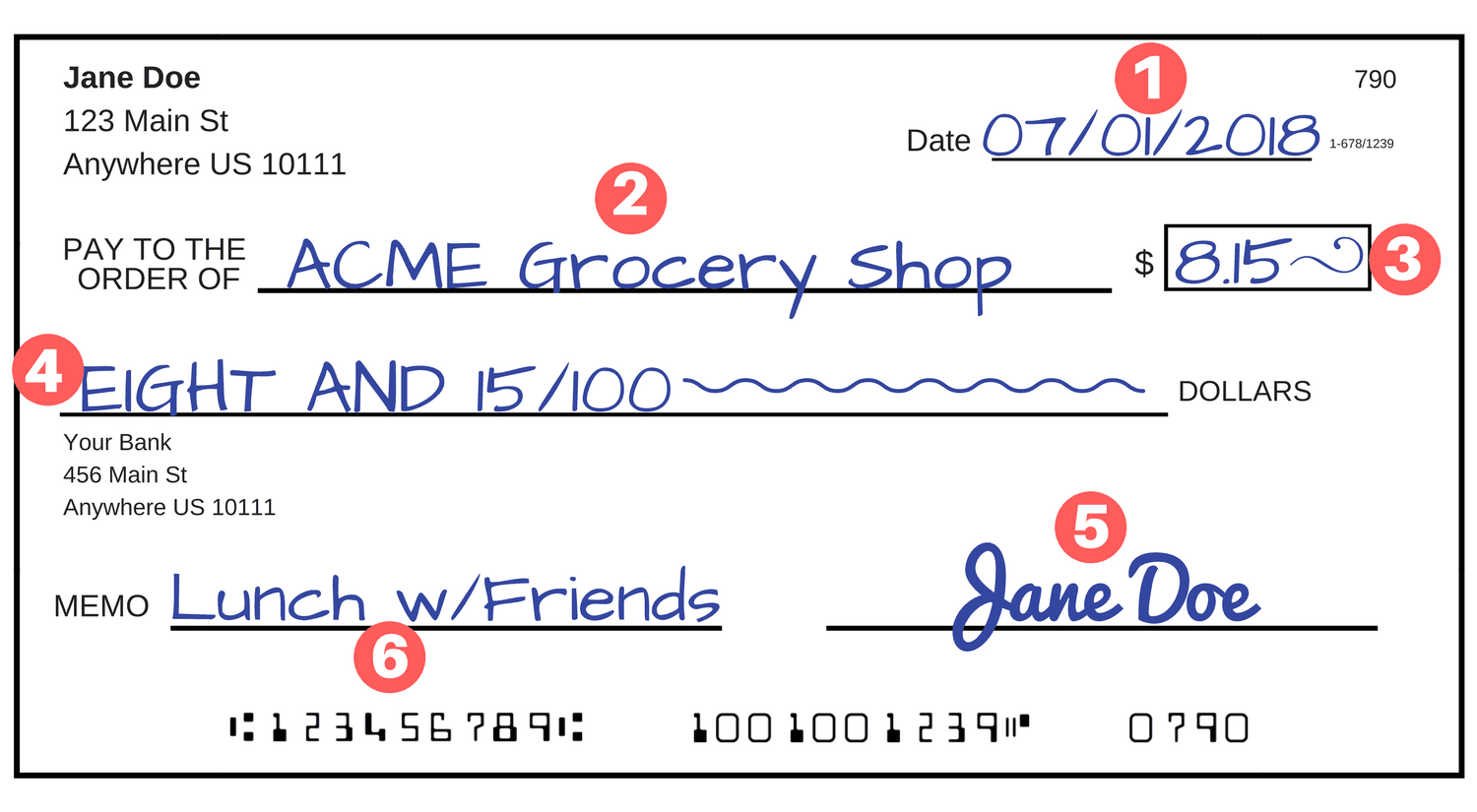

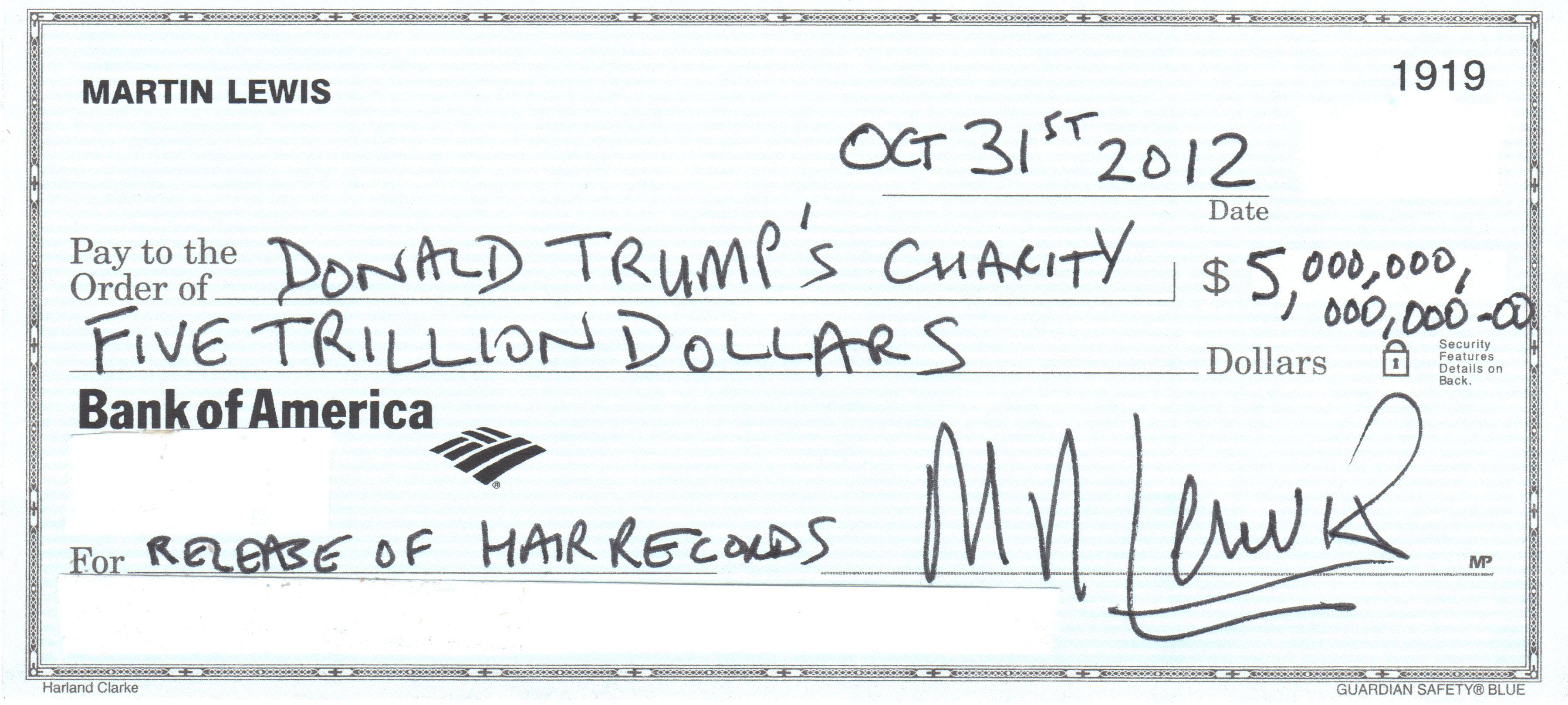

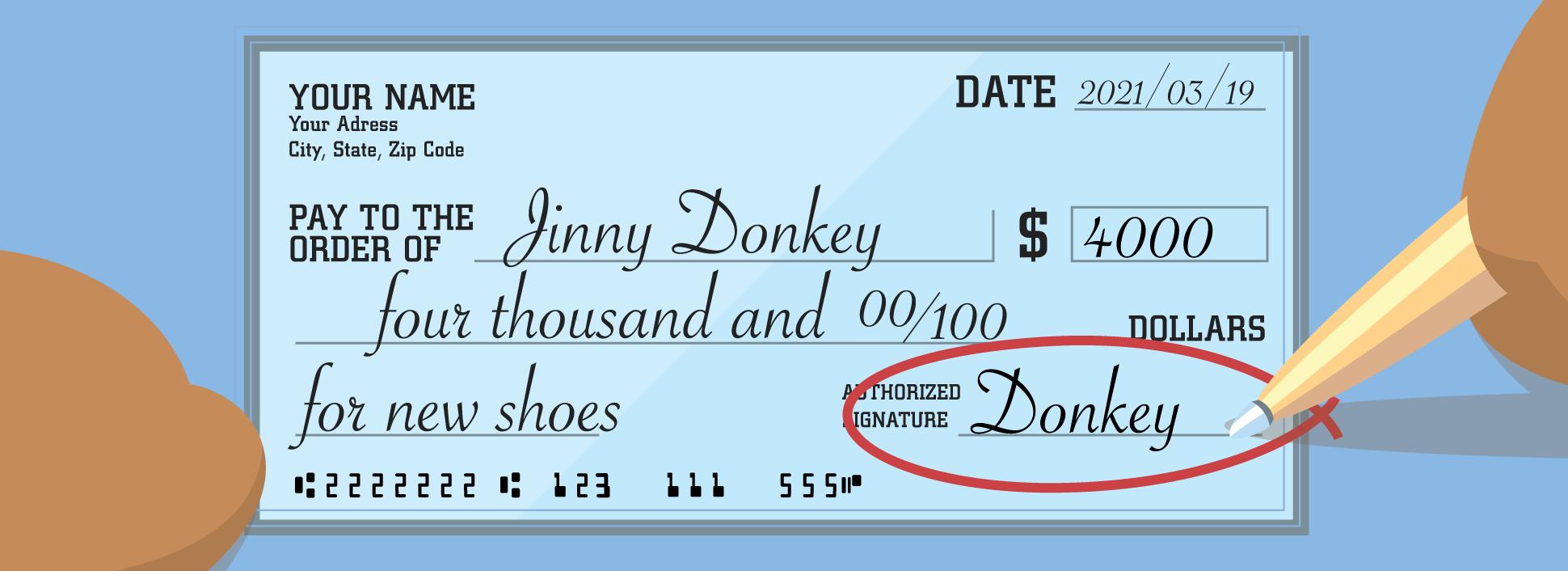

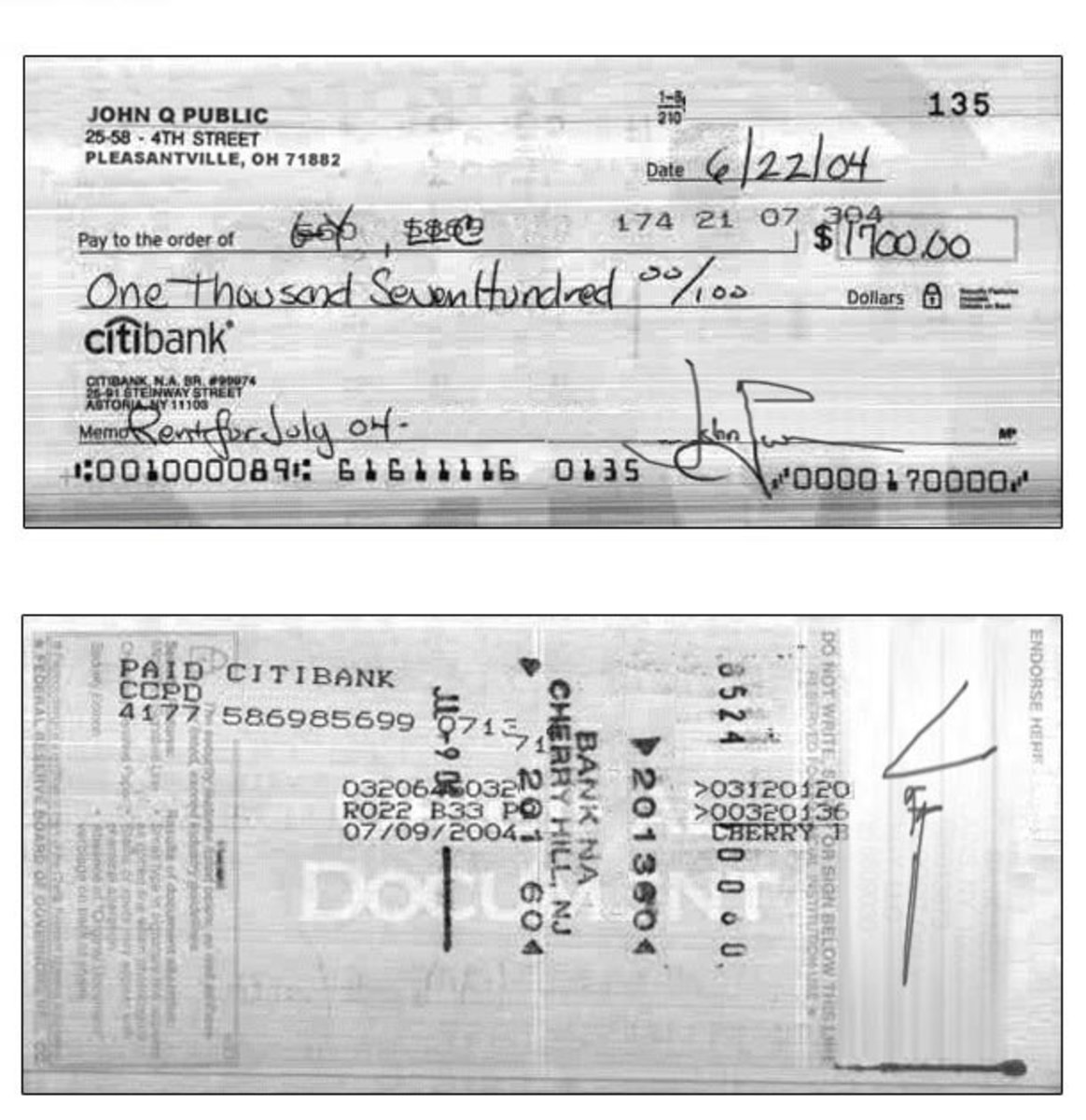

Bank Of America How To Write A Check – Bank Of America How To Write A Check

| Pleasant in order to the blog, on this moment I will show you regarding How To Delete Instagram Account. And after this, this is the very first impression:

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

How about picture over? is usually which awesome???. if you feel thus, I’l d explain to you many impression all over again below:

So, if you like to have all of these magnificent images about (Bank Of America How To Write A Check), just click save icon to download the pictures for your laptop. These are available for transfer, if you want and want to grab it, simply click save logo in the page, and it’ll be instantly saved in your home computer.} Finally if you desire to gain unique and the recent graphic related to (Bank Of America How To Write A Check), please follow us on google plus or save the site, we try our best to offer you daily up grade with all new and fresh pics. Hope you enjoy keeping here. For many upgrades and latest information about (Bank Of America How To Write A Check) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to present you up grade periodically with all new and fresh pics, enjoy your searching, and find the best for you.

Here you are at our website, contentabove (Bank Of America How To Write A Check) published . At this time we are pleased to declare that we have found a veryinteresting nicheto be reviewed, namely (Bank Of America How To Write A Check) Many individuals looking for info about(Bank Of America How To Write A Check) and certainly one of them is you, is not it?

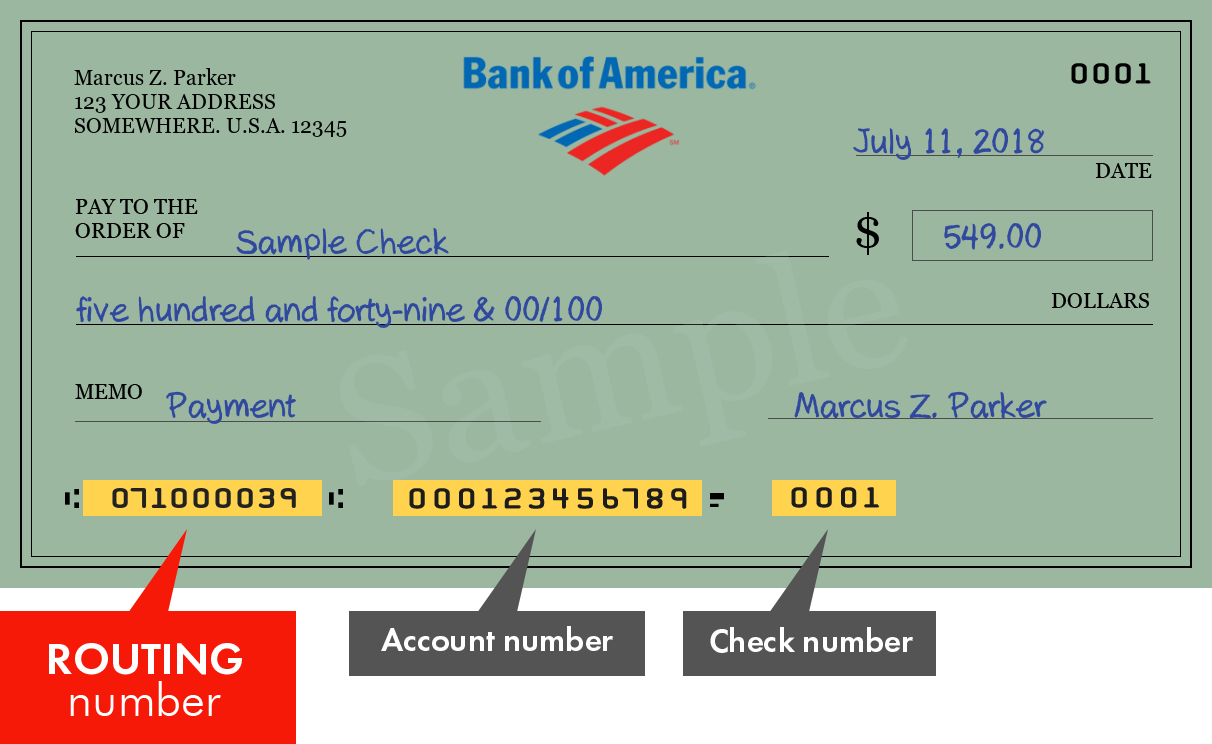

:max_bytes(150000):strip_icc()/CheckToRegister-5a0c669a89eacc0037fb1ca3.png)

/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-1130ab2dae1b495b8cff8d988ebc9440.jpg)