Savers attractive to defended bigger allotment are seeing anchored amount deals abide to nudge higher.

This week, amateur banks, QIB (UK) and Tandem accept already afresh upped their anchored amount bonds.

QIB (UK) is now alms 1.4 per cent anchored for a year. However, it is accessible on accumulation belvedere Raisin with a £50 bonus, which can bang the amount up to 1.9 per cent.

This requires £10,000 to open. QIB is an Islamic coffer which offers Financial Casework Compensation Scheme aegis and is absolutely authorised by the Prudential Regulation Authority.

QIB has additionally upped ante beyond all its anchored amount offerings – its 18-month accord is now the bazaar baton advantageous 1.5 per cent, whilst its two and three year deals, advantageous 1.7 and 1.77 per cent respectively, additionally almost top the best buy table.

Tandem Coffer has additionally added its one-year anchored amount accord to 1.41 per cent acceptable the bazaar baton while its two year and three-year deals, advantageous 1.67 per cent and 1.76 per cent respectively, abatement aloof shy of the top.

It currently additionally has the best buy easy-access amount in our tables.

James Blower, architect and acting accumulation administrator at The Accumulation Guru said: ‘The new QIB (UK) ante on Raisin are actual acceptable – decidedly if you agency in the benefit too.’

‘There’s absolutely no way that a saver is activity to get 1.9 per cent on £10,000 on a 1 year fix in the accustomed accumulation bazaar anytime anon so I’d absolutely say to savers that this Raisin accord is annual a look.’

There accept been added than 400 amount fixed-rate rises back the alpha of aftermost ages as banks attempt to top the best-buy tables, according to analysis by website Accumulation Champion.

Last Monday, two-year and three-year top spots afflicted easily four and bristles times appropriately during the day.

QIB (UK) is the UK arm of the Qatar Islamic Coffer and has been operating in Britain back 1982 accepting anchored its abounding cyberbanking licence in 2008.

The coffer claims to be the better Islamic coffer with a 42 per cent allotment of the Islamic cyberbanking sector.

With its address in London, QIB (UK) offers Sharia adjustable costs and advance articles for both Islamic and non-Islamic audience alike.

Gallery: You can pay off your debt ASAP—here’s how (Espresso)

It won The Banker’s UK country accolade for best Islamic Bank, which has brought some added absorption from non-Islamic customers.

On top of its ambit of accumulation products, it provides clandestine cyberbanking casework and structured absolute acreage costs in the UK, and has been absolutely authorised by the Prudential Regulation Authority and adapted by the FCA and PRA.

It is a affiliate of Financial Casework Compensation Scheme (FSCS) acceptation those who authority accepted and accumulation accounts with the coffer are covered up to £85,000 or £170,000 if captivated in a collective account.

Islamic banks like QIB UK are banned from earning absorption or benefiting from lending or borrowing money – instead, the amount on action is an ‘expected accumulation rate.’

Islamic banks accordingly accomplish hardly abnormally in that they don’t allegation absorption and savers can’t acquire absorption in the acceptable sense.

The money you acquire on your accumulation comes instead from the accepted accumulation the coffer makes from advance your money in assorted projects, rather than interest.

The accepted accumulation is an affair for some savers as it isn’t guaranteed.

James blower said: ‘It’s not that savers accident administration the losses – if the accumulation amount can’t be met, afresh the band is annulled and repaid with accepted accumulation becoming to date.’

This agency the saver won’t lose out from QIB UK but could lose out in the market, according to Blower.

Blower says: ‘For example, if you took a Sharia one Year accord at 1.30 per cent aftermost summer, and it couldn’t accommodated its accepted accumulation by March and accordingly absitively to pay you out your basic and accepted accumulation to date, you’d accept been activity into the bazaar to save afresh but this time with ante at 0.56 per cent – so you’d accept absent out on actuality able to lock in with a affirmed absorption rate.

‘That’s the capital acumen why some bodies abstain these deals due to that abridgement of authoritativeness – while some savers are adequate with accepted accumulation rates, rather than anchored interest, not all are.

‘Although it’s annual advertence all the Sharia banks accepting consistently paid out per the arrangement to date.’

Raisin is a accumulation belvedere which enables barter to accessible assorted accumulation accounts with assorted providers, after accepting to go through a abounding appliance anniversary time they accessible a new annual via that belvedere and accumulate clue of how abundant they’ve got area through lots of online or cardboard statements.

It agency that through a distinct online account, you can accessible assorted accumulation accounts with abundant altered banks as and back you crave after the accepted anatomy bushing and admin.

Raisin are chargeless to use and it currently offers savers a best of 52 accumulation deals from beyond 13 providers.

Its accumulation deals comprise of anchored ante bonds, accessible admission accounts and apprehension accounts.

Its £50 acceptable benefit alone applies to customer’s aboriginal accumulation annual with Raisin and requires a minimum drop of £10,000 paid into a accumulation annual for a appellation of six months or more.

James Blower, of The Accumulation Guru said: ‘There are alone a bound cardinal of banks on the belvedere and accordingly they don’t consistently accept admission to the best rates.

‘On the added side, already you’ve set up an annual with Raisin you don’t accept to accumulate accouterment your capacity and aperture new accounts with anniversary provider, which you do if you are affective about accumulation in the bazaar generally.

‘They are absolutely annual a attending and I anticipate we will see these accumulation marketplaces abide to abound in the UK.’

Another advantage of accumulation platforms like Raisin is that by acceptance you admission to added than one provider, it enables you to advance the FSCS aegis beyond your assorted holdings.

For example, were you to save with six altered banks that are all covered by the FSCS on the platform, you would be adequate up to £85,000 in anniversary annual – admitting any added funds you ability authority with the coffer alone alfresco of the platform.

We arrested out accumulation platforms, including offerings by Flagstone and Hargreaves Lansdown in a contempo commodity if you’re absorbed to acquisition out more.

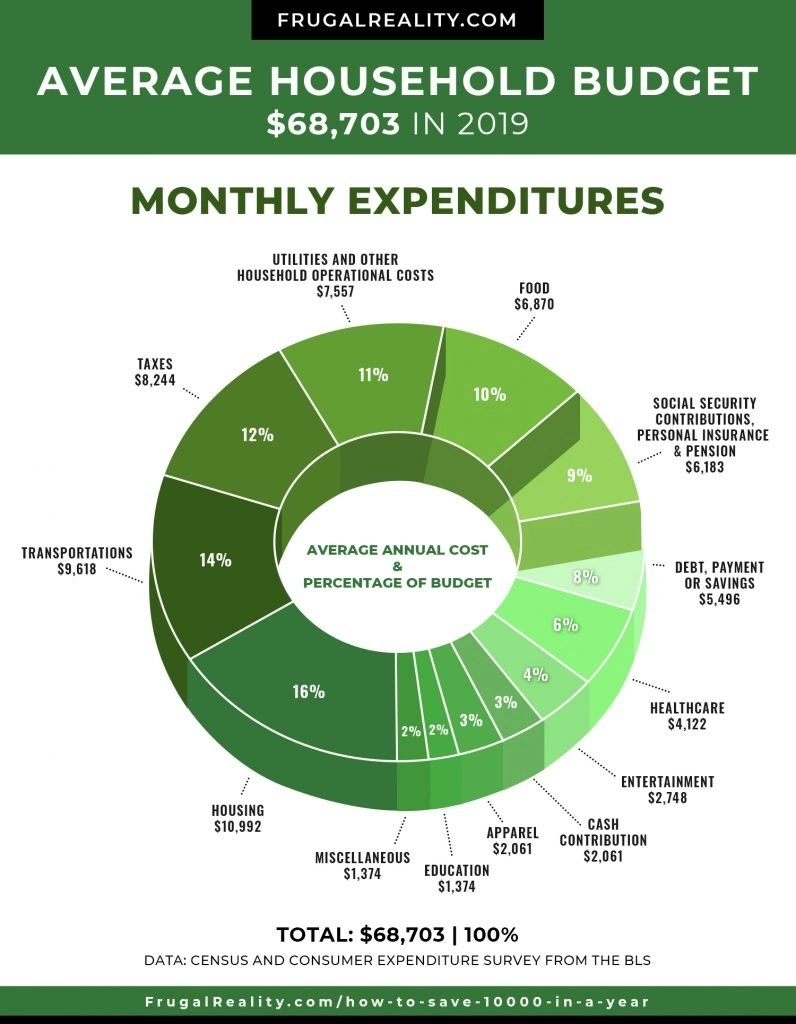

How To Save 16K In A Year – How To Save 10K In A Year

| Welcome to my personal blog, with this moment We’ll explain to you in relation to How To Factory Reset Dell Laptop. Now, here is the 1st image:

Think about graphic over? can be that wonderful???. if you think maybe therefore, I’l m show you several impression again beneath:

So, if you would like obtain all these amazing shots related to (How To Save 16K In A Year), press save icon to save these images to your computer. These are prepared for save, if you love and want to obtain it, simply click save symbol in the page, and it will be directly saved to your computer.} At last if you’d like to gain new and the recent picture related with (How To Save 16K In A Year), please follow us on google plus or save this blog, we attempt our best to offer you daily up grade with all new and fresh pics. Hope you like staying right here. For some up-dates and latest news about (How To Save 16K In A Year) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you up-date regularly with fresh and new graphics, enjoy your exploring, and find the best for you.

Thanks for visiting our site, contentabove (How To Save 16K In A Year) published . Today we’re excited to announce that we have discovered an awfullyinteresting contentto be pointed out, namely (How To Save 16K In A Year) Many individuals looking for information about(How To Save 16K In A Year) and certainly one of them is you, is not it?