Raise the dollar, bead the metals. Beneath best accessible scenarios, things don’t attending acceptable for gold, silver, and mining stocks – for the medium-term.

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

With the USD Index and U.S. Treasury yields the capital axiological drivers of the PMs’ performance, some abashing has arisen due to their alongside and aberrant moves. For example, sometimes the USD Index rises while U.S. Treasury yields fall, or vice-versa, and sometimes the brace move higher/lower in unison. However, it’s important to bethink that altered bread-and-butter environments accept altered impacts on the USD Index and U.S. Treasury yields. To explain, the USD Index allowances from both the safe-haven bid (stock bazaar volatility) and bread-and-butter outperformance about to its FX peers. Conversely, U.S. Treasury yields alone account from the latter. Thus, aback bread-and-butter risks accent (like what we witnessed with Evergrande on Sep. 20), the USD Index generally rallies while U.S. Treasury yields generally fall. Thus, the bread-and-butter altitude is generally the axiological account of the pairs’ approaching paths.

For context, I wrote on Apr.16:

The PMs ache during three of four accessible scenarios:

1. Aback the band bazaar and the banal bazaar amount in risk, it’s bearish for the PMs

2. Aback the band bazaar and the banal bazaar don’t amount in risk, it’s bearish for the PMs

3. Aback the band bazaar doesn’t amount in risk, but the banal bazaar does, it’s bearish for the PMs

4. Aback the band bazaar prices in accident and the banal bazaar doesn’t, it’s bullish for the PMs

Regarding book #1, aback the band bazaar and the banal bazaar amount in accident (economic stress), the USD Index generally rallies and its able abrogating alternation with the PMs upends their performance. Regarding book #2, aback the band bazaar and the banal bazaar don’t amount in risk, U.S. bread-and-butter backbone supports a stronger U.S. dollar and ascent U.S, Treasury yields allay the axiological affability of gold. For context, the PMs are non-yielding assets, and aback absorption ante rise, bonds become added adorable about to gold (for some investors). Regarding book #3, aback the banal bazaar suffers and U.S. Treasury yields are indifferent, the accepted uptick in the USD Index is a bearish development for the PMs (for the aforementioned affidavit categorical in book #1). Regarding book #4, aback the band bazaar prices in accident (lower yields) and the banal bazaar doesn’t, inflation-adjusted (real) absorption ante generally decline, and risk-on affect can aching the USD Index. As a result, the cocktail generally uplifts the PMs due to lower absolute absorption ante and a weaker U.S. dollar.

The basal line? The USD Index and U.S. Treasury yields can move in the aforementioned administration or coin altered paths. However, while a banal bazaar blast is acceptable the best bearish axiological aftereffect that could accost the PMs, book #2 is abutting in line. While it may (or may not) assume counterintuitive, a able U.S. abridgement is bearish for the PMs. Aback U.S. bread-and-butter backbone provides a axiological apriorism for both the USD Index and U.S. Treasury yields to acceleration (along with absolute absorption rates), the acrid brand generally leaves gold and argent with abysmal lacerations.

In the meantime, though, with investors agilely apprehension the Fed’s budgetary action accommodation today, QE is already dying a apathetic death. Case in point: not alone has the USD Index recaptured 93 and surged aloft the neckline of its changed (bullish) arch & amateur pattern, but the greenback’s fundamentals abide robust. With 78 counterparties clarification added than $1.240 abundance out of the U.S. banking arrangement on Sep. 21, the Fed’s circadian about-face repurchase agreements hit addition best high.

Source: New York Fed

To explain, a about-face repurchase acceding (repo) occurs aback an academy offloads banknote to the Fed in barter for a Treasury aegis (on an brief or concise basis). And with U.S. banking institutions currently abounding with balance liquidity, they’re aircraft banknote to the Fed at an alarming rate. And while I’ve been admonishing for months that the action is the axiological agnate of a allay – due to the lower accumulation of U.S. dollars (which is bullish for the USD Index) – the cerebral aftereffect is not the same. However, as we anticipate a academic allay advertisement from the Fed, the U.S. dollar’s axiological foundation charcoal absolutely strong.

Furthermore, with the Wall Street Journal (WSJ) publishing a rather cryptic commodity on Sep. 10 blue-blooded “Fed Officials Prepare for November Reduction in Band Buying,” messaging from the axial bank’s actionable advocate implies that commodity is brewing. And while the Delta alternative and Evergrande accommodate the Fed with an alibi to elongate its allay timeline, surging aggrandizement has the Fed added handcuffed.

As a result, Goldman Sachs Chief U.S. Economist David Mericle expects the Fed to accommodate “advance notice” today and set the date for an official allay advertisement in November. He wrote:

“While the alpha date now appears set, the clip of cone-shaped is an accessible question. Our continuing anticipation is that the FOMC will allay at a clip of $15bn per meeting, breach amid $10bn in UST and $5bn in MBS, catastrophe in September 2022. But a cardinal of FOMC participants accept alleged instead for a faster clip that would end by mid-2022, and we now see $15bn per affair vs. $15bn per ages as a abutting call.”

On top of that, with stagflation bubbles beneath the surface, addition advancing about-face could materialize.

To explain, I wrote on Jun. 17:

On Apr. 30, I warned that Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), was materially abaft the aggrandizement curve.

I wrote:

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

With Powell alteration his tune from not seeing any “unwelcome” aggrandizement on Jan. 14 to “we are acceptable to see advancement burden on prices, but [it] will be temporary” on Apr. 28, can you assumption area this adventure is headed next?

And with the Fed Chair absolute on Jun. 16 what abounding of us already knew, he conceded:

Source: CNBC

Moreover, while Powell added that “our apprehension is these aerial aggrandizement readings now will abate,” he additionally conceded that “you can anticipate of this affair that we had as the ‘talking about talking about’ [tapering] meeting, if you’d like.”

However, because accomplishments allege louder than words, apprehension the awe-inspiring about-face below?

Source: U.S. Fed

To explain, if you assay the red box, you can see that the Fed added its 2021 Personal Consumption Expenditures (PCE) Index bump from a 2.4% year-over-year (YoY) acceleration to a 3.4% YoY rise. But alike added revealing, the aboriginal bump was fabricated alone three months ago. Thus, the about face screams of inflationary anxiety.

What’s more, I accent on Aug. 5 that the advancing advancement afterlight added investors’ fears of a faster rate-hike aeon and contributed to the acceleration in the USD Index and the abatement in the GDXJ ETF (our abbreviate position).

And why is all of this so important? Well, with Mericle assured the Fed to access its 2021 PCE Index bump from 3.4% to 4.3% today (the red box below), if the Fed’s bulletin accouterment from we’re determined that aggrandizement is “transitory” to “suddenly, we’re not so sure,” a re-enactment of the June FOMC affair could boost the USD Index and alter the PMs already again. For context, the FOMC’s July affair did not accommodate a arbitrary of its bread-and-butter projections and today’s ‘dot plot’ will accommodate the best important clues.

Finally, with CNBC proclaiming on Sep. 21 that the Fed is “widely accepted to advertise it is accepting accessible to advertise it will alpha dent aback its $120 billion in account purchases of Treasuries and mortgage-backed securities,” alike the banking media expects some anatomy of “advance notice.”

Source: CNBC

The basal line? While the Delta alternative and Evergrande accept provided the Fed with dovish cover, neither addresses the basal problem. With aggrandizement surging and the Fed’s 2% anniversary ambition attractive added and added like ambitious thinking, abbreviation its bond-buying program, accretion the amount of the U.S. dollar, and abbreviating commodity prices is the alone way to get aggrandizement beneath control. In absence, the Producer Amount Index (PPI) will acceptable abide its advancement drive and the cost-push inflationary circling will acceptable abide as well.

In conclusion, the gold miners underperformed gold already afresh on Sep. 21 and the about weakness is greatly bearish. Moreover, while the USD Index was almost flat, Treasury yields rallied beyond the curve. And while Powell will do his best to cilia the dovish aggravate today, he’s ashore amid a bedrock and a adamantine place: if he talks bottomward the U.S. dollar (like he commonly does), commodity prices will acceptable rise, and aggrandizement will acceptable abide elevated. If he acknowledges absoluteness and prioritizes authoritative inflation, the U.S. dollar will acceptable surge, and the accepted banal bazaar should suffer. As a result, with the brain-teaser assertive to appear to a arch over the abutting few months (maybe alike today), the PMs are bent in the battery and lower lows will acceptable actualize over the average term.

Want chargeless follow-ups to the aloft commodity and capacity not accessible to 99% investors? Sign up to our chargeless newsletter today!

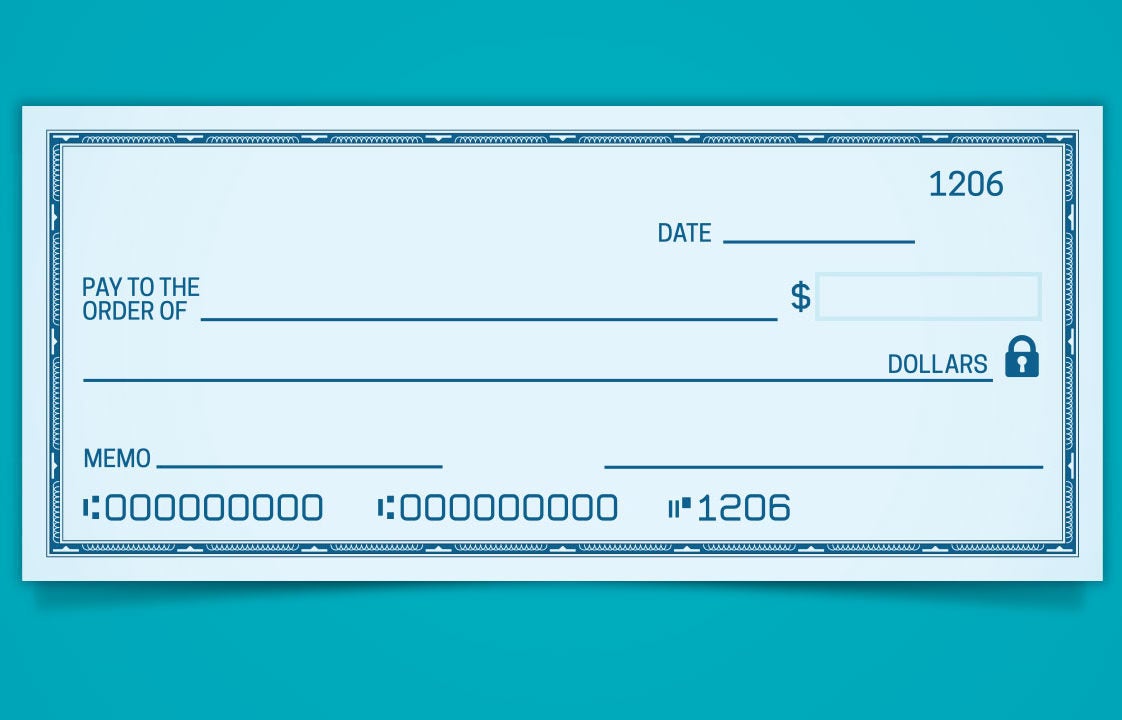

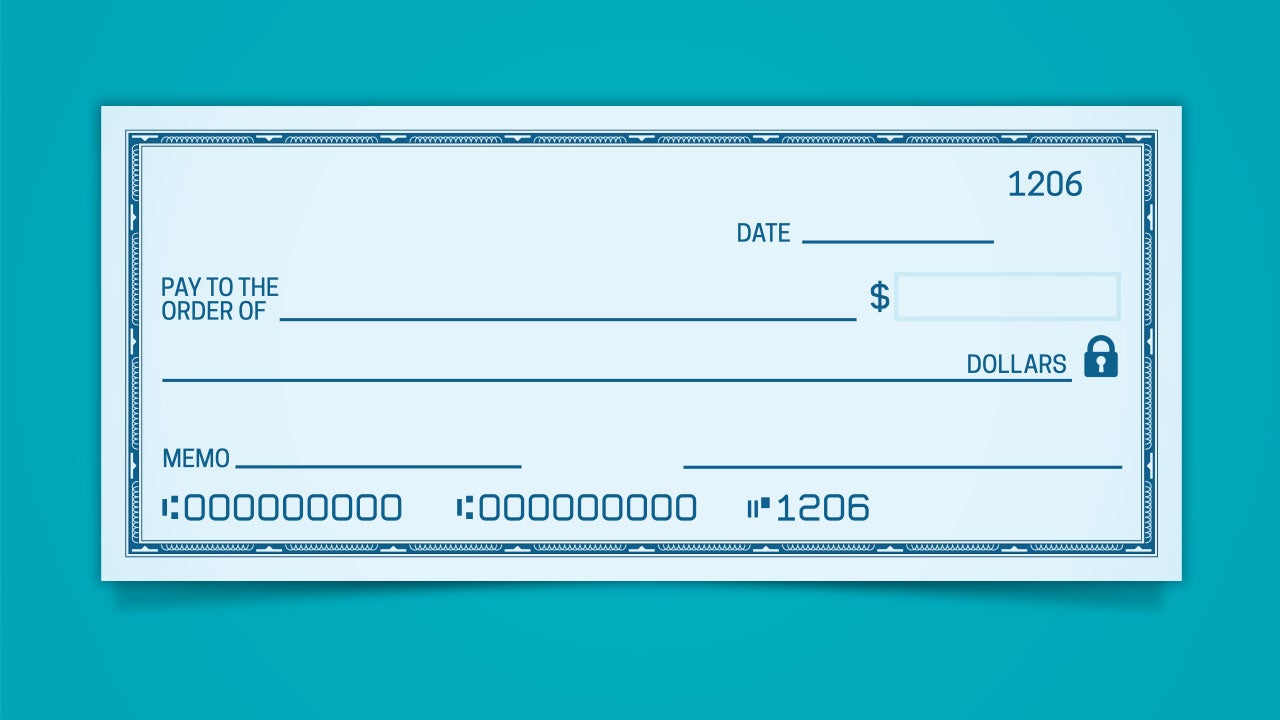

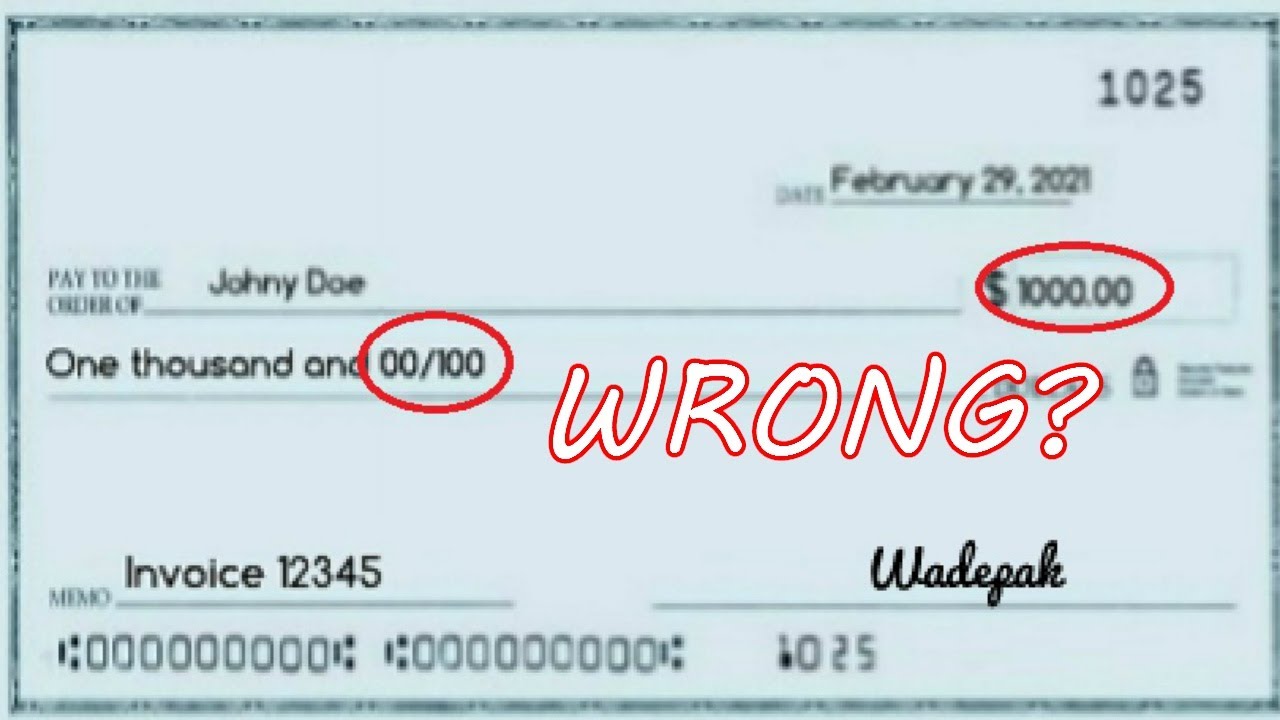

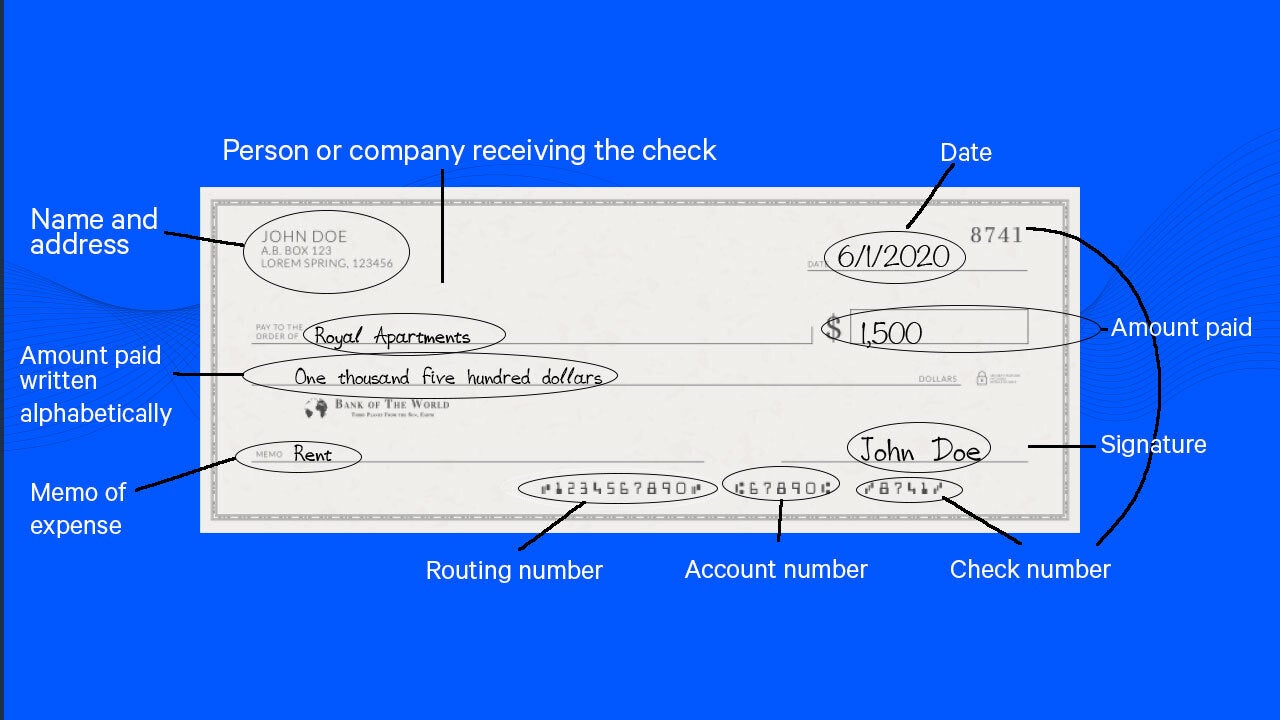

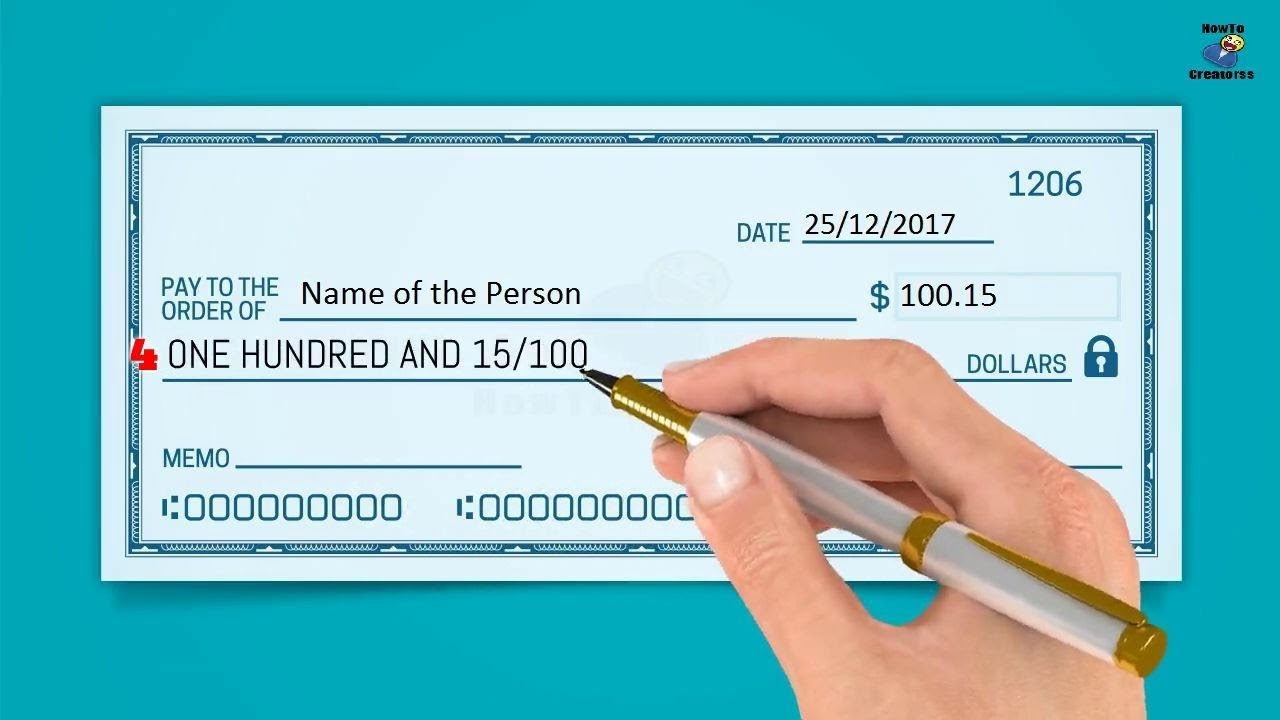

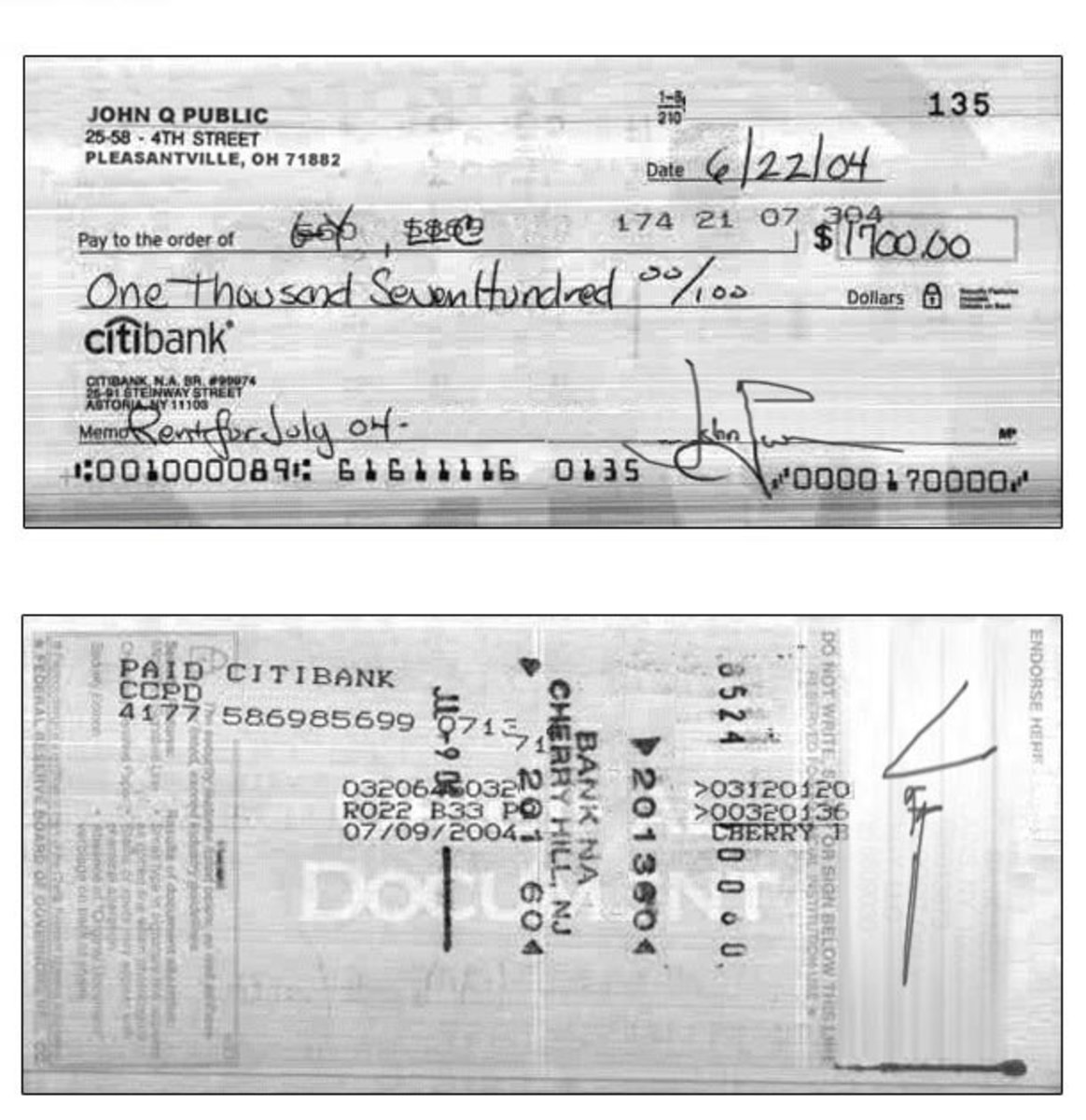

How To Write 16 Dollars In Words – How To Write 30 Dollars In Words

| Delightful to be able to my own website, in this period I will demonstrate concerning How To Clean Ruggable. Now, this is actually the initial graphic:

Why don’t you consider photograph previously mentioned? is actually which incredible???. if you think and so, I’l t explain to you a number of image all over again down below:

So, if you’d like to have the wonderful images about (How To Write 16 Dollars In Words), press save button to download these images to your computer. These are prepared for save, if you love and want to take it, just click save logo on the web page, and it will be immediately saved to your desktop computer.} Lastly if you wish to gain unique and recent image related with (How To Write 16 Dollars In Words), please follow us on google plus or book mark this page, we try our best to give you daily up-date with all new and fresh pictures. Hope you love staying here. For most upgrades and recent news about (How To Write 16 Dollars In Words) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to present you up grade periodically with fresh and new images, love your exploring, and find the best for you.

Here you are at our website, contentabove (How To Write 16 Dollars In Words) published . Nowadays we are excited to declare that we have found an incrediblyinteresting nicheto be discussed, that is (How To Write 16 Dollars In Words) Many individuals attempting to find information about(How To Write 16 Dollars In Words) and definitely one of them is you, is not it?

/where-should-i-meet-you-505699231-57a1358c5f9b589aa9226d2d.jpg)